| Low Range | High Range | |||||||

| Save | Risk | Retire | Save | Risk | Retire | Save | Risk | Retire |

| 500 | 0 | 48 | 500 | 0 | 48 | |||

| 1,000 | 10 | 50 | 1,000 | 10 | 50 | |||

| 1,500 | 20 | 52 | 1,500 | 20 | 52 | |||

| 2,000 | 30 | 54 | 2,000 | 30 | 54 | |||

| 2,500 | 40 | 56 | 2,500 | 40 | 56 | |||

| 3,000 | 50 | 58 | 3,000 | 50 | 58 | 3,000 | 50 | 58 |

| 3,500 | 60 | 60 | 3,500 | 60 | 60 | |||

| 4,000 | 70 | 62 | 4,000 | 70 | 62 | |||

| 4,500 | 80 | 64 | 4,500 | 80 | 64 | |||

| 5,000 | 90 | 66 | 5,000 | 90 | 66 | |||

| 5,500 | 100 | 68 | 5,500 | 100 | 68 | |||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

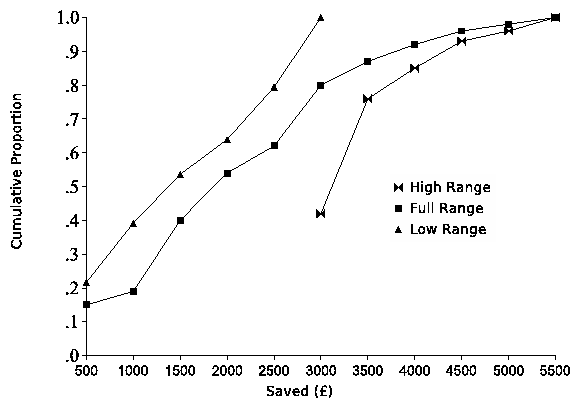

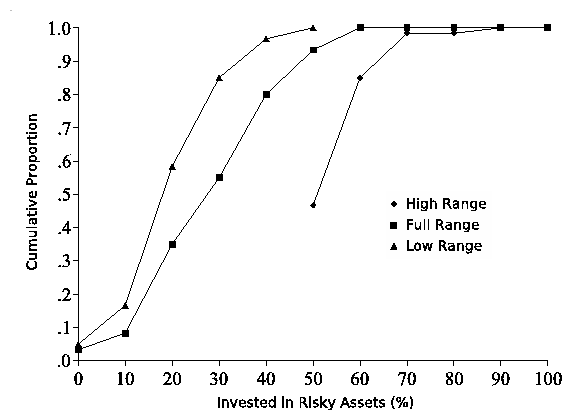

Saving questions There were five questions asking people to choose between savings options presented in monetary terms.The ten questions were presented in different order in the various conditions. We also counterbalanced the order of saving and risk questions by dividing the participants into two groups: one that first answered the saving questions and then the risk questions, and a second group that answered the risk questions before the saving ones. The high range condition was derived by deleting the lower five rows of the table for each question in the full range condition and the low range condition was derived by deleting the higher five rows in the tables in the full range condition (i.e., the same was done for each question). Therefore, in the full range condition, the participants had to choose among eleven possible answer options for each questions, although in the high and low range conditions there were only six available answer options. Note that in this design the participant had to choose among predetermined option values in all conditions. This design was similar to the design used in Experiment 4 reported by Stewart et al., (2003), where in the full range condition the participants had to choose among predefined set of risky prospects (gambles), although in the two context conditions they were asked to choose among predetermined choice options that were either the higher half or the lower half of the list of options offered in the full range condition. Vlaev, Chater, and Stewart (2007) also used very similar design. Realistic practical setting: In addition, the design of the experiment presented in this article had four new features relative to the work reported by Vlaev, Chater, and Stewart (2007). We designed these new characteristics in order to increase our study's relevance to real-world financial advice. These four new design features were: 1. Representative sample. The study was conducted on a sample of working people, rather than university students. In other words, we used participants who were more likely to be consumers of financial advice (e.g., people who were already working, had a family, and needed to save for retirement pension provision) than the student population used in Vlaev, Chater, and Stewart (2007). 2. Realistic financial assumptions. The future financial outcomes (e.g., expected annuity values) were calculated using very plausible financial assumptions (like inflation, risk free rate, risk premium rate, etc.). We undertook this work on consumer understanding of risk, both from a mathematical and from a psychological standpoint, with the help of the Actuarial Profession's Personal Financial Planning Committee in United Kingdom (who actively participated in creating the test materials and the descriptions of the risky assets). The age of the participants was also taken into account in calculating the time horizon of future returns. 3. Financial affordability questionnaire. In the light of the important discussion raised at our meetings with professional actuaries and personal financial advisers, we took account of financial affordability, as a constraint on people's choice of pension. We created a financial affordability test, which categorised people according to their individual financial circumstances. The financial affordability test was designed to help and encourage the participants to think through the practical viability of the financial options that they choose. An additional purpose of the financial affordability test was to make the experimental situation appear as a very realistic example of a financial advisory process. This was achieved by asking the participants concrete questions about their real life financial circumstances and problems. Thus, by explicitly focusing respondents' attention on their real life struggles at the beginning of the experimental session, we expected them to provide more adequate and valid responses to our saving and investment questions. The financial affordability questionnaire is presented in Appendix B and it had the following main features:Risk questions. Next are the five questions asking people to choose levels of risk formulated as percentage of saving invested in the High Risk asset:

- Choose how much to save without information about other variables.

- Choose how much to save and see expected retirement income.

- Choose how much to save and trade it off with retiring at different age and see the expected retirement income.

- Choose how much to save and see the retirement income and its minimum and maximum variability happening because assume that 50% of the savings are invested in the High Risk asset.

- Choose how much to save and take different levels of risk starting from low savings and investment risk and then increase both in parallel.

- Choose how much to invest without information about other variables.

- Choose how much to invest and see expected retirement income and its variability.

- Choose how much to invest and trade-off it with retiring at different age and see the expected retirement income and its variability.

- Choose how much to invest and trade-off it with amount to be saved (increasing investment corresponding to decreasing savings) and see the retirement income and its variability.

- Choose between levels of variability of the retirement income. Variability reflects different investment strategies and is increasing with the income (higher variability corresponds to higher income).

| Condition | ||||

| Low | Full | High | ANOVA | |

| Risk measure | range | range | range | p |

| Direct Risk | 2.40 | 2.47 | 2.20 | .5864 |

| (1.14) | (0.70) | (0.62) | ||

| Direct Concern | 3.30 | 3.47 | 3.15 | .6863 |

| (1.38) | (1.12) | (0.93) | ||

| Relative Risk | 2.65 | 2.75 | 2.47 | .6126 |

| (0.93) | (0.91) | (0.77) | ||

| Relative Concern | 2.85 | 3.05 | 2.84 | .7270 |

| (1.04) | (0.83) | (0.90) | ||

| Income Gamble | 0.70 | 0.67 | 0.53 | .5921 |

| (0.62) | (0.53) | (0.50) | ||

| Investment | Direct | Direct | Relative | Relative | |

| Risk | Risk | Concern | Risk | Concern | |

| Low Range (N=20) | |||||

| Direct Risk | .64** | - | |||

| Direct Concern | .38 | .27 | - | ||

| Relative Risk | .17 | .29 | -.10 | - | |

| Relative Concern | -.02 | -.02 | .39 | -.37 | - |

| Income Gamble | .34 | .16 | .08 | .64** | -.39 |

| Full Range (N=20) | |||||

| Direct Risk | .68** | - | |||

| Direct Concern | .29 | .33 | - | ||

| Relative Risk | .48* | .75** | .08 | - | |

| Relative Concern | .40 | .32 | .58** | .38 | - |

| Income Gamble | .10 | .39 | -.13 | .43 | -.10 |

| High Range (N=20) | |||||

| Direct Risk | .50* | - | |||

| Direct Concern | .07 | .08 | - | ||

| Relative Risk | .37 | .60** | .19 | - | |

| Relative Concern | .25 | .17 | .75** | -.12 | - |

| Income Gamble | .00 | -.09 | -.41 | -.44 | -.11 |

| . |

| Save per year |

| 500 |

| 1,000 |

| 1,500 |

| 2,000 |

| 2,500 |

| 3,000 |

| 3,500 |

| 4,000 |

| 4,500 |

| 5,000 |

| 5,500 |

| Save per year | Retirement Income |

| 500 | 1,000 |

| 1,000 | 2,500 |

| 1,500 | 3,500 |

| 2,000 | 4,500 |

| 2,500 | 5,500 |

| 3,000 | 7,000 |

| 3,500 | 8,000 |

| 4,000 | 9,000 |

| 4,500 | 10,000 |

| 5,000 | 11,500 |

| 5,500 | 12,500 |

| Save | Retirement | Retirement |

| per year | Age | Income |

| 500 | 68 | 1,500 |

| 1,000 | 66 | 2,500 |

| 1,500 | 64 | 3,000 |

| 2,000 | 62 | 3,000 |

| 2,500 | 60 | 3,000 |

| 3,000 | 58 | 3,000 |

| 3,500 | 56 | 3,000 |

| 4,000 | 54 | 2,500 |

| 4,500 | 52 | 2,000 |

| 5,000 | 50 | 2,000 |

| 5,500 | 48 | 1,500 |

| Save | Retirement income | ||

| per year | Minimum | Average | Maximum |

| 500 | 1,000 | 1,500 | 2,000 |

| 1,000 | 2,000 | 3,000 | 3,000 |

| 1,500 | 3,500 | 4,500 | 5,500 |

| 2,000 | 4,500 | 6,000 | 7,500 |

| 2,500 | 5,500 | 7,500 | 9,000 |

| 3,000 | 6,500 | 9,000 | 11,000 |

| 3,500 | 7,500 | 10,500 | 13,000 |

| 4,000 | 9,000 | 11,500 | 14,000 |

| 4,500 | 10,000 | 13,000 | 16,500 |

| 5,000 | 11,000 | 14,500 | 18,500 |

| 5,500 | 12,000 | 16,000 | 20,000 |

| Save | Invest in | Retirement income | ||

| per year | High Risk | Minimum | Average | Maximum |

| 500 | 0 % | 1,000 | 1,000 | 1,000 |

| 1,000 | 10 % | 2,000 | 2,500 | 2,500 |

| 1,500 | 20 % | 3,500 | 4,000 | 4,00 |

| 2,000 | 30 % | 4,500 | 5,500 | 6,000 |

| 2,500 | 40 % | 5,500 | 7,000 | 8,500 |

| 3,000 | 50 % | 6,500 | 9,000 | 11,000 |

| 3,500 | 60 % | 7,500 | 11,000 | 14,000 |

| 4,000 | 70 % | 8,500 | 13,000 | 17,500 |

| 4,500 | 80 % | 9,500 | 15,500 | 21,000 |

| 5,000 | 90 % | 10,500 | 18,000 | 25,500 |

| 5,500 | 100 % | 11,000 | 21,000 | 30,500 |

| Invest in |

| High Risk |

| 0 % |

| 10 % |

| 20 % |

| 30 % |

| 40 % |

| 50 % |

| 60 % |

| 70 % |

| 80 % |

| 90 % |

| 100 % |

| Retirement Income | |||

| Minimum | Average | Maximum | |

| 0 % | 6,500 | 6,500 | 7,000 |

| 10 % | 6,250 | 7,000 | 7,500 |

| 20 % | 6,000 | 7,500 | 8,500 |

| 30 % | 5,750 | 8,000 | 9,500 |

| 40 % | 5,500 | 8,500 | 10,000 |

| 50 % | 5,250 | 9,000 | 11,000 |

| 60 % | 5,000 | 9,500 | 12,000 |

| 70 % | 4,750 | 10,000 | 13,000 |

| 80 % | 4,500 | 10,500 | 14,000 |

| 90 % | 4,250 | 11,000 | 15,000 |

| 100 % | 4,000 | 11,500 | 16,500 |

| Save | Retirement | Retirement income | ||

| per year | Age | Minimum | Average | Maximum |

| 0 % | 68 | 9,500 | 10,000 | 10,500 |

| 10 % | 66 | 7,500 | 8,000 | 9,000 |

| 20 % | 64 | 6,000 | 6,500 | 7,500 |

| 30 % | 62 | 4,500 | 5,500 | 6,500 |

| 40 % | 60 | 3,500 | 4,500 | 5,500 |

| 50 % | 58 | 3,000 | 3,500 | 4,500 |

| 60 % | 56 | 2,500 | 3,000 | 3,500 |

| 70 % | 54 | 2,000 | 2,500 | 3,000 |

| 80 % | 52 | 1,500 | 2,000 | 2,000 |

| 90 % | 50 | 1000 | 1,500 | 1,500 |

| 100 % | 48 | 500 | 1,000 | 1,000 |

| Invest in | Save | Retirement income | ||

| High Risk | per year | Minimum | Average | Maximum |

| 0 % | 5,500 | 12,000 | 12,500 | 13,000 |

| 10 % | 5,000 | 11,000 | 12,000 | 13,000 |

| 20 % | 4,500 | 10,000 | 11,500 | 12,500 |

| 30 % | 4,000 | 9,000 | 10,500 | 12,500 |

| 40 % | 3,500 | 8,000 | 10,000 | 12,000 |

| 50 % | 3,000 | 6,500 | 9,000 | 11,000 |

| 60 % | 2,500 | 5,500 | 7,500 | 10,000 |

| 70 % | 2,000 | 4,500 | 6,500 | 8,500 |

| 80 % | 1,500 | 3,000 | 5,000 | 7,000 |

| 90 % | 1,000 | 2,000 | 3,500 | 5,000 |

| 100 % | 500 | 1,000 | 2,000 | 3,000 |

| % Variability above | Retirement |

| and below the average | Income |

| 0 % | 6,500 |

| 10 % | 7,000 |

| 20 % | 7,500 |

| 30 % | 8,000 |

| 40 % | 8,500 |

| 50 % | 9,000 |

| 60 % | 9,500 |

| 70 % | 10,000 |

| 80 % | 10,500 |

| 90 % | 11,000 |

| 100 % | 11,500 |

| Question | Mean | S. D. |

| General | ||

| Annual income | 19,235.5 | 15,492.6 |

| Spend less than you earn by | 3,601.1 | 3,032.7 |

| Spend exactly the amount you earn | 18,658.8 | 8,729.8 |

| Spend more than you earn by | 1,593.8 | 1,136.4 |

| Current Saving | 1,829.3 | 2,363.2 |

| Essential expenditure | ||

| Food | 2,147.3 | 1,905.0 |

| Rent / Mortgage | 3,177.0 | 1,990.6 |

| Utilities (electricity, gas, water, etc.) | 659.9 | 832.4 |

| Car | 1,301.5 | 1,616.8 |

| Other transport (train, busses) | 343.6 | 686.3 |

| Debt repayment | 1,021.2 | 1,234.8 |

| Communications (telephone, etc.) | 424.1 | 300.5 |

| Childcare and Schooling | 283.5 | 747.0 |

| Health | 76.3 | 109.7 |

| Repairs and Maintenance | 439.6 | 542.6 |

| Other (e.g., health, life insurance) | 425.0 | 479.6 |

| Holiday | 327.0 | 392.3 |

| Discretionary expenditure | ||

| Entertainment (e.g., cinema) | 234.0 | 356.5 |

| Sport | 177.5 | 222.1 |

| Hobbies | 554.7 | 516.4 |

| Meals and Drinks | 663.7 | 1,351.6 |

| Other | 1,249.0 | 5,816.9 |

| Total Expenditure | 13,504.9 | 1,123.6 |

| Demographics | ||

| Desired Saving | 3,606.9 | 3,589.4 |

| Household Income | 30,328.4 | 34,202.2 |

| Give up discretionary spending | Yes | 54.2% |

| to save | No | 45.8% |

| Employment | Part-time | 31.7% |

| Full-time | 68.3% | |

| Education | School | 5.08% |

| College | 28.8% | |

| University | 66.1% | |

| Time spent managing finances | Not at all | 13.3% |

| Occasionally | 28.3% | |

| Regularly | 35.0% | |

| Often | 15.0% | |

| Very often | 8.3% | |