Judgment and Decision Making, Vol. 16, No. 3, May 2021, pp. 709-728

Comparing mixed intertemporal tradeoffs with pure gains or pure losses

Jia-Tao Maa

Lei Wangb

Li-Na Chenc

Quan Hed

Qing-Zhou Sune

Hong-Yue Sunf

Cheng-Ming Jiangg

|

Abstract:

Intertemporal choices involve tradeoffs between outcomes that occur at

different times. Most of the research has used pure gains tasks and the

discount rates yielding from those tasks to explain and predict real-world

behaviors and consequences. However, real decisions are often more complex

and involve mixed outcomes (e.g., sooner-gain and later-loss or

sooner-loss and later-gain). No study has used mixed gain-loss

intertemporal tradeoff tasks to explain and predict real-world behaviors

and consequences, and studies involving such tasks are also scarce.

Considering that tasks involving a combination of gains and losses may

yield different discount rates and that existing pure gains tasks do not

explain or predict real-world outcomes well, this study conducted two

experiments to compare the discount rates of mixed gain-loss intertemporal

tradeoffs with those of pure gains or pure losses (Experiment 1) and to

examine whether these tasks predicted different real-world behaviors and

consequences (Experiment 2). Experiment 1 suggests that the discount rate

ordering of the four tasks was, from highest to lowest, pure gains,

sooner-loss and later-gain, pure losses, and sooner-gain and later-loss.

Experiment 2 indicates that the evidence supporting the claim that the

discount rates of the four tasks were related to different real-world

behaviors and consequences was insufficient.

Keywords: intertemporal choice, mixed outcome, discount rate,

real-world behavior, real-world consequence

1 Introduction

In daily life, many decisions involve tradeoffs between outcomes that occur

at different times, such as spending money or saving it by placing it in a

retirement account. Such tradeoffs are referred to as “intertemporal

choices” (Frederick et al., 2002). How we would like to experience

intertemporal outcomes is central to our well-being. Most laboratory

studies on intertemporal choices involve participants making choices

between pairs of positive dated outcomes that usually involve money—one

smaller-but-sooner and the other larger-but-later, such as receiving $200

now or $300 in six months.

However, such receiving tasks can represent only purely profitable

real-world situations, such as buying a new mobile phone with a bonus or

putting the bonus into a retirement account for later use (i.e., pure

gains). In fact, many decisions involve costs, even combinations of costs

and benefits. For example, an individual may choose to suffer a

potentially painful dental treatment now or choose to go to the dentist

later but suffer a much more painful treatment for a serious dental

disease (i.e., pure losses), or may enjoy smoking now but suffer long-term

future health complications (i.e., sooner-gain and later-loss), or may

take preventive measures now to obtain good health in the future (i.e.,

sooner-loss and later-gain). Several studies have examined pure losses

tasks, but the research on the other two mixed tasks is scarce.

A previous study (Ostaszewski, 2007) tested mixed tasks by constructing a

financial yes-or-no tradeoff involving a combination of a gain and loss.

Participants needed to decide whether to accept an offer that could be

either an immediate gain to be followed by a later loss or an immediate

loss to be followed by a later gain. The study found the hyperboloid

discounting type in these two tasks. Although it did not compare the

difference in the discount rates, the k values, which indicated

the rate, showed a trend in which the discount rate of the sooner-gain and

later-loss task was lower than that of the sooner-loss and later-gain

task. Estle et al. (2019) examined the difference in discount

rates between mixed (sooner-loss and later-gain) and pure gains tasks

because they focused on the self-control issue, which likely follows a

pattern of a sooner loss followed by a later gain. They found that, when

the combination represented a net loss but not a net gain, the discount

rate of the mixed task was less steep than that of the pure gains task.

However, they did not compare the other tasks and paid more attention to

incorporating self-control in the discounting framework.

It is certainly possible for different laboratory tasks to yield different

discount rates and represent different real-world behaviors and

consequences. However, few studies have attempted to compare the discount

rates for such tasks or examine the links between discounting rates

measured through these tasks and real-world behaviors and consequences.

This study aimed to fill that gap.

1.1 Tasks and Discount Rates

The discounted utility model, which is the normative model of intertemporal

choice, assumes that individuals discount future outcomes with a constant

ratio (discount rate). According to this model, an individual’s discount

rate should not change regardless of the method (e.g., choosing or

matching) used to yield the discount rates and the sign of the outcomes

(positive or negative). However, most of the evidence demonstrates that the

choosing and matching methods yield inconsistent discount rates (Hardisty,

Thompson, et al., 2013; Cohen et al., 2020). Specifically, a lower discount

rate is found via matching methods than via choosing methods (Read &

Roelofsma, 2003; Freeman et al., 2016). Furthermore, discount rates from

monetary gains are higher than those from losses (Thaler, 1981), known as

“gain-loss asymmetry” or the “sign effect.” These findings and others

suggest that no one constant discount rate can describe results for any

individual. Individuals may have different discount rates in mixed and pure

tasks.

1.2 Discount Rates in the Lab and Real-world Behaviors and

Consequences

The correlations between discounting rates and real-world behaviors and

consequence have been widely studied (Urminsky & Zauberman, 2015). The

research has found higher discount rates than matched ones among addicted

people, such as those addicted to food (Mole et al., 2015), cigarettes

(Reynolds & Fields, 2012), and videogames (Irvine et al., 2013). In

addition, a meta-analysis of discounting and addictive behavior (Mackillop

et al., 2011) showed that monetary discount rates are higher among

individuals who are dependent on alcohol (Cohen’s d = 0.50),

tobacco (d = 0.57), opiates (d = 0.76), stimulants

(d = 0.87), and gambling (d = 0.79) than among

non-dependent controls. Another meta-analysis (Amlung et al., 2017)

revealed that discounting is robustly associated with continuous measures

of addiction, specifically regarding severity and quantity frequency of

alcohol (Pearson’s r = 0.14), tobacco (r = 0.17),

gambling (r = 0.16), and cannabis (r = 0.10).

Researchers have also tried to use discounting to explain short-sighted

real-world behaviors in the normal population, such as consumer and health

decisions. However, a great deal of the research on the relations between

discount rates and field behaviors (e.g., exercise, seatbelt using, and

risky sexual activity) has revealed only weak correlations (Daugherty &

Brase, 2010; Sanchez-Roige et al., 2018). For example, Chabris et al.

(2008) examined the relations between discount rates and field behaviors

and consequences (e.g., BMI, smoking, and heathy food eating) and found

them to be small: None exceeded 0.28, and many were close to 0. However,

they found that the discount rate had at least as much predictive power as

other variables (e.g., gender, age, education) in their dataset, which

suggests that the discount rate can be a predictor of real-world behaviors

and consequences. Moreover, the superiority of the discount rate over other

predictors was enhanced when the behaviors and consequences were aggregated

into an index. However, several other studies do not support the claim that

discounting relates to potentially short-sighted real-world behaviors. For

instance, there is no evidence to support the claim that higher discount

rates via the choosing method correlate with more caffeine use

(Sanchez-Roige et al., 2018) and younger age at first sex (Hardisty,

Thompson, et al., 2013). Notably, most of these studies used pure gains

tasks to generate discount rates and examine the relations between them and

real-world behaviors and consequences. However, Hardisty, Thompson, et al.

(2013) showed that discount rates from pure gains or losses tasks predicted

different consequential outcomes. For example, discount rates via a pure

losses task with an alternative titration method had a positive predictive

relation regarding the frequency of dental checkups while those via a pure

gains task with the same method did not.

We argue that the pure gains monetary tasks used in the laboratory do not

provide a realistic representation of the important intertemporal behaviors

and consequences with which people deal every day. We speculate that this

may be part of the reason why discounting rates are only weakly related to

real-world behaviors and consequences. Thus, we proceeded on the assumption

that different tasks (i.e., pure gains, pure losses, sooner-gain and

later-loss, sooner-loss and later-gain) are associated with field behaviors

and consequences differentially based on the nature of the task.

We conducted two experiments to determine the differences in discount rates

between the four tasks and examine whether the tasks could represent

different real-world behaviors and consequences. In Experiment 1, we

examined the difference in discount rates between the four tasks using a

student sample with a well-validated and widely used monetary choice

questionnaire (MCQ; Kirby et al., 1999; Kirby, 2009).1 In Experiment

2, we examined the difference in discount rates by extending the sample

from students to community individuals with the same questionnaire, and

estimated the relations between the discount rates yielding from the four

tasks and real-world behaviors and consequences.

2 Experiment 1: Comparing Mixed Gain-Loss Intertemporal

Tradeoffs with Pure Ones

2.1 Method

In Experiment 1, 186 students from Zhejiang University of Technology were

approached in the library and were presented with an invitation letter

asking them to log on to a website for participation in our survey. They

were told that, after the experiment, the website would randomly select 1

out of 10 participants, who would receive 30 Chinese yuan (CNY).

Subsequently, they scanned a quick response (QR) code on the survey website

and were randomly assigned to one of the four conditions: pure gains, pure

losses, sooner-gain and later-loss, and sooner-loss and

later-gain.2

Participants in each condition were presented with 27 items about which

they needed to make choices. Those in the pure gains condition needed to

choose between a smaller immediate gain and a larger delayed gain; those in

the pure losses condition needed to choose between a smaller immediate loss

and a larger, delayed loss; those in the sooner-gain and later-loss

condition needed to decide whether to accept a smaller, immediate gain

followed by a larger, delayed loss; those in the sooner-loss and later-gain

condition needed to decide whether to accept a smaller, immediate loss

followed by a larger, delayed gain. The item order, specific amounts,

delays, and k values are shown in Table 1. Items are available in

a supplement. Further details on the materials and

data are available from https://osf.io/eq79p/. Examples are given

below:

Pure gains task:If you are faced with the following pairing options, which would you

prefer:

A: receive 24 CNY now

B: receive 35 CNY in 29 days

Pure losses task:

If you are faced with the following pairing options, which would you

prefer:

A: pay 24 CNY now

B: pay 35 CNY in 29 days

Sooner-gain and later-loss task:

Are you willing to “receive 24 CNY now and pay 35 CNY in 29 days”? Please

choose the option to indicate your willingness.

A: Yes

B: No

Sooner-loss and later-gain task: Are you willing to “pay 24 CNY

now and receive 35 CNY in 29 days”? Please choose the option to indicate

your willingness.

A: Yes

B: No

| Table 1: Twenty-seven items ordered by k value: amounts and delays. |

| Item | SIA | LDA | Delay (days) | k value | LDA size |

| 13 | 34 | 35 | 186 | 0.00016 | Small |

| 1 | 54 | 55 | 117 | 0.00016 | Medium |

| 9 | 78 | 80 | 162 | 0.00016 | Large |

| 20 | 28 | 30 | 179 | 0.0004 | Small |

| 6 | 47 | 50 | 160 | 0.0004 | Medium |

| 17 | 80 | 85 | 157 | 0.0004 | Large |

| 26 | 22 | 25 | 136 | 0.001 | Small |

| 24 | 54 | 60 | 111 | 0.001 | Medium |

| 12 | 67 | 75 | 119 | 0.001 | Large |

| 22 | 25 | 30 | 80 | 0.0025 | Small |

| 16 | 49 | 60 | 89 | 0.0025 | Medium |

| 15 | 69 | 85 | 91 | 0.0025 | Large |

| 3 | 19 | 25 | 53 | 0.006 | Small |

| 10 | 40 | 55 | 62 | 0.006 | Medium |

| 2 | 55 | 75 | 61 | 0.006 | Large |

| 18 | 24 | 35 | 29 | 0.016 | Small |

| 21 | 34 | 50 | 30 | 0.016 | Medium |

| 25 | 54 | 80 | 30 | 0.016 | Large |

| 5 | 14 | 25 | 19 | 0.041 | Small |

| 14 | 27 | 50 | 21 | 0.041 | Medium |

| 23 | 41 | 75 | 20 | 0.041 | Large |

| 7 | 15 | 35 | 13 | 0.1 | Small |

| 8 | 25 | 60 | 14 | 0.1 | Medium |

| 19 | 33 | 80 | 14 | 0.1 | Large |

| 11 | 11 | 30 | 7 | 0.25 | Small |

| 27 | 20 | 55 | 7 | 0.25 | Medium |

| 4 | 31 | 85 | 7 | 0.25 | Large |

The monetary choice questionnaire assesses discounting preferences across

three delayed magnitudes (LDA size): small (25–35), medium (50–60), and

large (75–85). SIA = smaller immediate amount; LDA = larger delayed amount;

k value is the value of the discount rate determined by SIA = LDA

/(1+k*Delay) (Mazur, 1987).3

2.2 Results and Discussion

A freely available Excel-based program was used to calculate the k

values. Following the literature, the k values were normalized

using log transformation because raw k values tend to be skewed

(Kaplan et al., 2016).

We excluded one participant each in the pure gains, pure losses, and

sooner-gain and later-loss conditions as well as two participants in the

sooner-gain and later-loss condition because they showed an overall

consistency score lower than 75% (see Kaplan et al., 2016), leaving a

total sample of 181 participants (90 males, Mage

= 22.30, SD = 3.54) for the final analysis (see Table 2).

| Table 2: Demographic characteristics and k value of the samples. |

| Tasks: | Pure

gains | Pure

losses | Sooner-gain

later-loss | Sooner-loss

later-gain |

| N | 46 | 45 | 46 | 44 |

| Male | 20 (43.5%) | 28 (62.2%) | 21 (45.7%) | 21 (47.7%) |

| Age (SD) | 21.98 (2.30) | 22.71 (2.51) | 21.74 (2.26) | 22.80 (5.86) |

| k value (SD) | 0.0486 (0.0587) | 0.0052 (0.0072) | 0.0020 (0.0046) | 0.0244 (0.0282) |

| Log k value (SD) | −1.68 (0.69) | −2.82 (0.78) | −3.28 (0.63) | −2.08 (0.85) |

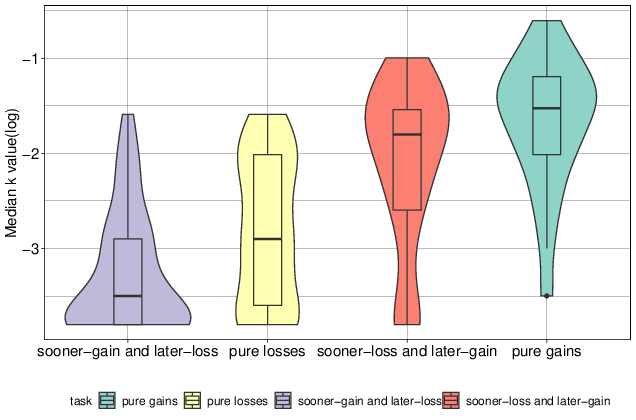

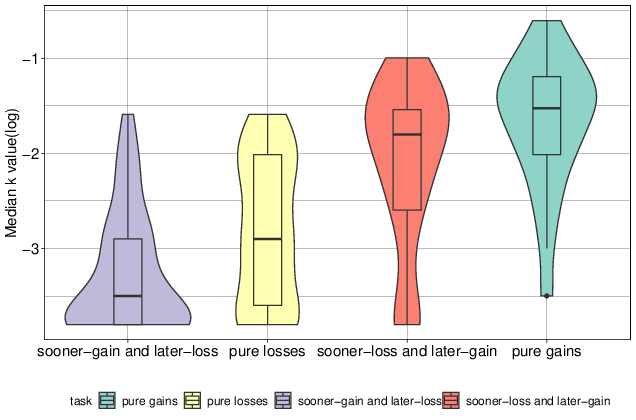

Using ANOVA, we found a statistically significant difference in mean log

k value of the four tasks (F (3,177) = 43.46, p

< .001, η2 = 0.424). Post-hoc tests revealed that

the mean log k value of the sooner-gain and later-loss task was

lower than that of the pure losses task (p = .019, d =

−0.65), the mean log k value of the pure losses task was lower

than that of the sooner-loss and later-gain tasks (p <

.001, d = 0.91), and the mean log k value of the

sooner-loss and later-gain task was lower than that of the pure gains

task (p = .050, d = −0.52). Therefore, the order of

these tasks according to their mean log k value, from highest to

lowest, was as follows: pure gains, sooner-loss and later-gain, pure

losses, and sooner-gain and later-loss. (See Figure 1 for the distribution

of log k values of the four tasks). This result is consistent

with those on gain-loss asymmetry (Thaler, 1981) and the trend of discount

rates in the two mixed tasks shown by Ostaszewski (2007).

| Figure 1: Violin and box plots of the median k value

(log) for the four discounting tasks, sorted according to the magnitude of

the median k value (log). The crossbar of each box represents the

median; the bottom and top edges of the box represent the first and third

quartiles; the dot represents one data point, which is an extreme outlier.

One data point lies outside the range of this figure in the pure gains

condition. The violin-shaded areas reflect the distribution shape of the

data. |

| Table 3: The effect of possible mechanisms on the discounting rate of four tasks. |

| Tasks: | Pure

gains | Sooner-loss

later-gain | Pure

losses | Sooner-gain

later-loss |

| Present bias | ↑ | - | ↓ | - |

| Status quo effect | - | ↑ | - | ↓ |

| Sequence effect | - | ↓ | - | ↓ |

| Salience account | - | ↓ | - | ↓ |

| Loss aversion | - | ↑ | - | ↓ |

| Debt aversion | - | ↑ | ↓ | ↓ |

As shown in Table 3, we concluded that various effects could contribute to the differences in the discounting rates between the four tasks. The “↑” represents an effect that can help to increase the discount rate in a task, “↓” represents an effect that can help to decrease the discount rate in a task, and “-” represents an effect that does not exist in a task.

Present bias describes a condition in which people are willing to

experience the outcome now rather than in the future regardless of whether

it is positive or negative (Hardisty, Appelt, et al., 2013), which could

help to yield a higher discount rate in the pure gains task and a lower

discount rate in the pure losses task.

The status-quo effect indicates a preference for the current state of

affairs or a tendency to leave a situation unchanged (Lempert & Phelps,

2016; Patty, 2006), which could lead to more rejections in the mixed

tasks, in which participants were asked to keep a status-quo or choose a

prospect. This effect could help to yield the higher discount rate in the

sooner-loss and later-gain task and the lower discount rate in the

sooner-gain and later-loss task.

The sequence effect proposed by Loewenstein and Prelec (1993) posits that

people favor an increasing sequence and disfavor a decreasing sequence. In

our study, the sooner-gain and later-loss task could be identified as a

decreasing sequence, while the sooner-loss and later-gain task may be an

increasing sequence; the sequence effect could help to yield the lower

discount rate of the sooner-gain and later-loss task and the higher

discount rate of the sooner-loss and later-gain task.

The salience account suggests that a discounting rate of intertemporal

sequences is generally (though not always) smaller than that of a

single-dated outcome (Jiang et al., 2014). When choosing between two

single-dated outcomes, people trade off outcomes against delays, and they

may pay equal attention to these two attributes (delay and outcome).

However, when choosing between prospects involving sequences, people may

be more focused on outcomes than on delays because, in sequences, outcomes

are more salient than delays. Thus, choices involving sequences often show

lower discounting rates than choices between single-dated outcomes (Jiang

et al., 2017; Jiang et al., 2016; Jiang et al., 2014; Sun & Jiang, 2015).

In the mixed tasks, prospects can be seen as sequences. Therefore, the

salience account would predict lower discounting rates for the mixed tasks

than for the other two tasks.

Loss aversion refers to the tendency to prefer avoiding losses to acquiring

equivalent gains, which is identified in risky choice rather than

intertemporal choice. Some researchers have borrowed this definition to

construct models of intertemporal choice (Loewenstein & Prelec, 1992;

Scholten & Read, 2010). Loss aversion would predict more rejections in

the mixed tasks, which would help to yield the lower discount rate in the

sooner-gain and later-loss task and the higher discount rate in the

sooner-loss and later-gain task. However, whether loss aversion actually

exists is debatable. Some researchers hold that the current evidence does

not support the view that losses tend to be any more impactful than gains

(Gal & Rucker, 2018).

Debt aversion suggests that people are unwilling to enter into a financial

contract framed or labeled as “debt” (Caetano et al., 2019). This aversion

has been used to explain why people often pay off mortgages and student

loans quicker than they have to (Eckel et al., 2007; Loewenstein & Thaler,

1989). In the mixed and pure losses tasks, the option involves a loss if it

is framed as a debt by participants, which could motivate them to avoid a

loss or pay it off as soon as possible. Therefore, debt aversion could help

to yield the lower discount rates in the pure losses task and sooner-gain

and later-loss task and the higher discount rate in the sooner-loss and

later-gain task.

Ultimately, a discount rate is an end product of mechanisms involving many

psychological factors, which affect the participants involved in different

tasks in various ways. The underlying mechanism of the differences in

discount rates between the four tasks remains an interesting topic for

exploration.

3 Experiment 2: Estimating the

Relations between Discount Rates and Real-world Behaviors and

Consequences

Experiment 1 revealed the differences in discount rates between the four

tasks preliminarily. To make the results more robust, we extended the

sample from students to community individuals in Experiment 2.

Furthermore, we estimated the relations between the four tasks and

real-world behaviors and consequences.

We assumed that any task at least measures some kind of discounting rate.

Thus, we predicted that, for all four tasks, a higher discounting rate was

associated with a lower frequency of floss use, less exercise, larger BMI,

a lack of following a diet, less credit paid in full, a higher frequency of

smoking, a higher frequency of alcohol use, a higher frequency of gambling,

a higher frequency of junk food eating, more time used for entertainment

and social interaction with smartphones, less savings compared to

colleagues, less savings compared to contemporaries, less success compared

to colleagues, and less success compared to contemporaries, largely based

on the literature (Amlung et al., 2017; Chabris et al., 2008; Hardisty,

Thompson, et al., 2013; Mackillop et al., 2011). (See the

supplement for the item wording; the full materials

and data are available at https://osf.io/eq79p/.)

Moreover, we predicted that the discounting rates yielded from the tasks

that represented real-world behaviors and consequences most closely would

be the best predictors of those behaviors and consequences. Specifically,

we predicted that the pure gains task would do better for saving behavior;

the pure losses task would do better for credit paid in full; that

smoking, alcohol use, gambling, junk food eating, and smartphone use for

entertainment would be explained better by the sooner-gain and later-loss

task; and that exercise, floss use, and diet status would be explained

better by the sooner-loss and later-gain task. We made no predictions

about which tasks would be most closely related to BMI and success because

there are too many influencing factors for them.

3.1 Method

Eight hundred and sixty-nine participants were recruited from Sojump

(http://www.sojump.com), a popular online

survey website in China. After completing discounting tasks similar to

those used in Experiment 1, participants were asked to report some of

their personal behaviors and consequences (mostly taken from Chabris et

al. [2008]; listed in Table 5). The order of the two options in the

discounting task items was counterbalanced among participants.

3.2 Results and Discussion

As in Experiment 1, we used an Excel-based program to calculate the

discounting rates. Six participants in the pure gains, 17 participants in

the pure losses, 16 participants in the sooner-loss and later-gain, and 15

participants in the sooner-gain and later-loss conditions who showed an

overall consistency score lower than 75% were excluded. We found no

difference in the exclusion amounts of the four tasks (χ2(3,

N = 869) = 5.9, p = .116). Hence, they were excluded

safely, leaving 815 valid questionnaires4

(316 males, Mage = 30.37, SD = 8.18) for

the final analysis (see Table 4).

| Table 4: Demographic characteristics and k values of the samples. |

| Tasks: | Pure

gains | Pure

losses | Sooner-gain

later-loss | Sooner-loss

later-gain |

| N | 209 | 204 | 197 | 205 |

| Male | 76 (33.4%) | 76 (37.3%) | 81 (41.1%) | 82 (40.0%) |

| Age (SD) | 30.26 (7.80) | 30.59 (8.06) | 30.53 (8.16) | 30.17 (8.68) |

| k value (SD) | 0.0423 (0.0613) | 0.0156 (0.0471) | 0.0129 (0.0492) | 0.0250 (0.0501) |

| Log k value (SD) | −1.84 (0.73) | −2.74 (0.86) | −3.00 (0.83) | −2.21 (0.78) |

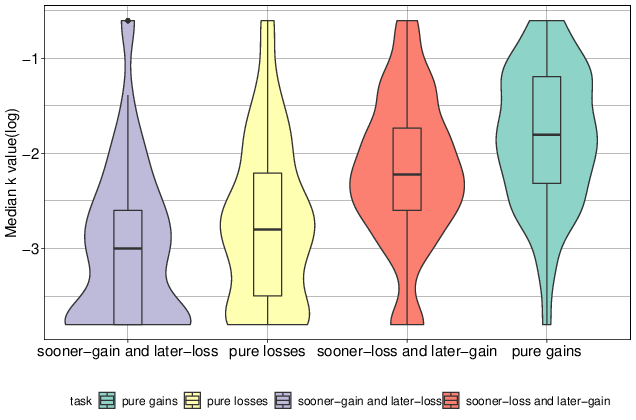

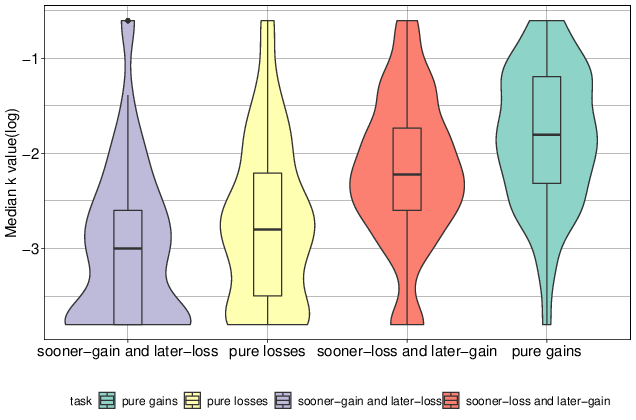

3.2.1 Tasks and Discount Rates

The differences in discount rates between the four tasks are consistent

with those in Experiment 1. The four tasks yielded different discount

rates (F (3,811) = 86.88, p < .001,

η2 = 0.243), and post-hoc tests revealed the same order of

discount rates among the four tasks as that found in Experiment 1

(ps < .005).5

| Figure 2: Violin and box plots of the median k value

(log) for the four discounting tasks, sorted according to the magnitude of

the median k value (log). The crossbar of each box represents the

median; the bottom and top edges of the box represent the first and third

quartiles. One data point lies outside the range of this figure in the

sooner-gain and later-loss condition. The violin-shaded areas reflect the

distribution shape of the data. |

3.2.2 Discount Rates and Real-world Behaviors and Consequences

We reverse-scored several items to make positive values, indicating the

relations in the predictive direction we assumed.6 We ran the liner regressions, and reported the

results in Table 5. The columns show the estimates of the log k

values when the behaviors and consequences are regressed on the demographic

characteristics (i.e., age, age2/100, education, gender

and family income) and the log k value. The complete regression

results are provided at the end of this paper (in the Extended Tables). The

results revealed that the discounting rates from the four tasks cannot

explain the behaviors and consequences except for a few, even some in the

reverse-predictive direction, which remains to be studied. Ultimately, we

found that the evidence supporting a relation between the discount rates of

the four tasks and the different real-world behaviors and consequences was

insufficient.

| Table 5: Regressions estimates of discount rates yielded from four tasks. |

| Tasks: | Pure

gains | Pure

losses | Sooner-gain

later-loss | Sooner-loss

later-gain |

| BMI | 0.15 | 0.07 | -0.14 | -0.01 |

| Exercise§ | 0.06 | -0.07 | -0.06 | -0.31^** |

| Diet status§ | 0.04 | 0.06 | -0.13^** | 0.13^** |

| Floss using§ | -0.10 | 0.15 | -0.27^** | 0.02 |

| Credit paid in full§£ | 0.17 | 0.03 | 0.21^* | -0.22^* |

| Smoking | 0.08 | -0.07 | 0.10 | 0.15 |

| Alcohol using | 0.14 | 0.04 | 0.11 | 0.02 |

| Gambling | 0.07 | -0.09 | 0.30^*** | -0.04 |

| Junk food eating | -0.02 | -0.05 | 0.04 | 0.08 |

| Smartphone using | -0.01 | -0.09 | -0.04 | 0.07 |

| Save / colleague§ | 0.11 | 0.00 | -0.10 | -0.06 |

| Save / contemporary§ | 0.09 | 0.08 | -0.11 | -0.09 |

| Success / colleague§ | 0.05 | 0.01 | -0.08 | -0.17 |

| Success / contemporary§ | 0.16 | 0.01 | -0.10 | -0.10 |

| § These items were reverse-scored so that positive values indicated a

correlation in the predicted direction;£ excluded participants who did

not use any credit tools because we could not arbitrarily classify them as

preferring the present or the future; hence, the samples of the items of

the four tasks are 166, 159, 157, and 163, respectively;

* p < .05; ** p < .01; *** p < .001. |

3.2.3 Pure Gains Task and Real-world Behaviors and Consequences

The evidence from research on the relations between intertemporal choices

of pure gains task in the laboratory and real-world behaviors and

consequences is relatively sufficient; thus, this issue will be discussed

first. In our study, the effects of the discount rate yielded from pure

gains task are statistically insignificant for all behaviors and

consequences. Previous studies based on non-clinical participants have

shown that discount rates are weakly correlated with real-world behaviors

and consequences (Chabris et al., 2008; Daugherty & Brase, 2010;

Sanchez-Roige et al., 2018). For example, Chabris et al. (2008) conducted

three studies to examine the relations between discount rates and

behaviors. Their Study 3, which measured 14 behaviors and consequences in

normal individuals with online questionnaires, is similar to the pure

gains condition in our Experiment 2. The results of their Study 3 showed

that the discounting rate had a positive and significant correlation with BMI and

credit card bill paid in full but a negative and significant relationship with

prescription drug compliance. Our results are not consistent with these.

The main reasons for the difference between the results may be that their

study excluded participants who always chose either the delayed or

immediate rewards and used a larger sample size than that used in our pure

gains condition; moreover, the participants in their study were

incentivized to be incentive compatible. These different measures may have

led to the different results. Although the effects of the discount rates

on all the behaviors and consequences we measured did not reach

statistical significance, most of them were consistent with the expected

directions (only three of the 14 were in the opposite direction).

Therefore, our study is generally consistent with previous studies on the

relations between the discount rate of the pure gains task and real-world

behaviors and consequences.

Some scholars have discussed why the discount rate is weakly related to

real-world behaviors and consequences (Urminsky & Zauberman, 2015). For

example, regarding the complexity of individual behavior, some behaviors,

which are assumed to be intertemporal choices, may not be dominated or

even affected by discount rates. For instance, some people exercise

because the people around them do (like in the herd effect). Once these

social influences exist, people’s decision making does not depend on their

own independent deliberations, and the impact of the discount rate on

real-world outcomes become smaller or even disappears. Furthermore, the

behaviors and consequences considered by researchers to be discount types

are actually not related or are the opposite. For example, some people

always need to balance between working hard for money and exercising, but

it is unreasonable to describe sacrificing exercise in order to work as

short-sighted. After all, making money is also done to obtain a better

life and prepare for the future.

3.2.4 Other Tasks and Real-world Behaviors and Consequences

As Table 5 shows, we found in the pure losses task that the discount rate

could not explain any real-world behavior and consequence, which is

inconsistent with Hardisty, Thompson, et al. (2013). Hardisty, Thompson,

et al. (2013) found that the discount rates yielded from pure losses task

with an alternative titration method could predict some consequential

outcomes (e.g., exercise, credit paid in full). Our results and Hardisty,

Thompson, et al.’s may differ because their study used non-parametric

correlations, while we used regressions and controlled for other

variables; moreover, we used Kirby’s task to yield the discount rate while

they used a self-designed task. For the newly introduced tasks, the

findings are both expected and unexpected. In the sooner-gain and

later-loss task, the discount rate can explain gambling (b =

0.30, p = .001) and credit paid in full (b = 0.21,

p = .024), consistent with our prediction; however, its effects

on diet status (b = −0.13, p = .002) and floss use

(b = −0.27, p = .002) are significant but contrary to

our prediction. In the sooner-loss and later-gain task, the discount rate

can explain diet status (b = 0.13, p = .002), consistent

with our prediction; however, its effects on credit paid in full

(b = −0.22, p = .031) and exercise (b = −0.31,

p = .006) are significant but contrary to our prediction. In

these three tasks, the other relations are not statistically significant,

and a considerable part of the behaviors and consequences (five, nine, and

eight of the 14 outcomes in the pure losses, sooner-gain and later-loss,

and sooner-loss and later-gain tasks) are contrary to our expectations.

It is possible that the discount rate of a pure gains task can

represent a “universal” discount rate, which is related to real behaviors

and consequences, while other tasks cannot. The relations in the two mixed

tasks may be false correlations (false positive errors) caused by multiple

tests. However, other discount tasks may also predict behaviors and

consequences, but our tasks did not include zero or negative discount rate

situations because we used and adjusted Kirby’s discounting task (Kirby et

al., 1999; Kirby, 2009). Previous research has shown that loss outcomes

can yield a negative discount rate (Hardisty, Thompson, et al., 2013). The

results may be different if the tasks can accommodate zero or negative

discount rates.

4 General Discussion

In Experiment 1, we compared mixed gain-loss intertemporal choices with

pure gains or pure losses choices with a college student sample. The

results demonstrated that the discount rate ordering of the four tasks,

from highest to lowest, was pure gains, sooner-loss and later-gain, pure

losses, and sooner-gain and later-loss. In Experiment 2, we repeated the

process for the four tasks with community participants and also measured

their self-reported real-world behaviors and consequences. We found that

the evidence supporting the claim that discount rates from different tasks

are related to different real-world behaviors and consequences was

insufficient.

In both experiments, we used hypothetical tasks rather than real monetary

incentives to yield the discount rates because it is almost impossible for

us to ask participants to pay money in the pure losses and mixed tasks.

Fortunately, previous studies have shown that there are no differences

between real and hypothetical intertemporal outcomes at the behavioral

level (Johnson & Bickel, 2002; Madden et al., 2003) or neural level

(Bickel et al., 2007).

We have confidence in our finding that different tasks yield different

discount rates. The results of this study further the research on

gain-loss asymmetry. However, more research is needed to explore the

relations between the discount rates of different tasks and real-world

behaviors and consequences.

References

Amlung, M., Vedelago, L., Acker, J., Balodis, I., & MacKillop, J. (2017).

Steep delay discounting and addictive behavior: A meta-analysis of

continuous associations. Addiction, 112(1), 51–62.

Bickel, W. K., Miller, M. L., Yi, R., Kowal, B. P., Lindquist, D. M., &

Pitcock, J. A. (2007). Behavioral and neuroeconomics of drug addiction:

competing neural systems and temporal discounting processes. Drug

and Alcohol Dependence, 90 (Suppl 1), S85.

Caetano, G., Palacios, M., & Patrinos, H. A. (2019). Measuring aversion to

debt: An experiment among student loan candidates. Journal of

Family and Economic Issues, 40(1), 117–131.

Chabris, C. F., Laibson, D., Morris, C. L., Schuldt, J. P., & Taubinsky,

D. (2008). Individual laboratory-measured discount rates predict field

behavior. Journal of Risk and Uncertainty, 37(2-3), 237–269.

Cohen, J., Ericson, K. M., Laibson, D., & White, J. M. (2020). Measuring

time preferences. Journal of Economic Literature, 58(2), 299–347.

Daugherty, J. R., & Brase, G. L. (2010). Taking time to be healthy:

Predicting health behaviors with delay discounting and time perspective.

Personality and Individual Differences, 48(2), 202–207.

Eckel, C. C., Johnson, C., Montmarquette, C., & Rojas, C. (2007). Debt

aversion and the demand for loans for postsecondary education.

Public Finance Review, 35(2), 233–262.

Estle, S. J., Green, L., & Myerson, J. (2019). When immediate losses are

followed by delayed gains: Additive hyperboloid discounting models.

Psychonomic Bulletin & Review, 26(4), 1418–1425.

Franco-Watkins, A. M., Mattson, R. E., & Jackson, M. D. (2016). Now or

later? Attentional processing and intertemporal choice. Journal of

Behavioral Decision Making, 29(2-3), 206–217.

Freeman, D., Manzini, P., Mariotti, M., & Mittone, L. (2016). Procedures

for eliciting time preferences. Journal of Economic Behavior &

Organization, 126, 235–242.

Frederick, S., Loewenstein, G., & O’donoghue, T. (2002).

Time discounting and time preference: A critical review. Journal

of Economic Literature, 40(2), 351–401.

Gal, D., & Rucker, D. D. (2018). The loss of loss aversion: Will it loom

larger than its gain?. Journal of Consumer Psychology, 28(3),

497–516.

Hardisty, D. J., Appelt, K. C., & Weber, E. U. (2013). Good or bad, we

want it now: Fixed-cost present bias for gains and losses explains

magnitude asymmetries in intertemporal choice. Journal of

Behavioral Decision Making, 26(4), 348–361.

Hardisty, D. J., Thompson, K. F., Krantz, D. H., & Weber, E. U. (2013).

How to measure time preferences: An experimental comparison of three

methods. Judgment and Decision Making, 8(3), 236–249.

Irvine, M. A., Yulia, W., Sorcha, B., Harrison, N. A., Bullmore, E. T., &

Valerie, V., et al. (2013). Impaired decisional impulsivity in

pathological videogamers. PLoS ONE, 8(10), e75914.

Jiang, C. M., Hu, F. P., & Zhu, L. F. (2014). Introducing upfront losses

as well as gains decreases impatience in intertemporal choices with

rewards. Judgment and Decision Making, 9(4), 297–302.

Jiang, C.-M., Sun, H.-M., Zhu, L.-F., Zhao, L., Liu, H.-Z., & Sun, H.-Y.

(2017). Better is worse, worse is better: Reexamination of violations of

dominance in intertemporal choice. Judgment and Decision Making,

12(3), 253–259.

Jiang, C. M., Sun, H. Y., Zheng, S. H., Wang, L. J., & Qin, Y. (2016).

Introducing upfront money can decrease discounting in intertemporal

choices with losses. Frontiers in Psychology, 7, 1256.

Johnson, M. W., & Bickel, W. K. (2002). Within-subject comparison of real

and hypothetical money rewards in delay discounting. Journal of

the Experimental Analysis of Behavior, 77(2), 129–146.

Kaplan, B. A., Amlung, M., Reed, D. D., Jarmolowicz, D. P., McKerchar, T.

L., & Lemley, S. M. (2016). Automating scoring of delay discounting for

the 21- and 27-item monetary choice questionnaires. The Behavior

Analyst / MABA, 39(2), 1–12.

Kirby, K. N. (2009). One-year temporal stability of delay-discount rates.

Psychonomic Bulletin & Review, 16(3), 457–462.

Kirby, K. N., Petry, N. M., & Bickel, W. K. (1999). Heroin addicts have

higher discount rates for delayed rewards than non-drug-using

controls. Journal of Experimental Psychology: General, 128(1), 78–87.

Lempert, K. M., & Phelps, E. A. (2016). The malleability of intertemporal

choice. Trends in Cognitive Sciences, 20(1), 64–74.

Loewenstein, G., & Prelec, D. (1992). Anomalies in Intertemporal Choice:

Evidence and an Interpretation. The Quarterly Journal of

Economics, 107(2), 573–597.

Loewenstein, G., & Prelec, D. (1993). Preferences for sequences of

outcomes. Psychological Review, 100(1), 91–108.

Loewenstein, G., & Thaler, R. H. (1989). Anomalies: intertemporal choice.

Journal of Economic Perspectives, 3(4), 181–193.

MacKillop, J., Amlung, M. T., Few, L. R., Ray, L. A., Sweet, L. H., &

Munafò, M. R. (2011). Delayed reward discounting and addictive behavior: a

meta-analysis. Psychopharmacology, 216(3), 305–321.

Madden, G. J., Begotka, A. M., Raiff, B. R., & Kastern, L. L. (2003).

Delay discounting of real and hypothetical rewards. Experimental

and Clinical Psychopharmacology, 11(2), 139–145.

Mazur, J. E. (1987). An adjusting procedure for studying delayed

reinforcement. In M. L. Commons, J. E. Mazur, J. A. Nevin, & H. Rachlin

(Eds.), Quantitative analyses of behavior: Vol. 5. The effect of

delay and of intervening events on reinforcement value (pp. 55-73).

Hillsdale, NJ: Erlbaum.

Myerson, J., Green, L., & Warusawitharana, M. (2001). Area under the curve

as a measure of discounting. Journal of The Experimental Analysis

of Behavior, 76(2), 235–243.

Mole, T. B., Irvine, M. A., Worbe, Y., Collins, P., Mitchell, S. P., &

Bolton, S., et al. (2015). Impulsivity in disorders of food and drug

misuse. Psychological Medicine, 45(04), 771–782.

Ostaszewski, P. (2007). Temporal discounting in “gain

now-lose later” and “lose now-gain

later” conditions. Psychological Reports,100(2),

653–660.

Patty, J. W. (2006). Loss aversion, presidential responsibility, and

midterm congressional elections. Electoral Studies, 25(2),

227–247.

Read, D., & Roelofsma, P. (2003). Subadditive versus hyperbolic

discounting: A comparison of choice and matching. Organizational

Behavior & Human Decision Processes, 91, 140–153.

Reynolds, B., & Fields, S. (2012). Delay discounting by adolescents

experimenting with cigarette smoking. Addiction, 107(2), 417–424.

Sanchez-Roige, S., Fontanillas, P., Elson, S. L., Pandit, A., Schmidt, E.

M., Foerster, J. R., ... & MacKillop, J. (2018). Genome-wide association

study of delay discounting in 23,217 adult research participants of

European ancestry. Nature Neuroscience, 21(1), 16–18.

Scholten, M., & Read, D. (2010). The psychology of intertemporal

tradeoffs. Psychological Review, 117(3), 925–944.

Sun, H. Y., & Jiang, C. M. (2015). Introducing money at any time can

reduce discounting in intertemporal choices with rewards: an extension of

the upfront money effect. Judgment and Decision Making, 10(6),

564–570.

Thaler, R. (1981). Some empirical evidence on dynamic inconsistency.

Economics Letters, 8(3), 201–207.

Urminsky, O., & Zauberman, G. (2015). The psychology of intertemporal

preferences. In Keren G., & Wu G. (Eds.), The Wiley-Blackwell

handbook of judgment and decision making (pp. 141–181). Chichester, UK:

John Wiley & Sons.

Appendix

Extended Table 1. Real-world behaviors and consequences regression in pure

gains task (s.e. in parentheses).

| Predictor | BMI | Exercise§ | Diet§ | Floss§ | Credit§£ | Smoke | Alcohol | Gamble | Junk food | Phone | Save.1§ | Save.2§ | Suc.1§ | Suc.2§ |

| Log k | 0.15 (0.08) | 0.06 (0.09) | 0.04 (0.05) | −0.10 (0.09) | 0.08 (0.07) | 0.17 (0.11) | 0.14 (0.09) | 0.07 (0.10) | −0.02 (0.10) | −0.01 (0.09) | 0.11 (0.10) | 0.09 (0.09) | 0.05 (0.09) | 0.16 (0.09) |

| Age | 0.91** (0.34) | −0.49 (0.40) | −0.18 (0.20) | −0.80* (0.41) | −0.64* (0.31) | 0.81 (0.63) | 0.49 (0.38) | 0.56 (0.41) | −0.76 (0.43) | −1.14** (0.39) | −0.43 (0.42) | −0.06 (0.40) | 0.43 (0.39) | 0.32 (0.39) |

| Age2/100 | −0.69* (0.35) | 0.56 (0.41) | 0.18 (0.20) | 0.82* (0.42) | 0.87** (0.32) | −0.96 (0.68) | −0.31 (0.39) | −0.56 (0.43) | 0.65 (0.44) | 0.92* (0.40) | 0.57 (0.43) | 0.08 (0.41) | −0.51 (0.40) | −0.41 (0.40) |

| Education | −0.03 (0.06) | 0.01 (0.08) | 0.00 (0.04) | 0.01 (0.08) | −0.02 (0.06) | −0.15 (0.09) | 0.02 (0.07) | −0.08 (0.08) | 0.08 (0.08) | 0.07 (0.07) | −0.05 (0.08) | −0.16* (0.08) | −0.28*** (0.07) | −0.25** (0.07) |

| Gender(male) | 0.65*** (0.12) | −0.25 (0.14) | −0.06 (0.07) | 0.04

(0.15) | 0.44*** (0.11) | −0.18 (0.17) | 0.59*** (0.14) | 0.30* (0.15) | −0.26 (0.16) | −0.08 (0.14) | −0.10 (0.15) | 0.01 (0.14) | 0.08 (0.14) | 0.02 (0.14) |

| Family income | −0.11 (0.06) | −0.14 (0.07) | −0.06 (0.04) | −0.20** (0.07) | 0.10 (0.06) | −0.02 (0.09) | 0.09 (0.07) | −0.01 (0.07) | 0.17* (0.08) | 0.03 (0.07) | −0.19* (0.08) | −0.24** (0.07) | −0.36*** (0.07) | −0.40*** (0.07) |

| Observations | 209 | 209 | 209 | 209 | 166 | 209 | 209 | 209 | 209 | 209 | 209 | 209 | 209 | 209 |

| R2 | 0.243 | 0.050 | 0.034 | 0.070 | 0.056 | 0.202 | 0.170 | 0.032 | 0.062 | 0.096 | 0.070 | 0.093 | 0.201 | 0.222 |

Extended Table 2. Real-world behaviors and consequences regression in pure

losses task (s.e. in parentheses).

| Predictor | BMI | Exercise§ | Diet§ | Floss§ | Credit§£ | Smoke | Alcohol | Gamble | Junk food | Phone | Save.1§ | Save.2§ | Suc.1§ | Suc.2§ |

| Log k | 0.07 (0.07) | −0.07 (0.07) | 0.06 (0.04) | 0.15 (0.08) | 0.03 (0.11) | −0.07 (0.08) | 0.04 (0.08) | −0.09 (0.09) | −0.05

(0.08) | −0.09 (0.09) | 0.00 (0.08) | 0.08 (0.08) | 0.01 (0.08) | 0.01 (0.08) |

| Age | −0.08 (0.30) | −0.16 (0.30) | −0.22 (0.18) | −0.04 (0.36) | 0.94 (0.72) | 0.17 (0.35) | 0.38 (0.38) | 0.51 (0.40) | −0.84* (0.34) | −0.74 (0.40) | −0.14 (0.35) | −0.11 (0.37) | 0.16 (0.37) | 0.51 (0.35) |

| Age2/100 | 0.27 (0.29) | 0.11 (0.30) | 0.18 (0.18) | −0.09 (0.35) | −1.08 (0.74) | −0.09 (0.34) | −0.32 (0.37) | −0.48 (0.39) | 0.56 (0.33) | 0.63 (0.39) | 0.11 (0.35) | 0.15

(0.36) | −0.24 (0.36) | −0.51 (0.34) |

| Education | 0.02 (0.06) | 0.00 (0.06) | 0.03 (0.03) | −0.13 (0.07) | −0.07 (0.11) | −0.05 (0.07) | −0.02 (0.07) | −0.08 (0.08) | −0.01 (0.07) | −0.05 (0.08) | 0.11 (0.07) | 0.09 (0.07) | 0.01

(0.07) | −0.04 (0.07) |

| Gender(male) | 0.46*** (0.12) | −0.22 (0.12) | −0.12 (0.07) | −0.03 (0.14) | 0.25 (0.17) | 0.83*** (0.14) | 0.55*** (0.15) | 0.48** (0.15) | −0.08 (0.13) | −0.16 (0.15) | −0.16 (0.14) | −0.33* (0.14) | −0.28 (0.14) | −0.26 (0.13) |

| Family income | −0.08 (0.06) | −0.15* (0.06) | −0.09* (0.04) | −0.21** (0.07) | −0.08 (0.11) | −0.04 (0.07) | 0.13 (0.08) | 0.02 (0.08) | 0.05 (0.07) | 0.02 (0.08) | −0.41*** (0.07) | −0.36*** (0.08) | −0.29*** (0.07) | −0.37*** (0.07) |

| Observations | 204 | 204 | 204 | 204 | 159 | 204 | 204 | 204 | 204 | 204 | 204 | 204 | 204 | 204 |

| R2 | 0.154 | 0.082 | 0.082 | 0.115 | 0.036 | 0.176 | 0.111 | 0.062 | 0.116 | 0.050 | 0.170 | 0.134 | 0.110 | 0.163 |

Extended Table 3. Real-world behaviors and consequences regression in

sooner-gain and later-loss task (s.e. in parentheses).

| Predictor | BMI | Exercise§ | Diet§ | Floss§ | Credit§£ | Smoke | Alcohol | Gamble | Junk food | Phone | Save.1§ | Save.2§ | Suc.1§ | Suc.2§ |

| Log k | −0.14 (0.10) | −0.06 (0.08) | −0.13** (0.04) | −0.27** (0.09) | 0.21* (0.09) | 0.10 (0.08) | 0.11 (0.08) | 0.30*** (0.09) | 0.04 (0.09) | −0.04 (0.09) | −0.10 (0.08) | −0.11 (0.08) | −0.08 (0.08) | −0.10 (0.08) |

| Age | 0.76 (0.45) | −0.19 (0.38) | −0.08 (0.19) | −0.77 (0.40) | 0.01 (0.50) | 1.00* (0.39) | 0.61 (0.37) | 1.14** (0.42) | −0.42 (0.42) | 0.57 (0.42) | 0.18 (0.37) | 0.57 (0.37) | 0.61 (0.39) | 0.56 (0.38) |

| Age2/100 | −0.53 (0.45) | 0.13 (0.39) | 0.13 (0.19) | 0.80* (0.40) | −0.21 (0.50) | −0.92* (0.39) | −0.57 (0.37) | −1.13** (0.42) | 0.25 (0.43) | −0.64 (0.42) | −0.09 (0.37) | −0.47 (0.37) | −0.56 (0.39) | −0.52 (0.38) |

| Education | −0.08 (0.08) | 0.03 (0.07) | −0.04 (0.03) | −0.07 (0.07) | −0.17 (0.09) | −0.14* (0.07) | 0.12 (0.06) | −0.04 (0.07) | −0.02 (0.07) | 0.10 (0.07) | −0.05 (0.06) | −0.10 (0.06) | −0.11 (0.07) | 0.01 (0.07) |

| Gender(male) | 0.52** (0.17) | −0.05 (0.14) | 0.05 (0.07) | 0.20 (0.15) | −0.11 (0.16) | 1.18*** (0.14) | 0.59*** (0.14) | 0.22 (0.15) | −0.31 (0.16) | −0.06 (0.16) | −0.06 (0.14) | −0.22 (0.14) | −0.15 (0.14) | −0.06 (0.14) |

| Family income | −0.15 (0.08) | −0.12 (0.07) | −0.02 (0.03) | −0.06 (0.07) | −0.01 (0.08) | 0.02 (0.07) | 0.15* (0.07) | 0.00 (0.08) | −0.01 (0.08) | −0.10 (0.08) | −0.15* (0.07) | −0.22** (0.07) | −0.26*** (0.07) | −0.27*** (0.07) |

| Observations | 197 | 197 | 197 | 197 | 157 | 197 | 197 | 197 | 197 | 197 | 197 | 197 | 197 | 197 |

| R2 | 0.134 | 0.031 | 0.083 | 0.097 | 0.096 | 0.337 | 0.186 | 0.118 | 0.060 | 0.037 | 0.046 | 0.098 | 0.099 | 0.085 |

Extended Table 4. Real-world behaviors and consequences regression in

sooner-loss and later-gain task (s.e. in parentheses).

| Predictor | BMI | Exercise§ | Diet§ | Floss§ | Credit§£ | Smoke | Alcohol | Gamble | Junk food | Phone | Save.1§ | Save.2§ | Suc.1§ | Suc.2§ |

| Log k | −0.01 (0.09) | −0.31** (0.11) | 0.13** (0.04) | 0.02 (0.09) | −0.22* (0.10) | 0.15 (0.08) | 0.02 (0.08) | −0.04 (0.08) | 0.08 (0.08) | 0.07 (0.08) | −0.06 (0.09) | −0.09 (0.09) | −0.17 (0.09) | −0.10 (0.09) |

| Age | 0.22 (0.36) | −0.51 (0.43) | 0.05 (0.16) | −0.67 (0.36) | −0.69 (0.57) | 0.38 (0.31) | 0.98** (0.33) | 0.27 (0.31) | −0.54 (0.33) | −0.39 (0.33) | −0.31 (0.35) | −0.18 (0.37) | −0.21 (0.34) | 0.51 (0.35) |

| Age2/100 | −0.13 (0.35) | 0.33 (0.42) | −0.07 (0.16) | 0.63 (0.35) | 0.72 (0.60) | −0.31 (0.30) | −0.86** (0.32) | −0.25 (0.30) | 0.28 (0.32) | 0.18 (0.32) | 0.10 (0.35) | 0.07 (0.36) | 0.17 (0.33) | −0.57 (0.34) |

| Education | −0.01 (0.08) | −0.09 (0.10) | 0.01 (0.04) | −0.08 (0.08) | −0.20 (0.10) | 0.04 (0.07) | 0.09 (0.07) | 0.00 (0.07) | 0.05 (0.07) | 0.14 (0.07) | −0.18* (0.08) | −0.10 (0.08) | −0.12 (0.08) | −0.11 (0.08) |

| Gender(male) | 0.73*** (0.15) | 0.22 (0.18) | 0.03 (0.07) | 0.03 (0.15) | −0.15 (0.16) | 0.95*** (0.13) | 0.63*** (0.14) | 0.37** (0.13) | −0.04 (0.14) | 0.08 (0.14) | 0.14 (0.15) | 0.06 (0.15) | 0.15 (0.14) | 0.07 (0.14) |

| Family income | 0.04 (0.08) | 0.07 (0.10) | −0.05 (0.04) | −0.06 (0.08) | −0.05 (0.09) | 0.13 (0.07) | 0.05 (0.07) | 0.11 (0.07) | 0.04 (0.07) | −0.15* (0.07) | −0.22** (0.08) | −0.21** (0.08) | −0.20** (0.08) | −0.26** (0.08) |

| Observations | 205 | 205 | 205 | 205 | 163 | 205 | 205 | 205 | 205 | 205 | 205 | 205 | 205 | 205 |

| R2 | 0.147 | 0.057 | 0.078 | 0.047 | 0.076 | 0.282 | 0.187 | 0.074 | 0.104 | 0.119 | 0.143 | 0.081 | 0.101 | 0.085 |

Notes for Extended Table 1-4: § and £ have the same meanings as those

given in Table 5 in the paper; * p < .05; ** p

< .01; *** p < .001

This document was translated from LATEX by

HEVEA.