Small investors flee the stock market

Subscribe to Decision Science News by Email (one email per week, easy unsubscribe)

Subscribe to Decision Science News by Email (one email per week, easy unsubscribe)

THE POTENTIAL FOR A BOND BUBBLE

Small investors have been a lot of fun to watch for quite some time now. In the 1930s, doing the opposite of the small investors (the so-called “odd lot” crowd because they could not afford to trade in amounts as large as standard units) was a popular contrarian strategy. The basic idea is that the small fries will always be wrong so that one can make money by doing the opposite.

In the 1990s, Barber and Odean excavated a goldmine of a data set of 60,000 individual investor accounts which revealed, among other things, that the more frequently individuals trade, the worse they do (see Figure 1).

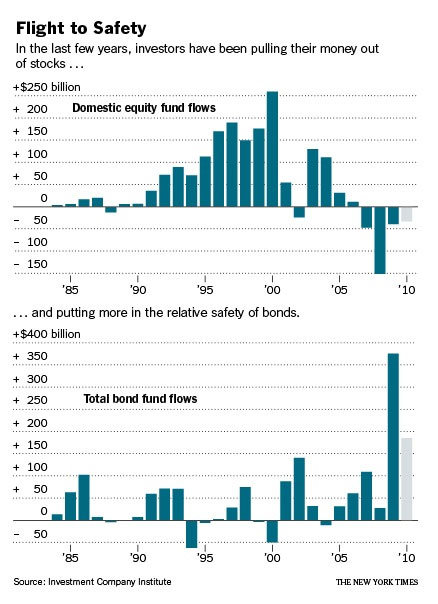

And in today’s gloomy economy, investors are fleeing the stock market and moving into bonds. Check out this article from the New York Times: In Striking Shift, Small Investors Flee Stock Market. Don’t miss that prodigious spike in the bond inflows at the bottom. Also note the inaccurate language about “the relative safety of bonds.” Bonds offer no safety against regret.

Shlomo Benartzi speaks of a bond bubble, and also suspects that people are probably overestimating the best that long-term bonds could do in the best possible scenario (for bonds). More to come on this.

SUGGESTED READING:

http://finance.yahoo.com/banking-budgeting/article/110706/bond-risks-and-how-to-beat-them

Photo credit: www.nytimes.com/2010/08/22/business/22invest.html