Judgment and Decision Making, Vol. 14, No. 2, March 2019, pp. 135-147

Are markets more accurate than polls? The surprising informational value of “just asking”

Jason Dana*

Pavel Atanasov#

Philip Tetlock#

Barbara Mellers#

|

Psychologists typically measure beliefs and preferences using

self-reports, whereas economists are much more likely to infer them

from behavior. Prediction markets appear to be a victory for the

economic approach, having yielded more accurate probability estimates

than opinion polls or experts for a wide variety of events, all without

ever asking for self-reported beliefs. We conduct the most direct

comparison to date of prediction markets to simple self-reports using a

within-subject design. Our participants traded on the likelihood of

geopolitical events. Each time they placed a trade, they first had to

report their belief that the event would occur on a 0–100 scale. When

previously validated aggregation algorithms were applied to

self-reported beliefs, they were at least as accurate as

prediction-market prices in predicting a wide range of geopolitical

events. Furthermore, the combination of approaches was significantly

more accurate than prediction-market prices alone, indicating that

self-reports contained information that the market did not efficiently

aggregate. Combining measurement techniques across behavioral and

social sciences may have greater benefits than previously thought.

Keywords: prediction, forecast, judgment, prediction markets, self-reports, surveys

1 Introduction

Behavioral and social scientists have long disagreed over how best to

measure mental states. While psychologists clearly value behavioral

measures, they quite often measure beliefs and preferences by simply

asking people to self-report them on a numerical scale. And while

economists place value on people’s judgments, they tend to place

greater value on inferring preferences and beliefs from behavior. For

example, if a person claims that the United States is on the verge of

an economic collapse or that a climate disaster is imminent, an

economist might look at that person’s investment portfolio or disaster

preparedness to reveal whether that person really believes

these statements. Indeed, the unwillingness of economists to rely on

survey questions has been called an important divide with other

behavioral scientists (Bertrand & Mullainathan, 2001).

Perhaps the most impressive demonstration of the power of using revealed

beliefs is the resounding success of prediction markets. Prediction

markets create contracts that pay a fixed amount if an event occurs,

and then allow people to trade on the contract by submitting buying or

selling prices in a manner similar to the stock market. The price at

which the contract trades at a given time can be taken to be the

market’s collective probability estimate of the event occurring. For

example, suppose the event to be predicted was the winner of the 2016

US presidential election, and that a contract paid $100 if Hillary

Clinton won. If the contract last traded at $60 – that is, someone

just purchased the contract from someone else for $60 — one could use

that price as a likelihood prediction of Clinton winning of 60%. In

other words, if a risk-neutral market is valuing a risky $100 contract

at $60, it implies that the expected value of the contract is $60 and

thus that it will pay out with probability .6.

Using prediction market prices in this manner has yielded impressively

accurate predictions for a wide array of outcomes, such as the winners

of elections or sporting events, typically exceeding the accuracy of

“just asking” methods such as opinion polls or expert forecasts (see

Wolfers & Zitzewitz, 2004; Ray, 2006, for reviews). When market

participants have some intrinsic interest in trying to predict results,

even markets with modest incentives or no incentives have been shown to

be effective. As examples, small markets using academics as

participants predict which behavioral science experiments will

successfully replicate (e.g., Camerer et al., 2018) and “play money”

markets in which participants play for prestige can be as accurate as

real-money markets (Pennock et al, 2001; Servan-Schreiber et al.,

2004). Because these probability forecasts are obtained without ever

asking anyone to self-report their beliefs, the success of prediction

markets appears to be a victory of the economic approach and a

repudiation of relying on self-reports.

The classic explanation for why prediction markets are so successful is

that they are efficient mechanisms for integrating information useful

to making predictions. To see why, suppose that someone had information

that suggested an event was much more likely to occur than the current

market price suggested. That person would now have the incentive to buy

the contract because its expected value would greatly exceed its cost.

The balance of such beliefs would eventually push the price up. Others

might have pieces of information that suggest the event is unlikely,

motivating them to sell and putting downward pressure on the price. In

the end, the market price will tend to reflect the balance of

information that participants have. Indeed, when traders try to engage

in market manipulation, buying and selling with the intent of changing

the price to provide misinformation, their attempts usually fail and

the market can become even more informative due to the incentives for

traders to act on their true beliefs (Hanson, Oprea & Porter, 2006).

In theory, there should be no information in their self-reports that is

not already reflected in the market price. The success of prediction

markets appears to support that theory.

It is difficult, however, to draw clean inferences from in-the-wild

comparisons of prediction markets and self-reports for several reasons.

Traders in markets are necessarily exposed to information from others

in the market, such as historical prices, the last price at which

shares traded, and the current buy and sell orders. In this way,

traders may be working with more information than poll respondents.

Further, prediction markets aggregate opinions in a unique way. The

market price is the point at which optimistic and pessimistic opinions

“cross”. The market price is thus a marginal opinion that is not simply

an average or a vote count (Forsythe et al., 1992). It could be that

the magic of prediction markets lies largely in superior aggregation

methods rather than superior quality or informativeness of responses.

Finally, selection issues could be serious when comparing market

participants with poll respondents. Participation in prediction markets

is nearly always self-selected and people who choose to trade might be

different by having more intrinsic interest or knowledge or better

analytic skills. We are unaware of a comparison between surveys and

prediction markets that addresses all of these problems, so it is not

even clear that in such a comparison, “just asking” would be inferior.

We had a unique opportunity to compare methods in an experiment that

addressed all of these issues and put both approaches on a level

playing field. During the IARPA Aggregative Contingent Estimation (ACE)

tournament (Mellers et al., 2014; Atanasov et al., 2017), our team, the

Good Judgment Project, randomly assigned participants to take part in a

prediction market. Each time participants wanted to place an order,

they were first asked to report their beliefs that an event would occur

on a 0 to 100 probability scale. We then aggregated these self-reports

in a pre-determined fashion using best practices gleaned from earlier

years of the tournament, such as extremizing the aggregate, weighting

recent opinions more heavily than older ones, and weighting forecasters

with a good track record more heavily. When aggregated this way,

simple self-reports were at least as accurate as market prices for

predicting a variety of geopolitical events.

Perhaps more importantly, a combination of prices and self-reports was

significantly better than prices alone, indicating that self-reports

contained incrementally useful information that market prices alone did

not capture. One could wonder whether “just asking” was good in our

study or whether our methods of aggregation were good. But proper

aggregation can have only limited benefits if the responses do not

contain information. Our results suggest that self-reports not only

contained useful information, but information that was not efficiently

captured by the market price.

Prior research that is perhaps most similar to ours was done by Goel et

al. (2010), who compared the accuracy of prediction markets with

opinion polls and simple statistical models. Across thousands of

American football games, betting markets were found to have only a tiny

edge over opinion polls. Across multiple domains, very simple

statistical models approached the accuracy of prediction markets,

suggesting diminishing returns to information; nearly all predictive

power was captured by 2 or 3 parameters. These studies, however, were

not experimental. Different people participated in the polls and

markets, raising the inferential problems noted above. Further, it is

unclear how general the comparisons between markets and polls were,

because they involved American football predictions. Fans of American

football are inundated with statistical information and betting lines,

and therefore their opinions might be highly correlated with betting

markets, which would naturally lead to similar accuracy. Here, we

employ 113 different geopolitical events, usually lasting months and

ranging from typical prediction market domains (e.g., who will win a

national election) to the exotic (e.g., will Kenneth Bae leave North

Korea or will construction begin on the Lamu pipeline before a given

date). The full list of prediction questions is included in the

Appendix.

Our study also bears similarities to research on “the wisdom of the

crowd within” (Vul & Pashler, 2008) or “dialectical bootstrapping”

(Herzog & Hertwig, 2009), in which averaging multiple judgments from

the same person exceeds the accuracy of the individual judgments

themselves. We find a similar increase in accuracy when we combine

aggregated self-reports and prediction market prices, which are

themselves determined by individual bids. While bids and self-reported

probability beliefs can be seen as two different measures, they are

highly correlated and thus can be seen as two “draws” from the same

personal generating process.

2 Method

Five hundred thirty-five volunteers participating in the third year of

the ACE tournament sponsored by the Intelligence Advanced Research

Project Activity (IARPA) were randomly assigned to participate in a

prediction market (see Atanasov, et al., 2017). In the prediction

market, participants could buy or sell shares of events at prices

between 0 and 100, where 0 represented the closing value of the shares

if the event did not occur and 100 represented the value of the shares

if the event did occur. Before they could complete their buy or sell

orders, participants also had to report their belief in the probability

of the event occurring on a 0 to 100 scale.

Our experimental design thus permits a better comparison between

self-reports and prediction markets because the participants saw the

same information — the last trading price and the bid and asking prices

in the market — when making trades and self-reporting beliefs. This

design also eliminates self-selection concerns because the market

participants were randomly assigned to the prediction market and other

conditions from a larger pool. Lastly, the same group of participants

both made trades and judged probabilities.

2.1 Participants

We recruited forecasters into the larger participant pool from

professional societies, research centers, alumni associations, science

blogs, and word of mouth. Participation required a bachelor’s degree or

higher and completion of a battery of psychological and political tests

that took an average of 2 hours. Participants were U.S. citizens and

mostly males (80%); with an average age of 43. Over two thirds (70%)

had postgraduate training.

2.2 Questions and measures

The dataset consisted of 113 forecasting questions with binary yes/no

outcomes. Questions with more than two outcomes raised complications

because participants were not asked to give a probability for each

outcome, just the one they were betting on. Examples of questions

included, “Will China seize control of the Second Thomas Shoal before 1

January 2014?” or “Will India and/or Brazil become a permanent member

of the U.N. Security Council before 1 March 2015?” Questions remained

open for an average of 102 days. A list of all questions is given in

the Appendix and criteria for resolving questions can be found at

https://dataverse.harvard.edu/file.xhtml?persistentId=doi:10.7910/DVN/BPCDH5/L8WZEF.

For each question, participants saw the prices and number of shares

requested for the six highest buy orders and the six lowest sell

orders. They could bid or ask for shares at the price that they

specified. Whenever participants entered an order, they stated their

belief that the event would occur on a 0 (certain it will not occur) to

100 (certain it will occur) probability scale before their order could

be confirmed. Participants were encouraged to return to the Web site

and update their predictions at any time until the question closed.

Throughout the year, participants could trade on any questions they

wished until either the events were resolved or the trading year

closed. Our data included 46,168 market orders and self-reported

beliefs. Of those, we focus primarily on the 37,000 of those orders

that were matched into trades, because those orders contributed

directly to market prices.

2.3 Incentives

Participants who made trades and self-reported beliefs on at least 25

events throughout the year were paid for their participation with a

$250 Amazon gift card. Participants competed for social rewards,

including a place on the leaderboard and the chance to join an elite

group of “superforecasters”, but payments were not tied directly to

their performance in the market.

2.4 Aggregating self-reported probability beliefs

The aggregate was formed using an algorithm (Atanasov et al., 2017) whose

parameters were determined using data from other forecasters in a prior

year of the competition. The algorithm had three features. First, more

recent self-reports were given priority over older ones because questions

were open for some time and older self-reports become outdated as new

information becomes available. Based on prior years, we used only the 20%

most recent self-reports at any time. Second, greater weight was assigned

to the beliefs of forecasters who had a track record of accuracy. For all

questions that had resolved as of the date of the opinion, participants

were scored for the accuracy of their self-reported beliefs. Their opinions

were then given weights ranging from .1 to 1 for the worst to the best

proportional to their Brier scores on past predictions, and those weights

were raised to an exponent of 4, which was determined to minimize the Brier

score of the aggregate error in previous years. Third, the aggregate was

extremized toward 0 or 1 because measurement error pushes individual

estimates toward the middle of a probability scale and because individual

estimates neglect the information that is in the other estimates (see Baron

et al., 2014). We used Baron et al.’s transformation formula for a

probability aggregate p, pa/pa+(1−p)a with a = 2

based on prior year data. We used an elastic net technique to avoid

overfitting. For a more detailed description of this aggregation procedure

and the logic behind it, see Atanasov et al. (2017).

3 Results

3.1 Quality of self-reported beliefs and their relationship

to market orders

Because participants were primarily recruited to participate in a

prediction market and were not incentivized to give accurate

self-reports of their beliefs, we first looked for signs that these

judgments were taken seriously. Participants’ order prices were

generally consistent with their stated beliefs, with the two being

similar, though not identical (r=0.66). This result suggests

that the self-report question was taken seriously, but also that the

two modes of answering could potentially yield different information,

since there is still a substantial amount of unshared variance between

the two.

Another way to explore whether the self-reported probability judgments

were taken seriously is to use them to imply the expected profit

margins of the participant’s market orders. The expected profit margin

is simply the participant’s reported probability minus the order prices

for buy orders, and order price minus the probability for sell orders.

If we are to take self-reported probability judgments seriously, one

would expect these profit margins to be positive. For example, if a

forecaster placed a buy order at a price that was higher than her

judged belief (e.g. $65 and 45%), she expects to lose $20

for each contract she buys. Only 16% of the orders had implied

negative profit margins. Further investigation reveals that traders

were less likely to transact at negative profits margins when entering

new positions (13%) than when reversing existing positions (28%).

This pattern suggests that some of these negative-profit trades simply

reflect risk aversion on the part of participants who pay a premium to

take profit on a trade that has already proven successful relative to

the current market price. Generally, then, we conclude that stated

beliefs at least pass the surface test of coherence.

Finally, we can assess the quality of self-reported beliefs by examining

their relationship to trading success. All else equal, we would expect

that participants whose reported probabilities proved more accurate

would also have better trading success. We calculated total earnings

from all closed questions after the market season closed. We also

calculated the mean standardized Brier scores (the squared

error between the forecast and the 0 or 1 outcome) for each

self-reported belief on each resolved event and converted these scores

to ranks so that 100% was the best and 0% was the worst. The rank

conversion ensured that the distributions were well-behaved in the

presence of outliers. For forecasters who made trades on at least 25

events (i.e., those who were eligible for payment for their

participation), belief accuracy and earnings were highly correlated

(r=0.55).

| Table 1: Brier scores for prices and beliefs. |

| Brier Score | vs. Prices |

| Prices | 0.227 (0.31) | |

| Beliefs, full algorithm | 0.210 (0.39) | t(113)=1.44, p=0.152 |

| Prices & beliefs | 0.210 (0.34) | t(113)=2.92, p=0.004 |

| Note: Brier score comparison for 113 forecasting events, with probability

beliefs aggregated using frequency weights, a discounted function over

time, and an extremizing transformation.

|

3.2 Relative accuracy of market prices and self-reports

Our goal was to compare the accuracy of prices and self-reported

beliefs. “Prices” are simply the last trading prices on a question at

midnight, Pacific Standard Time, for a given day. “Beliefs” are the

aggregated self-reported probability judgments.

We calculated the Brier score measure of accuracy for each method (Brier,

1950). For questions with binary outcomes, Brier scores range from 0 to 2,

where 0 is best and 2 is worst. Suppose the prediction for a two-outcome

event was that the event was 70% likely to occur (and 30% likely to not

occur) and the event occurred. The Brier score would be calculated as

(.7−1)2 + (.3−0)2, which equals 0.18. On the other hand, if the event

did not occur, the Brier score would be (.7−0)2 + (.3−1)2, which equals

0.98. If a forecaster gave a probability of 50%, the Brier score would be

0.5. We averaged scores over days and questions for each method.

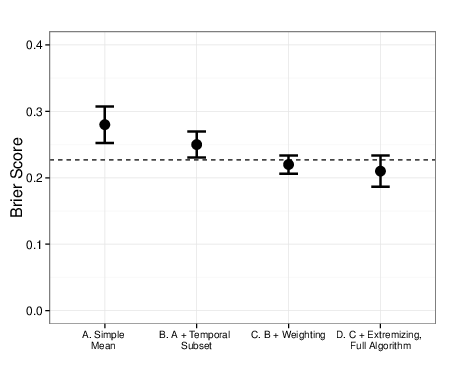

Table 1 compares Brier scores for Prices and Beliefs. A simple,

unweighted average of self-reports yielded a mean Brier score of .283

relative to a mean Brier score of 0.227 for Prices. One might be

tempted to conclude that “just asking” thus yielded inferior prediction

market prices. We resist this conclusion for a few reasons. First, as

noted above, simple averaging of probability estimates inappropriately

represents the information that they contain (Baron et al., 2014).

Second, a comparison of a simple average of self-reported beliefs with

Prices is awkward because prediction markets not only elicit

information, but they aggregate it in a way that is not a simple

average and does not weight everyone equally, so it would not be clear

which factor lends more to the relative success of prediction markets.

Finally, in the simple average of self-reports, old answers that were

based on stale information were weighted just as much as new ones. The

question we address is whether self-reports somehow fail to elicit

quality information, and we report the accuracy of the simple average

so that the reader may see the relative contribution to accuracy of the

different factors involved in the aggregation algorithm.

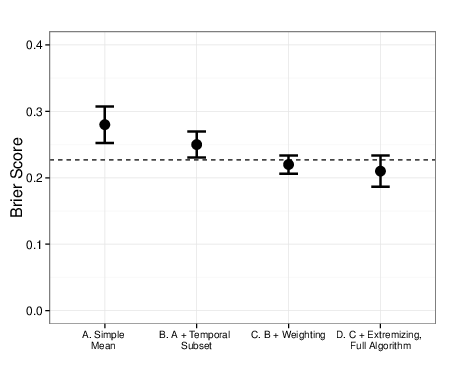

Removing older information by keeping only the 20% most recent

self-reports improved the accuracy of aggregated self-reports to a mean

of 0.249. Adding weights based on the prior accuracy of the person

giving the self-report further lowered mean Brier scores to 0.217.

Finally, adding belief extremization reduced mean Brier scores to

0.210. Thus, Beliefs yielded a 12% reduction in Brier score over

Prices, though this difference was not statistically significant

(paired t(112) = 1.44, p = .15, within-subjects

standardized d = .14). See Figure 1. In practical terms, this

Brier score difference is modest, equivalent to assigning a probability

of 66.3% to the correct answer for Prices and a probability of 67.6%

to the correct answer for Beliefs.

| Figure 1: Brier scores for aggregated forecasts, last-price aggregates are shown

as the horizontal solid line, the dotted-line shows Brier scores for

aggregation algorithms of Beliefs, starting from simple mean, then

adding temporal subsetting, past accuracy and update frequency to

weights, and extremizing. Error bands denote two standard errors of the

Brier scores difference between prices and aggregated beliefs. |

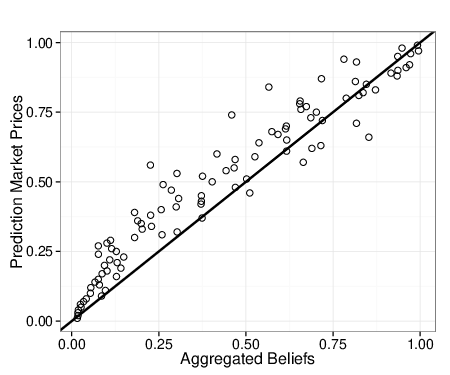

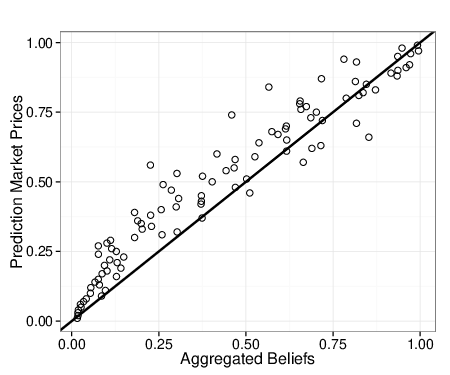

| Figure 2: Prediction market prices versus aggregated beliefs. Aggregated

belief probability values are averaged for every dollar increment in in

market prices, from $1 to $99, which correspond to probability values of

0.01 to 0.99. Aggregated beliefs tend to produce lower estimates than

market prices, which is denoted positioning of points above the diagonal

line. Prices are somewhat less extreme as well. (Note: While extremization

of aggregated beliefs boosts accuracy, extremizing market prices does not

reduce Brier scores.) (See Corrigendum.) |

Figure 2 plots the relationship between aggregated self-reports and

market prices. For every dollar increment in in market prices from $1

to $99, we aggregated corresponding self-reported beliefs. Not

surprisingly, the two are strongly related (r = .95). As

denoted by the datapoints to the left of the diagonal below the median

price and to the right above the median price, aggregated beliefs are

more extreme. This is again unsurprising because the algorithm for

aggregating beliefs involved an extremizing transformation. We note,

however, that while extremizing modestly improved the Brier scores of

Beliefs consistent with theory, it did not improve Prices.

We also computed the Brier score for the simple mean of Beliefs and

Prices. This hybrid probability estimate yielded a significant improvement

over Prices alone (paired t(112) = 2.92, p = 0.004,

within-subjects standardized d = .27) and directionally

outperformed Prices on 85% of the 113 forecasting

questions.1,2

This result suggests that there was incrementally valuable information

in self-reported beliefs that was not captured by market prices. If

different groups had participated in the market and given self-reports,

one could wonder if accuracy would be better still if the self-report

group had participated in a prediction market and the prices from the

two markets were averaged. In the present design, we can clearly infer

that self-reports added informational value above and beyond the

market.

3.3 Determinants of accuracy

When might self-reports be especially useful? When market volume is

thin, the spread between the highest buying price and the lowest

selling price is large, so people are less likely to trade, and the

last market price is less informative. Large spreads between highest

buying prices and lowest selling prices (bid-ask spreads) suggest low

engagement in the forecasting question. In these cases, informed

participants have fewer incentives to trade. In addition, sophisticated

probability polls have been shown to outperform market prices when the

resolution date of the forecasting question is in the distant future

(Atanasov et al., 2017). Page and Clemen (2013) describe a related

tendency for longer time until expiration to distort accuracy in the

direction of a favorite-long shot bias: market participants are

unwilling to lock in funds on relatively expensive bets on favorites

when the question will take a long time to resolve, instead preferring

small bets on long-shots, pushing market prices away from prices

denoting extreme probabilities.

We examined the relationship between relative performance of the

measure and the bid-ask spread using general estimating equations

(GEE), which permit clustering of errors within questions. The

criterion was the Brier score difference between Prices and Beliefs for

any question on any given day, and predictor variables were bid-ask

spreads (ranging from 0% to 100%), and number of months to question

resolution. Positive regression coefficients mean that Prices performed

worse than Beliefs.

| Table 2: Brier score differences for prices and beliefs. |

| Intercept | −0.042 (0.019) * |

| Bid-ask spread | 0.197 (0.009) * |

| Months to question resolution | 0.014 (0.003) ** |

| Observations | 11,251 |

| Questions | 113 |

| Note: Relative performance of Prices and aggregated Beliefs. Positive

values denote worse performance for last price. Larger bid-ask spreads and

longer months to resolution are associated with greater accuracy in

Beliefs. Standard errors are in parentheses; * p < .05, ** p<.01.

|

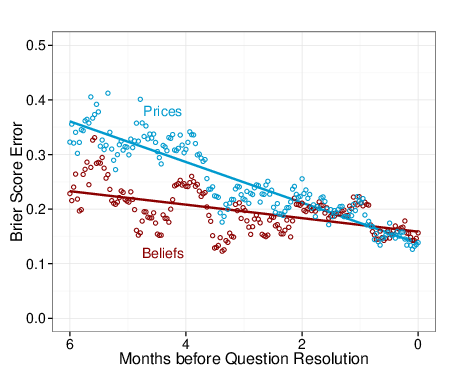

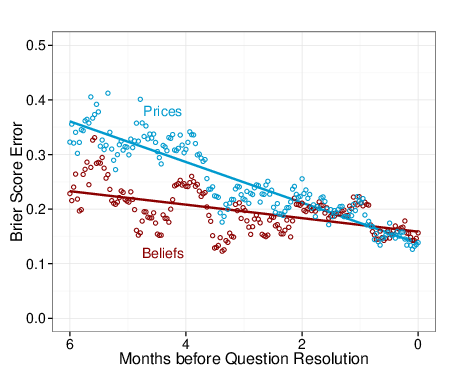

| Figure 3: Note: Prices refers to the last market price on a given day as the

probability estimate. Aggregated Beliefs are derived from forecasters’

beliefs stated on the 0–100 scale, aggregated with a statistical

algorithm (Atanasov, et al., 2017). Question sets varied over time;

more questions were open closer to resolution. Lines depict ordinary

least sequares model fits for each method. |

Table 2 shows the results. The intercept was negative, meaning that

Prices were more accurate than Beliefs on days immediately before

question resolution and markets had minimal bid-ask spreads (b

= −0.042, Wald test = 4.73, p = 0.030). Greater

bid-ask spreads were associated with worse performance of Prices

relative to Beliefs (b = 0.197, Wald test = 5.03, p =

.025). Prices were also worse relative to Beliefs when the resolution

of the question was far away into the future (b = 0.014,

Wald test = 16.04, p < .001).

Figure 3 shows Brier scores against months before question resolution.

Each line shows the predicted effect of each method over time. Beliefs

were better than last prices when the resolution of the question was

months away, but prices were better right before the question resolved.

As the regression in Table 2 shows, the direction and significance of

this pattern persisted even when adjusting to market liquidity, as

measured by bid-ask spreads – the lowest price of current sell orders

minus the highest price of current buy orders.

| Table 3: Brier score decomposition. |

| | Brier score | Calibration error | Discrimination |

| First half of question duration |

| Prices | 0.271 | 0.021 | 0.249 |

| Beliefs, full algorithm | 0.232 | 0.014 | 0.283 |

| Prices & beliefs | 0.240 | 0.008 | 0.268 |

| Second half of question duration |

| Prices | 0.185 | 0.019 | 0.334 |

| Beliefs, full algorithm | 0.191 | 0.031 | 0.341 |

| Prices & beliefs | 0.181 | 0.014 | 0.333 |

| Note: Brier score comparison for 113 forecasting events, with probability

beliefs aggregated using frequency weights, a discounted function over

time, and an extremizing transformation.

|

3.4 Factors influencing relative accuracy

What are the reasons behind the market’s relative inability to

process information? We examine two possibilities. First, as suggested

above, markets could be miscalibrated for far-off forecasts because

participants simply do not want to lock up their trading funds. Second,

market participants may be unable to find trading partners earlier on.

That is, they may have placed a bid or an ask on a question, but nobody

may have matched that bid or ask and thus, no trade occurred. Unmatched

bids and asks do not affect market prices directly, but the

participants placing those bids and asks may still have useful

information to contribute when asked to self-report their beliefs.

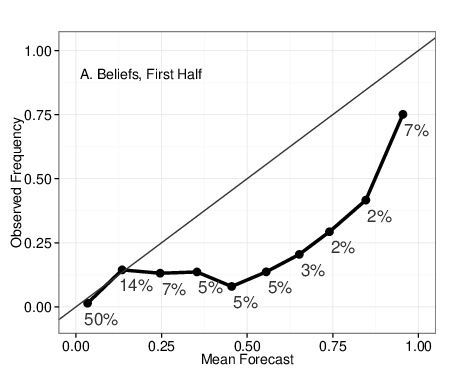

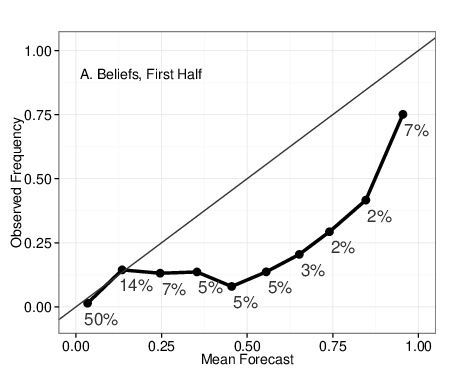

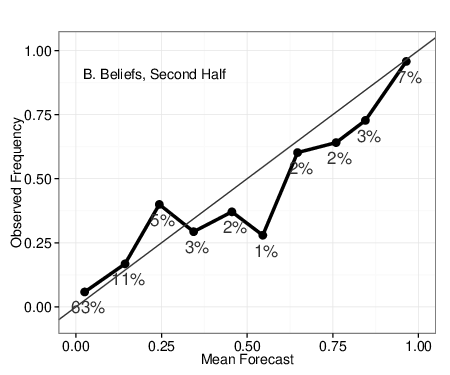

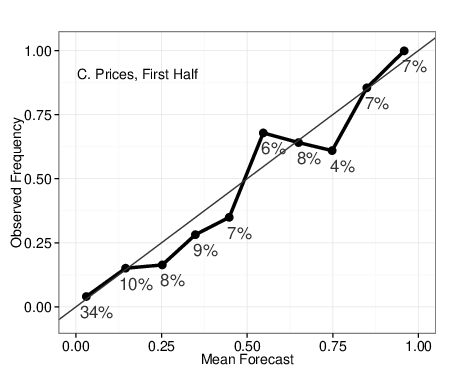

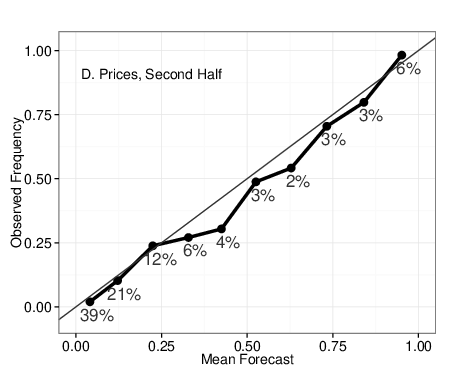

To assess the first possibility, we used the Murphy & Winkler (1987) Brier

score decomposition function to calculate calibration and discrimination

for Prices vs. Beliefs, separately by first vs. second half of each

question’s duration. In the calculation of these scores (as well as Brier

scores above), each question is weighted equally, independent of its

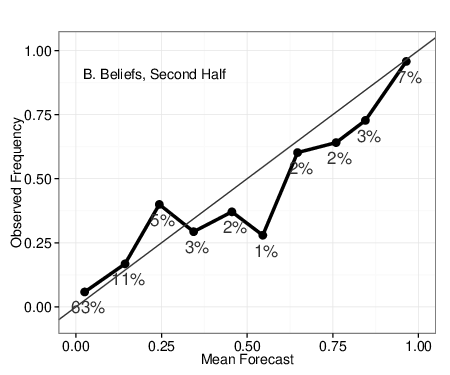

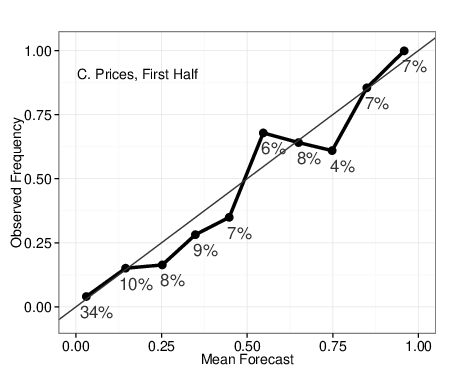

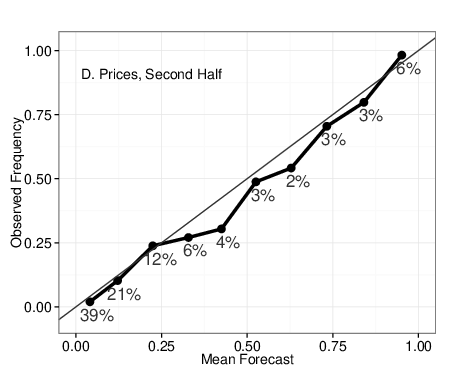

duration. The decomposition results are shown in Table 3 and illustrated in

calibration plots in Figure 4. The higher accuracy of Beliefs in the early

stages of questions is mostly due to superior discrimination (higher scores

denote better performance) – the ability of self-reports to simply identify

which events will occur and not. As shown in Figure 4, Panels A & C,

neither method is perfectly calibrated early on in questions, as both

methods tend to over-predicting events to occur relative to observed base

rates.3 For example, the fifth value in Panel C shows

that among the forecasts signifying between 41%-50% probability of event

occurrence, the events occurred in only about 25% of cases. In the second

half of question duration, calibration improved for both methods, with

self-reported beliefs showing signs of slight over-confidence,

i.e., predictions more extreme than observed rates.

| Figure 4: Calibration plots for Beliefs aggregated with full algorithm (A & B),

vs. Last Prices (C & D), for first and second half of question

duration. Forecasts are divided in 10 ordered bins (0%-10%,

11%-20%, etc.), and the mean forecast in each bin is plotted against

the observed frequency of occurrence of predicted events. Points to the

right of the 45-degree line denote overestimation of probability. |

To examine the role of unmatched orders, we extracted and aggregated

self-reports from matched orders and compared their accuracy to Beliefs

calculated from all orders, matched or unmatched. We can thus compare

the marginal value of self-reports associated with unmatched orders. We

found that adding these reports did not improve the accuracy of

Beliefs. Furthermore, the marginal benefit of self-reports associated

with unmatched orders did not vary over time. Thus, neither technical

explanation was empirically supported; it appears that self-reports

indeed contained useful and unique information that the market did not

capture, particularly when the event being predicted were farther into

the future.

Activity in the markets was not evenly distributed. Of the 535

prediction market forecasters who placed at least one market order, the

top 10 most active forecasters by number of orders accounted for

approximately 33% of all market orders, while the top 50 accounted for

60%. In terms of share volume, the top 10 most active participants

placed 44% of the shares ordered, while the top 50 accounted for 70%

of ordered share volume. Still, less active forecasters had some

influence over trading, at the very least by providing counterparties

for trading against the most active members. Market designers generally

do not see inequality of activity as a problem, but rather as a feature

of the market structure: the most accurate participants tend to

accumulate wealth funds over time, and are able to place more and

larger orders, while market participants who find themselves on the

wrong side of most bets tend to lose their wealth and thus the ability

to participate in markets and influence market prices.

| Table 4: Median Brier scores across ten iterations of each

simulated level of belief availability. |

| Availability of Beliefs | Brier score |

| 100% of dates | 0.210 |

| 75% of dates | 0.214 |

| 50% of dates | 0.219 |

| 25% of dates | 0.223 |

| 0% of dates (i.e. prices only) | 0.227 |

| First 30 days only | 0.218 |

| Note: Brier scores across all questions for hybrid method combining prices

and aggregated beliefs. Results are based on simulations in which beliefs

are made unavailable for a random set of date-question combinations, or

for dates beyond the first 30 days (last row).

|

Finally, we consider the marginal benefits of eliciting beliefs in

addition to market orders because collecting beliefs may be costly in

some settings. How would much would self-reported beliefs add if we had

limited ability to collect them? To answer this, we randomly selected

date-question combinations and deleted the aggregated belief values. On

those days, the hybrid prediction was based on prices alone. We then

rescored the accuracy of the hybrid forecasts in subsamples where

beliefs were available on 25%, 50%, 75% of date-question

combinations. At the ends of the spectrum are cases where beliefs are

available 0% of the time, thus only prices are used, and where beliefs

are available 100% of the time. Both of these are reported above. In

Table 4, we show median Brier scores across ten iterations of each

simulated level of belief availability. The relationship between

aggregate belief availability and accuracy appears to be approximately

linear. As the availability of aggregated beliefs is reduced, Brier

scores increase.

We also examined if availability of beliefs at specific points is

especially valuable at certain points of time. With the benefit of

hindsight, we can surmise that beliefs would be especially useful on

early days within a question, where beliefs tend to outperform prices

(See Figure 3). To test this, we simulated the performance of the

hybrid method if beliefs were only available for the first 30 days of

each question’s duration. If a question was open for more than 30 days,

beliefs were available for the full period. In this case, beliefs were

available for 30% of question-date combinations. Making beliefs

available at the beginning of questions was particularly helpful in

improving accuracy, with the hybrid method registering a Brier score of

0.218, slightly better than the simulated Brier score of 0.219,

registered when beliefs were made available randomly, on a larger

proportion (50%) of dates.

4 Discussion

Although it can be difficult to measure an attitude or belief better

than asking people to simply self-report it, mistrust of self-reports

in some areas of social science remains strong (Bertand &

Mullainathan, 2001). An apparent triumph of measuring beliefs using

behavioral methods has been the relative success of predictions

markets. We used a design in which prediction market participants also

provide self-reported beliefs every time they submitted an order. This

design holds information constant across methods. For approximately

37,000 forecasts from 535 participants for 113 unique events, we found

that self-reported beliefs were at least as informative as prediction

market prices when beliefs were properly aggregated. Prediction markets

do not simply average opinions or count votes. Similarly, our

pre-determined aggregation procedure gave more weight to recent

opinions than older ones, weighted opinions by the prior success of

people giving them, and extremized the aggregate, as is appropriate

when people express probabilistic beliefs (Baron et al., 2014). Notably

and consistent with theory, extremizing helped the aggregate, but did

not help market prices.

Perhaps more importantly, self-reports appeared to provide unique

information that the market mechanism did not integrate. Self-reports

were correlated with market bids, as would be expected if people took

the question seriously. But there was a substantial amount of

non-shared variance in reports and bids. When the methods were

combined, accuracy was significantly improved over prices alone,

indicating that distinctively useful information was contained in the

self-reports. While we do not know what precise information

was communicated through belief reports, we learned when

belief reports were most helpful in improving accuracy: at times with

relatively low trading activity, high-bid ask spreads, and when

questions are expected to resolve within months, rather than days or

weeks.

Simple self-reports have perhaps been under-rated in their capacity to

yield probability forecasts. But some caveats are in order.

Participants in the Good Judgment Project often display high levels of

motivation and put lots of time into the task. They are also highly

educated compared to the population at large (70% had some

postgraduate training). They also had no incentive to misrepresent

their beliefs for the questions we asked them. In situations where

participants are not motivated or might want to misreport their

beliefs, self-reports may be deficient. But there are situations where

participants are reasonably motivated and can be expected to take the

question seriously, such as organizations making internal predictions.

Several firms have attempted to use prediction markets for internal

applications (see, e.g., Cowgill & Zitzewitz, 2015; Healy et al.,

2010). When information is complex and the number of participants

limited, alternative methods like iterated polls have been found to

outperform markets (Healy et al., 2010). Our results lend further and

broader support to the idea that firms could be better off polling

properly incentivized participants and putting more effort into

aggregating opinions properly.

Skeptics might question whether our prediction markets had enough active

traders. Lack of liquidity can reduce the accuracy of prediction

markets because trades occur too infrequently and do not reflect the

most current state of information. The opposite can be true, however,

as more liquid real-money prediction markets have been shown to elicit

trades from naïve individuals during informative time periods such that

prices can deviate further from fundamentals (Tetlock, 2008). We have

found that low-liquidity markets can produce accurate predictions, and

vice versa. That said, self-reported beliefs were especially helpful in

our study when markets lacked liquidity, suggesting that indeed prices

were inefficient at aggregating new information in these situations.

Another concern is that participants were not trading for monetary

rewards. They did, however, compete for social rewards, including a

place on the leaderboard and the chance to join an elite group of

“superforecasters.” Moreover, this concern is probably over-stated;

both public prediction markets and those within organizations have

succeeded without financial incentives (Servan-Schreiber et al. 2014;

Cowgill & Zitzewitz, 2015; Plott & Chen, 2002).

Our results show that self-reports can capture information that markets

do not. There is a complementarity in the two approaches, and one can

obtain more accurate forecasts by using both. Many psychologists have

been surprised by how accurately market prices have estimated

probabilities in a variety of domains. Many economists may now be

surprised by how informative it is to “just ask.”

References

Atanasov, P., Rescober, P., Stone, E., Servan-Schreiber, E., Tetlock, P.,

Ungar, L. & Mellers, B. (2017) Distilling the wisdom of crowds with

prediction markets and prediction polls? Management Science,

63, 691–706.

Baron, J., Mellers, B. A., Tetlock, P. E., Stone, E., & Ungar, L. H.

(2014). Two reasons to make aggregated probability forecasts more

extreme. Decision Analysis, 11, 133–145.

Camerer, C., Dreber, A., Holzmeister, F. Ho, T., Huber, J., Johannesson,

M., Kirchler, M. et al. (2018). Evaluating the replicability of social

science experiments in Nature and Science between 2010

and 2015. Nature Human Behavior, 2,

637–644. https://doi.org/10.1038/s41562-018-0399-z.

Cowgill, B. & Zitzewitz, E. (2015). Corporate prediction markets: Evidence

from Google, Ford, and firm X. The Review of Economic Studies,

82(4), 1309–1341.

Forsythe, R., Nelson, F., Neumann, G. R., & Wright, J. (1992). Anatomy of

an experimental political stock market. The American Economic

Review, 82, 1142–1161.

Goel, S., Reeves, D., Watts, D., & Pennock, D. (2010). Prediction without

markets. Proceedings of the

11th ACM conference on Electronic

Commerce, 357–366.

Hanson, R., Oprea, R., & Porter, D. (2006). Information aggregation and

manipulation in an experimental market. Journal of Economic

Behavior and Organization, 60, 449–459.

Healy, P., Linardi, S., Lowery, J., & Ledyard, J. (2010). Prediction

markets: Alternative mechanisms for complex environments with few

traders. Management Science, 56, 1977-1996.

Herzog, S., & Hertwig, R. (2009). The wisdom of many in one mind:

improving individual judgments with dialectical bootstrapping.

Psychological Science, 20, 231–237.

Mellers, B., Ungar, L., Baron, J., Ramos, J., Gurcay, B., Fincher, K.,

Scott, S., Moore, D., Atanasov, P., Swift, S., Murray, T., & Tetlock, P.

(2014). Psychological strategies for winning a geopolitical forecasting

tournament. Psychological Science, 25(5), 1106–1115.

Murphy, A. H., & Winkler, R. L. (1987). A general framework for

forecast verification. Monthly Weather

Review, 115(7), 1330–1338.

Page, L. & Clemen, R. T. (2013). Do prediction markets produce

well-calibrated probabilityforecasts?, The Economic

Journal, 123, 491–513.

Pennock, D.M., Lawrence, S., Giles, C.L., & Nielsen, F.A. (2001). The real

power of artificial markets. Science, 291, 987–988.

Plott, C. & Chen, K. (2002) Information aggregation mechanisms:

Concept, design and implementation for a sales forecasting problem.

California Institute of Technology Social Science Working Paper 1131.

Retrieved from https://authors.library.caltech.edu/44358/1/wp1131.pdf.

Ray, R. (2006). Prediction markets and the financial “wisdom of crowds.”

Journal of Behavioral Finance, 7, 2–4.

Satopää, V., Baron, J. Foster, D. Mellers, B. Tetlock, P., & Ungar, L.

(2014). Combining multiple probability predictions using a simple logit

model. International. Journal of Forecasting, 30, 344–356.

Servan-Schreiber, E., Wolfers, J., Pennock, D.M., & Galebach, B.

(2004). Prediction markets: Does money matter? Electronic Markets,

14, 243–251.

Tetlock, P.C. (2008). Liquidity and prediction market efficiency.

Available at SSRN: http://ssrn.com/abstract=929916.

Thurstone, L. L. (1959). The measurement of values. Oxford, England:

University of Chicago Press.

Vul, E. & Pashler, H. (2008). Measuring the crowd within: Probabilistic

representations within individuals. Psychological Science, 19,

645–647.

Wolfers, J. & Zitzewitz, E. (2004). Prediction markets. Journal of

Economic Perspectives, 18, 107–126.

Wolfers, J. & Zitzewitz, E. (2006). Interpreting prediction market prices

as probabilities (No. w12200). National Bureau of Economic Research.

Appendix: Events to be predicted in the study

1. Will Iran blockade the Strait of Hormuz before 1 January 2014?

2. Will the World Trade Organization (WTO) rule in favor of the rare

earth metals complaint filed by the European Union against China before

31 December 2013?

3. Will either the French or Swiss inquiries find elevated levels of

polonium in the remains of Yasser Arafat’s body?

4. Will the Taliban and the Afghan government commence official peace

talks before 1 September 2013?

5. Will Angela Merkel win the next election for Chancellor of Germany?

6. Will North Korea attempt launch of a multistage rocket between 7

January 2013 and 1 September 2013?

7. Will Russia maintain any military presence at the Tartus Naval Base

in Syria as of 1 January 2014?

8. Will a foreign state or multinational coalition officially announce a

no-fly zone over Syria before 1 January 2014?

9. Will the Syrian government commence official talks with Syrian

opposition forces before 1 September 2013?

10. Will a significant North Korean military force violate the Military

Demarcation Line (MDL) of the Korean Demilitarized Zone (DMZ) before 1

October 2013?

11. Will there be a significant lethal confrontation in the East China

Sea region between Japan and China before 1 January 2014?

12. Will Turkey ratify a new constitution before 1 February 2014?

13. Will Uhuru Kenyatta be found guilty of any charges by the

International Criminal Court before 1 September 2013?

14. Will China seize control of the Second Thomas Shoal before 1 January

2014?

15. Before 1 May 2014, will Myanmar officially announce that

construction of the Myitsone Dam will resume?

16. Before 1 May 2014, will Chinese armed forces or maritime law

enforcement forces attempt to interdict or make physical contact with

at least one U.S. government naval vessel or airplane or Japanese

government naval vessel or airplane that it claims is in its

territorial waters or airspace?

17. Before 1 May 2014, will Iran abolish the office of President of the

Islamic Republic?

18. Will six-party talks with North Korea resume before 1 January 2014?

19. Before 1 May 2014, will Nicolas Maduro vacate the office of

President of Venezuela?

20. Before 1 January 2014, will the government of Bolivia invite the

U.S. Agency for International Development (USAID) to resume work in

Bolivia?

21. Before 1 January 2014, will the government of Afghanistan sign a

Status of Forces Agreement (SOFA) permitting U.S. troops to remain in

Afghanistan?

22. Will Libya complete elections for a Constitutional Commission before

1 October 2013?

23. Will India and/or Brazil become a permanent member of the U.N.

Security Council before 1 March 2015?

24. Will Chad experience an onset of insurgency between October 2013 and

March 2014?

25. Will China deploy any armed unmanned aerial vehicles (UAVs) over the

territory of another country before 1 May 2014?

26. Will China sell at least one unmanned aerial vehicle (UAV) to any

other country before 1 May 2014?

27. Will Guinea commence legislative elections before 1 October 2013?

28. Before 1 May 2014, will Joseph Kony be captured or incapacitated by

a Ugandan, foreign or multinational military/law enforcement force?

29. Before 1 December 2013, will Egypt impose a constitutional ban on

political parties based on religion?

30. Before 1 April 2014, will the International Atomic Energy Agency

(IAEA) inspect the Parchin Military Complex?

31. Before 1 May 2014, will Iran test a ballistic missile with a

reported range greater than 2,500 km?

32. Before 1 February 2014, will either India or Pakistan recall its

High Commissioner from the other country?

33. Will Prince Khalifa bin Salman Al Khalifa be Prime Minister of

Bahrain on 1 February 2014?

34. Will Syria attack Israel between 28 August 2013 and 31 December

2013?

35. Will Nawaz Sharif vacate the office of Prime Minister of Pakistan

before 1 May 2014?

36. Before 1 March 2014, will Gazprom announce that it has unilaterally

reduced natural-gas exports to Ukraine?

37. Will the Organization for the Prohibition of Chemical Weapons (OPCW)

complete its initial on-site inspections of Syria’s declared chemical

weapons sites before 1 December 2013?

38. Before 1 March 2014, will North Korea conduct another successful

nuclear detonation?

39. Before 1 May 2014, will any non-U.S. actor use, in a lethal

confrontation, either a firearm containing a critical part made with 3D

printing technology or a lethal explosive device containing a critical

part made with 3D printing technology?

40. Between 25 September 2013 and 31 March 2014, will any members or

alternate members of the 18th Central Committee of the Communist Party

of China be arrested on charges of bribery, embezzlement, or abuse of

power?

41. Before or during its next plenary meeting, will the Central

Committee of the Communist Party of China announce that it plans to

reform the hukou system nationwide by 2015?

42. Before 1 May 2014, will Russia sign an agreement with the de facto

government of South Ossetia delineating the border between the two?

43. Will the M-PESA system have a failure that results in at least

100,000 subscribers losing all ability to send and receive money from

their accounts for at least 48 hours before 31 December 2013?

44. Before 1 May 2014, will the government of Colombia and the FARC sign

a formal peace agreement?

45. Before 1 May 2014, will any U.N. member state offer diplomatic

recognition to the government of a new state on what is now territory

of Syria, Turkey, or Iraq?

46. Will Venezuela experience an onset of domestic political crisis

between December 2013 and April 2014?

47. Before 1 December 2013, will the government of Pakistan and

Tehrik-i-Taliban Pakistan announce that they have agreed to engage in

direct talks with one another?

48. Will the president of Brazil come to the United States for an

official State Visit before 1 February 2014?

49. Before 1 May 2014, will construction begin on the Lamu oil pipeline?

50. Will the INC (India National Congress) win more seats than any other

party in the Lok Sabha in the 2014 General Elections in India?

51. Before 1 April 2014, will the government of Syria and the Syrian

Supreme Military Command announce that they have agreed to a

cease-fire?

52. Will defense expenditures in Japan’s initial draft budget for fiscal

year 2014 exceed 1 percent of projected gross domestic product (GDP)?

53. Will the United Kingdom’s Tehran embassy officially reopen before 31

December 2013?

54. Will Facebook and/or Twitter be available in China’s Shanghai Free

Trade Zone before 31 March 2014?

55. Before 1 May 2014, will Russia rescind its law barring US citizens

from adopting Russian children?

56. Before 1 February 2014, will Iran officially announce that it has

agreed to significantly limit its uranium enrichment process?

57. Before 1 May 2014, will the government of any country other than

Armenia, Belarus, Kazakhstan, Kyrgyzstan, Russia or Tajikistan announce

its intention to join the Eurasian Customs Union?

58. Before 1 April 2014, will one or more countries impose a new

requirement on travelers to show proof of a polio vaccination before

entering the country?

59. Before 1 January 2014, will the Prime Minister of Japan visit the

Yasukuni Shrine?

60. Will Russia file a formal World Trade Organization (WTO)

anti-dumping dispute against the European Union (EU) before 31 March

2014?

61. Before 1 May 2014, will China arrest Wang Zheng on charges of

incitement to subvert state power and/or subversion of state power

and/or incite separatism?

62. Will the general elections in Guinea-Bissau commence on 16 March

2014 as planned?

63. Between 4 December 2013 and 1 March 2014, will the European

Commission officially state that Italy is eligible for the investment

clause?

64. Will South Korea and Japan sign a new military intelligence pact

before 1 March 2014?

65. Will North Kosovo experience any election-related violence before 31

December 2013?

66. Before 1 March 2014, will the U.S. and E.U. officially announce that

they have reached at least partial agreement on the terms of a

Transatlantic Trade and Investment Partnership (TTIP)?

67. Before 1 March 2014, will the European Commission (EC) announce that

Turkey is permitted to open a new chapter of accession negotiations?

68. Before 31 March 2014, will the Slovenian government officially

announce that it will seek a loan from either the European Union

bailout facilities or the IMF?

69. Before 1 May 2014, will General Abdel Fattah al-Sisi announce that

he plans to stand as a candidate in Egypt’s next presidential election?

70. Before 1 May 2014, will the U.S. and the European Union reach an

agreement on a plan to protect individuals’ data privacy?

71. Before 1 May 2014, will official representatives of the Syrian

government and the Syrian opposition formally agree on a political plan

for Syria?

72. Will the six-party talks with North Korea resume before 1 May 2014?

73. Before 1 March 2014, will the International Atomic Energy Agency

(IAEA) announce that it has visited the Gchine uranium mine site in

Iran?

74. Before 31 March 2014, will either Peru or India announce their

intention to formally launch negotiations on a preferential trade

agreement (PTA) with each other?

75. Will Israel release all of the 104 Palestinian prisoners from its

jails before 1 May 2014?

76. Will Thailand commence parliamentary elections on or before 2

February 2014?

77. Will inflation in Japan reach 2 percent at any point before 1 April

2014?

78. Will the U.N. Security Council approve a U.N. peacekeeping operation

for the Central African Republic before 1 April 2014?

79. Will negotiations on the TransPacific Partnership (TPP) officially

conclude before 1 May 2014?

80. Will Viktor Yanukovich vacate the office of President of Ukraine

before 10 May 2014?

81. Will Ukraine officially declare a state of emergency before 10 May

2014?

82. Will there be a lethal confrontation between national military

forces from China and Japan before 1 May 2014?

83. Before 1 May 2014, will China confiscate the catch or equipment of

any foreign fishing vessels in the South China Sea for failing to

obtain prior permission to enter those waters?

84. Before 1 May 2014, will Iran install any new centrifuges?

85. Will there be a significant attack on Israeli territory before 10

May 2014?

86. Will the Israeli-Palestinian peace talks be extended beyond 29 April

2014?

87. Before 1 April 2014, will the government of Venezuela officially

announce a reduction in government subsidies for gasoline prices?

88. Before 1 May 2014, will Kenneth Bae leave North Korea?

89. Before 1 May 2014, will China attempt to seize control of Zhongye

Island?

90. Will the Bank of Japan (BoJ) officially announce an enhancement of

its quantitative and qualitative monetary easing (QQE) policy before 10

May 2014?

91. Will the European Central Bank (ECB) officially announce a plan to

charge a negative interest rate on funds parked overnight at the ECB

before 31 March 2014?

92. Will Pakistan and the TTP reach a peace agreement before 10 May

2014?

93. Before 1 March 2014, will Russia purchase any additional Ukrainian

government bonds?

94. Will family reunions between South and North Korea begin on or

before 25 February 2014?

95. Before 1 May 2014, will North Korea conduct a new multistage rocket

or missile launch?

96. Will Syria’s mustard agent and key binary chemical weapon components

be destroyed on or before the 31 March 2014 deadline established by the

Executive Council of the Organization for the Prohibition of Chemical

Weapons (OPCW)?

97. Will the U.N. Human Rights Council (UNHRC) adopt a resolution

directly concerning Sri Lanka during its 25th regular session in March

2014?

98. Will Argentina, Brazil, India, Indonesia, Turkey, and/or South

Africa impose currency or capital controls before 1 May 2014?

99. Will the European Union and/or the U.S. impose new sanctions on

Viktor Yanukovich and/or members of his government before 10 May 2014?

100. Will Recep Tayyip Erdogan vacate the office of Prime Minister of

Turkey before 10 May 2014?

101. Will there be a significant lethal confrontation between armed

forces from Russia and Ukraine in Crimea before 1 April 2014?

102. Will Russian armed forces invade or enter Kharkiv and/or Donetsk

before 1 May 2014?

103. Will Bahrain, Egypt, Saudi Arabia, or the United Arab Emirates

return their ambassadors to Qatar before 10 May 2014?

104. Before 31 December 2014, will China seize control of Second Thomas

Shoal?

105. Before 1 May 2014, will the government of Myanmar sign a nationwide

ceasefire agreement with the Nationwide Ceasefire Coordination Team

(NCCT)?

106. Will Parti Quebecois hold a majority of seats in the Quebec

legislature after the 2014 provincial election?

107. Will a referendum on Quebec’s affiliation with Canada be held

before 31 December 2014?

108. Will China’s official annual GDP growth rate be less than 7.5

percent in Q1 2014?

109. Before 10 May 2014, will Russia agree to conduct a joint naval

exercise with Iran?

110. Between 2 April 2014 and 10 May 2014, will Russia officially annex

any additional Ukrainian territory?

111. Will Iran and the P5+1 countries officially announce an agreement

regarding the Arak reactor before 10 May 2014?

112. Will Nouri al-Maliki’s State of Law bloc win more seats than any

other entity in the 2014 parliamentary elections in Iraq?

113. Will Iran and Russia officially sign an agreement regarding the

exchange of oil for goods and services before 10 May 2014?

This document was translated from LATEX by

HEVEA.