Judgment and Decision Making, Vol. 14, No. 4, July 2019, pp. 381-394

Revealed strength of preference: Inference from response timesArkady Konovalov*

Ian Krajbich#

|

Revealed preference is the dominant approach for inferring preferences, but

it is limited in that it relies solely on discrete choice data. When a

person chooses one alternative over another, we cannot infer the strength

of their preference or predict how likely they will be to make the same

choice again. However, the choice process also produces response times

(RTs), which are continuous and easily observable. It has been shown that

RTs often decrease with strength-of-preference. This is a basic property

of sequential sampling models such as the drift diffusion model. What

remains unclear is whether this relationship is sufficiently strong,

relative to the other factors that affect RTs, to allow us to reliably

infer strength-of-preference across individuals. Using several

experiments, we show that even when every subject chooses the same

alternative, we can still rank them based on their RTs and predict their

behavior on other choice problems. We can also use RTs to predict whether

a subject will repeat or reverse their decision when presented with the

same choice problem a second time. Finally, as a proof-of-concept, we

demonstrate that it is also possible to recover individual preference

parameters from RTs alone. These results demonstrate that it is indeed

possible to use RTs to infer preferences.

Keywords: response times, preferences, drift-diffusion model, risky choice,

intertemporal choice, social preferences

1 Introduction

When inferring a person’s preferences, decision scientists often rely on

choice outcomes. This is the standard revealed preference approach

(Samuelson, 1938). While very powerful, relying purely on choice data

does have its limitations. In particular, observing a single choice

between two options merely allows us to order those two options (as less

and more preferred); we cannot infer the strength of the preference. That

is, we do not know the confidence with which the person made the choice or

the likelihood that they would choose the same alternative again.

Choice itself is not the only output of the choice process. We are also

often able to observe other features such as response times (RT), which

are continuous and so may carry more information than discrete choice

outcomes (Loomes, 2005; Spiliopoulos & Ortmann, 2017). The potential

issue with RTs is that they are known to reflect many factors, including

subject-level traits such as decision strategy and motor latency

(Kahneman, 2013; Luce, 1986), as well as features of the choice problems

such as complexity, stake size, and option similarity (or attributes)

(Bergert & Nosofsky, 2007; Bhatia & Mullett, 2018; Diederich, 1997;

Fific, Little & Nosofsky, 2010; Gabaix, Laibson, Moloche & Weinberg,

2006; Hey, 1995; Rubinstein, 2007; Wilcox, 1993).

One useful characteristic of RTs is that they often correlate (negatively)

with strength-of-preference. This effect was observed in early studies in

psychology and economics (Dashiell, 1937; Diederich, 2003; Jamieson &

Petrusic, 1977; Mosteller & Nogee, 1951; Tversky & Shafir, 1992) and has

been recently extensively researched using choice models (Alós-Ferrer,

Granić, Kern & Wagner, 2016; Busemeyer, 1985; Busemeyer & Rapoport,

1988; Busemeyer & Townsend, 1993; Echenique & Saito, 2017; Hutcherson,

Bushong & Rangel, 2015; Krajbich, Armel & Rangel, 2010; Krajbich &

Rangel, 2011; Moffatt, 2005; Rodriguez, Turner & McClure, 2014). In

other words, choices between more equally-liked options tend to take more

time. If this relationship is strong, relative to the other factors that

affect RT, then we should be able to infer strength-of-preference

information from RTs.1

Consider the following example. Suppose we are attempting to determine

which of two people, Anne or Bob, has a higher discount factor for future

rewards (in other words, is less patient). We ask each of them the same

question: “would you rather have $25 today or $40 in two weeks?”

Suppose that both take the $40. With just this information there is no

way to distinguish between them. Now suppose Anne made her choice in 5

seconds, while Bob made his in 10 seconds. Who is more patient? We argue

that the answer is likely Anne. Since Anne chose the delayed option more

quickly than Bob, it is likely that she found it more attractive. In

other words, Anne’s relative preference for the delayed option was likely

stronger than Bob’s; she was farther from indifference (i.e., the point at

which she is equally likely to choose either option).

Of course, if Anne and Bob employ different decision strategies (e.g., Anne

chooses based on heuristics while Bob chooses based on deliberation) or

differ on other relevant characteristics (e.g., Anne is smarter or younger)

then we might be misled about their preferences. It is thus an empirical

question whether our example is actually feasible, or merely speculation.

This is a key question that we tackle in this paper.

The answer to this question has potential practical importance.

Consider an online marketplace. A customer might inspect a series of

products but reject them all, making the choice data uninformative.

However, the customer may linger more on certain items, revealing which

ones were most appealing. The online seller could use that information to

target related products at the customer. Or returning to an interpersonal

example, an overloaded clothes salesman might focus their attention more

on customers who hesitate longer before returning items to the rack.

Taking this idea one step further, we might also want to know whether

choice data are necessary to infer preferences, or whether RTs alone could

suffice. In the example with Anne and Bob, we used both the choice

outcome and the RT to rank the two decision makers on patience. While the

RT told us how easy the decision was for each person, without the choice

outcome we could not know whether Anne faced an easy decision because she

was very patient or very impatient. This might lead one to believe that

it is still necessary to observe choice outcomes in order to infer

preferences. However, in theory, all we need is a second RT.

Suppose that both Anne and Bob take 5 seconds to choose between the $25

today vs. $40 in two weeks, but we do not see their choices. Let us

assume, for the sake of this example, that strength-of-preference is the

only factor that affects RT. At this point we can use Anne and Bob’s RTs

to infer their distance from indifference, but we cannot say whether they

were on the patient side or impatient side. Now we ask a second question:

$25 today vs. $50 in two weeks. Relative to the previous question, we

have made the “patient” option more attractive, i.e., we have made the

decision easier for a patient person (e.g., someone who chose the $40) and

more difficult for an impatient person (e.g., someone who chose the $25).

Suppose Anne makes this decision in 6 seconds while Bob makes this

decision in 4 seconds. We can then conclude that Bob is on the patient

side and Anne is on the impatient side. With just two questions we are

thus able to infer their temporal discounting factors (preferences, more

generally). Of course, this procedure assumes a noiseless relationship

between strength-of-preference and RT. In what follows, we investigate

the usefulness of this procedure using more than two decisions (to

compensate for noise in the decision process) and show that the

preferences inferred from RTs can indeed be reliable.

Our work builds on a growing literature focused on sequential sampling

models (SSM) (such as the drift-diffusion model (DDM)) of economic

decision making. The idea of applying SSMs to economic choice was first

introduced by Jerome Busemeyer and colleagues in the 1980s (Busemeyer,

1985) and further developed into decision field theory in subsequent years

(Diederich, 1997, 2003; Roe, Busemeyer & Townsend, 2001). Recent years

have seen renewed interest in this work due to the ability of these models

to simultaneously account for choices, RTs, eye movements, and brain

activity in many individual preference domains such as risk and

uncertainty (Fiedler & Glöckner, 2012; Hunt et al., 2012; Stewart,

Hermens & Matthews, 2015), intertemporal choice (Amasino, Sullivan,

Kranton & Huettel, 2019; Dai & Busemeyer, 2014; Rodriguez et al.,

2014), social preferences (Hutcherson et al., 2015; Krajbich, Bartling,

Hare & Fehr, 2015; Krajbich, Hare, Bartling, Morishima & Fehr, 2015),

food and consumer choice (De Martino, Fleming, Garret & Dolan, 2013;

Krajbich et al., 2010; Milosavljevic, Malmaud, Huth, Koch & Rangel,

2010; Polanía, Krajbich, Grueschow & Ruff, 2014), and more complex

decision problems (Caplin & Martin, 2016; Konovalov & Krajbich, 2016).

The SSM framework views simple binary decisions as a mental tug-of-war

between the options (Bogacz, Brown, Moehlis, Holmes & Cohen, 2006;

Brunton, Botvinick & Brody, 2013; Fudenberg, Strack & Strzalecki,

2018; Shadlen & Shohamy, 2016; Tajima, Drugowitsch & Pouget, 2016;

Usher & McClelland, 2001; Woodford, 2014). For options that are similar

in strength (subjective value) it takes more time to determine the winner,

and in some cases the weaker side may prevail. In other words, these

models predict that long RTs indicate indifference, and that RTs decrease

as the superior option gets better than the inferior option.

Here, we estimate individual preferences using subjective value (utility)

functions with single parameters and demonstrate the strength of the

relationship between preference and RT, using experimental data from three

prominent choice domains: risk, time, and social preferences. We show

that single-trial RTs can be used to rank subjects according to their

degree of loss aversion, that RTs on “extreme” trials (where most subjects

choose the same option) can be used to rank subjects according to their

loss, time, and social preferences, and that RTs from the full datasets

can be used to estimate preference parameters. In every case these

rankings significantly align with those estimated from subjects’ choices

over the full datasets. We also show that trials with longer RTs are less

consistent with a subject’s other choices, and more likely to be reversed

if presented a second time.

These results complement several recent papers that have investigated the

relationship between RT and preferences. Chabris et al. (2009) use a

structural RT model to estimate time preferences in groups, but they do not

attempt the same exercise at the individual level. Alós-Ferrer et al.

(2016) demonstrate that preference reversals between choice and valuation

tasks are associated with longer RTs. We take this idea a step further by

looking at reversals between two instances of identical choice problems.

Finally, Clithero (2018) uses the DDM to improve out-of-sample predictions

in food choice. We provide a complementary approach where subjective

values can be inferred parametrically, and apply the DDM without using the

choice data. Considering these results, our main contribution is in

demonstrating that, across many decision domains, there are several ways in

which RTs can supplement or even replace choice data in individual

preference estimation.

2 Methods

We analyze four separate datasets: the last two (Studies 2 and 3) were

collected with other research goals in mind, but included precise

measurements of RTs, while the first two (Study 1) were collected

specifically for this analysis (see Note 1 in the Supplement for summary

statistics). For each dataset, we selected a common, single-parameter

preference model (i.e., subjective-value function). Our goal here was not

to compare different preference models but rather to identify best-fitting

parameter values given a particular model that explains the data well.

The decision problems in these datasets were specifically designed with

these particular models in mind.

In addition to the differing domains, these tasks vary along a couple of

dimensions that might affect the relationship between preference and RT.

One dimension is time constraint. Time limits are common in binary choice

tasks in order to keep subjects focused, but overly restrictive cutoffs

may dampen the effect of strength-of-preference on RTs. Here we examine

datasets with varying time constraints (3s, 10s, and unlimited) in order

to explore the robustness of our results.

2.1 Study 1: risky choice

2.1.1 Participants

This experiment was conducted at The Ohio State University. The

experiment had two versions: 61 subjects participated in the adaptive

version of the task, earning $17–20 on average; and 39 subjects

participated in the non-adaptive version, earning $18 on average. In

order to cover any potential losses, subjects first completed an unrelated

task that endowed them with enough money to cover any potential losses.

2.1.2 Adaptive risky choice task

In each trial, subjects chose between a sure amount of money and a 50/50

lottery that included a positive amount and a loss (which in some rounds

was equal to $0). The set of decision problems was adapted from

Sokol-Hessner et al. (2009). Subjects’ RTs were not restricted. In the

adaptive experiment, each subject’s choice defined the next trial’s

options using a Bayesian procedure to ensure an accurate estimate of the

subject’s risk and loss aversion within a limited number of rounds

(Chapman, Snowberg, Wang & Camerer, 2018). Each subject completed the

same three unpaid practice trials followed by 30 paid trials. Each

subject received the outcome of one randomly selected trial. Importantly,

every subject’s first paid trial was identical.

2.1.3 Non-adaptive risky choice task

In the non-adaptive experiment, each subject first completed a three-trial

practice followed by 276 paid trials. These trials were presented in two

blocks of the same 138 choice problems, each presented in random order

without any pause between the two blocks. Subjects were endowed with $17

and additionally earned the outcome of one randomly selected trial (in

case of a loss it was subtracted from the endowment).

2.1.4 Preference model

For both experiments we assumed a standard Prospect Theory value function

(Kahneman & Tversky, 1979):

|

U(x)= | ⎧

⎨

⎩ | | xρ | if | x ≥ 0 |

| −λ · −xρ | if | x<0 , |

|

(1) |

where x is the monetary amount, ρ reflects risk

aversion, and λ captures loss aversion. For

simplicity, we assumed linear probability weighting. Similar to prior work

using this task, we found that risk aversion plays a minimal role in this

task relative to loss aversion, with ρ estimates

typically close to 1. Therefore, acknowledging that varying levels of risk

aversion could add noise to the RTs, for the analyses below (both choice-

and RT-based) we assumed risk neutrality (ρ=1).

In the non-adaptive experiment, the preference functions were estimated

using a standard MLE approach with a logit choice function. We used only

trials with non-zero losses (specifically, 112 out of 138 decision

problems). Two subjects with outlying estimates of λ (beyond three

standard deviations of the mean) were removed from the analysis due to

unreliability of these estimates (subjects making choices that are

extremely biased towards one of the options). The same exclusion criterion

was used for the other datasets.

2.2 Study 2: intertemporal choice

2.2.1 Participants

This experiment was conducted while subjects underwent functional magnetic

resonance imaging (fMRI) at the California Institute of Technology (Hare,

Hakimi & Rangel, 2014). 41 subjects participated in this experiment,

earning a $50 show-up fee and the amount from one randomly selected

choice. The payments were made using prepaid debit cards that were

activated at the chosen delayed date.

2.2.2 Task

In each round, subjects chose between getting $25 right after the

experiment or a larger amount (up to $54) at a later date (7 to 200

days). There were 108 unique decision problems and subjects encountered

each problem twice. All 216 trials were presented in random order. Each

trial, the amount was first presented on the screen, followed by the

delay, and subjects were asked to press one of two buttons to accept or

reject the offer. The decision was followed by a feedback screen showing

“Yes” (if the offer was accepted) or “No” (otherwise). The decision time

was limited to 3 seconds, and if a subject failed to give a response, the

feedback screen contained the text “No decision received”. These trials

(2.6% across subjects) were excluded from the analysis. Trials were

separated by random intervals (2–6 seconds).

2.2.3 Preference model

In line with the authors who collected this dataset, we used a hyperbolic

discounting subjective-value function (Loewenstein & Prelec 1992; Ainslie

1992):

where x is the delayed monetary amount, k is the discount factor

(higher is more impatient), and D is the delay period in days. One

subject who chose $25 now on every trial was removed from the analysis.

Preference parameters were estimated using a standard MLE approach with a

logit choice function. Two subjects with outlying estimates of k were

also removed from the analysis.2

2.3 Study 3: social preference

2.3.1 Participants

This dataset was collected while subjects underwent fMRI at the Social and

Neural Systems laboratory, University of Zurich (Krajbich et al., 2015).

In total, 30 subjects were recruited for the experiment. They received a

show-up fee of 25 CHF and a payment from 6 randomly chosen rounds,

averaging at about 65 CHF.

2.3.2 Task

Subjects made choices between two allocations, X and Y, which specified

their own payoff and an anonymous receiver’s payoff. The payoffs were

displayed in experimental currency units, and 120 predetermined

allocations were presented in random order. Each allocation had a tradeoff

between a fair option (more equal division) and a selfish option (with

higher payoff to the dictator). 72 out of 120 decision problems per

subject had higher payoff to the dictator in both options X and Y (to

identify advantageous inequality aversion), while the rest of the problems

(48/120) had higher payoffs to the receiver in both options (to identify

disadvantageous inequality aversion). In each trial, subjects observed a

decision screen that included the two options, and had to make a choice

with a two-button box. Subjects were required to make their decisions

within 10 seconds; if a subject failed to respond under this time limit,

that trial was excluded from the analysis (4 trials were excluded).

Intertrial intervals were randomized uniformly from 3 to 7 seconds.

Subjects read written instructions before the experiment, and were tested

for comprehension with a control questionnaire. All subjects passed the

questionnaire and understood the anonymous nature of the game.

2.3.3 Preference model

To fit choices in this experiment, we used a standard Fehr-Schmidt

other-regarding preference model (Fehr & Schmidt, 1999):

|

Ui(xi, xj)=xi−α · max(xj−xi, 0)−β · max(xi−xj,0),

(3) |

where xi is the dictator’s payoff, xj is the receiver’s payoff,

α reflects disadvantageous inequality aversion,

and β reflects advantageous inequality aversion.

Each trial was designed to either measure α or

β, so we treated this experiment as two separate

datasets. The preference parameters were estimated using a standard MLE

approach with a logit choice function. One subject with an outlying

estimate of α was removed from the analysis.

2.4 Computational modeling

2.4.1 Choice-based estimations

The three preference functions we selected to model subjects’ choices

performed well above chance. To examine the number of choices that were

consistent with the estimated parameter values, we used standard MLE

estimates of logit choice functions (see the Supplement) to

identify the “preferred” alternatives in every trial and compared those to

the actual choice outcomes. More specifically, we calculated subjective

values using parameters estimated purely from choices, and in every trial

predicted that the alternative with the higher subjective value would be

chosen with certainty. All subjects were very consistent in their choices

even in the datasets with a large number of trials: social choice

α: 94%, social choice β:

93%, intertemporal choice: 83%, non-adaptive risky choice: 89% (see

Figure S5).

2.4.2 Drift-diffusion model (DDM)

We used the simple, most robust SSM variant, which is the DDM with constant

thresholds (see Note 2 in the Supplement), where we assumed that drift rate on

every trial is a linear function of the difference in the subjective

values of the two alternatives. Unlike previous studies, we assume that

only RT data are available and use the RT probability densities to estimate

the preference parameter for each subject i

(θi) given the empirical distribution of RTs.

Note that we do not use choice-conditioned RT distributions. Instead we

maximize the RT likelihood function across both choice boundaries:

|

| | LL | | | log | ⎛

⎝ | f(R Tn, an = 1 | b, τ, vn) | ⎞

⎠ |

|

| | + | | log | ⎛

⎝ | f(R Tn, an=2 | b, τ, vn) | ⎞

⎠ | .

|

|

|

(4) |

Here f(·) is the response time density function, RT

is the response time on a specific trial, a is the choice the subject

could have made, b is the DDM decision boundary,

τ is non-decision time, and vn is the drift

rate on the specific trial n, which depends on the difference in subjective

values, which in turn depends on the subject’s preference parameter

(θi) (see Note 2 in the Supplement). Intuitively,

the individual parameter is identified due to the fact that longer RTs

correspond to lower drift rates and thus smaller subjective-value

differences. Please see the Supplement for more detail.

3 Results

3.1 RTs peak at indifference

We first sought to establish the hypothesized negative correlation between

strength-of-preference and RT. For this analysis, our measure of

strength-of-preference was the difference between the subject’s preference

parameter (estimated purely from their choices, see Note 2 in the Supplement)

and the parameter value that would make the subject indifferent between

the two options in that trial (we refer to this as the “indifference

point”). When a subject’s parameter value is equal to the indifference

point of a trial, we say that the subject is indifferent on that trial and

so strength-of-preference is zero.

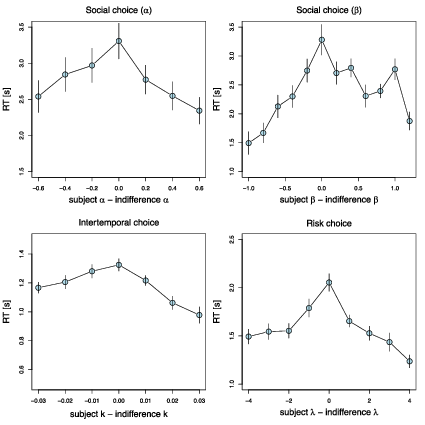

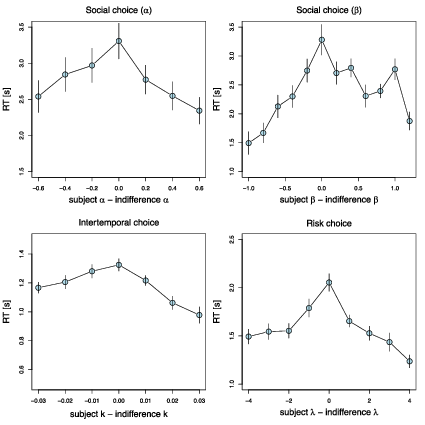

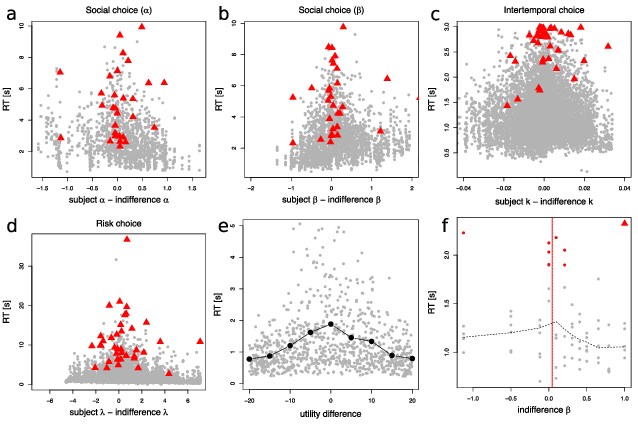

| Figure 1: RTs peak at indifference. Mean RT in seconds as a function of the

distance between the individual subject’s preference function parameter

and the indifference point on a particular trial; data are aggregated into

bins of width 0.02 (top row), 0.01 (bottom left panel), and 1 (bottom

right panel), which are truncated and centered for illustration purposes.

Bins with fewer than 10 subjects are removed for display purposes. Bars

denote standard errors, clustered at the subject level. |

Let us illustrate this concept with a simple example. Suppose that in the

intertemporal-choice task a subject has to choose between $25 today and

$40 in 30 days. The subject would be indifferent with an individual

discount rate k∗ that is the solution to the equation $25 =

$40/(1+30 k∗), or k∗ = 0.0125. This would be the

indifference point of this particular trial. A subject with k=k∗

would be indifferent on this trial, a subject with a k < k∗ would

favor the delayed option, and a subject with a higher k > k∗ would

favor the immediate option.

We hypothesized that the bigger the absolute difference between the

subject’s parameter and the trial’s indifference point |k−k∗|, the

stronger the preference, and the shorter the mean RT. This is analogous to

how, in decision field theory, the difference in valence between the two

options determines the preference state and thus the average speed of the

decision (Busemeyer & Townsend 1993). We observe this effect in all of our

datasets, with RTs peaking when a subject’s parameter is equal to the trial

indifference point (Figure 1). Mixed-effects regression models show

strong, statistically significant effects of the absolute distance between

the indifference point and subjects’ individual preference parameters on

log(RTs) for all the datasets (fixed effect of distance on RT: dictator

game α: t = −7.5, p < 0.001; dictator game β: t

= −9.1, p < 0.001; intertemporal choice k: t = −9.9, p

< 0.001; non-adaptive risky choice λ: t = −9.6, p

< 0.001, adaptive risky choice λ: t = −4.4, p

< 0.001).

Having verified the relationship between strength-of-preference and RT, we

next asked whether we could invert this relationship. In other words, we

sought to test whether one can estimate preferences from RTs. First, we

investigated whether RTs can reveal preference information when only a

single trial’s data is available.

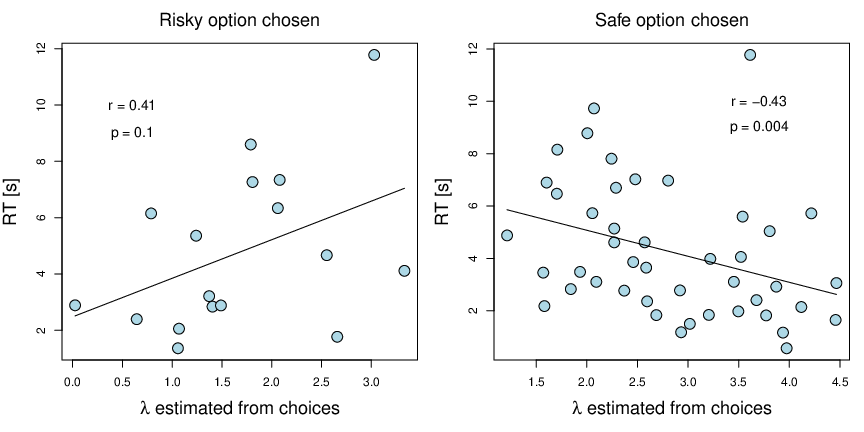

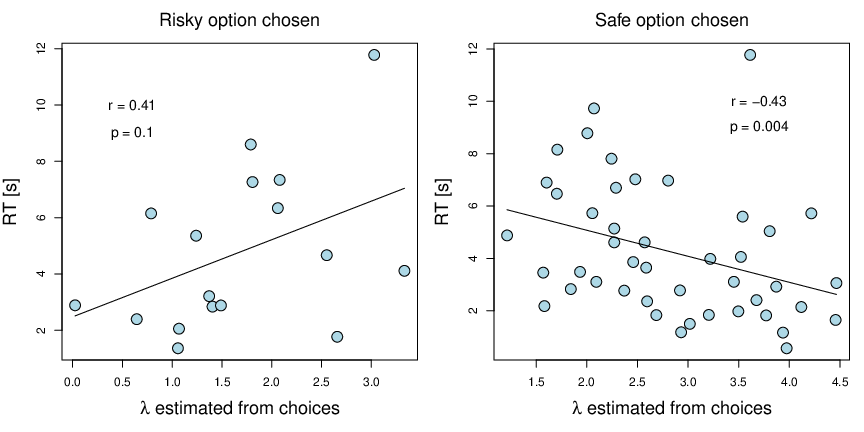

| Figure 2: Preference rank inferred from a single decision problem. RTs in

the first trial of the adaptive risk experiment as a function of the

individual subject’s loss-aversion coefficient from the whole experiment;

each point is a subject, Spearman correlations displayed. In this round,

each subject was presented with a binary choice between a lottery that

included a 50% chance of winning $12 and losing $7.5, and a sure option

of $0. The right panel displays subjects who chose the safe option, and

the left panel shows those who chose the risky option. The solid black

lines are regression model fits. |

3.2 One-trial preference ranking

In the adaptive risk experiment, all subjects faced the same choice problem

in the first trial. They had to choose between a 50/50 lottery with a

gain ($12) and a loss ($7.5), vs. a sure amount ($0).

Assuming risk neutrality, a subject with a loss aversion coefficient of

λ=1.6 should be indifferent between these two

options, with more loss-averse subjects picking the safe option, and the

rest picking the risky option.

Because the mean loss aversion (estimated based on all the

choices) in our sample was 2.5 (median = 2.46), most of the subjects (44

out of 61) picked the safe option in this first trial. Now, if we had to

restrict our experiment to just this one trial, the only way we could

classify subjects’ preferences would be to divide them into two groups:

those with λ ≥ 1.6 and those

with λ < 1.6. Within each group

we would not be able further distinguish between individuals.

However, by additionally observing RTs we can establish a ranking of the

subjects in each group. Specifically, we hypothesized that subjects with

loss aversion closer to 1.6 would exhibit longer RTs. To test this

hypothesis we ranked subjects in each group according to their RTs and then

compared those rankings to the “true” loss aversion parameters estimated

from all 30 choices in the full dataset (see Figure 2, Note 2 in the

Supplement, and Figure S5 for the choice-based estimates).

There was a significant rank correlation (Spearman) between RTs and

loss seeking in the “safe option” group (r = 0.43, p = 0.004) and

marginally between RTs and loss aversion in the “risky option” group (r =

0.41, p = 0.1). Thus, the single-trial RT-based rankings aligned quite

well with the 30-trial choice-based rankings.

3.3 Uninformative choices

A similar use of RT-based inference is the case where an experiment (or

questionnaire) is flawed in such a way that most subjects give the same

answer to the choice problem (e.g., because it has an extreme indifference

point, or because people feel social pressure to give a certain answer,

even if it contradicts their true preference (Coffman, Coffman &

Ericson, 2017)). This method could be used to bolster datasets that are

limited in scope and so unable to recover all subjects’ preferences.

To model this situation, for each dataset (non-adaptive risk, intertemporal

choice, and social choice) we isolated the 4–10 trials (depending on the

dataset) with the highest indifference points, where most subjects chose

the same option (e.g., the risky option), and limited our analysis to

those subjects who picked this most popular option. Then we iterated an

increasing set of trials (just the highest point, the first and the second

highest points, the first, second, and third, and so on), took the median

RT in this set, and correlated it with the “true” choice-based estimates.

We hypothesized that the slower the decisions on these trials, the more

extreme the choice-based parameter value for that subject.

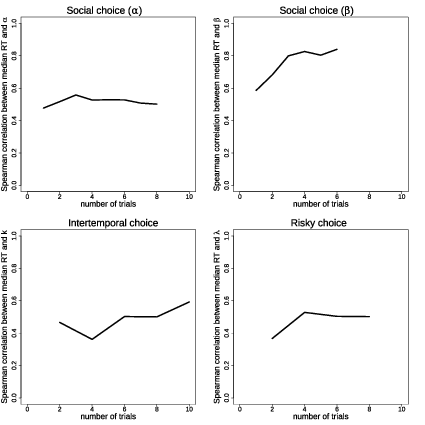

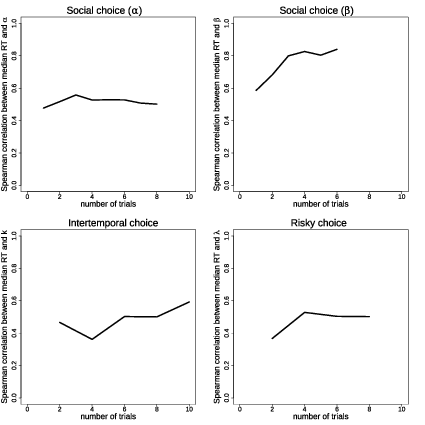

| Figure 3: Spearman correlations between choice-based parameter estimates

and the median RT in the trials with the highest indifference points, for

increasing sets of these extreme trials. |

The set of trials varied across datasets due to the structure of the

experiments. In the risk and intertemporal datasets every decision problem was shown

twice, so we started with two trials and then increased in steps of two.

For the risk task there were several trials with identical indifference

points after the first 8 trials, so we stopped there. For the

social-preference datasets there were many trials with the same

indifference point (8 and 6 for α and

β respectively) so we simply used those trials,

going from lowest to highest game id number (arbitrarily assigned in the

experiment code). Note that we used only the highest indifference points,

since trials with indifference parameters close to zero were often trivial

“catch” trials, e.g., $25 today vs. $25 in 7 days.

Confirming the hypothesis, we found that the RTs on these trials were

strongly predictive of subjects’ choice-based parameters in all four

domains (Figure 3), with Spearman correlations ranging from 0.37 to 0.84

(for the largest set: risk choice (n = 19): ρ =

0.50, p = 0.03; intertemporal choice (n = 25): ρ =

0.59, p = 0.002; social choice α (n = 26):

ρ = 0.50, p = 0.009; social choice

β (n = 20): ρ = 0.84, p

< 0.001). Thus, we again see, in every domain, that RT-based

rankings from a small subset of trials align well with choice-based

rankings from the full datasets. These analyses also hint at potential

benefits from including more trials, but also suggest that RTs may not be

that noisy once we control for the difficulty of the question and

subject-level heterogeneity.

3.4 DDM-based preference parameter estimation from RTs

The results described in the previous sections demonstrate that we can use

RT to rank subjects according to their preferences on trials where they

all make the same choice. A more challenging problem is to estimate a

subject’s preferences from RT alone. In this section, we explore ways to

estimate individual subjects’ preference parameters from their RTs across

multiple choice problems.

The DDM predicts more than just a simple relationship between

strength-of-preference and mean RT; it predicts entire RT distributions.

The drift rate in the model is a linear function of the subjective value

difference (or in decision field theory the valence difference) and so by

estimating drift rates we can potentially identify the latent preference

parameters. We hypothesized that the DDM-derived preference parameters,

using only RT data, would correlate with the choice-based preference

parameters estimated in the usual way.

We used the simple standard DDM, but did not condition the RT distributions

on the choice made in each trial (see Section 2.4. and the

Supplement). We assumed no starting point bias and,

following the traditional approach, assumed that the drift rate is a simple

linear function of the difference in subjective values (Busemeyer &

Townsend, 1993; Dai & Busemeyer, 2014). Parameter recovery simulations

confirmed that the preference parameters could be identified using this

method (Figure S6).

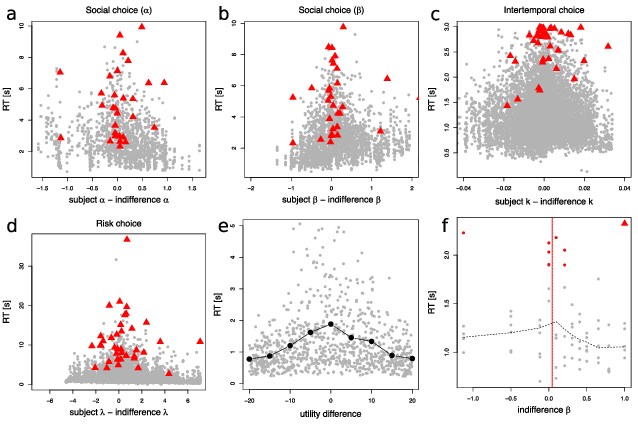

| Figure 4: Slow decisions tend to occur at indifference. (a-d) Subject data

from each task. RT in seconds as a function of the distance between the

individual subject preference parameter and the indifference point on a

particular trial; gray dots denote individual trials. Red triangles denote

trials with the highest RT for each individual subject. (e) Simulation of

the DDM. Response times (RTs) as a function of the difference in

utilities between two options in 900 simulated trials. The gray dots show

individual trials, the black circles denote averages with bins of width

10. The parameters used for the simulation correspond to the parameters

estimated at the group level in the time discounting experiment (b =

1.33, z = 0.09, τ = 0.11). Subjective-value

differences are sampled from a uniform distribution between −20 and 20.

(f) Example of an individual subject’s RT-based parameter estimation. The

plot shows RTs in all trials as a function of the indifference parameter

value on that trial. Observations in the top RT decile are shown in red.

The red triangle shows the longest RT for the subject. The solid vertical

red line shows the subject’s choice-based parameter estimate. The dotted

vertical red line shows the average indifference value for the top RT

decile approach. The dotted grey line shows the local regression fit

(LOWESS, smoothing parameter = 0.5). |

First, we estimated the DDM assuming that the boundary parameter b,

non-decision time τ, and drift scaling parameter z were fixed across

subjects (see Note 2 in the Supplement). We made this

simplifying assumption to drastically reduce the number of parameters we

needed to estimate. In each dataset, we found that DDM-derived preference

parameters were correlated with the choice-based parameters (social choice

α: r = 0.39, p = 0.04, t(27) = 2.2; social choice β: r = 0.52,

p = 0.003, t(28) = 3.2; intertemporal choice k: r = 0.57, p <

0.001, t(37) = 4.2; risky choice λ: r = 0.36, p = 0.03, t(35) =

2.26; Pearson correlations, Figure S7).

We did not use the adaptive risk dataset here (or for subsequent analyses)

since the adaptive nature of the task means that subjects should be closer

to indifference as the experiment progresses. The well-established

negative correlation between trial number and RT would thus counteract the

strength-of-preference effects and interfere with our ability to estimate

preferences.

We also estimated the DDM for each subject separately, assuming individual

variability in the boundary parameter b, non-decision time τ, and

drift scaling parameter z. In some cases, this causes identification

problems for certain subjects (the parameters were estimated at the bounds

of the possible range), most likely due to the small number of trials (only

48 trials to estimate 4 parameters in the case of α in the social

preference task) and the tight distribution of subjects’ indifference

points in that task. After excluding these subjects (2/30 and 2/30 in the

social choice dataset, 16/39 in the intertemporal choice dataset, and 7/37

in the risk choice dataset), we found that in most cases correlations

between DDM parameters and choice-based parameters were stronger than in

the pooled estimation variant (social choice α: r = 0.09, p = 0.65,

t(25) = 0.45; social choice β: r = 0.74, p < 0.001, t(26) =

5.54; intertemporal choice k: r = 0.63, p = 0.001, t(22) = 3.84; risky

choice λ: r = 0.53, p = 0.002, t(28) = 3.33; Pearson correlations,

Figure S8).

These results highlight that it is useful to have trials with a wide range

of indifference points. This can be inefficient with standard choice-based

analyses, since most subjects choose the same option on trials with extreme

indifference points. However, when including RTs, these trials can still

convey useful information, namely the strength-of-preference.

3.5 Alternative approaches to preference parameter estimation from RTs

The DDM may seem optimal for parameter recovery if that is indeed the data

generating process. However, several factors likely limit its usefulness

in our settings. The DDM has several free parameters that are identified

using features of choice-conditioned RT distributions. Identification

thus typically relies on many trials and observing choice outcomes.

Without meeting these two requirements, the DDM approach may struggle to

identify parameters accurately. Thus, we explored alternative, simpler

approaches to analyzing the RTs.

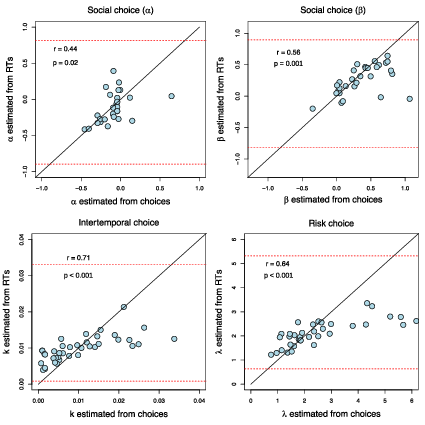

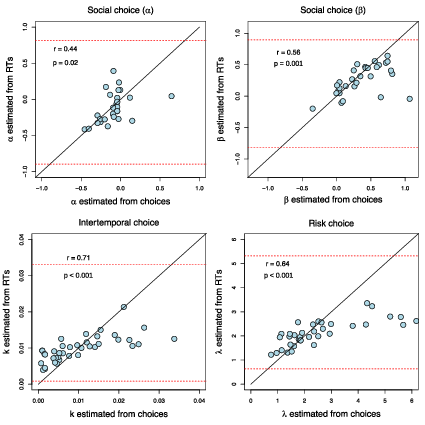

| Figure 5: Estimates of subjects’ preference parameters, estimated using the

top RT decile method. Subject-level correlation (Pearson) between

parameters estimated from choice data and RT data. The solid lines are 45

degree lines. The dotted red lines indicate the minimum and maximum

parameter values that can be estimated from the RTs. |

One alternative approach is to focus on the longest RTs. Long RTs are

considerably more informative than short RTs. Sequential sampling models

correctly predict that short RTs can occur at any level of

strength-of-preference, but long RTs almost exclusively occur near

indifference (Figure 4). With these facts in mind, we set about

constructing an alternative method for using RTs to infer a subject’s

indifference point. Clearly, focusing on the slowest trials would yield

less biased estimates of subjects’ indifference points. However, using

too few slow trials would increase the variance of those estimates. We

settled on a simple method that uses the slowest 10% of a subject’s

choices, though we also explored other cutoffs (Figure S9).

In short, our estimation algorithm for an individual subject includes the

following steps: (1) identify trials with RTs in the upper 10% (the

slowest decile); (2) for each of these trials, calculate the value of the

preference parameter that would make the subject indifferent between the

two alternatives; (3) average these values to get the estimate of the

subject’s parameter (see Figure 4f and the Supplement for

formal estimation details and Figure S6 for the parameter recovery

simulations). It is important to note that this method puts bounds on

possible parameter estimates: the average of the highest 10% of all

possible indifference values is the upper bound, while the average of the

lowest 10% of the indifference values is the lower bound.

Again, the parameters estimated using this method were correlated with the

same parameters estimated purely from the choice data, providing a better

prediction than the DDM approach (social choice α:

r = 0.44, p = 0.02, t(27) = 2.54; social choice β:

r = 0.56, p = 0.001, t(28) = 3.57; intertemporal choice k: r = 0.71, p

< 0.001, t(37) = 6.17; risky choice λ:

r = 0.64, p < 0.001, t(35) = 4.9; Pearson correlations; Figure

5, see the Supplement for estimation details for both methods).

Furthermore, these parameters provided prediction accuracy that was better

than the informed baseline in three out of four cases (excluding social

choice α). In all cases, a random 10% sample of

trials produced estimates that were not a meaningful predictor of the

choice-based parameter values (since these estimates are just a mean of

10% random indifference points). The RT-based estimations have upper and

lower bounds due to averaging over a 10% sample of trials and thus are

not able to capture some outliers (Figure 5). Furthermore, the number of

“extreme” indifference points in the choice problems that we considered is

low, biasing the RT-based estimates towards the middle.

We also explored a method using the whole set of RT data and a

non-parametric regression, but its performance was uneven across the

datasets (see the Supplement and Figure S6 for the parameter

recovery).

3.6 Choice reversals

Finally, we explored one additional set of predictions from the revealed

strength-of-preference approach. We know that when subjects are closer to

indifference, their choices become less predictable, and they slow down.

Therefore, slow choices should be less likely to be repeated (Alós-Ferrer

et al., 2016).

In all three datasets, the choice-estimated preference model was

significantly less consistent with long-RT choices than with short-RT

choices (based on a median split within subject): 80% vs 89% (p

< 0.001) in the risky choice experiment, 71% vs 79% (p

< 0.001) in the intertemporal choice experiment, 88% vs 94% (p

= 0.008) and 90% vs 96% (p < 0.001) in the dictator game

experiment; p-values denote Wilcoxon signed rank test significance on the

subject level.

A second, more nuanced feature of DDMs is that with typical parameter

values, without time pressure, they sometimes predict “slow errors”, even

conditioning on difficulty (Ratcliff & McKoon, 2008). In preferential

choice there are no clear correct or error responses, however, we can

compare choices that are consistent or inconsistent with the best-fitting

choice model. The prediction is that inconsistent choices should be

slower than consistent ones.

To control for choice difficulty, we ran mixed-effects regressions of

choice consistency on the RTs and the absolute subjective-value difference

between the two options. In all cases we found a strong negative

relationship between the RTs and the choice consistency (slower choice =

less consistent) (fixed effects of RTs: social choice

α: z = −2.62, p = 0.009; social choice

β: z = −3.3, p < 0.001, intertemporal

choice: z = −5.28, p < 0.001, risk choice: z = −5.35, p

< 0.001).

In two of the datasets (intertemporal choice and non-adaptive risk choice)

subjects faced the same set of decision problems twice. This allowed us to

perform a more direct test of the slow inconsistency hypothesis by seeing

whether slow decisions in the first encounter were more likely to be

reversed on the second encounter.

In the intertemporal choice experiment, the median RT for a later-reversed

decision was 1.36 s, compared to 1.17 s for a later-repeated decision. A

mixed-effects regression effect of first-choice RT on choice reversal,

controlling for the absolute subjective-value difference, was highly

significant (z = 4.04, p < 0.001). The difference was even

stronger in the risk choice experiment: subsequently reversed choices took

2.36 s versus only 1.4 s for subsequently repeated choices. Again, a

mixed-effects regression revealed that RT was a significant predictor of

subsequent choice reversals (controlling for absolute subjective-value

difference, z = 5.2, p < 0.001).

There are a couple of intuitions for why slow decisions are still less

consistent, even after controlling for difficulty. First, the true

difficulty of a decision can only be approximated. Even with identical

choice problems, one attempt at that decision might be more subjectively

difficult than another. In the DDM, this is captured by across-trial

variability in drift rate. In other words, one cannot fully control for

difficulty in these kinds of analyses. So, slow decisions can still

signal proximity to indifference, and thus inconsistency in choice.

Second, slow errors can also arise from starting-points that are biased

towards the preferred category (e.g., risky options) (Chen & Krajbich,

2018; White & Poldrack, 2014). In these cases, preference-inconsistent

choices typically have longer distances to cover during the diffusion

process and so take more time.

4 Discussion

Here we have demonstrated a proof-of-concept for the method of revealed

strength-of-preference. This method contrasts with the standard method of

revealed preference, by using response times (RTs) rather than choices to

infer preferences. It relies on the fact that people generally take

longer to decide as they approach indifference. Using datasets from three

different choice domains (risk, temporal, and social) we established that

preferences are highly predictable from RTs alone. Finally, we also found

that long RTs are predictive of choice errors, as captured by

inconsistency with the estimated preference function and later choice

reversals.

Our findings also have important implications for anyone who studies

individual preferences.

First, using RTs may allow one to estimate subjects’ preferences using very

short and simple decision tasks, even a single binary-choice problem.

This is important since researchers, and particularly practitioners, can

often only record a small number of decisions (Toubia, Johnson, Evgeniou

& Delquié, 2013). Since RT data is easily available in online

marketplaces, and many purchases or product choices occur only once, these

data might provide important insight into customers’ preferences. Along

the way, the speed with which customers reject other products might also

reveal important information. On the other hand, clients who wish to

conceal their strength-of-preference, might use their RT strategically to

avoid revealing their product valuations.

Second, the fact that RTs can be used to infer preferences when choices are

unobservable or uninformative is an important point for those who are

concerned about private information, institution design, etc. For

instance, while voters are very concerned about the confidentiality of

their choices, they may not be thinking about what their time in the

voting booth might convey about them. In an election where most of a

community’s voters strongly favor one candidate, a long stop in the voting

booth may signal dissent. Another well-known example is the implicit

association test (IAT), where subjects’ RTs are used to infer personality

traits (e.g., racism) that the subjects would otherwise not admit to or

even be aware of (Greenwald, McGhee & Schwartz, 1998). Thus, protecting

privacy may involve more than simply masking choice outcomes.

Third, our work highlights a method for detecting choice errors. While the

standard revealed preference approach must equate preferences and choices,

the revealed strength-of-preference approach allows us to identify choices that are

more likely to have been errors, or at the very least, made with low

confidence.

There are of course limitations to using RTs to infer strength-of-preference. Other

factors may influence RTs in addition to strength-of-preference, such as

complexity, stake size, and trial number (Krajbich, Hare, Bartling & Fehr, 2015; Logan,

1992; Moffatt, 2005). It may be important to account for these factors in

order to maximize the chance of success. A second issue is that we have

focused on repeated decisions which are made quite quickly (1–3 seconds on

average) and so the results may not necessarily extend to slower, more

complex decisions (but see Krajbich, Hare, Bartling & Fehr, 2015).

More research is required to distinguish between SSMs and alternative

frameworks (Achtziger & Alós-Ferrer, 2013; Alós-Ferrer et al., 2016;

Alós-Ferrer & Ritschel, 2018; Hey, 1995; Kahneman, 2013; Rubinstein,

2016), where long RTs are associated with more careful or deliberative

thought and short RTs are associated with intuition. It may in fact be

the case that in some instances people do use a logic-based approach, in

which case a long RT may be more indicative of careful thought, while in

other instances they rely on a SSM approach, in which case a long RT

likely indicates indifference. This could lead to contradictory

conclusions from the same RT data; for example, one researcher may see a

long RT and assume the subject is very well informed, while another

researcher may see that same RT and assume the subject has no evidence one

way or the other. More research is required to test whether SSMs, which

are designed to tease apart such explanations, can be successfully applied

to complex decisions.

5 References

Achtziger, A., & Alós-Ferrer, C. (2013). Fast or rational? A

response-times study of Bayesian updating. Management Science,

60(4), 923–938.

Ainslie, G. (1992). Picoeconomics: The strategic interaction of

successive motivational states within the person. Cambridge University

Press.

Alós-Ferrer, C., Granić, Ð.-G., Kern, J., & Wagner, A. K. (2016).

Preference reversals: Time and again. Journal of Risk and

Uncertainty, 52(1), 65–97.

Alós-Ferrer, C., & Ritschel, A. (2018). The reinforcement heuristic in

normal form games. Journal of Economic Behavior & Organization,

152, 224–234.

Amasino, D. R., Sullivan, N. J., Kranton, R. E., & Huettel, S. A. (2019).

Amount and time exert independent influences on intertemporal choice.

Nature Human Behaviour. https://doi.org/10.1038/s41562-019-0537-2

Bergert, F. B., & Nosofsky, R. M. (2007). A response-time approach to

comparing generalized rational and take-the-best models of decision

making. Journal of Experimental Psychology: Learning, Memory, and

Cognition, 33(1), 107.

Bhatia, S., & Mullett, T. L. (2018). Similarity and decision time in

preferential choice. Quarterly Journal of Experimental

Psychology, 1747021818763054.

Bogacz, R., Brown, E., Moehlis, J., Holmes, P., & Cohen, J. D. (2006). The

physics of optimal decision making: A formal analysis of models of

performance in two-alternative forced choice tasks. Psychological

Review, 113(4), 700–765.

Brunton, B. W., Botvinick, M. M., & Brody, C. D. (2013). Rats and humans

can optimally accumulate evidence for decision-making. Science,

340, 95–98.

Busemeyer, J. R. (1985). Decision making under uncertainty: A comparison of

simple scalability, fixed-sample, and sequential-sampling models.

Journal of Experimental Psychology: Learning, Memory, and

Cognition, 11(3), 538–564.

https://doi.org/10.1037/0278-7393.11.3.538

Busemeyer, J. R., & Rapoport, A. (1988). Psychological models of deferred

decision making. Journal of Mathematical Psychology, 32,

91–134.

Busemeyer, J. R., & Townsend, J. T. (1993). Decision field theory: A

dynamic-cognitive approach to decision making in an uncertain environment.

Psychological Review, 100(3), 432–459.

Caplin, A., & Martin, D. (2016). The dual-process drift diffusion model:

evidence from response times. Economic Inquiry, 54(2),

1274–1282. https://doi.org/10.1111/ecin.12294

Chabris, C. F., Morris, C. L., Taubinsky, D., Laibson, D., & Schuldt, J.

P. (2009). The allocation of time in decision-making. Journal of

the European Economic Association, 7(2–3), 628–637.

Chapman, J., Snowberg, E., Wang, S., & Camerer, C. (2018). Loss attitudes

in the U.S. population: Evidence from dynamically optimized sequential

experimentation (DOSE). National Bureau of Economic Research

Working Paper Series, No. 25072. https://doi.org/10.3386/w25072

Chen, F., & Krajbich, I. (2018). Biased sequential sampling underlies the

effects of time pressure and delay in social decision making.

Nature Communications, 9(1), 3557.

https://doi.org/10.1038/s41467-018-05994-9.

Cleveland, W. S. (1979). Robust locally weighted regression and smoothing

scatterplots. Journal of the American Statistical Association,

74(368), 829–836.

Clithero, J. A. (2018). Improving Out-of-Sample Predictions. Using Response

Times and a Model of the Decision Process. Journal of Economic

Behavior & Organization. https://doi.org/10.1016/j.jebo.2018.02.007.

Coffman, K. B., Coffman, L. C., & Ericson, K. M. M. (2017). The size of

the LGBT population and the magnitude of antigay sentiment are

substantially underestimated. Management Science,

63(10), 3168–3186. https://doi.org/10.1287/mnsc.2016.2503.

Dai, J., & Busemeyer, J. R. (2014a). A probabilistic, dynamic, and

attribute-wise model of intertemporal choice. Journal of

Experimental Psychology: General, 143(4), 1489–1514.

https://doi.org/10.1037/a0035976.

Dashiell, J. F. (1937). Affective value-distances as a determinant of

esthetic judgment-times. The American Journal of Psychology.

De Martino, B., Fleming, S. M., Garret, N., & Dolan, R. J. (2013).

Confidence in value-based choice. Nature Neuroscience,

16(1), 105–110.

Diederich, A. (1997). Dynamic stochastic models for decision making under

time constraints. Journal of Mathematical Psychology,

41(3), 260–274. https://doi.org/10.1006/jmps.1997.1167.

Diederich, A. (2003). MDFT account of decision making under time pressure.

Psychonomic Bulletin & Review, 10(1), 157–166.

https://doi.org/10.3758/BF03196480.

Echenique, F., & Saito, K. (2017). Response time and utility.

Journal of Economic Behavior & Organization, 139,

49–59.

Fehr, E., & Schmidt, K. M. (1999). A theory of fairness, competition, and

cooperation. The Quarterly Journal of Economics, 114(3),

817–868.

Fiedler, S., & Glöckner, A. (2012). The dynamics of decision making in

risky choice: An eye-tracking analysis. Frontiers in Psychology,

3. https://doi.org/10.3389/fpsyg.2012.00335.

Fific, M., Little, D. R., & Nosofsky, R. M. (2010). Logical-rule models of

classification response times: A synthesis of mental-architecture,

random-walk, and decision-bound approaches. Psychological Review,

117(2), 309.

Fudenberg, D., Strack, P., & Strzalecki, T. (2018). Speed, accuracy, and

the optimal timing of choices. American Economic Review,

108(12), 3651–3684.

Gabaix, X., Laibson, D., Moloche, G., & Weinberg, S. (2006). Costly

Information Acquisition: Experimental Analysis of a Boundedly Rational

Model. American Economic Review, 96(4), 1043–1068.

https://doi.org/10.1257/aer.96.4.1043.

Greenwald, A. G., McGhee, D. E., & Schwartz, J. L. (1998). Measuring

individual differences in implicit cognition: the implicit association

test. Journal of Personality and Social Psychology,

74(6), 1464.

Hare, T. A., Hakimi, S., & Rangel, A. (2014). Activity in dlPFC and its

effective connectivity to vmPFC are associated with temporal discounting.

Frontiers in Neuroscience, 8.

https://doi.org/10.3389/fnins.2014.00050.

Haxby, J. V., Connolly, A. C., & Guntupalli, J. S. (2014). Decoding neural

representational spaces using multivariate pattern analysis.

Annual Review of Neuroscience, 37, 435–456.

Hey, J. D. (1995). Experimental investigations of errors in decision making

under risk. European Economic Review, 39(3), 633–640.

Hunt, L. T., Kolling, N., Soltani, A., Woolrich, M. W., Rushworth, M. F.

S., & Behrens, T. E. (2012). Mechanisms underlying cortical activity

during value-guided choice. Nature Neuroscience, 15,

470–476.

Hutcherson, C. A., Bushong, B., & Rangel, A. (2015). Al neurocomputational

model of altruistic choice and its implications. Neuron,

87(2), 451–462.

Jamieson, D. G., & Petrusic, W. M. (1977). Preference and the time to

choose. Organizational Behavior and Human Performance,

19(1), 56–67.

Kahneman, D. (2013). Thinking, Fast and Slow (Reprint edition).

New York: Farrar, Straus and Giroux.

Kahneman, D., & Tversky, A. (1979). Prospect theory: an analysis of

decision under risk. Econometrica, 4, 263–291.

Konovalov, A., & Krajbich, I. (2016). Gaze data reveal distinct choice

processes underlying model-based and model-free reinforcement learning.

Nature Communications, 7, 12438.

Krajbich, I., Armel, K. C., & Rangel, A. (2010). Visual fixations and the

computation and comparison of value in simple choice. Nature

Neuroscience, 13(10), 1292–1298.

Krajbich, I., Bartling, B., Hare, T., & Fehr, E. (2015). Rethinking fast

and slow based on a critique of reaction-time reverse inference.

Nature Communications, 6, 7455.

https://doi.org/10.1038/ncomms8455.

Krajbich, I., Hare, T., Bartling, B., Morishima, Y., & Fehr, E. (2015). A

common mechanism underlying food choice and social decisions. PLoS

Computational Biology, 11(10), e1004371

Krajbich, I., & Rangel, A. (2011). Multialternative drift-diffusion model

predicts the relationship between visual fixations and choice in

value-based decisions. Proceedings of the National Academy of

Sciences, 108(33), 13852–13857.

Laibson, D. (1997). Golden eggs and hyperbolic discounting. The

Quarterly Journal of Economics, 443–477.

Loewenstein, G., & Prelec, D. (1992). Anomalies in intertemporal choice:

Evidence and an interpretation. The Quarterly Journal of

Economics, 107(2), 573–597.

Logan, G. D. (1992). Shapes of reaction-time distributions and shapes of

learning curves: A test of the instance theory of automaticity.

Journal of Experimental Psychology: Learning, Memory, and

Cognition, 18(5), 883.

Loomes, G. (2005). Modelling the stochastic component of behaviour in

experiments: Some issues for the interpretation of data.

Experimental Economics, 8, 301–323.

Luce, R. D. (1986). Response Times: Their Role in Inferring

Elementary Mental Organization. Oxford: Oxford University Press.

Milosavljevic, M., Malmaud, J., Huth, A., Koch, C., & Rangel, A. (2010).

The drift diffusion model can account for the accuracy and reaction time

of value-based choices under high and low time pressure. Judgment

and Decision Making, 5(6), 437–449.

Moffatt, P. G. (2005). Stochastic choice and the allocation of cognitive

effort. Experimental Economics, 8(4), 369–388.

Mosteller, F., & Nogee, P. (1951). An experimental measurement of utility.

Journal of Political Economy, 59(5), 371–404.

Polanía, R., Krajbich, I., Grueschow, M., & Ruff, C. C. (2014). Neural

Oscillations and Synchronization Differentially Support Evidence

Accumulation in Perceptual and Value-Based Decision Making.

Neuron, 82(3), 709–720.

https://doi.org/10.1016/j.neuron.2014.03.014.

Ratcliff, R., & McKoon, G. (2008). The diffusion decision model: Theory

and data for two-choice decision tasks. Neural Computation,

20(4), 873–922.

Rodriguez, C. A., Turner, B. M., & McClure, S. M. (2014). Intertemporal

choice as discounted value accumulation. PloS One, 9(2),

e90138.

Roe, R. M., Busemeyer, J. R., & Townsend, J. T. (2001). Multialternative

decision field theory: A dynamic connectionist model of decision making.

Psychological Review, 108(2), 370–392.

Rubinstein, A. (2007). Instinctive and cognitive reasoning: A study of

response times. The Economic Journal, 117(523),

1243–1259.

Rubinstein, A. (2016). A typology of players: Between instinctive and

contemplative. The Quarterly Journal of Economics,

131(2), 859–890.

Samuelson, P. A. (1938). A note on the pure theory of consumer’s behaviour.

Economica, 5(17), 61–71.

Shadlen, M. N., & Shohamy, D. (2016). Decision Making and Sequential

Sampling from Memory. Neuron, 90(5), 927–939.

https://doi.org/10.1016/j.neuron.2016.04.036.

Sokol-Hessner, P., Hsu, M., Curley, N. G., Delgado, M. R., Camerer, C. F.,

& Phelps, E. A. (2009). Thinking like a trader selectively reduces

individuals’ loss aversion. Proceedings of the National Academy of

Sciences, 106(13), 5035–5040.

Spiliopoulos, L., & Ortmann, A. (2017). The BCD of response time analysis

in experimental economics. Experimental Economics.

https://doi.org/10.1007/s10683-017-9528-1.

Stewart, N., Hermens, F., & Matthews, W. J. (2015). Eye Movements in Risky

Choice: Eye Movements in Risky Choice. Journal of Behavioral

Decision Making, 29(2-3),116-136. https://doi.org/10.1002/bdm.1854.

Tajima, S., Drugowitsch, J., & Pouget, A. (2016). Optimal policy for

value-based decision-making. Nature Communications, 7,

12400. https://doi.org/10.1038/ncomms12400.

Toubia, O., Johnson, E., Evgeniou, T., & Delquié, P. (2013). Dynamic

experiments for estimating preferences: An adaptive method of eliciting

time and risk parameters. Management Science, 59(3),

613–640.

Tversky, A., & Shafir, E. (1992). Choice under conflict: The dynamics of

deferred decision. Psychological Science, 3(6), 358–361.

Usher, M., & McClelland, J. (2001). The time course of perceptual choice:

The leaky, competing accumulator model. Psychological Review,

108(3), 550–592.

Wabersich, D., & Vandekerckhove, J. (2014). The RWiener package: An R

package providing distribution functions for the Wiener diffusion model.

R Journal, 6(1).

White, C. N., & Poldrack, R. A. (2014). Decomposing bias in different

types of simple decisions. Journal of Experimental Psychology:

Learning, Memory, and Cognition, 40(2), 385.

Wilcox, N. T. (1993). Lottery choice: Incentives, complexity and decision

time. The Economic Journal, 1397–1417.

Woodford, M. (2014). Stochastic Choice: An Optimizing Neuroeconomic Model.

American Economic Review, 104(5), 495–500.

https://doi.org/10.1257/aer.104.5.495.

This document was translated from LATEX by

HEVEA.