Judgment and Decision Making, Vol. 17, No. 5, September 2022, pp. 1015-1042

Loss aversion (simply) does not materialize for smaller losses

Dana Zeif*

Eldad Yechiam#

|

Abstract:

Loss aversion, the argument that losses are given more weight than gains,

has been recently shown to be absent in small losses. However, a series of

studies by Mrkva et al. (2020) appear to demonstrate the existence of loss

aversion even for smaller losses. We re-ran Mrkva et al.’s decision tasks

after removing features of the task that differentiated losses from the

gains, particularly asymmetries in sizes of gains and losses, an

increasing order of losses, and status quo effects. The results show that

we replicate Mrkva et al.’s (2020) findings in their original paradigm

with online participants, yet in five studies where gains and losses were

symmetrically presented in random order (n = 2,001), we find no loss

aversion for small amounts, with loss aversion surfacing very weakly only

for average losses of $40 (mean λ = 1.16). We do find loss

aversion for higher amounts such as $100 (mean λ = 1.54) though

it is not as extreme as previously reported. Furthermore, we find weak

correlation between the endowment effect and loss aversion, with the

former effect existing simultaneously with no loss aversion. Thus, when

items are presented symmetrically, significant loss aversion emerges only

for large losses, suggesting that it cannot be argued that (all) “losses

loom larger than gains.”

Keywords: loss aversion, incentive size, endowment effect, biases

1 Introduction

“Dulce periculum” (danger is sweet)Horace, Odes III, 25, 16

Loss aversion, the notion that losses are given more subjective weight than

gains (Kahneman & Tversky, 1979), is considered one of the most important

contributions of psychology to the emerging science of behavioral

economics (Kahneman, 2011). However, the existence and magnitude of loss

aversion is also one the most debated issues in behavioral economics today

(see e.g., Gal & Rucker, 2018; Yechiam, 2019; Mrkva, Johnson, Gachter &

Herrmann, 2020). The current study aims to revisit a recent set of

findings showing that loss aversion can be demonstrated even in small

monetary amounts (Mrkva et al., 2020). We argue that this and similar

studies may have been using research methods that bias towards loss

aversion and produce conflating evidence.

The polarity of the issue can perhaps best be illustrated by the results of

two (yet unpublished but already influential) meta-analyses. Both used the

extant literature on loss aversion to estimate the value of λ

(loss aversion parameter) which dictates how much a loss outcome is given

more subjective weight than a respective gain outcome.1 The first meta-analysis is by Walasek, Mullett and Stewart

(2018). In their analysis the mean λ across studies was 1.31,

with a lower confidence interval of 1.1 which is rather close to 1

(implying gain-loss neutrality) and a far cry from the initial postulation

by Tversky and Kahneman (1992) that losses have more than twice the weight

of gains (i.e., λ = 2.25). Additionally, only six out of 19

studies in this meta-analysis observed significant loss aversion. These

findings challenge the claim that loss aversion is reliable and robust. On

the other hand, a meta-analysis by Brown, Imai, Vieider and Camerer

(2021) examined a much broader literature and used more lenient inclusion

criteria. Its results indicate a confidence interval between 1.8 and 2.1

for λ. These starkly different findings seem to be due to the

examination of different literatures, different types of tasks used to

elicit loss aversion, and different versions of the models used to

estimate λ (i.e., prospect theory). Importantly, the gap also

emphasizes the fact that there’s no done deal in this story, and suggests

the importance of revisiting prior findings in a meticulous fashion.

A key issue in the debate on loss aversion is whether it is revealed only

for large losses, or also for small losses. The existence of loss aversion

in smaller losses is important both empirically and theoretically.

Theoretically, loss aversion is differentiated from the previous notion of

risk aversion (e.g., Markowitz, 1952; Pratt, 1964; Sharpe, 1964) in

arguing for a simple linear subjective weighting of losses to gains which

is not a function of the size of the outcome (or in other words, that even

small symmetrical risks-benefits are avoided). Moreover, it has been

formally demonstrated by Hansson (1988) and Rabin (2000) that if people

are loss averse for small amounts, this implies that under expected

utility theory with a concave utility function, they should show

puzzlingly high risk-aversion rates.2 Thus, the emergence of loss

aversion for smaller losses results in baffling predictions for a simple

expected utility model.

Yet inconsistently with the notion that loss aversion emerges for smaller

losses, a recent string of studies showed that for small losses

individuals do not reliably show loss aversion, but rather exhibit

loss-gain neutrality (Ert & Erev, 2013; Yechiam & Hochman, 2013; Gal &

Rucker, 2018; Yechiam, 2019) and even gain seeking in some settings (Gal

& Rucker, 2018).

Reacting to these findings, Mrkva et al. (2020) argued that loss aversion

is “alive and well” even for small outcomes. They examined two behavioral

phenomena which they argue are demonstrative of loss aversion. The first

is avoiding risky outcomes involving losses. Specifically, participants

were asked if they agree to accept (i.e., take) or reject a series of

lotteries and investments, with increasing losses. For instance, in their

“lottery task” the first lottery involved a coin toss for either losing 2

Euros or winning 6 Euros, the second lottery had a larger loss of 3 Euros,

etc., up to 7 Euros. The second phenomenon is the endowment effect, the

tendency to valuate sold objects more than purchased ones (Thaler, 1980).

While this phenomenon may be driven by other factors besides loss aversion

(as noted in Gal, 2006; Morewedge & Giblin, 2015; and see also Plott &

Zeiler, 2005), Mrkva et al. (2020) suggested that a correlation between

the size of the endowment effect and the estimated loss aversion for risky

lotteries implies that both are related to the same construct.

Mrkva et al.’s (2020) results using a very large sample showed a mean

λ parameter higher than 1 (indicatory of loss aversion) in all

of their studies of risky lotteries and investments, even for small losses

of 2 to 7 Euros. Moreover, in most of their studies the mean λ

topped the 2.25 observed in the seminal study by Tversky and Kahneman

(1992). There was also a strong correlation between λ in

hypothetical investments and the extent of the endowment effect calculated

for the same participants.

However, there are important details that must be considered when

evaluating these results, and those of previous studies that used the same

approach for extracting the loss aversion parameter (e.g., Tversky &

Kahneman, 1992; Shang et al., 2021), which could be referred to as the

“list method” (Holt & Laury, 2002) and is indeed one of the most popular

ways of quantifying loss aversion in the literature (see e.g., Brown et

al., 2021).

The first and perhaps most important feature of the list method is that

gains and losses are asymmetric, and therefore random noise and

ranking-based choices may bias participants towards loss aversion (as also

noted by Mrkva et al., 2020; and see related results in Ert & Erev, 2013;

Walasek & Stewart, 2019; Rakow, Cheung & Restelli, 2020). For example,

in Study 1B, Mrkva et al. (2020) examined the response to investments with

a 50:50 chance of winning $100 and losing either $10, $25, $50, or

$100 (in different investments). Notice the asymmetry of gains and

losses. Under prospect theory (specified with a linear value/utility

function, as detailed in Study 1), responding “reject” to all four items

implies a lower boundary of 10 for λ, while rejecting three to

zero items (in order) implies a lower boundary of 4, 2, 1.33, and 0,

respectively. Therefore, if a person answers randomly s/he would have a

mean orthodox λ of 3.47, and random error biases responses in

the direction of loss aversion (see also Budescu, Wallsten & Au, 1997).

In addition, if a person is highly sensitive to the ranking of gains and

losses, they would similarly opt for the option with the middle-sized loss

producing an inflated λ score (Walasek & Stewart, 2019).

Secondly, because losses presented in the list method steadily increase

some participants may treat multiple items inter-relatedly and accept the

lottery with the lowest loss, as if it was the “most correct” answer in a

multiple-choice exam. Thus, the monotonically increasing size of losses may

further bias participants towards loss aversion. Thirdly, the list method

typically conflates loss aversion with the status quo effect because

rejecting the lottery (and avoiding losses) is the status quo (Ert & Erev,

2013; Yechiam & Hochman, 2013).3 Notice that these

effects not only potentially increase loss aversion but can also create a

false correlation between the endowment effect and loss aversion. This

correlation could result from the similarity of the phrasing and the fact

that participants who treat the task as a multiple-choice test would aim to

get the best “bargain” in both.4

Here, we aimed to examine whether these features of the list method provide

sufficient conditions for the gap between Mrkva et al.’s (2020) results

and the absence of loss aversion recorded in other studies (e.g., Ert &

Erev, 2013; Gal & Rucker, 2018). Our study can be thought of as extending

the critique of Ert and Erev (2013) on the list method with the additional

novel prediction that the monotonic order of outcomes sizes inflates loss

aversion, in addition to the non-symmetry of gains and losses and the

status quo effect (examined by Ert and Erev, 2013). Indeed, Ert and Erev

(2013) were not able to significantly replicate loss aversion in their

study of the “original” list method, and this may be because they used a

random rather than increasing-losses order. By examining all three

features of the list method – asymmetry of items, order, and status quo –

we wish to shed light and explicate the gap between the arguments made in

favor and against loss aversion, and specifically the argument that loss

aversion emerges both for smaller and larger losses, versus the

counter-claim that it only emerges for larger losses.

Following Kahneman and Tversky’s (1979) original postulation that loss

aversion implies that “most people find symmetric bets of the form (x,

.50; -x, .50) distinctly unattractive” (p. 279), and the modeling critique

of Walasek et al. (2018), our primary dependent variable is a behavioral

measure of loss aversion given symmetric gains and losses. In addition, we

also approximated λ, using the exact same modeling approach as

in Mrkva et al. (2020). In the first five studies we focused on the

emergence of loss aversion in decisions under risk and experimentally

tested the possible effect of items order (increasing versus random

losses), the status quo bias, the size of the outcomes, and task

instructions (lottery versus investment task). In the last study we

examined the possible correlation between loss aversion and the endowment

effect.

2 Study 1: Replication and the effect of random order

Our studies were administered online with Prolific Academic participants.

Therefore, given the different population from that of Mrkva et al. (2020)

it was important for us to try and replicate their results using their

original lottery and investment tasks. In addition, in this study we

examined the effect of the increasing losses used in Mrkva et al. (2020).

As noted above, we argue that these monotonic increases can lead to a

mindset that different items are inter-related. This can escalate loss

aversion because some participants may treat items interconnectedly and

select the “best answer” of partaking the lottery (or investment) with the

smallest loss. We therefore compared an increasing-loss order to a

condition where items are randomly ordered.

2.1 Method

2.1.1 Participants

All studies were conducted with Prolific Academic workers from the USA, UK,

Ireland, Australia, and Canada who had an approval rate of at least 95%

and who stated that English was their first language. Higher approval

rates on Prolific are associated with less dishonest behavior (Schild,

Lilleholt & Zettler, 2019). A total of 400 participants (199 females,

197 males, 4 other) volunteered to take part in the study.5

Their average age was 37.4 (SD = 12.7) with individuals ranging from 18 to

78 years old. From this sample, 201 participants were randomly allocated

to the increasing-loss condition and 199 participants were allocated to

the random-loss condition. Participants provided informed consent

statements, and all studies were ethically approved by the authors’

university ethics committee. Participants in both conditions received a

fee of $1 for completing the study.

2.1.2 Task

We administered Mrkva et al.’s (2020) lottery task (from their Study 1)

followed by the investment task (from their studies 2B-2D). The

increasing-loss condition conformed to the exact order of items as in

Mrkva et al, with the first items having the smallest losses, and with the

loss monotonically increasing from item to item (see supplementary section

for the exact items and their order). In the random-loss version we used

the exact same items, but their order was separately randomized for each

participant. Subsequent studies also controlled for task order (lottery

vs. investment). Complete task instructions are presented in Appendix A.

Each item (lottery/investment) was presented on a separate screen with a

“next” button to move to the next item. In total, the two tasks included

10 items. Following these two tasks, participants completed a short

demographic questionnaire in which they reported their age, gender,

education, and definition of wealth and household income (following Mrkva

et al., 2020; see supplementary section).

2.1.3 Analysis

We used two indicators of loss aversion: First, we examined risk taking for

the lottery with symmetric gains and losses (following Kahneman & Tversky,

1979). Secondly, the loss aversion coefficient λ was cautiously

estimated for each individual participant by dividing the constant gain

(e.g., 6 in the lottery task, 100 in the investment task) by the smallest

loss for which the gamble was not accepted (see also Hermann, 2017), as in

Mrkva et al. (2020). Mrkva et al.’s (2020) basic version of prospect

theory assumed a linear weighting function, namely no diminishing

sensitivity (indeed for the amount sizes used here, no strong diminishing

sensitivity is expected; Abdellaoui, Bleichrodt & L’Haridon, 2008). It

also assumes no probability weighting. This latter assumption is not

material because given that the probabilities are the same for gains and

losses in all of the lotteries we used, the multiplication of the

probability weight is canceled out because it is identical for the gain and

loss components (and immaterial for the zero outcome).

For example, respondents who accepted the investment producing $100 gain

and $25 loss with 50%, but not the respective investment with $100 gain

and $50 loss were coded as having a λ of 2 because their value

function (V) gives more weight to the loss component V(−|50α|)

than the gain component of the lottery V(100α)), and assuming

α to be 1, the minimal λ required to reject the lottery

is 2. Importantly, we also used a version of prospect theory with

diminishing sensitivity based on previously estimated values of α ,

and this is reported in the supplementary section.

As in Mrkva et al. (2020), we excluded participants who provided

nonmonotonic responses from this modeling analysis. All effects remained

similar in size when using alternative modeling approaches (see

supplementary section). Throughout, we report both the median and average

λ because each has relative faults and advantages. The median

does not take into account the precise value of each observation and may

be particularly biased when there is a large disparity between responses.

This is likely given low-grain items with respect to the size of gains and

losses.6 On the other hand, the average loss aversion is

biased. For example, consider an individual who gives losses twice the

weight of gains. Her λ would be 2. Now consider the

“opposite” character who gives gains twice the

weight of losses. Her λ would be 0.5. On average, their

λ would be 1.25 although clearly the non-biased central tendency

should be loss neutrality (i.e., λ = 1); the latter is

represented by the median.

2.2 Results

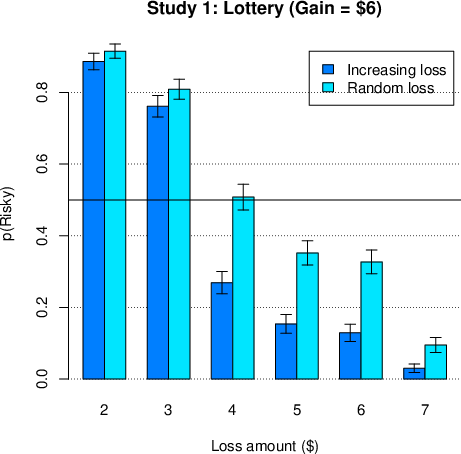

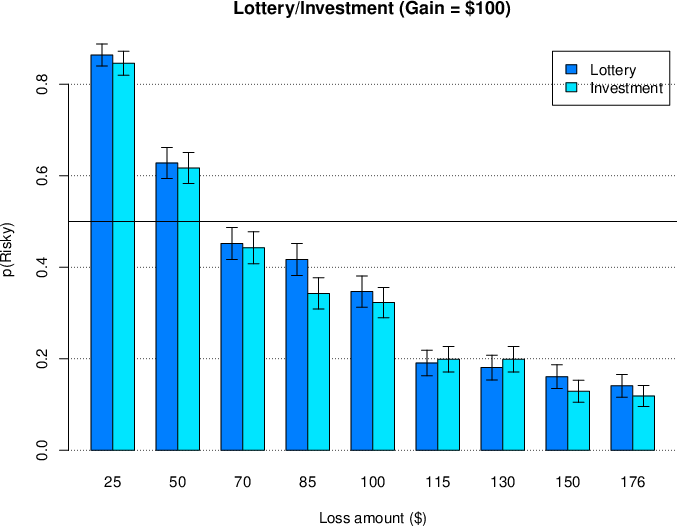

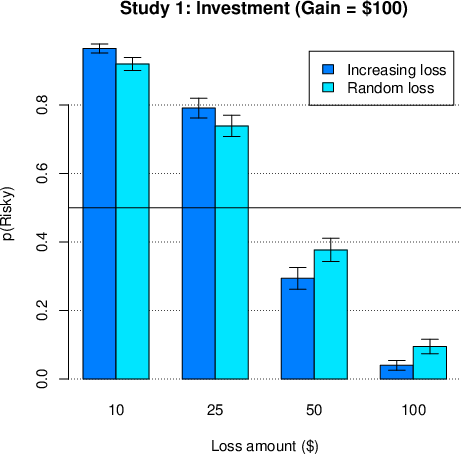

The mean responses to the different items in the two tasks are shown in

Figure 1 top panel. As can be seen in the figure, participants were highly

sensitive to the gains/losses ratio despite the hypothetical nature of the

task, and modified their answer in accordance by varying their risk taking

level, from 6% when losses were high to about 94% when they were small.

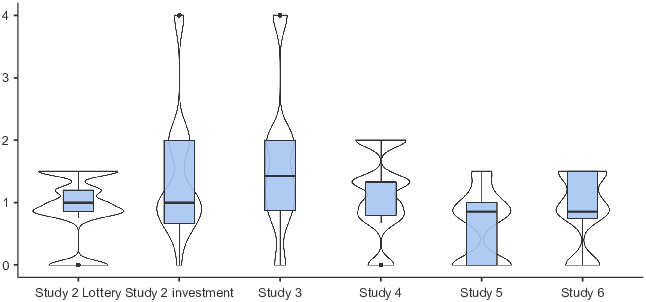

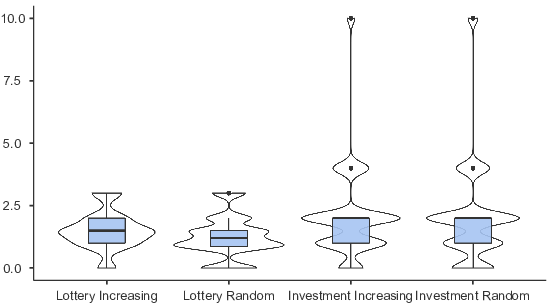

| λ |

|

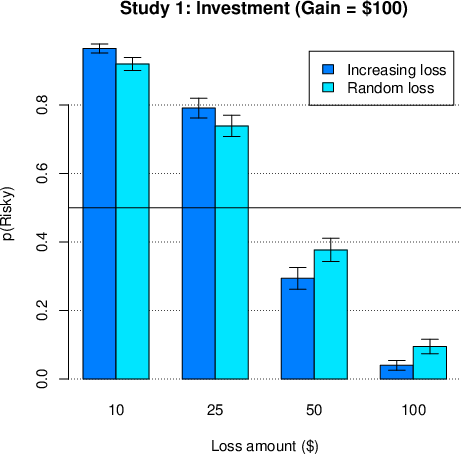

| Figure 1: Top: Study 1 results (replication of Mrkva et al., 2020). Top

panel: Proportion of individuals selecting the risky option in the lottery

and investment task as a function of the order condition (increasing

versus random losses) and size of losses (error terms denote standard

errors). Bottom: Violin plots displaying the distribution of λ

in Study 1. Wider areas of each violin indicate more participants with

that λ coefficient. Box plots display the median

(horizontal dark line) and interquartile range for each study. All study

conditions had median λ well over 1. |

2.2.1 Lottery task

Across conditions, for the symmetric gain-loss lottery task, only 22.8% of

the participants selected the risky option, which is significantly lower

than 50% (binomial test p < 0.001). This replicates Mrkva et

al.’s (2020) findings that have led to their conclusion that loss aversion

emerges even for small losses. Our modeling analysis similarly revealed

that for the lottery task, the average λ was 1.46 (with a median

of 1.50; see Figure 1 bottom panel).

Examining the effect of item order, we find that, on average, participants

took significantly more risk when items were randomized than when losses

were increasing (t(398) = 5.21, p < .001). The average

λ in the increasing losses condition was 1.59 compared to only

1.32 in the random loss condition (the respective medians were 1.50 and

1.20). Therefore, steadily increasing losses biased participants in the

direction of loss aversion.

2.2.2 Investment task

For the item with symmetric gains and losses (of $100), only 6.8% of the

participants selected the investment, which appears to be consistent with

loss aversion (binomial test p < .001). Modeling revealed a

corresponding average λ of 2.38 (median λ = 2.00). In

this task, the effect of random order was not significant (t(398) = 0.44,

p = .33).

2.2.3 Additional effects

There was no effect of gender on the estimated λ in the lottery

task (t(360) = 1.85, p = .07) but there was a significant effect in the

investment task (t(384) = 3.45, p < .001), with men having lower

estimated loss aversion in this task.7 With respect to age, however, there was no correlation

in either task (Lottery: r = -0.01, p = .80: Investment: r = -0.03, p =

.59), which does not replicate the results of Mrkva et al. (2020) that

older individuals tend to be more loss averse. We also did not replicate

the correlation between λ and ranked education in either task (r

= 0.07, p = .19; r = 0.03, p =.56, respectively).

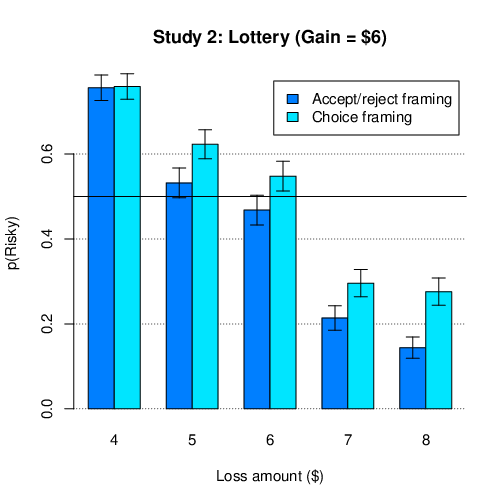

3 Study 2: Symmetric random items and the effect of accept/reject

framing

In this study and in the remaining studies the lottery and investment tasks

were modified such that losses were symmetric in terms of their distance

above and below the gain outcomes. For instance, the lottery task (shown

in Table 1) produced a win of $6 and a loss of either $4, $5, $6, $7,

or $8. In this symmetric task, random noise does not bias towards loss

aversion. We used the version of Study 1 where the order of the items was

randomly determined for each participant. Finally, we manipulated the

possible strength of the status quo effect. Though the instructions for

the two tasks were the same (see below), in one condition participants

were given choices between accepting and rejecting the lottery. In this

accept/reject framing the status quo is that one does not possess the

lottery (i.e., reject). In the alternative choice-framing condition

participants were given a choice between getting the lottery and getting

zero, and thus the status quo was less clear. Accordingly, we examined

whether a task with balanced gains and losses and random order would

eliminate the loss aversion observed for small losses; and also evaluated

the potential influence of the status quo effect.

| Table 1: Outcomes in the lottery and investment task used in Study 2. Gains

and losses were presented with equal (50%) probabilities. The lottery

task was also used in Studies 5 and 6. |

| Item | Lottery (gain/loss) | Investment (gain/loss) |

| 1 | $6 / –$4 | $100 / –$25 |

| 2. | $6 / –$5 | $100 / –$50 |

| 3. | $6 / –$6 | $100 / –$100 |

| 4. | $6 / –$7 | $100 / –$150 |

| 5. | $6 / –$8 | $100 / –$175 |

3.1 Method

3.1.1 Participants

We recruited 401 Prolific Academic participants (193 females, 202 males, 6

other) to take part in this study. Their average age was 34.6 (SD = 12.9).

From this sample, 201 participants were randomly allocated to the

accept/reject framing condition and 200 were allocated to the choice

framing condition. Participants in both conditions received a fee of $1

for completing the study.

3.1.2 Task

The revised lotteries for both tasks appear in Table 1. Items were

presented randomly. Task instructions were as in Study 1, with the

complete instructions available in Appendix A. In the accept/reject

framing condition the lottery was shown in one line (e.g., “If the coin

turns up head, then you lose $6; if the coin turns up tails, then you win

$6”) while the response, shown in the line below, was either “Accept” or

“Reject”. In the choice framing condition the first line indicated “Choose

one of the options” and in the response line below participant selected

between the lottery (e.g., “50% chance to lose $6 and 50% chance to win

$6”) and an option of getting zero (i.e., “get 0”). As in Study 1, each

item was presented on a separate screen, and the two tasks included 10

items. After completing the two tasks participants filled in demographic

and financial questionnaires (see supplementary section). Modeling

analyses were conducted as in Study 1.

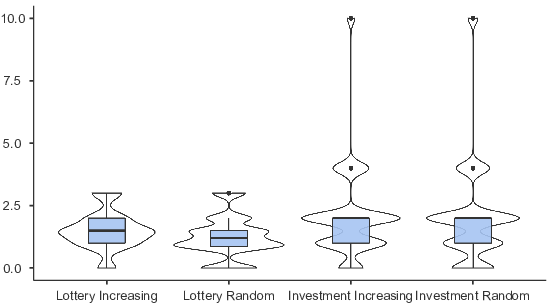

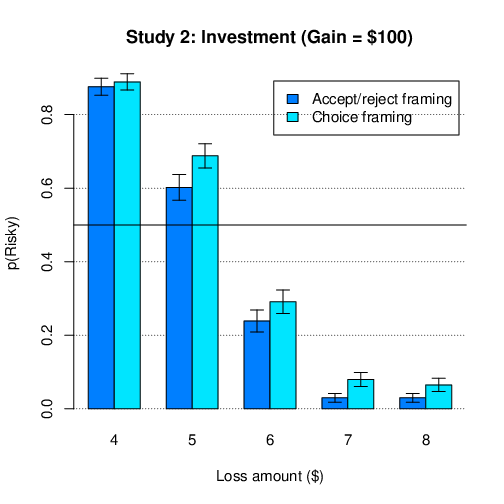

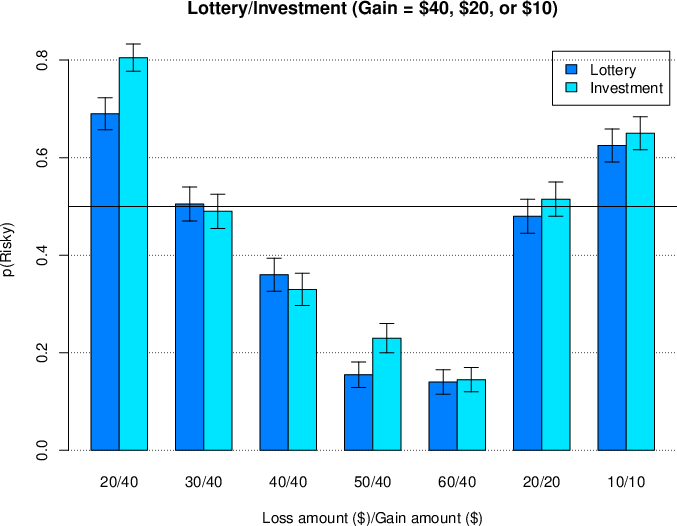

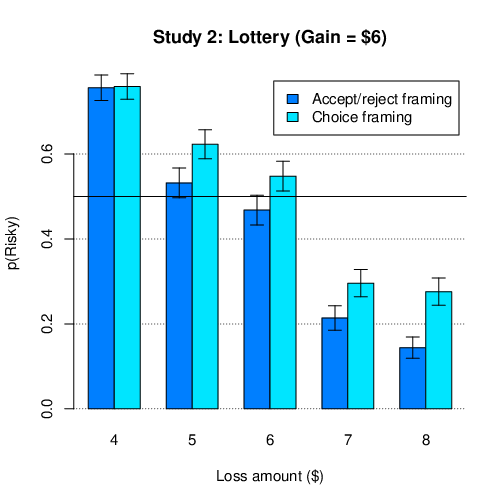

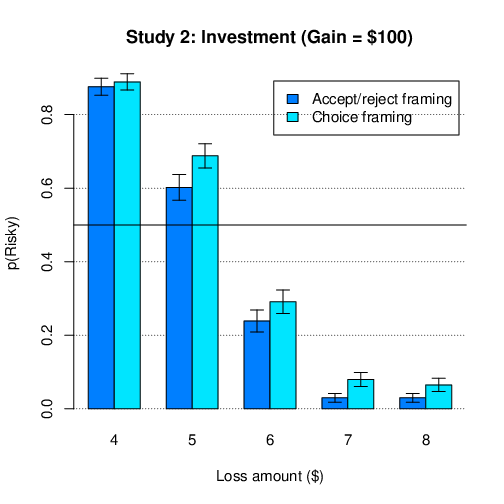

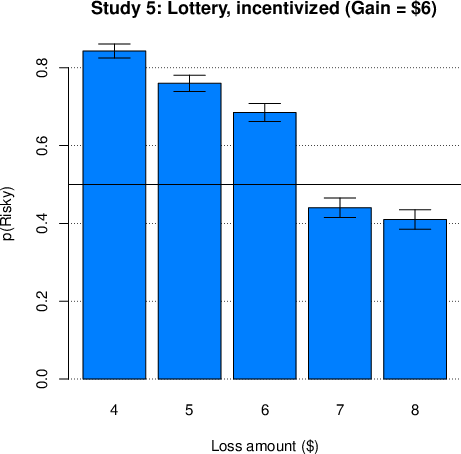

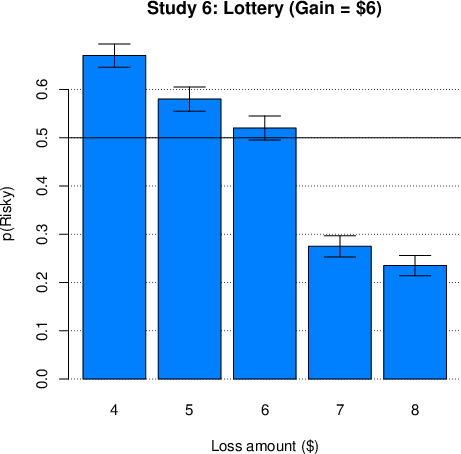

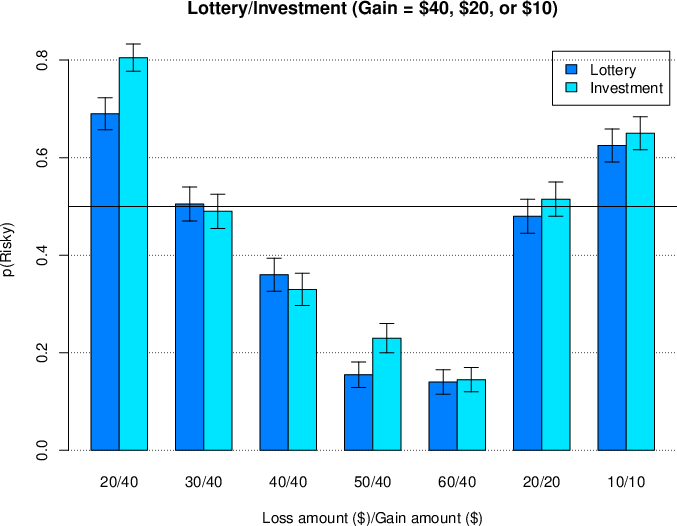

| Figure 2: Study 2, 5, and 6 results using symmetric items. Proportion

of individuals selecting the risky option in the lottery and investment

task as a function of the framing condition (accept/reject vs. choice

framing) and size of losses. Error terms denote standard errors. |

3.2 Results

The mean responses to the different items in the two tasks are shown in

Figure 2 top panel. As in the previous study, participants were highly

sensitive to the gains/losses ratio and on average modified their

risk-taking level monotonically with the size of the loss.

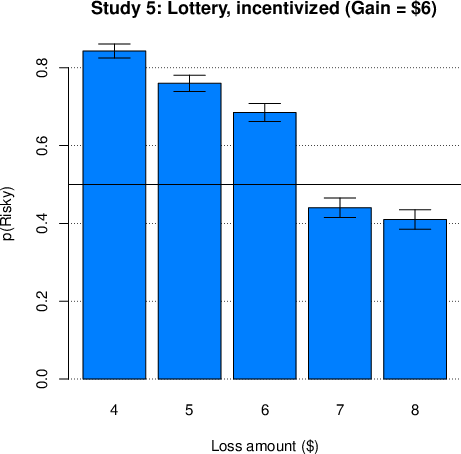

3.2.1 Lottery task

Across conditions, in this symmetric gain-loss task version, 50.7% of the

participants picked the risky option, which is not significantly different

from 50% (binomial test p = .80), and indicates gain-loss neutrality.

Consistently with this, our modeling analysis revealed that the average

λ was 0.92 (the median was 1.0; see Figure 3). The

effect of the accept/reject framing was in the direction of loss aversion

(t(398) = 2.33, p = .02). The average λ for the

accept\reject framing was 1.00, while for the choice

framing it was 0.84 (respective medians were 1.00 and 0.86).

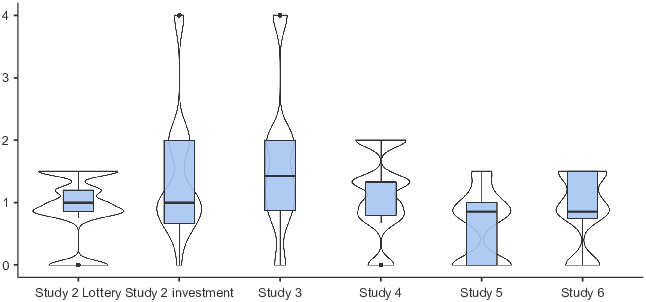

| λ |

|

| Figure 3: Violin plots displaying the

distribution of λ in Studies 2-6. Wider areas of each violin

indicate more participants with that λ coefficient. Box

plots provide the median (horizontal dark line) and interquartile range

for each study. The median Lamda approached 1 in the lottery task in

Study 2, 5, and 6 in which symmetric small losses and gains were used.

Also, in Study 4 with a moderate loss of $40, only about half (51%) of

the participants had λ above 1. |

:

3.2.2 Investment task

For the item producing a loss and a gain of $100, 27% of the participants

selected the investment, which is somewhat higher than in Study 1, though

still consistent with loss aversion (binomial test p < .001).

Modeling revealed an average λ of 1.45 (median λ =

1.00; see Figure 3). The lower median is partially due to the low

granularity of the task; namely most participants rejected the symmetric

loss/gain investment but accepted the one with a somewhat lower loss.

Again, the effect of the accept/reject framing was in the direction of

loss aversion for all lotteries (t(398) = 2.19, p = .03) denoting the

biasing effect of this phrasing.

3.2.3 Additional effects

As in Study 1, we observe no effect of gender on λ estimated in

the lottery task (t(338) = 0.33, p = .74) while in the investment task we

do find an effect of gender (t(378) = 2.41, p < .02), with men

having lower loss aversion estimates.8 With respect to age, we

find no significant correlation for the lottery task (r = 0.03, p = .63)

but a weak correlation for the investment task (r = 0.11, p = .04), thus

partially replicating the correlation found in Mrkva et al. (2020). For

conciseness, similar analyses in all subsequent studies are included in the

supplementary section and summed up in the general discussion.

4 Study 3: High stake lotteries versus investments

In Study 2 we found loss aversion in the investment task and no loss

aversion in the lottery task when using symmetrical items. There are two

main differences between the two tasks: the first is the size of the

outcomes, and other is the framing of the task as lotteries versus

investment. Possibly, participants in an investment context want to feel

that they gain money rather than stay even (Shang, Duan & Lu, 2021), and

for this reason may be more loss averse in this task. We therefore

manipulated the task context to involve either a risky lottery or an

investment. The payoffs used in the current study were those of the

(revised) investment task used in Study 2. In addition, because in Study 2

it was difficult to characterize the median of the loss aversion

parameter, we added items so that there was a finer grain of losses (as

shown in Table 2).

| Table 2: Outcomes in the lottery and investment task used in Study 3 and 4.

Gains and losses were presented with equal (50%) probabilities. Outcomes

in Studies 3 and 4 were presented as either lotteries or investments (in

two conditions). |

| | Study 3 (large losses) | Study 4 (moderate losses) |

| Item | (gain/loss) | (gain/loss) |

| 1 | $100 / –$25 | $40 / –$20 |

| 2. | $100 / –$50 | $40 / –$30 |

| 3. | $100 / –$70 | $40 / –$40 |

| 4. | $100 / –$85 | $40 / –$50 |

| 5. | $100 / –$100 | $40 / –$60 |

| 6. | $100 / –$115 | $20 / –$20 |

| 7. | $100 / –$130 | $10 / –$10 |

| 8. | $100 / –$150 | |

| 9 | $100 / –$175 | |

4.1 Method

4.1.1 Participants

A total of 400 participants (219 females, 174 males, 7 other) volunteered

to take part in the study. Their average age was 35.8 (SD = 13.5). From

these participants, 201 individuals were randomly allocated to the

investment condition and the remaining 199 were allocated to the lottery

condition. Participants in both conditions received a fee of $1 for

completing the study.

4.1.2 Task and analysis

The study included a single task which was performed using either the

instructions of the lottery task or those of the investment task (see

Appendix A). Task outcomes are shown in Table 2. As in Study 2, the order

of the items was randomized for each participant. Items were administered

using the choice-framing format, namely with the first line in each item

indicating “Choose one of the options” and the response line below

involving a selection between the lottery or the investment and getting

zero (e.g., “50% chance you could win $100 and 50% chance you could

lose $25” or “get 0”). As previously, following the main task

participants completed a short demographic test (see supplementary

section). Analyses were conducted as in the previous studies.

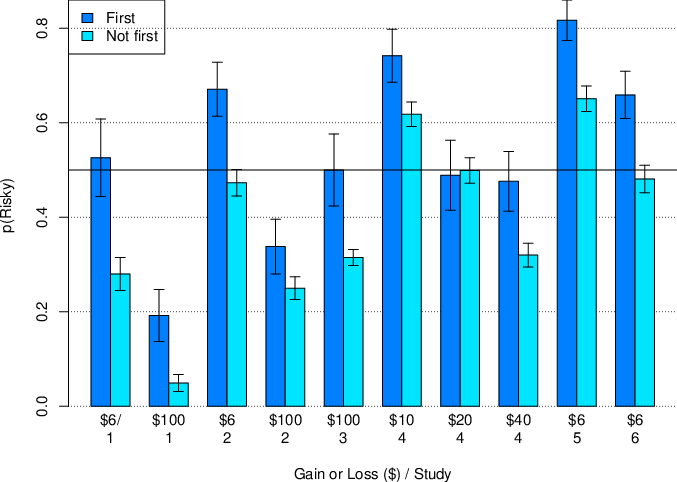

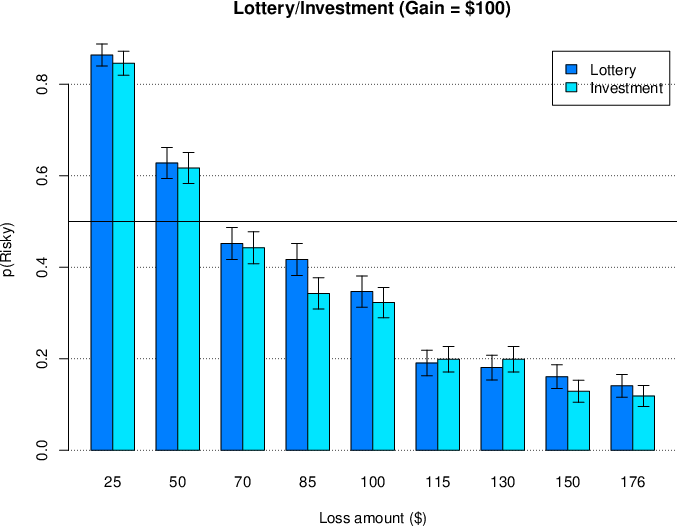

4.2 Results

The mean responses to the different items are summarized in Figure 4. As

evident in the figure, participants again seemed to be sensitive to the

size of gains and losses. They also seemed to be relatively unaffected by

whether the task involved lotteries or investments. Across task

conditions, only 33.5% of the participants select the risky option with

symmetric gains and losses, which was significantly below 50% (binomial

test p < .001)), thus replicating our results in Study 2.

Modeling analyses revealed an average λ of 1.64 (median of 1.43;

see Figure 3). Participants came closest to equal rates of risky and safe

choices when the gain was $100 and the loss was $70 (in this case 44.8%

picked the risky option, slightly differing from 50%; binomial test p =

.04). When examining the effect of task type we find no significant

difference across items (t(398) = 0.62, p = .40). Thus, we find that it is

not the investment context that produces what appears like loss aversion

for high amounts, but rather the magnitude of losses. High magnitudes

provide sufficient conditions for the emergence of a loss-aversion like

behavior. An examination of gender and age differences appears in the

supplementary section.

| Figure 4: Study 3 results. Proportion of individuals selecting the risky

option in the lottery/investment tasks as a function of the size of the

loss. Error terms denote standard errors. |

5 Study 4: Moderate losses

One could argue that the absence of loss aversion only emerges for the

small loss of $6 in the lottery task but not for less trivial losses. In

this study we examined lotteries with symmetric gains and losses of either

$10, $20, and $40, along with items with varying gains and losses, as

shown in Table 2. Specifically, outcomes in the investment task used in

Study 2 were reduced by a factor of 2.5 (resulting in a mean loss of

$40), and two items were added with symmetric gains and losses of $10

and $20. For robustness, we administered the task as either a lottery or

an investment task (as in Study 3).

5.1 Method

5.1.1 Participants

A total of 400 participants (218 females, 180 males, 2 other) took part in

the study. Their average age was 37.7 (SD = 14.1). From these individuals,

200 were randomly allocated to the investment task and 200 to the lottery

task. Participants in both conditions received a fee of $1 for completing

the study.

5.1.2 Task and analysis

As in the previous study, participants completed a single task which was

performed either with the instructions of the lottery task or the

investment task (see Appendix A). Task payoffs appear in Table 2. Items

were administered using the choice-framing format, and in random order.

This task was followed by a short demographic survey (see supplementary

section). The analysis was as in the previous studies, though we

separately examined the response to items with symmetric gain/loss

magnitudes ($10, $20, $40) in order to evaluate the effect of payoff

size. In the modeling analysis we only included items with varying gains

presented for the same loss ($40).

5.2 Results:

Mean responses to the different items are summarized in Figure 5. As can be

seen, participants’ tendency to avoid the risky lottery

depended on the magnitude of gains and losses. Again, our initial focus

was on the lotteries with symmetric gains and losses. When responding to

the $40 gain/loss item, only 34.5% of the participants selected the

risky option, significantly below 50% (binomial test p < .001).

However, for the item with a gain/loss of $20, 49.8% of the participants

preferred the risky option (binomial test p = .96), while for the $10

loss/gain 63.8% preferred to take risk (binomial test p < .001,

above 50%). Thus, behavioral indications of loss aversion started to

emerge only for losses of $40.

| Figure 5: Study 4 results. Proportion of individuals selecting the risky

option in the lottery/investment tasks as a function of the size of gains

and losses. Error terms denote standard errors. |

Focusing on the items with a fixed $40 gain and a mean $40 loss, our

modeling analysis reveals an average λ of 1.16 (median of 1.33;

see Figure 2), which is rather low in comparison to previous estimates

(e.g., Mrkva et al., 2020). Indeed, for the average $40 loss only 51.0%

of the participants had λ above 1. For the $20 loss the best

proxy of the mean λ appears to be 1.0 (given the proximity of

choices to preference neutrality), while for the amount of $10,

λ seems to fall well below this value (though we cannot estimate

it using the current task). Finally, there was no effect of task type on

choices across items (t(398) = 0.96, p = .34), showing that the current

results are robust to task instructions.

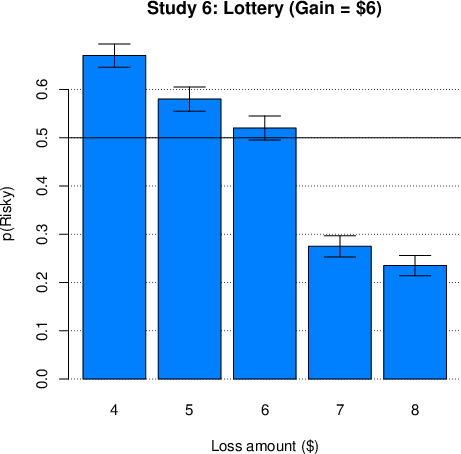

6 Study 5: Effect of incentivization

In Studies 2 and 4 we find that for lotteries and investments with small

gains and losses, up to $20, individuals do not display loss aversion.

However, one might argue that this is due to the fact that gains and

losses in our previous studies were not incentivized. Though Mrkva et al.

(2020) also did not incentivize participants in the lottery and investment

tasks, one might argue that hypothetical losses produce different response

from actual losses (e.g., Holt & Laury, 2002). We therefore aimed to

evaluate whether for small incentivized lotteries as well, individuals do

not exhibit loss aversion. For this purpose, we used an incentivized

version of the lottery task in Study 2 (see Table 1).

6.1 Method

6.1.1 Participants

A total of 400 participants (230 females, 166 males, 4 other) took part in

the study. Their average age was 36.5 (SD = 13.8). Participants received a

fee ranging between $1 to $15 for completing the study, based on their

choices and the realization of the lotteries. Specifically, there was a

$1 participation fee while the remaining amount was based on

participants’ choices and the realization of a randomly selected lottery.

6.1.2 Task and analysis

In this study all participants performed the lottery task. Items were

administered using the choice-framing format, and in random order. The

only difference between the current study and the choice-framing condition

of Study 2, is that choices were incentivized. Specifically, participants

were initially informed that in addition to their participation fee of

$1, an amount of $8 would be deposited at their temporary account, and

that at the end of the task the temporary account will be added to their

participation fee. Also, as part of the lottery/ investment task

instructions, participants were informed that one of the

lotteries/investments will be randomly selected and based on their choice

it will be either played or not, and that any resulting gains or losses

will affect their temporary account (see complete instructions in Appendix

A).

6.2 Results

The mean responses to the different items are summarized in Figure 2 bottom

left panel. For symmetric gains and losses of $6, we find that 68.5% of

the participants preferred the lottery over the safe option, significantly

above 50% (binomial test p < .001). Our modeling analysis

indicated an average λ of 0.64 (median of 0.86; see Figure 3)

which denotes gain seeking (opposite of loss aversion). Most participants

(68.8%) had λ estimates below 1. Furthermore, the lottery where

responses were closest to 50% involved a gain of $6 and a loss of $7.

Only 56% of the participants avoided this lottery (binomial test p =

.02). Our results thus show that incentivization did not produce loss

aversion.

7 Study 6: Relationship with the endowment effect

In our final study we leave our main focus on the weighing of gains and

losses, and examine the relationship between risk taking for gains and

losses and valuation of objects. Mrkva et al. (2020) argued that, if both

risk aversion and the endowment effect are driven by loss aversion, the two

behavioral phenomena should correlate positively. This was strongly

supported in their study with a positive correlation of 0.55 between the

extra surplus an individual charged as a seller compared to a buyer, and

the loss aversion parameter estimated for risky lotteries. However, an

alternative account is that the correlation is due to the same “subject

misconceptions” (to borrow a term used by Plott & Zeiler, 2005) by the

same individuals in both tasks. Particularly, since both tasks in Mrkva et

al. (2020) adopted the same paradigm of steadily and monotonically

increasing costs, the correlation could be due to the resulting tendency of

some individuals to treat items inter-relatedly (see footnote 4). We

therefore supplemented the lottery task with a buying and a selling

task. As in Mrkva et al. (2020) participants performed one task at the

beginning of the experiment and at the other at the end, with

counter-balanced order. However, while the buying and selling tasks used

monotonically increasing prices as in Mrkva et al. (2020), our risk-taking

task involved randomly presented gains and losses as in Study 2-5. Another

difference was that Mrkva et al. (2020) used a physical object (car model)

as the endowed object, while we used a lottery ticket. A recent

meta-analysis evidenced strong endowment effects for lottery tickets

similar to those observed for other commodities (Yechiam, Ashby & Pachur,

2017).

7.1 Method

7.1.1 Participants

A total of 400 participants (196 females, 198 males, 6 other) took part in

the study. Participants were randomly allocated into two order conditions.

Two- hundred performed the selling task first and the buying task last,

and 200 performed the tasks in reverse order. Participants’ average age

was 35.5 (SD = 13.2). They received a fee ranging from $1 to $1.6 based

on their choices and the realization of the lotteries in the

buying/selling tasks. Specifically, there was a $1 participation fee and

the remaining amount was based on their choices.

7.1.2 Task

The initial task was either a buying or a selling task. In the selling task

participants were informed that they are given a lottery ticket with a

1/100 chance to win 20 experimental dollars which they could keep or sell

to the organizers of the study. In the buying condition participants had

the opportunity to buy the same lottery ticket. The instructions for both

conditions were adopted from Mrkva et al. (2020) and appear in Appendix B.

Importantly, as in Mrkva et al. (2020) participants were incentivized for

their buying/selling decisions, with a conversion rate of $1 for each 100

experimental dollars. The initial buying/selling task was followed by the

lottery task which was administered with choice framing and random order of

items, and was not incentivized, as in Mrkva et al. (2020). Next,

participants completed a demographic questionnaire, and a longer financial

survey (from Mrkva et al., 2020; see our

supplemen) that was

used as a filler, followed by the remaining selling/buying task.

7.1.3 Analysis

We calculated selling and buying prices for all participants based on the

lowest price which sellers agreed to sell, and the highest price that

buyers agreed to buy. We also conducted an analysis in which we removed

buyers and sellers who exhibited inconsistent responses (e.g., selling in

a certain price but then refusing to sell given a higher price). We first

tested whether there was an endowment effect by using a repeated-measures

ANOVA with condition (buying/selling) and task order as within-subject

factors. Next, we calculated each individual’s selling premium by

deducting each individual’s buying price from their selling price. We then

replicated our examination of loss aversion in the lottery task as in the

previous studies. Finally, we examined the correlation between the selling

premium and choices in the lottery task as well as the estimated

λ parameter.

7.2 Results

Participants’ mean selling price (i.e., willingness to accept price; WTA)

was $4.28 (SE = 0.16), compared to a mean buying price (i.e., willingness

to pay; WTP) of $2.47 (SE = 0.11), denoting a 1.73 relative increase in

selling estimates. An ANOVA examining the endowment effect and the order

of the buying/selling task showed that the selling premium was

significantly above zero, F(1,398) = 109.50, p < .001). The

effect of the task order was also significant (F(1,398) = 12.16, p

< .001), with higher valuations for those initially allocated to

the selling conditions: On average $5.66 (SE = 0.15) compared to 4.51 (SE

= 0.15) for those who bought first.

The results of the lottery task are shown in Figure 2 bottom right panel.

As can be seen, we replicate our finding of no behavioral loss aversion

for the item with symmetric gains and losses. For this item, 52.0% of the

participants picked the risky lottery (binomial test p = .45). An

estimation of λ conducted as in the previous studies revealed a

mean λ of 0.91 (median of 0.86; see Figure 3).

We next examined the correlation between the selling premium and risk

taking in the lottery task as the individual level. We first focused on

the mean tendency to avoid losses across lotteries. We recover a

correlation of 0.17 (p < .001) between the endowment effect and

avoidance of the lotteries. We thus replicate the positive correlation

observed in Mrkva et al. (2020) though in our study it is considerably

smaller. Indeed, behavioral responses to the gain-loss lotteries account

for only 2.9% of the variance in the selling premium. We find a similar

correlation between the selling premium and λ (r = 0.16, p =

.001).

We also conducted a robustness test that focused on individuals who

performed the selling and buying task without any inconsistencies. This

removed 14% of the selling estimates and 21.5% of the buying estimates

(the greater coherence of selling price is consistent with that found in

other studies; see Yechiam et al., 2017). The results for this subset

showed a significant endowment effect, with a mean selling price of $4.75

compared to a buying price of $2.95 (F(1,276) = 79.36, p <

.001) and again a small positive correlation between risk avoidance in the

lottery task and the selling premium, r = 0.20, p < .001.

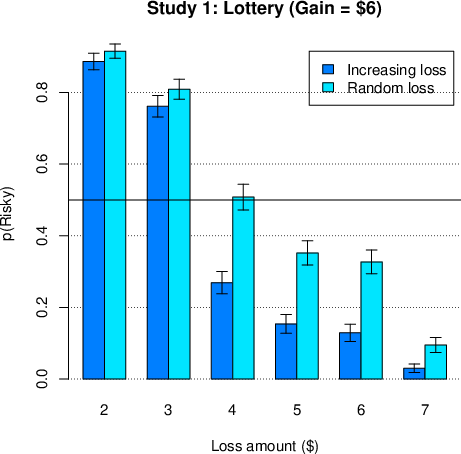

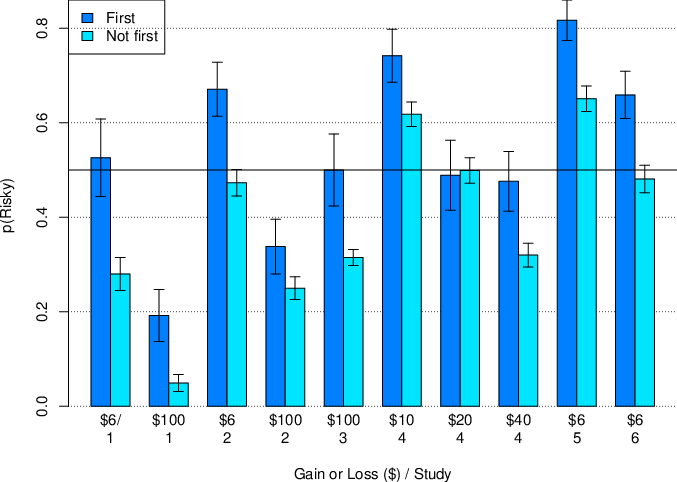

8 An analysis of first presentation effects

One might argue that the design of the current studies involving multiple

items could bias responses towards loss neutrality despite the balanced

range of expected values and random order, because some items are typically

presented before the target lotteries with equal-sized gains and

losses. Thus, it was important to examine these key lotteries when

presented first. To evaluate this, we examined the responses to the

lotteries involving same sized gains and losses when these were

administered as the first lotteries (to about 1/k of the participants,

where k is the number of items which ranged from 5 to 9 in different

studies), or not. The results are presented in Figure 6, and relevant

statistical analyses appear in the

supplemen. As can be

seen, in all studies across key lotteries, the results trended in the

direction of lower loss aversion when these items were presented

first. A statistical analysis, available in the supplementary section,

shows that this effect was significant in some of the studies, and that it

consistently emerged when the loss amount was small ($6). Interestingly,

in Study 1 which uses Mrkva et al.’s original task conditions, when the

item with symmetric gains and losses of $6 is presented first, eliminating

the effect of asymmetrical outcome sizes and any type of order effect,

participants also did not significantly avoid the lottery (53% chose to

enter the lottery; see supplementary section). Importantly, these results

do not imply that those who were not presented with the target

prospects first, showed loss aversion for smaller amounts (except in Study

1 which replicated Mrkva et al.’s task conditions). The rate of those who

were presented with these key prospects first was relatively small and

therefore removing these participants from the sample does not markedly

change the results reported in our main analysis, as shown in Figure 6 and

analyzed in the supplementary section.

| Figure 6: First-presentation effects in the studies in which the order of

the lotteries was randomized (Study 1 random-order condition, and Studies

2-6). Proportion of individuals selecting the risky option in the

lottery/investment tasks in items with identical-sized gains and losses,

as a function of whether it was the first presented lottery or not, and

given different sizes of (identical) gains and losses. Error terms denote

standard errors. |

9 Discussion

Our first study showed that Mrkva et al.’s (2020) findings of apparent loss

aversion for small losses are replicable in online participants. However,

our next set of five studies show that they are driven by design features

in the list method used by Mrkva et al. (2020) and others (e.g., Tversky

& Kahneman, 1992), especially the non-symmetric gains and losses and

non-random order. In Studies 2–6 we find that when gains and loss items

are symmetrical, namely when the average loss is equal to the average

gain, and items are administered randomly, individuals do not behave in a

strong loss-averse manner unless the losses are high (around $100).

Specifically, for average losses of up to $20 participants did not show

loss aversion, even in a condition when they were incentivized. For an

average loss of $40 participants showed weak loss aversion with a mean

λ of 1.16 and with only 51% of the participants having

λ estimates above 1. In tasks with higher losses averaging

$100, we do observe what appears to be loss aversion. Yet even in these

higher stakes lotteries/investments, our estimate of λ for

symmetric items is not as high as in previous studies (e.g., Tversky &

Kahneman, 1992; Mrkva et al., 2020), with a mean λ of 1.54

across studies. This indicates that differently from the notion espoused

in prospect theory, the λ coefficient is not constant across

different loss amount, but instead is highly dependent on the amount, and

goes to 1 or below for smaller amounts.

Our findings also show that a variety of task-related factors can bias

participants to behave in an apparent loss averse manner. As noted at the

outset these factors include: a) items with asymmetric sizes of gains and

losses, b) monotonically increasing/decreasing loss amounts which may

lead to perceived inter-item relationships, and c) the usage of an

accept/reject framing for possible options. In Study 1 we found a notable

effect of randomizing items. Even given non-symmetrical gains and losses,

randomizing items reduced loss aversion by about half (from λ of

1.59 to 1.32, on average). In Study 2 we found that changing the

asymmetric loss/gain items to symmetrical ones and randomizing item order

provided sufficient conditions for the complete disappearance of loss

aversion with small losses. In this study we also found that not using an

accept/reject framing further reduces loss aversion. By contrast, a factor

that was not found to affect choices (in Studies 3–4) is the framing of

the task as a lottery or an investment (Shang et al., 2021).

Our analysis of order effects in all studies indicated that loss aversion

in symmetric gain/loss lotteries was apparently further reduced when

small-sized lotteries were presented first. This is consistent with Ert

and Erev’s (2013) finding that loss aversion was lower when tasks are

relatively simple, though they did not find a significant order effect in

their study. This first-presentation effect is an interesting and hitherto

unobserved moderator of people’s sensitivity to losses.

In addition, our final study examined the relationship between the

sensitivity to gains and losses in lotteries and the endowment effect. To

our surprise, we did find a small positive correlation between these

indices, consistently with Mrkva et al. (2020). The correlation admittedly

could be weak because the two measures are noisy and not necessarily

because they are unrelated. This suggests that the weighting of gains and

losses may be implicated to some degree in both phenomena at the individual

level. However, it is quite erroneous to extrapolate from these findings

that loss aversion “drives” both phenomena at the population

level. Simultaneously with the positive correlation at the individual

level, we found no loss aversion for the average participant in the lottery

task compared to a huge endowment effect for the same

participants. Moreover, the endowment effect was observed for a lottery

with a moderate amount (nominal outcome of $20) for which no loss aversion

emerged in our studies. Thus, it does not seem to make sense to refer to

the same construct as underlying both phenomena.

We also do not replicate the correlation with age and education observed by

Mrkva et al. (2020) consistently across studies. In particular, as

detailed in the supplementary section, the positive correlation between

loss aversion and age appeared only sporadically, in one of our studies.

The only consistent individual difference factor affecting choices was

gender, but its effect was not coherent across payoff magnitudes, being

present only for risks involving large losses. This again emphasizes the

fact that the loss aversion parameter is not stable given different payoff

magnitudes.

Notice that some of these effects can be captured by expected utility

theory (von Neumann & Morgenstern, 1944). Most especially the absence of

loss aversion for small amounts and increased risk aversion with stake

size can be captured if one assumes a certain wealth level to which

outcomes are added, and a diminishing marginal utility of wealth (Hansson,

1988). Indeed, the current findings seem to reconcile (or at least

alleviate) the paradoxical EU theory predictions implied by assuming loss

aversion for lower losses (Hansson, 1988; Rabin, 2000). However, other

aspects of our findings, such as the reduced loss aversion with random

order, and the first presentation effect, violate the procedural

invariance assumption of expect utility theory. Also, another implication

of risk aversion contingent on wealth level which does not emerge in our

data, is that (in approximation) loss aversion should be sensitive to

one’s income (similarly, Mrkva et al., 2020 also found inconsistent

correlations between income and loss aversion in their studies).

Limitations of our study include the reliance on online participants from

Prolific Academic, namely individuals who have experience in engaging in

behavioral experiments. One could ask whether for these individuals, our

presentation of potential losses or even actual losses in Study 5 was

sufficient to produce the same kind of feeling one gets when losing money

out of one’s own wallet. A further limitation is our usage of a fixed text

of “get $0” for the outcomes of the safe alternative, which may have been

unattractive to the participants. While we cannot directly address these

issues with the current dataset (and indeed the former is difficult to

examine without some ethical issues), we can say that we do replicate in

this population and paradigm the very high degrees of loss aversion found

in Mrkva et al. (2020) when we use the exact same conditions of their

study: non-symmetric gains and losses, an order effect, and a status quo

effect.9 Still, we realize further studies

should validate the possibility that experience in participation in

decision making studies, particularly online, might alleviate the loss

aversion tendency.

To sum, when using non-symmetric items we do replicate Mrkva et al.’s

(2020) results of “loss aversion” even for small amounts and in an online

sample, but using balanced symmetric gains and losses and random items

this is not replicated. Instead, we find that loss aversion does not

emerge for small amounts and emerges very weakly for a moderate amount

($40). This finding has important ramifications to the question for

whether loss aversion exists. As aptly noted by Mrkva et al. (2020), a

critical implication of loss aversion is that for small amounts as well

individuals overweigh losses compared to gains. Moreover, loss aversion

implies that the ratio of inflating losses over gains should be constant

over different amounts. The findings that loss aversion does not emerge

for small losses and is much weaker for moderate losses suggest that there

is no grand simple explanation related to the subjective weighting of

gains and losses across different amounts. We hope that new models are

developed to account for these findings.

10 References

Abdellaoui, M., Bleichrodt, H., & L’Haridon, O. (2008). A

tractable method to measure utility and loss aversion under prospect

theory. Journal of Risk and Uncertainty, 36, 245–266.

Argaman, E., Ludvig, E. A, & Yechiam, E. (2020). Probability errors of

buyers and sellers, loss aversion, and loss attention. Unpublish

manuscript. Technion- Israel Institute of Technology.

Brown, A. L., Imai, T., Vieider, F., & Camerer, C. F. (2021).

Meta-analysis of empirical estimates of loss-aversion (2021). CESifo

Working Paper No. 8848, Available at SSRN:

https://ssrn.com/abstract=3772089.

Budescu, D. V., Wallsten, T. S., & Au, W. T. (1997). On the importance of

random error in the study of probability judgment. Part II: Applying the

stochastic judgment model to detect systematic trends. Journal of

Behavioral Decision Making, 10, 173–188.

Ert, E., & Erev, I. (2013). On the descriptive value of loss aversion in

decisions under risk: Five clarifications. Judgment and Decision

Making, 8, 214–235.

Gal, D. (2006). A psychological law of inertia and the illusion of loss

aversion. Judgment and Decision Making, 1, 23–32.

Gal, D., & Rucker, D. (2018). The loss of loss aversion: Will it loom

larger than its gain? Journal of Consumer Psychology,

28, 497–516.

Hansson, B. (1988). Risk aversion as a problem of conjoint measurement. In

P. Gardenfors & N.-E. Sahlin (Eds.), Decision, probability, and

utility (pp. 136–158). NY: Cambridge University Press.

Hermann, D. (2017). Determinants of financial loss aversion: The influence

of prenatal androgen exposure (2D:4D). Personality and Individual

Differences, 117, 273–279.

Holt, C. A., & Laury, S. K. (2002). Risk aversion and incentive effects.

American Economic Review, 92, 1644–1655.

Kahneman, D. (2011). Thinking, fast and slow. Detroit, MI: Macmillan.

Kahneman, D. & Tversky, A. (1979). Prospect theory: An analysis of

decision under risk. Econometrica, 47, 263–291.

Markowitz, H. M. (1952). Portfolio selection. Journal of Finance,

7, 77–91.

Morewedge, C. K., & Giblin, C. E. (2015). Explanations of the endowment

effect: An integrative review. Trends in Cognitive Sciences,

19, 339–348.

Mrkva, K., Johnson, E. J., Gächter, S., & Herrmann, A. (2020). Moderating

loss aversion: Loss aversion has moderators, but reports of its death are

greatly exaggerated. Journal of Consumer Psychology, 30,

407-428.

O’Donoghue, T., Somerville, J. (2018). Modeling risk aversion in economics.

Journal of Economic Perspectives, 32, 91–114.

Plott, C. R., & Zeiler, K. (2005). The willingness to pay-willingness to

accept gap, the “endowment effect,” subject

misconceptions, and experimental procedures for eliciting valuations.

American Economic Review, 95, 530–545.

Pratt, J. W. (1964). Risk aversion in the small and in the large.

Econometrica, 32, 122-136.

Rabin, M. (2000). Diminishing marginal utility of wealth cannot explain

risk aversion. In D. Kahneman & A. Tversky (Eds.), Choices,

values and frames (pp. 202-208). NY: Cambridge University press.

Rakow, T., Cheung, N. Y., & Restelli, C. (2020). Losing my loss aversion:

The effects of current and past environment on the relative sensitivity to

losses and gains. Psychonomic Bulletin & Review, 27,

1333–1340.

Schild, C., Lilleholt, L., & Zettler, E. (2019). Behavior in cheating

paradigms is linked to overall approval rates of crowdworkers.

Journal of Behavioral Decision Making, 34, 157–166.

Segal, U., & Spivak, A. (1990). First order versus second order risk

aversion. Journal of Economic Theory, 51, 111–125,

Shang, X., Duan, H., & Lu, J. (2021). Gambling versus investment: Lay

theory and loss aversion. Journal of Economic Psychology,

84, 102367.

Sharpe, W. F. (1964). Capital asset prices: A theory of market equilibrium

under conditions of risk. Journal of Finance, 19,

425-442.

Thaler, R. (1980). Toward a positive theory of consumer choice.

Journal of Economic Behavior and Organization, 1, 39–60.

Tversky, A., & Kahneman, D. (1992). Advances in prospect theory:

Cumulative representation of uncertainty. Journal of Risk and

Uncertainty, 5, 297–323.

von Neumann, J., & Morgenstern, O. (1944). Theory of games and economic

behavior. Princeton University Press, Princeton, NJ.

Walasek, L., Mullett, T. L., & Stewart, N. (2018). A meta-analysis of loss

aversion in risky contexts. Working paper. Available at

http://dx.doi.org/10.2139/ ssrn.3189088.

Walasek, L., & Stewart, N. (2019). Context-dependent sensitivity to

losses: Range and skew manipulations. Journal of Experimental

Psychology: Learning, Memory, and Cognition, 45, 957–968.

Yechiam, E. (2019). Acceptable losses: The debatable origins of loss

aversion. Psychological Research, 83, 1327–1339.

Yechiam, E., Ashby, N. J. S., & Pachur, T. (2017). Who’s biased? A

meta-analysis of buyer-seller differences in the pricing of risky

prospects. Psychological Bulletin, 143, 543–563

Yechiam E., & Hochman, G. (2013). Losses as modulators of attention:

Review and analysis of the unique effects of losses over gains.

Psychological Bulletin, 139, 497–518.

Appendix A: Lottery and investment task instructions

General instructions

In this study, you will answer a brief survey including some demographic

questions as well as some questions about hypothetical preferences. The

duration of the study will be about 5-7 minutes. In return for completing

the survey, you will be awarded $1.

Study 5/6: In addition, an amount of $8/$0.2 is deposited at your

temporary account. This amount may increase or decrease depending on your

choices during the study. At the end of the task, your temporary account

will be added to your $1 participation fee, and your final fee will be

$1 to $15/$1.6.

Lottery task

Suppose you were offered an opportunity to enter a lottery based on a toss

of a fair coin. If the coin turns up heads, you lose some money; if it

turns tails, you win some money. Please indicate for each lottery whether

you would ’accept’ that is play the

lottery, for a chance of winning or

’reject’ it and not receive anything.

Investment task

Suppose you were offered an opportunity to make an investment where you had

a 50% chance of winning $10010 and a 50% chance of losing various set

amounts. Would you make any of the following investments?

Study 5 (only): One of the lotteries/investments will be randomly selected

and based on your choice it will be either not played (and you will get 0

for it) or played with a virtual coin having 50% chance of turning either

heads or tails. The resulting gains or losses will be added to/ deducted

from your temporary account.

Appendix B: Incentivized buying and selling instructions

Buying task

We will offer you the chance to buy the following lottery ticket with a

1/100 chance to win 20 Experimental Dollars. This lottery ticket can be

yours! If you want to acquire this lottery ticket, you can buy it from the

organizers. Please indicate below for each respective price if you are

ready to buy the lottery ticket.

• If at the price for which we sell the lottery ticket to you, you have

indicated that you are ready to buy, you will receive the lottery ticket

from us at this price, which you have to pay to us. Then we will inform

you whether the lottery ticket won.

• If at the price for which we sell the lottery ticket to you, you have

indicated that you are not ready to buy, you do not receive the lottery

ticket.

The price at which we will sell the lottery ticket to you will be randomly

determined by us and for sure be between 0 and 10 Experimental dollars.

That is, our selling price will be determined by rolling dice after you

have filled in the table. All prices are equally likely.

Since you cannot influence the selling price, which we will determine

randomly, you have an incentive to state the price that corresponds to

your true preference.

Once you have made your choice, you cannot change it anymore. We are also

not able to negotiate the randomly determined selling price.

For each 100 experimental dollars, you gain/ lose $1 (actual dollars) and

this will be added/ deducted from your fixed amount of $1.2 (actual

dollar) earning for the experiment.

If the price is $X11

o I am ready to buy

o I am not ready to buy

Selling task

We will give you the following lottery ticket with a 1/100 chance to win 20

Experimental dollars which you can keep. This lottery ticket is yours! If

you do not want to keep the lottery ticket, you can sell it to the

organizers of this study. Please indicate below for each respective price

if you are ready to sell the lottery ticket.

• If at the price for which we buy the lottery ticket from you, you have

indicated that you are ready to sell, you will receive this amount of

experimental dollars instead of the lottery ticket.

• If at the price for which we buy the lottery ticket from you, you have

indicated that you are not ready to sell, you will keep your lottery

ticket and one lottery outcome will be randomly selected at the end of the

study.

The price at which we will buy your lottery ticket will be randomly

determined by us and for sure be between 0 and 10 Experimental dollars.

That is, our buying price will be determined by rolling dice after you

have filled in the information below. All prices are equally likely.

Since you cannot influence the buying price, which we will determine

randomly, you have an incentive to state the price that corresponds to

your true preference. Once you have made your choice, you cannot change it

anymore. We will also not be able to negotiate the randomly determined

buying price.

For each 100 experimental dollars, you gain/ lose $1 (actual dollars) and

this will be added/ deducted from your fixed amount of $1.2 (actual

dollar) earning for the experiment.

If the price is $X12

o I am ready to sell

o I am not ready to sell

This document was translated from LATEX by

HEVEA.