The skill element in decision making under uncertainty:

Control or competence?

Adam S. Goodie1

and Diana L. Young

University of Georgia

Judgment and Decision Making,

vol. 2, no. 3, June 2007, pp. 189-203,

Abstract

Many natural decisions contain an element of skill. Modern conceptions

of the skill component include control (Goodie, 2003) and competence

(Heath & Tversky, 1991). The control hypothesis states that a

task's skill component (the sensitivity of

the task to skill) affects decision making; the competence hypothesis

states decision making is affected only if the participant possesses

the skill. Three experiments compared risk taking patterns between two

groups. One group faced bets on random events, and another group faced

bets on their answers to general knowledge questions, which is a task

characterized by control. In Experiment 1, control increased risk

taking markedly with all statistical properties held constant. In

Experiment 2, decisions made in domains of varying difficulty, and by

individuals of varying ability, yielded further qualified support for

the role of competence. In Experiment 3, the role of control was

replicated, and participants' perceptions of the

differences in group treatments aligned more with the implications of

the control hypothesis than with the competence hypothesis. Results

offered support for the control hypothesis across a range of

competence.

Keywords: control, competence, decision making, choice, betting, risk,

overconfidence, college students.

1 Introduction

Decision researchers know a great deal about the terms of risk that

people will accept and reject on random events such as the drawing of a

lottery number, rolling a die, or pulling a poker chip from a bookbag.

Less is known about how individuals accept or reject risk when they are

betting on their own golf putts, stock picks, organizational decisions

or answers to trivia questions.

Researchers readily build models of decision making around risky

decisions based on random events. Much decision research is analogous

to psychophysical perception research, relating psychological events

to objective criteria. A bookbag with 70 percent white and 30 percent

red poker chips presents a clear objective criterion to which

subjective perceptions may readily be compared. Sinking a free throw

does not present such a clear criterion with regard to its associated

probabilities. For this reason, researchers have difficulty in

evaluating performance relative to a normative criterion when the task

is assessing the probability of a made free throw, as well as in

establishing valid lawful relationships between relevant probabilities

and decisions.

1.1 Ambiguity and skill

Ellsberg (1961) and many others have found that people are generally

ambiguity averse; in the domain of gains, people prefer a prospect in

which probabilities of possible outcomes are known to a prospect in

which probabilities of the same outcomes are not stated (ambiguous) but

have the same average value. The major exception to this is at very low

probabilities, where ambiguity is preferred. In the domain of losses,

these preferences are reversed.

Examination of the effect of a skill element constitutes a special case

of ambiguity. What is Shaquille

O'Neal's probability of making his next

free throw? At the conclusion of the 2006-07 season, his career free

throw rate was 52.5%, but his free throw rate for the season was only

42.2%. At his next free throw opportunity, he may be suffering from

the flu, or coming off a terrible game, or on a hot streak, or he may

merely believe he's on a hot streak (Gilovich,

Vallone, & Tversky, 1985). Unlike a lottery draw, in which it is

easier to construct a reasonable estimate of the probability of winning

(for example, by reading the ticket), the sample space for a successful

free throw is not clearly defined. In other words, the prediction of

performance is variable over time in a skilled task, hence it is more

difficult to predict on the basis of past performance. In fact, most

definitions of skill state or imply that the person exerting skill can

change the probability of success.

The existing evidence suggests that a skilled task that determines an

uncertain outcome has an effect on probability assessment and decision

making that is distinct from that of ambiguity alone. For example, in

demonstrating the illusion of control,

Langer (1975) showed that people responded differently to vague

likelihoods when certain superficial characteristics of the prospects

were distorted, for example when the familiar symbols of a deck of

cards were replaced by unfamiliar symbols, or when participants were

permitted to practice on a random mechanism similar to a roulette

wheel. Langer argued that the changes in the appearance of a skill

component caused changes in responses. Confidence ratings, bet

acceptance and bet amounts were all affected by apparent control,

although the illusion of control is not robust to multi-shot gambles

(Koehler, Gibbs, & Hogarth, 1994). Participants bet more when given

skill-relevant manipulations such as being able to choose whether to

receive more cards in a simulated blackjack game, but not when given

skill-irrelevant manipulations such as choosing a different dealer

(Chau & Phillips, 1995). Also, participants high in desire for control

bet more than those low in desire for control on events over which they

had falsely perceived control. Those high in desire for control bet

less than others on events over which they did not have illusory

control (Burger & Schnerring, 1982).

1.2 Control and competence

Recent research has advanced two major conceptions of the role of skill

in decision making: competence (Heath & Tversky, 1991) and control

(Goodie, 2003). These conceptions have important commonalities, sharing

an emphasis on the role that the skill component of a task plays in

shaping decision making under uncertainty (apart from the probability

and magnitude of possible outcomes. The control hypothesis claims that

people bet more when skill makes a difference; the competence

hypothesis claims the same effect but only when an individual possesses

the relevant skill. Control is a property of the task: if the task

requires actions that can be learned, then it is characterized by

control, even if a participant has not yet learned the skill.

Competence, on the other hand, is an interactive characteristic of both

the task and the person: competence exists only if the task both can be

learned (the task component) and has been learned (the person

component).

Heath and Tversky (1991) argued that people prefer to bet on questions

about knowledge topics in which they feel competent rather than

incompetent. In their studies, participants chose to bet on either the

correctness of their answer to a general knowledge question or a random

event whose probability matched their previously stated confidence,

with identical payoffs in each bet offer. Across an assortment of

situations, when betting on questions drawn from intermixed domains,

the proportion of times that participants chose to bet on their

knowledge was a steeply increasing function of the probability of

winning (Experiments 1 and 3). Because confidence consistently exceeded

accuracy in these experiments, betting on a random event whose

probability of winning was equal to confidence was more likely to win

than betting on the belief itself, and Heath and Tversky (1991) noted

that the acceptance of knowledge-based bets over random bets resulted

in a 15% loss of expected earnings.

Heath and Tversky then (Experiment 4) tested the competence hypothesis

by drawing questions from discrete domains in which participants

believed themselves to be either competent or incompetent. They

observed that, with subjective probability held constant, participants

displayed a consistent behavioral pattern: bets in a domain of

competence were preferred to bets on random events, which in turn were

preferred to bets in a domain of incompetence. They concluded that

people seek out ambiguity in domains of competence but avoid it in

areas of incompetence.

Fox and Tversky (1995; Fox & Weber, 2002; see also Chow & Sarin, 2001)

presented a companion to the competence hypothesis, the comparative

ignorance hypothesis, positing that relative knowledge affects

decisions most strongly when the contrast between conditions of greater

and lesser competence is brought to the decision

maker's attention.

These findings are notably contrary to the early ambiguity findings

with random events: when evaluating bets on vaguely probable events

with a skill component, participants preferred the ambiguous (skilled)

option at high probabilities but preferred the unambiguous (random)

option at low probabilities. However, the evidence specifically in

support of the control hypothesis remains limited to Heath and

Tversky's Experiment 4 comparing just two domains

under unusual selection techniques, which are discussed at more length

below.

More recent studies (Goodie, 2003) assessed risk attitude by pitting a

bet on knowledge item against no bet at all, rather than a bet on a

random event of equivalent probability. Goodie constructed bets on

knowledge items to be fair, having zero average marginal value if

confidence was well calibrated. In the first two experiments, bet

acceptance sharply increased as confidence increased for knowledge

bets, bearing a striking resemblance to the comparable data obtained by

Heath and Tversky (1991) when using mixed-domain questions. In

Experiment 3, one group considered bets on their knowledge. The other

groups considered bets on events that appeared random to participants

but that Goodie constructed to be identical in every statistical way to

bets on knowledge. Participants accepted more bets on random events at

low probabilities and more bets on their knowledge at high

probabilities, revealing the anticipated crossover effect.

An important difference arises between studies that utilize questions

drawn from a single domain (e.g., U.S. history) and those that use

questions from mixed domains (e.g., Greek mythology, U.S. history, and

sports). As Heath and Tversky (1991) noted in discussing the

differences between single and mixed domains, low confidence items in

mixed-domain populations will systematically include more questions

from low-competence domains. Similarly, Gigerenzer (1991) noted the

importance of utilizing single-domain questions in assessing confidence

in answers. In a mixed-domain set of general knowledge questions, the

methods used by the decision maker to generate confidence assessments

become uninterpretable because the decision maker may be using a

different reference set than the experimenter. Asking participants

questions in a single domain allows for more reliable representations

of confidence across all questions asked.

There is reason to expect that control per se influences decision

making. Skinner (1996), in a major review of the literature, notes that

"[w]hen people perceive that they have a high degree

of control, they exert effort, try hard, initiate action, and persist

in the face of failures and setbacks; they evince interest, optimism,

sustained attention, problem solving, and an action

orientation" (p. 556, cf. Seligman, 1975). Where

control prevails, a prospect with negative expected value, narrowly

conceived, might also be an opportunity to learn new skill that will

result in future prospects with positive value, and might therefore be

worth accepting. This is an interesting complement to the normative

argument made by Frisch and Baron (1988; Baron, 2000) that other

ambiguous prospects, even with positive expected value, might be worth

postponing until further information is available to permit

better-valued decisions. We argue that ambiguous prospects

characterized by control, even with negative expected value, might be

worth pursuing in order to set up better-valued decisions later. The

possibility of accepting bets in order to increase skill does not apply

when competence already exists, only when the possibility of exerting

control to increase competence prevails.

1.3 The present experiments

The goals of this paper are: a) to compare across domains wherein people

have different degrees of competence, in order to observe the degree to

which variation in competence makes a difference in risk attitude; b)

to extend the risk-attitude findings of Goodie (2003) to single-domain

formats, a manipulation that made a considerable difference in the

ambiguity-attitude findings of Heath and Tversky (1991); and c) to

begin to compare the roles of competence and control in decisions under

uncertainty. The present experiments test the competence hypothesis

against the control hypothesis by eliciting betting decisions within

domains of varying difficulty and among participants of varying

ability.

The distinction between competence and control is most evident in a

skill-based task in which a particular participant has little skill.

The control hypothesis suggests people bet more when skill could be

attained, the competence hypothesis only when it has been attained. We

can best differentiate between these two hypotheses when skill could be

attained but has not. The control hypothesis suggests the skill element

does alter decision making under such conditions, whereas the

competence hypothesis suggests it does not.

1.4 General Method

We report three experiments which use the methods developed by Goodie

(2003; Campbell, Goodie, & Foster, 2004). The basic task of fair bets

on knowledge uses three kinds of questions, administered in two phases.

1.4.1 Phase 1. General knowledge and confidence assessment

The first question type was a two-alternative forced choice question.

Prior studies (Goodie, 2003) adapted questions from a collection

(Nelson & Narens, 1980) that sampled from diverse domains. The present

studies randomly selected questions from five well-defined domains.

Three question populations selected two of the 50 U.S. states at random

and asked for a binary comparison on one statistic: population, land

area, or population density, manipulated between-subjects. The other

two question populations randomly selected two of the 50 largest U.S.

cities and elicited a comparison of the cities on either population or

driving distance to Athens, Georgia.2

The second question type asked for an assessment of confidence in each

question, placed in one of the following categories: 50-52%, 53-60%,

61-70%, 71-80%, 81-90%, 91-97%, and 98-100%. In a binary task such

as this one, the range of 50%-100% reflects the full range of

competence, from complete ignorance where accuracy would be 50% and

confidence should not be much higher, to absolute knowledge where

accuracy and confidence are both 100%. Confidence was taken as the

midpoint of the selected confidence category. We used these categories

to assess risk taking across a well-defined array of probabilities from

chance to certainty, combining equal spacing of categories in the

mid-range and greater discrimination near the endpoints. This range

confers the advantages of reflecting all binary choices and being

simple and easily understood, although it also bears the clear

limitations of excluding half the probability spectrum. These studies

adopted confidence elicitation methods without alteration from those

used by Goodie (2003; Campbell et al., 2004).

1.4.2 Phase 2. Betting on answers

A third question type elicited acceptance or rejection of a bet on the

correctness of each answer that was given. Participants played out

these bets for point accumulations that were not backed by monetary

incentives. In all conditions, participants faced a two-alternative

choice between a certain outcome and a bet. The bet was always fair,

having average value equal to the certain option if the

participant's confidence judgment was well-calibrated.

Its average value was less than that of the certain option if the

participant was overconfident and greater than the certain option if

the participant was underconfident. After accepting or rejecting the

bet, the participant received feedback, including the correct answer to

the question, the number of points gained or lost (including if no

points were gained or lost), and the cumulative point total.

1.4.3 The betting formats

We used two betting formats, with Mixed gains and

losses, and Gains Only. The Mixed format was used in order to reflect

the structure of many risks which contain the possibility of either

gain or loss. The Gains Only format was used to eliminate the

complexity of possibly differing value and weighting for gains and

losses. We designed both betting formats to provide average outcomes

that were equal if the bet was accepted or rejected, assuming good

calibration. Betting formats were always varied between subjects, or

were kept constant within an experiment, so that no participant needed

to comprehend, remember, or distinguish between both.

In the Mixed format, the certain option was no change in points, and the

bet provided for a gain of 100 points if the answer was correct or a

loss of 100 * confidence/(1-confidence) points if the

answer was incorrect. For example, if a participant was 75% confident

in an answer, then she considered a bet wherein she won 100 points if

the answer was correct but a loss of 100 * (.75/.25) = 300 points if

the answer was wrong. If she rejected the bet, she did not gain or lose

any points.

In the Gains Only structure, the certain option was a gain of 100

points. The bet offered a gain of 100 /confidence points if

the answer was correct and no gain if the answer was wrong. So, if the

participant bet on an answer in which she had 75% confidence, she won

100/.75 = 133 points if the answer was correct but nothing if the

answer was wrong. She gained 100 points if she rejected the bet. It is

easy to show that the average outcome of accepting a bet in either

format is equal to the certain option (no change in the Mixed format or

a gain of 100 points in Gains Only) if p(correct) =

confidence, less than the certain option if p(correct)

confidence, and greater than the certain option if

p(correct) confidence.

Table 1: Structure of the experiments

|

| N | Question Types | Betting Format | Survey |

|

1 | | | single domains | mixed and gains-only | No |

| 1a | 76 | state population | mixed | No |

| 1b | 67 | city population | mixed | No |

| 1c | 48 | state population | gains-only | No |

| 1d | 35 | city population | gains-only | No |

|

2 | | | single domains | mixed and gains-only | No |

| 2a | 112 | 5 groups* | mixed | No |

| 2b | 152 | 5 groups* | gains-only | No |

|

3 | | 185 | state population | gains-only | Yes |

|

|

1.4.4 "Answers" and "Random" groups

In Experiments 1 and 3, we randomly assigned participants to two groups

that differed in whether they believed they were betting on their

knowledge or on a random event. The Answers group bet on their answers,

using either the Mixed or Gains Only format in different experiments.

The Random group's bets held all statistical properties

constant, differing from the Answers group's only in

appearing to rely on random events rather than

participants' answers. Many dimensions of bets on

knowledge are determined by the participants'

responses, such as the distribution of subjective probabilities of

winning (determined by confidence), the frequency of winning

(determined by accuracy), and any order effects on these dimensions

(for example, if overconfidence declines with experience, cf. Sieck &

Arkes, 2005, or accuracy declines with fatigue, or any number of other

possibilities). By basing the apparently random bets on the

participant's responses, we can rule out these and any

other alternative explanations based on such statistical properties of

the responses of participants in the Answers condition.

Bets that appeared stochastic in fact relied on

participants' answers and confidence assessments in the

knowledge questions. In the betting phase, each answer was converted

into a bet on a seemingly random event with the stated probability of

winning equal to assessed confidence in a corresponding trivia answer;

the correctness of the corresponding answer determined the

bet's outcome. For example, if a participant expressed

75% confidence in her answer to the first question, then the first bet

she encountered in the betting phase instructed: A

number will be chosen at random between 0 and 100, and to win the bet,

the Chosen number must be less than or equal to the Magic Number. The

Magic Number this time is: 75. If the chosen number is LESS THAN or

equal to the Magic Number, you gain 100 points. If the chosen number is

greater than the Magic Number, you lose 300 points. If

the participant accepted the bet, she won the bet if her answer to the

corresponding question was correct and lost the bet if her answer was

incorrect. The Magic Number, the magnitude of the gain if the bet was

won, and the determination of whether the bet was won or lost changed

on each betting trial to reflect the confidence expressed in the

corresponding answer from the first phase and whether it was correct.

1.4.5 Other general facets

In all experiments, we recruited participants from the Research Pool of

the Psychology Department at the University of Georgia and compensated

them with partial credit toward lower-division courses. We prevented

participants from participating in more than one of the present

experiments or in any additional related experiments. Participants ran

in groups of up to three in a room with individual computer stations

separated by five-foot-tall partitions. We omitted

participants' data from analysis if they did not use

more than three confidence categories, or if they showed evidence of

not attending to the task (i.e., exclusive betting acceptance or

rejection, or radical over- or underconfidence). Thirty participants

were excluded for this reason (13 out of 239 in Experiment 1, 10 out of

274 in Experiment 2, and 7 out of 192 in Experiment 3). See Table 1 for

a layout of the structure of our experimental design.

2 Experiment 1

The first experiment assessed the effect of a skill component using

items from single domains, comparing participants betting on answers

with those betting on random events. Four sub-experiments utilized

different question populations and betting formats.

2.1 Method

In Experiment 1a (N=76; 37 in Answers and 39 in Random), participants

answered binary choices comparing states' populations

and faced bets constructed in the Mixed format. In Experiment 1b (N=67;

33 in Answers and 34 in Random), participants compared cities in

population with bets in the Mixed format. In Experiment 1c (N=48; 23 in

Answers and 25 in Random), participants compared

states' populations with bets in the Gains Only

format. In Experiment 1d (N= 35; 17 in Answers and 18 in Random),

participants compared cities' populations with bets in

the Gains Only format.

2.2 Results

2.2.1 Confidence, accuracy and calibration

Average confidence, accuracy and over/underconfidence are given in Table

2.

2.2.2 Bet acceptance

The principal finding of these experiments is that, using questions from

single domains with all statistical properties of bets held constant

between groups, participants consistently accepted more bets when

betting on their answers than they did when betting on random events.

These results are presented in Table 3 and show dramatically greater

rates of bet acceptance in the Answers group in all four

sub-experiments, which were statistically significant in all cases.

Averaged across sub-experiments, those betting on their answers

accepted 75.8% of all bets, and those betting on random events

accepted 55.5% of all bets.

Table 2: Average confidence, accuracy and overconfidence in Experiment

1, and comparisons between Answers and Random groups.

| Experiment | Answers | Random | t | df | p |

|

|

| 1a | .751 | .753 | 0.07 | 74 | .95 |

| 1b | .768 | .764 | 0.21 | 65 | .83 |

| 1c | .780 | .726 | 2.31 | 46 | .026 |

| 1d | .778 | .756 | 0.80 | 33 | .43 |

|

|

| 1a | .745 | .757 | 0.73 | 74 | .47 |

| 1b | .713 | .713 | 0.01 | 65 | .99 |

| 1c | .760 | .751 | 0.50 | 46 | .61 |

| 1d | .665 | .694 | 1.07 | 33 | .29 |

|

|

| 1a | .007 | -.004 | 0.57 | 74 | .57 |

| 1b | .055 | .051 | 0.19 | 65 | .85 |

| 1c | .020 | -.025 | 1.52 | 46 | .14 |

| 1d | .113 | .062 | 1.33 | 33 | .051 |

|

|

Table 3: Overall percentage of bets accepted on answers and random

events in Experiment 1.

| Experiment | Answers | Random | t | df | p |

|

1a | 73.9 | 55.2 | 4.17 | 74 | .000 |

| 1b | 73.8 | 62.1 | 2.41 | 65 | .019 |

| 1c | 80.2 | 55.0 | 4.90 | 46 | .000 |

| 1d | 75.2 | 49.8 | 2.67 | 33 | .012 |

|

Average | 75.8 | 55.5 | | | |

|

|

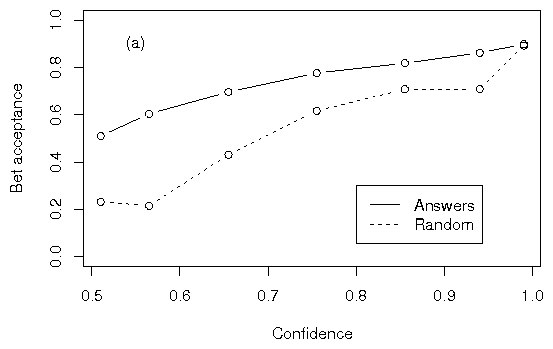

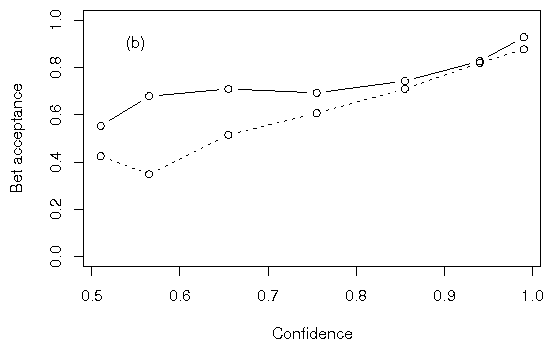

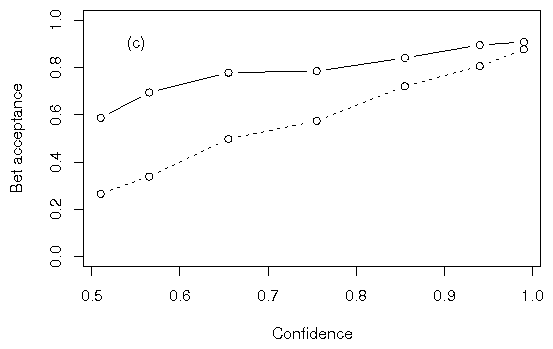

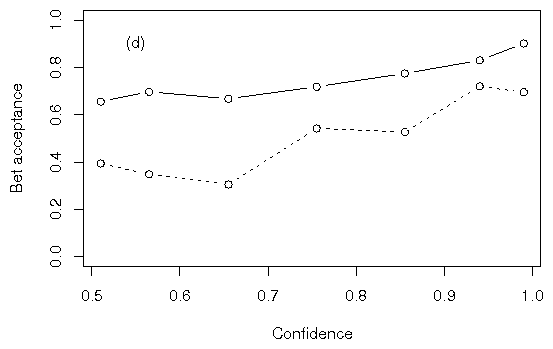

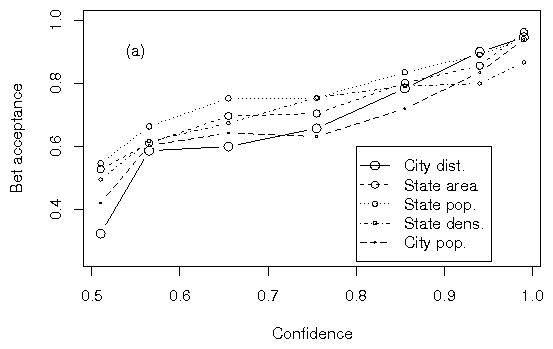

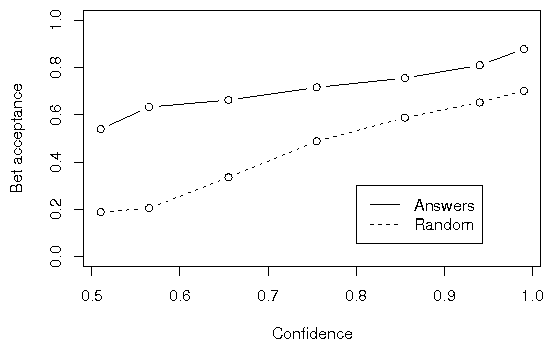

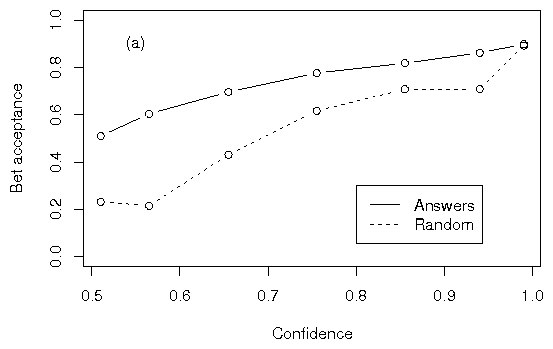

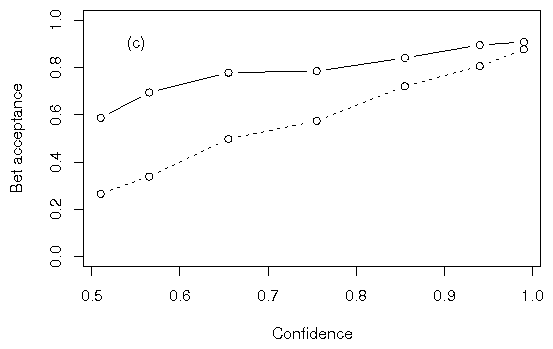

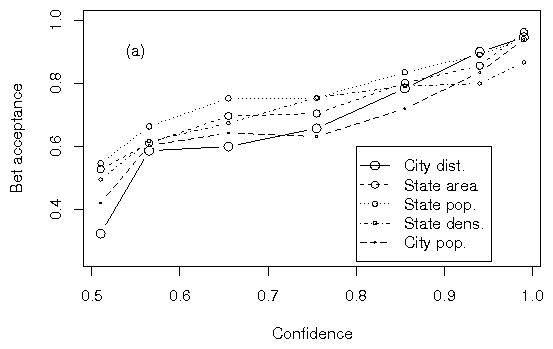

Betting rates conditionalized on confidence are shown in Figure 1. We

found higher betting rates when participants bet on their own

knowledge, compared with bets that were identical in every statistical

way but appeared to rely on random events, at all confidence levels in

all sub-experiments. Because accuracy did not differ significantly

between groups, neither group experienced a systematically greater

proportion of won bets. In addition, because overconfidence did not

differ significantly between groups, neither group benefited from a

systematically more favorable outcome for betting. The comparison of

the betting curves is thus an appropriate reflection of the different

appearance of betting on knowledge versus betting on random events,

rather than a reflection of differing probabilities or magnitude of

possible outcomes. Had we found a trend of higher accuracy or

overconfidence in either group, the higher bet acceptance among those

betting on knowledge would have suggested a different explanation for

the difference in bet acceptance other than the difference between

groups.

Figure 1: Proportions of bets accepted in

(a) Experiment 1a, (b) Experiment 1b, (c) Experiment 1c, and (d)

Experiment 1d. Mean bet acceptance was aggregated across all subjects

at each level of confidence, ignoring subject identity. At all

confidence levels in all sub-experiments, participants accepted bets

more frequently on answers than on random events.

The findings in bet acceptance mark a departure from what Goodie (2003,

Experiment 3) observed with items from assorted domains, where

participants bet on their knowledge relatively seldom at low levels of

confidence and increasingly often as confidence increased. In the

present experiments, rates of bet acceptance are higher for bets on

answers at all levels of confidence, though there is still an

increasing rate of bet acceptance as confidence increases, as can be

seen in Figure 1. The comparison between the present experiments with

single domains and past experiments with mixed domains resembles the

trend across experiments in Heath and Tversky (1991). When Heath and

Tversky narrowed the focus of questions, they observed a preference to

bet on items in domains in which participants had competence that did

not depend on probability level. That is, if a participant was

competent in the domain of politics but felt uncertain about a

particular political question, she still preferred to bet on that

answer rather than an equally uncertain random event or item from a

domain of incompetence. The current study incorporates the same

narrowing of focus to a single domain, relative to the studies of

Goodie (2003), and the same trend is observed: the increased risk

preference does not depend on probability level.

Table 4: Descriptive statistics of confidence, accuracy, overconfidence

and betting slope within the groups in Experiment 2.

Figure 1: Proportions of bets accepted in

(a) Experiment 1a, (b) Experiment 1b, (c) Experiment 1c, and (d)

Experiment 1d. Mean bet acceptance was aggregated across all subjects

at each level of confidence, ignoring subject identity. At all

confidence levels in all sub-experiments, participants accepted bets

more frequently on answers than on random events.

The findings in bet acceptance mark a departure from what Goodie (2003,

Experiment 3) observed with items from assorted domains, where

participants bet on their knowledge relatively seldom at low levels of

confidence and increasingly often as confidence increased. In the

present experiments, rates of bet acceptance are higher for bets on

answers at all levels of confidence, though there is still an

increasing rate of bet acceptance as confidence increases, as can be

seen in Figure 1. The comparison between the present experiments with

single domains and past experiments with mixed domains resembles the

trend across experiments in Heath and Tversky (1991). When Heath and

Tversky narrowed the focus of questions, they observed a preference to

bet on items in domains in which participants had competence that did

not depend on probability level. That is, if a participant was

competent in the domain of politics but felt uncertain about a

particular political question, she still preferred to bet on that

answer rather than an equally uncertain random event or item from a

domain of incompetence. The current study incorporates the same

narrowing of focus to a single domain, relative to the studies of

Goodie (2003), and the same trend is observed: the increased risk

preference does not depend on probability level.

Table 4: Descriptive statistics of confidence, accuracy, overconfidence

and betting slope within the groups in Experiment 2.

| | Accuracy | Confidence | Overconfidence |

|

Experiment 2a | | | |

|

City driving distance | .856 | .887 | .030 |

| State area | .799 | .843 | .044 |

| State population | .746 | .711 | -.035 |

| State population density | .707 | .742 | .035 |

| City population | .706 | .758 | .053 |

|

Experiment 2b | | | |

|

City driving distance | .840 | .868 | .028 |

| State area | .778 | .817 | .039 |

| State population density | .764 | .730 | -.033 |

| State population | .730 | .751 | .021 |

| City population | .691 | .741 | .049 |

|

|

2.3 Discussion

These results indicate that control affects risk attitude when extended

to the important case of a single domain, broadly across question

populations. This supports the conclusion of Goodie (2003) that control

affects risk attitude, but these findings suggest that the nature of

that effect may be different within single domains than in mixed

domains. Whereas in mixed domains participants showed betting

proportions that were lower at low judged probabilities and higher at

high judged probabilities (when compared to participants who bet on

random events), participants who bet on their answers in this

experiment accepted risk more often at all levels of confidence than

those who bet on random events.

Goodie (2003) discussed the possibility of modeling the effect of

control in terms of the probability weighting function proposed by

Gonzalez and Wu (1999). This weighting function includes two parameters

that are notable for their psychological plausibility: elevation, which

reflects the overall attractiveness of risk; and curvature, which

reflects the discriminability of different levels of probability.

Goodie (2003), interpreting the betting proportions that increased with

judged probability, speculated that the data could be accounted for by

positing a more linear weighting function under conditions of control.

The present data suggest that, when answering questions from

well-defined domains with random sampling and transparent rules (i.e.,

under representative sampling), control may increase the attractiveness

of risk and the elevation of the probability weighting function.

However, these data do not permit firm conclusions on the mathematical

form of the weighting function.

3 Experiment 2

In Experiment 1, the primary aim was to manipulate control to determine

its effect on risky decisions in single domains. In Experiment 2, in

order to test the competence hypothesis, we sought to observe

differences in competence through both correlation and experimental

manipulation and measure the effect of these competence differences on

performance measures. One way to obtain diverse degrees of competence

is to rely on naturally occurring variability in competence among

participants, observing performance differences that depend

correlationally on demonstrated knowledge in the content area. Another

way is to observe differences that arise between groups when groups are

given questions that differ in difficulty. We accomplished this by

using five question populations: comparisons between pairs of U.S.

states on population, land area and population density; and between

pairs from among the fifty largest U.S. metropolitan areas on

population and driving distance from Athens, Georgia. We assumed that

some of these question populations would be more difficult than others

and could be identified by showing a sizable degree of variability in

average accuracy between groups. We also assumed that some participants

would be more competent in each content area than others, which could

be identified by differences in accuracy. Would people display

different patterns of betting on a task characterized by control when

they have different degrees of competence?3 If so, the competence hypothesis would be

supported.

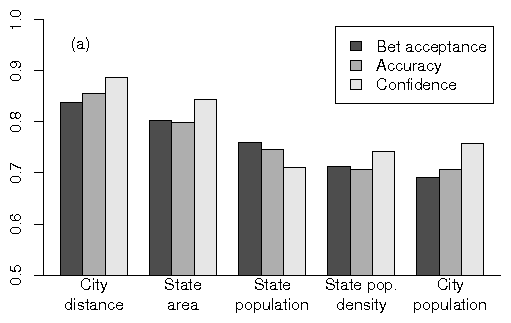

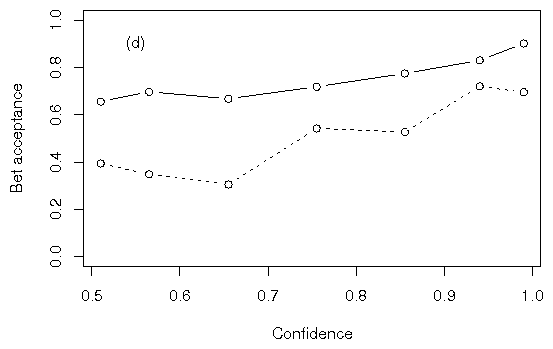

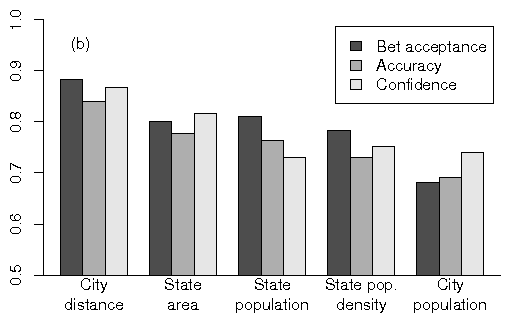

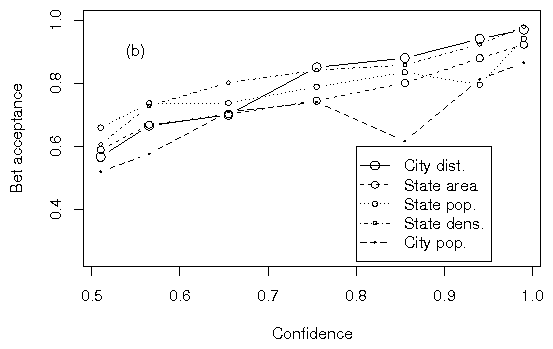

Figure 2: Overall bet acceptance, accuracy and confidence in the five

groups in (a) Experiment 2a and (b) Experiment 2b. Bet acceptance

correlated strongly with accuracy, but this could be partly

attributable to correlations between accuracy and confidence.

Figure 2: Overall bet acceptance, accuracy and confidence in the five

groups in (a) Experiment 2a and (b) Experiment 2b. Bet acceptance

correlated strongly with accuracy, but this could be partly

attributable to correlations between accuracy and confidence.

3.1 Method

Experiment 2a used the Mixed betting format; Experiment 2b used the

Gains Only betting structure. We randomly divided participants (N=112

for Experiment 2a, 152 for Experiment 2b) into five groups, with each

group differing in the domain of questions asked. Three groups answered

questions seeking comparisons between pairs of randomly selected U.S.

states on the dimensions of population (n=25 for Experiment 2a, 32 for

Experiment 2b), land area (n=25 for Experiment 2a, 32 for Experiment

2b) and population density (n=25 for Experiment 2a, 32 for Experiment

2b). The other two groups made binary comparisons between U.S. cities

on the dimension of metropolitan area population (n=18 for Experiment

2a, 28 for Experiment 2b) and driving distance from Athens, Georgia

(n=19 for Experiment 2a, 28 for Experiment 2b).

3.2 Results

3.2.1 Confidence, accuracy and calibration

Confidence, accuracy and overconfidence values for the two

sub-experiments are given in Table 4. Unlike in Experiment 1,

differences in accuracy and confidence were not only expected but

essential as a manipulation check for the effect of differential

competence on betting.

Average accuracy at the group level ranged from .706 to .856 in

Experiment 2a, and from .691 to .840 in Experiment 2b (Table

4). In a binary choice task, where the proportions are constrained to

[0.5,1.0], this overall accuracy range of .165 is considerable. The

differences among the groups defined by question domains were also

statistically significant. In Experiment 2a, for accuracy, F

(4,171)=22.2, p.001; for confidence, F (4,171)=22.6,

p.001. In Experiment 2b, for accuracy, F(4,145)=18.9,

p.001; for confidence, F(4,145)=15.0, p.001. The

robustness of the differences in accuracy among the groups is reflected

in a robust correlation of .864 between accuracy and confidence, using

group averages in both sub-experiments as the unit of analysis.

3.2.2 Bet acceptance

Overall bet acceptance in the two sub-experiments is presented in Figure

2 as a function of groups, shown in descending order of accuracy among

groups. Bet acceptance is closely correlated with accuracy at the group

level - in Experiment 2a, r=.98; in Experiment 2b, r=.96

(each correlation based on five pairs). Such a correlation is

the essential claim of the competence hypothesis; therefore, these very

strong correlations constitute prima facie evidence for the competence

hypothesis. However, one must remember that in such settings of betting

on knowledge, betting frequency correlates positively with confidence,

which is reflected in increasing betting curves such as those in Figure

1. Accuracy also correlates with confidence, as can also be seen in

Figure 2 - in Experiment 2a, r=.88; in Experiment 2b, r=.84 at the

group level. In short, when participants have competence, they also

have high confidence, which may account for the increased bet

acceptance. Consequently, as Heath and Tversky (1991) did in their

Experiment 4, domains must be compared at equivalent levels of

confidence.

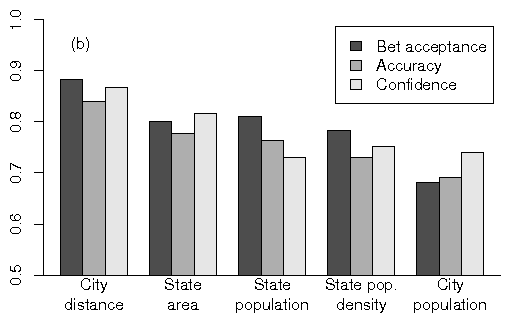

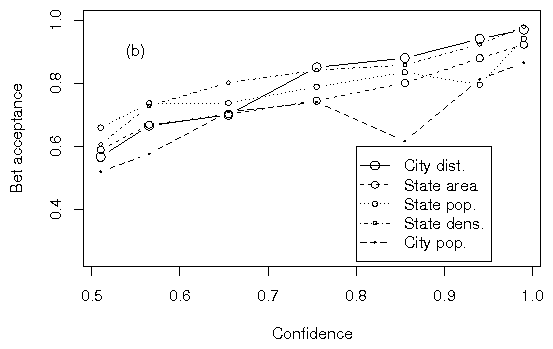

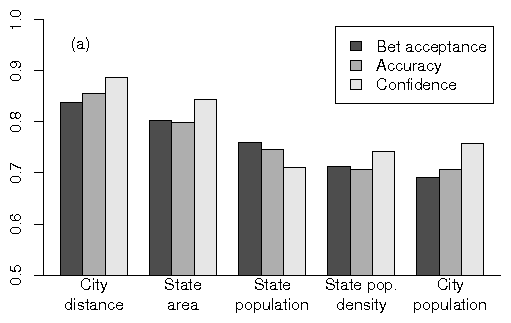

We achieved this by comparing curves relating bet acceptance curves to

confidence. Betting proportions across confidence categories for the

five groups in both sub-experiments are shown in the two panels of

Figure 3; each point on the graph represents the proportion of bets

accepted at a given confidence level. The graph reflects increasing

risk seeking as a function of subjective probability in all groups.

Larger symbols reflect domains of greater accuracy. The competence

hypothesis predicts larger symbols to appear above smaller symbols, and

this prediction receives little support. It is clear that any

differences between groups are small and do not reflect a consistent

ordering as a function of competence.

Figure 3: Bet acceptance among the five groups in (a) Experiment 2a and

(b) Experiment 2b. Groups with higher accuracy are depicted with larger

symbols.

Figure 3: Bet acceptance among the five groups in (a) Experiment 2a and

(b) Experiment 2b. Groups with higher accuracy are depicted with larger

symbols.

3.2.3 Individual variation

We also tested correlationally within groups for the effect of

individual variation in competence on bet acceptance curves. For this

analysis we constructed a linear model of each

participant's betting function, using confidence level

as the predictor variable and bet acceptance rate as the criterion. A

linear model was used because the betting function has consistently

been approximately linear at the group level in both Goodie (2003) and

the present studies. This produced a slope and y-intercept for each

participant. (Here, the y-axis reflects bet acceptance.) Then, in each

sub-experiment, we computed a partial correlation between each

individual's accuracy and the slope and intercept of

their betting functions, controlling for the average accuracy observed

in the participant's question domain group. We

performed this partial correlation in order to observe only individual

differences effects and not group treatment effects. In Experiment 2a,

neither slope (r(170)=.089 ; p=.247) nor intercept (r(170)=-.038 ;

p=.621) correlated significantly with accuracy. Given that slope was

not significantly related to competence, the intercept was a reasonable

measure of the overall attractiveness of risk. The absence of a

significant correlation indicates that competence did not increase risk

seeking. However, in Experiment 2b, as predicted by the competence

hypothesis, accuracy did correlate positively and significantly with

intercept (r(147)=.183, p.025), although the magnitude of

the correlation is relatively small. (Slope and accuracy did not

significantly correlate; r(147)=-.124, p=.133.)

3.3 Discussion

The results of these two sub-experiments provide further qualified

support for the competence hypothesis. The correspondence between

group-level accuracy and betting proportions is strikingly close,

which, in addition to supporting the competence hypothesis, also

bolsters the robustness of using binary choice tasks with a half-range

probability spectrum. However, the correlations between accuracy and

confidence, and between confidence and betting proportion, needed to be

taken into account, and this diminished the strength of evidence in

favor of the competence hypothesis. At the individual level, the

partial correlation between accuracy and betting curve elevation was

small but significant in Experiment 2b and non-significant in

Experiment 2a.

4 Experiment 3

In Experiment 3, in addition to risk acceptance data, we sampled

subjective measures of both competence and control. In this experiment,

we replicated the methods of the earlier experiments but sought further

to examine how participants' perceptions of their

competence and control correlated with performance measures.

4.1 Method

Participants (N=185) all encountered state population comparisons, in

the Gains Only betting format. They were divided into Answers (n=92)

and Random (n=93) groups, which differed as they did in Experiment 1.

In a third phase, all participants answered the following survey

questions:

1. How competent do you feel you are at this task?

2. How do you think your abilities at this task compare to others?

3. How much control do you feel you had over this task?

4. If you were to do this task again one week from now, how much could

you do between now and then to improve your performance?

Participants responded to these questions on a seven-point Likert scale

labeled from 1 (not at all) to 7 (very much). The first two questions

reflected responses to the term

"competence" and to a definition

of competence, respectively. The last two reflected responses to the

term "control" and a definition of

control utilized by Goodie (2003). The definition of competence

conveyed in Question 2 reflects just one of multiple possible

definitions. This definition is social in nature, comparing

one's competence with that of others. For both Heath

and Tversky (1991) and Fox and Tversky (1995), this is appropriate. We

framed the survey question in a social-comparative way because

non-comparative questions appeared to offer little more than synonyms

of competence. The definition of control conveyed in Question 4

represented an attempt to reduce confusion about possible alternative

definitions of the term control, such as internal control.

4.2 Results and Discussion

4.2.1 Calibration, overall bet acceptance and bet acceptance

curves

Average confidence across both groups was .759, average accuracy was

.751, and average overconfidence was .007. The difference between the

two groups was less than .007, and statistically non-significant, for

all three measures.

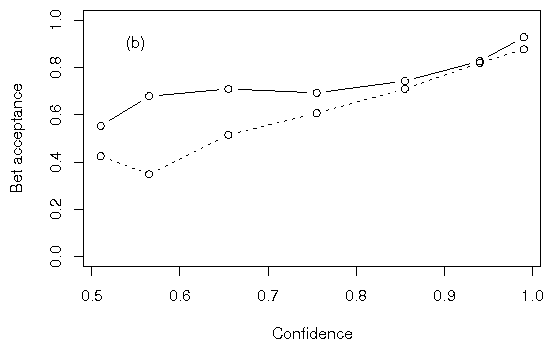

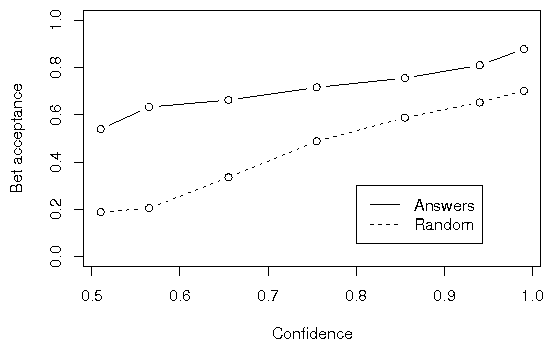

Once again, those betting on their own knowledge bet considerably more

frequently than those betting on events that were identical in every

statistical way but appeared random. The Answers group accepted 71.9%

of all bets, whereas the Random group accepted only 45.6% of all bets.

This difference was statistically significant (t(183)=7.77,

p.001); thus, Study 3 replicated the large effect of

control. Betting proportions across confidence categories for all three

groups are shown in Figure 4 and reflect greater risk acceptance in all

confidence categories when control prevails.

Figure 4: Bet acceptance in the two groups in Experiment 3. As in

Experiment 1, all calibration measures are equivalent, but the Answers

group accepted significant more bets.

Figure 4: Bet acceptance in the two groups in Experiment 3. As in

Experiment 1, all calibration measures are equivalent, but the Answers

group accepted significant more bets.

4.2.2 Survey results

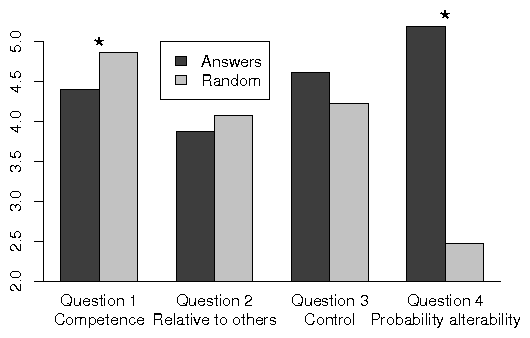

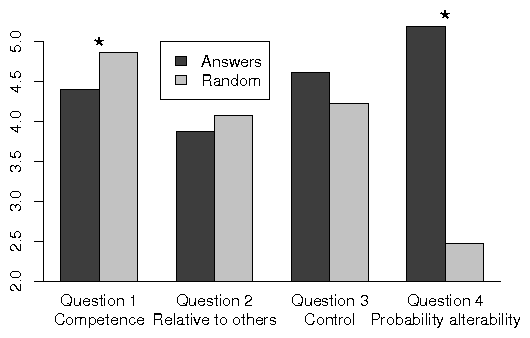

Figure 5 depicts the survey results. On the seven-point scale that we

used, there was a large difference between the groups in the perception

of control as defined here (Question 4, t(183)=11.68,

p.001). There was also a marginally significant effect on

responding to the term "control"

(Question 3, t(183)=1.78, p=.077). There was a small but statistically

significant difference between the groups (t(182)=2.30;

p=.023) in response to the term

"competence" (Question 1) but in

the opposite direction to that predicted by the competence hypothesis,

with the Random group perceiving more

competence than the Answers group. There was no difference between

groups in perceptions of the social-comparative definition of

competence (Question 2). It would appear from these survey data that,

in the minds of our participants, the concept of control as defined

here is prominent in explaining the effect of the control manipulation

on risk taking. The term "control"

itself, however, proved less compelling a description of the difference

for our participants. Neither the term

"competence" nor its

social-comparative definition was able to account for how the groups

perceived their conditions. This preliminary survey demonstrates that

probability alterability appears to be pertinent to the perceived

decision making processes of participants, but the terms

"control" and

"competence" may not be what they

are thinking about.

Figure 5: Survey results in Experiment 3. All responses were made on a

scale from 1 to 7. * p .05.

Figure 5: Survey results in Experiment 3. All responses were made on a

scale from 1 to 7. * p .05.

5 General Discussion

In three experiments, we assessed bet acceptance under ambiguity, where

determination of the uncertain outcome was based on ability rather than

a random event. This is a special case in the decision making

literature, which has been treated both in terms of competence (Heath

& Tversky, 1991) and control (Goodie, 2003). Control has been defined

as a characteristic of the task wherein there are steps that could

improve the probability of a favorable outcome. Competence is an

interactive property of both the task and the individual, wherein

improvement is possible and the participant has achieved it. According

to the control hypothesis, it is the possibility of improvement that

makes a difference.

In Experiment 1, using representative sampling in single domains, and

with all statistical properties of bets held constant between groups,

participants consistently accepted more bets when betting on their

answers than when betting on random events. At all confidence levels in

all experiments, those betting on their answers bet more frequently

than those betting on a random event. These results provided strong

support for the role of control in decision making.

In Experiment 2, overall bet acceptance was closely correlated

with accuracy when assessed across the groups that were exposed

to questions in differing domains. Such a correlation is the

essential claim of the competence hypothesis. However, the trend

of bet acceptance increasing with accuracy was not observed at

the group level when acceptance was conditionalized on

confidence. At the individual level, we found a significant

correlation between accuracy and intercept within groups in

Experiment 2b but not Experiment 2a.

In Experiment 3, as in Experiment 1, those betting on their own

knowledge bet considerably more frequently than those betting on events

that were identical in every statistical way but appeared random.

Survey results indicated a large difference between the groups in the

perception of control as defined here and a marginally significant

effect on responding to the concept

"control." We found no difference

between groups in perceptions of the concept

"competence" or its

social-comparative definition.

5.1 Competence or control?

The current results provide strong support for the effect of control

across a spectrum of degrees of competence, although there was also

some degree of evidence in support of an effect of competence.

Experiments 1 and 3 showed strong effects of control on risk

acceptance. Importantly, those experiments used the question domains of

city population and state population, which proved to be among the

domains with the lowest accuracy in Experiment 2. The average accuracy

using these two question domains was less than .75, lower than other

domains. Yet, participants consistently chose to bet on them much more

frequently than on equivalent random events. This provides evidence for

the effect of control even when competence is relatively low. This

supports the theoretical underpinning of control (Skinner, 1996) that

people demonstrate more persistence and initiative when control

prevails, perhaps to enhance future outcomes in domains where the

likelihood of success can be increased.

In Experiment 3, the perceptions of participants suggested that the

manipulation that had a profound effect on bet acceptance also affected

probability alterability and, to an extent that was only marginally

statistically significant, the term

"control." This may be

attributable at least in part to low accuracy; perhaps participants

betting on their own answers would have rated competence higher in a

similar setting but with easier questions. The conclusion remains,

however, that control increases risk taking, even when competence is

relatively low. These results are analogous to Cohen, Dearnaley, and

Hansel's (1956) finding that inexperienced and

experienced bus drivers assess future risky driving maneuvers

similarly; both groups of drivers accept risk at a relatively similar

rate.

We also found evidence to favor the competence hypothesis - that is,

people accept risk more often when they perceive themselves to be

competent than when they do not. In Experiment 2, bet acceptance at the

group level correlated extremely closely with accuracy. However, when

we controlled for the correlation between confidence and bet acceptance

by examining bet acceptance curves, we found no group-level correlation

between the intercept (overall elevation) of the betting curves and

average accuracy within groups and only limited correlation at the

individual level.

The present experiments utilized questions drawn from single domains,

which allowed for a more accurate assessment of true confidence within

that given set of questions than when utilizing questions drawn from

mixed domains (as in Goodie, 2003). In that study, bet acceptance was

low (Experiments 1 and 2) and lower than bet acceptance on matched

random events (Experiment 3) at low levels of confidence. However, when

low competence domains are removed in tests using single domains, bet

acceptance at the lowest levels of confidence increases. The comparison

between the present experiments and those of Goodie (2003) thus

provides support for the competence hypothesis.

5.2 Why did the present studies find less strong evidence for

the competence hypothesis?

The evidence to support the competence hypothesis was less strong in the

present studies than in those of Heath and Tversky (1991). Perhaps the

most striking finding of Heath and Tversky's studies

came in their Experiment 4, where participants who perceived themselves

as competent in one domain but incompetent in another consistently

preferred to bet on a random event over an event of matched probability

in the domain of incompetence. We didn't observe such

an effect in these studies - any time participants could bet on their

answers, they were considerably more prone to do so than bet on a

random event, even when their answers were not terribly competent.

Why did this difference emerge? The answer may relate to a special

feature of Heath and Tversky's sample. They sought

participants who felt themselves of above-average competence in either

football or political prediction, and also of below-average competence

in the other domain. Of 110 participants they screened, 25 (23 percent)

fit this criterion and constituted the sample. (Two of the 25 selected

participants declined to participate.) If participants were well

calibrated in evaluating their own abilities, and if these ratings were

independent of each other, then half of all screened participants would

fall on opposite sides of the median on the two measures. But less than

a quarter satisfied the criterion. Most of the screened participants

self-evaluated on the same side of the median for both tasks and were

thus excluded. The data reflected only the rather small minority who

placed themselves on opposite sides of the median for the two tasks.

This could reveal participants who feel unusually weak competence in

the weak area; it could reflect an individual difference that led these

subjects, in contrast with the majority, to self-evaluate divergently

in different domains. The larger effect observed by Heath and Tversky

could also be attributable to their use of within-subjects designs,

which may highlight comparisons among the three kinds of bets they

employed.

5.3 Probability weighting and control

Goodie (2003) suggested that, within the framework of prospect theory

(Kahneman & Tversky, 1979), the effect of control on decision making

might most fruitfully be attributed to an effect on the probability

weighting function considered from the perspective of the model offered

by Gonzalez and Wu (1999). This model in turn relied on advances of

Tversky and Wakker (1995) and Fox and Tversky (1995), demonstrating the

psychological plausibility and empirical validity of considering a

weighting function based on uncertain outcomes. These demonstrations

culminated in a two-stage model (Fox & Tversky, 1998) wherein

subjective probabilities elicited in a first stage can be weighted in a

second stage in a comparable manner to objective (known) probabilities.

The present studies adhered to this procedural framework.

In the studies of Goodie (2003), bet acceptance was an interactive

function of confidence and control, such that participants accepted

less often with control at low probabilities and more often with

control at high probabilities. Goodie attributed this to an effect on

the discriminability of probabilities. In the current experiments, no

such interaction was evident: participants accepted more often with

control than without across the entire spectrum of subjective

probability. Thus, in the terms of Gonzalez and Wu's

(1999) model, the effect of control may be better attributed to

attractiveness. In short, people accept more risk under conditions of

control than under conditions of no control. The idea of making

weighting functions sensitive to properties of the setting other than

perceived probability is not new. Kilka and Weber (2001) suggested that

the probability weighting function should be "source

dependent," which in their study reflected the

degree of competence participants perceived in the domain of the

uncertain judgment. The present experiments suggest that control may be

a relevant and systematic dimension guiding the source dependence of

the weighting function.

5.4 The importance of control

Natural decisions often contain an element of ability across domains.

Examples of this include business-related decisions such as those in

organizational management (Forlani, 2002; Hiller & Hambrick, 2005),

marketing (White, Varadarajan, & Dacin, 2003), and investment

(Fellner, Guth, & Maciejovsky, 2004); personal decisions such as mate

selection (Hinsz, Matz, & Patience, 2001) and child rearing (Pridham,

Denney, Pascoe, Chiu, & Creasey, 1995); health-related decisions such

as dieting, exercise, diagnosis and treatment; law-related decisions

such as regulation and jury decision making (Weinstock & Flaton,

2004), and even union leaders assessing random events, fictional

elections and real elections (Maffioletti & Santoni, 2005). In all

these cases, skill matters: some individuals can make systematically

better decisions than others with more favorable consequences, and each

individual can take steps to make better decisions. The effect of

controllable situations on decision-making is an important aspect of

decisions to study.

In one domain where control is present, March and Shapira (1987)

famously cautioned decision theorists that organizational managers view

the risks they take as being fundamentally different from gambling. To

the extent this is true, it diminishes the applicability to management

settings of the wealth of empirical decision research using real or

hypothetical lottery pulls, rolls of dice, or poker chips drawn from

bookbags. March and Shapira conclude, a bit cynically, that the

distinction is a matter of "managerial

conceit." In their view, managers suppose that the

risks they take are different from (and better than) gambling because

they are trained by societal norms to think so and also because among

managers whose decisions have coincidentally succeeded, just as among a

convention of lottery winners, the relative rate of winning is greater

than the odds that are built into the game.

The present results build on March and Shapira's

conclusion that the norms of society and the conceits of managers play

a role in managerial decision making. In managerial settings and many

other settings where control prevails - that is, where

one's actions are thought to make a difference in the

probability of success - the control itself makes a difference in

decision making.

More generally, the control hypothesis has both positive and negative

implications for applied decision making. The positive implication is

that people may be expected to adopt a relatively broad horizon,

sacrificing short-term expected value for the opportunity to learn and

develop skill that will enhance future prospects. The negative

implication is that, in cases where relatively short-term consequences

are major - for example, when it is important not just to learn for

the future but to manage the current organizational challenge, treat

the current patient successfully, or win the current war - people may

be excessively willing to accept risk even when they know they are

incompetent.

5.5 Limitations and future directions

These results may have been different if participants in the Random

groups were told that they were being given a bet concerning another

participant's answer and confidence assessment.

However, one might suspect that posing bets to participants in this

manner may instead measure a different, unintended construct, such as

skepticism in others' knowledge or social comparison

(Moore & Kim, 2003).

Also the current studies only offered bets whose probabilities of

winning were above 50%. This carries at least two limitations. First,

of course, half the probability spectrum is excluded. Second, the

excluded half is the lower half, and thus the many low-probability

events that are the subject of much research cannot be directly

addressed. However, although the range excludes half of the numerical

range between 0 and 1, it reflects the full range of competence from

random choice to full knowledge within a binary choice paradigm, and a

wide swath of this possible range was encompassed within the present

studies.

It is possible that participants would be motivated to perform

differently for money than they did for points in these studies. The

findings of Goodie and Fantino (1995) suggest that there may be little

effect. In the end, we subscribe to the prescription to do it both ways

(Hertwig & Ortmann, 1999), and have found essentially similar results

using monetary incentives (Young, Goodie, & Hall, 2007).

5.6 Conclusions

The present results provide evidence that control affects decision

making apart from competence. There is also new evidence that

competence affects decision making. The unique contribution of control

to decision making has important theoretical and applied implications,

suggesting that decisions may be influenced by the opportunity to

improve at tasks that can be learned, even at short-term expected loss,

in order to create more advantageous prospects in the future.

References

Baron, J. (2000). Thinking and deciding, (Third

Ed.) Cambridge University Press.

Burger, J. M., & Schnerring, D. A. (1982). The effects of desire for

control and extrinsic rewards on the illusion of control and gambling.

Motivation & Emotion, 6, 329-335.

Campbell, W. K., Goodie, A. S., & Foster, J. D. (2004). Narcissism,

confidence and risk attitude. Journal of Behavioral

Decision Making, 17, 297-311.

Chau, A. W., & Phillips, J. G. (1995). Effects of perceived control upon

wagering and attributions in computer blackjack. Journal of

General Psychology, 122, 253-269.

Chow, C. C., & Sarin, R. K. (2001). Comparative ignorance and the

Ellsberg Paradox. Journal of Risk and Uncertainty, 22,

129-139.

Cohen, J., Dearnaley, E. J., & Hansel, C. E. M. (1956). Risk and hazard:

Influence of training on the performance of bus drivers.

Operational Research, 7, 67-82.

Ellsberg, D. (1961). Risk, ambiguity, and the Savage axioms.

Quarterly Journal of Economics, 75, 643-669.

Fellner, G., Guth, W., & Maciejovsky, B. (2004). Illusion of expertise

in portfolio decisions: An experimental approach. Journal of

Economic Behavior and Organization, 55, 355-376.

Forlani, D. (2002). Risk and rationality: The influence of decision

domain and perceived outcome control on managers' high-risk decisions.

Journal of Behavioral Decision Making, 15, 125-140.

Fox, C. R., & Tversky, A. (1995). Ambiguity aversion and comparative

ignorance. Quarterly Journal of Economics, 110, 585-603.

Fox, C. R., & Tversky, A. (1998). A belief-based account of decision

under uncertainty. Management Science, 44, 879-895.

Fox, C. R., & Weber, M. (2002). Ambiguity aversion, comparative

ignorance, and decision context. Organizational Behavior and

Human Decision Processes, 88, 476-498.

Frisch, D., & Baron, J. (1988). Ambiguity and rationality.

Journal of Behavioral Decision Making, 1, 149-157.

Gigerenzer, G. (1991). How to make cognitive illusions disappear: Beyond

"heuristics and biases." In W.

Stroebe & M. Hewstone (Eds.), European review of social

psychology, (Vol. 2, pp.83-115). Chichester, England: Wiley.

Gilovich, T., Vallone, R., & Tversky, A. (1985). The hot hand in

basketball: On the misperception of random sequences. Cognitive

Psychology, 17, 295-314.

Gonzalez, R., & Wu, G. (1999). On the shape of the probability

weighting function. Cognitive Psychology, 38, 129-166.

Goodie, A. S. (2003). Paradoxical betting on items of high confidence

with low value: The effects of control on betting. Journal of

Experimental Psychology: Learning, Memory, and Cognition, 29, 598-610.

Goodie, A. S., & Fantino, E. (1995). An experientially derived

base-rate error in humans. Psychological Science, 6, 101-106.

Heath, C., & Tversky, A. (1991). Preference and belief - ambiguity and

competence in choice under uncertainty. Journal of Risk and

Uncertainty, 4, 5-28.

Hertwig, R., & Ortmann, A. (2001). Experimental practices in economics:

A methodological challenge for psychologists? Behavioral and

Brain Sciences, 24, 383-403.

Hiller, N. J., & Hambrick, D. C. (2005). Conceptualizing executive

hubris: The role of (hyper-) core self-evaluations in strategic

decision-making. Strategic Management Journal, 26, 297-319.

Hinsz, V. B., Matz, D. C., & Patience, R. A. (2001). Does

women's hair signal reproductive potential?

Journal of Experimental Social Psychology, 37, 166-172.

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of

decision under risk. Econometrica, 47, 263-291.

Kilka, M., & Weber, M. (2001). What determines the shape of the

probability weighting function under uncertainty? Management

Science, 47, 1712-1726.

Koehler, J. J., Gibbs, B. J., & Hogarth, R. M. (1994). Shattering the

illusion of control: Multi-shot versus single-shot gambles.

Journal of Behavioral Decision Making, 7, 183-191.

Langer, E. J. (1975). The illusion of control. Journal of

Personality and Social Psychology, 32, 311-328.

Maffioletti, A., & Santoni, M. (2005). Do trade union leaders violate

subjective expected utility?: Some insights from experimental data.

Theory and Decision, 59, 207-253.

March, J. G., & Shapira, Z. (1987). Managerial perspectives on risk and

risk-taking. Management Science, 33, 1404-1418.

Moore, D. A., & Kim, T. G. (2003). Myopic social prediction and the solo

comparison effect. Journal of Personality and Social

Psychology, 85, 1121-1135.

Nelson, T. O., & Narens, L. (1980). Norms of 300 general-information

questions: Accuracy of recall, latency of recall, and

feeling-of-knowing ratings. Journal of Verbal Learning and

Verbal Behavior, 19, 338-368.

Pridham, K., Denney, N., Pascoe, J., Chiu, Y. M., & Creasey, D. (1995).

Mothers solutions to child-rearing problems - conditions and

processes. Journal of Marriage and the Family, 57, 785-799.

Seligman, M. E. P. (1975). Helplessness: On depression, development, and

death. San Francisco: Freeman.

Sieck, W. R., & Arkes, H. R. (2005). The recalcitrance of

overconfidence and its contribution to decision aid neglect.

Journal of Behavioral Decision Making, 18, 29-53.

Skinner, E. A. (1996). A guide to constructs of control. Journal

of Personality and Social Psychology, 17, 549-570.

Tversky, A., & Wakker, P. P. (1995). Risk attitudes and decision

weights. Economectrica, 63, 1255-1280.

Weinstock, M. P., & Flaton, R. A. (2004). Evidence coverage and argument

skills: Cognitive factors in a juror's verdict choice.

Journal of Behavioral Decision Making, 17, 191-212.

White, J. C., Varadarajan, P. R., & Dacin, P. A. (2003). Market situation

interpretation and response: The role of cognitive style,

organizational culture, and information use. Journal of

Marketing, 67, 63-79.

Young, D. L., Goodie, A. S., & Hall, D. B. (2007). Modeling effects of

perceived control on the probability weighting function. Unpublished

manuscript, University of Georgia.

Footnotes:

1This research was supported by National Institutes of Health research

grant MH067827. Address correspondence to: Adam S. Goodie, Department

of Psychology, University of Georgia, Athens, GA 30602-3013; Phone

706-542-6624; Fax 706-542-3275; Email goodie@uga.edu

2State population was

taken as the 1999 Census Bureau estimate, and population density was

the ratio of population to land area. Questions involving city

comparisons used the 50 largest metropolitan areas in the continental

U.S., to eliminate the confusion involved in considering driving

distance to San Juan, Puerto. City population was taken as the

population of the entire metropolitan area as identified by the Census

Bureau (this was made clear in the instructions), and driving distance

was the distance to the central city.

3In their empirical

studies, Heath and Tversky (1991) established two levels of competence,

but they did not claim that competence is an inherently binary

construct. We take it to be a variable that can have several levels,

and that may be continuous.

File translated from

TEX

by

TTH,

version 3.67.

On 14 Jun 2007, 16:19.