Judgment and Decision Making, Vol. 14, No. 5, September 2019, pp. 573-590

Limited resources or limited luck? Why people perceive an illusory negative correlation between the outcomes of choice options despite unequivocal evidence for independence Déborah Marciano* #

Eden Krispin$ X

Sacha Bourgeois-GirondeY

Leon Y. Deouell|| **

|

When people learn of the outcome of an option they did not choose (the

alternative outcome) before they know their own outcome, they see an

illusory negative correlation between the two outcomes,

the Alternative Omen Effect (ALOE). Why does this happen? Here, we tested

several alternative explanations and conclude that the ALOE may derive

from a pervasive belief that good luck is a limited resource. In

Experiment 1, we show that the ALOE is due to people seeing a good

alternative outcome as a bad sign regarding their outcome, relative to

seeing a neutral alternative, but find no evidence for seeing a bad

alternative outcome as a good sign. Experiment 2 confirms that the ALOE

replicates across tasks, and that the ALOE

cannot be explained by preconceptions regarding outcome distribution,

including: 1) the Limited Good Hypothesis (zero-sum bias), according to

which people see the world as a zero-sum game, and assume that resources

there means fewer resources here, and/or 2) a more specific assumption

that laboratory tasks are programmed as zero-sum games. To neutralize

these potential beliefs, participants had to draw actual colored beads

from two real, distinct bags. The results of Experiment 3 were consistent

with a prediction of the Limited Luck Hypothesis: by eliminating the value

of the outcomes we eliminated the ALOE. Taken together, our results

show that either the limited good belief is so robust that it defies

strong situational evidence, or that individuals perceive good luck itself

as a limited resource. Such a limited-luck belief might have important

consequences in decision making and negotiations.

Keywords: alternative outcome, illusory correlation, alternative omen effect, zero-sum bias

1 Introduction

Imagine you are at the casino. You spot a nice little corner with two slot

machines, and hesitate between the two: should you sit on the blue one or

the yellow one? You eventually decide to go with the blue one. A moment

later, a woman sits next to the yellow one. You haven’t even pulled yet

the handle of your machine when you hear a cry of joy: the woman on the

yellow slot machine just won the jackpot! If you had to guess, what would

you say are the odds that you too will get the jackpot when you pull the

handle of the blue machine? Given what happened to the lucky lady on the

yellow machine, would you say the odds went up? Down? Are you now more or

less likely to give up using your machine and go have a quiet dinner?

The results of our recent study (Marciano-Romm et al., 2016) suggest that

most individuals would believe that their odds of winning went down

despite the clear lack of correlation between the two machines. We found

that information about the outcome of the unchosen option (“the

alternative outcome”) induces biased predictions regarding the unknown

outcome of the chosen option (“the chosen outcome”). Specifically,

individuals seem to perceive an illusory negative correlation between the

two outcomes: they see a good (bad) alternative outcome as a bad (good)

sign regarding their own outcome when the two outcomes are in fact

uncorrelated. We coined this phenomenon the “Alternative Omen Effect”

(ALOE).

Similar situations in which one has to choose between two or more options

with uncertain outcomes abound. Consider choosing between two stocks to

invest in, choosing whether to take the highway or the city roads on one’s

commute without information about the traffic situation, or choosing

between two resorts to go to for vacation. In all of these cases, the

alternative outcome might be revealed first, creating the Alternative Omen

Effect, and affecting one’s subsequent decisions (selling the stock or

zigzagging between routes). However, whereas we found that the effect is

robust, the sources of the bias remained unclear. In the present paper, we

investigate the sources of the Alternative Omen Effect: why do individuals

perceive an illusory correlation between the outcomes of choice options?

1.1 Illusory correlations

The ability to detect correlations between events is an essential component

of adaptive behavior. However, past studies have shown that individuals

are often inaccurate in their evaluation of the strength and/or the

direction of correlations between events (for reviews see Alloy &

Tabachnik, 1984; Beyth-Marom, 1982). In particular, people tend to

perceive association where there is in fact none (e.g., Bar-Hillel &

Wagenaar, 1991; Chapman & Chapman, 1967, 1969). While illusory

correlations were previously shown between an action and its outcome or

between two separate events, the perception or misperception of

correlation between the outcomes of two choice options has received little

attention.

1.2 The alternative option as a creator of expectations

In many instances, following a choice between two uncertain options, the

uncertainty is eventually resolved for both options, and we get feedback

on the outcomes of both the unchosen option (henceforth the

alternative option) and the chosen option. For instance, in such

a “total feedback” situation (Mellers, Schwartz & Ritov, 1999), while

stuck in traffic on the expressway, you might hear on the radio that the

city roads are clear. Total feedback is also common in social settings,

where one can observe the outcomes of those who selected a different

option, especially in the era of social media. A large body of work has

shown that individuals’ satisfaction with their own outcome varies as a

function of the value of the alternative’s outcome (Bell, 1982; Loomes &

Sugden, 1982; Inman et al., 1997; Mellers et al., 1999).

In all the above examples, the alternative outcome might be presented

before that of the chosen option. For example, the annual fiscal reports

of a company you decided not to invest in may be published before those of

the company whose stocks you purchased. Or, in the vacation example,

sometime before your planned vacation, you may see on Facebook pictures of

your friend having fun at the unchosen resort. In such cases, the

alternative’s outcome may induce expectations regarding the (as yet

unrevealed) value of the chosen option. Indeed, individuals might believe,

either rightly or not, that the two outcomes are correlated and hence that

the alternative’s outcome has some predictive value regarding the outcome

of the chosen option. This may be true in some cases but not in others.

1.3 The Alternative Omen Effect (ALOE)

The ALOE was established in a series of 3 behavioral experiments, using the

“Sequential Coin in the Box” (sCIB; Marciano-Romm et al., 2016, see also

Marciano et al., 2018, for neural correlates of the effect). In this task,

participants chose in each trial between two boxes appearing on the

screen, and then the outcomes of the two boxes were sequentially revealed

(the alternative outcome first in two experiments and the chosen outcome

first in the remaining experiment). For each box, the outcome was either a

monetary gain or loss. In a minority of trials, after the first outcome

had been revealed, the subjects were explicitly or implicitly probed to

predict the other outcome. In all three experiments, unbeknown to

participants, the outcomes were actually drawn randomly (P(Gain)=0.5) and

independently. Nevertheless, participants predicted a good chosen outcome

more often following a bad alternative outcome than following a good

alternative outcome, as if a negative correlation existed between the

outcomes of the two boxes. The importance of this bias was underlined by

the fact that participants actually modified their behavior based on this

illusory correlation: they were willing to pay to give up a trial before

they even saw their outcome, based on the content of the unchosen box.

Interestingly, the ALOE was significantly diminished when participants

predicted the alternative outcome after seeing the chosen outcome (vs. the

opposite), suggesting that the ALOE is modulated by self-relevance.

1.4 Understanding the sources of the ALOE

Understanding the sources of the ALOE is imperative. First, as noted,

individuals might change their behavior based on the alternative outcome,

when it is in fact an irrelevant and uninformative signal, even at a cost

(Marciano-Romm et al., 2016). For instance, in the above stocks example,

one might decide to sell the purchased stocks prematurely, following

exposure to the positive results of the unchosen stocks. Second, forming

expectations for upcoming outcomes modulates the emotional impact of these

outcomes: surprising wins are more pleasurable than expected wins, and

surprising losses are more painful than expected losses (Mellers et al.,

1997; Oliver, 1980; Churchill & Surprenant, 1982; Thompson & Yarnold,

1995; Oliver & DeSarbo, 1988).

The results of the 3 experiments in Marciano-Romm et al. suggested that the

ALOE is not based on a bias of statistical learning, in which subjects

overweigh alternating sequences, nor is it based on novelty seeking, in

which subjects a-priori prefer alternating sequences. Both explanations

were not consistent with the diminished ALOE effect when the alternative

was revealed after, rather than before, the chosen outcome and

participants had to predict the alternative outcome. Another potential

mechanism is emotion regulation. Participants might predict bad received

outcomes as an attempt to reduce their potential disappointment with

actual bad outcomes or increase their joy from unpredicted good outcomes

(Meller et al., 1997). A recent study has shown that under certain

circumstances people may bet against the occurrence of desired outcomes in

order to reduce the impact of negative outcomes – a process called

emotional hedging (Morewedge et al., 2016). In fact, in the sCIB paradigm,

participants did not appear to always get ready for the worst: rather,

they tended to predict that their outcome would be a gain (wishful

thinking; Marciano-Romm et al., 2016). Nevertheless, as seeing a good

alternative outcome sets the ground for a potential experience of regret,

participants might choose (consciously or not) to expect a bad received

outcome specifically in this case, as a way to alleviate the potential

pain of regret (Zeelenberg, 1999). While we cannot rule out the

contribution of emotion regulation to the ALOE, this explanation is

complicated by the results of Experiment 2 of Marciano-Romm et al. (2016),

in which one may experience not only regret based on the outcome, but also

regret based on the validity of the prediction. Moreover, it is also

incompatible, in any simple way, with the results of Experiment 3 of

Marciano-Romm et al. in which the participants first saw their outcome and

had to predict the alternative outcome. Consider the case of a trial in

this experiment in which the received outcome happens to be a loss. If the

alternative is then revealed to be a gain, the participant would

experience regret for not choosing the alternative option. Therefore,

under the assumption that the participant aims to alleviate the experience

of regret, she should predict a gain in the alternative. However, we found

no evidence of biased expectations in this condition.

Why is it then that people see a negative correlation between the outcomes

of choice options, when they are in fact uncorrelated? In the present

study, we examine the “why” question empirically. First, we address the

symmetry of the ALOE. Do individuals perceive a bad alternative as a good

sign, a good alternative as a bad sign, or is the ALOE a combination of

these two effects (Experiment 1)? Next, we investigated whether the ALOE

can be explained by prior beliefs regarding the limitedness of good

outcomes (Experiment 2). Finally, we tested whether the ALOE could be due

to individuals’ preference for novelty over repetition (Novelty

Preference), or to prior beliefs regarding the limitedness of luck rather

than of material resources (Experiment 3). We elaborate on each one of

these questions in the introduction to each experiment.

2 Experiment 1

Is the ALOE produced by the belief that a good alternative signals

a bad chosen outcome, by the belief that a bad

alternative signals a good chosen outcome, or by a combination

of the two? The answer depends on people’s baseline tendency to predict

that their outcome will be a gain. To examine this question, we tested for

individuals’ predictions when no information regarding the alternative is

given. This situation provides a reasonable baseline against which the

effect of a good/bad alternative can be compared.

We predicted that participants would see a good alternative as a bad sign

for their own outcome. This hypothesis was motivated by the Limited Good

theory (Foster, 1965). Foster claims that, because many desirable goods

exist in limited quantity (e.g., arable lands), people tend to generalize

and assume that other valuable goods are exhaustible as well, even when

they are not. In our task, participants would thus assume that a good

alternative means fewer good outcomes for them, which would lead to a

smaller tendency to predict a gain in the chosen box. The Limited Good

theory makes no predictions regarding the influence of a bad

alternative on prediction.

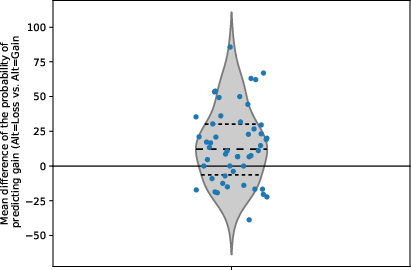

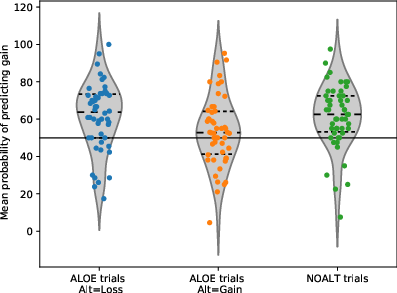

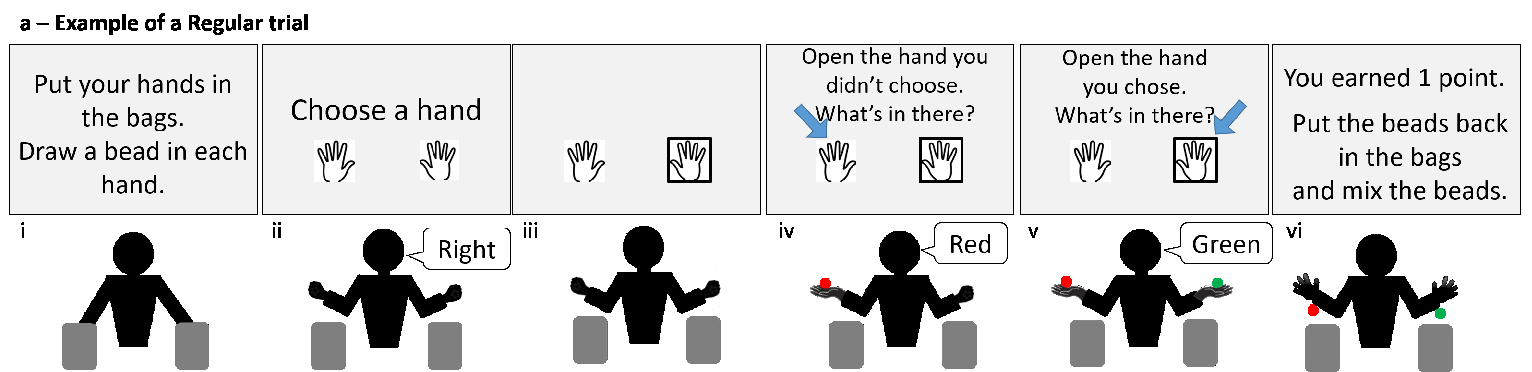

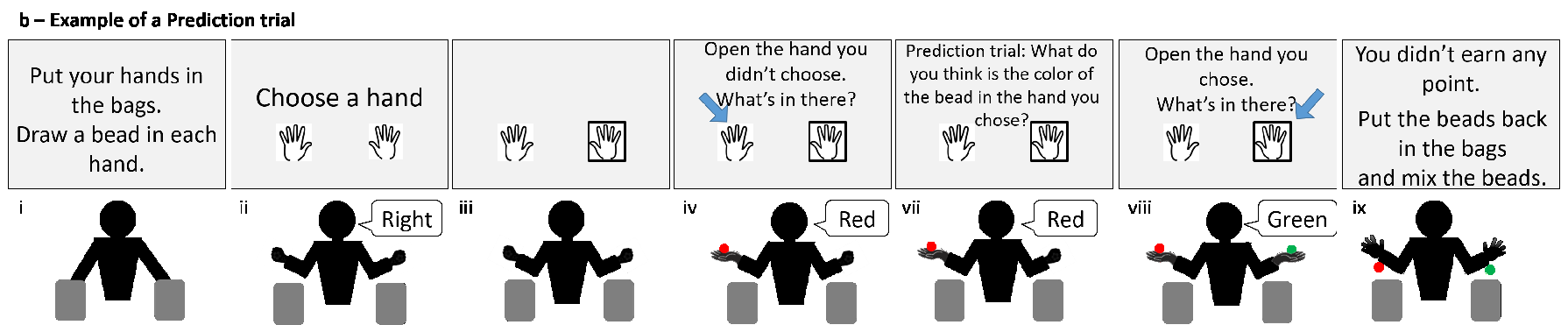

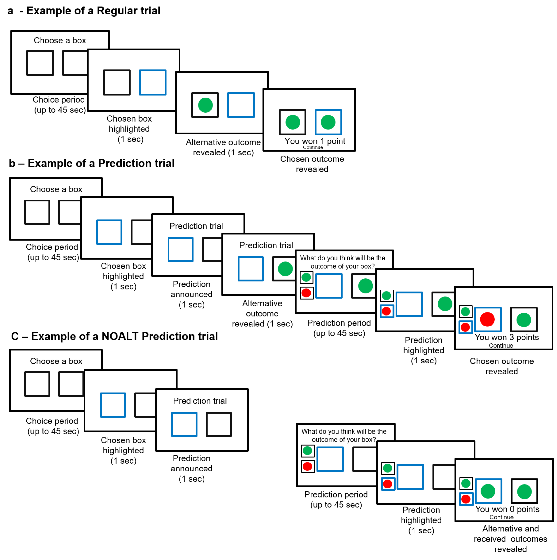

Figure 1: The Sequential Coin in the Box task.

(a) Example of a Regular trial. In this example, the participant won one point because the chosen box contained a green coin.

(b) Example of a classical Prediction trial (“ALOE Prediction trial” in Exp. 1). In this example, the participant accurately guessed that the chosen box would contain a red coin, and thus he won 3 points.

(c) Example of a NOALT Prediction trial (Exp. 1). In this example, the participant guessed that the chosen box would contain a red coin, but it actually contained a green coin. Therefore, he did not win points. Note that when the participant made a prediction, he had no information regarding the value of the alternative outcome. |

2.1 Methods

2.1.1 Participants

The experiment was conducted in Hebrew on 50 participants (24 females, mean age=24.5,

SD=2.0). All were students recruited at the Hebrew University of

Jerusalem. On average, the experiment lasted 35 minutes and participants

received 40 New Israeli Shekels (approximately $11.70).

2.1.2 Stimuli and procedure

Participants sat in cubicles, about 60 cm away from the computer monitor.

The task was programmed in C++ language. Participants encountered the

following types of trials:

Regular trials (120 trials; Figure 1a): Participants saw two boxes

on the screen (7.93 by 7.93 cm). They were told that each box would contain

either a green or a red coin (radius: 2.31 cm). Participants had to choose

a box by clicking on it using the computer mouse. If the participant did

not make a choice within 45s, a choice was randomly made by the computer

(however, this time limit was never reached). When a choice was made, a

blue frame (0.26 cm wide) immediately appeared around the chosen box and

remained visible until the end of the trial. One second after the

appearance of the blue frame, the outcome of the unchosen box appeared in

the middle of the box. After one additional second, the outcome of the

chosen box appeared as well, together with written feedback (“You lost 1

point”/”You won 1 point”), based solely on the outcome of the chosen box:

if the chosen box contained a green (red) coin, participants won (lost) 1

point. In order to move on to the next trial, participants had to click on

a “Continue” box that appeared at the bottom of the screen together with

the opening of the second box.

ALOE Prediction trials (40 trials; Figure 1b): The trials began

exactly as Regular trials. Participants saw two boxes on the screen and

were asked to choose a box by clicking on it. After a choice was made, a

blue frame immediately appeared around the chosen box and remained until

the end of the trial. One second after the blue frame appeared, yet before

any box opened, the words “Prediction trial” appeared on the screen, and

stayed on the screen for one second. The outcome of the unchosen,

alternative box then appeared in the middle of the box. After a second, the

following question appeared on the screen: “What do you think will be the

outcome of your box?” Together with the question, two small “prediction

buttons” (5.29 by 5.29 cm) appeared on the side of the chosen box, one on

top of the other. One contained a small red coin, and the other one a small

green coin. Whether the upper button contained a red or a green coin was

determined randomly in each trial. Participants had to guess the outcome by

clicking on one of the two buttons. If no choice was entered within 45s,

the prediction was chosen randomly by the computer (this time limit was

never reached). Once the choice had been made, a blue frame appeared around

the chosen prediction button. After a second, the outcome of the chosen box

appeared on the screen, together with the written feedback “You won 3

points” if the participant correctly predicted her outcome, or “You won 0

points” if the prediction was wrong. That is, winning was based solely on

the accuracy of the prediction, rather than on the chosen outcome.

NOALT Prediction trials (40 trials; Figure 1c): The trials were

identical to ALOE Prediction trials, except that the “alternative outcome

revealed” step was skipped. That is, participants were asked to guess the

outcome of their box without seeing the alternative outcome. In the last

step of the trial, the two outcomes were revealed simultaneously, together

with the feedback regarding the accuracy of the participant’s prediction.

As noted, to reduce the motivation to form strategies irrelevant to the

study, the payoff for both NOALT and ALOE Prediction trials was determined

by participants’ predictions only. That is, participants did not lose or

win money according to the color of the coin in the chosen box. Indeed, if

we had rewarded/punished participants based on the outcome as well as the

prediction, participants aiming to limit their losses might have been

tempted always to predict that the chosen box would contain a red coin

(Morewedge et al., 2016). The same logic held for Experiment 2 below.

There were no Prediction trials in the first 10 trials of the experiment,

so that participants had a chance to experience the lack of correlation

between the outcomes. The distribution of the remaining 190 trials was

pseudo-random. The trials were divided into 10 concatenated chunks: in

each chunk there were 11 Regular trials and 8 Prediction trials (4 of them

ALOE Prediction and 4 of them NOALT Prediction). Within each chunk the

order of the trials was random. This procedure ensured a constant

probability of Prediction trials during the experiment. Participants were

also unaware of the number of trials (neither in total nor divided into

“Regular” and “Prediction” trials).

Participants were not told that, overall, the two boxes had the same

probability of containing a green coin (0.5). That is, there were no

“good” or “bad” boxes. Moreover, unbeknown to the participants, the

outcomes of each trial were predetermined. That is, each outcome

combination (Received=Gain + Alternative=Loss; Received=Loss +

Alternative=Gain; both = loss; or both = gain) appeared in 25% of the

trials.

Every 3 points accumulated during the game were worth one New Israeli

Shekel (approximately $0.29).1

2.2 Statistical analysis

For each participant, we computed the probability of choosing “Gain” in

each of the three experiment conditions: in NOALT trials; in trials when

the alternative was a gain (AltGain trials); and in trials when the

alternative was a loss (AltLoss trials). These probabilities were entered

into a one-way repeated measure ANOVA with conditions NOALT, AltGain,

AltLoss.

In addition, to be consistent with the analyses presented in Marciano-Romm

et al., we ran a series of logistic regressions using a Generalized

Estimating Equation (GEE) clustered by participant (Hanley et al., 2003).

The regression analysis allows us to control potential confounding

factors. The details of the regressions and the results are provided in the

Supplement (Tables 1-2)

All the analyses presented in this paper resulted in similar results with

both approaches.

2.5ex

2.5ex

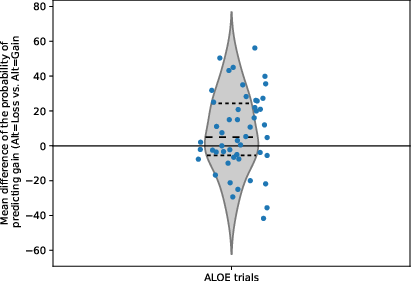

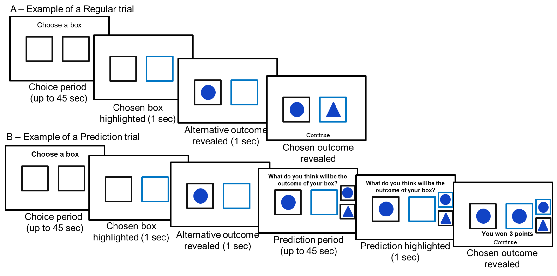

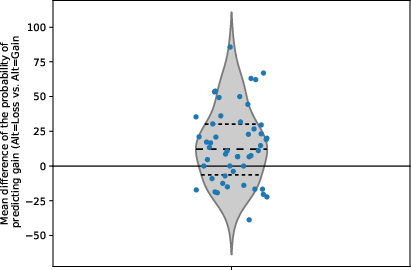

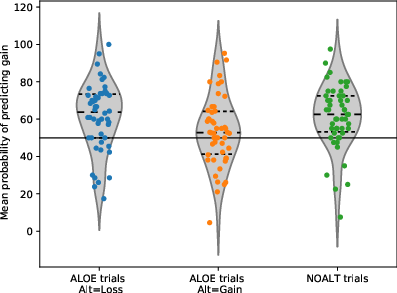

Figure 2: Violin plots. Each dot represents a participant. The black dashed lines indicate the 25th, 50th and 75th quartiles of the distribution. The width of the outline (‘violin’) represents the density of observations at each level. The plots were realized using the seaborn.violinplot function in Python.

a) Distribution of the mean probability of predicting Gain by type of prediction trial. The solid horizontal line indicates 50%.

b) Distribution of the difference between the mean probability of predicting gain when the alternative was a loss vs. a gain. The solid horizontal line indicates zero. |

2.3 Results

2.3.1 Descriptive statistics

On average, participants chose the right-side box in 54.84% of the trials

(SD=25.009, Range: [2.5–99.5]). In ALOE Prediction trials, participants

predicted that there was a green coin in the chosen box in 57.15% of the

trials (SD=15.278, Range: [22.5–97.5]); in NOALT Prediction trials, this

number was equal to 61.2% (SD=17.285, Range: [7.5–97.5].

As expected, participants’ overall predictions were at chance: they were

accurate on average in 47.93% of the trials (SD= 6.10, Range: [35–60]).

2.3.2 ALOE results

The probability of predicting gain differed significantly across the 3

conditions F(2,98)=4.97, p=0.0088; Figure 2). Planned contrasts demonstrated that the

probability of predicting gain was significantly lower when the alternative

outcome was a gain (mean=53.55, SD=18.930) than when the alternative was a

loss (mean=61.248, SD=18.369; t(49)=−2.43, p=0.0189), thus replicating the

ALOE effect. Critically for the present experiment, the probability of

predicting gain was significantly lower when the alternative outcome was a

gain than when no alternative was shown (NOALT trials, mean=61.20,

SD=17.285; t(49)=−3.084,p=0.0034). However, the probability of predicting

gain when the alternative outcome was a loss did not significantly differ

from the probability of predicting gain when no alternative outcome was

shown (t(49)=0.017, p=0.9862). Similar results were found in the GEE

analysis (see Supplement

Tables 1–2).

There was a larger absolute difference between AltGain and NOALT, than

between NOALT and AltLoss, but the difference was not quite significant

two-tailed (t(49)=1.8338, p=0.0728).2 The

same contrast using the GEE approach, which

included potentially relevant covariates as well using a different

statistical approach, was significant (p=0.0058;

Supplement).

2.4 Discussion

Experiment 1 provides a clear replication of the Alternative Omen Effect.

In ALOE Prediction trials, participants were significantly less likely to

predict that the outcome of the chosen box would be a gain when the

alternative’s outcome was a gain than when it was a loss. Going beyond the

replication, the results of Experiment 1 also show that prediction of a gain was

less likely when the alternative’s outcome was not reported (the NOALT

Prediction trials). It thus seems that the Alternative Omen Effect is

an asymmetric bias: we found that optimism was reduced,

compared to the NOALT Prediction trials, when the alternative outcome was

a gain, but we found no evidence that predictions differed from this baseline

when the alternative outcome was a loss. We can therefore refine the ALOE: it appears to be

mostly due to individuals seeing a good alternative outcome as a bad sign

regarding their outcome. The ALOE could thus be classified as a negative

superstition (Wiseman & Watt, 2004), as it reflects the idea that a

certain omen (seeing a good alternative outcome) is magically associated

with potentially harmful consequences (getting a bad outcome). This result

seems consistent with the notion that most superstitions that come to mind are

negative rather than positive (e.g., in Western societies: walking under a

ladder, seeing a black cat, breaking a mirror, spilling salt) rather than

positive (e.g., finding a penny),3 although we couldn’t find scientific literature

supporting this intuition.

Experiment 1’s findings also reinforce the idea that the Novelty Preference

Hypothesis cannot provide a good explanation for the Alternative Omen

Effect: why would individuals be attracted to change when the alternative

outcome is a green coin, but not when it is a red coin?

Experiment 2 was designed to test whether the ALOE can be explained by

prior beliefs regarding outcome distribution.

3 Experiment 2

3.1 Introduction

In their seminal paper on the assessment of correlation by humans and

animals, Alloy and Tabachnik (1984) argue that the perception of

correlation between events is determined not only by the information

provided by the environment about the objective correlation, but also by a

person’s prior expectations about this correlation. When the situational

information is unavailable or weak, individuals rely on their prior

expectancies. In Experiment 1 above, one could argue that the situational

information was weak: a null correlation is ambiguous. Moreover, while the

outcomes of the two boxes were drawn randomly and independently, the

drawing mechanism was not visible, nor explained to participants: it was

hidden in the computer’s “black box”. Thus, according to Alloy and

Tabachnik, these settings might have encouraged participants to make

predictions according to their prior beliefs, at least until they got

enough information on the actual correlation. As it appears, these prior

beliefs were, on average, that the outcomes of the two boxes were

negatively correlated, or at least that a good alterntative outcome was

correlated with a bad received outcome (per Experiment 1 above). Why is it

then that people expect the outcomes of the two choice options to be

correlated? We offer two putative explanations, which are not mutually

exclusive, related to the way people might perceive an outcome

distribution.

3.1.1 Individuals might assume that good outcomes exist in limited

quantities: The Limited Good Hypothesis

People might subscribe to a belief that life is a zero-sum game for goods:

they might assume (perhaps for a good reason) that particularly valuable

goods and resources exist in finite limited quantities and generalize from

goods that are indeed limited to other goods that are not (Foster, 1965).

One might thus believe that there are only so many green coins in the world

of the sCIB game. With this belief in mind, a participant seeing a green

coin in the alternative box will conclude that there are fewer green coins

available in this trial, and thus that the chances of getting a green coin

in the chosen box are smaller than if the alternative outcome was red.

3.1.2 Individuals might have preconceptions about experimental

design

A less far-reaching yet plausible possibility is that the Alternative Omen

Effect we observed does not reflect an overarching belief about the world,

but merely a belief about the way experimenters design and program

computerized experiments. Subjects might believe that lab experiments are

programmed as zero-sum games; that is, they believe that experimenters are

unlikely to design a game in which you win or lose no matter which option

you choose. With such a belief in mind, seeing a good alternative outcome

also translates to a higher chance of receiving a bad outcome.4

If the ALOE is indeed a manifestation of prior beliefs regarding outcome

distribution, either in general or in the experiment, then neutralizing

these beliefs should lead to an elimination of the effect. To that end,

we made the situational evidence of the outcome distribution unequivocal

in the present experiment. We developed the Sequential Bead in the Bag

task (sBIB), a task very similar in essence to the Sequential Coin in the

Box (sCIB), but happening in the real, analog world, outside of the

computer’s digital realm. Instead of choosing between two boxes presented

on a computer screen, participants are asked to choose between two

physical bags and to manually draw actual palpable colored beads from

them. In the sBIB, the generating mechanism is doubly transparent. First,

it is clear that the two bags are separate entities, that the outcomes of

the two bags must be independent, and that the resources cannot be

exhausted as the beads are returned to the bags after each trial. Second,

participants are the ones drawing beads from the bags, thus experiencing

the randomness of the game and the fact that it is not rigged. In such

conditions, there is no room for participants’ potential preconceptions

about the kind of sequences that can be generated in the game. This

experiment also neutralizes by design the potential effect of local

correlations. Even if the subject noticed such spurious correlations, the

physical situation is such that participants should deduce that this

happened by pure chance.

We also asked participants to fill the recently introduced Belief in a

Zero-Sum Game scale (BZSM; Różycka-Tran et al., 2009; Różycka-Tran et al.,

2015). While the questionnaire focuses on the perception of social

interactions, Różycka-Tran and colleagues hypothesize that it is likely to

reflect one’s belief that life in general has a zero-sum game structure.

If the ALOE reflects prior beliefs regarding outcome distribution, we

should expect people scoring higher on the BZSM to evince a stronger ALOE

than people scoring lower.

3.2 Methods

3.2.1 Participants

The experiment was conducted on 50 students from the Hebrew University of

Jerusalem (34 females, mean age=24.1, SD=2.54). On average, the experiment

lasted 35 minutes and participants received 40 New Israeli Shekels

(approximately $11.70).

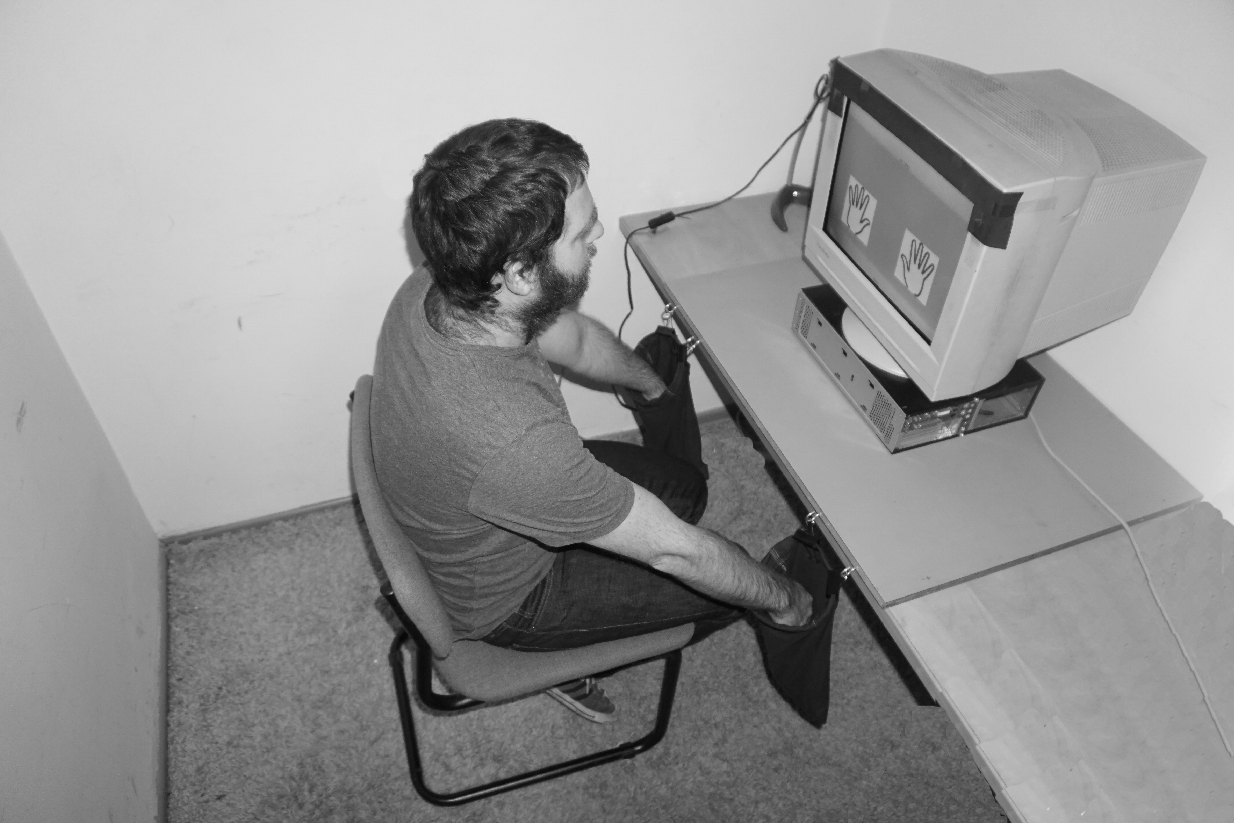

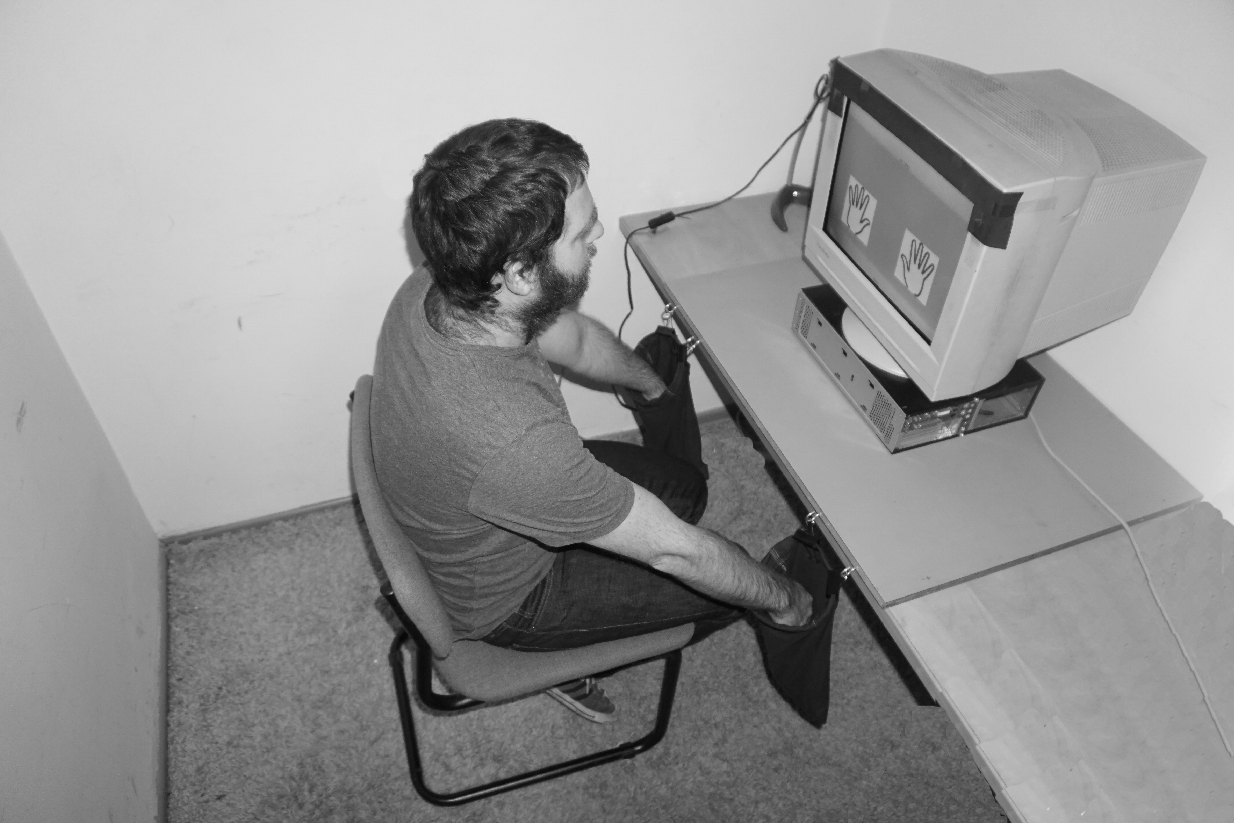

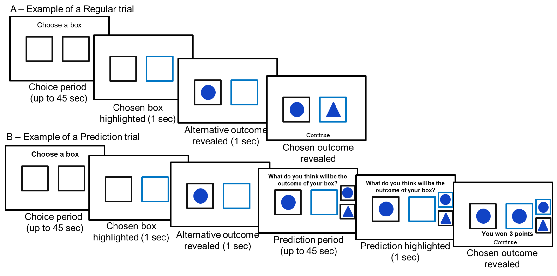

| Figure 3: The experimental settings. |

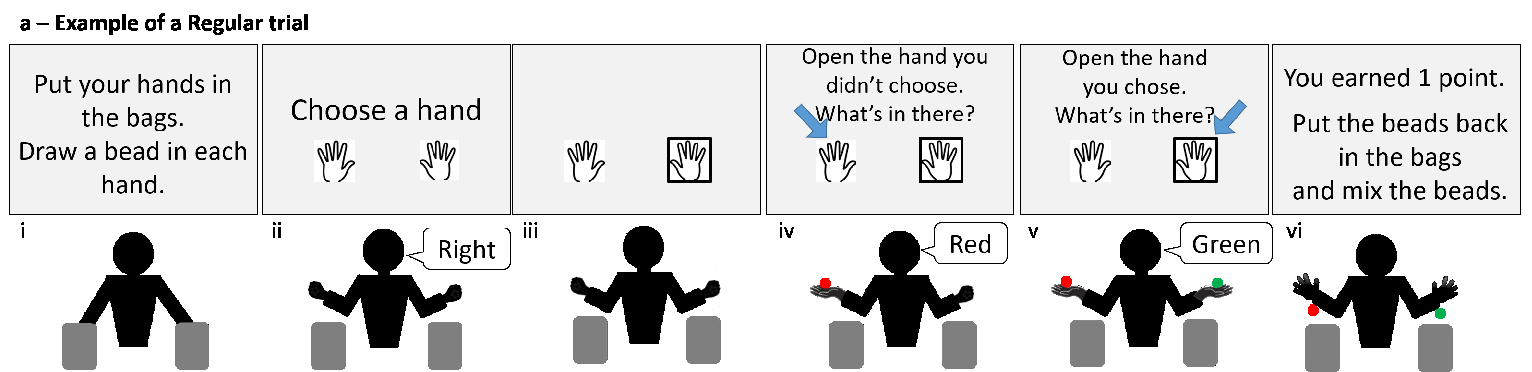

Figure 4: The Sequential Bead in the Bag game (sBIB) Upper panel: the computer screens displayed to participants. Lower panel: a schematic back view of the participant and the bags.

(a) Example of a Regular trial. In this example, the participant earned one point because there was a green bead in the chosen hand.

(b) Example of a Prediction trial. In this example, the participant didn’t earn points because his guess wasn’t accurate. |

3.2.2 Procedure

The Sequential Bead in the Bag game (sBIB)

Participants sat in a small room, in front of a desk (Figure 3). Before the

game began, oral instructions regarding the task as well as regarding the

payment were given to participants. Participants were instructed to

blindly pick beads from two identical totally opaque dark blue cotton bags

(depth: 30cm) hanging down from the side of the desk facing the

participant, the participant’s own knees separating the two bags. There

underside of the table was free of any objects and visible to the

participant. The distance of the subjects from the bags was such that they

could put their right and left hand comfortably down the right and left

bags, respectively, but could not see into the bags. Participants were

told that each bag contained green and red beads. They were not informed

of the precise beads distribution (50 green beads and 50 red beads in each

bag). With the exception of their color, all the beads (13mm diameter)

were identical and could not be differentiated based on touch. A computer

screen placed on the desk was used solely for presenting instructions

regarding each step of the trials and for recording decisions and events

by the experimenter, who sat in the room behind the participants.

Participants encountered two different types of trials, equivalent to those

presented digitally in Experiment 1:

“Regular trials (50 trials; Figure 4a): Participants were asked to

put their right hand in the right bag and their left hand in the left bag,

and to draw one bead in each hand. Participants could not see the beads or

their hands in the bag (Figure 4a). While holding the selected beads in

their closed fists outside the bag, participants had to choose a hand by

stating out loud “Right” or “Left” (Figure 4a-i). As soon as the

experimenter entered the choice into the computer, a black frame appeared

around the drawing of the corresponding hand on the screen (Figure 4a-iii)

and remained visible until the end of the trial. The goal of this feature

was to help the participant remember his or her current choice. Five

hundred milliseconds after the appearance of the frame, participants were

asked to open the unchosen hand and to report out loud the color of the

bead in this hand (that is, the alternative outcome; Figure 4a-iv). Once

the alternative outcome was entered into the computer by the experimenter,

participants were asked to open the chosen hand and to report the color of

the bead in this hand (that is, the chosen outcome; Figure 4a-v). Feedback

then appeared on the screen accordingly (Figure 4a-vi). Participants earned

one point if there was a green bead in the chosen hand, and they lost one

point if there was a red bead in the chosen hand. At the end of the trial,

participants were instructed to drop each bead back into its

bag5,6 and to mix the

beads.

“Prediction trials (30 trials; Figure 4b): The trials began exactly like

the Regular trials (steps (i) to (iv)). However, after participants opened

the unchosen hand, instead of being asked to open the chosen hand, the

following sentence appeared on the screen: “Prediction trial: what do you

think is the color of the bead in the hand you chose?” (Figure 4b-vii).

Participants had to guess the outcome of the chosen hand by saying out

loud “Green” or “Red.”7 Once the experimenter entered the prediction into the

computer, participants were asked to open the chosen hand and to report

the color of the bead (Figure 4b-viii). Feedback then appeared on the screen

(Figure 4b-ix). Participants earned 3 points if their prediction was

accurate, and they did not earn or lose points if their prediction was

wrong. As in Experiment 1, to reduce the motivation to form strategies

irrelevant to the study, the payoff on Prediction trials was determined by

prediction accuracy only.

Regular and Prediction trials were pseudo-randomly mixed, under the

constraint that there would be no Prediction trials in the first 10 trials

of each block. Participants were unaware of the number of trials (neither

in total nor divided into “Regular” and “Prediction” trials).

The room was dimly lit by the computer screen and a small table lamp

(either on the right or the left side of the computer screen,

counterbalanced across subjects). The light was sufficient to allow the

participants and the experimenter to see the colors of the drawn beads

clearly but did not allow the participants to see into the bags.

Participants were told that they would earn 20 New Israeli Shekels

(approximately $5.85) for their participation in the experiment, and that

they could earn a significant bonus depending on their performance in the

task. Every 3 points accumulated during the game were worth one New

Israeli Shekel (approximately $0.29).

Questionnaires

At the end of the experiment, participants were asked to fill in the Belief

in a Zero-Sum Game scale (Różycka-Tran et al., 2009; Różycka-Tran et al.,

2015). Forty participants filled out the questionnaire. The scale was

composed of 8 items, rated on a seven-point Likert scale, ranging from one

(strongly disagree) to seven (strongly agree). Examples of items from the

questionnaire are: “Life is so devised that when somebody gains, others

have to lose” and “When some people are getting poorer, it means that

other people are getting richer.”

3.3 Statistical analysis

3.3.1 Analysis of the behavioral data

For each participant, we computed the difference between the probability

of predicting that the received outcome would be a gain given that the

alternative was a loss, and the probability of predicting that the

received outcome would be a gain given that the alternative was a gain

(P(pred=gain|alt=loss) − P(pred=gain|alt=gain). We then

ran a t-test across subjects to test whether this difference was superior

to zero as hypothesized. In addition, to be consistent with our previous

report of the ALOE (Maciano-Romm et al., 2016), we ran a logistic

regression clustered by participant (see Table 3 in the Supplement for

details and results) All the analyses presented in this paper resulted in

similar results with both approaches.

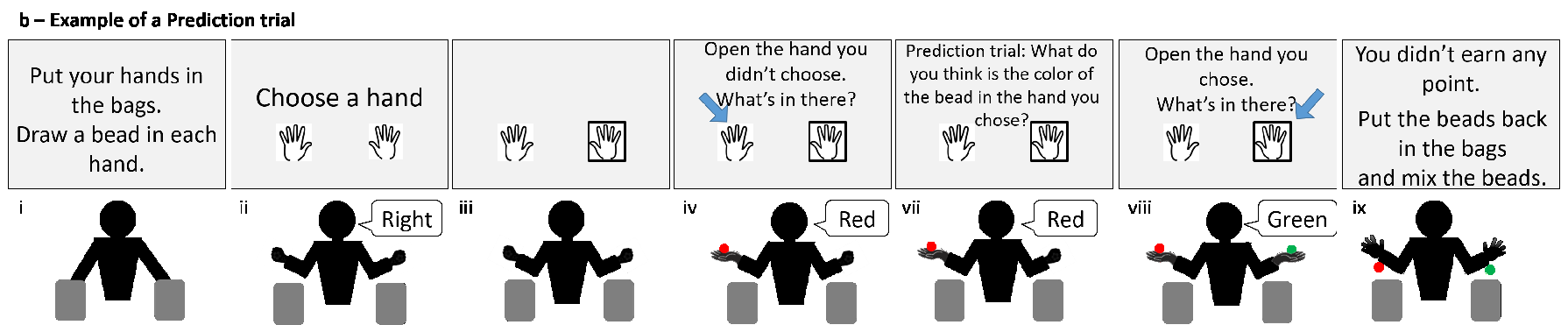

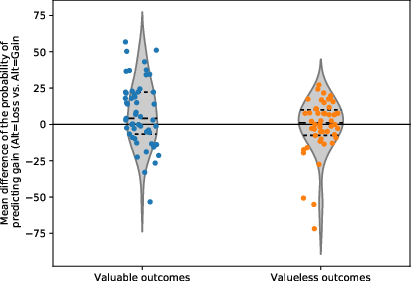

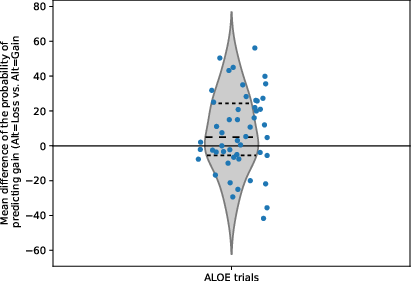

| Figure 5: Distribution of the difference between the mean probability of predicting Gain when the alternative was a loss vs. a gain. Each blue dot represents a participant. The black solid line indicates zero. The black dashed lines indicate the 25th, 50th and 75th quartile. The width of the outline (‘violin’) represents the density of observations at each level. |

3.4 Results

3.4.1 Descriptive statistics

On average, participants chose the right hand on 53.85% of the trials

(SD=25.132, Range: [0–100]). There was a green bead in the chosen hand on

52.45% of the trials (SD=6.045, Range: [38.75–67.5]), and in the

alternative hand in 50.275% of the trials (SD=6.465, Range:

[33.75–63.75]). In Prediction trials, participants predicted that there

was a green bead in the chosen hand in 52.267% of the trials (SD=21.322,

Range: [0–100]).8 As expected,

participants’ overall predictions were at chance: they were accurate on

average in 49.4% of the trials (SD=11.851, Range: [30–83.333]).

3.4.2 Effect of the alternative

Across participants, the probability of predicting “Gain” was significantly

higher when the alternative outcome was a loss (mean=59.401, SD=22.146) vs.

a gain (mean=44.614, SD=28.538, t(49)=3.8382, p=0.0004; Figure 5). Similar results

were obtained with the regression analysis (see Supplement Table 3).

The correlation between the effect of the alternative value on predictions

and the scores on the zero-sum questionnaire was not significant

(Spearman’s ρ=−0.0536, p=0.7117).

3.5 Discussion

Experiment 2 shows that the ALOE cannot be explained solely by

preconceptions participants might have regarding outcome distributions, or

regarding the way experimenters design computerized experiments. The ALOE

did not disappear when we tested it in a non-computerized, physical setup

in which any dependence between the two outcomes, and thus any effect of

resource limitation, was physically inconceivable.

The lack of correlation between the Belief in a Zero-Sum Game questionnaire

and the ALOE is consistent with these conclusions, although, as a null

result, it should be taken with caution. First, the power (40

participants) was relatively low for this type of questionnaire. Second,

it could also be a matter of construct validity. The Belief in a Zero-Sum

Game questionnaire focuses on whether people believe that one person’s

gain is possible only at the expense of other persons. In our experiments,

no social relations are formed.

The persistence of the ALOE in the current low-tech version of the

experiment alleviates any explanation of the ALOE as resulting from effects

of local correlations, or from other spurious effects that might influence

the way participants estimate the actual relationship between the

outcomes.9 However, by design, the current experiment renders control for

such relationships redundant: regardless of any biased calculations, the

physical situation is such that the independence between outcomes is

unequivocal. Moreover, the fact that the beads were returned to the bags

after each trial, by the participants, “resets” the game, and mitigates the

possible effects of any perceived local correlations.

In summary, Experiment 2 suggests that the ALOE does not derive from a

limited goods belief — at least in its explicit form — as it persisted despite unequivocal situational

evidence to the contrary. This raised the possibility that, even if

participants cannot possibly believe that the drawing of a green bead from

one bag depletes the amount of green beads in the other bag, they might

still believe that it reduces their chances of drawing another green bead

because of the restriction of good luck (henceforth Luck)

in each trial. In the final experiment, we began to address this

hypothesis.

4 Experiment 3

4.1 Introduction

In the Limited Goods Hypothesis presented in Experiment 2, green

coins are perceived as the limited goods. In the Limited-Luck

Hypothesis, on the other hand, Luck itself, rather than green

coins, is the resource perceived as limited. Indeed, one might believe that

there is only so much luck in the world, or in the game, and that if some

of it has been allocated to the alternative outcome in a given trial, then

there is that much less luck left for one’s received outcome. With this

belief in mind, a participant seeing a green coin in the alternative box or

hand will conclude that luck has been “depleted” in this trial, and thus

that his or her chances of getting a green coin in the chosen box (in the

sCIB) or hand (in the sBIB) have been reduced. We hypothesized that if luck

is the determining factor, then removing the value from the outcomes should

eliminate the ALOE.

In the present experiment, we replicated the original ALOE experiments

using the Sequential Coin in the Box task (Figure 1a,b); the only difference

was that in the present experiment we did not attach value to the content

of the boxes. That is, participants did not win or lose money in Regular

trials, but only in Prediction trials. This manipulation allowed us to

eliminate the role of luck, as there was no good or bad outcome, and thus

no lucky or unlucky draw. Persistence of the effect would rule out the

Limited Luck Hypothesis and could suggest that the ALOE was due to a

preference for novelty.

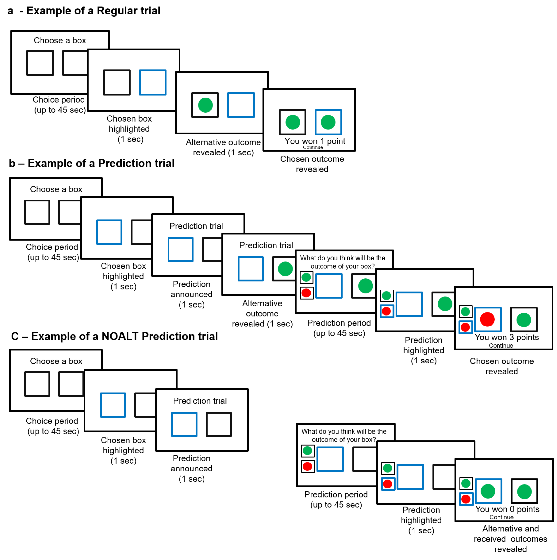

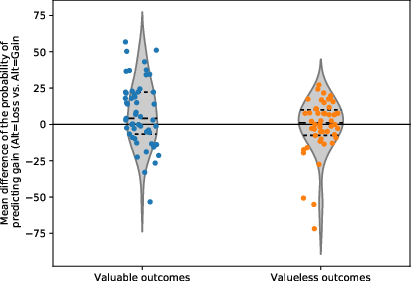

Figure 6: Experiment 3 paradigm.

(a) Example of a Regular trial. Notice that the participant does not win or lose points in Regular trials.

(b) Example of a Prediction trial. In this example, the participant accurately guessed that the chosen box would contain a triangle, and thus he won 3 points. |

4.2 Methods

4.2.1 Participants

The experiment was conducted on 50 students (26 females, mean age=24.4,

SD=1.87). On average, the experiment lasted 35 minutes and participants

received 40 New Israeli Shekels (approximately $11.70).

4.2.2 Procedure

The task

The task was a computerized game replicating the sCIB task (Experiment 1)

with the following exceptions:

-

Instead of green and red disks we used a blue disk and a blue

triangle. The color blue was chosen in order to avoid the possible

cultural association of red and green with specific valence (Figure 6).

- Participants could not win or lose money in Regular trials and thus

the disk or triangle were not associated with gain or loss. Participants

could only gain money (3 points per trial) by making correct predictions

in the Prediction trials.10

4.3 Statistical analysis

The analysis scheme was equivalent to the analysis of Experiments 1 and 2,

with the necessary changes. For each participant, we computed the

difference between the probability of predicting that the received outcome

would be a disk, when the alternative outcome was a disk, and when the

alternative outcome was a triangle. We then ran a one-sample t-test across

participants on these differences.

4.4 Results

4.4.1 Descriptive statistics

On average, participants chose the right-side box in 57.78% of the trials

(SD=36.574, Range: [0–100]). In Prediction trials, participants predicted

that there was a disk in the chosen box in 48.775% of the trials

(SD=8.966, Range: [8.75–61.25]). As expected, participants’ overall

predictions were at chance: they were accurate on average in 50.58% of

the trials (SD=9.620, Range: [37.5–86.25]).

4.4.2 Effect of the alternative

We found no significant difference between the probability of predicting

“disk” when the alternative was a disk (mean=49.274, SD=14.952), and when

the alternative was a triangle (mean=48.138, SD=10.946; t(49)=0.4185,

p=0.6774; Figure 7). Similar results were obtained with the regression analysis (see

Supplement Table 4).

The absence of the ALOE in this experiment suggests that for the ALOE to

occur, the outcomes of the choice options have to hold some value.

However, these results should be interpreted cautiously as they rely on the

acceptance of the null hypothesis. To directly test the impact of the

outcomes’ value on the ALOE, we conducted two additional analyses. First,

we compared participants’ behavior in Experiment 3 to participants’

behavior in the zero correlation block of Experiment 1 of Marciano-Romm et

al. (2016, 53 participants).11 Importantly, Experiment 3 was

purposely designed to be identical to Experiment 1 of Marciano-Romm et al.

(2016): we used the same instructions, the same stimuli (colored disks and

triangles), and the same incentives for predictions (3 points for accurate

predictions). The only difference between the two paradigms is that in

Marciano-Romm et al., participants lost or gained money in Regular trials

according to the content of the chosen box, whereas in the current

Experiment 3, the outcomes had no value. For each participant in Experiment

1 of Marciano-Romm et al. we calculated the difference in the probability

of predicting “Gain” when the alternative was a gain vs. a loss, as we did

for the current study. We then ran a t-test between the groups from the

different experiments on these differences. We found that the differential

influence of the alternative on predictions in the current study

(mean=−1.136, SD=19.193) was significantly lower than in Experiment 1 of

Marciano-Romm et al. (mean=7.313, SD=22.635, t(101)=2.0374, p=0.0442). A

similar approach was taken with the GEE analysis, which yielded similar

results (see Table 5 in the

Supplement). This

confirms that the ALOE is significantly modulated by the value (or the

absence thereof) of the choice options’ outcomes.

Figure 7: Distribution of the difference between the mean probability of predicting Gain when the alternative was a loss vs. a gain. The black dashed lines indicate the 25th, 50th and 75th quartile. The width of the outline (‘violin’) represents the density of observations at each level.

The left “violin” shows the distribution for Experiment 1 of Marciano-Romm et al. (2016), which is used here as a control condition in which the outcomes were valuable; the right violin shows the distribution for Experiment 3 in which the outcomes were valueless. Each dot represents a participant. |

Second, we performed a Bayesian analysis, to assess the likelihood of

having no effect of the alternative outcome in Experiment 3, given the

data. Bayes factors (BFs) reflect the strength of evidence for one

hypothesis relative to another. In contrast with null-hypothesis

significance testing, BFs can distinguish sensitive evidence for

the null hypothesis H0 from no evidence for any conclusion at all (Dienes,

2014). The results of the analysis indicate evidence for a lack of ALOE

when the outcomes of choice options are valueless (BF<1/3). The

details of this analysis appear in the

Supplement (Table 6).

4.5 Discussion

According to the Limited Luck Hypothesis, the positive value of the

alternative outcome indicates a depletion of good luck, which instigates

negative expectations for the value of one’s outcome. A

direct prediction of this hypothesis is that the elimination of value will

eliminate the ALOE. The results of Experiment 3 are consistent with this

prediction: we neutralized the potential role of luck by making the

outcomes of the boxes equally valueless, and the ALOE was eliminated. In

addition, these results rule out mechanisms based on Novelty Preference.

Indeed, under the Novelty Preference hypothesis, one would expect the ALOE

to persist in Experiment 3, independently of the value (or lack of value)

or the outcomes.

5 General discussion

We recently showed that after making a choice between two uncertain

options, people tend to perceive an illusory negative correlation between

the outcomes of these two options. That is, people see a good (bad)

alternative outcome as a bad (good) sign of their own outcome, when the

two outcomes are in fact uncorrelated – an effect we coined the

Alternative Omen Effect (Marciano-Romm et al., 2016). Here, we confirmed

the robustness of the ALOE across settings, and explored

potential explanations for this novel bias. We find that the ALOE is due

to individuals seeing specifically a good alternative outcome as a bad

sign regarding their outcome, but find no evidence that they see a bad

outcome as a positive sign. In that respect, the ALOE seems to be asymmetric. We

rule out explanations of the ALOE based on (1) Novelty Preference, (2)

local correlations with or without biased contingency perception, and (3)

the Limited Goods Belief. Rather, we suggest that the ALOE could be

related to the Limited Luck Belief.

5.1 The ALOE is a robust bias

The Alternative Omen Effect is a newly described bias that has been

reported so far in one article only. Experiment 1 provided a direct

replication of the original ALOE findings (Marciano-Romm et al., 2016).

Experiment 2 allowed us to test the ALOE’s robustness in two ways. First,

we tested the ALOE in a different environment: we used a low-tech paradigm

instead of a computerized task. Second, we investigated whether the effect

survives when the lack of correlation between the outcomes is made

obvious. We believe that having participants draw beads from two real,

distinct cloth bags and experience by themselves that the two bags did not

communicate (i.e., there was no “secret tunnel” between the two) is

stronger than explicitly telling participants about the lack of

correlation between the outcomes, as individuals in general are not

acquainted with the statistical terms “correlation” and “covariation”.

Despite the changes in the paradigm, and despite the unequivocal

situational evidence, we found a strong ALOE in this experiment too.

5.2 The Alternative Omen Effect is distinct from the Gambler’s

Fallacy

The Alternative Omen Effect bears a similarity to the Gambler’s Fallacy,

yet the two phenomena are distinct. First, the ALOE relates to the

perception of a correlation between the outcomes of two different

generators (two boxes or two bags), whereas the Gambler’s Fallacy does not

occur when a second generator is introduced (e.g., when the coin is changed

in the middle of the experiment; Gold & Hester, 2008; or when a different

person tosses the coin; Roney & Trick, 2009). Second, the Gambler’s

Fallacy occurs even when the outcomes of the random process are valueless

(e.g., in the case of a coin toss, “heads” is not considered a good or a

bad outcome). In contrast, in Experiment 3 we found no ALOE when the

outcomes of the choice options are valueless. Finally, while the ALOE

seems to be asymmetrical (Experiment 1), the Gambler’s Fallacy is

symmetrical: people predict tails after a streak of heads just as they

predict heads after a streak of tails.

5.3 The ALOE is not due to novelty preference

According to the Novelty Preference Hypothesis, individuals are attracted

to change rather than repetition, and thus would prefer to see a

red coin after seeing a green coin, regardless of the value attached (or

not) to these events. This is inconsistent with Experiment 3’s findings,

as making the boxes’ outcomes valueless made the ALOE disappear.

Additionally, the Novelty Preference Hypothesis cannot provide a good

explanation of the asymmetry found in Experiment 1. Similarly, the Novelty

Preference Hypothesis cannot account for the effect of self-relevance

(Marciano-Romm et al., 2016): there is no good reason to expect

individuals to be attracted to change when they have to predict the

content of their box, but not when they have to predict the alternative

outcome. It thus seems reasonable to conclude that the ALOE is not a

manifestation of novelty preference.

5.4 The ALOE could be due to emotion regulation

The findings of the present studies can be explained by the emotion

regulation hypothesis. According to this mechanism, individuals form

expectations regarding the value of the received outcome aiming to

regulate the emotions this outcome might elicit. In this framework, the

asymmetry of the ALOE found in Experiment 1 indicates that it is

specifically regret that people try to regulate by expecting that a good

alternative will be followed by a bad received outcome. In Experiment 3,

when there were no valuable outcomes at stake, one does not need to

regulate emotions as much, which is in line with the lack of ALOE found in

this study. However, as discussed in the introduction section, emotion

regulation cannot explain some of the previous results. Nevertheless, the

implications of emotion regulation in the ALOE should be further

investigated.

5.5 The ALOE and the Limited Good Belief

Our main hypothesis regarding the source of the ALOE was that it might be

due to the belief that material goods and resources exist in limited

quantities. A more limited version of this hypothesis, leading to the same

predictions, is that the ALOE reflects only participants’ specific belief

that computerized lab experiments are designed like zero-sum games in

which good outcomes come in finite quantities.

5.5.1 Previous empirical evidence for the limited-good hypothesis

Evidence for a zero-sum/limited good bias comes from various fields.

Individuals tend to see negotiations as zero-sum, “fixed-pie” situations

and often assume that their interests directly conflict with the other

party’s interests (Bazerman, 1983). For example, students tend to predict

that a series of good grades will be followed by a bad one, seeing good

grades as a limited good (Meegan, 2010), people assume that having more

than one romantic partner in a polyamorous relationship results in less

love for each of the partners (Burleigh et al., 2017), and tend to assume

that the success of one person in the workplace implies less success for

others (Sirola & Pitesa, 2017). In these examples, good grades, romantic

love, and work success are seen as limited commodities.

The Limited Good belief can have a tremendous impact on behavior and

decision-making. For example, it might lead negotiating parties to

suboptimal agreement or no agreement at all (Baron et al., 2006; Bazerman,

1983), make employees less inclined to help each other (Sirola & Pitesa,

2017), reduce cooperation in the classroom (Burleigh, 2016), lead to

social bias against consensual non-monogamists (Burleigh et al., 2017), or

to prejudice against immigrants perceived as players in a zero-sum game

(Esses et al., 1998). Given the pervasiveness of the Limited Good belief

and its substantial effects, it is important to deepen our understanding

of the bias, as well as try to identify the conditions under which the

bias can be reduced.

5.5.2 Is the

ALOE explained by the Limited Good belief?

Experiment 2, the “Beads in the Bag Experiment”, was designed to test

whether the ALOE is caused by the Limited Good belief: if the ALOE is

indeed a manifestation of beliefs regarding the limitedness of goods, then

neutralizing these beliefs should lead to an elimination of the effect.

Some of the zero-sum studies mentioned above have used a similar

rationale, but it is unclear whether they have managed to convince

participants that the resource at stake was indeed unlimited. In the

academic grades study (Meegan, 2010), the experimenter highlighted the

unlimitedness of good grades by explicitly telling participants that

grading was absolute (vs. relative); however, participants’ own experience

with grades distribution might have led them to assume otherwise. In the

study on the zero-sum construal of success in the workplace (Sirola &

Pitesa, 2017), participants read a scenario describing a work situation in

which they were told that all the department members were to submit a

proposal, and that a bonus would be given to all proposals satisfying a

certain standard of quality. Participants were then asked whether they

would be willing to help a coworker, who had obviously misunderstood the

assignment. Here too, it is unclear whether mentioning that the proposals

were judged in an absolute fashion was enough to overcome years of

experience in the workplace, where usually only top performers are

rewarded. Moreover, participants might have assumed that other resources

beyond the scope of the scenario (e.g., future promotions) are in fact

limited, and that helping a coworker now might come at a cost later.

The Beads in the Bag Experiment, on the other hand, tested the Limited Good

Belief for the first time in a controlled environment in which: 1) the

participants had no prior experience; 2) the unlimitedness of the

resources was visible, palpable, and physically unequivocal. Yet, despite

the unequivocal situational evidence, the ALOE held: participants acted as

if they saw a good alternative outcome as a bad sign regarding their

outcome.

These findings could indicate one of two things. First, some heuristic

behaviors persist despite the existence of rational reasons why they should

not (Denes-Raj & Epstein, 1994), and the Limited Good belief might be one

of these. However, undermining the possibility that the Limited Goods

belief is immutable, Marciano-Romm et al. (2016) found that participants

got debiased with time: they evinced a smaller ALOE in the second half of

the experiments than in the first half. Similar effects of experience were

found for Experiment 1 herein (see Table 1 in the

Supplement). This seems

to indicate that individuals are sensitive to the information provided by

the environment.

A second possibility is that the ALOE — and potentially some of the

zero-sum behaviors referenced above — are explained at least partly by a

somewhat different mechanism. We suggest that such a mechanism could be

the Limited Luck belief.

5.6 The ALOE and the Limited Luck Belief

5.6.1 The Limited Luck Belief

According to the Limited Luck Hypothesis, luck – rather than material goods

– is the resource perceived as limited in the ALOE experiments. The

Limited Luck belief states that there is only so much luck in a given

situation and that if some of it has been allocated, then there is less

luck left.

For luck to be invoked as a causal factor for an outcome, two conditions

must be realized. First, the outcome must be generated by a process

involving at least a certain degree of randomness, as without uncertainty,

there is no room for luck to affect outcomes. Second, the outcome of a

random event needs to be associated with some value (either positive or

negative) to be considered lucky or unlucky. In Experiment 3, we removed

the value from the outcomes, and hypothesized that this manipulation

should neutralize the Limited Luck belief and thus eliminate the ALOE.

Consistent with this conjecture, we found that when the outcomes of the

boxes were valueless geometrical shapes (vs. shapes associated with

monetary gains and losses), participants did not evince the ALOE. Together

with the asymmetry of the ALOE found in Experiment 1, these results

suggest that it is specifically good luck that is perceived as

limited. Interestingly, the studies of Meegan on students’ perception of

grades report a similar asymmetry: when many high grades had already been

given, participants were more likely to predict that the next assignment

would receive a low grade; however, when many low grades had already been

given, there was not a corresponding increase in high grade predictions

(Meegan, 2010).

The idea that luck can be conceived as an exhaustible resource might appear

at first as a little farfetched. Yet, it is consistent with the

observations of Keren and Wagenaar (1985), who found that people believe

that luck can be detected and used wisely, or that it can be squandered

foolishly and wasted – for example if one fails to recognize that it is his

lucky day. It is also consistent with the Stock of Luck belief (Sundali

& Croson, 2006), according to which individuals believe they have a

fixed amount of luck and that once it is exhausted, their probability of

winning decreases.

The Limited Luck Belief might explain why the ALOE results apparently

contradict the findings of Kareev (1995) and Wilke and Barrett (2009), who

reported an illusory positive correlation between sequential events. In

Kareev’s sequential task, participants were told that someone had produced

a list of Xs and Os, and they were asked to predict, in each trial, the

next item on the list. In Wilke & Barrett (2009), participants played a

computerized sequential foraging game in which they experienced a sequence

of hits and misses and were asked, after each event, to predict whether

the next event would be a hit or miss. Notably, in these experiments,

while accurate predictions were rewarded (as in our own studies), the

specific outcomes of the sequential events (e.g., Xs and Os) were

valueless. These experiments were thus by essence free of the Limited Luck

Belief.

The Limited Luck Belief could partly explain the findings of some of the

zero-sum studies mentioned above. Getting a good grade on an assignment,

being successful at one’s job, or finding a meaningful romantic

relationship, are valuable outcomes that all comprise a certain amount of

uncertainty and that could be perceived as benefiting from some good luck

– or suffering from the lack of it.

5.6.2 Disentangling the Limited Luck belief from the Limited Good

belief

Under certain circumstances, the Limited Good hypothesis and the Limited

Luck hypothesis might have different predictions, allowing future studies

to explore the unique contribution of each one of these biases to the

observed behaviours.

5.6.3 Individual differences

The data from past and present studies of the ALOE indicate that some

participants were more strongly biased than others, and that a minority

were even biased in the opposite direction. Questionnaires targeting

specific luck-related beliefs, such as the Belief in Good Luck scale

(Darke & Freedman, 1997; Maltby et al., 2008), as well as targeting the

locus of control, might shed some light on the heterogeneity between

individuals.

5.6.4 Situations

with low vs. high controllability

Individuals are likely to attribute a bigger role to luck in situations

that are perceived as less controllable or more uncertain than others

(Vyse, 1997). For example, superstitious beliefs increase following

exposure to unsolvable, but not solvable problems (Dudley, 1999). The

Limited Luck belief — but not the Limited Good belief — thus predicts

that increasing the perceived randomness of a situation will lead to more

ALOE and zero-sum-like behaviors. This prediction is consistent with our

finding of a strong ALOE effect in the Beads in the Bag Experiment. By

making the situational evidence unequivocal, we might have neutralized any

part of the ALOE due to the Limited Good Belief, but at the same time, we

might have strengthened the effect of the Limited Luck Belief, as the

randomness of the game and its uncontrollability became obvious.

The controllability parameter might also explain why worse economic periods

are associated with a more zero-sum-like construal of success (Sirola &

Pitesa, 2017). Economic crises are characterized by greater uncertainty

and feelings of insecurity regarding the future. As a result, individuals

might give a larger weight to luck in determining their success than they

would in better times. Indeed, individuals who were subject to

macroeconomic volatility during early adulthood tend to believe that

individual success depends more on luck than effort (Giuliano &

Spilimbergo, 2008), and individuals in bad macroeconomic environments

offer higher prices on vehicle license plates with lucky numbers (Ng et

al., 2010). Controllability could be manipulated by introducing some

stochastic noise to the mechanism generating the outcomes. For example, in

the grades experiment (Meegan, 2010), participants could be told that the

professor grading the assignments tends to make mistakes when summing up

the scores of the different parts of the assignment – resulting in some

students getting better or worse grades than they actually deserve.

5.6.5 Interventions to reduce

the bias

The Limited Good belief and the Limited Luck belief have different

predictions regarding the efficiency of specific interventions. Esses et

al. (1998) suggest that tensions between immigrants and host populations

could be alleviated by interventions specifically targeting zero-sum

beliefs (e.g., “jobs are not a limited resource”). We suggest that such

interventions might not have the expected impact because, while

neutralizing false beliefs regarding the scarcity of material resources,

they do not address the Limited Luck belief. On the other hand, increasing

individuals’ sense of control over desired outcomes might diminish the

place given to luck, and thus decrease the bias. Managers and teachers

could highlight the fact that success is highly correlated with skills and

efforts. They could provide the criteria they use to judge one’s

work in order to show that the evaluation process is immune to external

noise (e.g., the boss being in a bad mood) – thus reducing the uncertainty

experienced by their employees and students. Interventions targeted to

reduce the Limited Luck belief may decrease the tendency to perceive the

successes of others as a threat to one’s own success, and in consequence

encourage cooperation and reduce discrimination.

5.7 Open questions

The Limited Luck Hypothesis assumes that individuals see luck as limited

for a certain situation. In our studies, for example, participants acted

as if luck was limited per trial. But in general, what is perceived as “a

situation”? One can think of a few factors that are likely to play a role

in grouping events into a situation, such as temporal proximity

(temporally contiguous events are more likely to be grouped together than

events spread out over time), similarity (similar events are more likely

to be grouped than dissimilar events), or context (events happening in the

same context are more likely to be grouped than events happening in

different contexts). Further experiments will be necessary to understand

how and when individuals see distinct events as being governed by the same

limited amount of luck – that is, how the luck economy works.

5.8 Conclusions

Following a choice between two options, individuals tend to see a good

alternative outcome as a bad sign regarding their outcome. This is the

Alternative Omen Effect (Marciano-Romm et al., 2016). Our current findings

bolster the robustness of the ALOE and show that it cannot be explained by

a preference for novelty or from perception of local sequential

correlations. Importantly, our findings are inconsistent with the

possibility that the ALOE results from the Limited Good belief. Rather,

our findings could be explained either by individuals trying to regulate

their anticipated emotions, or by individuals assuming that good luck is

limited. The Limited Luck belief, which should be explored in future

studies, could be the cause of a wide range of behaviors that have been

attributed to the Limited Good belief, such as suboptimal negotiations,

poor cooperation in the workspace and negative views toward immigration.

Interventions specifically designed to neutralize this belief could reduce

deadlocks and harmful, costly behaviors.

6 Bibliography

Alloy, L. B., & Tabachnik, N. (1984). Assessment of covariation by humans

and animals: The joint influence of prior expectations and current

situational information. Psychological Review, 91(1), 112–149.

Bar-Hillel, M., & Wagenaar, W. A. (1991). The perception of

randomness. Advances in Applied Mathematics, 12(4),

428–454.

Baron, J., Bazerman, M. H., & Shonk, K. (2006). Enlarging the societal pie

through wise legislation: A psychological perspective. Perspectives

on Psychological Science, 1(2), 123–132.

Bazerman, M. H. (1983). Negotiator judgment: A critical look at the

rationality assumption. American Behavioral Scientist, 27(2),

211–228.

Bell, D. E. (1982). Regret in decision making under

uncertainty. Operations Research, 30(5), 961–981.

Beyth-Marom, R. (1982). Perception of correlation

reexamined. Memory & Cognition, 10(6), 511–519.

Burleigh, T. J. (2016). "Your gain is my loss":

An examination of zero-sum thinking with love in multi-partner romantic

relationships and with grades in the university classroom (Doctoral

dissertation). http://hdl.handle.net/10214/10034.

Burleigh, T. J., Rubel, A. N., & Meegan, D. V. (2017). Wanting ‘the whole

loaf’: Zero-sum thinking about love is associated with prejudice against

consensual non-monogamists. Psychology & Sexuality, 8(1–2),

24–40.

Chapman, L. J., & Chapman, J. P. (1967). Genesis of popular but erroneous

psychodiagnostic observations. Journal of Abnormal Psychology,

72(3), 193–204.

Chapman, L. J., & Chapman, J. P. (1969). Illusory correlation as an

obstacle to the use of valid psychodiagnostic signs. Journal of

Abnormal Psychology, 74(3), 271–280.

Churchill, G. A., Jr., & Surprenant, C. (1982). An investigation into the

determinants of customer satisfaction. Journal of Marketing

Research, 19(4), 491–504.

Darke, P. R., & Freedman, J. L. (1997). The belief in good luck

scale. Journal of Research in Personality, 31(4),

486–511.

Denes-Raj, V., & Epstein, S. (1994). Conflict between intuitive and

rational processing: When people behave against their better

judgment. Journal of Personality and Social Psychology,

66(5), 819–829.

Dienes, Z. (2014). Using Bayes to get the most out of non-significant

results. Frontiers in psychology, 5, 781.

Dudley, R. T. (1999). The effect of superstitious belief on performance

following an unsolvable problem. Personality and Individual

Differences, 26(6), 1057–1064.

Esses, V. M., Jackson, L. M., & Armstrong, T. L. (1998). Intergroup

competition and attitudes toward immigrants and immigration: An

instrumental model of group conflict. Journal of social issues,

54(4), 699–724.

Foster, G. M. (1965). Peasant society and the image of limited good.

American Anthropologist, 67(2), 293–315.

Giuliano, P., & Spilimbergo, A. (2008). Growing up in bad times:

Macroeconomic Volatility and the Formation of Beliefs. UCLA mimeo.

Gold, E., & Hester, G. (2008). The gambler’s fallacy and the coin’s

memory. In J. I. Krueger (Ed.), Rationality and Social

Responsibility: Essays in Honor of Robyn Mason Dawes (pp. 21–46). London:

Psychology Press.

Hanley, J. A., Negassa, A., & Forrester, J. E. (2003). Statistical

analysis of correlated data using generalized estimating equations: An

orientation. American Journal of Epidemiology, 157(4),

364–375.

Inman, J. J., Dyer, J. S., & Jia, J. (1997). A generalized utility model

of disappointment and regret effects on post-choice valuation.

Marketing Science, 16(2), 97–111.

Kareev, Y. (1995). Positive bias in the perception of

covariation. Psychological Review, 102(3), 490–502.

Keren, G. B., & Wagenaar, W. A. (1985). On the psychology of playing

blackjack: Normative and descriptive considerations with implications for

decision theory. Journal of Experimental Psychology: General,

114(2), 133–158

Loomes, G., & Sugden, R. (1982). Regret theory: An alternative theory of

rational choice under uncertainty. The Economic Journal, 92(368),

805–824.

Maltby, J., Day, L., Gill, P., Colley, A., & Wood, A. M. (2008). Beliefs

around luck: Confirming the empirical conceptualization of beliefs around

luck and the development of the Darke and Freedman beliefs around luck

scale. Personality and Individual Differences, 45(7),

655–660.

Marciano, D., Bentin, S., & Deouell, L. Y. (2018). Alternative outcomes

create biased expectations regarding the received outcome: Evidence from

event-related potentials. Neuropsychologia, 113, 126–139.

Marciano-Romm, D., Romm, A., Bourgeois-Gironde, S., & Deouell, L. Y.

(2016). The Alternative Omen Effect: Illusory negative correlation between

the outcomes of choice options. Cognition, 146, 324–338.

Meegan, D. V. (2010). Zero-sum bias: perceived competition despite

unlimited resources. Frontiers in psychology, 1, 191.

Mellers, B. A., Schwartz, A., Ho, K., & Ritov, I. (1997). Decision affect

theory: Emotional reactions to the outcomes of risky options.

Psychological Science, 8(6), 423–429.

Mellers, B. A., Schwartz, A., & Ritov, I. (1999). Emotion-based

choice. Journal of Experimental Psychology: General,

128(3), 332–345.

Morewedge, C. K., Tang, S., & Larrick, R. P. (2016). Betting your favorite

to win: Costly reluctance to hedge desired outcomes. Management

Science, 64(3), 997–1014.

Ng, T., Chong, T., & Du, X. (2010). The value of

superstitions. Journal of Economic Psychology, 31(3), 293–309.

Oliver, R. L. (1980). A cognitive model of the antecedents and consequences

of satisfaction decisions. Journal of Marketing Research,

17(4), 460–469.

Oliver, R. L., & DeSarbo, W. S. (1988). Response determinants in

satisfaction judgments. Journal of Consumer Research, 14(4),

495–507.