Filed in

Profiles

Subscribe

Subscribe to Decision Science News by Email (one email per week, easy unsubscribe)

DECISION SCIENCE RESEARCHER PROFILE: GERD GIGERENZER

Gerd Gigerenzer is Director of the Center for Adaptive Behavior and Cognition at the Max Planck Institute for Human Development in Berlin and former Professor of Psychology at the University of Chicago. He won the AAAS Prize for the best article in the behavioral sciences.

Recent Career:

1997-Present Director (Managing Director, 2000-2001) Max Planck Institute for Human Development, Berlin

1995-1997 Director Max Planck Institute for Psychological Research, Munich

1992-1995 Professor, Department of Psychology, and Committee for the Conceptual Foundations of Science University of Chicago, USA

1990-1992 Professor of Psychology University of Salzburg, Austria

1984-1990Professor of Psychology University of Konstanz (Chairman, 1988-1989)

1982-1984 Privat-Dozent Department of Psychology, University of Munich

1977-1982 Assistant Professor Department of Psychology, University of Munich

Selected Books Published:

*Calculated Risks: How To Know When Numbers Deceive You, the German translation of which won the Scientific Book of the Year Prize in 2002.

Gerd Gigerenzer has also published two books on simple Hueristics:

* Simple Heuristics That Make Us Smart (with Peter Todd & The ABC Research Group) and

* Bounded Rationality: The Adaptive Toolbox (with Reinhard Selten, a Nobel laureate in economics).

* Adaptive Thinking: Rationality in the Real World

* The Empire of Chance : How Probability Changed Science and Everyday Life

Selected Honors and Awards:

*Batten Fellow, Darden Business School, University of Virginia, Charlottesville, 2004.

*Visiting professor, University of Munich, 2004.

*2003 Reckoning with Risk shortlisted for the Aventis Prize for Science Books

*2002 Science Book of the Year Prize for Einmaleins der Skepsis (German translation of Calculated Risks), awarded by bild der wissenschaft

Quotes:

“What interests me is the question of how humans learn to live with uncertainty. Before the scientific revolution determinism was a strong ideal. Religion brought about a denial of uncertainty, and many people knew that their kin or their race was exactly the one that God had favored. They also thought they were entitled to get rid of competing ideas and the people that propagated them. How does a society change from this condition into one in which we understand that there is this fundamental uncertainty? How do we avoid the illusion of certainty to produce the understanding that everything, whether it be a medical test or deciding on the best cure for a particular kind of cancer, has a fundamental element of uncertainty?”

“Isn’t more information always better?” asks Gerd Gigerenzer. “Why else would bestsellers on how to make good decisions tell us to consider all pieces of information, weigh them carefully, and compute the optimal choice, preferably with the aid of a fancy statistical software package? In economics, Nobel prizes are regularly awarded for work that assumes that people make decisions as if they had perfect information and could compute the optimal solution for the problem at hand. But how do real people make good decisions under the usual conditions of little time and scarce information?”

Gerd Gigerenzer’s Home Page at the Max Planck Institute

Dissertations:

*Gigerenzer, G. (1982). Messung und axiomatische Modellbildung: Theoretische Grundlagen und experimentelle Untersuchungen zur sensorischen und sozialen Wahrnehmung. Habilitationsschrift, Munich.

*Gigerenzer, G. (1977). Nonmetrische multidimensionale Skalierung als Modell des Urteilsverhaltens. Zur Integration von dimensionsanalytischer Methodik und psychologischer Theorienbildung. Dissertation, Munich.

Gerd Gigerenzer Profile continued…

THE SOCIAL DILEMMA OF EXAGERATING THE POSITIVE-OF PEOPLE AND OF POLICIES

Imagine you are invited to a party with ten strangers and asked to play an unusual game. Upon arrival you are presented with a choice. You can either 1) choose to receive $10 now, which you may keep, or 2) choose to receive $20, which you must entirely give away by evenly dispersing $2 dollars to each of the other 10 strangers.

If everyone votes for (2), everyone leaves with $20. However, if only you vote for (2) and everybody else votes (1), they leave with $12 each, and you leave with nothing. Many other combinations of votes are possible.

Carnegie Mellon professor Robyn Dawes speculates on this problem …

Now suppose that this game is repeated over a number of trials. What happens? Many colleagues around the world and I have conducted similar games, and the results are quite predictable. Especially if people are able to communicate with each other and make commitments prior to the first trial, almost all give the money away. But what happens on later trials where people know what they did on the previous trial and can infer from their payoff what other people did collectively? The rate of cooperation (giving) over trials is highly predictable. If this rate does not reach 100% on the first trial, some people note that they are making less money than those who keep their $10 stake and they then switch from being cooperators to being defectors. Subsequently, more people do so, often at an accelerating rate. By the end of ten trials, virtually no one is giving away the money. What has happened is that behavior has stabilized on the sink of universal defection. The one exception is that if people do not find out what happened after the first trial, where generally a majority honor the commitments to cooperate, subjects avoid the sink. When a few people know, however, that they are being “suckered” by others when they give away their $10 they stop doing it. (It is even possible to “reset” the situation by having an additional discussion prior to some trial, but even then over trials without discussion, the group ends up in the sink.)

An observer looking at behavior at the beginning of this degenerating process and ascribing the results to personality characteristics would conclude that people are altruistic and cooperative, while someone observing the end of the process and making similar personality attributions would conclude that people are generally selfish and uncooperative. But it is the situation itself that yields the behavior, at least on the part of anyone attempting to behave “rationally”.

Full Article

HOW FINANCIAL INCENTIVES AND COGNITIVE ABILITIES AFFECT TASK PERFORMANCE IN LABORATORY SETTINGS

Ondrej Rydval and Andreas Ortmann have a paper forthcoming in Economic Letters in which they re-analyze some data from Gneezy and Rustichini (2000) and look at the relative importance of financial incentives and cognitive capabilities on reasoning tasks.

The various NIS levels reflect the level of payment incentive (New Israeli Shekels, get it?) used by Gneezy and Rustichini (2000).

Rydval and Ortmann give the following interpretation:

“First of all, notice that the performance curves for the high-incentive treatments (NIS1 and NIS3) are virtually identical and slope considerably upwards, implying that there is a high within-treatment variation in performance but hardly any across-treatment one. Arguably, this is most likely due to a significant within-treatment variation in cognitive abilities. One could conceive that the large within-treatment performance variation is partly also effort-driven, but the variation in cognitive effort required to generate this result is unlikely; plus one would need to explain why the two performance curves seem almost identical despite the across-treatment incentive (and thus presumably effort) differential. Therefore, consistent with the interpretation of the IQ score as ability rank, it seems quite plausible that ability rather than incentive differentials determine individual performance differentials when incentives are high enough.

Next inspect the performance curves for the low-incentive treatments (no-pay and NIS0.1). Clearly, Gneezy and Rustichini (2000) were right in asserting that the NIS0.1 subjects overall were less motivated than the ones in the no-pay treatment. This is particularly apparent at the low-performance end where the gap between the performance curves for the low-incentive treatments widens (and, in addition, so does the gap between the performance curves of the two low-incentive treatments and the two high-inventive treatments). That the NIS0.1 subjects were less motivated than the ones in the no-pay treatment also seems confirmed by the performance curve for the NIS0.1 treatment lying below that for the no-pay treatment across the whole performance range. It is highly unlikely that this would be caused by across-treatment ability differentials, and thus across-treatment differences in motivation must have played the main role.

Finally and most importantly, focus on the slope of all four performance curves and the distance between them. An eyeball test reveals that, leaving aside the motivational problems at the low-performance end, the within-treatment variation in performance is generally much greater than the variation across treatments. To give a meaningful comparison, consider the largest across-treatment performance differential at the median rank. This turns out to be 13 (i.e., 24 correct answers in the NIS0.1 treatment vs. 37 in the NIS1 treatment), which is equivalent to the performance differential associated with moving up from the first to the third quartile within the NIS1 treatment (28 vs. 41). Note, however, that within-treatment performance differentials can be much larger. For instance, in both of the high-incentive treatments (NIS1 & NIS3), the difference in performance for individuals ranked 1 and 40 is as large as 34.”

Reference

Gneezy, U. & Rustichini, A. (2000). Pay enough or don’t pay at all, Quarterly Journal of Economics 115, 791-811.

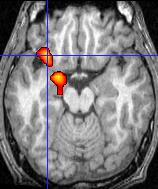

THE INVOLVEMENT OF THE ORBITOFRONTAL CORTEX IN THE EXPERIENCE OF REGRET

The study of decision making would be incomplete without consideration of the role of regret. A recent article seeks its place in the brain.

The orbitofrontal cortex is a small area of the brain that is located just behind the eyes. It is involved in cognitive and affective functions such as assessing emotional significance of events, anticipating rewards and punishments, adjusting behaviors to adapt to changes in rule contingencies, and inhibiting inappropriate behaviors.

A recent article in Science discusses neural responses associated with regret in gambling tasks.

Abstract

Facing the consequence of a decision we made can trigger emotions like satisfaction, relief, or regret, which reflect our assessment of what was gained as compared to what would have been gained by making a different decision. These emotions are mediated by a cognitive process known as counterfactual thinking. By manipulating a simple gambling task, we characterized a subjects choices in terms of their anticipated and actual emotional impact. Normal subjects reported emotional responses consistent with counterfactual thinking; they chose to minimize future regret and learned from their emotional experience. Patients with orbitofrontal cortical lesions, however, did not report regret or anticipate negative consequences of their choices. The orbitofrontal cortex has a fundamental role in mediating the experience of regret.

Exerpt

“Previous work implicating the orbitofrontal cortex in emotion-based decision making principally emphasized bottom-up influences of emotions on cortical decision processes. We propose a different role whereby the orbitofrontal cortex exerts a top-down modulation of emotions as a result of counterfactual thinking, after a decision has been made and its consequences can be evaluated. As shown by the model of choice, the feeling of responsibility for the negative result, i.e., regret, reinforces the decisional learning process. The orbitofrontal cortex integrates cognitive and emotional components of the entire process of decision making; its incorrect functioning determines the inability to generate specific emotions such as regret, which has a fundamental role in regulating individual and social behavior.”

A recent article in The Journal of Economic Perspectives by Justin Wolfers and Eric Zitzewitz describes how a new kind of market for prediction and forecasting delivers surprisingly accurate results in a variety of domains.

Here, we see predicted versus actual movie opening takes, based on data from the Hollywood Stock Exchange.

Exerpt from article:

These insights suggest that some prediction markets will work better when they concern events that are widely discussed, since trading on such events will have higher entertainment value and there will be more information on whose interpretation traders can disagree. Ambiguous public information may be better in motivating trade than private information, especially if the private information is concentrated, since a cadre of highly informed traders can easily drive out the partly informed, repressing trade to the point that the market barely exists. Indeed, attempts to set up markets on topics where insiders are likely to possess substantial information advantages have typically failed.

Reference:

Wolfers, J. & Zitzewitz, E. Prediction Markets. The Journal of Economic Perspectives, 18(2),107-126

Filed in

Conferences

Subscribe

Subscribe to Decision Science News by Email (one email per week, easy unsubscribe)

20TH ANNUAL INTERNATIONAL MEETING OF THE BRUNSWIK SOCIETY

The 20th Annual International Meeting of the Brunswik Society will be held on Thursday and Friday, November 18-19, 2004 in Minneapolis, MN, at the Millennium Hotel. The program begins at 1:30 on Thursday afternoon. We invite proposals for papers on your recent research and panel discussions on any theoretical or empirical/applied topic related to Egon Brunswik’s philosophy and paradigm.

Please send a brief abstract (50 words), and indicate whether the paper/discussion is theoretical or empirical, to Jim Holzworth by Friday,July 16th. Kindly respect this submission due date.

The organizing committee is:

Jim Holzworth holz@uconn.edu

Mandeep K. Dhami mkdhami@uvic.ca

Elise Weaver eweaver@wpi.edu

Tom Stewart t.stewart@albany.edu

The meeting is held concurrently with the Psychonomic Society Annual Meeting and just before The Society for Judgment and Decision Making meeting. More details about the 12 2004 meeting, including registration instructions, will be posted on the Brunswik Society website, http://brunswik.org.

Filed in

Profiles

Subscribe

Subscribe to Decision Science News by Email (one email per week, easy unsubscribe)

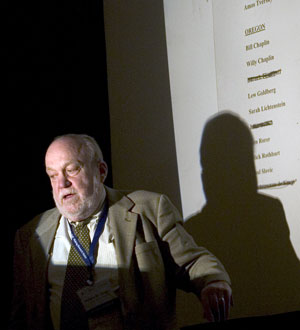

DECISION SCIENCE RESEARCHER PROFILE: ROBYN DAWES

Recent Career:

1997-Present The Charles J. Queenan, Jr. University Professor, Carnegie Mellon University.

1995-1996 Acting Head, Dept. of Social & Decision Sciences, Carnegie Mellon University

1994 Fellow, Center for Rationality & Interactive Decision Making, Hebrew University of Jerusalem,

1992-Present University Professor, Carnegie Mellon University (CMU)

1990-Present Professor of Psychology, Department of Social & Decision Sciences, CMU

Selected Books Published

* Rational Choice in an Uncertain World

* House of Cards

Quotes:

“My current research spans five areas: intuitive expertise, human cooperation, retrospective memory, methodology and United States AIDS policy. […] I write journal articles and books because I believe the information they contain could be valuable — at least on a “perhaps, maybe” basis. I have never written anything with the expectation that it will sell, or become a ‘”citation classic” (although one of my articles has). I believe that in American culture we are obsessed with outcomes rather than with behaving in ways that tend to bring about the best expected outcomes, while “time and chance” play a very important role. […] Some of my clinical colleagues claim that feelings are not understood until they can be put into words. My own view is that every translation of a feeling, thought, idea or mathematical form into words involves at least a small element of automatic distortion, often a much larger element.

“We observe more human cooperation than can be readily inferred from a game theoretic analysis that assumes people are = selfish. I have long been dubious that we can “rescue” this analysis by extending it to include “side payments” (e.g. reciprocal altruism, concern with reputation, utility for acting in accord with a socially instilled conscience, benefit to those genetically related.”

An interview with Dawes

Home page at CMU

Continue reading Robyn Dawes

Will decision making styles figure into who the US chooses as a president? This question is taken up in a recent Wall Street Journal article:

For those without WSJ access, an exerpt:

[While they differ on issues, t]here is also a big difference in their decision-making styles. Mr. Bush often makes quick judgments. Mr. Kerry likes to immerse himself in detail, read extensively and consult a wide circle of advisers before making a decision.

Mr. Bush paints in black and white, Mr. Kerry in shades of gray. Mr. Bush establishes broad principles and sticks to them. Mr. Kerry is willing to tack with changing conditions.

WHAT IS THE ENCYCLOPEDIA?

Decision Science News draws upon theory and method from a range of social and behavioral science disciplines such as economics, psychology, political science, marketing, management, and beyond. The Encyclopedia entries we present here offer a reference containing information on terms, theories, people and concepts within these fields. By providing this easily-accessible resource, we hope to encourage and facilitate interdisciplinary understanding.

Decision Theory: Decision theory is a body of knowledge and related analytical techniques of different degrees of formality designed to help a decision maker choose among a set of alternatives in light of their possible consequences. Decision theory can apply to conditions of certainty, risk, or uncertainty. More…

Filed in

Conferences

Subscribe

Subscribe to Decision Science News by Email (one email per week, easy unsubscribe)

ANNOUNCEMENT FROM THE AMERICAN MARKETING ASSOCIATION SUMMER EDUCATORS’ CONFERENCE

Dear Colleagues,

On behalf of the AMA Academic Council (the leadership group of the AMA Academic Division), I want to take this opportunity to welcome you to the home page for the 2004 AMA Summer Marketing Educatorsâ Conference, which is taking place August 6-9 at the Boston Marriott Copley Place.

Conference co-chairs Ken Bernhardt, Jim Boles, and Pam Ellen, all of Georgia State University, along with an outstanding group of track chairs, have assembled a program that can only be described as truly superb. The theme of the conference is âEnhancing Knowledge Development in Marketing,â and this theme is well-supported by the sessions within the program.

In particular, a number of special sessions feature multiple perspectives from practitioners, academicians, and policy makers, focusing on issues that are the subject of contemporary debate and research in marketing. For example, in an opening session one firm, VIA, will discuss how they practice integrated brand building. Another session features a panel of industry experts examining the topic of marketing metrics to reinforce what we are finding from our own research and teaching—marketing performance does indeed matter and the use of such performance metrics is becoming increasingly important.

On the customer side, several sessions will address the issues of customer loyalty and customer relationship management (CRM). Another session focuses on the important subject of privacy from three different perspectives: industry, academia, and public policy making.

Overall, the conference offers programming that is of strong interest to marketers across a wide spectrum of specializations. As you peruse the program, you will immediately notice the richness of topics and impressive array of scholars representing both the paper and panel sessions. A variety of SIG-sponsored sessions add great value to the program by promoting opportunities for networking with colleagues who share similar interests.

After reviewing the program that Ken, Jim, Pam, and the track chairs have assembled, Iâm sure you will agree that the 2004 Summer Educatorsâ Conference is a high value-adding event for marketing academicians. I hope you will join us in Boston.

Best Wishes,

Greg W. Marshall, President

AMA Academic Division

For more information see http://ecommerce.ama.org/summered/

Continue reading AMA Summer Educators’ Conference

Subscribe to Decision Science News by Email (one email per week, easy unsubscribe)

Subscribe to Decision Science News by Email (one email per week, easy unsubscribe)