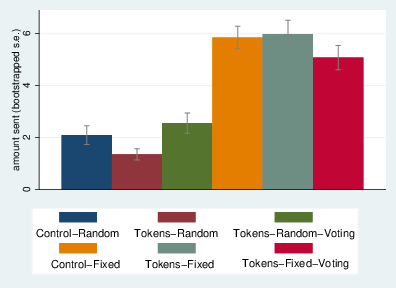

| Figure 1: Average amount sent (trust) in the six studies |

Judgment and Decision Making, Vol. 17, No. 5, September 2022, pp. 1123-1145

Pledging one’s trustworthiness through gifts: An experimentGiuseppe Danese* Luigi Mittone# |

Abstract:Ethnographers have recorded many instances of tokens donated as gifts to attract new partners or strengthen ties to existing ones. We study whether gifts are an effective pledge of the donor’s trustworthiness through an experiment modeled on the trust game. We vary whether the trustee can send a token before the trustor decides whether to transfer money; whether one of the tokens is rendered salient through experimental manipulations (a vote or an incentive-compatible rule of purchase for the tokens); and whether the subjects interact repeatedly or are randomly re-matched in each round. Tokens are frequently sent in all studies in which tokens are available, but repeated interaction, rather than gifts, is the leading behavioral driver in our data. In the studies with random pairs, trustors send significantly more points when the trustee has sent a token. Subjects in a fixed matching achieve comparable levels of trust and trustworthiness in the studies with and without tokens. The trustee’s decision to send a token is not predictive of the amount the trustee returns to the trustor. A token is used more sparingly whenever salient — a novel instance of endogenous value creation in the lab.

Keywords: pledges, gifts, time delay, trust game, tokens

In the Genealogy of Morals, Nietzsche (1989, p. 57) remarked, “To breed an animal with the right to make promises — is not this the paradoxical task that nature has set itself in the case of man?” The problem described in the Genealogy is how the debtors make themselves “calculable, regular, necessary” (p. 58) – one might say trustworthy – in the eyes of creditors. Creditor-debtor relations (abbreviated as CDRs) become pervasive once the economy becomes “political,” i.e., when individuals transition from the simple household and kin-based sharing structures of the subsistence economy and start to rely on trading for their livelihood (Johnson & Earle, 2000, p. 26; also, Graeber, 2014, pp. 76 ff.). In his celebrated The Gift, Marcel Mauss describes the role of tokens in CDRs: “In Germanic law, every contract, every sale or purchase, loan or deposit, includes the making of a pledge; an object is given to the other contracting party, generally of little value: a glove, a coin (Treugeld), a blade – or, as is still the case in France, pins – that they will give back upon payment for the thing being handed over” (Mauss, 2016, pp. 172–173).

One finds a similar script, whereby the giving of tokens initiates exchanges, also in Malinowski’s Argonauts of the Western Pacific (Malinowski, 2014). Malinowski, in his book, gave a detailed account of the practice of the kula in the Trobriand and adjacent islands. The kula is a complex inter-island exchange of tokens (vaygu’a in the local language, necklaces, and bracelets made of shells). We learn from Malinowski’s account that the kula created opportunities for cooperation within each community (e.g., in the building of canoes needed for the inter-island expeditions) and across communities, in an area characterized by local chiefs often in conflict with each other. Malinowski writes that: “…[t]he vaga [elsewhere in the book translated as “opening gift,” authors’ note] entails more wooing or soliciting than the yotile [return gift, authors’ note]. This process […] consists among others of a series of solicitary gifts. One type of such gifts is called pokala, and consists of food … When a good valuable is known to be in the possession of a man, some of this food will be presented to him, with the words: ‘I pokala your valuable, give it to me.’ If the owner is not inclined to part with his valuable, he will not accept the pokala. If accepted, it is an intimation that the vaygu’a will sooner or later be given to the man who offers the pokala. The owner, however, may not be prepared to part with it at once, and may wish to receive more solicitary gifts” (p. 364). Rather than the gloves or pins used in the Germanic societies, the Trobriand islanders pledged utilitarian items such as foodstuff to gain access to the local valuables.

Persuading others of one’s trustworthiness as a trade partner through tokens is sensible in societies characterized by weak formal institutions of contract enforcement (Greif, 1993; Voigt, 2013; Robinson, 2013; Posner, 1980; Landa, 1983).1 In these societies, the uncertainty and time lag of the consideration (or repayment) might require, at a minimum, a pledge in the form of a token given to the vulnerable party of the exchange relationship. The token helps create “suitably concordant mutual expectations” (Lewis, 2008, p. 25) amongst the transactors, increasing the chances of mutually advantageous trades. Whether a creditor trusts the debtor with his/her resources crucially depends on the creditor’s expectations regarding the trustworthiness of the debtor (see, e.g., Bicchieri et al., 2011),2 especially among new partners. One-shot interactions seem positioned to benefit from the ability of the (potential) debtor to send a token before the economic interaction starts. Through a field study, Falk (2007) showed that charities that included a token in their mailings to potential donors received significantly higher donations than those that did not include a token. In these infrequent interactions, the token can be interpreted as a signal of the sender’s trustworthiness, honor, creditworthiness, or liquidity. Mauss employed such terms largely interchangeably in his book, but we stick in this paper to the term trustworthiness for its relation to the trust game, which forms the backbone of our experimental design.

In repeated CDRs, expectations of trustworthiness can be established by sending a token and examining the partner’s past conduct. Previous literature has found that past behavior “speaks louder” than verbal, non-binding pledges (or “cheap talk,” e.g., Duffy & Feltovich, 2002; Servátka et al., 2011a; Servátka et al., 2011b), a robust finding we confirm in our study.

In this paper, we study how effective gifts are in fostering mutually-advantageous exchanges between two players, either two (lab) strangers or two fixed (lab) partners. The tokens we use are everyday items of low value. As in traditional societies, there are no external institutions to register complaints about the counterpart’s failure to live up to expectations. We use the trust game3 as the building block of our experimental design because it captures a generic CDR: one player, the trustor, might give something valuable to a trustee, hoping to receive something in return from the trustee at the agreed time. In his/her turn, the trustee might try to persuade the trustor to enter into an exchange relationship by giving a token.

In a related contribution, Servátka et al. (2011b) studied a trust game in which the trustee can send a hand-written message or a monetary gift (his/her entire endowment of $10) to the trustor before the trustor’s decision. This design choice transforms the trustee of the traditional trust game into a new trustor. Our experimental design maintains the trust game’s core idea: the trustor is the party whose money is at risk of expropriation in any round. The trustee can give the trustor a token of a symbolic nature.

We ran a total of seven studies, divided into two controls, four treatments, and a robustness check. In the control studies, there are no tokens, just a repeated trust game. In the first treatment study, the trustee can send a token before the trust game. In the second treatment study, and the robustness study, trustees can send a token as in the first treatment, and in addition, an experimental manipulation creates a basis for common knowledge that one of the tokens is ranked as more valuable than the others. All studies are implemented with fixed and randomly-formed pairs, except the robustness study (random pairs only).

Our design allows us to study three questions. First, whether the trustor is persuaded to send more points after receiving a token. Based on the anthropological literature discussed above and evidence from the field (Falk, 2007), we hypothesize that trustors will be more inclined to send money after receiving a token compared to the scenario in which the trustee did not send a token. The data from our studies with random pairs support this hypothesis. Fixed pairs exchange tokens frequently, but receiving a token does not significantly increase the trustor’s willingness to send money.

Second, we ask whether the trustee’s transfer of a token is positively related to his/her trustworthiness or rather a “bait” that the trustee uses in an attempt to induce the trustor to send money. Baits were most likely unappealing in traditional societies where, Mauss (2016, p. 115) tells us, those engaging in such behavior would quickly “lose face”. However, the bait question becomes relevant when exchanges are among largely anonymous individuals. In the absence (to the best of our knowledge) of previous literature on using gifts to create a false impression of trustworthiness, we approach this question in an exploratory fashion. We find that baiting behavior is not the most common, but it occurs in about one-third of the cases among random pairs.

Third, we ask whether any gift can function as a pledge of one’s trustworthiness. In the traditional societies studied by Mauss and Malinowski, the “inertia of customs” (Malinowski, 2014, p. 236) bestowed upon specific tokens the status of a valid (if not always helpful, one guesses) pledge. No such pre-existing consensus can be assumed in the lab regarding which pledge will satisfy the trustor. In an attempt to bridge this gap, we imbue one of the tokens with special status within the experiment’s context. If it is common knowledge that an object among several is especially valuable, this particular object should pledge the sender’s trustworthiness more convincingly than the other objects. Our data do not support this hypothesis. However, we find that once a token is charged with value, the players send that token more sparingly.

We recruited 120 University of Trento, Italy (undergraduate) students to participate in the experiment. We randomly assigned subjects to one of six studies (two controls and four treatments).4 The sample of subjects was gender-balanced. Subjects won, on average, 12 euros, not including a show-up fee of two euros. The experiments lasted an average of one hour.

The control study with random pairs (Control-Random) is a simple, repeated trust game. Subjects are randomly seated in the experimental room, after which instructions are read aloud. After a comprehension test has been individually checked, the experiment starts. Each subject is randomly matched with another subject from the pool of those present in the room. The system randomly assigns to one subject the role of the trustor and the other that of the trustee. The randomizations of pairs and roles are carried out independently in each round. The pairs can be re-matched but are informed that the system imposes an embargo period for re-matching of 10 rounds. In this way, we attempted to neutralize any re-encounter concerns in this study. Trustors and trustees are endowed with ten experimental points (10 euros) in each round. The trustor decides first how many points to send to the trustee. The trustee receives the amount sent by the trustor, doubled by the experimenter.5 The trustee decides how many points to return to the trustor, from zero to his/her entire endowment.6 The subjects are then shown their payoffs. The experiment at this point restarts. Points earned in earlier rounds are not carried forward to the next round. At the end of the 20th round, the subjects fill in a debriefing and demographic questionnaire. We pay the subjects according to their earnings in one randomly-extracted round, plus the show-up fee. All features of the experiment are communicated to the subjects in the instructions.7

The control study with fixed pairs (Control-Fixed) is equivalent to the Control-Random study, except that the subjects in a pair know they will be interacting for the entire experiment. Roles are, as above, randomized in every round.

In the treatment study Tokens-Random, all subjects are endowed with five tokens, shown as pictures on the screens, and ten experimental points (as in the controls described above). In choosing which tokens to use in this study, we used three criteria. The first was the simplicity of the items. Second, we looked for items that a student pool might easily relate to, such as stationery. Third, we looked for items with low market prices relative to the stakes in the trust game. We chose an eraser, a pencil sharpener, a candy, a Monopoly bill (worth 1,000 units in the popular board game), and a rubber elastic. We chose to use photographic depictions of actual items rather than the purely “virtual” tokens used by Camera et al. (2013) and Bigoni et al. (2019)8 in an attempt to approximate the ancient Germanic arrangement described in the Introduction (“pin before trading”). We also opted for several tokens, rather than five tokens of the same type, to study the effect of different types of tokens on behavior, particularly the stationery items and the candy versus the Monopoly bill, the apparent outlier among the five objects. The number of tokens (five) was chosen as a compromise between two incompatible desiderata: on one side, tokens had to be relatively scarce; otherwise, they might have been seen as a cheap pledge. On the other side, we did not want subjects to become constrained by the lack of tokens after a few rounds. The tokens circulated as pictures to accelerate the experiment and avoid long lags between rounds, but the subjects were informed that they would receive the tokens in their physical form at the end of the experiment.

Unlike the control studies, in the Tokens-Random study, the trustee in round 1 moves first and decides which, if any, of the five tokens he/she wishes to send to the trustor he/she was randomly matched with. The trustor observes the choice of the trustee and decides how many points to send to the trustee. In later rounds, if the trustee had no token available, the trustor was informed of the circumstance when his/her turn came. We tried to avoid trustors assuming the trustees did not intend to send a token when actually none was available for the trustee to send. The trustee receives the amount sent by the trustor, doubled by the experimenter (as in the control study). The trustee decides how many points to return to the trustor (as in the control study). The subjects are subsequently shown their payoffs. The experiment restarts, with random re-matching in every period, and the number of rounds set at 20, as in the control studies. Subjects carry over their objects from one round to the next. Subjects do not carry over their points from one round to the next, as in the Control studies. After the questionnaire, subjects are paid their earnings in one randomly extracted round. Subjects also received all the tokens in their availability at the end of the last round as part of their payout. All features of the game were common knowledge, including the payout rules for money and tokens.

In the treatment study Tokens-Random-Voting, before the repeated trust game with tokens and random pairs described above for the study Tokens-Random, each subject was asked to vote for one of the tokens. The subject who voted for the most voted article in an experimental session, in the shortest amount of time, won three euros. After the subjects’ choices were recorded, the system showed all subjects the votes received by each token. To avoid triggering income effects from different endowments, the subject who won the contest was not informed he/she was the winner. He/she knew of being a potential winner, but the sheer fact that he/she chose the most commonly-chosen token prevented any conclusion about him/her having won the prize. This voting game is an adaptation of the newspaper “beauty contest” described in the magnum opus of J. M. Keynes (1973, p. 156; see also Nagel, 1995). As in the classic study of conventions by Lewis (2008, p. 56), a “basis for common knowledge” exists that one of the tokens is “special” in the study Tokens-Random-Voting. This basis for common knowledge arises when we show all subjects the number of votes received by each token.9 In the treatment with voting, the trustees might choose to send the most-voted token to reinforce the pledge value of their gift. The Monopoly bill was likely salient in all our studies with tokens, but only in the studies with the voting procedure, the saliency was established as a matter of common knowledge in Lewis’s sense (everyone knows that everyone knows …. that the Monopoly bill is “special”).

The study Tokens-Fixed is, in all regards, equivalent to the study Tokens-Random, except that the pairs are now fixed. The same is true for the study Tokens-Fixed-Voting vis-à-vis Tokens-Random-Voting.

A feature of our design deserves re-stating. The subjects do not carry earnings from one round to the next. Allowing subjects to carry over their earnings would create differences in the strategy spaces from the second round. Some trustors could also start a round with no points at all. We believed this heterogeneity to be undesirable when studying tokens as pledges of trustworthiness. In the treatment studies, the subjects carry the tokens over from one round to the next. The software kept track of each subject’s balance of each of the tokens at the end of each round (subjects might possess several tokens of the same type in the course of the experiment, e.g., two erasers). A token received by another subject in a previous round could be sent in a later round. Subjects can also send any of the tokens in their original allotment of five that were not previously sent. This design choice ensures that the tokens are relatively abundant at the beginning and replenishable in the course of the experiment, but not to the point of receiving a fresh allocation of tokens in each round, which would have likely trivialized the pledge value of the tokens.

In the same spirit of guaranteeing a high degree of uniformity across subjects and rounds, we randomized the trustee and trustor roles in each round. In this way, we avoided having one subject, the trustor, always being the vulnerable one, and the other, the trustee, necessitating many tokens. Role reversals in experiments have not been found to affect results in a predictable direction (see Brandts & Charness, 2011). In our study, the choice of randomizing roles in each round was driven by convenience, as role reversals even out the transfers of tokens throughout the experiment, as well as by the desire to mimic the arrangements described in the Introduction from traditional societies, where it was rare to observe some traders always on the giving side and others constantly on the receiving side.10 We summarize all our treatments and controls in Table 1.

Table 1: Summary of the six studies.

Study/feature Token circulates Matching Type Voting Number of Subjects Control-Random N Random N 20 Tokens-Random Y Random N 20 Tokens-Random-Voting Y Random Y 20 Control-Fixed N Fixed N 20 Tokens-Fixed Y Fixed N 20 Tokens-Fixed-Voting Y Fixed Y 20

Subjects were observed for 20 rounds, on average ten times as trustees and ten times as trustors. We created two separate panels, one for trustees and one for trustors. A subject can either act as a trustor or a trustee in each round. Consequently, the two panels have gaps, meaning that each subject is not observed in every round within a panel.

The first question we address is whether the median amounts sent and returned differ across the six studies. A Kruskal-Wallis non-parametric test11 finds significant differences across the six studies for the amounts sent and the amounts returned (p<0.001). We further investigated the determinants of such differences across the studies through panel regression analysis later in this Section.

In the two studies with voting, the Monopoly bill was the most voted item, receiving 50% of the votes. In the studies with voting, the most common choice was not to send any object, which occurred in about one-third of the cases, followed by the rubber elastic, sent in about one-fifth of the cases. The Monopoly bill was the token sent least frequently. In the two studies with tokens circulating but no vote, the most common choice was to send the Monopoly bill (in about one-fifth of the cases). Subjects in all studies likely saw the Monopoly bill as salient, but we have initial evidence that only in the studies with voting did the subjects send the Monopoly bill sparingly.

Table 2 presents summary statistics related to the trustee, who might send the token in the treatments in which a token circulated and send back money to the trustor. The amounts returned by the trustees to their trustors (trustworthiness) in the studies with fixed pairs are visibly higher than those with random pairs. The difference between the amount sent back by the trustee and the amount sent by the trustor (unmultiplied), surplus, shows that trustors received back more than they sent only in the studies with fixed pairs. A token was sent, in all studies, in 70% or more of the cases (token). The Monopoly bill appears to have been sent less when the study incorporated the voting procedure (monopoly). The Monopoly bill’s unavailability (noMonopolyEndofRound) was an issue in the studies without voting, but subjects rarely had no token to send at the end of a period (noTokenEndofRound).

Table 2: Summary statistics for the trustees’ behavior.a

Variable Control-Random trustworthiness surplus Tokens-Random trustworthiness surplus monopolyc tokend noTokenEndofRound noMonopolyEndofRound Tokens-Random-Voting trustworthiness surplus monopoly token noTokenEndofRound noMonopolyEndofRound Control-Fixed trustworthiness surplus Tokens-Fixed trustworthiness surplus monopoly token noTokenEndofRound noMonopolyEndofRound Tokens-Fixed-Voting trustworthiness surplus monopoly token noTokenEndofRound noMonopolyEndofRound a We use STATA 17® for all statistical analyses presented in the paper. Figures are also produced through the same software. Bootstrapped standard errors are based on 500 replications in all our graphs. b The number of observations equals the number of subjects in each study (20) times the number of rounds in which each subject played the role of trustee (10), unless otherwise shown. c The observation is set to missing when the subject had no Monopoly bill available to send. dThe observation is set to missing when the subject had no token available to send.

Table 3 shows summary statistics for the trustor, who might send points to the trustee, and observes whether a token was sent (in the studies with a token). Trustors seem to send more points when they are in a fixed pair.

.

Table 3: Summary statistics for the trustors’ behavior, variable Trust

Variable Control-Random Tokens-Random Tokens-Random-Voting Control-Fixed Tokens-Fixed Tokens-Fixed-Voting a The number of observations equals the number of subjects in each study (20) times the number of rounds in which each subject played the role of trustor (10).

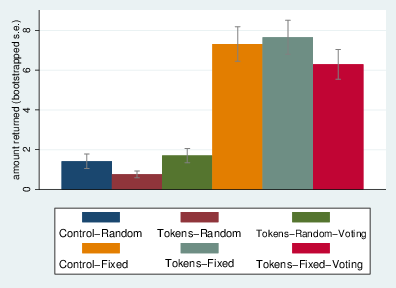

Figure 1 shows the average amount sent by trustors in each of the six studies. The mean and the standard errors are obtained by pooling observations from all trustors in each study. Studies with fixed pairs exhibit higher levels of trust than studies with random pairs, as in Table 3. The same pattern is confirmed by inspection of the points returned in the six studies (Figure 2). We defer a discussion of the statistical significance of these differences to the regression analysis.

Figure 1: Average amount sent (trust) in the six studies

Figure 2: Average amount returned (trustworthiness) in the six studies.

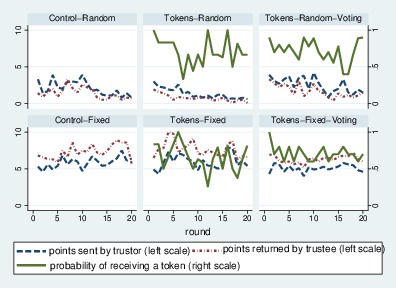

Figure 3 shows, for each round and in each study: the points the trustor sent to the trustee, the points the trustee sent back, and the probability of receiving a token (when at least one token was available to be sent).

Figure 3: The trustors’ and trustees’ behavior in each round, by study.

In all studies with fixed pairs, points returned were higher than points sent in every round, and the opposite is almost always the case with random pairs. Even though the players switched roles in all studies, creating a favorable environment for the rise of a “golden rule” (as in Costa-Gomes et al., 2019), such rule did not develop among random pairs. It is, therefore, unlikely that the high levels of trust and trustworthiness in the studies with fixed pairs are attributable to role reversals. A downward trend in amounts sent and returned is apparent in the studies with random pairs. In terms of the tokens, it is apparent that much experimentation took place.

We start with the richest dataset, which includes the observations from the four treatments and the two controls. Then we narrow our analysis to the data from the treatments only. Finally, we discuss the studies with fixed and random pairs separately. This strategy allows us to capture the marginal contribution to the two outcome variables (trust and trustworthiness) of having the tokens as part of the design, receiving a token, and matching technology. Table 4 shows the output of a random-effects (RE) regression of the amount sent by the trustor on a dummy equal to one if the study incorporated the possibility of sending the tokens,12 the matching type (dummy-coded), the interaction of these two dummies, controls, and a time trend, using data from all six studies. Standard errors are estimated through bootstrap. The bootstrap replications are based on 120 clusters (the total number of subjects in the treatments and controls). We find that amounts sent are significantly higher in fixed pairs, male trustors send significantly more points,13 and a negative trend. The estimate for the token dummy ζ 1 is positive but not significantly different from zero. Controlling for the matching type, the possibility of receiving a token did not significantly increase the willingness to send points. The most helpful information for the trustor is, however, most likely not whether the trustee could send a token or not, but whether the token was set or not, a question that Table 4 cannot investigate. Table 4 sheds further light on the sources of the statistically significant differences in trustors’ behavior across the six studies that we uncovered through nonparametric testing. These trusting behavior differences derive from matching technology differences rather than whether the tokens were part of the trading institution.

Table 4: The dependent variable is the amount sent by the trustors, all studies.

Regressor Coef. Observed Coef. Bootstrapped Std. Err. Tokens_circulating ζ 1 1.350 0.758 Fixedpairs ζ 2 3.796*** 0.654 Tokens_circulating & fixedpairs ζ 3 –0.306 0.914 TimeTrend ζ 4 –0.037** 0.016 Male ζ 5 1.009** 0.434 Age ζ 6 0.300 0.124 Constant ζ 0 –4.470 2.935 ***p<0.01, **p<0.05. Overall R-squared = 0.30. All subjects included in the analysis (120 subjects).

We now estimate, using again a RE panel regression model, the impact of receiving a token (dummy-coded as 1/0), the voting manipulation (dummy-coded 1/0, 1 for voting), being in a fixed pair (dummy-coded 1/0, 1 for fixed), cross-terms, a time trend, gender, and age, on the amount sent by trustors. The observations come only from the four studies in which the tokens circulated. The replications are, therefore, based on 80 clusters. The regression output is shown in Table 5.

Table 5: The dependent variable is the amount sent by the trustors, treatments only.

Regressor Coef. Observed Coef. Bootstrapped Std. Err. Token β 1 1.300*** 0.206 Voting β 2 1.303** 0.546 Token & voting β 3 –0.321 0.445 Fixedpairs β 4 4.642*** 0.917 Token & fixedpairs β 5 –0.322 0.651 Voting & fixedpairs β 6 –1.503 1.409 Token & voting & fixedpairs β 7 –0.464 0.999 TimeTrend β 8 –0.044** 0.019 Male β 9 1.243** 0.549 Age β 10 0.201 0.197 Constant β 0 –4.034 4.224 ***p<0.01, **p<0.05. Overall R-squared = 0.34. Only subjects from the treatment studies included (80 subjects).

Receiving a token, the voting, and the fixed-pair manipulations are associated with significantly higher amounts sent — greater trust. We confirm that male subjects send significantly more points and a negative time trend. Several robustness checks presented in the Supplement confirm these findings. The ratio of the two coefficients β 4/β 1=3.57 indicates that the type of matching, rather than the token, is the key predictor of trust. The ratio β 2/β 1≈1 shows that voting and receiving the token yield similar benefits to trust. Running the same regression with a dummy equal to one if the monopoly bill was sent, rather than any token as in Table 5, cross terms with the new variable, and the same controls, we find a positive but insignificant relationship with receiving the Monopoly bill.

In Table 4, we found that the mere presence at the macro level of tokens did not produce significant differences in trusting behavior. In Table 5, we found that trusting behavior changes only if tokens are part of the trading institution and if a token is sent — any token. This result supports one of the central theses of Marcel Mauss: one “must” give to initiate exchanges.14

Running the regressions separately for the random and fixed pairs yields further insights into the relative contributions of the matching technology and the tokens to trusting behavior. The insignificance of ζ 1 in Table 4, and the ratio of the coefficients of the token and matching technology dummies in Table 5 show that the matching technology is the primary driver of trust behavior in our treatment studies. A regression of the amount sent by the trustors, using the two studies featuring tokens and fixed pairs, on the token dummy, the voting dummy, the interaction between these two variables, and the usual controls, shows that the token and the voting procedure are positively associated with trusting behavior, as in Table 5, but insignificantly so (Table 6). The same regression using data from the two studies with random pairs finds instead a significant relationship between the amounts sent and the token and voting dummies (Table 7). Although a significant number of tokens are sent in all studies and all rounds, as shown in Figure 3, only in the studies with random pairs receiving the token was (estimated to be) informative enough to change trusting behavior. We also confirm a finding from Figure 3, namely that trust progressively diminished in the studies with random pairs but not in the studies with fixed pairs. We return to this finding below after analyzing the trustees’ behavior.

Table 6: The dependent variable is the amount sent by the trustors, fixed pairs.

Regressor Coef. Token ν 1 Voting ν 2 Token & voting ν 3 TimeTrend ν 4 Male ν 5 Age ν 6 Constant ν 0 **p<0.05. Overall R-squared = 0.181. Only subjects from the treatment studies with fixed pairs included (40 subjects).

Table 7: The dependent variable is the amount sent by the trustors, random pairs.

Regressor Coef. Token ϕ 1 Voting ϕ 2 Token & voting ϕ 3 TimeTrend ϕ 4 Male ϕ 5 Age ϕ 6 Constant ϕ 0 ***p<0.01. Overall R-squared = 0.178. Only subjects from the treatment studies with random pairs included (40 subjects).

We move now to the trustee. We ran a RE regression of the amount returned by the trustee on the amount sent by the trustor (before the multiplication, trust), whether the tokens circulated or not, the matching technology, an interaction term, controls, and a time trend. Amounts returned are higher in fixed pairs, and there is a positive, but less than unitary, relationship between amounts received and amounts sent back.15 The output of this regression is shown in Table 8.

Table 8: The dependent variable is the amount sent back by the trustee, all studies.

Regressor Coef. Observed Coef. Bootstrapped Std. Err. Trust µ 1 0.838*** 0.072 Tokens_circulating µ 2 0.125 0.360 Fixedpairs µ 3 2.844*** 0.746 Token_circulating & fixedpairs µ4 –0.090 0.833 TimeTrend µ 5 –0.001 0.016 Male µ 6 0.400 0.403 Age µ 7 0.080 0.103 Constant µ 0 –2.383 2.400 ***p<0.01. Overall R-squared = 0.7. All subjects included in the analysis (120 subjects).

As in the case of trustors, in the case of trustees the differences between the studies we uncovered through nonparametric testing are mainly caused by different matching technologies (and the amount received by the trustee) rather than the tokens.

We now narrow the sample to the treatment studies. We regress the amount returned on the usual dummies, the number of points sent by the trustor in that round, interaction terms, controls, and whether the trustee sent a token in the same round. We have included this last regressor to ascertain if the trustees use the tokens as “bait.” The regression output is shown in Table 9.16

Table 9: The dependent variable is the amount sent back by the trustee, treatments only.

Regressor Coef. Trust θ 1 Voting θ 2 Voting & Trust θ 3 Fixedpairs θ 4 Fixedpairs & trust θ 5 Voting & fixedpairs θ 6 Voting & fixedpairs & trust θ7 TimeTrend θ 8 TrusteeSentToken θ 9 Male θ 10 Age θ 11 Constant θ 0 ***p<0.01, **p<0.05. Overall R-squared = 0.761. Only subjects from the treatment studies included (80 subjects).

We confirm a significant positive relationship between the amount sent and the amount returned, and the less-than-unitary size of θ 1. While inspecting Figure 3, we have already observed that in all studies with random pairs, the points returned were less than points sent, which counteracts the opposite trend observed in the sessions with fixed pairs. We also confirm that trustees send back more points when in fixed pairs. There is no significant link between the decision to send a token and the amount returned: neither a significant negative relation and hence there is no evidence of widespread baiting behavior; nor a significant positive relation. In the studies in which tokens circulated, the pledge value of the tokens was low. Trustors in the studies with fixed pairs learned to disregard the token decision of the trustee, as shown in Table 6. Trustors in random pairs were influenced by the token decision of the trustee, as we saw in Table 7, but their trust decreased in the course of the experiment, possibly as a result of a feeling that their trust was betrayed (see, e.g., Aimone & Houser, 2012; also Cubitt et al., 2017), both because the token was not a reliable pledge, and the trustees did not guarantee a positive return on their investment.

We conducted a debriefing survey at the end of all our sessions. Roughly 40% of the respondents (in the four treatment studies) reported that subjects might have stockpiled tokens, to use them later. The same percentage answered that the subjects did not send the tokens because they thought them unhelpful. The remaining respondents provided a free-form answer. We also elicited, for each token, the perceived usefulness in the experiment and the estimated market price of each token. The rubber elastic was chosen as the most helpful token (the average score is 7.3 out of 10, with ten being “very useful”), but also the one with the lowest price (16 euro cents on average). The subjects perhaps felt that the inexpensive token was the most helpful as a pledge, a mere “token of appreciation,” one might say. According to the respondents, the most expensive item was the sharpener (92 cents). The average price of the Monopoly bill was 36 cents. The questionnaire answers allow us also to assess the likelihood that subjects sent tokens in our experiment because they felt compelled to do so by the experimenter (a “demand effect,” cf. Zizzo, 2010). The subjects’ perceptions of the usefulness and raison d’être of the tokens varied substantially, with a sizable share of the subjects expressing skepticism as to the tokens’ usefulness. This variety of opinions shows that it is unlikely that we biased results in an ex-ante predictable way through our design choices.

We suspect that some subjects might have been uncertain what the purpose of the tokens was. As we saw from the questionnaire answers, some subjects thought that the tokens might have been helpful in the future, perhaps in future experiments. We speculate that some subjects failed to see the logical progression from voting on the tokens to the modified trust game. We were also concerned about our choice to give out the tokens for free at the beginning of the experiment. The tokens might have been perceived as a cheap means of pledging because they were given free of charge.

We devised a new treatment study, Tokens-Random-BDM, to address these concerns. Instructions were amended in two essential regards: first, the tokens in this new study were for purchase. Subjects were given a larger endowment than in earlier studies, 10 euros, which they could use to purchase the same five tokens we used in the earlier studies with tokens. The subjects stated a maximum buying price, between zero and two euros, in increments of ten cents. They could purchase each token if its buying price was lower than or equal to a random number between 0 and 2, in increments of ten cents. A confederate extracted the number in front of the subjects, with replacement. Subjects were instructed that under these rules, the well-known procedure of Becker, DeGroot & Marschak (1964, the “BDM”), they had no incentive in misrepresenting their valuation of the tokens. Second, we stressed that the tokens did not have any use outside of the lab room.

After the subjects chose their maximum buying prices and the extractions, the system informed the subjects of the tokens they had purchased and the average buying prices of all the tokens chosen by the subjects in the room. We showed the average prices to the subjects to mimic the same procedure in the studies with voting, where we showed the number of votes received by each token. The experiment then proceeded as in the Tokens-Random study.

We recruited 24 new subjects from the same pool of earlier studies (excluding students who had taken part in our earlier studies). Table 10 shows descriptive statistics for the subjects’ (maximum) willingness to pay for the tokens in euros.

Table 10: Willingness to pay for the tokens (in euros).

Objects Candy – Elastic – Eraser – Monopoly bill – Sharpener –

The subjects paid, on average, €3.6, out of their endowment to purchase tokens. The highest stated prices are for the sharpener (identified as the most expensive item in the earlier studies’ questionnaire) and the Monopoly bill. The willingness to pay for the Monopoly bill is almost three times as big as the perceived “cost” of the bill in the debriefing survey of the earlier studies: even though the subjects knew that the “objective” price of the Monopoly bill was nil, they seemed to perceive the saliency of the Monopoly bill within the experiment. They were ready to pay a much higher price for the bill in the lab than they would pay outside of the lab. Nonparametric tests on the amounts sent and returned in this new study and Tokens-Random-Voting do not reveal significant differences between the two studies. In the Supplement, we use the new data to shed further light on the question of “baits.” We find that the proportion of such behaviors is roughly one-third for the studies with random pairs and even lower for studies with fixed pairs. In Table 9, we already failed to find evidence of baiting.

We use the robustness study to gain further insights into whether the decision to send the Monopoly was different when there was common knowledge that this token was “special.” Figure 4 shows that Monopoly bills, the most voted token in the studies with voting and the token associated with the highest willingness to pay in the study with the BDM, were sent more frequently in the treatments without any common-knowledge-of-saliency manipulation (voting or BDM). We take these results as evidence that it is possible to influence the perception of the value and scarcity of tokens endogenously in the lab through manipulations — a topic we hope to further investigate in the future.

Figure 4: The Monopoly-bill sending decision, with and without common knowledge that the bill is salient.

“Men knew how to pledge their honor and their names long before they knew how to write,” according to Mauss (2016, p. 119). Pledges in this paper are devices of an informal nature that have emerged to sustain relationships that feature a certain degree of uncertainty in the form of delayed repayment. Our results show that receiving a token increases trust, while the mere presence at the institutional (macro) level of the possibility of sending and receiving tokens does not. We conclude that gifts do not promote trust at the aggregate level. Instead, conditional on the presence of the institution, trust is higher among those trustors receiving gifts.

Gifts were sent in over 70% of the cases in which one was available for sending. Around one-third of trustees in the studies with random pairs engage in baiting, but most trustees do not engage in this behavior. We did not find that receiving the salient token elicits higher levels of trust. The saliency manipulation decreases the frequency with which the “special” token is sent. We also find that fixed pairs display higher levels of trust and trustworthiness than randomly-formed pairs, as in Cochard et al. (2004). The relative magnitudes of the token dummy’s regression coefficient and the fixed-pair dummy’s show that the horizon of the relation stimulates trust to a much higher degree than receiving a token. The high level of control that the experimental methodology grants to the researcher allows us to conclude that repeated interaction, rather than gifts, is the leading behavioral driver in our data, both for what concerns the trust that the trustor places in the trustee and the trustworthiness of the trustee. In the studies with randomly formed pairs, the trustors use the only information available, whether a token was received or not, to anchor their trust decision. Although the data show that there is no relation in the studies with random couples between token behavior and points returned, it is not apparent whether the trustors’ exposure to earlier trustees was conclusive enough for them to disregard the trustees’ token decision when deciding how many points to send. The trustors seem to overestimate the effect of the trustees’ decision to send a token on the ensuing levels of trustworthiness. This “trustors’ illusion” result mirrors a similar result in Danese and Mittone (2018a), using a public good in which another institution of an informal type was used, moral suasion, rather than the tokens. In all our studies, we have also shown that trustees send tokens in more than 70% of the instances in which one was available to them. Faced with limited levels of trust from the trustors, trustees might have also felt “betrayed” by the trustors and proceeded in the studies with random pairs to send back fewer points than they received. A novelty of our design is that both the trustors and the trustees might condition their decision on a display of “kindness” of the opponent (see, e.g., Fischbacher et al. 2001; Rabin, 1993). Future research might further investigate whether the sending of the token contained an implicit demand that the trustor sends his/her entire endowment.

The underperformance of the tokens in our treatment studies is in line with the findings of Fatas et al. (2021) about the limited usefulness of symbolic prizes. In their Symbolic treatment, rule-abiding taxpayers received a targeted “symbolic” reward (£ 0.05) on top of an untargeted (and more substantial) monetary reward funded by fines on the evaders. The subjects in this study confronted two possible (targeted) reinforcement rules: a negative reinforcement (punishment) that consisted of paying a fine if audited and found to be an evader; on the other side, a positive reinforcement — the symbolic reward if the audited subject was found compliant. In our experiment, there is no formal punishment or reward ex-post (as in the trust game studied by Rigdon, 2009; see also Fehr & Rockenbach, 2003; Bartoš & Levely, 2021; Houser et al., 2008; Calabuig et al., 2016; Xiao, 2021), but only an informal pledge that could be sent ex-ante. The decision to send this pledge is up to the trustees and not externally administered.

Returning to our theoretical framework, we offer some speculative considerations for the underperformance of gifts in our study compared to the time horizon of the interaction. In the societies studied by Mauss, and in many instances in which gifts are exchanged nowadays, tokens are invested with ritual meanings. These properties of gifts are difficult to reproduce in the laboratory because they require a complex network of rules and traditions and because the laboratory time is not sufficient to allow the tokens to acquire ritual value spontaneously. An analysis of the opponent’s past behavior (where available, i.e., in the studies with fixed matching) might have seemed more informative to the trustors than the receipt, or lack thereof, of tokens.

In our experiment, the tokens were highly stylized and chosen by the experimenter. If the subjects could bring a token with them, the tokens’ pledge value might be increased (see, e.g., Danese and Mittone, 2018a). Bloom (2010, p. 83) noticed that displays of personal quality, such as a pledge, will only be relied upon by the receiver if they involve some sacrifice or cost, a point often made in signaling theories popular in anthropology and biology (see, e.g., Hauser, 1996; Gintis et al., 2001; Zollman et al., 2013; Guilford & Dawkins, 1995). Cumbersome religious and ritual practices have been explained by Irons (2001) as a “hard-to-fake sign of commitment” to a particular group. In our studies, sending a token was costly, as the endowment of tokens was not replenished. However, the number of tokens available (five) likely meant that every token’s pledge value was not very high. Lastly, gifts and commodities do not often mix in traditional and modern societies. Players might be unsure what is “monetarily” appropriate in return for a token. Conditioning strategies on the previous history of play might have been a more “available” heuristic (Tversky & Kahneman, 1973) than analyzing the opponent’s gift behavior.

Aimone, J. A., & Houser, D. (2012). What you don’t know won’t hurt you: a laboratory analysis of betrayal aversion. Experimental Economics, 15(4), 571–588.

Anderhub, V., Engelmann, D., & Güth, W. (2002). An experimental study of the repeated trust game with incomplete information. Journal of Economic Behavior & Organization, 48(2), 197–216.

Bartoš, V., & Levely, I. (2021). Sanctioning and trustworthiness across ethnic groups: Experimental evidence from Afghanistan. Journal of Public Economics, 194, 104347

Becker, G. M., DeGroot, M. H., & Marschak, J. (1964). Measuring utility by a single-response sequential method. Behavioral Science, 9(3), 226–232.

Benveniste, É. (2016 [originally 1969]). Dictionary of Indo-European concepts and society. Hau Books.

Berg, J., Dickhaut, J., & McCabe, K. (1995). Trust, reciprocity, and social history. Games and Economic Behavior, 10(1), 122–142.

Bicchieri, C., Xiao, E., & Muldoon, R. (2011). Trustworthiness is a social norm, but trusting is not. Politics, Philosophy & Economics, 10(2), 170–187.

Bigoni, M., Camera, G., & Casari, M. (2019). Partners or Strangers? Cooperation, monetary trade, and the choice of scale of interaction. American Economic Journal: Microeconomics, 11(2), 195–227.

Bloom, P. (2010). How pleasure works: The new science of why we like what we like. Random House.

Brandts, J., & Charness, G. (2011). The strategy versus the direct-response method: a first survey of experimental comparisons. Experimental Economics, 14(3), 375–398

Calabuig, V., Fatas, E., Olcina, G., & Rodriguez-Lara, I. (2016). Carry a big stick, or no stick at all: Punishment and endowment heterogeneity in the trust game. Journal of Economic Psychology, 57, 153–171.

Camera, G., Casari, M., & Bigoni, M. (2013). Money and trust among strangers. Proceedings of the National Academy of Sciences, 110(37), 14889–14893.

Chen, D. L., Schonger, M., & Wickens, C. (2016). oTree — An open-source platform for laboratory, online, and field experiments. Journal of Behavioral and Experimental Finance, 9, 88–97.

Cochard, F., Van, P. N., & Willinger, M. (2004). Trusting behavior in a repeated investment game. Journal of Economic Behavior & Organization, 55(1), 31–44.

Costa-Gomes, M. A., Ju, Y., & Li, J. (2019). Role-reversal consistency: An experimental study of the Golden Rule. Economic Inquiry, 57(1), 685–704.

Cox, J. C., Kerschbamer, R., & Neururer, D. (2016). What is trustworthiness and what drives it? Games and Economic Behavior, 98, 197–218.

Cubitt, R., Gächter, S., & Quercia, S. (2017). Conditional cooperation and betrayal aversion. Journal of Economic Behavior & Organization, 141, 110–121.

Danese, G., & Mittone, L. (2015). Norms and trades: An experimental investigation. Rationality and Society, 27(3), 259–282.

Danese, G., & Mittone, L. (2018a). Trust and trustworthiness in organizations: The role of monitoring and moral suasion. Managerial and Decision Economics, 39(1), 46–55.

Danese, G., & Mittone, L. (2018b). The circulation of worthless tokens aids cooperation: An experiment inspired by the kula. Games, 9(3), 63.

Duffy, J., & Feltovich, N. (2002). Do actions speak louder than words? An experimental comparison of observation and cheap talk. Games and Economic Behavior, 39(1), 1–27.

Engle-Warnick, J., & Slonim, R. L. (2004). The evolution of strategies in a repeated trust game. Journal of Economic Behavior & Organization, 55(4), 553–573.

Evans, A. M., Dillon, K. D., Goldin, G., & Krueger, J. I. (2011). Trust and self-control: The moderating role of the default. Judgment & Decision Making, 6(7).

Evans, A. M., & Krueger, J. I. (2014). Outcomes and expectations in dilemmas of trust. Judgment & Decision Making, 9(2).

Falk, A. (2007). Gift exchange in the field. Econometrica, 75(5), 1501–1511.

Fatas, E., Nosenzo, D., Sefton, M., & Zizzo, D. J. (2021). A self-funding reward mechanism for tax compliance. Journal of Economic Psychology, 86, 102421.

Fehr, E., & Rockenbach, B. (2003). Detrimental effects of sanctions on human altruism. Nature, 422(6928), 137–140.

Fischbacher, U., Gächter, S., & Fehr, E. (2001). Are people conditionally cooperative? Evidence from a public goods experiment. Economics Letters, 71(3), 397–404

Gintis, H., Smith, E. A., & Bowles, S. (2001). Costly signaling and cooperation. Journal of Theoretical Biology, 213(1), 103–119.

Graeber, D. (2001). Toward an anthropological theory of value: The false coin of our own dreams. Palgrave.

Graeber, D. (2014). Debt: The first 5000 years. Penguin U.K.

Greif, A. (1993). Contract enforceability and economic institutions in early trade: The Maghribi traders’ coalition. The American Economic Review, 525–548.

Guilford, T., & Dawkins, M. S. (1995). What are conventional signals? Animal Behaviour, 49(6), 1689–1695.

Hauser, M. (1996). The Evolution of Communication. Cambridge, MA: MIT Press.

Houser, D., Xiao, E., McCabe, K., & Smith, V. (2008). When punishment fails: Research on sanctions, intentions and non-cooperation. Games and Economic Behavior, 62(2), 509–532

Holt, C. A. (2019). Markets, games, and strategic behavior: An introduction to experimental economics. Princeton University Press.

Irons, W. (2001). Religion as a hard-to-fake sign of commitment. In R. M. Nesse (Ed.), Vol. 3 in the Russell Sage Foundation series on trust. Evolution and the capacity for commitment (pp. 290–309). Russell Sage Foundation.

Johnson, A. W., & Earle, T. K. (2000). The evolution of human societies: from foraging group to agrarian state. Stanford University Press.

Johnson, N. D., & Mislin, A. A. (2011). Trust games: A meta-analysis. Journal of Economic Psychology, 32(5), 865–889.

Keynes, J.M. (1973 [originally 1936]). The collected writings of John Maynard Keynes: Vol. VII. The general theory of interest, employment and money. London: Macmillan.

Kreps, D. M. (1990). Corporate culture and economic theory. In J. E. Alt & K. A. Shepsle (Eds.), Firms, Organizations and Contracts (pp. 221–275). Oxford, U.K.: Oxford University Press.

Landa, J. T. (1983). The enigma of the kula ring: Gift-exchanges and primitive law and order. International Review of Law and Economics, 3(2), 137–160.

Lewis, D. (2008 [originally 1969]). Convention: A philosophical study. John Wiley & Sons.

Malinowski, B. (2014, originally 1922). Argonauts of the Western Pacific. Routledge.

Mauss, M. (2016 [originally 1925]). The gift. Chicago: The University of Chicago Press.

Nagel, R. (1995). Unraveling in guessing games: An experimental study. The American Economic Review, 85(5), 1313–1326.

Nietzsche, F. W. (1989, originally 1887). On the genealogy of morals. Vintage.

Posner, R. A. (1980). A theory of primitive society, with special reference to law. The Journal of Law and Economics, 23(1), 1–53.

Rabin, M. (1993). Incorporating fairness into game theory and economics. The American Economic Review, 1281–1302.

Rigdon, M. (2009). Trust and reciprocity in incentive contracting. Journal of Economic Behavior & Organization, 70(1–2), 93–105.

Robinson, J. A. (2013). Measuring institutions in the Trobriand Islands: a comment on Voigt’s paper. Journal of Institutional Economics, 9(1), 27–29.

Servátka, M., Tucker, S., & Vadovič, R. (2011a). Building trust — one gift at a time. Games, 2(4), 412–433.

Servátka, M., Tucker, S., & Vadovič, R. (2011b). Words speak louder than money. Journal of Economic Psychology, 32(5), 700–709.

Tversky, A., & Kahneman, D. (1973). Availability: A heuristic for judging frequency and probability. Cognitive Psychology, 5(2), 207–232.

Voigt, S. (2013). How (not) to measure institutions: a reply to Robinson and Shirley. Journal of Institutional Economics, 9(1), 35–37.

Xiao, E. (2021). Human punishment behavior. Oxford Research Encyclopedia of Economics and Finance. Retrieved 21 Sep. 2021, from https://oxfordre.com/economics/view/10.1093/acrefore/9780190625979.001.0001/acrefore-9780190625979-e-470.

Zizzo, D. J. (2010). Experimenter demand effects in economic experiments. Experimental Economics, 13(1), 75–98.

Zollman, K. J., Bergstrom, C. T., & Huttegger, S. M. (2013). Between cheap and costly signals: the evolution of partially honest communication. Proceedings of the Royal Society B: Biological Sciences, 280(1750), 20121878.

We thank Zev Berger, Cristina Bicchieri, Eugen Dimant, Maroš Servátka, Alessandro Sontuoso, two anonymous referees, and seminar participants at BEEMA V (Villanova) for helpful comments. The usual disclaimer applies.

The data are at https://data.mendeley.com/datasets/fwncj8y7ys/1.

Copyright: © 2022. The authors license this article under the terms of the Creative Commons Attribution 4.0 License.

This document was translated from LATEX by HEVEA.