Judgment and Decision Making, Vol. 13, No. 6, November 2018, pp. 501-508

Valuing bets and hedges:

Implications for the construct of risk

preference

Shane Frederick*

Amanda Levis#

Steven Malliaris$

Andrew Meyer!

|

Risk attitudes implied by valuations of risk-increasing assets depart

markedly from those implied by valuations of risk-reducing assets. For

instance, many are unwilling to pay the expected value for a risky asset

or for its perfect hedge. Although nearly every theory of risk

preference (and

logic) demands a negative correlation between valuations of

bets and hedges, we observe positive correlations. This inconsistency

is difficult to expunge.

Keywords: bets, hedges, risk attitude

A fair coin is about to be flipped. |

A Heads voucher pays $10 if that coin lands heads. |

A Tails voucher pays $10 if that coin lands tails.

|

What is the most you would pay for a Heads voucher? $______ |

If you owned a Heads voucher, what is the most you would pay for a

Tails voucher? $______ |

1 Introduction

Analyses of choice under uncertainty typically treat risk aversion as a

primitive and stylized fact. As frequently-cited evidence, the

certainty equivalent of a gamble is nearly always below its expected

value. For instance, a typical person finds a sure $3 about as

attractive as a coin flip for $10.

From the perspective of Expected Utility Theory, the level of risk aversion

implied by such small-stakes choices exceeds the level exhibited at larger

stakes. For example, someone who’d always prefer a sure $3

over a coin flip for $10 must also prefer a sure $100 over a

coin flip for a billion dollars (Rabin 2000; Rabin & Thaler, 2001). Prospect

Theory (Kahneman & Tversky, 1979) was developed, in part, to accommodate

such discrepancies.

In this project, we investigate a different sort of inconsistency

in risk attitudes by comparing the valuation of a bet (e.g., a

voucher which pays $10 if a coin lands heads) with the valuation of its

perfect hedge (e.g., a second voucher which pays $10 if tails

obtains). Logic requires that these

two valuations sum to the amount their joint possession guarantees

(e.g., $10) and, accordingly, correlate −1.0.1 We find,

instead, that they correlate positively. Furthermore, risk

aversion implies that hedges should be worth more than their

expected value – an implication many find counterintuitive.

| Table 1: Summary of studies 1a to 1g. Correct is % summing to prize; ugrads

are Yale undergraduates; r is the correlation between bet and hedge WTP. |

| | | | | | | Mean WTP | | |

| | N | Ss | Prize | Framing | Response | Bet | Hedge | Correct | r |

a | 73 | ugrads | $10 real | Buying a TAILS voucher when you already own a

HEADS voucher | What is the most you would pay? | $4.90 | $5.82 | 32% | 0.41 |

b1 (subset) | 1176 (267) | MTurk | $10 hypothetical | Buying a TAILS

voucher when you already own a HEADS voucher | What is the most you would pay? | $4.04 ($4.95) | $4.21 ($4.64) | 23% (30%) | 0.64 (0.74) |

c | 986 | MTurk | $10 hypothetical | Buying a TAILS voucher when you already

own a HEADS voucher | 10 question BDM, buy and sell | $3.98 | $4.49 | 17% | 0.55 |

d | 226 | ugrads | $10 hypothetical | Paying to paint faces of a coin which

yields prize if landing on a painted face | How much would you pay? | $2.66 | $4.38 | 9% | 0.11 |

e | 684 | MTurk | $10 hypothetical | Converting from 50% to 100%

probability of winning | 10 question BDM | $3.09 | $6.50 | 14% | 0.19 |

f | 207 | MBAs | $100 real (for one) | Betting on a football team when you

have a bet on its opponent | What is the most you would pay? | $22.71 | $44.10 | 11% | 0.29 |

g1 (subset) | 1285 (240) | MTurk | $10 Amazon gift

card hypothetical | Buying a TAILS voucher when you already

own a HEADS voucher | What is the most you would pay? | $4.41 ($4.21) | $4.07 ($4.26) | 22% (25%) | 0.74 (0.76) |

| 1 In study 1b, we separately analyzed

results for 267 participants who answered $10 when asked: “What is the most

you would pay for $10?

In study 1g, we separately

analyzed results for 240 participants who valued a pair of $5

Amazon gift certificates at $10 and scored perfectly on an

eight-item test intended to assess their comprehension of bets and

hedges (see Appendix B). In

both subsets, results are consistent with the full sample. Since those who

would pay $10 for $10 (or for two $5 gift certificates) were probably not

understating their willingness to pay, this weighs against the idea

that the positive relation between bet and hedge valuations was driven

by heterogeneity in the degree to which participants shaded their true

valuations downward.

|

Because lower bet valuations imply more risk aversion, whereas lower hedge

valuations imply more risk tolerance, a positive correlation between them

means that those who appear more risk-averse by one measure appear more

risk-tolerant by the other. Although previous research has questioned the

generality2 and predictive power3 of risk attitudes,

our results are even more problematic,

as these two measures come from the same domain (small stakes gambles

involving money) and not only fail to cohere, but strongly contradict one

another. Though levels of risk aversion are known to vary across

elicitation procedures, many nevertheless assume that such procedures at

least serve to rank individuals by their risk attitudes (see,

e.g., Charness, Gneezy & Imas, 2013, p. 50). However, our results cast

doubt upon even this more modest claim. They also raise the question of how

bet and hedge valuations would be altered by an appreciation of this logic,

if that could somehow be instilled – which is not so easy, as we will show.

2 Studies 1a to 1g

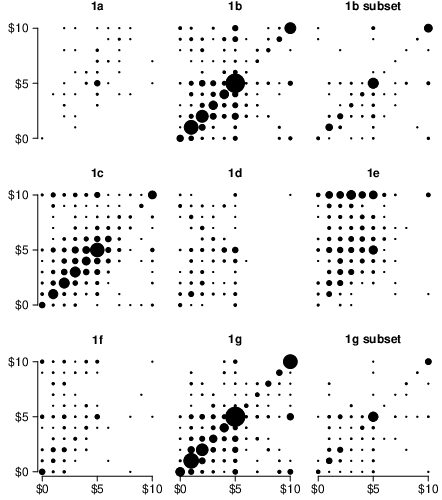

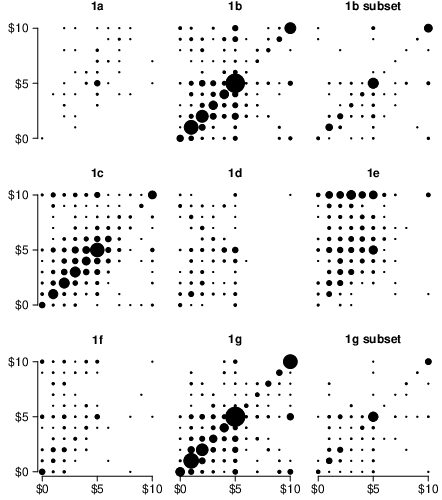

Our first set of experiments (summarized in Table 1) document this curious

phenomenon. Though designs varied slightly (see

Appendix B for

methodological details), each participant was essentially asked the most

they would pay for a 50% chance of $10 and the most they would pay to

convert that to a certain $10 (by acquiring a perfect hedge). Logic

requires that one’s valuation of the hedge equal $10 minus their valuation of the

bet; that all responses in Figure 1 lie along the southeast

diagonal (y=10-x). But as can be seen, few actually do, in

any of the studies.4

| Figure 1: Results of studies 1a-g. The figure plots bet valuations

(x-axis) against hedge valuations (y-axis) for the seven experiments

and two separately analyzed subsets

summarized in Table 1. Dot area is proportional

to number of participants at each coordinate. Note that 1f

actually ranged from $0 to $100, but is re-scaled to match other

studies in this figure. (see

Appendix B for

materials). |

| Table 2: Materials for Studies 2a and 2b. |

| 2a (N=297) | 2b

(N=299) |

Suppose a fair coin is going to be flipped once.

A “HEADS Voucher” pays out $10 if the coin lands heads.

A “TAILS Voucher” pays out $10 if the coin lands

tails.

Which would you rather have?

A) A HEADS voucher and a TAILS voucher 66%

B) A HEADS voucher and a five dollar bill 34%

Which would you rather have?

A) A HEADS voucher 30%

B) A five dollar bill 70% | | Suppose a fair coin is going to be flipped once.

A “HEADS Voucher” pays out $10 if the coin lands heads.

A “TAILS Voucher” pays out $10 if the coin

lands tails.

Which would you rather have?

A) A HEADS voucher and a TAILS voucher, so that you make $10

if the coin lands heads and $10 if the coin lands tails

74%

B) A HEADS voucher and a five dollar bill, so that you make

$15 if the coin lands heads and $5 if the coin lands tails

26%

Which would you rather have?

A) A HEADS voucher, so that you make $10 if the coin lands

heads and $0 if the coin lands tails 11%

B) A five dollar bill, so that you make $5 if the coin lands

heads and $5 if the coin lands tails

89% |

Studies 2a and 2b

Evaluating Heads and Tails vouchers separately and sequentially partially

obscures their complementarity.5 Thus, in our next two

studies, MTurk workers chose between the pair of vouchers {Heads

& Tails} and the package {Heads & $5} (see Table 2). With this more

transparent

formulation, most did prefer the voucher pair – and thus, at least

implicitly, valued the Tails hedge above its expected value, as risk

aversion dictates.6,7 However, even here, the explanatory

power of risk preference remains in doubt, since those who preferred

{Heads & Tails} to {Heads & $5} should also have preferred a sure

$5 over a single Heads voucher, and vice versa. Yet we observed little

relation between those two choices.8

Study 3

When considered separately, the Heads and Tails vouchers are symmetric:

equivalent and interchangeable. Thus, it is easy to understand why many

respondents value them similarly, even though the first voucher adds

risk and the second removes it. To test whether respondents would

explicitly endorse the symmetry argument over the normative argument,

we presented them side by side (Table 3), with order counterbalanced,

and simply asked respondents to choose one.

| Table 3: Materials for Study 3 |

A fair coin will be flipped once.

A HEADS voucher pays $10 if the coin lands HEADS.

A TAILS voucher pays $10 if the coin lands TAILS.

Bob was willing to pay up to $3 for a HEADS voucher and

purchased one at that price.

How much should he be willing to pay for a TAILS voucher? (So

that he would own both vouchers before the coin is flipped.)

∘ $7 (He should value the pair of vouchers

at $10 because owning both guarantees him $10.)

∘ $3 (He should value each voucher the same because

each offers the same chance of $10.)

|

Only one in ten respondents (53/505) chose the correct argument ($7)

over the symmetry argument ($3). Moreover, this small minority might

actually have been even more confused, as those choosing $7 were

less likely to pass an attention check and did significantly

worse on a numeracy test appended to subsequent demographics

questions (see

Appendix

D).9

Study 4

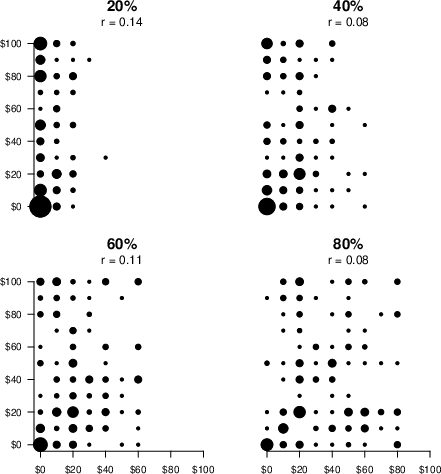

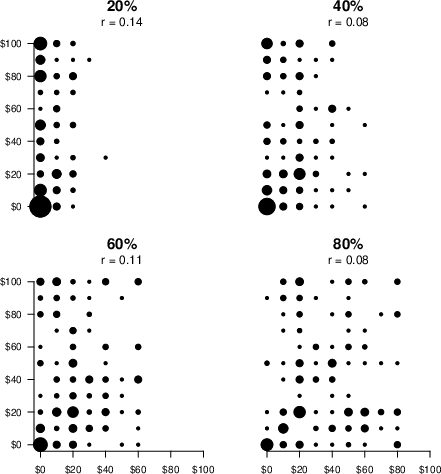

To slightly generalize our basic paradigm, we next removed the

symmetry between the bet and the hedge. We asked 182 MTurkers how much

they would pay for four different bets: a 20% chance of $100, a 40%

chance of $100, a 60% chance of $100, and an 80% chance of $100

as well as how much they would pay for the four corresponding

hedges (which pay off in the remaining states). All four bet-hedge pairs were

presented to each participant in random order. For each pair, respondents

indicated their valuations of the

bet, and then their valuations of the corresponding hedge. As before,

possession of both guarantees the prize, and thus their two

valuations should sum to $100 and correlate −1.0. However, unlike

before, the bet and hedge are not symmetric, as they have

different probabilities of delivering the prize. The results are

summarized in Figure 2.

| Figure 2: WTP for a P% chance at $100 and for its perfect

hedge. The figure plots bet valuations (x-axis) against hedge

valuations (y-axis) for each probability of $100 in Study 4. Dot

area is proportional to number of participants at each coordinate. |

With symmetry removed, valuations of the bet and the hedge correlate

much more weakly, though still positively. Again, almost no

data lie along the southeast diagonal, as the two

valuations sum to well below $100 in all four cases. The mean

valuations of the bet and hedge are reported in Table 4, with the

subscript representing the asset’s valuation relative to its expected

value.

A comparison of the subscripts reveals that the bets and hedges

generally deviate in the same direction from expected value

(below it), rather than diverging to reveal a coherent attitude toward

risk. However, though the two valuations do not cohere, hedges are, at

least, valued at a higher fraction of their expected value.

Moreover, respondents are willing to pay more than expected value to

hedge the small residual risk of the 80% bet – providing at least one

instance where a perfect hedge is priced above its expected value

($20), as should be universally expected for respondents who are risk

averse.

| Table 4: Mean bet and hedge valuations. |

21inAsset acquired or hedged | Mean WTP

proportion of EV |

| | Bet | Hedge |

20% of $100 | $6 0.32 | $41 0.51 |

40% of $100 | $15 0.36 | $39 0.66 |

60% of $100 | $22 0.36 | $40 0.99 |

80% of $100 | $34 0.42 | $38

1.91 |

The considerable difference between bet and hedge subscripts in Table

4 suggests that respondents are not simply ignoring

possession of the bet when evaluating the hedge. For instance, they

are willing to pay $6 for a 20% chance of $100 alone, but $38

for the same asset once they already own an 80% chance of $100.

Although respondents clearly

fail to fully appreciate the covariance between bets and hedges, the

pattern remains distinct from complete covariance neglect, in which

hedges and bets are treated as independent.10

Nor are respondents

in earlier “Heads and Tails” studies merely referencing their

valuation of the bet to construct an equivalent valuation of the

hedge. Although a substantial minority of hedge prices do equal bet

prices in

those studies, most don’t. And of the minority that do, many come from

respondents who “simply” report the expected value for each asset ($5, $5).

Though those are certainly reasonable valuations (and demanded by EUT), we

strongly suspect that many of these respondents are treating these questions as

math problems rather than an elicitation of their preferences (and would

continue to just perform the math even if the numbers referenced

millions of dollars). This suspicion draws some support from an

analysis in Appendix C, which

reports the data broken down by CRT score: those who answer ($5, $5)

are no more reflective than off diagonal respondents and less

reflective than the small minority of responses that lie elsewhere on

the southeast diagonal.

In opposition to various “narrow framing” theories (e.g., Tversky &

Kahneman, 1986) that assume respondents ignore possession of the bet when

evaluating the hedge stand “multiple reference point” theories (e.g.,

Koszegi & Rabin, 2006, 2007) in which evaluation of hedge entails

full consideration of both possible outcomes of the bet:

the one in which the bet pays off (in which case money spent on the hedge

is a waste and a loss) and the one in which the bet does not (but

the hedge does, minus acquisition costs). By this multiple reference point

formulation, acquisition of the hedge constitutes both a loss and

a gain, which tends to make an unattractive combination to the extent that

losses loom larger than gains. (See

Appendix E for an

examination of whether the multiple reference point perspective can make

sense of our results. We conclude it cannot.11)

3 Discussion

Valuations of bets and hedges are theoretically equivalent measures of

risk attitudes, yet they often compel opposite conclusions. For

instance, many who place a low value on risk-creating bets also place a

low value on risk-reducing hedges. This marked departure from

theoretical expectations seemingly impugns the construct validity of

risk attitudes – even within the narrow domain of stylized

monetary gambles. Of course, identifying

discrepancies between a subset of measurement techniques isn’t usually

regarded as sufficient cause to jettison a theoretically cherished

construct – at least not within the social sciences. Nevertheless, to

the extent that the two measures depart, it certainly raises the question

about which, if either, better captures whatever we think we mean by

risk aversion.

Adjudicating between potential measures of a putative construct requires

the very thing that is lacking for constructs whose validity is still

in question – agreement about the other thing(s) with which we should

expect them to correlate. For instance, suppose Holt and Laury’s (2002)

measure of risk preferences had corresponded much more highly

with hedge valuations than with bet valuations. The conclusions drawn

from this will still be conditioned by your prior faith in those

measures. If you are confident that Holt and Laury’s measure

captures the construct you care about, it would affirm hedge valuations

and impugn bet valuations, but if you are confident that bet valuations

best capture risk attitudes, the lack of relation with that other method would

impugn that method.

In the experimental paradigm we use most commonly, the hedges are

perfect, such that possession of one renders the coin irrelevant. This

evokes the image of a very unusual transaction in which an owner of the

bet pays $7 for the hedge and is then immediately handed $10. Since

this is obviously equivalent to simply receiving $3, buying the hedge

is equivalent to selling the bet. But the value of a perfect hedge also

determines the aggregate value of the partial hedges from which it

might be constructed. Consider

an experiment in which chances to win a $100 prize can be

purchased in cumulative increments of one percentage point each; a

single point entitles its owner to a 1% chance of $100; fifteen

points yields a 15% chance of $100, and so on. The expected value of

each 1% chance is, of course, $1. Now consider a respondent for whom

a 50% chance of winning a $100 prize is worth $30. That person

values the first 50 points at 60 cents each, on average.

However, since the next 50 points must be worth $70 in total,

their average value must be $1.40. Moreover, if any of the incremental

percentage points beyond 50% are also valued below $1.00, achieving

that $1.40 average requires that valuation of later

increments exceed $1.40. In other words, continuity demands

that these partial hedges must eventually be worth much more than their

expected value – and this point will typically come well before one has

acquired a 100% chance of winning.

Note further that once a prize becomes more likely than not, additional

increases in the chances of winning reduce variance at an

accelerating rate. Since aversion to variance dominates every formal

definition of risk aversion, those who are risk averse should often

treat partial hedges like perfect hedges – as variance reducing assets

that are worth even more than their expected value. Thus, assets that

eliminate risk, like Tails vouchers, are an illustrative case,

but not a special case.

The construct of risk aversion seemingly draws support from the

popularity of insurance contracts, on which U.S. customers alone spend

over a trillion dollars a year.12

However, while people typically insure against their house catching

fire, they rarely insure against a decline in house prices, though

home equity comprises most of a household’s net worth

at retirement.13 Moreover, analogous contracts that extract a premium

to reduce the variability of uncertain gains are also

rare.14

Thus, as Friedman et al. (2014) point out, while insurance contracts

are typically invoked as evidence of risk aversion, customer behavior

actually departs from textbook risk aversion; customers appear

motivated to reduce the possibility of some types of harm, rather than

reduce variance, per se. This distinction between downside

risk and upside risk raises further questions about how subjects in

our experiments interpret an actuarially unfair hedge: as an

attractive premium to limit losses from unfavorable

realizations of their risky asset (e.g., spending $700,000 on

insurance to guard against the 50% chance their million dollar house

will burn down) or as an unattractive censoring of the upside of their

risky asset (e.g., as guaranteeing a mere $300,000 when they know

their house will be worth a million if it does not burn

down).

When we’ve presented this research, the most common objection is that

respondents are just confused. We “concede” that, at some

level, they are. For instance, consider the common response of someone

who indicates they’d pay up to $3 for the bet and up to $3

for a hedge (if they had purchased or were endowed with the bet). This,

in turn implies they’d pay up to $6 for both, but not, say,

$7.50. But since the bet and hedge are worth $10 in combination,

their responses imply they would decline receiving $2.50 if you

attempted to hand it to them. This is obviously false and so their

answer is, in an important sense, a mistake. And this mistake persists

even when participants are explicitly given the normative explanation,

as in Study 3. However, we see these mistakes as the

phenomenon of interest. We don’t doubt

that after a sufficiently intense and prolonged training session

respondents could generate a normative pair of valuations, much as they

could be taught to use Venn Diagrams or apply Bayes' Rule, or produce

normative responses in many other contexts. But this doesn’t vitiate

the phenomenon nor remove the challenges it poses to conceptions of

risk attitudes.

References

Barber, B., & Odean, T. (2000). Trading is hazardous to your wealth:

The common stock investment performance of individual

investors. Journal of Finance, 55, 773–806.

Barseghyan, L. Prince, J., & Teitelbaum, J. C. (2011). Are risk

preferences stable across contexts?

Evidence from insurance data. American Economic Review,

101, 591–631.

Barsky, R. B., Juster, T., Kimball, M., & Shapiro, M. (1997). Preference

parameters and behavioral heterogeneity: An experimental approach in the

health and retirement study. Quarterly Journal of

Economics, 112, 537–579.

Benartzi, S. & Thaler, R. H. (2001). Naïve diversification strategies

in defined contribution saving plans, American Economic Review,

91, 79–98.

Brown, J. R. (2009). Understanding the role of annuities in retirement

planning. In A. Lusardi (Ed.), Overcoming the savings slump: How to

increase the effectiveness of financial education and saving

programs, pp. 178–206. University of Chicago Press.

Charness, G., Gneezy, U., & Imas, A. (2013). Experimental methods: Eliciting

risk preferences. Journal of Economic Behavior & Organization, 87,

43-51.

Choi, J. J., Laibson, D., & Madrian, B. C. (2005). Are empowerment and

education enough? Underdiversification in 401(k) plans.

Brookings Papers on Economic Activity 2005, 2, 151–198.

Choi, J. W., & Lee, J. M. (2015). Housing futures markets. In

The World Scientific Handbook of Futures Markets, 15,

465–485.

Cornil, Y., & Bart, Y. (2013). The diversification paradox: Covariance

information and risk perception among lay investors. Unpublished

manuscript. [Singapore: INSEAD Working Paper Series, 1-45.]

Cutler, D. M., & Glaeser, E., (2005). What explains differences in

smoking, drinking, and other health-related behaviors? American

Economic Review, 95, 238–242.

Einav, L., Finkelstein, A., Pascu, I., & Cullen, M. (2012). How general

are risk preferences? Choices under uncertainty in different domains.

American Economic Review, 102, 2606–2638.

French, K. R., & Poterba, J. M. (1991). Investor diversification and

international equity markets. American Economic Review,

81, 222–226.

Frederick, S. (2005). Cognitive reflection and decision making.

Journal of Economic Perspectives, 19, 25–42.

Friedman, D., Isaac, R. M., James, D., & Sunder, S. (2014). Risky

curves: On the empirical failure of expected utility. Routledge.

Grinblatt, M., & Keloharju, M. (2001). How distance, language, and

culture influence stockholdings and

trades. Journal of Finance, 56, 1053–1073.

Holt, C. A., & Laury, S. K. (2002). Risk aversion and incentive

effects. American Economic Review, 92, 1644–1655.

Huberman, G. (2001). Familiarity breeds investment. Review of

Financial Studies, 14, 659–680.

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of

decision under risk. Econometrica, 47, 263–291.

Kőszegi, B., & Rabin, M. (2006). A model of reference-dependent

preferences. The Quarterly Journal of Economics, 121,

1133–1165.

Kőszegi, B., & Rabin, M. (2007). Reference-dependent risk

attitudes. American Economic Review, 97, 1047–1073.

Markle, A. B., & Rottenstreich, Y. (2018). Simultaneous preferences for

hedging and doubling down: Focal prospects, background positions, and

nonconsequentialist conceptualizations of uncertainty.

Management Science, https://doi.org/10.1287/mnsc.2017.2918.

Meulbroek, L. (2002). Company stock in pension plans: How costly is it?

Unpublished manuscript.

Poterba, J. M. (2014). Retirement security in an aging population.

American Economic Review, 104, 1–30.

Rabin, M. (2000). Risk aversion and expected-utility theory: A

calibration theorem. Econometrica, 68, 1281–1292.

Rabin, M, & Thaler, R. H. (2001). Anomalies: Risk aversion.

Journal of Economic Perspectives, 15, 219–232.

Reinholtz, N., Fernbach, P., & Langhe, B. D. (2018). Do people

understand the benefit of diversification? Available at SSRN 2719144.

Thaler, R. H., & Johnson, E. J. (1990). Gambling with the house money

and trying to break even: The effects of prior outcomes on risky

choice. Management science, 36, 643–660.

Tversky, A., & Kahneman, D. (1986). Rational choice and the framing of

decisions. Journal of Business, S251-S278.

Welch, I. (2001) The top achievements, challenges, and failures of

finance. Unpublished Manuscript. [Yale ICF Working Paper Series, No.

00–67.]

This document was translated from LATEX by

HEVEA.