What’s your planner score?

QUIZ YOUR LOVED ONES ABOUT THEIR PROPENSITY TO PLAN

John Lynch, Richard Netemeyer, Stephen Spiller, Alessandra Zammit have recently published in the Journal of Consumer Research this article on the propensity to plan and financial well being

ABSTRACT

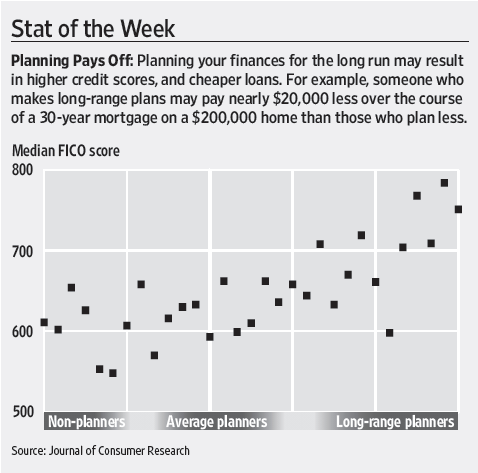

Planning has pronounced effects on consumer behavior and intertemporal choice. We develop a six-item scale measuring individual differences in propensity to plan that can be adapted to different domains and used to compare planning across domains and time horizons. Adaptations tailored to planning time and money in the short run and long run each show strong evidence of reliability and validity. We find that propensity to plan is moderately domain-specific. Scale measures and actual planning measures show that for time, people plan much more for the short run than the long run; for money, short- and long-run planning differ less. Time and money adaptations of our scale exhibit sharp differences in nomological

correlates; short-run and long-run adaptations differ less. Domain-specific adaptations predict frequency of actual planning in their respective domains. A “very long-run” money adaptation predicts FICO credit scores; low planners thus face materially higher cost of credit.

And while reading the article is fun, it’s also a hoot to take the propensity to plan test yourself, and give it to your friends and family. Give it a whirl, see if it accords with their behavior. Here are the items. Feel free to post your score in the comments.

For each question, answer on a scale from 1 to 6 in which 1 means “I strongly disagree” and 6 means “I strongly agree.”

Propensity to Plan for Money—Short Run:

1. I set financial goals for the next few days for what I

want to achieve with my money.

2. I decide beforehand how my money will be used in

the next few days.

3. I actively consider the steps I need to take to stick to

my budget in the next few days.

4. I consult my budget to see how much money I have

left for the next few days.

5. I like to look to my budget for the next few days in

order to get a better view of my spending in the future.

6. It makes me feel better to have my finances planned

out in the next few days.

Propensity to Plan for Money—Long Run:

1. I set financial goals for the next 1–2 months for what

I want to achieve with my money.

2. I decide beforehand how my money will be used in

the next 1–2 months.

3. I actively consider the steps I need to take to stick to

my budget in the next 1–2 months.

4. I consult my budget to see how much money I have

left for the next 1–2 months.

5. I like to look to my budget for the next 1–2 months

in order to get a better view of my spending in the

future.

6. It makes me feel better to have my finances planned

out in the next 1–2 months.

Propensity to Plan for Time—Short Run:

1. I set goals for the next few days for what I want to

achieve with my time.

2. I decide beforehand how my time will be used in the

next few days.

3. I actively consider the steps I need to take to stick to

my time schedule the next few days.

4. I consult my planner to see how much time I have left

for the next few days.

5. I like to look to my planner for the next few days in

order to get a better view of using my time in the

future.

6. It makes me feel better to have my time planned out

in the next few days.

Propensity to Plan for Time—Long Run:

1. I set goals for the next 1–2 months for what I want

to achieve with my time.

2. I decide beforehand how my time will be used in the

next 1–2 months.

3. I actively consider the steps I need to take to stick to

my time schedule in the next 1–2 months.

4. I consult my planner to see how much time I have left

for the next 1–2 months.

5. I like to look to my planner for the next 1–2 months

in order to get a better view of using my time in the

future.

6. It makes me feel better to have my time planned out

in the next 1–2 months.

ARTICLE TEXT [Download]

MEDIA MENTIONS

Wall Street Journal: http://jcr.wisc.edu/publicity/authors/docs/SUNJ.AA.1A020.A1.361Z2009.pdf

Yahoo Finance: http://finance.yahoo.com/retirement/article/109540/fast-track-to-financial-success

Decision Science News (meta-reference): http://www.decisionsciencenews.com/2010/06/18/the-propensity-to-plan-is-good-for-your-wallet/

If “long run” planning is 1-2 months, I’m amazed that anyone can save up money for their Hawaiin vacation next summer, much less for their children to go to college.

I wonder if they’d included questions on long-long-long-long range planning, like for college, if there would have been an even stronger correlation with FICO scores.

June 21, 2010 @ 6:19 pm