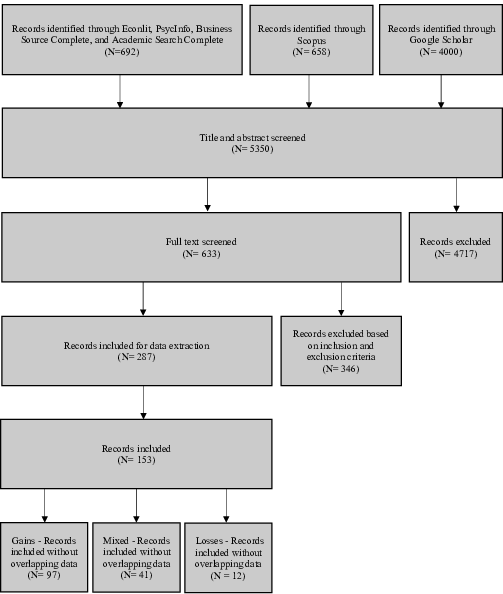

| Figure 1: Overview of the literature search. |

Judgment and Decision Making, Vol. 14, No. 3, May 2019, pp. 234-279

Cognitive ability and risk aversion: A systematic review and meta analysisLau Lilleholt* |

Are highly intelligent people less risk averse? Over the last two decades scholars have argued the existence of a negative relationship between cognitive ability and risk aversion. Although numerous studies support this, the link between cognitive ability and risk aversion has not been found consistently. To shed new light on this topic, a systematic review and meta-analysis was conducted. A total of 97 studies were identified and included for meta-analysis in the domain of gains (N=90,723), 41 in the mixed domain (N=50,936), and 12 in the domain of losses (N=4,544). Results indicate that there exists a weak, but significant negative relationship between cognitive ability and risk aversion in the domain of gains. However, no relationship was observed in the mixed domain or in the domain of losses. Several meta-regressions were performed to investigate the influence of moderator variables. None of the moderator variables were found to consistently influence the relationship between cognitive ability and risk aversion across the domain of gains, mixed and losses. Moreover, no significant difference was observed between males and females across all three domains. In conclusion, this systematic review and meta-analysis provides new evidence that the relationship between cognitive ability and risk aversion is domain specific and not as strong as suggested by some previous studies.

Keywords: risk aversion, cognitive ability, risk preferences,

intelligence, meta-analysis

In economic theory, risk aversion is assumed to be a key determinant of human decision making. Naturally, the study of risk aversion has gained a lot of attention, attracting researchers from all over the world. For the past two decades, a number of scholars have argued that highly intelligent individuals tend to be less risk averse (Benjamin, Brown & Shapiro, 2013; Dohmen, Falk, Huffman & Sunde, 2010, 2018; Frederick, 2005), and thus more likely to optimize their choices in line with the normative benchmark of Expected Utility Theory (Rabin, 2000; Rabin & Thaler, 2001). Although a substantial amount of empirical evidence supports this conclusion (Dohmen et al., 2018), several studies do not find cognitive ability to be consistently related to risk aversion. For instance, some studies have found cognitive ability to be negatively related to risk aversion in the domain of gains but positively related in the mixed domain (Burks, Carpenter, Goette & Rustichini, 2009; Chapman, Snowberg, Wang, & Camerer, 2018). Similarly, Andersson, Holm, Tyran and Wengström (2016), concluded that the relationship might be spurious and dependent on the choice architecture of the decision task used to elicit risk preferences. Specifically, they reported a negative relationship when the percentage of alternative responses indicating risk aversion was set to 80% and a positive relationship when this was set to 50%. A potential explanation for this result is that people with low cognitive ability tend to make more random errors, leading risk aversion to be overestimated for this group when the percentage of alternatives permitting a choice indicating risk aversion is high, while underestimated when the opposite is the case (Andersson et al., 2016). Finally, several studies suggest that the negative relationship between cognitive ability and risk aversion exists only when the decision task used to elicit risk aversion is unincentivized and purely hypothetical (Sousa & Rangel, 2014; Taylor, 2013, 2016). In summary, it is unclear whether a negative relationship actually exists, and if so, to what extent. The purpose of this study is to investigate the nature of the relationship between cognitive ability and risk aversion, through a systematic literature review and meta-analysis.

The remainder of this article is organized as follows. First, a brief definition of cognitive ability and risk aversion is provided. Next, several theoretical explanations for why cognitive ability and risk aversion might be negatively related are presented, followed by an outline of the present investigation. Then the literature review and meta-analysis are discussed.

When conducting a systematic literature review and meta-analysis it is important to define the key variables of interest (Borenstein, Hedges, Higgins & Rothstein, 2009; Cooper, 2010).

Cognitive ability is one of the best researched, yet most controversial constructs within the field of psychology (Eysenck, 1998; Freund & Kasten, 2012; Sternberg, 1985). In general terms, cognitive ability is considered an extensive category, encompassing a wide range of abilities such as reasoning, problem solving and abstract thinking (Gottfredson, 1997). Throughout the history of the field, several influential scholars have attempted to converge on a single definition of the construct (Carroll, 1997; Freund & Kasten, 2012). Although no uniform definition of cognitive ability exists, Murphy and Davidshofer (1998) provides a definition that has proven useful in applied psychology (e.g., Seijts & Crim, 2009; Yeo & Neal, 2004). In line with their definition, cognitive ability will for the purposes of this study be defined as individual differences in the capacity to successfully perform tasks that require the manipulation, retrieval, evaluation or processing of mental information. This definition is closely related to what psychologists refer to as g or general cognitive ability, a factor considered to be the core of, and primary source of variance common to, cognitive abilities and cognitive ability tests (Spearman, 1904a; Yeo & Neal, 2004).

Based on the definition put forward by Fox, Erner and Walters (2016), an individual will for the purposes of this study be considered risk averse if he or she prefers a certain or risky option to a riskier option with equal or higher expected value. Conversely, an individual will be considered risk seeking, if he/she prefers a risky option to a certain or less risky option with higher expected value.

Various theoretical explanations have been put forward to explain why cognitive ability and risk aversion might be negatively related. One prominent explanation based on dual process theory (Evans & Stanovich, 2013; Kahneman & Frederick, 2002; Loewenstein & O’Donoghue, 2004) is that people with high cognitive ability are more reflective and, thus, less likely to make judgement and decision errors (Benjamin et al., 2013). According to dual-process theory, judgment and decision-making is the result of an interaction between two distinct cognitive processes; type 1 and type 2 (Evans & Stanovich, 2013). Type 1 are fast, automatic, low-effort and high-capacity processes, usually associated with heuristic and intuitive decision-making (Evans & Stanovich, 2013; Frankish, 2010). Type 2 are conversely, slow, controlled, high-effort and low capacity processes, typically associated with deliberate, reflective and rational decision-making (Evans & Stanovich, 2013; Frankish, 2010). Given that type 2 processes are assumed to tax working memory capacity (Evans & Stanovich, 2013; Stanovich, 2010), which is known to be highly correlated with cognitive ability (Conway, Kane & Engle, 2003; Kyllonen & Christal, 1990; Süß, Oberauer, Wittmann, Wilhelm, & Schulze, 2002), it is likely that people with high cognitive ability are more capable of engaging in reflective and rational decision-making. The dual-process explanation holds that people with high cognitive ability are likely to realize that risk aversion over small stakes is irrational (Rabin, 2000; Rabin & Thaler, 2001), because they have more cognitive capacity to deliberately reflect and think about their choices. In support of this argument, Cokely and Kelley (2009) found that highly intelligent individuals were more likely to engage in expected value maximization, report more elaborate and reflective thought patterns, and spend more time deliberating when choosing between prospects. Moreover, many other studies have shown that people with high cognitive ability display fewer behavioral biases across a wide range of decision tasks that arguably require type 2 processes to derive what is considered to be the normative response (e.g., Bergman, Ellingsen, Johannesson & Svensson, 2010; Hoppe & Kusterer, 2011; Oechssler, Roider & Schmitz, 2009; Stanovich & West, 1998; Toplak, West & Stanovich, 2011).

A similar explanation is that people with high cognitive ability are more likely to bracket their choices broadly; considering the bearing of their experimental decisions in a broader lifetime perspective (Dohmen et al., 2010; Koch & Nafziger, 2016; Read, Loewenstein & Rabin, 1999). Theoretically, this makes sense, as broad bracketing is cognitively taxing compared to narrow bracketing (Read et al., 1999), increasing the likelihood that people with low cognitive ability engages less in broad bracketing due to a lack of cognitive resources. Hence, given that broad bracketing has been linked with lower levels of risk aversion (Gneezy & Potters, 1997; Hilgers & Wibral, 2014; Thaler, Tversky, Kahneman & Schwartz, 1997), it is not unlikely that broad bracketing is one of the driving forces behind the negative relationship between cognitive ability and risk aversion observed in some previous studies.

A third possible explanation is that risk preferences play a role in the development of cognitive ability, and that individual risk preferences influence people’s choice of environment, which in turn could affect cognitive development (Dohmen et al., 2018). As an example, risk preferences might play a role in choices about investment in education, which has been shown to foster the development of cognitive abilities (Falch & Sandgren Massih, 2011; Ritchie, Bates & Deary, 2015; Schneeweis, Skirbekk & Winter-Ebmer, 2014). On the other hand, it is of course possible that people with high cognitive ability seek out environments which foster the development of risk tolerance. For instance, several studies have shown that people with high cognitive ability are more active in the stock market (Christelis, Jappelli & Padula, 2010; Grinblatt, Keloharju & Linnainmaa, 2011; Van Rooij, Lusardi & Alessie, 2011), which could lead them to become more risk tolerant over time.

Finally, it could be that the relationship between cognitive ability and risk aversion, is coevolutionary: meaning that certain configurations of cognitive ability and risk aversion have been evolutionary beneficial (Dohmen et al., 2010, 2018). Hence, evolutionary pressures might have created a general tendency for low cognitive ability to be coupled with risk aversion and vice versa.

In light of the mixed findings on the relationship between cognitive ability and risk aversion, the first aim of this study is to systematically investigate the nature of the relationship across the domain of gains, mixed and losses. In line with the existing literature, the second aim is to examine to what extent the choice architecture of the decision task used to elicit risk preferences influence the relationship between cognitive ability and risk aversion. The current study will also ask whether the relationship exists only when the decision task is unincentivized and purely hypothetical, and whether the relationship is influenced by how cognitive ability is measured. Finally, given that age (Defoe, Dubas, Figner & van Aken, 2015; Mata, Josef, Samanez-Larkin & Hertwig, 2011) and gender (Charness & Gneezy, 2012; Croson & Gneezy, 2009) have been found to be related to risk preferences, the last aim of this study is to investigate the influence of these variables on the relationship between cognitive ability and risk aversion.

In line with the guidelines provided by Cooper (2010) the systematic literature review and meta-analysis performed in this study comprised three steps: (1) literature search, (2) data extraction and coding, and (3) data analysis.

In order to identify studies examining the relationship between cognitive ability and risk aversion, the following four electronic databases were searched: Econlit, PsycInfo, Business Source Complete, and Academic Search Complete. All databases were searched using the following keywords in the first search field: “risk avers*” OR “loss avers*” OR “prospect theory” OR “expected utility” OR “risk toleran*” OR “risk preference*” OR “risk neutral” OR “risk attitude*”; and the following keywords in the second search field: “cognitive abilit*” OR “intelligence” OR “IQ” OR “cognitive skills” OR “mental abilit*” OR “cognitive function*” OR “cognitive performance” OR “intelligence quotient” OR “general mental abilit*” OR “cognitive capacit*” OR “mental capacit*” OR “intellectual function*”. The keywords from the two search fields were combined using the Boolean operator “AND”, leading to the final search string presented below: (“risk avers*” OR “loss avers*” OR “prospect theory” OR “expected utility” OR “risk toleran*” OR “risk preference*” OR “risk neutral” OR “risk attitude*”) AND (“cognitive abilit*” OR “intelligence” OR “IQ” OR “cognitive skills” OR “mental abilit*” OR “cognitive function*” OR “cognitive performance” OR “intelligence quotient” OR “general mental abilit*” OR “cognitive capacit*” OR “mental capacit*” OR “intellectual function*”)

The search was limited to studies written in English published from 1900 to 2018 and yielded a total of 692 hits. Next, Scopus was searched using the same combination of keywords in first and second search-field. The Scopus search was also limited to studies written in English, published from 1900 to 2018 and yielded a total of 658 hits. Finally, four independent searches on Google Scholar were conducted using the keywords: (1) “risk aversion” AND “cognitive ability”; (2) “risk aversion” AND “intelligence”; (3) “risk aversion” AND “mental ability”; (4) “risk aversion” AND “cognitive skills”. Each independent Google Scholar search resulted in somewhere between 625 and 19,900 hits, of which Google Scholar displayed the first thousand. All searches were conducted from 03.12.2018 to 11.12.2018. To supplement the electronic search, a manual search of reference lists of key empirical and theoretical articles was performed. The manual search yielded no additional studies. For all studies identified as relevant, title and abstract were screened for appropriate content and a total of 633 studies were extracted for full text screening. For an overview of the literature search process see Figure 1.

Studies were included for data extraction and coding if they reported either Pearson´s r, Spearman´s rho, means and standard deviations (i.e., descriptive statistics), or beta-coefficients for the relationship between cognitive ability and risk aversion. Studies were excluded if they (a) investigated decision-making under ambiguity, (b) relied on self-report measures of risk aversion, (c) used academic performance, literacy, reading proficiency, financial literacy, or educational attainment as proxies for cognitive ability, or (d) solely relied on participants experiencing any form of mental health problems or cognitive impairment. After carefully reviewing all 633 studies based on the inclusion and exclusion criteria, 287 studies were selected for coding and data extraction. More specifically, 111 studies were excluded because they relied upon self-report measures of risk aversion, while 114 studies were excluded for using either academic performance, literacy, reading proficiency, financial literacy or educational attainment as proxies for cognitive ability. Another 107 studies were excluded because they did not report data on either cognitive ability, risk aversion or both. Three studies were excluded because data were available only for participants with mental health problems or cognitive impairment. Finally, 11 studies were excluded for investigating decision-making under ambiguity.

In order to obtain as much data as possible, all corresponding authors were contacted via email and asked to provide the raw data or any relevant information on the relationship between cognitive ability and risk aversion in all three domains. The response rate was approximately 29%. Next, data was extracted from the remaining 205 studies from which the raw data was not obtained. Following, Peterson and Brown (2005), Pearson’s r was imputed from beta coefficients using the following formula whenever necessary: r = β + .05λ, where λ = 1 if β > 0 and λ = 0 if β < 0. In cases where only means and standard deviations were reported, Pearson´s r was computed by using the formulas provided by Borenstein et al. (2009). Whenever data for the same participants was reported across multiple outcomes, effect sizes were combined, in line with guidelines provided by Borenstein and colleagues (2009). In 134 studies out of the 287 studies included for data extraction, the information reported on the relationship between cognitive ability and risk aversion was insufficient. That is, even though these studies appeared to contain data on both cognitive ability and risk aversion neither Pearson´s r, Spearman’s rho, nor the data necessary to impute Pearson´s r were reported. Hence, data was available from 153 articles. Among these, several had overlapping data. To avoid using the same data multiple times, only one study per data set was included in the final analysis. In total, 97 studies were included for meta-analysis in the domain of gains, 41 in the mixed domain, and 12 in the domain of losses.

To allow for moderator analysis, studies were coded based on several different features. First, all studies were coded based on sample characteristics, including mean age of the participants, male to female ratio, and sample type (i.e., student, community or children). Second, studies were coded based on the class of decision task used to measure risk aversion. More specifically, each decision task was categorized based on whether it was incentivized, the probabilities and payoffs were varied or kept constant and if there was a certain option or not. The percentage of possible risk averse choices (i.e., the percentage of choices in which the riskier option had equal or higher expected value than the safer option) was also calculated if possible. Third, in order to investigate the extent to which the study purpose influenced results, all studies were coded based on whether or not one of their primary objectives was to investigate the relationship between cognitive ability and risk aversion. Fourth, studies were coded based on the psychometric measure used to assess cognitive ability (as described shortly), and whether or not participants received payment for participating in the experiment.

Figure 1: Overview of the literature search.

All studies included measured cognitive ability with one of the following psychometric measures: Cognitive Reflection Task (CRT), Raven´s Progressive Matrices (RPM), numeracy tests (NUM), working memory capacity tests (WMC), or cognitive ability test batteries (CATB).

CRT is a three-item instrument designed to measure cognitive ability and reflective thinking (Frederick, 2005). The task is frequently used in experimental research within the field of economics (e.g., Albaity, Rahman, & Shahidul, 2014; Corgnet et al., 2016; Deppe et al., 2015) and has been associated with other measures of cognitive ability such as the Wonderlic Personnel Test (Frederick, 2005).

RPM is a widely recognized nonverbal measure of fluid intelligence which has been used across a wide range of disciplines (Carpenter, Just & Shell, 1990; Raven, 2000). It consists of 3 x 3 matrices, in which the bottom right figure is missing and must be identified among several alternatives. The test-taker is instructed to look across the rows and/or down the columns to find a pattern and determine the missing entry. Importantly, the difficulty of the matrices is gradually increased, so that it requires greater mental capacity to determine the missing entry for each consecutive matrix (Raven, 2000).

NUM refers to a variety of tests designed to measure numerical ability. NUM usually consists of a range of mathematical problems to be solved without using a calculator (e.g., Cokely, Galesic, Schulz, Ghazal & Garcia-Retamero, 2012; Lipkus, Samsa & Rimer, 2001; Weller et al., 2013). Numerical ability has consistently been linked with numerous cognitive ability measures (e.g., Cokely et al., 2012; Cokely & Kelley, 2009; Del Missier, Mäntylä & De Bruin, 2012; Liberali, Reyna, Furlan, Stein & Pardo, 2012), and can be considered a reasonable measure of cognitive ability.

WMC typically consist of a set of tasks where the participant is asked to recall a number of items while performing an attention-demanding assignment (Engle, 2002). Working memory capacity has consistently been found to be highly correlated with general intelligence (Conway et al., 2003; Kyllonen & Christal, 1990), and is believed to be involved in a wide range of complex cognitive operations, such as comprehension, reasoning and problem solving (Conway et al., 2005; Engle, 2002).

CATB refers to comprehensive measures of intelligence where several instruments are used to assess different aspects of an individual’s cognitive ability. Common examples of such measures are the Wechsler Adult Intelligence Scale (WAIS; Wechsler, 2008), and the Stanford-Binet Intelligence Scale (SBIS; Roid, 2003), which both consist of no less than ten subtests (DiStefano & Dombrowski, 2006; Roid, 2003; Wechsler, 2008). Although CATB´s provide a comprehensive measure of cognitive ability, it is often not feasible to use such measures in experimental research, as they are time consuming and difficult to administer. Instead, most researchers either adopt a small number of subtests from a well-established CATB, or construct a less time consuming CATB by combining a few commonly used cognitive ability measures such as those mentioned above (e.g., RPM, CRT, NUM WMC, etc.). Accordingly, CATB will in this study refer to any measure utilizing more than one instrument to assess cognitive ability.

Across all three domains risk aversion was measured with one of the following decisions tasks: Bomb Risk Elicitation Task (BRET), Decision Task Battery (DTB), Eckel-Grossman Risk Task (EGRT), Ellsberg Urn Risk Task (EURT), Gift Gambling Task (GGT), Income Gambling Task (IGT), Lottery Task (LT), Multiple Price List (MPL), One-shot Gambling Task (OGT), Sabater-Grande-Georgantzis Lottery Panel (SGG), Wheel of Fortune Task (WFT), Cups Task (CT), Portfolio Choice Task (PCT), Budget Line Allocation Task (BLAT), Cambridge Gambling Task (CGT), Gneezy-Potters Investment Task (GPIT) or Adaptive Lottery Task (ALT). Specifically, risk aversion was measured with 13 different decision tasks in the domain of gains (i.e. ALT, BRET, CT, DTB, EGRT, EURT, GGT, IGT, LT, MPL, OGT, SGG, WTF), 12 in the mixed domain (i.e., ALT, BLAT, CGT, DTB, EGRT, GPIT, IGT, LT, MPL, OGT, PCT, SGG), and 6 in the domain of losses (i.e., ALT, CT, EGRT, GGT, LT, MPL).

BRET is a dynamic real time elicitation task in which the participant is required to decide how many boxes to collect in a matrix containing 100 boxes, one of which hides a bomb (Crosetto & Filippin, 2013). The payoff of each box collected is exactly the same. Hence, the potential earning increases linearly. In case the box with the bomb is collected, the payoff for the whole round is zero. As all outcomes, as well as the probabilities associated with each outcome, is fully specified, BRET allows for a good estimation of individual risk preferences in the domain of gains, simply by counting the number of boxes collected (Crosetto & Filippin, 2013; Holzmeister & Pfurtscheller, 2016).

EGRT is a simple risk elicitation method in which the participant is asked to choose between one of six gambles (Dave, Eckel, Johnson & Rojas, 2010; Eckel & Grossman, 2008). Each gamble typically involves a 50% chance of winning a low payoff and a 50% chance of winning a high payoff. One of the gambles is a sure thing, in which the low and high payoff is exactly equal. The gambles are designed so that the expected payoff increases linearly with risk, as represented by the standard deviation (Charness, Gneezy & Imas, 2013). A risk averse individual should thus choose gambles with lower standard deviations whereas a risk neutral individual should choose the gamble with the highest expected return.

In EURT, participants are presented with an urn containing five blue and five yellow balls. For each round a random ball is drawn from the urn, and participants are asked to guess its color. If the participants guess correctly, they win a specified amount of money. Before the ball is drawn, however, each participant is asked to indicate the price they are willing to sell the bet for. A computer then generates a random offer to buy the bet. If this sum is higher than the minimum selling price set by the participant, the bet is sold and no ball is drawn from the urn. If the offer is lower than the minimum selling price, a ball is drawn and the bet is carried out. Risk aversion is inferred based on the minimum selling price set by the participant. A high selling price indicates risk tolerance while a low selling price suggests risk aversion (Borghans, Heckman, Golsteyn & Meijers, 2009).

The GGT is a simple decision task often used to elicit risk preferences among children (Levin & Hart, 2003). The participant is presented with four identical boxes, two of which are placed to the left of the participant and two of which are placed to the right. Under each box on the left side, a small gift is hidden, whereas two small gifts are hidden under one of the boxes on the right. Risk aversion is measured by asking the participant to indicate from which side he or she would like to draw a box. As the expected value of the two sides are equal, participants are considered risk averse if they prefer to draw a box from the left side.

MPL refers to a class of decision tasks in which participants are asked to choose between two different lotteries (Dohmen et al., 2018). MPL generally comes in two formats: The first format involves two lotteries in which the potential outcome of each lottery are kept constant, while the probabilities of the outcomes vary from row to row (e.g., Holt & Laury, 2002); the second format involves a safe and a risky lottery, in which the probabilities of outcomes are kept constant, while the potential outcomes of either the safe or risky lottery are gradually increased (e.g. Andersson et al., 2016). Risk preferences are inferred either based on the number of risky choices made, or on the participant’s unique switching point (i.e., the point where the participant switched from the risky to the safe lottery).

OGT refers to a simple type of decision tasks in which the participant is presented with only one choice between a safe/risky option and a riskier option with equal or higher expected value. In this task, risk aversion is inferred based on whether the participant chose the riskiest option or not.

In IGT participants are asked to consider several hypothetical income gambles. More specifically, the participants are asked to choose between a certain income for some specified amount of time or a gamble in which this income is either increased or decreased by some amount with probability p and 1–p (e.g., Barsky, Juster, Kimball & Shapiro, 1997; Beauchamp et al., 2017). Based on the number of rejected gambles, individual risk preferences can be determined.

LT refers to any decision task in which the participants are asked to choose between a number of gambles sequentially. Each set of gambles can be constructed in a number of different ways so that the probabilities and payoffs associated with each gamble changes or are kept constant. Moreover, each gamble may differ with regard to whether the participants has to choose between two different gambles, or a certain option and a gamble. As with most decision tasks, risk aversion is inferred based on the number of risky and safe option chosen by the participant.

SGG is a standard risk elicitation task in which participants are asked to choose one gamble from four different lottery panels (Sabater-Grande & Georgantzis, 2002). Each panel consists of ten gambles with decreasing probabilities and increasing expected value. Consequently, if the participant chooses the first gamble in each lottery panel, he or she can be considered highly risk averse. If the participant, on the other hand, chooses the last gamble in each lottery panel he or she can be considered risk tolerant.

WFT is a visual gambling task in which the participants are asked to make a series of choices between pairs of fortune wheels (Blankenstein, Crone, van den Bos & van Duijvenvoorde, 2016). The first fortune wheel is always presented as a certain option that pays some specified amount of money. The second fortune wheel, on other hand, is presented as a risky option in which the magnitude of the monetary outcome and the probability of obtaining this outcome varies. Accordingly, risk aversion is inferred based on the number of times each participant prefers the first over the second fortune wheel.

CT is another visual gambling task in which participants are asked to choose between 54 gambles presented as two arrays of cups containing monetary payoffs (Levin, Weller, Pederson & Harshman, 2007). In each trial, participants are asked to decide from which of two arrays of two, three or five cups containing monetary payoffs they would like to draw a cup. One of the two arrays is a certain option in which all of the cups contain the same payoff whereas the second array is a risky option in which only one of the cups contains a monetary payoff. In some of the gambles, the risky option has the same expected value as the certain option while in others the expected value is either higher or lower for the risky option. Risk aversion is estimated based on the number of times the participant decides to draw a cup from the certain array.

PCT is a decision task in which the participants are asked to rank their most and least preferred investment options from a menu of three investment portfolios: safe, risky and intermediate (e.g., Bateman, Stevens & Lai, 2015). The safe option guarantees an annual return of x% while the risky option provides a mean annual return of x% + y% with a standard deviation of z%. The intermediate option is dynamically rebalanced so that 50% is invested in the safe and the risky option. The mean annual return of the intermediate option is, thus, the average of the safe and risky option with a standard deviation of z%/2. A highly risk averse investor would, in this setup, always prefer the safe option to the intermediate and risky option, as well as the intermediate option to the risky option. Consequently, risk aversion is estimated based on how each participant ranks the attractiveness of the three portfolios described above.

In BLAT participants are asked to allocate points between accounts x and y, which are represented visually on a two-dimensional budget line (Choi, Fisman, Gale & Kariv, 2007; Choi, Kariv, Müller & Silverman, 2014). After allocating points, either x or y is randomly chosen, and the participant receives the points he or she allocated to the chosen account, while all points in the other account is lost. On each budget line, there are three points: A, B and C. Point A is where the budget line hits the y-axis and represents allocating all points to the y account. Conversely, B is where the budget line hits the x-axis and represents allocating all points to the x account. Finally, point C, which lies on the 45-degree line, ensures a certain payoff and corresponds to an equal allocation between x and y. Importantly, the slope of the budget line AB is always chosen so that the payoff of choosing an allocation between A and C has a higher expected return than point C, whereas choosing an allocation between B and C has a lower expected return than C. Hence, an individual who is infinitely risk averse will always choose an allocation equal to C, whereas an individual who is less risk averse or risk seeking will choose an allocation between A and C or B and C, respectively. This makes it possible to estimate individual risk preferences based on the amount of points allocated between A and C, and B and C on the budget line.

GPIT is a classic investment task in which the participant have to decide how much to invest ($x), out of an initial endowment ($y), in a risky asset (e.g., Charness, Gneezy & Imas, 2013; Gneezy & Potters, 1997). The amount invested yields a dividend of $kx (k > 1) with probability p and is lost with probability 1–p. The money not invested ($y–x) is kept by the participant. The payoff of each choice is therefore $y–x+kx, with probability p, and $y–x with probability 1–p. In all cases k and p is chosen so that the expected value of investing is either higher or equal to the expected value of not investing. Risk aversion is estimated based on the amount invested, with lower amounts indicating higher levels of risk aversion.

In CGT a yellow token is hidden under one of ten blue or red boxes (e.g., Clark et al., 2008). The amount of red and blue boxes varies from trial to trial, so that the probability that the token is hidden under a blue or red box, changes. On each trial, participants have to decide how much to wager out of their current endowment, that the yellow token is hidden under either a red or a blue box. If the participant chooses the right color, the amount wagered is added to his or her current endowment. Conversely, if the participant chooses the wrong color the amount is lost. Just like in the GPIT, risk aversion is inferred based on the amount wagered on each trial.

ALT is similar to the standard LT, in which participants are asked to choose between a number of gambles sequentially. However, as opposed to the standard LT, the gambles in ALT is iteratively adapted based on the participant’s choices, allowing for a more efficient and precise estimation of individual risk preferences (e.g., Chapman, Snowberg, et al., 2018; Frey, Pedroni, Mata, Rieskamp & Hertwig, 2017).

Finally, DTB refers to measures of risk aversion relying on more than one single elicitation task. That is any measure in which two or more of the decision tasks described above were used to construct a composite score of risk aversion within the domain of gains, mixed or losses.

First, all effect sizes were converted into a common metric (i.e., correlation coefficients), as previously described. Correlations were defined as negative when people with higher cognitive ability were to be less risk averse. In line with the guidelines provided by Borenstein et al. (2009), all correlation coefficients were converted into Fisher’s z. Next, a random-effects model meta-analysis using the restricted maximum likelihood estimator (REML; Viechtbauer, 2005, 2010) was performed in order to investigate the relationship between cognitive ability and risk aversion for the domains of gains, mixed and losses. Moreover, two additional meta-analyses were conducted in each of these three domains, one using only males and one using only females. A random-effects model was chosen, as opposed to a fixed-effect model, because the assumptions behind the random-effects model tend to be more realistic (Borenstein et al., 2009; Cooper, 2010). Results from the meta-analyses is presented as a correlation, ρ, equivalent to Pearson’s r. Correlations ranging from .10 to .29, .30 to .49 and .50 to 1.00 are interpreted as weak, moderate and strong, respectively (Cohen, 1988).

In order to test for heterogeneity, Q and I2 statistics were calculated. The Q statistic was computed by summing the squared deviations of each study’s effect from the combined effect size, weighting each study by its inverse variance (Huedo-Medina, Sánchez-Meca, Marín-Martínez & Botella, 2006). The Q statistic tests for heterogeneity by testing the null hypothesis that all studies share a common effect size (Borenstein et al., 2009). Under the null hypothesis, the Q statistic follows a chi-square distribution with k–1 degrees of freedom, k being the number of studies included in the meta-analysis (Huedo-Medina et al., 2006). A significant Q indicates that true heterogeneity exists (Borenstein et al., 2009). The I2 statistic investigates the amount of true heterogeneity by dividing the result of the Q statistic and its degrees of freedom (k–1) by the Q value, and multiplying it by 100 (Huedo-Medina et al., 2006). Consequently, the I2 statistic can be interpreted as the percentage of total variance in a set of observed effect sizes due to true heterogeneity. Higgins, Thompson, Deeks and Altman (2003) suggest that I2 approximating 25%, 50%, and 75% can be considered as low, moderate, and high, respectively.

To investigate the impact of moderator variables, several meta-regressions were performed. Meta-regressions are analogous to standard regression analysis, and can, with appropriate coding, be used to examine the influence of both categorical and continuous moderator variables (Hedges & Pigott, 2004; Viechtbauer, 2010). All moderator analyses were performed independently, as testing multiple moderators simultaneously may lead to a mis-estimation of moderator effects, especially when the number of studies included is small (Steel & Kammeyer-Mueller, 2002).

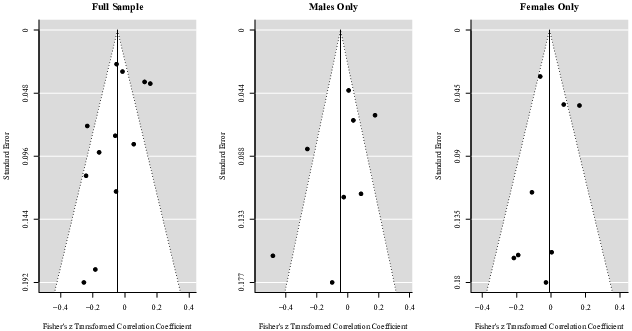

Publication bias, the tendency to leave out non-significant results and publish only positive results, was examined in two steps. First, it was visually assessed using a funnel plot of all studies included in the random-effects model meta-analysis. If no publication bias exists, the two sides of the funnel plot should be symmetrical (Borenstein et al., 2009; Rothstein, Sutton & Borenstein, 2006). That is, if no publication bias exists, the observed effect sizes should not be asymmetrically distributed around the combined effect size. Second, a rank correlation test (Begg & Mazumdar, 1994) and a regression test (Egger, Smith, Schneider & Minder, 1997) was performed to test for funnel plot asymmetry.

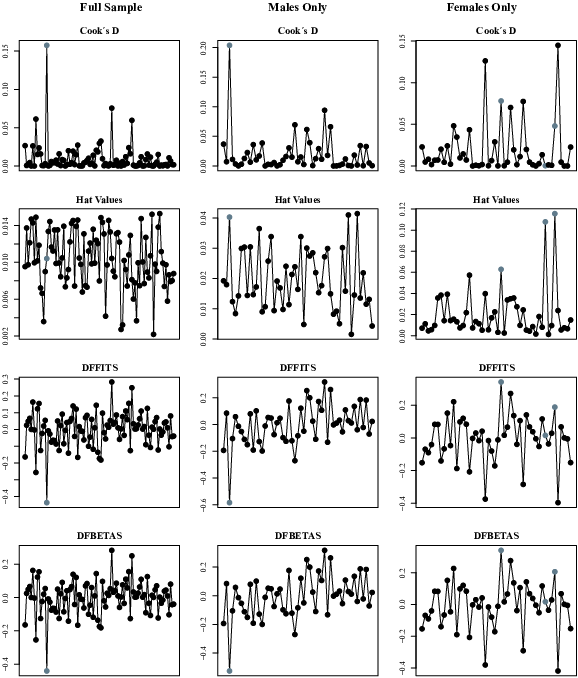

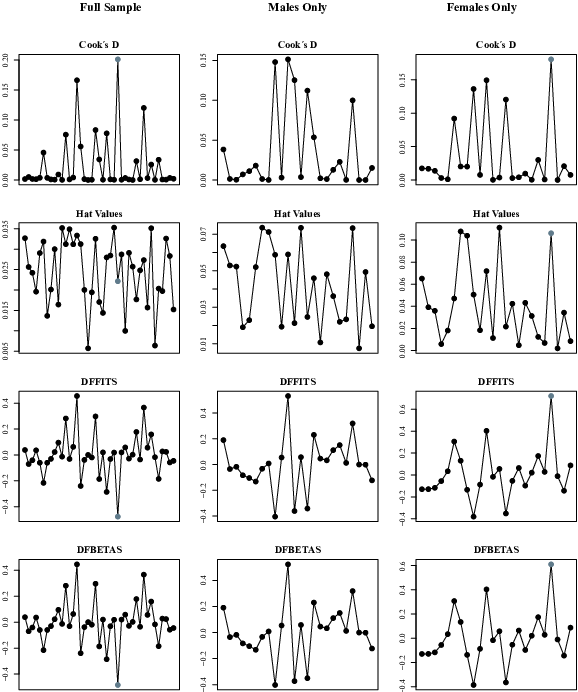

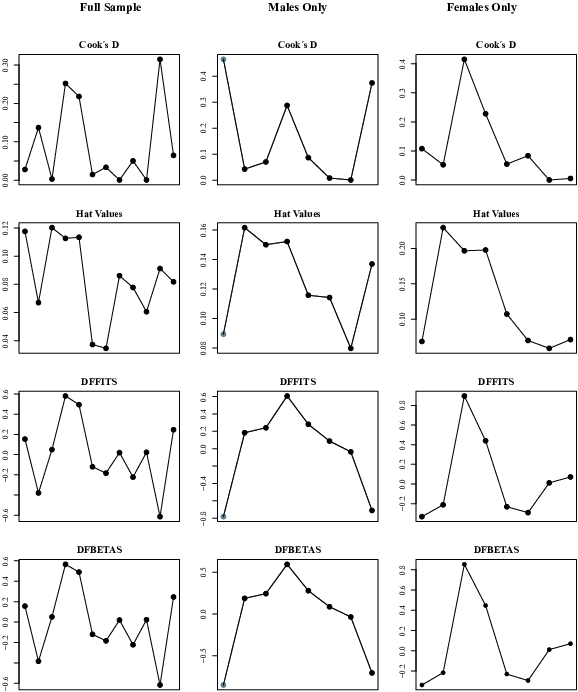

Finally, case deletion diagnostics were performed in order to identify any influential studies and/or possible outliers (Viechtbauer, 2010; Viechtbauer & Cheung, 2010). According to Viechtbauer (2010), studies might be considered either as influential or as outliers if one or more of the following statements are true: (a) the absolute DFFITS value is larger than 3√p/(k–p) where p is the number of model coefficients and k the number of studies; (b) the lower tail area of a chi-square distribution with p degrees of freedom cutoff by the Cook’s distance is larger than .50; (c) the hat value is larger than 3(p/k) or (d) the DFBETAS value is larger than 1. The DFFITS value is an estimate of how many standard deviations the predicted effect for the ith study changes after excluding the ith study from the model fitting. Cook´s distance is essentially the Mahalanobis distance between the full set of predicted values with or without the ith study included in the model fitting. The hat value is simply the ith diagonal element of the hat matrix, also known as the so-called leverage of the ith study. Finally, the DFBETAS value indicates how many standard deviations the estimated correlations coefficient changes after removing the ith study from the model fitting.

All statistical analyses were performed in R (R Core Team, 2017) with the following packages installed: metafor (Viechtbauer, 2010) and dplyr (Wickham, François, Henry & Müller, 2018).

As previously described, a total of 97 studies published between 2003 and 2018 were included for meta-analysis in the domain of gains (N = 90,723). The mean age of participants was available for 66 studies and ranged from 6.0 to 81.2 years with a mean of 29.5. Participants were either university, college or high school students in 56 of the 97 studies included. Out of the remaining 41 studies, 35 were based on various community samples, while 5 relied on samples of children. For the last study the specifics of the sample used was not available. In 35 studies there were more males than females, while the opposite was true in 42 studies. The male to female ratio was exactly 1.00 in one study while the proportion of males and females was unavailable for 19 studies. Risk aversion was measured using MPL in 45 studies, LT in 26, OGT in 7, DTB in 5, EGRT in 4 and BRET in 3. In the remaining 7 studies risk aversion was assessed with one of the following decision tasks: ALT, CT, EURT, GGT, IGT, SGG, and WFT. The decision task was fully incentivized in 23 studies, randomly incentivized in 47, and purely hypothetical in 14. Moreover, participants were paid for participation in 81 out of 97 studies. Information about whether the participants were paid and the extent to which the decision task was incentivized were unavailable in 16 and 13 studies, respectively. The average payment for the whole experiment ranged from $5 to $125 with a mean of $30. The average payment was, however, only available for 34 studies. Cognitive ability was measured using CATB in 36 studies, CRT in 30, RPM in 18, NUM in 12 and WMC in 1. Finally, in 24 of the 97 studies included, one of the primary purposes of the study was to investigate the relationship between cognitive ability and risk aversion. For an overview of the studies included for meta-analysis in the domain of gains see Table 1.

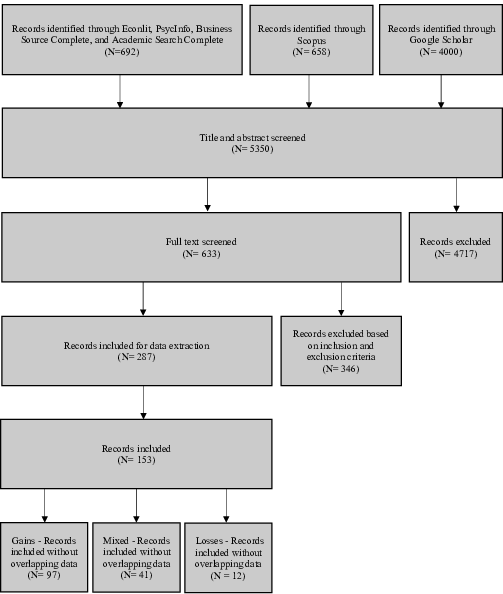

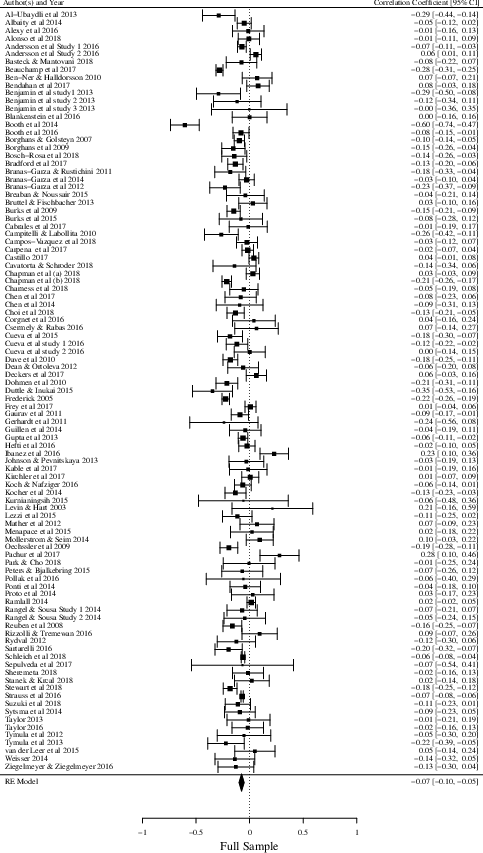

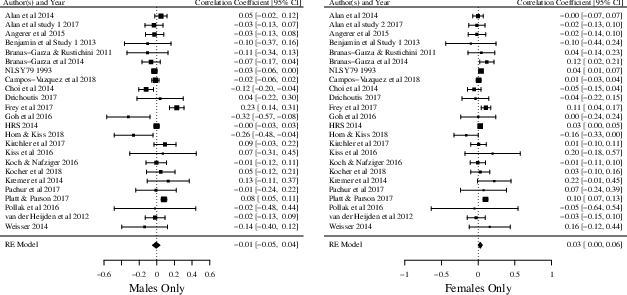

Results from the random-effects model meta-analysis suggest that there exist a weak but significant negative relationship between cognitive ability and risk aversion in the domain of gains (k = 97, ρ = −.07, Z = −6.11, p < .001, 95% CI [−.10, −.05]). Looking at the results for males (k = 51, ρ = −.09, Z = − 4.81, p < .001, 95% CI [−.12, −.05]) and females only (k = 48, ρ = −.05, Z = −4.39, p < .001, 95% CI [−.08, −.03]) a similar pattern emerges. The forest plots depicted in Figure 2 provides an overview of the studies included, their individual correlation coefficients with 95% confidence intervals, and the overall results from the random-effects model meta-analyses.

Figure 2: Forest plots for the domain of gains — full sample, males and females only.

Figure 2 continued.

The results from the Q statistics were highly significant for the full sample (Q = 612.83, df = 96, p <.001) as well as for males only (Q = 210.79, df = 50, p < .001), indicating the presence of true heterogeneity. The Q statistic for females only, however, was not significant (Q = 60.38, df = 47, p >.05), suggesting that only a small amount of true heterogeneity exist between the studies included when looking exclusively at the results for females. These results were further confirmed by the I2 statistics which indicated that the amount of total variance observed due to true heterogeneity was high for the full sample (I2 = 88.69%, 95% CI [83.49, 92.09]) and males only (I2 = 78.48%, 95% CI [60.85, 89.44]), but low for females (I2 = 33.56%, 95% CI [.00, 72.33]).

The results from the meta-regressions showed that none of the moderator variables had any influence on the relationship between cognitive ability and risk aversion in the domain of gains for the full sample and males only (see Table 2–3). Looking at the results for females only, the meta-regressions suggest that both the decision task used, and the payoff structure of the riskier choice explained a substantial amount of the observed heterogeneity (Table 4). Specifically, the relationship between cognitive ability and risk aversion is stronger when the payoff of the riskier choice is kept constant compared to when it changes. Even though the overall result of the meta-regressions suggests that the decision task used to measure risk aversion explains a substantial amount of the observed heterogeneity for females only, no single tasks appeared to significantly influence the relationship between cognitive ability and risk aversion.

A total of 41 studies published from 1993 to 2018 were included for meta-analysis in the mixed domain (N = 50,936). The mean age of participants was available for 27 studies and ranged from 8.9 to 75.4 years with a mean of 31.9. Participants were either university, college or high school students in 17 of 41 studies included. Out of the remaining 24 studies 18 were based on various community samples, while 6 relied on samples of children. In 12 studies there were more males than females, while the opposite was true in 18 studies. The male to female ratio was exactly 1.00 in one study while the proportion of males and females was not available for 10 studies. Risk aversion was measured using GPIT in 11 studies, LT in 9, and MPL in 8. ALT, BLAT, OGT and IGT were all used to measure risk aversion in 2 studies, while EGRT, CGT, DTB, PCT and SGG were used in the remaining 5 studies. The decision task was fully incentivized in 11 studies, randomly incentivized in 14, and purely hypothetical in 11. Moreover, participants were paid for participating in the experiment in 31 out 41 studies. Information about whether participants were paid for their participation and the extent to which the decision task was incentivized was unavailable in 10 and 5 studies, respectively. The average payment for the whole experiment ranged from $2 to $58 with a mean of $21. However, information about the average payment was only available for 10 studies. Cognitive ability was measured using CATB in 19 studies, CRT in 9, RPM in 8, and NUM in 5. Finally, in 5 of the 41 studies included, one of the primary purposes of the study was to investigate the relationship between cognitive ability and risk aversion. For an overview of studies included for meta-analysis in the mixed domain see Table 5.

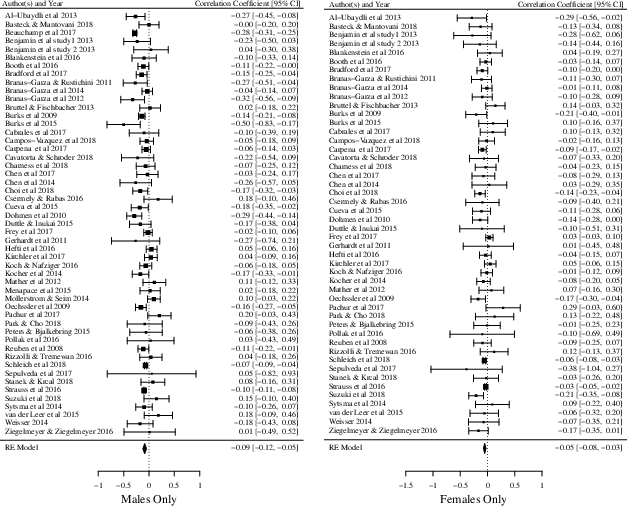

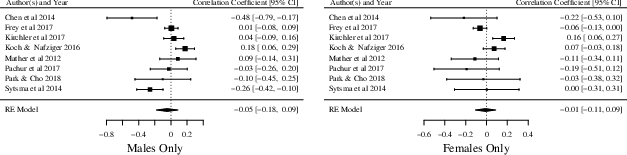

Results from the random-effects model meta-analysis indicate no relationship between cognitive ability and risk aversion in the mixed domain (k = 41, ρ = .01, Z = 0.82, p > .05, 95% CI [−.02, .04]). The same goes for the result for males only (k = 24, ρ = −.01, Z = −0.32, p > .05, 95% CI [−.05, .04]). However, the result for females only suggest a weak but significant positive relationship between cognitive ability and risk aversion in the mixed domain (k = 24, ρ = .03, Z = 2.15, p < .05, 95% CI [.00, .06]). The forest plots depicted in Figure 3 provide an overview of the included studies, their individual correlation coefficients with 95% confidence intervals, and the overall results from the random-effects model meta-analyses described above.

Figure 3: Forest plot for the mixed domain — full sample, males and females only.

Results from the Q statistics were highly significant for the full sample (Q = 247.07, df = 40, p < .001), males (Q = 86.42, df = 23, p < .001), and females only (Q = 45.57, df = 23, p < .01), indicating a substantial amount of true heterogeneity among the 41 studies included in the mixed domain. These results were further confirmed by the I2 statistics which indicated that the amount of total variance observed due to true heterogeneity was high for the full sample (I2 = 88.49%, 95% CI [79.25, 92.88]) and males (I2 = 80.74%, 95% CI [58.75, 92.55]), while moderate for females (I2 = 54.65%, 95% CI [7.97, 82.23).

The overall results from the meta-regression showed that only the cognitive ability measure and the decision task used had an influence on the relationship between cognitive ability and risk aversion in the mixed domain (Table 6). More specifically, the relationship between cognitive ability and risk aversion is positive when cognitive ability was measured with CATB, while increasingly negative when assessed by RPM, CRT and NUM. Similarly, the meta-regressions suggest that the relationship between cognitive ability and risk aversion is positive when risk aversion was measured using ALT, while less positive and even negative when one of the following decision tasks were utilized: CGT, MPL, IGT, OGT, LT, GPIT, BLAT, PCT or EGRT.

For males only, the decision task used, probabilities and whether or not there was a certain option were found to be significant predictors (Table 7). Specifically, the relationship between cognitive ability and risk aversion is positive when the probabilities of the decision task was changing as well as when there was no certain option, while negative when the opposite was true. Moreover, the relationship was found to be increasingly positive when risk aversion was measured using CGT and DTB.

For females only, cognitive ability measure, the decision task used, probabilities, and whether or not there was a certain option were significant predictors for the relationship of interest (Table 8.). More specifically, the relationship between cognitive ability and risk aversion is positive when cognitive ability was measured using CATB while increasingly negative when assessed by RPM and CRT. Similarly, the relationship is positive when risk aversion was measured using ALT, while moving toward negative when using GPIT and BLAT. Finally, the relationship between cognitive ability and risk aversion is stronger when there was no certain option and the probabilities were changing.

Figure 4: Forest plots in the domain of losses — full sample, males and females only

A total of 12 studies published from 2003 to 2018 were included for meta-analysis in the domain of losses (N = 4,544). The mean age of participants was available for 11 studies and ranged from 6.0 to 68.7 years with a mean of 32.1. Participants were either university, college or high school students in 4 of 12 studies. Out of the remaining 8 studies, 7 were based on various community samples, while one relied on samples of children. In 6 studies there were more males than females, while the opposite was true in 5 studies. For one study, the proportion of males and females was not available. Risk aversion was measured using LT in 6 studies and MPL in 2. In the remaining 4 studies risk aversion was assessed with one of the following decision tasks: ALT, CT, EGRT and GGT. The decision task was fully incentivized in 2 studies and randomly incentivized in 7. Moreover, participants were paid for participation in 10 out of 12 studies. Information about whether the participants were paid for their participation and the extent to which the decision task was incentivized were unavailable in 2 and 3 studies, respectively. The average payment for the whole experiment ranged from $9 to $25 with a mean of $15. The average payment was however only available for 3 studies. Cognitive ability was measured using CATB in 9 studies, CRT in 2 and RPM in 1. Finally, in 4 of the 12 studies included, one of the primary purposes of the study was to investigate the relationship between cognitive ability and risk aversion. For an overview of the studies included for meta-analysis in the domain of losses see Table 9.

Results from the random-effects model meta-analysis indicate no link between cognitive ability and risk aversion in the domain of losses (k = 12, ρ = −.05, Z = −1.10, p > .05, 95% CI [−.13, .04]). The story is the same for males only (k = 8, ρ = −.05, Z = −0.68, p > .05, 95% CI [−.18, .09]) and females only (k = 8, ρ = −.01, Z = −0.19, p > .05, 95% CI [−.11, .09]). The forest plots in Figure 4 provides an overview of the studies included, their individual correlation coefficients with 95% confidence intervals, and the overall results from the random-effects model meta-analyses described above.

The result from the Q statistics were significant for the full sample (Q = 50.63, df = 11, p < .001), males (Q = 29.18, df = 7, p < .001), and females only (Q = 19.10, df = 7, p < .01), indicating the existence of true heterogeneity. These results were further corroborated by the I2 statistics which indicated that the amount of total variance observed due to true heterogeneity was high for the full sample (I2 = 82.13%, 95% CI [56.30, 94.07]) and males (I2 = 81.15%, 95% CI [51.46, 96.43]) as well as moderate for females (I2 =63.26%, 95% CI [8.58, 90.88]).

The meta-regressions indicate that cognitive ability measure, probabilities, and the payoff structure of the riskier choice had a significant influence on the relationship between cognitive ability and risk aversion in the domain of losses (Table 10). More specifically, the relationship is positive when cognitive ability was measured using CRT, while increasingly negative when measured using either CATB or RPM. Furthermore, the relationship between cognitive ability and risk aversion is positive when the probability was kept constant at 50% and the payoff of the riskier option did not change, while negative when this was not the case.

For males only, both the payoff structure of the safer choice and the decision task used to measure risk aversion were significant predictors of the relationship of interest (Table 11). The relationship between cognitive ability and risk aversion is positive when risk aversion was measured using MPL, while increasingly negative when assessed with either EGRT or CT. Moreover, the relationship moved in the negative direction when the payoff of the safer choice was kept constant.

For females only, the percentage of risk averse choices, cognitive ability measure, probabilities, sample type, and the payoff structure of the riskier choice influenced the relationship between cognitive ability and risk aversion for males only (Table 12). The result for percentage of risk averse choices suggest that the relationship of interest moves in a negative direction as the percentage of risk averse choices increases. Moreover, the relationship between cognitive ability and risk aversion is negative when cognitive ability was measured with CATB, while going in the opposite direction when assessed by CRT. Conversely, the relationship is positive when the probability was kept constant at 50%, the sample consisted of students, and the payoff of the riskier choices was kept constant, while negative when this was not the case.

In order to compare the results for males and females across the domain of gains, mixed and losses, three separate meta-regressions were performed. The results indicate no significant differences between males and females in the domain of gains (QM (df = 1) = 2.43, p > .05), mixed (QM (df = 1) = 2.02, p >.05) or losses (QM (df = 1) = 0.19, p >.05). These results corroborate findings from Table 2, 6 and 10 that the male to female ratio has no influence on the relationship between cognitive ability and risk aversion in either of the three domains.

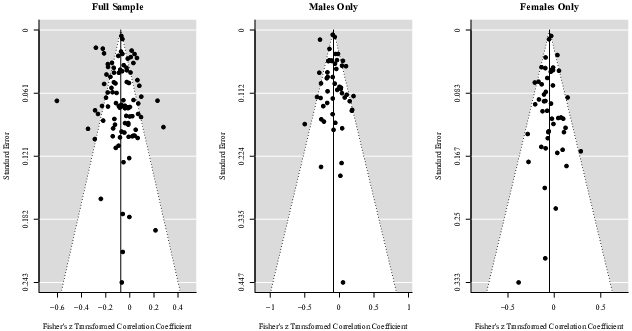

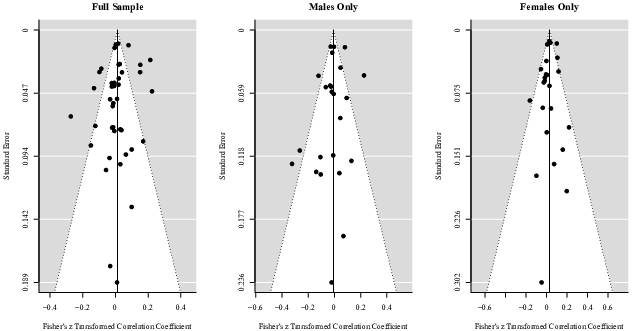

Nine funnel plots were created by plotting each effect size against the standard error of the observed effect sizes for the full sample, males and females only across all three domains (Figure 5–7). Visual examination of each funnel plot suggests that the observed effect sizes are not asymmetrically distributed around the combined effect size, implying that no publication bias exist. Furthermore, neither the rank correlation test nor the regression test for funnel plot asymmetry provides any substantial evidence of publication bias for the full sample (Gains: τ = −.01, p > .05, Z = 0.91, p > .05; Mixed: τ = .08, p > .05, Z = −0.97, p > .05; Losses: τ = −.12, p > .05; Z = −2.10, p < .05), males (Gains: τ = −.06, p > .05; Z = 0.64, p > .05; Mixed: τ = .08, p > .05; Z = −1.35, p > .05; Losses: τ =-.36, p > .05; Z = −1.56, p > .05), and females only (Gains: τ = .07, p > .05, Z = −0.11, p > .05; Mixed: τ = .14, p > .05; Z = −0.56, p > .05; Losses:τ =-.14, p > .05; Z = −1.29, p > .05) across the domain of gains, mixed and losses.

As shown in Figures 8–10, two studies were found to be influential when looking at the results for the full sample across the three decision domains. Similarly, when looking at the results for males only, two studies were identified as influential across the domain of gains, mixed and losses, while four studies could be regarded as influential for females only. The results did however not change substantially after removing all studies identified as influential from the full sample (Gains: k = 96, ρ = −.07, Z = −6.31, p < .001, 95% CI [−.09, −.05]; Mixed: k = 40, ρ = .02, Z = 1.35, p > .05, 95% CI [−.01, .05]), males (Gains: k = 50, ρ = −.08, Z = −4.94, p < .001, 95% CI [−.11, −.05]; Losses: k = 7, ρ = .00, Z = −0.00, p > .05, 95% CI [−.11, .11]) and females only (Gains: k = 45, ρ = −.06, Z = −4.39, p < .001, 95% CI [−.09, −.03]; Mixed: k = 23, ρ = .02, Z = 2.28, p < .05, 95% CI [.00, .04]).

In this study a systematic review and meta-analysis was conducted in order to empirically investigate the nature of the relationship between cognitive ability and risk aversion. A total of 97 studies (N=90,723) was included for meta-analysis in the domain of gains, 41 (N=50,936) in the mixed domain and 12 (N=4,544) in the domain of losses. The overall results from the random-effects model meta-analyses suggest that a weak, but significant relation between cognitive ability and risk aversion exist in the domain of gains. Thus, the current meta-analysis provides evidence that highly intelligent individuals tend to be less risk averse in the domain of gains. However, the strength of the relationship between cognitive ability and risk aversion was estimated to be rather weak (ρ = −.07), and not as strong as suggested by some previous studies. No evidence was found for a relationship between cognitive ability and risk aversion in the mixed domain or the domain of losses. Taken together, these results suggest that the relationship between cognitive ability and risk aversion is domain specific and present only for the domain of gains. Given the weak nature of this relationship, we should be cautious in drawing conclusions about its practical significance.

Interestingly, the relationship between cognitive ability and risk aversion appear to be quite stable across genders. That is, even though the relationship between cognitive ability and risk aversion appears to differ somewhat between males and females for the domains of gains (ρmale = −.09; ρfemale = −.05), mixed (ρmale = −.01; ρfemale = .03) and losses (ρmale = −.05; ρfemale = −.01), these differences were not found to be significant. This is important, as it suggests that the observation that females tend to be more risk averse than males (e.g., Charness & Gneezy, 2012; Croson & Gneezy, 2009), is probably not driven by gender differences in cognitive ability. Contrary, to the results from the full sample and males only, a significant positive relationship between cognitive ability and risk aversion was observed in the mixed domain for females only. This suggest that highly intelligent females tend to be more risk averse in the mixed domain, compared to females with lower cognitive ability. However, as with the negative correlation observed in the domain of gains, the relationship is very weak (ρ = .03), and, thus, potentially not of practical significance. Notably, the amount of true heterogeneity observed, were consistently higher for males as compared to females across all three domains (Gains [Imale2 = 78.48%, Ifemale2 =33.56%]; Mixed [Imale2 = 80.74%, Ifemale2 = 54.65%], Losses [Imale2 =81.15%, Ifemale2 = 63.26%]. This is an interesting result, as it suggests that the relationship between cognitive ability and risk aversion is considerably more stable and varies less across studies for females. A possible explanation is that males show more variability in cognitive ability than females (e.g., Arden & Plomin, 2006; Deary, 2003; Feingold, 1992; Lakin, 2013; Lohman & Lakin, 2009; Strand, Deary & Smith, 2006). This is in line with the greater male variability hypothesis, which states that males generally tend to differ more than females on a number of individual characteristics such as personality (Borkenau, McCrae, & Terracciano, 2013), creativity (He & Wong, 2011), and cognitive ability (Arden & Plomin, 2006; Deary, 2003; Feingold, 1992; Lakin, 2013; Lohman & Lakin, 2009; Strand et al., 2006). Consequently, the relationship between cognitive ability and risk aversion might be less stable across studies for males, because the sample of male participants in each study is more likely to vary in terms of cognitive ability. This is, likely due to the fact that the variation between samples depends partially on the amount of variability in the population from which they are drawn (Swinscow & Campbell, 2002).

The fact that the relationship between cognitive ability and risk aversion is non-existent or rather weak across all three domains suggest that risk preferences may reflect an independent construct which does not substantially overlap with intelligence. This interpretation is line with the conclusion drawn by Frey and colleagues (2017), who used several risk elicitation measures to extract a latent risk preference factor (R) which was not found to be associated with cognitive ability. This is very intriguing as cognitive ability has been found to be strongly related to how proficient people are at understanding and evaluating risk (Cokely et al., 2012). Consequently, in some cases there appear to be a gap between people’s ability to understand and evaluate risk, and their willingness to take risk. This gap could potentially have important real-world implications as it might lead some people who have a limited understanding of risk to take on too much of it, while others who do have the capabilities to properly evaluate risk might take on too little.

Compared to other meta-analyses linking cognitive ability to individual preferences, the effect sizes reported here are small. For instance, Shamosh and Gray (2008) found the mean correlation between cognitive ability and delayed discounting across 24 studies to be −.23, suggesting that highly intelligent individuals are more patient and have higher levels of self-control. Similarly, in a more recent meta-analysis Sharma, Bottom and Elfenbein (2013), found a positive mean correlation of .24 between cognitive ability and cooperative tendencies across five studies with a total of 1,123 participants. Hence, even though cognitive ability was not found to be strongly related to risk aversion in the present meta-analysis, it should still be regarded as an important variable that needs to be taken into consideration when investigating the antecedents of human decision making.

Overall, none of the moderator variables consistently influenced the relationship between cognitive ability and risk aversion across the domain of gains, mixed and losses. Although no clear pattern from the meta-regressions emerged, the following five moderators were found to be influential in more than one instance: the decision task used to measure risk aversion, the psychometric instrument used to assess cognitive ability, whether the payoff of the riskier choice and probabilities varied or were kept constant, and if there was a certain option or not. Specifically, the decision task used to measure risk aversion consistently moderate the relationship in the mixed domain, while also moderating the relationship in the domain of gains for females and the domain of losses for males. This result suggest that the relationship between cognitive ability and risk aversion is especially sensitive to how risk aversion is assessed in the mixed domain, while only somewhat sensitive to this in the domain of gains and losses.

Similarly, the psychometric measure used to assess cognitive ability was found to influence the relationship between cognitive ability and risk aversion for the full sample and females only in the mixed domain, and the domain of losses. As with the results for the decision task used to measure risk aversion, these results indicate that it somehow matters more how cognitive ability is assessed in the mixed domain and the domain of losses as compared to the domain of gains.

Whether the probabilities were varied or kept constant was not found to moderate the relationship between cognitive ability and risk aversion in the domain of gains, but to be somewhat influential in the mixed domain and the domain of losses. More precisely, it was found to influence the relationship between cognitive ability and risk aversion in the mixed domain for males and females only, as well as in the domain of losses for the full sample and females only. Likewise, whether or not there was a certain option was found to moderate the relationship in the mixed domain for males and females only. In both cases, the relationship between cognitive ability and risk aversion is positive when there was no certain option and less positive when the opposite was true. Finally, whether the payoff of the riskier option was kept constant or varied was found to moderate the relationship in the domain of gains for females, as well as in the domain of losses for the full sample and females only.

Collectively, these results indicate that the relationship between cognitive ability and risk aversion is more sensitive to the setup of the decision task, as well as how cognitive ability is measured in the mixed domain and the domain of losses.

In contrast to the results from Taylor (2013, 2016) and Sousa and Rangel (2014), no evidence of a hypothetical bias was observed. Hence, neither the existence nor the strength of the relationship between cognitive ability and risk aversion were found to be contingent on whether the decision task was incentivized or not. Furthermore, contrary to the results presented by Andersson et al. (2016), the number of possible risk averse choices was not found to moderate the relationship, except in the domain of losses for females only. These results suggest that the negative relationship observed between cognitive ability and risk aversion in the domain of gains is most likely not just an artefact of people with low cognitive ability making more random choice errors.

Across all three domains there was no substantial evidence of publication bias when looking at the funnel plots as well as the results from the rank correlation tests (Begg & Mazumdar, 1994) and the regression tests (Egger et al., 1997). Furthermore, the moderator analyses indicate that results were not influenced by whether or not one of the primary purposes of the study was to investigate the relationship between cognitive ability and risk aversion. All in all, these results strengthen the conclusions drawn from current meta-analysis, as they suggest that the estimated effect sizes are not considerably skewed in any direction due to publication bias.

This study is the first to systematically review and synthesize data on the relationship between cognitive ability and risk aversion. Furthermore, it is the first study that systematically explores the circumstances under which the relationship between cognitive ability and risk aversion exist, as well as whether specific factors moderate it. Despite these strengths, some limitations should be acknowledged.

First, several scholars have pointed out that many of the decision tasks most commonly used to elicit risk preferences are subject to a considerable amount of measurement error (Crosetto & Filippin, 2016; Frey et al., 2017; Pedroni et al., 2017). Given that the measurement error associated with any two measures naturally impose an upper limit for the correlation that can be expected between them (Muchinsky, 1996; Spearman, 1904b), it is likely that the current meta-analysis underestimates the true strength of the relationship between cognitive ability and risk aversion. In light of this fact, it would have been more appropriate to conduct the meta-analysis using disattenuated correlations (Osborne, 2008). Unfortunately, this was not possible, because the data needed to correct for attenuation (i.e., reliability estimates for both the decision task and cognitive ability measure) was rarely available or impossible to obtain. On the other hand, it is important to note that correcting for attenuation when the reliability estimate drops below .70 can lead to overestimation of the strength of the relationship of interest (Osborne, 2008). Accordingly, given that the measurement error, associated with many of the decision tasks commonly used to elicit risk preferences, is far from zero, correcting for attenuation would have been problematic in the context of the current meta-analysis.

Second, the systematic literature search as well as all the coding and data-extraction procedures was only performed by one individual. This is a limitation as it naturally increases the risk of human errors (Mathes, Klaßen & Pieper, 2017).

Third, recent evidence suggest that the imputation of beta values, proposed by Peterson and Brown (2005), could be somewhat problematic, as it has been found to produced overly small estimates of meta-analytic mean correlations (Roth, Le, Oh, Van Iddekinge & Bobko, 2018). Although this clearly presents a limitation, the meta-regressions suggests that the results were not significantly influenced by whether or not Pearson’s r was imputed using the Peterson and Brown (2005) formula. Hence, even though the imputation proposed by Peterson and Brown (2005) generally tend to produce overly small estimates of meta-analytic mean correlations (Roth et al., 2018), this does not appear to be a severe problem in the current meta-analysis.

Finally, only a few studies were identified and included for meta-analysis in the domain of losses, making the meta-analytic results for this domain less convincing compared to the results for the mixed domain and the domain of gains (Borenstein et al., 2009). Moreover, given that the number of studies included in domain of losses was so small (k = 12) the conclusions drawn from the meta-regressions should be taken with extreme caution (Steel & Kammeyer-Mueller, 2002; Thompson & Higgins, 2002).

Although the current meta-analysis sheds light on a number of important aspects concerning the relationship between cognitive ability and risk aversion, there is still much work to be done. Future studies should seek to gain a more comprehensive understanding of the circumstances under which a negative relationship between cognitive ability and risk aversion in the domain of gains exists. Looking at the results from the meta-regressions, it is clear that the moderator variables investigated do not sufficiently explain the high amount of heterogeneity observed in the domain of gains. Furthermore, additional studies are needed before any definite conclusions about the relationship between cognitive ability and risk aversion in the domain of losses can or should be drawn.

Another potentially fruitful line of research is to consider the possibility that the relationship between cognitive ability and risk aversion is nonlinear. In a recent study, Mandal and Roe (2014) used NLSY79 and HRS to investigate this possibility and found a quadratic pattern where respondents with the highest and lowest cognitive ability were most risk tolerant. This is intriguing, as it suggests that the inconsistent findings on the relationship between cognitive ability and risk aversion could be explained by the relationship being nonlinear. Following Mandal and Roe (2014) future studies should, therefore, set out to ask whether the relationship is indeed better described as quadratic and nonlinear.

Finally, as many of the decision tasks most commonly used to elicit risk preferences are subjected to a considerable amount of measurement error (Crosetto & Filippin, 2016; Frey et al., 2017; Pedroni et al., 2017), future studies should strive to develop new and better ways of measuring individual risk preferences. In this regard, a promising line of research is the recent development of adaptive elicitations tasks which have been found to reduce measurement error and outperform standard elicitation procedures on a number of important parameters (Chapman, Snowberg, et al., 2018; Toubia, Johnson, Evgeniou & Delquié, 2013). Another viable solution would be to use different risk elicitation tasks to extract a common risk factor (R), thereby increasing accuracy and reducing measurement error (Frey et al., 2017). Extending this possibility, risk could be measured in a variety of domains, both to study effects in each domain and to extract a cross-domain general factor (e.g., Harris, Jenkins & Glaser, 2006).

In conclusion, the current meta-analysis provides strong evidence for a significant but weak negative relationship between cognitive ability and risk aversion in the domain of gains. However, no significant relationship was found in the mixed domain or the domain of losses, suggesting that the relationship is domain specific. Importantly, no significant difference was observed between males and females across the domain of gains, mixed and losses. Moreover, none of the moderator variables investigated in this study consistently influenced the relationship between cognitive ability and risk aversion across all three domains. Future research should aim to gain a deeper understanding of the relationship between cognitive ability and risk aversion using more reliable measures to elicit risk preferences.

Al-Ubaydli, O., Jones, G., & Weel, J. (2013). Patience, cognitive skills, and coordination in the repeated stag hunt. Journal of Neuroscience, Psychology, and Economics, 6(4), 71–96. https://doi.org/10.1037/npe0000005.

Alan, S., Baydar, N., Boneva, T., Crossley, T. F., & Ertac, S. (2017). Transmission of risk preferences from mothers to daughters. Journal of Economic Behavior & Organization, 134, 60–77.

Alan, S., & Ertac, S. (2014). Good things come to those who (are taught how to) wait: Results from a randomized educational intervention on time preference. Available at SSRN 2566405.

Albaity, M., Rahman, M., & Shahidul, I. (2014). Cognitive reflection test and behavioral biases in Malaysia. Judgment and Decision Making, 9(2), 148–151.

Alexy, M., Georgantzis, N., Kácer, M., & Péliová, J. (2016). Risk attitude elicitation methods: Do they tell similar stories? Ekonomicky Casopis, 64(9), 847–877.

Alonso, J., Di Paolo, R., Ponti, G., & Sartarelli, M. (2018). Facts and Misconceptions about 2D: 4D, Social and Risk Preferences. Frontiers in Behavioral Neuroscience, 12, 22.

Andersson, O., Holm, H. J., Tyran, J.-R., & Wengström, E. (2016). Risk aversion relates to cognitive ability: Preferences or noise? Journal of the European Economic Association, 14(5), 1129–1154. https://doi.org/10.1111/jeea.12179.

Angerer, S., Lergetporer, P., Glätzle-Rützler, D., & Sutter, M. (2015). How to measure time preferences in children: a comparison of two methods. Journal of the Economic Science Association, 1(2), 158–169.

Ann Arbor, M. (2014). Health and Retirement Study, ([RAND HRS Longitudinal Fil 2014 (v.2))]) public use dataset. Produced and Distributed by the University of Michigan with Funding from the National Institute on Aging (Grant Number NIA U01AG009740).

Arden, R., & Plomin, R. (2006). Sex differences in variance of intelligence across childhood. Personality and Individual Differences, 41(1), 39–48. https://doi.org/10.1016/j.paid.2005.11.027.

Barsky, R. B., Juster, F. T., Kimball, M. S., & Shapiro, M. D. (1997). Preference parameters and behavioral heterogeneity: An experimental approach in the health and retirement study. The Quarterly Journal of Economics, 112(2), 537–579.

Basteck, C., & Mantovani, M. (2018). Cognitive ability and games of school choice. Games and Economic Behavior, 109, 156–183.

Bateman, H., Stevens, R., & Lai, A. (2015). Risk information and retirement investment choice mistakes under Prospect Theory. Journal of Behavioral Finance, 16(4), 279–296. https://doi.org/10.1080/15427560.2015.1095749.

Beauchamp, J. P., Cesarini, D., & Johannesson, M. (2017). The psychometric and empirical properties of measures of risk preferences. Journal of Risk and Uncertainty, 54(3), 203–237. https://doi.org/10.1007/s11166-017-9261-3.

Begg, C. B., & Mazumdar, M. (1994). Operating characteristics of a rank correlation test for publication bias. Biometrics, 1088–1101.

Ben-Ner, A., & Halldorsson, F. (2010). Trusting and trustworthiness: What are they, how to measure them, and what affects them. Journal of Economic Psychology, 31(1), 64–79.

Bendahan, S., Goette, L., Thoresen, J., Loued-Khenissi, L., Hollis, F., & Sandi, C. (2017). Acute stress alters individual risk taking in a time-dependent manner and leads to anti-social risk. European Journal of Neuroscience, 45(7), 877–885.

Benjamin, D. J., Brown, S. A., & Shapiro, J. M. (2013). Who is ‘behavioral’? Cognitive ability and anomalous preferences. Journal of the European Economic Association, 11(6), 1231–1255.

Bergman, O., Ellingsen, T., Johannesson, M., & Svensson, C. (2010). Anchoring and cognitive ability. Economics Letters, 107(1), 66–68.

Blankenstein, N. E., Crone, E. A., van den Bos, W., & van Duijvenvoorde, A. C. K. (2016). Dealing with uncertainty: Testing risk- and ambiguity-attitude across adolescence. Developmental Neuropsychology, 41(1–2), 77–92. https://doi.org/10.1080/87565641.2016.1158265.

Booth, A., Cardona-Sosa, L., & Nolen, P. (2014). Gender differences in risk aversion: Do single-sex environments affect their development? Journal of Economic Behavior & Organization, 99, 126–154. https://doi.org/10.1016/j.jebo.2013.12.017.

Booth, A., Fan, E., Meng, X., & Zhang, D. (2016). Gender differences in willingness to compete: The role of culture and institutions. IZA Discussion Papers, No. 10364, Institute for the Study of Labor (IZA), Bonn. Retrieved from https://www.econstor.eu/handle/10419/149223.

Borenstein, M., Hedges, L. V., Higgins, J. P. T., & Rothstein, H. R. (2009). Introduction to meta-analysis (1st ed.). The Atrium, Southern Gate, Chichester, West Sussex, PO19 8SQ, United Kingdom: John Wiley and Sons Ltd.

Borghans, L., & Golsteyn, B. H. H. (2007). Are courses chosen to reduce skill-deficiencies? an experimental approach. Working paper). Maastricht University, Research Centre for Education and the Labour Market (ROA

Borghans, L., Heckman, J. J., Golsteyn, B. H. H., & Meijers, H. (2009). Gender differences in risk aversion and ambiguity aversion. Journal of the European Economic Association, 7(2–3), 649–658.

Borkenau, P., McCrae, R. R., & Terracciano, A. (2013). Do men vary more than women in personality? A study in 51 cultures. Journal of Research in Personality, 47(2), 135–144. https://doi.org/10.1016/j.jrp.2012.12.001.

Bosch-Rosa, C., Meissner, T., & Bosch-Domènech, A. (2018). Cognitive bubbles. Experimental Economics, 21(1), 132–153.

Bradford, D., Courtemanche, C., Heutel, G., McAlvanah, P., & Ruhm, C. (2017). Time preferences and consumer behavior. Journal of Risk and Uncertainty, 55(2–3), 119–145.

Branas-Garza, P., Espín, A. M., & Neuman, S. (2014). Religious pro-sociality? Experimental evidence from a sample of 766 Spaniards. PloS One, 9(8), e104685.

Brañas-Garza, P., Garcia-Munoz, T., & González, R. H. (2012). Cognitive effort in the beauty contest game. Journal of Economic Behavior & Organization, 83(2), 254–260.