Judgment and Decision Making, vol. 3,

no. 7, October 2008, pp. 483-492.

The value of victory: social origins of the winner’s curse in

common value auctionsWouter van den Bos* 1,2, Jian Li3, Tatiana

Lau1, Eric

Maskin4,

Jonathan D. Cohen1,5, P. Read Montague3, and Samuel M. McClure6

1 Department of Psychology and

Center for the Study of Brain, Mind, & Behavior, Princeton University

2 Institute for Psychological Research, Leiden University

3 Department of Neuroscience and Human Neuroimaging Laboratory,

Baylor College of Medicine

4 Institute for Advanced Study, Princeton

5 Department of Psychiatry, University of Pittsburgh

6 Department of Psychology, Stanford University |

Auctions, normally considered as devices facilitating trade, also

provide a way to probe mechanisms governing one’s

valuation of some good or action. One of the most intriguing phenomena

in auction behavior is the winner’s curse — the strong

tendency of participants to bid more than rational agent theory

prescribes, often at a significant loss. The prevailing explanation

suggests that humans have limited cognitive abilities that make

estimating the correct bid difficult, if not impossible. Using a series

of auction structures, we found that bidding approaches rational agent

predictions when participants compete against a computer. However, the

winner’s curse appears when participants compete

against other humans, even when cognitive demands for the correct

bidding strategy are removed. These results suggest the humans assign

significant future value to victories over human but not over computer

opponents even though such victories may incur immediate losses, and

that this valuation anomaly is the origin of apparently irrational

behavior.

Keywords: auctions, winner’s curse, bounded rationality.

1 Introduction

Auctions of various types constitute a ubiquitous mechanism for buying

and selling items of limited quantity or availability. Given the commonality

of auctions, it is noteworthy that under fairly general conditions,

even highly experienced bidders tend to suffer net losses (Kagel &

Richard, 2001). This fact has come to be called the winner’s

curse and was first identified in auctions for drilling rights in

the Gulf of Mexico (Capen, Clapp, & Campbell, 1971). The phenomenon

has since been reported in a range of other field settings (Ashenfelter

& Genesove, 1992; Blecherman & Camerer, 1998; Cassing & Douglas,

1980; Dessauer, 1981) as well as laboratory studies (Bazerman & Samuelson,

1983; Kagel & Levin, 1986; Kagel, Levin, Battalio, & Meyer, 1986).

Experiments have shown that naive bidders initially incur large losses

that decline over time, but the “curse”

nonetheless persists even for very experienced (Garvin & Kagel, 1994;

Milgrom & Weber, 1982) or professional (Dyer, Kagel, & Levin, 1989)

auction participants.

The winner’s curse arises in auctions for items of fixed, but unknown,

value (known as common value auctions). Oil drilling rights satisfy

these conditions because the amount of oil in a region (and hence its

market value) is the same for all bidders, yet cannot be precisely

estimated. To understand the source of the winner’s curse, begin by

assuming that estimates of value for each bidder are correct on

average with some amount of variance. If participants bid their

estimated value, the winner of the auction will be that participant

with the most optimistic estimate. Since estimates are distributed

around the true value, the most optimistic estimate will generally be

an overestimate of the true value and a net loss will therefore occur

for that bidder. Hence, on average the winner is cursed by the

statistical fact that their estimate is more likely than not to be

greater than the true value.

To avoid the winner’s curse it is necessary to modify

one’s bid beyond one’s estimate of the true value to account for the

conditional probability of winning the auction. That is, a “good”

bid ought to be sufficiently less than one’s estimate

in order to acknowledge the fact that winning is most likely to occur

for an overestimate. In practice, auction participants do modify their

bids strategically, but the correction is not sufficient to avoid

the winner’s curse (Eyster & Rabin, 2005; Kagel &

Richard, 2001; Kagel & Levin, 2002).

There have been several proposed mechanisms for the winner’s

curse (e.g., Eyster & Rabin, 2005; Parlour, Prasnikar, & Rajan, 2007).

These explanations generally propose that bidders fail to perform

rationally due to cognitive limitations (Fudenberg, 2006). The hypothesis

is that people understand they must submit bids less than their estimates,

but they are unable to accurately calculate exactly how much less

to bid. In this study, we examine this hypothesis and find no support

for it. We first present data demonstrating that the winner’s

curse is not a consequence of limited cognitive abilities. We then

demonstrate that the curse depends instead on the social nature of

the auction environment.

Previous work on the psychology of auctions has demonstrated that

social influences have a significant effect on bidding. In escalating

auctions, in which participants bid sequentially until a single high

bidder remains, people are subject to intense emotions that impede

rationalization and may lead to extremely high bids (Ku et al., 2005).

This phenomenon, known as “auction fever,”

is likely to be related to the winner’s curse, according

to our thesis. The winner’s curse has previously be

thought to be an entirely separate phenomenon because the uncertainty

inherent in common value auctions presumably make cognitive demands

overwhelming (Ku et al., 2005; Kagel and Levin, 2002). Additionally,

in our experiments the social environment is minimal. Each participant

submits a sealed bid essentially in isolation and the highest submitted

bid wins, leaving no opportunity for competitive fire to escalate

with the progression of the auction. Our findings address both of

these points. First, despite the challenges posed by lack of information

in common value auctions, people are able to converge to stable bidding

strategies in less than 50 trials that remain constant when cognitive

demands are eliminated. Second, we find that the winner’s

curse is in fact strongly dependent on social context. We conclude

that competitive arousal, and not cognitive limitations, underlies

the winner’s curse.

2 Method

2.1 Participants

The studies were conducted at Princeton University in Princeton, NJ

and Baylor College of Medicine in Houston, TX, where respectively

47 and 48 volunteers participated in the experiments. The average

age of the group was 26.39 years (S.E. 0.90), and consisted of 33

male and 62 female participants. Although volunteers were recruited

from separate participant pools they were instructed identically, but

separately, at each institution (instructors presented an identical

set of PowerPoint slides as instructions for the task). All participants

passed a mathematics quiz given after the experiment to ensure that

all had the quantitative skills necessary for this experiment.

2.2 Procedure

The experiments were run in three conditions with separate groups

of participants. In all conditions, participants first engaged in auctions

of 5 or 6 participants in a baseline condition that we call Human/Naive

(Experiment 1). The behavior of the three participant groups of in this

initial experiment was undistinguishable and are reported in aggregate.

After this first experiment, participants were excused and recalled to

the laboratory after a 2 week period. At this point, all participants

were given instructions about the winner’s curse and

instructed how to calculate the risk-neutral Nash equilibrium (RNNE)

bidding strategy that maximizes expected profits (see below). All

participants were given written tests to confirm that they understood

the RNNE strategy and could compute RNNE bids easily. It was after

this initial auction experience and instruction that the three conditions

differed in experimental procedure.

In the first of the three conditions, which we call Human/Expert (Experiment

2; n=28), participants engaged in another set of auctions against

5 or 6 other people. For the other two conditions, participants bid

against computer algorithms whose bidding strategy was explained to

the participants. For the second condition, called Computer/Emulation

(Experiment 3; n=38), the computer opponents bid by drawing from the

distribution of bids submitted by human participants in Experiment

2. In the final condition, Computer/RNNE (Experiment 4; n=28), computer

opponents bid the RNNE strategy explained below.

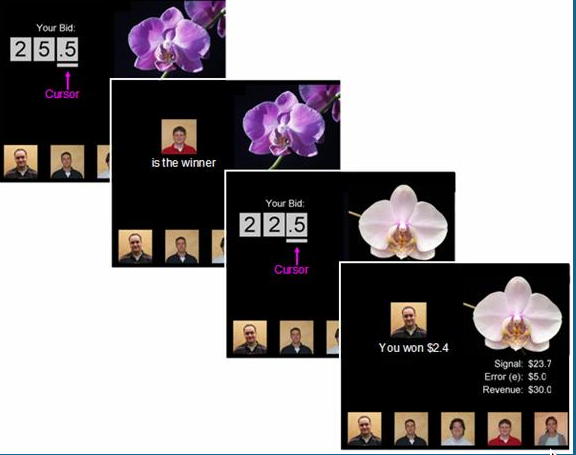

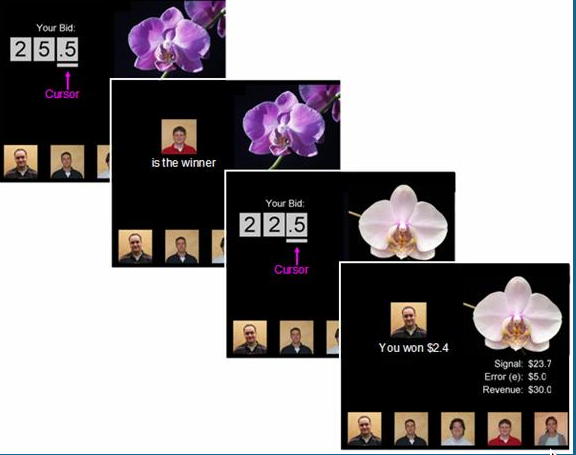

| Figure 1: For each auction, participants were told their personal

estimate of the item’s value (xi), the error term

ε, and their current revenue. Pictures of the other

participants were displayed on the bottom of the screen. For

experiments 3 and 4, the participant photos were replaced with icons

of computers. In each auction, all participants simultaneously

entered their bids; individual bids were never revealed to other

participants. After all bids were submitted, the winning bidder was

revealed to all with no information given about the amount of money

won or lost in the auction. In each of the four experiments,

participants completed 50 rounds of auctions with random estimates

and errors determined on each round. |

The procedures during the auctions was identical in all experiments

(see Appendix A for task insructions). Each experiment consisted of

fifty consecutive sealed bid auctions. In each auction round,

participants were provided with two pieces of information about the

value of the item under auction (see Figure 1). First, they were

provided independent estimates of the value of the item under auction,

which we call xi in the remainder of the paper. They were also

instructed that estimates were drawn from a uniform distribution with

maximum error ε around the true common value x0.

Before the start of the experiment, participants were additionally

instructed that x0 was randomly drawn from uniform distribution

with maximum and minimum values xH and xL, respectively.

All participants were endowed with $30 at the beginning of the

experiment. The winner of each auction round earned x0−b, where

b is the size of the winning bid. This amount (which could be a gain

or a loss) was added to his or her revenue. All other participants

earned $0. Fifteen of the participants lost all of their endowment during

the course of the Human/Naive experiment. We allowed participants to

continue bidding in this case to preserve the number of participants in

the auctions and to ensure equal experience prior to receiving

instruction on how to perform in accord with RNNE. Allowing

participants to continue bidding after bankruptcy has been found to

have no effect on bidding (Lind & Plott, 1991).

In all experiments, the winner of the auction was shown how much they

earned or lost, but all other participants were only shown the identity

of the winner. This corresponds to Armantier’s (2004)

minimal information condition, but deviates from other common value

auction experiments. In particular, we did not inform participants

how much the other participants bid. We also did not show losing bidders

the true value of the item, x0 (cf. Kagel & Levin, 1986).

2.3 RNNE bid strategy

With the information given to participants in the experiments, the risk-neutral

Nash equilibrium (RNNE) bidding strategy can be determined. RNNE bidding

gives the optimal bidding strategy in the sense that it maximizes

expected earnings for all participants. The solution is given by

where

|

Y= | | exp | ⎛

⎜

⎜

⎝ | | ⎡

⎣ | xi− | ⎛

⎝ | xL−ε | ⎞

⎠ | ⎤

⎦ | ⎞

⎟

⎟

⎠ | (2) |

and n is the number of bidders (Milgrom & Weber, 1982). This

function assumes that participants are risk neutral. When estimates

are farther than ε from the bounds on x0 (which

was always true in our experiments), then Y is very close to zero,

and can be ignored (Garvin & Kagel, 1994).

| Figure 2: Over-bidding relative to the rational bidding strategy (bid factor) in

plotted, averaged over sequential 5 rounds of auctions in the Naive

experiment (Experiment 1; gray bars indicate S.E.). An ANOVA with

number of rounds as a between participants factor confirmed that the

naïve participants learned to decrease the size of their bids (F

(9,86)=-16.509, p<.001). This learning effect was absent in

all follow up experiments (p >.1 for Experiments 2, 3, and

4). |

As can be seen in Figure 2, participants almost always bid above the

Nash equilibrium bidding strategy in Experiment 1. One possibility for

why this occurs is that people adopt a “naive” bidding so that bids

match their estimates. A continuum can be generated between this

strategy and the optimal strategy by expressing bids according to

where κ captures the degree to which bids exceed the optimal

strategy. The Nash equilibrium and naive bidding strategies fall conveniently

at κ=0 and κ=1, respectively. We call κ the

“bid factor” in subsequent discussion.

Importantly, for our experiments the RNNE strategy is achieved by

bidding xi−ε. Since both xi and ε

were presented on each round of auction, optimal RNNE bids could be

calculated with a single subtraction. In the “expert” conditions

in Experiments 2, 3, and 4 below, we ensured that all participants

understood the rationale behind bidding below estimates in this manner

and that they were able to compute this quantity easily.

In some cases our experimental data were not normally distributed

(as determined by Kolmogorov-Smirnov tests). We handle this by reporting

the results using both non-parametric tests as well as using t

tests on data transformed according to

This allows us to take advantage of the power of the parametric tests

while also avoiding problems based on inappropriate assumptions about

the structure of the data. As seen in the results, the exact statistical

test used had no effect on our conclusions.

3 Results

| Figure 3: Histograms of the frequency of bid factors for all bid submitted in each

of the four experiments. Bids were significantly reduced when

participants bid against computer opponents (lower plots). Most

participants in the expert auctions (all but top-left plot) appear to

have treated the RNNE bidding strategy (κ=0) as a

lower bound for submitted bids. The distribution of bids was positively

skewed in these auctions as a consequence. |

3.1 Experiment 1: The winner’s curse

| Figure 4: Participants were endowed with $30 at the beginning of each experiment.

The average revenue at the end of 50 rounds of auctions is shown for

each of the experiments (error bars represent S.E.). |

The results for Experiment 1 demonstrate that naive participants consistently

bid above the Nash equilibrium (median κ=0.655; Figure 2 and

Figure 3A) and consistently lose money (Figure 4). Losses are particularly

strong in early rounds and diminish with time as participants gain experience

(Figure 2). However, the winner’s curse (indicated

by κ>0) persists through all 50 rounds of auctions of our

experiment. This is consistent with prior studies demonstrating that

the winner’s curse is evident even for participants

with a large amount of experience (Garvin & Kagel, 1994; Milgrom

& Weber, 1982; Dyer et al., 1989).

The size of the winner’s curse (given by the magnitude

of bids relative to RNNE, i.e. b−bRNNE) correlated strongly

with the possible error in value estimates (ε; r=0.35;

p<10−10). This implies that participants use the error information

to scale their as suggested by Equation 3. This finding justifies

the use of the bid factor to summarize bidding.

3.2 Experiment 2: Persistence of winner’s curse in absence

of cognitive demands

For Experiment 2, auctions were composed of a subset of the participants from Experiment

1 who had received instruction about how to maximize expected earnings

in the task using the RNNE strategy. Despite being fully competent

in implementing this strategy, the winner’s curse

persisted (median κ=0.25), remaining at the same level at

which bidding ended in Experiment 1 (t(1,27)=1.383; p=0.178;

comparison with median κ in final 5 rounds in Experiment 1).

Interestingly, this bid factor produces an average of no net change

in revenue during the course of the experiment (t(1,27)=−.238,

p=0.813). With our number of participants, the RNNE strategy guarantees

no loss of revenue in each auction and expected profits overall. Since

participants were instructed in the RNNE bidding strategy and tested to

ensure their ability to implement this strategy, the fact that bids

were unaffected by this manipulation strongly suggests that factors

other than purely cognitive limitations underlie the winner’s

curse. Instead, post-experiment debriefings strongly suggested that

overbidding was driven by the social nature of the auctions. Participants

reported that their bidding was driven by a desire to “win”

more often than the rationally optimal strategy allowed.

3.3 Experiment 3: Social factor underlie the winner’s

curse

The final two experiment conditions were designed to test our hypothesis

that social context modulates the winner’s curse.

In both conditions we had participants bid against computer opponents

while preserving all other aspects of the task from Experiment 2.

The RNNE strategy assumes that all participants bid optimally. However,

in Experiment 2, participant bid with positive bid factor. There are

strategic consequences when bidding against overly aggressive opponents.

In particular, the RNNE strategy increases when opponents bid above

the RNNE solution in Equation 1. For Experiment 3 (Computer/Emulation)

we had the computer bid so as to match the distribution of bids submitted

by experienced participants in Experiment 2. The strategic effects

of the behavior of the other participants is therefore equivalent

in this experiment and in Experiment 2.

A different subset of participants from Experiment 1 participated in

Experiment 3. Despite the fact that performance by the other

participants was preserved in this experiment relative to the

Human/Expert condition (Experiment 2), the winner’s curse was

significantly reduced with the change to computer opponents (Figure 3;

median κ=0.102, Mann-Whitney U-test, z=−2.674, p=0.003,

one-sided; κ′: t(1,64)=8.527; p<0.001; two-tailed; Figure 3).

Additionally, for the first time participants earned net profits

during the experiment (t(1,37)=−5.407, p<.001; Figure 4). This

finding indicates that social factors play an important role in

generating the winner’s curse evident in the behavior of the

“expert” bidders in Experiment 2.

3.4 Experiment 4: Strategic effects of bidding against participants

The remaining participants from Experiment 1 participated in

Experiment 4. In our final experiment, Experiment 4 (Computer/RNNE

condition), we had computer opponents bid according to the RNNE

strategy (i.e. xi−ε). All other aspects of the task

were identical to the Computer/Emulation experiment.

With this final manipulation, bidding was reduced by a small but significant

amount compared with Experiment 3 (median κ=0.07, Mann-Whitney

U-test, z=−1.778, p=0.04, one-sided; κ′: t(1,65)=2.168;

p<0.017, one-tailed; Figure 3). The fact that bid factors are still

above zero seems to be due to the fact that participants’

used RNNE bidding as a lower bound and occasionally bid above this

value (Figure 3, lower right panel). The distribution of bids is significantly

skewed and has a positive median bid factor as a consequence. Nonetheless,

the distribution of bids submitted in this experiment indicates that

with our instructions participants are able to implement the RNNE bid

strategy, but may fail to do so as a consequence of social context

and subsequent (small) strategic effects.

4 Discussion

Social factors have been discussed as a potential cause of the

winner’s curse for some time, but have been dismissed on various

grounds (e.g., Holt & Sherman, 1994; Goeree et al., 2002; Ku et al.,

2005; but see Delgado, Schotter, Ozbay, & Phelps, 2008)). One

attraction of the hypothesis is that it preserves optimality analyses

by the inclusion of a couple of additions terms in participants’

utility functions. In particular, the utility based on earnings for

bidder i is given by

where bi is the bid, n is the set of participants in the

auction, and x0 is the common value of the item under auction.

If winning and losing affect utility independent of the monetary consequences

of the auction such that:

|

Ui= | ⎧

⎪

⎪

⎨

⎪

⎪

⎩ | | x0−bi+rwin | |

| −rlose | otherwise |

|

| (6) |

where rwin and rlose depend on social factors, then optimal

bids are increased by an amount equal to rwin+rlose.

One problem with this explanation is that it implies that bids should

be increased by a constant amount relative to RNNE. Thus, variables

such as the error (ε) should not correlate with the size

of bids relative to RNNE. However, in our experiments participants

bid farther above RNNE with greater error (a similar finding was reported

for private value auctions by Goeree et al., 2002). Unless it is assumed

that rwin and rlose are also proportional to ε

then this observation is unexplained by the “utility

of winning” in Equation 6. We do not have a complete

explanation for this, but note that if rwin and rlose

do depend on ε then it allows the probability of winning

to be increased independent of ε (see Appendix B). It

seems reasonable to presume that competition may drive people to alter

behavior with the goal of increasing the chances of winning. Thus,

it is not unreasonable that the utility of winning depends on factors

that alter the probability of winning as well.

Other work has taken a similar approach to ours to directly measure

the utility of winning. In a clever experiment by Holt and Sherman

(1994), a separate statistical effect that produces a “loser’s

curse” was used to offset the winner’s

curse. With the proper parameters, the two effects should perfectly

offset leaving only the utility of winning as a bias on bidding. With

this approach, Holt and Sherman concluded that the utility of winning

is zero. However, these auctions were of a very different structure

than standard common value auctions and in fact only had single participants.

The finding that there is no utility of winning when a single person

bids against a computer is fully consistent with our results.

Finally, the utility of winning has been dismissed as an explanation

for the winner’s curse due to the fact that the scarcity of

information in common value auctions make the statistical argument

seem natural and compelling (Kagel & Levin, 2002; Ku et al., 2005).

Additionally, compared with other auction structures in which social

factors are especially salient, sealed bid auctions do not seem to

evoke the same level of competitive exhilaration that is presumed to

underlie “auction fever” (Ku et al., 2005). We can speak to this in

two ways. First, we note that people seem perfectly capable of

adapting to the winner’s curse with a moderate amount of experience.

In Experiment 1, bidding reached asymptote after less than 50 trials.

Armantier (2004) proposed that people learn through reinforcement

learning, which predicts the gradual learning curve in Figure 2. Thus,

while calculating the appropriate bid shading is possible using

mathematical reasoning, it appears that people may actually do

something far easier. In particular, the reinforcement learning

approach suggests that people learn from trial-and-error and gradually

reduce their bids until they reach a desired level of average returns.

The naturalness of the statistical problem that underlies the winner’s

curse may be entirely unrelated to how people respond to incurred

losses and gains.

Second, it is certainly true that the social context

in sealed bid common value auctions is not as enveloping as, for example,

English outcry auctions in which the escalation of offers is publicly

observed. However, our results indicate that the mere presence of human

competitors in sufficient to increase bidding. Furthermore, the social

context is certainly more powerful in our experiments than other manipulations

that are known to affect behavior in economic games. For example,

in Miller et al. (1998), simply telling someone that a fictional partner

shares one’s birthday increases cooperation in a Prisoner’s

Dilemma game. We had participants meet each other prior to the experiment

and displayed pictures of participants’ faces during

the experiment, which seems like a richer social context than Miller

et al.

Our intention in designing the experiments was to maximize the feelings

associated with being in a social context. This was the motivation

behind displaying the winner’s picture after each

auction. Other investigators have made efforts to minimize this effect

with the goal of equalizing behavior when playing against human and

computer competitors (Walker et al., 1987). Exactly what manipulations

are necessary to create a competitive social context remains a difficult

future challenge. However, it is important to note here that it seems

certainly possible that subtle variations on our experimental design

may eliminate competitive motivations that we find to underlie the

winner’s curse. By contrast, our results suggest other

conditions under which the winner’s curse may become

especially pronounced. For example, situations in which auction winners

are highly visible, such as occur in sports free agency, may incur

especially high utility for winning.

Finally, the ability to measure individual susceptibility to the Winner’s

Curse offers a mechanism to measure socially-derived value in units

of dollars. This, in turn, may enable finer investigation of psychiatric

disorders with associated social dysfunctions. Behavioral economics

experiments of this sort have recently been used to probe psychiatric

disorder in this manner (King-Casas et al., 2008); common value auctions

may be another tool in a behavioral economics-derived psychiatry battery.

References

Armantier, O. (2004). Does observation influence learning? Games and

Economic Behavior, 46, 221–239.

Ashenfelter, O., & Genesove, D. (1992). Testing for price anomalies

in real-estate auctions. American Economic Review, 82, 501–505.

Bazerman, M. H., & Samuelson, W. F. (1983). I won the auction but

don’t want the prize. Journal of Conflict Resolution, 27, 618–634.

Blecherman, B., & Camerer, C. F. (1998). Is there a winner’s

curse in the market for baseball players? Brooklyn Polytechnic University,

mimeograph, Brooklyn, NY.

Capen, E. C., Clapp, R. V., & Campbell, W. M. (1971). Competitive

bidding in high risk situations. Journal of Petroleum Technology,

23, 641–53.

Cassing, J., & Douglas, R. W. (1980). Implications of the auction

mechanism in baseball’s free agent draft. Southern Economic

Journal, 47, 110–121.

Delgado, M.R., Schotter, A., Ozbay, E.Y., & Phelps, E.A. (2008).

Understanding overbidding: using the neural circuitry of reward to

design economic auctions. Science, 321, 1849–1852.

Dessauer, J. P. (1981). Book publishing: What it is, what it

does. Bowker: New York.

Dyer, D., Kagel, J. H., & Levin, D. (1989). A comparison of naive

and experienced bidders in common value offer auctions: A laboratory

analysis. The Economic Journal, 99, 108–115. E

Eyster, E., & Rabin, M. (2005). Cursed equilibrium. Econometrica,

73, 1623–1672.

Fudenberg, D. (2006). Advancing beyond advances in behavioral economics.

Journal of Economic Literature, 44, 694–711.

Garvin, S., & Kagel, J. H. (1994). Learning in common value auctions:

Some initial observations. Journal of Economic Behavior & Organization,

25, 351–372.

Goeree. J. C., & Offerman., T. (2002). Efficiency in auctions with

private and common values: an experimental study, American Economic

Review, 92, 625–643.

Holt, C. A., & Sherman, R. (1994). The loser’s curse. American

Economic Review, 84, 642–652.

Kagel, J. H., & Richard, J.-F. (2001). Super-experienced bidders

in first-price common-value auctions: Rules of thumb, Nash equilibrium

bidding, and the winner’s curse. The Review of Economics and

Statistics, 83, 408–419.

Kagel, J. H., & Levin, D. (1986). The winner’s curse and public information

in common value auctions. American Economic Review, 76, 894–920.

Kagel, J. H., Levin, D., Battalio, R. C., & Meyer, D. J. (1989).

First price common value auctions: Bidder behavior and the "winner’s

curse." Economic Inquiry, 27, 241–258.

Kagel, J. H., & Levin, D. (2002). Common Value Auctions and

the Winner’s Curse. Princeton University Press: Princeton, NJ.

King-Casas, B., Sharp, C., Lomax-Bream, L., Lohrenz, T. Fonagy, P.

& Montague, P.R. (2008) The rupture and repair of cooperation in

borderline personality disorder. Science, 321, 806–810.

Ku, G., Malhotra, D., & Murnighan, J. K. (2005). Towards a competitive

arousal model of decision-making: A study of auction fever in live

and internet auctions. Organizational Behavior and Human Decision

Processes, 96, 89–103.

Lind, B., & Plott, C. R. (1991). The winner’s curse: experiments with

buyers and with sellers. American Economic Review, 81, 335–346.

Milgrom, P. R., & Weber, R. J. (1982). A theory of auctions and competitive

bidding. Econometrica, 50, 1089–1122.

Miller, D.T., Downs, J.S., & Prentice, D.A. (1998). Minimal conditions

for the creation of a unit relationship: the social bond between birthdaymates.

European Journal of Social Psychology, 28, 475–481.

Parlour, C. A., Prasnikar, V. & Rajan, U. (2007).Compensating for

the winner’s curse: Experimental evidence. Games and Economic

Behavior, 60, 339–356.

Walker, J. M., Smith, V. L. & Cox, J. C. (1987). Bidding behavior

in first price sealed bid auctions: use of computerized Nash competitors.

Economic Letters, 23, 239–244.

Appendix A: Task instructions

Sealed bid auction experiment

For experiments against human participants:

During this experiment you will participate in multiple Sealed Bid

Auctions with 5 other players.

For experiments against computer opponents:

During this experiment you will participate in multiple Sealed Bid

Auctions against 5 computer players. These computer players

will be playing according to a pre-set method that is explained later

in these instructions.

Sealed bid auction

A Sealed Bid Auction (SBA) is an auction where several bidders

simultaneously submit bids to the auctioneer without knowledge of the

amount bid by other participants. The person who submits the highest

bid is the winner of the auction. Subsequently, the winner will pay the

price of his bid for the object under auction. Usually, and also in

this experiment, the auction is also a common value auction — meaning

that the item up for auction has a fixed, but unknown value.

Common value auction

In all auctions in this experiment, the goods will be worth exactly

the same for each of the participants. Usually the objects that are

bought at a common value auction are sold at a later stage. The true

value of the objects is the future resale value of the objects, and is

the same for everybody. However, it is important to understand that

this true value will not be known by any of the participants.

Instead, every participant has a privately known estimate of

the true value. That private estimation is called the

signal, and it is given by the experimenter. Naturally the signal

can be higher or lower than the true value.

The experiment

In this experiment you will be participating in a series of sealed bid

auctions that will be auctioning different types of flowers. In each

auction a new type of flower will be presented. Each flower will be

shown with two additional pieces of information:

(1) your PERSONAL SIGNAL of the value of the flower,

(2) an ERROR TERM that indicates how far your signal can be

from the true value of the flower.

Based on this information you will know only imprecisely the actual,

true value of the flower being auctioned. More detail on the signal and

error information is below.

Each player will begin with the same amount of money. When the new

object (a flower) is presented on your computer screen, you can make

your bid; adjust the digits so that they represent the bid you want to

make and then submit it. When all sealed bids are received the winner

is determined. The revenue (which is explained later) of that bid

(which can be negative or positive) will be added to the

winner’s revenue, and the name and picture of the

winner will be displayed on every screen. The next round will start

after a few seconds.

Revenue

The earnings on each auction are determined as the difference between

the amount paid (winning bid) and the true value of the flower. Since

the true value is not known until the end of the auction, it is to your

advantage to make bids that you believe to be less than the

(unknown) true value of the flowers. As long as you bid less than the

true value of the items, you will make profits on the auctions. If you

win an auction with a bid that is above the true value of the flower,

you will lose certain amount of money that is equal to the difference

between your winning bid and the true value of the flower.

The Signal (s) and the Error term (e)

Each participant will receive a private signal (s) that is based upon

the real true value of the flowers for sale (the private signal will be

different for each participant). For each round of the auction, an error

range (e) is picked. The error term (e) is displayed for each round and

indicates how far estimates can be from the true value of the flower

being auctioned. All players receive the same error range (e) for any

specific round. The true value of the auctioned flower will be within

the error range of the private signal (s±e).

Example:

True Value | $16 | Same for everybody, but not known |

| |

Error (e) | $2 | Indicates that individual signals of the true value can be between $14

and $18 |

A random personal error is picked for each round. Unlike the error range

(e), this personal error is different for each player and will remain

unknown.

For instance, assume that the error picked for you is –$1.25. That

means that your signal will be:

$16 – $1.25 = $14.75

Keep in mind that you do not know your personal error. However, you do

know that the real common value must be somewhere in between your

signal ($14.75) minus maximal error ($14.75-$2=$12.75) and your

signal plus maximal error ($14.75+$2=$16.75), thus in the range of

$12.75 to $16.75.

The distribution of the error term is uniform; this means that real

value of the auctioned flower is equally possible between s±e

(signal ± error range). A larger error is as likely as a small

error.

For computer/emulation experiment the following

paragraph was included here:

Computer players will also play under these rules. Each one will be

assigned different personal errors and signals. Each computer player,

however, will submit bids based on how previous experiment participants

performed with your same level of experience.

For computer/rnne experiment the following paragraph was included

here:

Computer players will also play under these rules. Each one will be

assigned different personal errors and signals. Each computer player,

however, will automatically submit the Nash equilibrium bid (see below)

every round.

After each round of bidding, the picture and name of the winner for that

specific round will be revealed to all participants, though none of the

participants knows exactly how much revenue the winner earned for that

round.

The range of the common value

There is also a minimum possible real value and a maximum real value for

the flowers sold on the auction. All goods in this experiment will have

a real value between $10 and $48.

What to do?

| To change the digit bid amount: | Press 1 |

| To move the cursor to another digit: | Press 2 |

| To enter a bid: | Press 3 or 4 |

Please use your left hand for buttons 1 and 2 on the keyboard and you

right hand for button 3 or 4 on the numpad (check numlock is on). This

will prevent to submit bids by mistake.

Every player must try to make as much revenue as possible during the

course of the experiment. At the end there will be an extra monetary

reward based upon how much revenue you made.

-

Everybody will earn at least $15 dollars for playing the game.

- If you end up with less virtual money than you start with in the

game you will not make any extra money.

- If you end up with negative revenue (below zero!), money will be

subtracted from your original $15 dollars.

- If you make money in the game you can make up to $30 dollars

total.

Only at the end of the experiment will the total revenue of each player

will be revealed to everyone else.

Remember that if you never win an auction, you will not garner any

additional revenue. However, bidding too high and paying more than the

real common value means losing revenue!

At the end you will be asked how well you believe you did relative to

the other players, so try to guess how the other players are doing.

For all experiments except for human/naive the following section was

included:

Risk neutral bidding strategy

It is common that people lose money in common value actions like this

one. Economists hypothesize that this is caused by a combination of two

factors: (1) the bidders all have different imprecise estimations of

the real common value and (2) the bidders do not take the behavior of

the other players into account.

The winner of each auction is the one who submits the highest bid; this

bid is based on the signal and the error. At the moment that the winner

is revealed, you can be sure that none of the other players was willing

to pay the amount the winner bid, or they would have made higher bid.

The fact that all other players were not willing to bid as much as the

winner did is information that can be taken into account.

Again, it can mean one of two things. (1) It can mean that the signals

of all other players are lower than the winner’s

signal, or (2) it can mean that they play by a different strategy. Of

course, it also could be a combination of the two, but it is more

likely that some, if not all, of the other players’

signals are lower than the winner’s signal. Thus, it is

very possible that the winner’s signal is an

overestimation.

Because personal signals are imprecise, bidding at or above your signal

risks overpaying, thereby losing money on an auction. According to

economic theory, you can protect yourself from the risk of overpaying

(and losing money) by bidding no more than your signal minus the

general error term (e).

Example:

| Your estimate | $14.75 |

| Error (e) | $2.00 |

| Risk Neutral bid | $12.75 |

It is easy to see why this is the safe strategy: if your signal is the

true value plus the maximum error, then subtracting the error will

leave you to bid the exact true value. So, in the worst case, having

maximum positive error, you will break even. And in all other cases you

will make money.

Appendix B: Derivation of probability of winning as a function of

error

If all other bidders (j) employ the RNNE bid strategy or any other

bidding strategy that is lineary dependent on xj, the the probability

of winning the auction for player i is given by

for xi∈[xL+ε,xH−ε]. If player i

unilaterally increases her bid by an amount ρ above RNNE then

this increases the probability of winning by different amount depending

on the relative values of xi and x0. In particular, if

xi is a high estimate (i.e. xi≈ x0+ε

then increasing one’s bid has only a small effect on the probability

of winning. However, if xi is a low estimate (i.e. xi≈ x0−ε

then the probability of winning can be increased from close to zero

to 1 if ρ is large enough. To examine the dependence of the

probability of winning on ρ, first note that the probability

of winning is 1 anytime ρ≥ x0+ε−xi, or x0≤ xi+ρ−ε.

This gives the solution to the integral above for any ρ∈[0,2ε]:

| Pi | = | |

| | | |

| | = | | + | | ⎡

⎢

⎢

⎢

⎢

⎢

⎣ | 1− | ⎛

⎜

⎜

⎝ | | ⎞

⎟

⎟

⎠ | | ⎤

⎥

⎥

⎥

⎥

⎥

⎦ | . |

|

|

For any ρ, note that its effect on the probability of winning

an auction diminishes as ε increases. However, if ρ

is increased as a function of ε (e.g., ρ=αε)

then the chances of winning will be increased independent of the specifics

of the auction.

This document was translated from LATEX by

HEVEA.