Howard C. Kunreuther

The Wharton School

University of Pennsylvania

"And do you, like a skillful weigher, put into the balance the pleasures and the pains, and their nearness and distance, and weigh them, and then say which outweighs the other...." (Jowett translation)This view is central to Plato's thought, underlying his theories of education and government. Studies in mathematics, science, and metaphysics are needed to educate the "skillful weigher", who must integrate across different goals and across near and distant times. Similar views dominated utilitarian thought in the 17th to 19th centuries, and included integration of value across individuals in a society as well as different goals and times. (e.g., Bentham, 1789). Aristotle's Ethics, by contrast, partially disagreed, emphasizing multiple goods, and stating that the way in which different goals fit together should vary with the occasion. Aristotle can perhaps be read as advocating situation-dependent integration of multiple goals, an idea that we pursue and elaborate in this paper. Despite this hint from Aristotle, Plato's concept of a single common currency that serves to integrate value across myriad goals has largely held sway both in general psychology and in decision science. Freud's concept of libido (1920), Beebe-Center's hedonic tone (1932), Hull's concept of generalized drive (1951), work on reward systems in the brain (Olds & Milner, 1954; Wise, 2004), and Diener's and Seligman's concepts of general happiness (e.g., Diener & Seligman, 2002) all suggest some general quality that is linked to many different goals. An exception is Keeney (1992), who advocates that decision analysis focus on separate goals and values as a starting point, rather than on goal tradeoffs as represented by overall utility. In decision science, the concept of maximization is linked closely to a mapping onto a single dimension of utility. A bounded set of real numbers has a limiting maximum; but there is no natural total ordering of sets of vectors in two or more dimensions, and therefore no natural concept of maximization. In fact, total ordering is fundamental to most foundational theories in decision science (Savage, 1954; Krantz, Luce, Suppes & Tversky, 1971; Kahneman & Tversky, 1979; Tversky & Kahneman, 1992). The idea that all human goods can be weighed in the same balance is a fascinating scientific hypothesis that has been worth pursuing, to determine the extent of its applicability and the ways in which it fails. Translating many goods into a one-dimensional currency fits well with human thought processes, especially analog mental models (Attneave, 1974; Egan & Grimes-Farrow, 1982). Unidimensionality opens the way to the application of powerful mathematical methods for computing or for approximating maxima (Gregory & Lin, 1992; Nocedal & Wright, 2006).

|

| Possible events | ||||||||

| (mutually exclusive and exhaustive) | ||||||||

| (r)2-5 Possible strategies | E1 | E2 | ... | En | ||||

| strategy 1 | o11 | o12 | ... | o1n | ||||

| strategy 2 | o21 | o22 | ... | o2n | ||||

| ... | ... | ... | ... | ... | ||||

| strategy m | om1 | om2 | ... | omn | ||||

| Outcomes have subjective values uij = value(oij). | ||||||||

| uij may be integrated across multiple attributes of oij. | ||||||||

Multi-attribute utility is integrated

across uncertain events:

| ||||||||

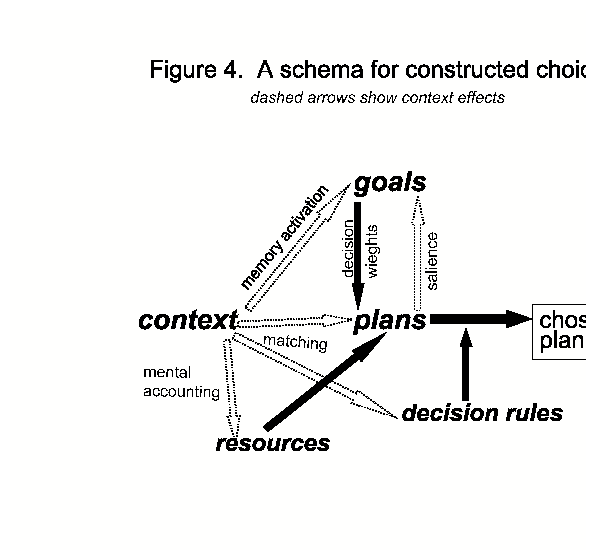

| Active goals | ||||

| Possible plans | G1 | G2 | ... | Gn |

| plan 1 | w11 | w12 | ... | w1n |

| plan 2 | w21 | w22 | ... | w2n |

| ... | ... | ... | ... | ... |

| plan m | wm1 | wm2 | ... | wmn |

| Plans have decision weights for each goal: wij=w(Gj | plan i) | ||||

| Plan i is evaluated in terms of the vj and wij. | ||||

|

| Events | ||||

| E1 | E2 | E3 | E4 | |

| event description | no flood | flood causes | damaging | destructive |

| little damage | flood | flood | ||

| event probability | .85 | .09 | .04 | .02 |

| Outcome components | ||||

| financial cost | premium | premium | premium | premium |

| hassles | none | minor | major | great |

| chronic flood-related anxiety | none | none | none | none |

| acute anxiety (at flood) | none | little | little | little |

| other feelings | regret | justification | justification | justification |

| Outcome components | ||||

| financial cost | none | small | large | catastrophic |

| hassles | none | minor | major | great |

| chronic flood-related anxiety | some | some | some | some |

| acute anxiety (at flood) | none | much | much | much |

| other feelings | justification | relief | major regret | vast regret |

| Goals | ||||||||

| feel | avoid | avoid | avoid | avoid | avoid | avoid | avoid | |

| justified | small | major | catastrophic | chronic | acute | major | vast | |

| Plans | loss | loss | loss | anxiety | anxiety | regret | regret | |

| Plan 1: Purchase flood insurance | .15 | 0 | 1 | 1 | 1 | mostly | 1 | 1 |

| Plan 2: No insurance | .85 | .85 | .94 | .98 | 0 | .85 | .94 | .98 |

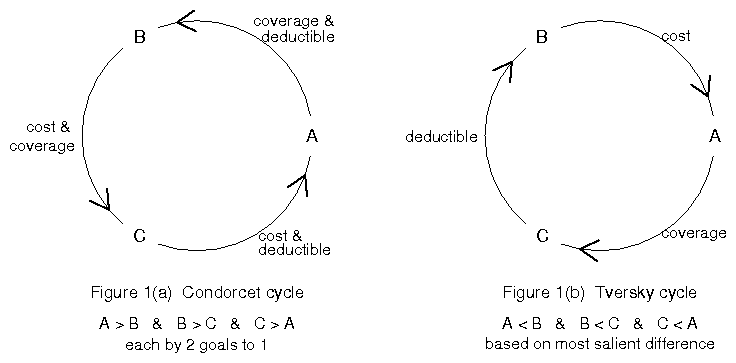

| Goals | |||

| Insurance plans | Avoid catastrophc loss | Avoid regretting a modest loss | Minimize up-front costs |

| A | excellent (high limit) | OK | poor (expensive) |

| B | OK | poor (high deductible) | excellent (cheap) |

| C | poor (low limit) | excellent (low deductible) | OK |

| (1) |

| (2) |

| (3) |

| (4) |

| (5) |

|

|

| annual | coverage | ||

| premium | deductible | limit | |

| policy A | $600 | $1000 | $100,000 |

| policy B | $750 | $ 500 | $100,000 |

| policy C | $750 | $1000 | $150,000 |

| annual | |||

| premium | deductible | rebate | |

| policy A | $1000 | $600 | $0 |

| policy B | $1600 | $0 | $600 |

You are shipping two vases you purchased for $200 each to your home. Suppose that the two vases will be packed in the same box so that if one vase is damaged, the other is also damaged, and if one is not damaged, the other is also not damaged. Of the two vases, you love one much more than the other. You feel that the vase you love is worth $800 to you and the other one is worth only $200 to you. Suppose you have the opportunity to purchase shipping insurance and that you have enough money to insure only one vase. Which one of the two polices will you purchase? Policy A: The insurance premium for the vase you love is $12. Policy B: The insurance premium for the vase you don't love as much is $10.The decision maker should choose Policy B, because it costs only $10, yet offers exactly the same financial benefit as Policy A. When subjects were asked to make the choices between the two policies 63.5% of the respondents chose Policy A. Presumably policy A evoked a goal of being consoled somewhat for the loss of the vase that was loved, or the goal of showing how much one cares about the loved vase. Of course, this is a contrived situation, in which there is no real benefit, emotional or otherwise, to paying $2 extra for the insurance. The more general point is that attachment to objects, and other s emotional goals, should raise a flag for consideration as to how important the goals are and what one is really getting from the insurance, in the same way that violation of the financial benchmarks raises a flag. There are certainly situations where an individual should be willing to violate financial benchmarks to satisfy important emotional goals. Consider the following example. A couple is renting a car for a vacation trip and is asked by the rental company whether they want to pay $2 extra per day to avoid paying up to $1000 if they should have an accident. The couple can manage the payment of $1000 if necessary, and the chance of an accident happening on any one day is much less than 1/500, so paying the $2 has negative expected value. According to the second financial benchmark, they should take the $1000 deductible and save $2 per day. Suppose, however, that the person arranging for the contract is unable to convince her spouse of the benefits of following this rule he will worry much less if they pay the $2 per day for full coverage. She will probably conclude that $2 per day is a small price to maintain peace of mind for her husband and harmony on the vacation.