Finance 101 in the brain

Subscribe to Decision Science News by Email (one email per week, easy unsubscribe)

Subscribe to Decision Science News by Email (one email per week, easy unsubscribe)

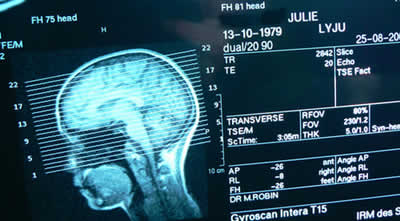

NEURAL DIFFERENTIATION OF EXPECTED REWARD AND RISK

Neurofinance. Yes, everybody is talking about it, but that doesn’t make it any less interesting. Same for neuroeconomics.

This work by Kerstin Preuschoff, Peter Bossaerts, and Steven Quartz looks for the neural underpinnings of the two pillars of mid 20th century financial decision theory: risk and return.

ABSTRACT

In decision-making under uncertainty, economic studies emphasize the importance of risk in addition to expected reward. Studies in neuroscience focus on expected reward and learning rather than risk. We combined functional imaging with a simple gambling task to vary expected reward and risk simultaneously and in an uncorrelated manner. Drawing on financial decision theory, we modeled expected reward as mathematical expectation of reward, and risk as reward variance. Activations in dopaminoceptive structures correlated with both mathematical parameters. These activations differentiated spatially and temporally. Temporally, the activation related to expected reward was immediate, while the activation related to risk was delayed. Analyses confirmed that our paradigm minimized confounds from learning, motivation, and salience. These results suggest that the primary task of the dopaminergic system is to convey signals of upcoming stochastic rewards, such as expected reward and risk, beyond its role in learning, motivation, and salience.

TO READ THE ARTICLE:

Kerstin Preuschoff, Peter Bossaerts, and Steven R. Quartz (2006). Neural Differentiation of Expected Reward and Risk in Human Subcortical Structures, Neuron 51, 381–390

.