Judgment and Decision Making, Vol. 13, No. 4, July 2018, pp. 372-381

Numerate decision makers don’t use more effortful strategies unless it pays: A process tracing investigation of skilled and adaptive strategy selection in risky decision making

Jakub Traczyk*

#

Agata Sobkow#

Kamil Fulawka# Jakub Kus#

Dafina Petrova$

Rocio Garcia-Retamero!

|

The present study investigated skilled and adaptive strategy

selection in risky decision making. We proposed that people with

high objective numeracy, a strong predictor of general decision

making skill, would have a broad repertoire of choice strategies and

adaptively select these strategies depending on the importance

of the decision. Thus more objectively numerate people would

maximize their effort (e.g., invest more time) in important,

high-payoff decisions and switch to a simple, fast heuristic

strategy in trivial decisions. Subjective numeracy would, by

contrast, be more closely related to interest in problem solving for

its own sake and would not yield such an effect of

importance. Participants made twelve high-payoff choices and twelve

low-payoff choices in binary two-outcome gambles framed as gains. We

measured objective and subjective numeracy using standard

measures. Results showed that people with high subjective numeracy

generally maximized the expected value (EV) in all decisions. In

contrast, participants with high objective numeracy maximized EV

only when choice problems were meaningful (i.e., they could result

in high payoffs). When choice problems were trivial

(i.e., choosing the normatively better option would not result in a

large payoff), more objectively numerate participants

made choices consistent with faster, more frugal heuristic

strategies.

Keywords: numeracy, strategy selection, risky choice, prospect theory, priority heuristic, skilled decision making, deliberation

1 Introduction

In real-life financial situations, people use various choice

strategies and decision rules to deal with problems that involve

processing of outcomes and probabilities. For instance, if we use the

expected value (EV) maximization principle as a model of rational

behavior under risk, the decision regarding whether or not to buy a

lottery ticket for 3 EUR with a probability of winning a one-million

main prize at 0.0000072%, should be preceded by optimization analyses

that include calculations comparing EV of the bet (i.e., +0.072 EUR)

with the certain loss of −3 EUR. However, comprehensive optimization

is almost impossible in the majority of everyday decision problems, as

they are usually very complex, dynamic and uncertain (people do not

know every possible alternative, precise values of probabilities,

etc.). Furthermore, apart from material and accountable consequences

(e.g., money), people also attach value to other resources such as

their effort and time spent on making a decision.

Many studies have reported that people with greater numerical

abilities are more likely to make better choices in similar problems,

that is, decisions more consistent with EV maximization (Cokely et al., 2018; Pachur &

Galesic, 2013; Jasper, Bhattacharya, Levin, Jones & Bossard, 2013;

Peters & Bjalkebring, 2015). Nonetheless,

there is compelling evidence that superior decisions in more numerate

people do not simply result from complex computations of EVs but

rather they are driven by exhaustive considerations of multiple

aspects of the problem (i.e., elaborate heuristic processing, Cokely

& Kelley, 2009; Ghazal, Cokely & Garcia-Retamero, 2014; Jasper, Bhattacharya & Corser,

2017). The ability to understand and use statistical and probability

information) is also related to superior decision making in both

health and financial domains (Galesic & Garcia-Retamero, 2011; Garcia-Retamero, Andrade, Sharit &

Ruiz, 2015; Ghazal et al., 2014, 2014; Reyna &

Brnst-Renck, 2014) and is associated with greater personal wealth in

general (Estrada-Mejia, de Vries & Zeelenberg, 2016). However, the

question of how people with high numeracy arrive at better decisions

seems to be complex.

Researchers argue that more (objectively) numerate individuals have

better understanding of the gist of decisions (Reyna, Nelson, Han &

Dieckmann, 2009), deliberatively employ metacognitive heuristics

(Garcia-Retamero, Cokely & Hoffrage, 2015; Ghazal et al., 2014), draw

precise affective meaning from numbers (Peters, 2012; Peters et al.,

2006), and are more likely to conduct explicit number operations

(Peters & Bjalkebring, 2015). Higher numeracy is also related to

more exact mental number-line mapping (Schley & Peters, 2014) and

more linear transformations of objective numbers (Millroth & Juslin,

2015), resulting in less pronounced distortions in processing outcomes

and probabilities (Patalano, Saltiel, Machlin & Barth, 2015),

although other results raise questions about this conclusion (Peters

et al., 2006). Furthermore, people with higher objective numeracy seem

to be less prone to affective influences during decision making (e.g.,

Petrova, van der Pligt & Garcia-Retamero, 2014; Traczyk & Fulawka,

2016; Traczyk et al., 2018).

A question posed here is whether those with higher objective numeracy

are more inclined to adaptively change choice strategy depending on

the task requirements. Do they allocate their time and effort in

proportion to the importance of decisions? In particular, we

investigated how the structure of the environment (operationalized as

the difference in the magnitudes of expected payoffs) influences

strategy selection under risk and what is the role of numeracy in this

process. The present study thus investigated whether highly numerate

individuals always engage more time and effort to compute EV, or

rather adaptively select their choice strategy depending on the

task and environment (Jasper et al., 2013).

Additionally, we examined the relative contribution of objective

(i.e., inferred from the numerical task performance) and subjective

(i.e., declared preference for numbers and number-related operations)

numeracy in predicting choices. Although a measure of subjective

numeracy has been shown to be a good proxy for objective numeracy

(e.g., it predicts performance in numerical tasks; Fagerlin et

al., 2007) and some researchers use objective and subjective numeracy scales

interchangeably (Zikmund-Fisher, Smith, Ubel & Fagerlin, 2007), other

studies have demonstrated that these tests measure different traits

(Anderson, Obrecht, Chapman, Driscoll & Schulkin, 2011; Miron-Shatz,

Hanoch, Doniger, Omer & Ozanne, 2014; Peters & Bjalkebring, 2015;

Petrova et al., 2017). For instance,

subjective numeracy predicts perceptions of health, whereas objective

numeracy predicts actual health in patients (Garcia-Retamero et al. 2015).

Taking this into account, in the present study we

measured both subjective and objective numeracy to examine their

relative contribution to choice.

1.1 Research problem and hypothesis

In this study, we ask whether people with high objective numeracy

adapt their effort to the importance of the decision, or whether they

simply make better decisions regardless of the importance of the decision.

On the one hand, more numerate subjects are likely to make more normatively

superior choices in financial problems as a result of greater

deliberation during decision making (Ghazal et al., 2014). This effect

can be presumably attributed to the elaborative heuristic search

posited by Cokely and Kelley (2009) — a larger number of simple

considerations as well as better understanding of formal operations

with numbers. On the other hand, more numerate subjects could also

strategically allocate deliberation time and use different choice

strategies depending on the importance of a decision, quantified here

by the EV ratio between gambles. That is, people high in numeracy

would maximize their effort (e.g., invest more time and deliberation)

when the decision really matters (i.e., when differences between

expected payoffs are large), but when the decision is trivial (i.e.,

when differences between expected payoffs are small) they would switch

to a simple and fast heuristic strategy.

Prior research suggests two potential outcomes. Firstly, in the case

of trivial choice problems, more numerate individuals would behave

similarly as in meaningful problems. That is, they will deliberate more

on the problem, leading to more of their choices being consistent with

EV (Ghazal et al., 2014; Jasper et al., 2017). Secondly, because of

the adaptive sensitivity to changes in EV that is exhibited by more

numerate people (Jasper et al., 2013), their ability to get the gist

of numbers (Reyna et al., 2009) and to employ heuristic processing

(Cokely & Kelley, 2009), they are expected to switch to a faster

heuristic-based strategy as it provides comparable performance in case

of decisions that seem trivial (i.e., low-payoff gambles with similar

EVs).

| Table 1: Twelve low-payoff (with EV ratios around 1) and twelve high-payoff (with EV ratios between 5 and 6) binary choice problems consisting of two-outcome gambles in the gain domain. The priority heuristic (PH) and cumulative prospect theory (CPT) predicted opposite choices. Each problem met criteria of nondominance. |

Gamble A | Gamble B | EV Gamble A | EV Gamble B | EV ratio | Choice by PH | Choice by CPT |

5.40, 0.29; 0, 0.71 | 9.70, 0.17; 0, 0.83 | 1.57 | 1.65 | 1.05 | A | B |

17.50, 0.17; 0, 0.83 | 3.00, 0.94; 0, 0.06 | 2.98 | 2.82 | 1.05 | B | A |

9.70, 0.17; 0, 0.83 | 5.40, 0.29; 0, 0.71 | 1.65 | 1.57 | 1.05 | B | A |

3.00, 0.29; 0, 0.71 | 5.40, 0.17; 0, 0.83 | 0.87 | 0.92 | 1.06 | A | B |

31.50, 0.17; 0, 0.83 | 5.40, 0.94; 0, 0.06 | 5.36 | 5.08 | 1.05 | B | A |

31.50, 0.29; 0, 0.71 | 56.70, 0.17; 0, 0.83 | 9.14 | 9.64 | 1.06 | A | B |

9.70, 0.17; 0, 0.83 | 3.00, 0.52; 0, 0.48 | 1.65 | 1.56 | 1.06 | B | A |

5.40, 0.17; 0, 0.83 | 3.00, 0.29; 0, 0.71 | 0.92 | 0.87 | 1.06 | B | A |

3.00, 0.52; 0, 0.48 | 9.70, 0.17; 0, 0.83 | 1.56 | 1.65 | 1.06 | A | B |

17.50, 0.52; 0, 0.48 | 56.70, 0.17; 0, 0.83 | 9.1 | 9.64 | 1.06 | A | B |

9.70, 0.52; 0, 0.48 | 31.50, 0.17; 0, 0.83 | 5.04 | 5.36 | 1.06 | A | B |

56.70, 0.17; 0, 0.83 | 17.50, 0.52; 0, 0.48 | 9.64 | 9.1 | 1.06 | B | A |

3.00, 0.17; 0, 0.83 | 56.70, 0.05; 0, 0.95 | 0.51 | 2.84 | 5.56 | A | B |

3.00, 0.94; 0, 0.06 | 31.50, 0.52; 0, 0.48 | 2.82 | 16.38 | 5.81 | A | B |

56.70, 0.05; 0, 0.95 | 3.00, 0.17; 0, 0.83 | 2.84 | 0.51 | 5.56 | B | A |

5.40, 0.94; 0, 0.06 | 56.70, 0.52; 0, 0.48 | 5.08 | 29.48 | 5.81 | A | B |

31.50, 0.52; 0, 0.48 | 3.00, 0.94; 0, 0.06 | 16.38 | 2.82 | 5.81 | B | A |

56.70, 0.52; 0, 0.48 | 5.40, 0.94; 0, 0.06 | 29.48 | 5.08 | 5.81 | B | A |

3.00, 0.94; 0, 0.06 | 56.70, 0.29; 0, 0.71 | 2.82 | 16.44 | 5.83 | A | B |

5.40, 0.52; 0, 0.48 | 56.70, 0.29; 0, 0.71 | 2.81 | 16.44 | 5.86 | A | B |

31.50, 0.29; 0, 0.71 | 3.00, 0.52; 0, 0.48 | 9.14 | 1.56 | 5.86 | B | A |

56.70, 0.29; 0, 0.71 | 5.40, 0.52; 0, 0.48 | 16.44 | 2.81 | 5.86 | B | A |

3.00, 0.29; 0, 0.71 | 56.70, 0.09; 0, 0.91 | 0.87 | 5.1 | 5.87 | A | B |

56.70, 0.09; 0, 0.91 | 3.00, 0.29; 0, 0.71 | 5.1 | 0.87 | 5.87 | B | A |

| CPT and EV were always consistent in their choice predictions in these problems. |

2 Method

2.1 Subjects

One hundred and thirty-nine volunteers from the general population

(age range: 18–58 years; Mage = 29.21; SD = 8.57; 52% female)

participated in an online study for a 30 PLN (Polish Zloty)

compensation (equivalent to approximately 8 EUR).1 Subjects

were recruited via an advertisement published on a local

webpage. Subjects received explicit information stating that the

study examined cognitive abilities and were assured that payment was

not related to their performance. Volunteers gave informed consent

before the study.

| Table 2: An example of cognitive operations and choice predictions according to cumulative prospect theory (CPT) and priority heuristic (PH). |

| | Gamble A: 29% probability to win 5.40 EUR or 71% probability to win nothing (0 EUR) | Gamble B: 17% probability to win 9.70 EUR or 83% probability to win nothing (0 EUR) |

Cumulative prospect theory (CPT) | | |

Step 1: compute the CPT value of a gamble | Using equation V = ∑i = 1n w( pi )v( xi ), where w is the decision weight for probability pi, and v is a value of an outcome xi with standard CPT parameters (0.88 for the value function and 0.61 for the probability weighting function in gain domain), CPT values for Gamble A and B equal 1.38 and 1.78, respectively. |

Decision: select the gamble with a higher CPT value | Select Gamble B because of the higher CPT value. |

Priority heuristic (PH) | | |

Step 1: is the difference in minimum gains larger than 10% of minimum gain? | No. Minimum gain in Gamble A (0 EUR) equals to the minimum gain in Gamble B (0 EUR) |

Step 2: is the difference in the probability of the minimum gain larger than 10% in the probability scale? | Yes. 71% in Gamble A vs. 83% in Gamble B (the difference of 12% is larger than 10%). Thus, considering the last step posited by PH (i.e., the difference between maximum gains) is not necessary. |

Decision: stop the process and select the gamble with a lower probability of minimum gain | Select Gamble A. |

| CPT and EV were always consistent in their choice predictions in these problems. |

2.2 Design and materials

The study was designed to investigate the relationship between

numeracy and choices under risk. We measured both subjective and

objective numeracy as main predictors in this study as well as fluid

intelligence and need for cognition. We also introduced a

within-subjects manipulation of choice payoff (i.e., 12 low-payoff vs. 12

high-payoff binary two-outcome choice problems). The dependent

variable was subjects’ choices in these problems. Response

latencies in each problem were used to operationalize deliberation

time and enhance our understanding of the cognitive processes

underlying decision making.

Subjects completed the following measures:

2.2.1 The Berlin Numeracy Test

The Berlin Numeracy Test (BNT; Cokely, Galesic, Schulz, Ghazal &

Garcia-Retamero, 2012) is a psychometric instrument that measures

statistical numeracy, risk literacy and comprehension of the concept

of probability. The BNT is widely used as an efficient research tool

to measure objective numerical abilities (Cokely et al., 2012). In the

current study, we used a computerized version of the BNT consisting of

four items presented to subjects in a fixed order. Subjects

were not forced to provide any response to complete the items.

2.2.2 The Subjective Numeracy Scale

Subjects completed the Subjective Numeracy Scale (SNS; Fagerlin et

al., 2007), an 8-item self-assessment scale that measures subjective

numeracy and includes two subscales referring to perceived numerical

abilities (e.g., “How good are you at working with percentages?”) and

preference for numerical and statistical information (e.g., “How often

do you find numerical information to be useful?”). Subjects

completed the SNS by answering each question using a 6-point scale.

2.2.3 The Need for Cognition Scale

Individual differences in epistemic motivation were assessed using the

Need for Cognition Scale (NCS; Cacioppo & Petty, 1982). The Polish

adaptation of the scale (Matusz, Traczyk & Gąsiorowska, 2011)

includes 36 items and measures "the tendency for an individual to

engage in and enjoy thinking" (Cacioppo & Petty, 1982, p. 116). The

main goal of the NCS is to assess the individual’s level of joy and

satisfaction emerging from the processes of thinking, resolving

problems, learning new things, etc. Subjects used a 5-point scale

to indicate the extent they agree with each statement (e.g., “Thinking

is not my idea of fun”).

2.2.4 The Raven’s Advanced Progressive Matrices

To measure individual differences in fluid intelligence we used the

Raven’s Advanced Progressive Matrices test (RAPM; Raven, 2000). The

RAPM is a nonverbal test that is typically employed to assess basic

cognitive functioning such as abstract reasoning. Problems included in

this test are presented in the form of matrices (e.g., 3 x 3 elements)

with one missing piece. The task is to figure out the rule underlying

the uncovered elements and select the missing element that satisfies

the appropriate rule. In the present study, we used a short form of

the RAPM consisting of two training and six test matrices displayed

with ascending difficulty.

2.2.5 Choice problems

We used twenty-four binary choice problems consisting of two-outcome

gambles from a study by Pachur, Hertwig, Gigerenzer and Brandstätter

(2013, Experiment 2). The outcomes of the choice problems were framed

as gains. Choice problems differed in their EV ratios (Table 1), which

we used to define high- and low-payoff problems. If the EVs of two

gambles were similar (dividing their EVs led to outcomes around 1),

then we classified them as low-payoff problems in comparison to high-payoff

problems in which the EVs of the two gambles differed

substantially (dividing their EVs led to outcomes between 5 and 6). In

other words, low-payoff problems (with EVs ratios around 1) can be

regarded as trivial, because playing them repeatedly would lead to

relatively small differences in payoffs irrespective of the chosen

gamble (i.e., it does not really matter which option you should

select, because in the long-run a decision maker would get a similar

payoff). In contrast, high-payoff problems (with EVs ratios between 5

and 6) are more meaningful, because their EVs differ and choosing the

gamble with the higher EV will lead to much higher payoffs (i.e., it

pays to choose the gamble with higher EV because differences in

payoffs are large in the long run).

The problems were generated in such a way that two competing models of

choice under risk — the priority heuristic (PH; Brandstätter,

Gigerenzer & Hertwig, 2006) and cumulative prospect theory (CPT;

Tversky & Kahneman, 1992) — always led to different predictions on

choice. According to CPT, a decision-maker multiplicatively combines

the subjectively transformed outcomes and their weighed probabilities

to arrive at an overall value of a gamble. Next, a gamble with a

higher value is chosen. In contrast, the PH posits that a decision

maker relies on a series of sequential steps aimed at comparing

gambles according to their minimum gains, the probabilities of these

minimum gains, and the maximum gains (in fixed order). The sequence of

comparative operations is stopped resulting in a choice when the

difference between minimum (maximum) gains is larger than 10% of the

minimum (maximum) gain, or if the difference in probabilities of

minimum gains is larger than 10% of the probability scale (Table 2).

Let us illustrate the difference between CPT and PH in the following

two gambles presented in the first row of Table 1, (Gamble A: 5.40,

0.29; 0, 0.71 and Gamble B: 9.70, 0.17; 0, 0.83). PH predicts that a

decision maker will choose Gamble A because the difference in minimum

gain probabilities is larger than 10% of the probability scale (i.e.,

0.71 vs. 0.83). In contrast, CPT with standard parameters from Tversky

and Kahneman (1992) predicts that a decision maker will choose Gamble

B because of its greater CPT value (i.e., 1.38 vs. 1.78).

The choice of CPT and PH for assessing the gambles is not meant to

imply that subjects conform to either theory. Rather it was intended

to reflect the difference between simple heuristics and more

compensatory approaches to decision making. In general, we expect CPT

predictions to be the same as EV predictions.

2.3 Procedure

Subjects were instructed that they should complete the procedure

individually during one session. Subjects also confirmed that they

would focus on the task at hand and turn off other applications/music

that could distract their attention. In reference to the BNT they were

informed that they were not allowed to use calculators, but they could

take notes on paper.

Tasks were administered with the InquisitWeb (2016) software and ran

in pseudorandom order. Text was displayed in a black font on a light

gray background. All subjects started by reading instructions and

completing a demographic survey. They then completed a block of tasks

including the BNT, RAPM, and choice problems (presented in random

order), followed by another block which included the self-report

measures of SNS and NCS (also presented in random

order). Additionally, twelve low- and twelve high-payoff choice

problems were mixed and presented to each subject in a different

random order. At the end of the study, subjects declared whether

we could include their data in the analyses. The entire procedure took

approximately 40 minutes (although there were no time

constraints). There was no immediate feedback regarding

performance. However, after the study, subjects received

information on their results in comparison to average scores

calculated from the study sample.

| Table 3: Descriptive statistics for measures used in the study. BNT – the Berlin Numeracy Test, NCS – the Need for Cognition Scale, RAPM – the Raven’s Advanced Progressive Matrices, SNS – the Subjective Numeracy Scale. CPT/EV-consistent choices in low- and high-payoff problems refer to the number of expected value choices in these problems. |

| | BNT | SNS | RAPM | NCS | CPT/EV-consistent choices in high-payoff problems | CPT/EV-consistent choices in low-payoff problems |

| Mean | 1.75 | 34.87 | 3.71 | 131.9 | 8.8 | 4.41 |

| SEM | 0.11 | 0.67 | 0.13 | 1.66 | 0.27 | 0.27 |

| Median | 2 | 36 | 4 | 133 | 10 | 4 |

| SD | 1.27 | 7.88 | 1.48 | 19.38 | 3.17 | 3.15 |

| Minimum | 0 | 11 | 0 | 75 | 0 | 0 |

| Maximum | 4 | 48 | 6 | 171 | 12 | 11 |

| N | 139 | 139 | 136 | 136 | 138 | 138 |

| Table 4: Pearson zero-order correlation coefficients for the relationships between measures used in the study. CPT/EV-consistent choices in low- and high-payoff problems refer to the number of expected value choices in these problems. BNT – the Berlin Numeracy Test, NCS – the Need for Cognition Scale, RAPM – the Raven’s Advanced Progressive Matrices, SNS – the Subjective Numeracy Scale. Deliberation time is log-transformed median choice latency. |

| | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 1. BNT | . | .503*** | .529*** | .214* | .344*** | .281*** | -.085 | .301*** |

| 2. SNS | | . | .372*** | .428*** | .315*** | .196* | .200* | .323*** |

| 3. RAPM | | | . | .238** | .178* | .121 | -.077 | .241** |

| 4. NCS | | | | . | .237** | .163 | .182* | .137 |

| 5. Deliberation time in low-payoff problems (log) | . | .807*** | .144 | .519*** |

| 6. Deliberation time in high-payoff problems (log) | . | -.106 | .389*** |

| 7. CPT/EV choices in low-payoff problems | | . | .340*** |

| 8. CPT/EV choices in high-payoff problems | | | . |

| * p < .05, ** p < .01, *** p < .001.

|

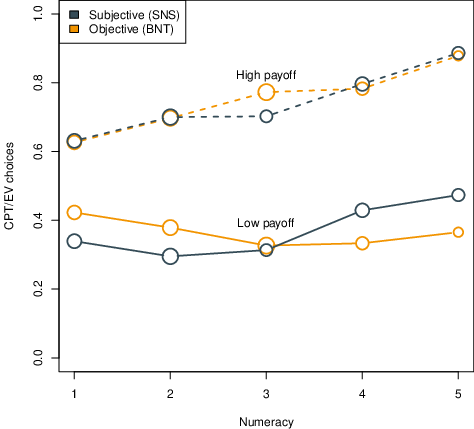

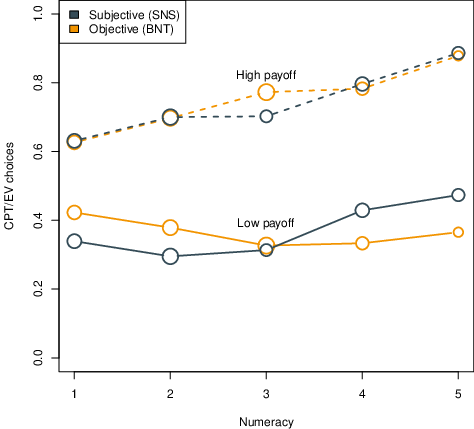

| Figure 1: Proportion of choices consistent with expected value (CPT/EV) as

a function of payoff (high/low, dashed lines are high) and numeracy

(subjective in dark blue, objective in orange). Subjective numeracy (SNS)

scores are displayed in quintiles (as equal as possible), so that

the number of subjects in each point — represented by the area of

each point — are roughly comparable to those for objective

numeracy. |

| Table 5: Loadings on canonical variates (pairs of linear combinations

of X and Y variables), CV1 and CV2. |

| | CV1 | CV2 |

| Four X’s |

| BNT | 0.92 | 0.09 |

| SNS | 0.46 | 0.88 |

| RAPM | 0.76 | 0.08 |

| NCS | 0.03 | 0.61 |

| Y’s with four X’s |

| CPT/EV choices | 0.23 | 0.97 |

| Payoff sensitivity | 0.97 | -0.23 |

| Two X’s |

| BNT | 0.92 | -0.38 |

| SNS | 0.78 | 0.62 |

| Y’s with two X’s |

| CPT/EV choices | 0.61 | 0.79 |

| Payoff sensitivity | 0.79 | -0.61 |

3 Results

Descriptive statistics for the measures used in the study and the

correlations between them are presented in Table 3 and Table 4

respectively. Higher scores in the BNT, SNS, and RAPM as well as

longer deliberation time were correlated with more choices consistent

with CPT/EV in high-payoff problems. In low-payoff problems, only

SNS and NCS, but not BNT or RAPM were positively correlated with

CPT/EV-consistent choices. Of interest is the large difference between

objective and subjective numeracy in predicting choices in

low-payoff problems. In high-payoff problems, both objective and

subjective numeracy strongly predicted CPT/EV choices, explaining almost

twice as much variance as RAPM or NCS.

Figure 1 shows the different roles of subjective and objective

numeracy by plotting a proportion of CPT/EV choices as a function of numeracy for high- and

low-payoff conditions, for both subjective and objective numeracy. Note

that the CPT/EV choice proportion increases with subjective numeracy for both

payoff conditions, but the choice proportion increases with objective

numeracy only for the high-payoff condition. Thus, higher objective

numeracy (BNT) appears to lead to greater sensitivity to payoffs

(greater difference between top and bottom lines in Figure 1).

To ask whether subjective and objective numeracy predict different

aspects of performance, we calculated the mean proportion of

CPT/EV-consistent choices for each subject and the difference

between high- and low-payoff conditions in CPT/EV-consistent choices, to

assess sensitivity to payoff.

Next, we asked whether these two components, CPT/EV choices and payoff

sensitivity, were differentially affected by measures of individual differences used in the study.

To do this, we used canonical correlation (fit by the R package yacca: Butts,

2012). The idea is to find a linear combination of the “X” variables

(BNT, SNS, RAPM, NCS) that correlate with a linear combination of the

“Y” variables (CPT/EV choices and payoff sensitivity), optimizing the

weights for the two combinations so as to get the highest

correlation. Then (in essence) repeat the process on the residuals, to

see if a different pattern of weights can account for additional

variance (here we can have only two of these canonical variates

because we have only two Y variables). Table 5 shows the loadings

(analogous to factor loadings) on the two canonical variates.

The top half of Table 5 shows the weights for all four X

variables. The two objective X variables (BNT and RAPM) load mostly on

CV1, which is most strongly related to Payoff-sensitivity, while the

two subjective X variables (SNS and NCS) load on CV2, which is related

to CPT/EV choices. The bottom half shows similar results using only the two

numeracy measures as X variables. For both of these analyses (with four and two X variables), the

second canonical variate was significant (p = .0024 and p = .0004,

respectively, by Bartlett’s χ2 test), indicating that the second

canonical variate accounted for significant variance. Thus, the

results cannot be explained in terms of a single underlying factor

affecting all X and Y variables.

Finally, we investigated the relationships among payoff, choices and response times.

Log response times were slower for the low-payoff condition,

presumably because the decision was more difficult, and slower for the

choice of the better option (CPT/EV-consistent choice), presumably because the choice was made

after more thought. The latter effect was greater in the low-payoff

condition.2 Means (in msec, derived from the mean logs) were: 3631

for high payoff, CPT/EV choice; 3280 for high payoff, PH choice; 6542 for

low payoff, CPT/EV choice; and 3364 for low payoff, PH choice. Mean log

response times increased with both BNT (r=.32, p<.001) and SNS

(r=.25, p=.003), but the two measures of numeracy did not differ

significantly in any analysis, and, if anything, show effects opposite

to those that might be expected given other results. Likewise, the two

correlations did not differ for just the low-payoff condition (r=.33,

p<.001 for BNT, r=.30, p=.001 for SNS; calculated with logs

taken before averaging).

4 Discussion

In the present study, we demonstrated that more statistically numerate

decision makers are able to strategically invest sufficient

deliberation to make adaptive choices. When decisions really

mattered and could result in high payoffs, people with high objective

numeracy made normatively better choices predicted by CPT and

EV. However, when decisions were trivial and did not matter because

the payoffs of the available options were similar, those with high

objective numeracy made choices predicted by a heuristic strategy

(i.e., PH). These PH-consistent choices were also “better”, because

they resulted in getting an equally good payoff without wasting

additional time and effort that could be of more value than the negligible

difference in payoff earned by selecting the CPT/EV-consistent option.

At first glance, it may seem counterintuitive that those with high

objective numeracy did not always maximize EV. However, after deeper

consideration, we can conclude that decision makers with high

objective numeracy exhibited adaptive rationality as they tried to

maximize payoffs when choice problems were meaningful and, at the same

time, minimized effort when choice problems were trivial. What is

a potential cognitive mechanism underlying these effects?

Accordingly, our findings are a straightforward demonstration that

more numerate subjects adaptively selected their choice strategy

on more important choices. Nevertheless, it is not clear whether they

performed EV-like computations (i.e., multiplying outcomes and

probabilities) or rather used sophisticated heuristic processing

(i.e., transforming and comparing probabilities and outcomes,

reframing the problem, and so forth). Although the choice problems we

used in our study clearly distinguish between two choice models, the

lack of more sophisticated process-tracing measures (e.g., eye

tracking) does not allow us to conclude that subjects processed

gambles accordingly. For instance, Cokely and Kelley (2009)

demonstrated that choices consistent with EV rarely resulted from EV

computations but they were driven by elaborative heuristic processing

instead. Moreover, Pachur et al. (2013) also demonstrated that using

simple heuristics (e.g., the equiprobable heuristic, the equal-weight

heuristic, or the better-than-average heuristic, Brandstätter et al., 2006) can lead to the same choices as those

predicted by CPT or EV models. Indeed, Pachur et al. (2013)

documented that these trade-off heuristics reveled the same

performance as CPT in problems with both similar and different EV

ratios, but at the same time lead to the opposite predictions to

PH. Therefore, different cognitive processes from those posited by

CPT/EV can be responsible for CPT/EV-consistent choices. This research

problem can be addressed in future studies using process-tracing

measures like think-aloud protocols or Mouselab-type methods in order

to reveal the underlying cognitive process.

4.1 The role of subjective and objective numeracy

Apart from a measure of objective numeracy, we also used scales

measuring subjective numeracy as well as need for cognition and fluid

intelligence. These measures were related to choices. In particular,

SNS was associated with more CPT/EV choices in both low and high

payoff problems. NCS correlated with choices in low-payoff problems,

and RAPM was positively related to more choices that maximized EV in

high-payoff problems. While objective numeracy was a marker of adaptive

strategy selection, SNS was a persistent marker of CPT/EV

choices. These results are in line with recent advances in numeracy

theory and they show that objective and subjective numeracy (although

often used interchangeably) map different numerical competencies,

consequently eliciting different implications for decisions (Peters &

Bjalkebring, 2015). Objective numeracy has been more strongly linked

to number comparisons, operations, and calculations. Subjective

numeracy, on the other hand, has been primarily linked to emotional

reactions to numbers, preference for them as well as motivation and

confidence in numeric tasks (Peters & Bjalkebring, 2015). This

differentiation allows for qualitatively different predictions for

subjective and objective numeracy that can help understand the role of

these constructs in risky choices.

In light of our findings, it seems that objective numeracy is a marker

of adaptive and meta-cognitive strategy selection related to numerical

processing. Consistent with previous research (Ghazal et al., 2014;

Petrova, Garcia-Retamero, Catena & van der Pligt, 2016), subjects

with higher objective numeracy spent more time deliberating on

problems, but they were also able to switch to a faster strategy when

choice problems became more trivial (i.e., the differences in payoffs

were small).

Higher subjective numeracy was related to EV maximization processes

irrespectively of the problem payoff. Subjective numeracy may, in a

sense, indicate additional utility from trying to solve a problem. If

so, subjects with high subjective numeracy would be less sensitive to

the lack of extrinsic reward. They may have simply found the task

interesting enough so that they tried to find the best option even

when it was clear that the two options did not differ much in their

expected outcomes.

4.2 Conclusions

To summarize, we demonstrated that subjective and objective numeracy play different roles in choices under risk.

While people with high subjective numeracy tried to maximize every decision irrespectively of its payoff, objectively numerate, skilled decision makers did not waste extra time thinking harder and longer about trivial problems. Importantly, these people were able to assess which problem is meaningful and adapt their choice strategy to maximize payoff.

References

Anderson, B. L., Obrecht, N. A., Chapman, G. B., Driscoll, D. A., &

Schulkin, J. (2011). Physicians communication of Down syndrome

screening test results: The influence of physician

numeracy.

Genetics in Medicine, 13(8),

744–749.

http://doi.org/10.1097/GIM.0b013e31821a370f.

Brandstätter, E., Gigerenzer, G., & Hertwig, R. (2006). The priority heuristic: making choices without trade-offs. Psychological Review, 113(2), 409–432. http://doi.org/10.1037/0033-295X.113.2.409

Butts, C. T. (2012). yacca: Yet another canonical correlation

analysis package. R package version 1.1. https://CRAN.R-project.org/package=yacca.

Cacioppo, J. T., & Petty, R. E. (1982). The need for cognition. Journal of Personality and Social Psychology, 42(1), 116–131.

Cokely, E. T., Feltz, A., Ghazal, S., Allan, J. N., Petrova, D., &

Garcia-Retamero, R. (2018). Skilled decision theory: From intelligence

to numeracy and expertise. In K. A. Ericsson, R. R. Hoffman,

A. Kozbelt, & A. M. Williams (Eds.), The Cambridge Handbook

of Expertise and Expert Performance (2nd ed.), pp. 476–505. New

York, NY: Cambridge University Press.

Cokely, E. T., Galesic, M., Schulz, E., Ghazal, S., & Garcia-Retamero, R. (2012). Measuring risk literacy: The Berlin numeracy test. Judgment and Decision Making, 7(1), 25–47. http://journal.sjdm.org/11/11808/jdm11808.pdf.

Cokely, E. T., & Kelley, C. M. (2009). Cognitive abilities and superior decision making under risk A protocol analysis and process model evaluation. Judgment and Decision Making, 4(1), 20–33. http://journal.sjdm.org/81125/jdm81125.pdf.

Estrada-Mejia, C., de Vries, M., & Zeelenberg, M. (2016). Numeracy and wealth. Journal of Economic Psychology, 54, 53–63. http://doi.org/10.1016/j.joep.2016.02.011.

Fagerlin, A., Zikmund-Fisher, B. J., Ubel, P. A, Jankovic, A., Derry, H. A, & Smith, D. M. (2007). Measuring numeracy without a math test: development of the Subjective Numeracy Scale. Medical Decision Making, 27(5), 672–680. http://doi.org/10.1177/0272989X07304449.

Galesic, M., & Garcia-Retamero, R. (2011). Communicating consequences of risky behaviors: Life expectancy versus risk of disease. Patient Education and Counseling, 82(1), 30-35. https://doi.org/10.1016/j.pec.2010.02.008.

Garcia-Retamero, R., Andrade, A., Sharit, J., & Ruiz,

J. G. (2015). Is patients’ numeracy related to physical and mental

health? Medical Decision Making, 35(4),

501–511. http://doi.org/10.1177/0272989X15578126.

Garcia-Retamero, R., Cokely, E. T., & Hoffrage, U. (2015). Visual aids improve diagnostic inferences and metacognitive judgment calibration. Frontiers in Psychology, 6, 1–12. http://doi.org/10.3389/fpsyg.2015.00932.

Ghazal, S., Cokely, E. T., & Garcia-Retamero, R. (2014). Predicting biases in very highly educated samples: Numeracy and metacognition. Judgment and Decision Making, 9(1), 15–34.

Jasper, J. D., Bhattacharya, C., & Corser, R. (2017). Numeracy predicts more effortful and elaborative search strategies in a complex risky choice context: A process-tracing approach. Journal of Behavioral Decision Making, 30(2), 224–235. http://doi.org/10.1002/bdm.1934.

Jasper, J. D., Bhattacharya, C., Levin, I. P., Jones, L., & Bossard, E. (2013). Numeracy as a predictor of adaptive risky decision making. Journal of Behavioral Decision Making, 26(2), 164–173. http://doi.org/10.1002/bdm.1748

Matusz, P. J., Traczyk, J., & Gasiorowska, A. (2011). Kwestionariusz Potrzeby Poznania – konstrukcja i weryfikacja empiryczna narzędzia mierzącego motywację poznawczą. Psychologia Społeczna [Social Psychology], 6(2), 113–128.

Millisecond Software. (2016). Inquisit 4. Seatle. http://www.millisecond.com.

Millroth, P., & Juslin, P. (2015). Prospect evaluation as a function of numeracy and probability denominator. Cognition, 138, 1–9. http://doi.org/10.1016/j.cognition.2015.01.014.

Miron-Shatz, T., Hanoch, Y., Doniger, G. M., Omer, Z. B., & Ozanne, E. M. (2014). Subjective but not objective numeracy influences willingness to pay for BRCA1/2 genetic testing. Judgment and Decision Making, 9(2), 152–158.

Pachur, T., & Galesic, M. (2013). Strategy selection in risky choice: The impact of numeracy, affect, and cross-cultural differences. Journal of Behavioral Decision Making, 26(3), 260–271. http://doi.org/10.1002/bdm.1757.

Pachur, T., Hertwig, R., Gigerenzer, G., & Brandstätter, E. (2013). Testing process predictions of models of risky choice: A quantitative model comparison approach. Frontiers in Psychology, 4, 1–22. http://doi.org/10.3389/fpsyg.2013.00646.

Patalano, A. L., Saltiel, J. R., Machlin, L., & Barth, H. (2015). The role of numeracy and approximate number system acuity in predicting value and probability distortion. Psychonomic Bulletin & Review, 22(6), 1820–1829. http://doi.org/10.3758/s13423-015-0849-9.

Peters, E. (2012). Beyond Comprehension: The role of numeracy in judgments and decisions. Current Directions in Psychological Science, 21(1), 31–35. http://doi.org/10.1177/0963721411429960.

Peters, E., & Bjalkebring, P. (2015). Multiple numeric competencies: When a number is not just a number. Journal of Personality and Social Psychology, 108(5), 802–822. http://doi.org/10.1037/pspp0000019.

Peters, E., Vastfjall, D., Slovic, P., Mertz, C. K., Mazzocco, K., & Dickert, S. (2006). Numeracy and decision making. Psychological Science, 17(5), 407–413. http://doi.org/10.1111/j.1467-9280.2006.01720.x.

Petrova, D., Garcia-Retamero, R., Catena, A., Cokely, E., Heredia Carrasco, A., Arrebola Moreno, A., & Ramírez Hernández, J. A. (2017). Numeracy predicts risk of pre-hospital decision delay: A retrospective study of acute coronary syndrome survival. Annals of Behavioral Medicine, 51(2), 292–306. http://doi.org/10.1007/s12160-016-9853-1.

Petrova, D., Garcia-Retamero, R., Catena, A., & van der Pligt, J. (2016). To screen or not to screen: What factors influence complex screening decisions? Journal of Experimental Psychology: Applied, 22(2), 247–260. http://doi.org/10.1037/xap0000086.

Petrova, D., van der Pligt, J., & Garcia-Retamero, R. (2014). Feeling the numbers: On the interplay between risk, affect, and numeracy. Journal of Behavioral Decision Making, 27(3), 191–199. http://doi.org/10.1002/bdm.1803.

Raven, J. (2000). The Raven’s Progressive Matrices: change and stability over culture and time. Cognitive Psychology, 41(1), 1–48. http://doi.org/10.1006/cogp.1999.0735

Reyna, V. F., & Brnst-Renck, P. G. (2014). A review of theories of numeracy: psychological mechanisms and implications for medical decision making. In B. L. Anderson & J. Schulkin (Eds.), Numerical reasoning in judgments and decision making about health (pp. 215–251). Cambridge, UK: Cambridge University Press.

Reyna, V. F., Nelson, W. L., Han, P. K., & Dieckmann, N. F. (2009). How numeracy influences risk comprehension and medical decision making. Psychological Bulletin, 135(6), 943–973. http://doi.org/10.1037/a0017327.

Schley, D. R., & Peters, E. (2014). Assessing “economic value” symbolic-number mappings predict risky and riskless valuations. Psychological Science, 25(3), 753–761. http://doi.org/10.1177/0956797613515485.

Traczyk, J., & Fulawka, K. (2016). Numeracy moderates the influence of task-irrelevant affect on probability weighting. Cognition, 151, 37–41. http://doi.org/10.1016/j.cognition.2016.03.002.

Traczyk, J., Lenda, D., Serek, J., Fulawka, K., Tomczak, P., Strizyk, K., Polec, A., Zjawiony, P, & Sobkow, A. (2018). Does Fear Increase Search Effort in More Numerate People? An Experimental Study Investigating Information Acquisition in a Decision From Experience Task. Frontiers in Psychology, 9(1203). https://doi.org/10.3389/fpsyg.2018.01203.

Tversky, A., & Kahneman, D. (1992). Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty, 5(4), 297–323. http://doi.org/10.1007/BF00122574.

Zikmund-Fisher, B. J., Smith, D. M., Ubel, P. A., & Fagerlin, A. (2007). Validation of the Subjective Numeracy Scale: Effects of low numeracy on comprehension of risk communications and utility elicitations. Medical Decision Making, 27(5), 663–671. http://doi.org/10.1177/0272989X07303824.

This document was translated from LATEX by

HEVEA.