| Figure 1: An example of the sequential trust game. |

Judgment and Decision Making, Vol. 12, No. 6, November 2017, pp. 584-595

Ambiguity and expectation-neglect in dilemmas of interpersonal trustAnthony M. Evans* Joachim I. Krueger# |

Recent research suggests that people discount or neglect expectations of reciprocity in trust dilemmas. We examine the underlying processes and boundary conditions of this effect, finding that expectations have stronger effects on trust when they are made accessible and when they are provided as objective probabilities (Study 1). Objective expectations have stronger effects when they are based on precise, rather than ambiguous, probabilities (Study 2). We also find that trust decisions differ from individual risk-taking decisions: people are more willing to trust, and expectations have stronger effects on trusting behavior (Study 2). These results show that the availability and ambiguity of expectations shape trust decisions, and that people differentially weight expectations in dilemmas of trust and individual risk-taking.

Keywords: trust, risk, expectations, bounded rationality

To what extent does trust among strangers depend on expectations of reciprocity? This question is important to understand trust in zero-acquaintance interactions, such as online exchanges, when future interactions are unlikely and antisocial behavior is difficult to sanction (Aggarwal, Goodell & Selleck, 2015; Ert, Fleischer & Magen, 2016). Some theories assume that expectations are central to trust, and that people trust others only insofar as they expect positive reciprocity (Camerer, 2003; Rotter, 1967; Thielmann & Hilbig, 2015). If so, then trust behavior can be encouraged by providing information to bolster positive expectations. Yet, recent research finds that expectations only weakly predict trust behavior (Dunning, Anderson, Schlösser, Ehlebracht & Fetchenhauer, 2014; Evans & Krueger, 2014), suggesting that merely strengthening expectations may not substantially increase trust behavior. However, little is known about why trustors neglect expectations or the boundary conditions of this effect. Our working hypothesis is that people discount expectations when they do not come to mind easily (Evans & Krueger, 2011) and when they are based on ambiguous information (Einhorn & Hogarth, 1985).

If people neglect their own expectations in trust dilemmas, it is important to ask whether similar processes occur in the domain of individual risk-taking, where uncertain outcomes are determined by chance. Even when trust and risky choice dilemmas are economically equivalent (e.g., the probabilities and payoffs are identical), the two situations have important psychological differences. Previous studies focused on mean-level differences – asking if people are more (or less) willing to trust than take personal risks (e.g., Bohnet & Zeckhauser, 2004; Fetchenhauer & Dunning, 2009). In addition to these mean-level differences, people may weight expectations differently in the two domains. Indeed, it has been hypothesized that expectations have weaker effects on trust decisions (Evans & Krueger, 2016), though previous work has not tested this claim directly. The present work examines how expectations shape trust, and reveals the distinct processes that influence behavior in dilemmas of individual and social uncertainty.

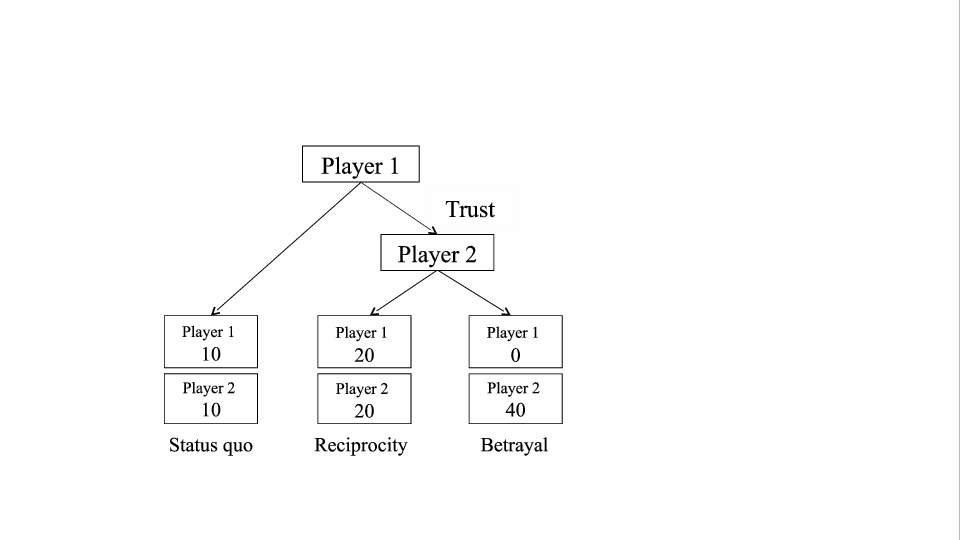

To investigate trust behavior, researchers use variants of the sequential trust game (Camerer, 2003; Evans & Krueger, 2009). Figure 1 shows the basic structure of the game as used here. By design, both players have full knowledge of the game’s structure and potential outcomes. In the first stage, Player 1 (the trustor) chooses between the status quo and trust. Selecting the status quo terminates the interaction with modest outcomes for both parties. If Player 1 chooses to trust, thereby increasing the total available wealth, Player 2 (the trustee) chooses between reciprocity and betrayal. Reciprocity leaves both players with outcomes better than the status quo. Betrayal leaves Player 1 with an outcome worse than the status quo, while giving Player 2 the best possible outcome. The trustor’s dilemma is to choose between the security of an inefficient status quo and the uncertainty of trust. In turn, the trustee faces a moral dilemma: to honor trust with reciprocity or to profit at the trustor’s expense.

Figure 1: An example of the sequential trust game.

Formal models posit that expectations of reciprocity are essential to trusting behavior (Thielmann & Hilbig, 2015). Dispositional models explore individual and societal differences as differences in generalized expectations about the trustworthiness of other people (Balliet & Van Lange, 2013; Rotter, 1967; Yamagishi et al., 2015). In other words, dispositional trust and positive expectations are interchangeable. Likewise, game-theoretic models stipulate a direct correspondence between expectations of reciprocity and trusting behavior (Camerer, 2003; Krueger, Evans & Heck, 2017). In short, there is interdisciplinary consensus that trusting behavior should depend on the belief that reciprocity will follow (Evans & Krueger, 2016).

Yet, the empirical effect of expectations on trusting behavior is relatively weak (Dunning et al., 2014; Schlösser, Mensching, Dunning & Fetchenhauer, 2015). When faced with trust dilemmas, people do not fully engage in consequentialist thinking; in other words, they do not focus on how trustees will respond in the event that they are trusted (Kugler, Connolly & Kausel, 2009). Instead, trust decisions are influenced by other factors, such as the emotions felt at the moment of decision-making (Martinez & Zeelenberg, 2015; Schlösser, Fetchenhauer & Dunning, 2016) and the feeling that trust is the right thing to do (Dunning et al., 2014). These findings led to the proposal that trust decisions are blind and “economically” irrational, rather than strategically self-interested (Dunning et al., 2014; Schlösser et al., 2015).

The perspective of bounded rationality offers an alternative explanation for why trustors neglect their own expectations of reciprocity (Hertwig & Herzog, 2009). People tend to focus on salient, easy-to-process cues, thereby ignoring information that requires effort to process (Gigerenzer, Todd & ABC Research Group, 1999; Simon, 1955). In dilemmas of trust, people have ready access to their own experiences and preferences (Krueger, 2003), and overriding egocentrism requires time and cognitive effort (Lin, Keysar & Epley, 2010; Tamir & Mitchell, 2013). Consistent with this view, we found in earlier work that changes in outcomes have stronger effects on behavior than changes in expectations (probabilities of these outcomes), even when outcomes and expectations have equivalent effects on the expected value of trust (Evans & Krueger, 2014). Information search and self-report data suggest that many trust decisions occur without consideration of the trustee’s potential payoffs, information that is critical for the formation of accurate expectations of reciprocity (Evans, Athenstaedt & Krueger, 2013; Evans & Krueger, 2014). In other words, people focus on the potential payoffs associated with trust, without fully considering the probabilities of those payoffs occurring.

The reasons why people prioritize payoffs over expectations are not fully understood, but one possible explanation is that expectations are less salient and more ambiguous than outcomes. The present studies are designed to test this account.

We propose that the tendency to discount expectations (and focus on outcomes instead) depends on the extent to which expectations are based on subjective versus objective information: Fully subjective expectations are generated by the decision-maker; they are based on general beliefs about the trustworthiness of strangers (Evans & Revelle, 2008; Rotter, 1967) or on inferences from relevant cues (Brunswick, 1955; Thielmann & Hilbig, 2015). In contrast, fully objective expectations are provided by a knowledgeable source and are based on descriptive probability information (Hertwig & Erev, 2009; Van Dijk & Zeelenberg, 2003). Expectations can also lie somewhere between these two extremes; they may be based on a combination of subjective and objective information. For example, even when trustors have access to objective information about the probability of reciprocity, they may also consider their subjective beliefs and experiences.

Expectations based on subjective and objective information differ in two important ways: First, subjective expectations are more ambiguous than objective expectations (Einhorn & Hogarth, 1985). Objective expectations are described as exact numerical probabilities, but subjective expectations may be vague or imprecise estimates (Olson & Budescu, 1997). The famous Ellsberg paradox illustrates that people are more willing to accept gambles based on precise (vs. ambiguous) probabilities (Einhorn & Hogarth, 1995; Ellsberg, 1961; Van Dijk & Zeelenberg, 2003). Second, objective expectations based on descriptive probabilities are more likely to be salient at the moment of decision-making, especially if they are made available as descriptive probabilities. Objective expectations are readily available to the decision-maker, whereas subjective expectations must be derived from cues, such as the trustee’s payoffs (Evans & Krueger, 2011). Decision-makers may be reluctant (or unable) to use cues to form and update subjective expectations. One (or both) of these factors may explain why subjective expectations have comparably weak effects on trusting behavior.

The question of how expectations influence behavior has implications for the comparison of trust and individual risk-taking decisions. Previous studies focused on mean-level differences, asking if people are more willing to accept uncertain outcomes in the domain of social trust compared with non-social risk-taking. The results are mixed: Some researchers found that people are more willing to take individual risks than engage in trusting behavior (Aimone & Houser, 2012; Hong & Bohnet, 2007; Bohnet, Greig, Herrmann & Zeckhauser, 2008), whereas others found the opposite (Dunning et al., 2014; Fetchenhauer & Dunning, 2012; Schlösser et al., 2015).

A problem pervading previous research is a confound between the distinction between social trust and individual risk-taking and the distinction between subjective and objective expectations. The typical trust decision is based on subjective expectations (e.g., Berg, Dickhaut & McCabe, 1995), whereas the typical risk-taking decision is based on objective expectations. This confound raises the possibility that people weight information differently in the domains of trust and risk-taking. For example, trust decisions may de-emphasize expectations, whereas individual risk-taking decisions more closely resemble expected utility calculation (Evans & Krueger, 2016).

We conducted two experiments to examine the effects of expectations in dilemmas of trust and reciprocity. Study 1 compares decisions in the typical trust game, where subjective expectations are elicited after decisions are made, with decisions in a modified game where expectations are measured at the moment of decision-making and a condition where expectations are provided as objective probability information. Study 2 considers how the ambiguity of objective probability information affects trust and risk-taking decisions, comparing the effects of ambiguous versus precise probabilities on trust and individual risk-taking decisions.

Study 1 had three conditions: In the subjective condition, players made decisions in a trust game where they had to form subjective expectations of trustees’ behavior, with expectations measured after decisions were made. In the salient condition, players estimated, and thereby expressly brought to mind, the likelihood of reciprocity immediately before each decision. In the objective condition, players received explicit information about the probability of reciprocity before they made each decision.

We focus on two comparisons: First, we ask if the effects of expectations on trust are comparable in the subjective and salient conditions. If people neglect expectations because they do not easily come to mind (Evans & Krueger, 2014; Lin et al., 2010), then salient expectations should predict trust more strongly than subjective expectations. Reminding trustors to form an expectation at the moment of decision-making may be enough to shift their process of decision-making to favor expectations (Kugler et al., 2009). Second, we ask if the effects of expectations are similar in the salient and objective conditions. If trustors neglect expectations because self-generated predictions are ambiguous and vague (Einhorn & Hogarth, 1985; Van Dijk & Zeelenberg, 2003), then objective expectations should predict trust more strongly than salient expectations. If so, one may infer that trustors discount self-generated expectations, even when they are reminded of them before making a decision.

A total of 244 (96 women) U.S. participants were recruited from Mturk. The average age was 33.3 years, SD = 10.4. Each participant received 60 cents for their time. The sample size was sufficient to detect a medium sized effect (f = .20) with 80% power.

Participants read detailed instructions explaining the rules of the game, and learned that they had been assigned to the role of Player 1 (trustor). They also read that they would be randomly assigned to a partner, and that those assigned to the role of Player 2 (trustee) had already made their decisions. After reading the instructions, participants completed 24 trials of the game, with the order randomized for each participant (see Evans & Krueger, 2014). For each trial, they could choose “IN” (trust) or ”OUT” (the status quo).

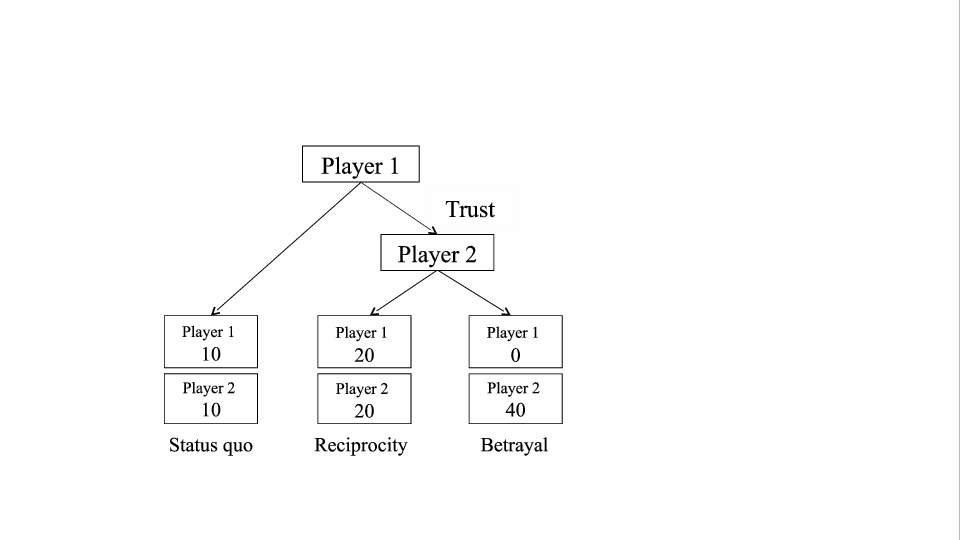

Two factors were manipulated in the game’s payoff structure, the cost-benefit ratio of choosing trust, (p1−S)/(R1−S), and the trustee’s financial temptation to choose betrayal, (T−R2)/T (see Figure 2). When the cost-benefit ratio was high, the trustor had little to gain (and much to lose) from choosing trust.1 This ratio ranged from .20 to .79, M = .49, SD =.26. We also manipulated the trustee’s temptation, her economic incentive to choose betrayal instead of reciprocity. As this temptation increased, Player 2 (trustee) earned more money from choosing betrayal. The trustee’s temptation ranged from .13 to .71, M = .45, SD = .20. The specific payoff values used in each round are reported in the Appendix.

Figure 2: The payoff structure of the trust game.

Participants were randomly assigned to the subjective, the salient, or the objective condition:

In this condition, participants made all 24 trust decisions before they were asked to form explicit expectations of reciprocity. After making all 24 decisions, participants estimated the percentages of Player 2s (out of 100) who would choose SHARE (reciprocity) in each trial of the game. Thus, each participant provided 24 trust decisions and 24 expectations.

Participants in this condition were instructed to estimate the percentages of Player 2s who would choose “SHARE” (reciprocity) at the decision screen of the trust game. That is, expectations were measured before participants made each trust decision. Otherwise, they followed the same protocol as participants in the subjective condition.

Participants in the objective condition received explicit information about the probability of reciprocity before each decision. They were informed that 100 workers had previously made decisions as Player 2. At the decision screen, participants were told how many trustees (out of 100) chose SHARE (and the number who chose KEEP). The objective probabilities for each trial were based on the average expectations of reciprocity stated by participants from Study 2 of Evans & Krueger (2014): M = 45.9%, Min = 32%, Max = 64%. That is, at each trial participants learned that the probability of reciprocity was the average expectation stated by participants (for that trial) in the previous study.

To account for the clustered nature of the data, we used the lme4 package in R to estimate multilevel models (Bates, Maechler, Bolker & Walker, 2014) and the lmertest package to obtain p-values (Kuznetsova, Brockhoff & Christensen, 2015).

Expectations of reciprocity were scaled to range from 0 to 1. Note that in the subjective and salient conditions, expectations at each trial varied across participants (depending on participants’ differing beliefs), whereas expectations in the objective condition were provided by the experimenter and were therefore the same for all participants. We used dummy variables to compare the three conditions, treating the salient condition as a reference level.

Table 1: The effects of expectation and experimental condition on trust. We report unstandardized beta weights (b); the standard errors of beta weights (SE); and the standard deviations of the random intercepts and random slopes estimated for each participant (SD).

Full model Subjective condition Salient condition Objective condition Fixed effects b (SE) p b (SE) p b (SE) p b (SE) p Intercept −1.98 (.38) < .001 −.01 (.17) .92 −2.14 (.49) < .001 −5.58 (.70) < .001 Expectation 5.69 (.74) < .001 .82 (.25) < .001 6.13 (.94) < .001 12.73 (1.43) < .001 Subjective condition 1.77 (.52) .13 Objective condition −2.78 (.57) .56 Subjective*Expectation −4.37 (.98) < .001 Objective*Expectation 5.27 (1.10) < .001 Random effects SD SD SD SD Intercept 2.82 1.15 3.61 5.50 Expectation 5.09 .26 6.29 11.01

To begin, we tested for mean-level differences in trusting behavior across the three conditions. Here, we had no a priori predictions. We submitted a logistic model with trust decisions (1 = trust; 0 = status quo) as the dependent variable. The two condition dummy variables were entered as predictors, and the model also included random intercepts for each participant. The rates of trust were comparable in the subjective (.55), salient (.55), and objective (.54) conditions, bsubjective = .0059, SE = .25, p = .98; bobjective = −.010, SE = .25, p = .67.

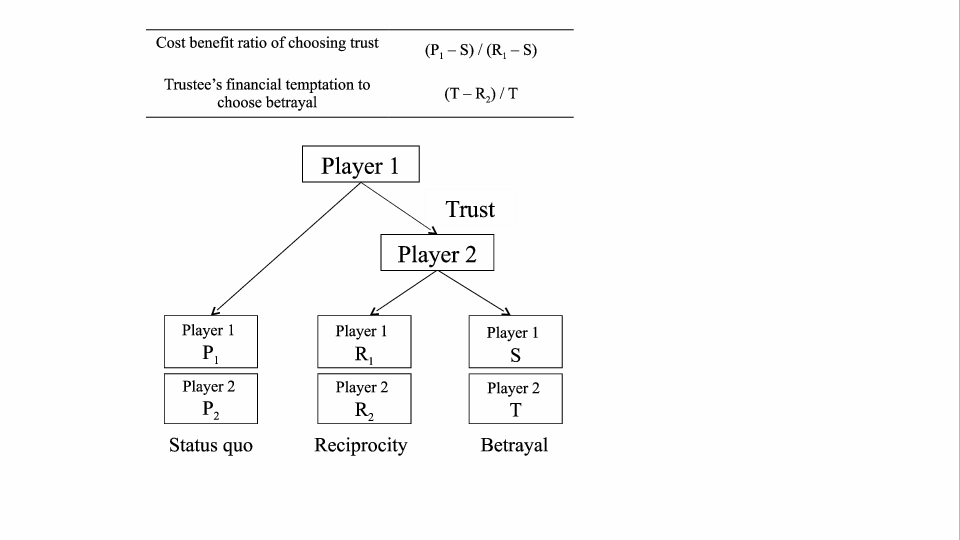

Figure 3: The individual-level effects of expectations on trusting behavior. For each participant, we estimated a simple logistic model using expectation to predict trust. Top: Individual-level intercepts and slopes were then used to generate predicted probabilities of trust at different levels of expectation. Bottom: The distribution of individual-level regression slopes (i.e., the effect of expectations on trust for each participant) is displayed for each condition.

Our primary analyses compared the effects of expectations on trust across conditions. To allow the effects of expectations to vary across participants, we estimated a model that included both random intercepts for participants and within-participant random slopes for expectations (Table 1). Overall, expectations were positively associated with trusting behavior, but the effects of expectations differed significantly across conditions.

First, we compared the effects of expectations on behavior in the subjective and salient conditions. Our hypothesis was that increasing the salience of expectations would strengthen the positive relationship between expectations and trusting behavior. Indeed, there was a significant interaction, indicating that the effects of expectations differed in the subjective and salient conditions: bsubjective*expectation = −4.37, p < .001. To understand this interaction, we estimated the simple effects of expectations within the subjective and salient conditions: Though the effects of expectations were significant in both conditions, the simple effect of expectations on trust was significantly stronger in the salient condition (b = 6.13) compared to the subjective condition (b = .82).2 In other words, increasing the expectation of reciprocity by +.01 was associated with a 6.3% increase in the odds of trust in the salient condition and a .82% increase in the subjective condition.

We also tested whether salient and objective expectations had different effects on trust. Here, we predicted that expectations would have a stronger influence on behavior when they were explicitly provided as objective probabilities. Consistent with our prediction, we observed a significant condition by expectations interaction: bobjective*expectation = 5.26, p < .001. We then compared the simple effects of expectations in the objective and salient conditions: the effect of expectations was stronger when they were objective (b = 12.73) than when they were salient. Increasing the expectation of reciprocity by +.01 was associated with a 13.5% increase in the odds of trust in the objective condition.

Figure 3 displays the effects of expectations on trust at the level of individual participants. Trustors in the objective condition were the most sensitive to expectations, and those in the subjective condition were the least sensitive.

Finally, we asked whether participants generated equivalent expectations in the subjective and salient conditions. We estimated a linear model with expectations as the dependent variable. Condition (subjective vs salient), temptation, and the cost-benefit ratio were entered as predictors. Overall, expectations of reciprocity were similar in the salient (.44) and subjective (.40) conditions, bsubjective = −.040, SE = .027, p = .13. Expectations were, however, significantly affected by changes in payoffs: participants expected less reciprocity when the trustee’s temptation was large (btemptation = −.51, SE = .037, p < .001) and when the trustor’s cost-benefit ratio was large (bcost-benefit = −.028, SE = .012, p = .013).

Similar to previous studies, trustors believed that the trustee’s financial incentives (i.e., temptation) could be used to form an educated expectation of the other player’s behavior (Evans & Krueger, 2014; Snijders & Keren, 1999). Importantly, the time at which expectations were measured (pre vs. post decision) did not significantly influence average expectations or the specific information trustors used to form expectations. The time of measurement only influenced the effect of those expectations on trustors’ final decisions.

Study 1 showed how that the salience and the objectivity of social expectations can strengthen their effects on trust. When participants first formed expectations, thereby making them salient, they relied on them more in their final decisions. Expectations had the strongest effect on trust decisions when they were externally and objectively provided. In short, decisions in the salient condition fell somewhere in between the two patterns of behavior observed in the subjective and objective expectations conditions. A limitation of comparing the effects of expectations in the salient and objective conditions is that expectations varied between participants in the salient condition, whereas those in the objective condition received identical expectation information. Hence, variance in expectations (rather than ambiguity) may have attenuated the effects of expectations in the salient condition. Study 2 was designed to address this concern.

The first study showed that even when subjective expectations are salient, they have weaker effects on behavior than objective expectations. Study 2 was designed test the hypothesis that trustors discount expectations – even ones based on explicit information – when they are ambiguous, rather than precise, probabilities (Einhorn & Hogarth, 1985; Van Dijk & Zeelenberg, 2003). We therefore manipulated the ambiguity of objective expectations: In the low-ambiguity conditions, participants learned about the precise probability of reciprocity (e.g., 20%). In the high-ambiguity conditions, participants received the same probability described as the midpoint of a range. For instance, participants were told that the probability of reciprocity was between 10 and 30%. Consistent with previous studies (Van Dijk & Zeelenberg, 2003), we predicted that ambiguous expectations would have a weaker effect on trusting than precise expectations.

We also introduced an individual risk-taking condition, where participants made decisions that were equivalent – in terms of probabilities and personal outcomes – to trust decisions. Outcomes in the individual risk-taking condition were determined by chance, rather than by another person. This condition allowed us to test for mean-level differences in the rates of trust and risk-taking, and allowed us to ask if expectations differently influenced trust and risk-taking decisions. Previous studies speculated that expectations have stronger effects on risk-taking decisions (Dunning et al., 2014; Evans & Krueger, 2014), but did not directly test this claim.

A total of 200 U. S. American participants (74 women) were recruited from Mturk. The average age was 33.6, SD = 9.8. Participants received 50 cents for their time and a bonus based on one randomly selected choice. Given the 2 x 2 design, the sample size was sufficient to detect medium sized effects (f = .20) with 80% power. Decisions were incentivized and no deception was employed.

The study had a 2 (ambiguity: low vs. high) X 2 (decision type: trust vs risk-taking) design. Participants made a series of 24 trust or risk-taking decisions. The instructions and trust game parameters were based on the materials used in Study 1.

We conducted a pre-test where we collected responses for Player 2 in the trust game, so that participants in the role of Player 1 could interact with actual partners. This “past partners” design allowed us to fully incentivize participants’ decisions (Camerer & Mobbs, 2017). We recruited an initial group of 100 American participants on Mturk to make a series of 24 decisions as Player 2 in the trust game. These participants were informed that they would be randomly partnered with trustors who would make decisions at a later time. Trustees always made decisions about whether to reciprocate, but they understood that their decisions would matter only if their partner chose to trust them in the first stage of the game. This means that each Player 2 made 24 separate reciprocity decisions.

Rates of reciprocity ranged from 31 to 72%, with an overall average of 48.0%. Across trials, the rate of reciprocity was strongly correlated with the trustee’s temptation, r(22) = −.92, p < .001, and uncorrelated with the trustor’s cost-benefit ratio, r(22) = .051, p = .81. Participants in the trust game conditions were randomly partnered with these initial 100 participants.

Before making a decision, participants received information about the probability of reciprocity. In each trial of the game, the probability of reciprocity was based on the actual reciprocity decisions of workers from our pre-test. In the low-ambiguity conditions, the probabilities given to participants were precise values (e.g., 60%). In the high-ambiguity conditions, these probabilities were presented as estimates with a 20% range of possibility. For example, if the probability of reciprocity was 60%, participants were informed that the probability of reciprocity was between 50 and 70%. Participants did not receive any further information about the distribution of probabilities within the given interval.

Participants in the trust conditions followed the procedure outlined in the objective condition from Study 1.

Participants in the risk-taking conditions read about individual gambles that were equivalent to the trust game in terms of personal outcomes, probabilities, and the presence (vs. absence) of ambiguity. They made a series of 24 decisions, choosing between “IN” (the risky option) and “OUT” (the safe option). They were informed that the consequences of their choices would be determined by a random number generator, and they would learn the chances of receiving “LEFT” (winning the gamble) and “RIGHT” (losing the gamble). At the decision screen for each trial, they were informed about the “chance of receiving LEFT” and the “chance of receiving RIGHT.” These probabilities were reported as percentages.

Table 2: The effects of ambiguity, decision type, and expectations on behavior (Study 2).

Fixed effects b 95% CI SE p Intercept .027 −.18, .22 .10 .79 Decision type (risk vs. trust) .47 .094, .80 .20 .020 Ambiguity .23 −.18, .63 .20 .25 Expectation 5.42 4.39, 6.48 .55 < .001 Ambiguity*Decision type −.13 −.89, .63 .28 .64 Expectation*Ambiguity −2.80 −4.66, −.99 1.09 .010 Expectation*Decision type 2.60 .46, 4.52 1.09 .017 Expectation*Decision*Ambiguity −2.94 −5.70, .11 2.17 .17 Random effects SD 95% CI Correlation Intercept 1.32 1.13, 1.47 Expectation 6.10 4.87, 6.92 −.03

To begin, we tested the effects of ambiguity and decision type on mean-level differences in behavior. We estimated a logistic model of trust with ambiguity (low = −.5; high = +.5), decision type (risk-taking = −.5; trust = +.5), and the ambiguity by decision type interaction entered as predictors; random intercepts were also included for each participant. The rate of trust was significantly higher (.52) than the rate of individual risk-taking (.44), b = .37, SE = .18, p = .036. Ambiguity had no significant effects on the overall rates of trust or risk-taking behavior, b = .25, SE = .18, p = .16, and there was no significant ambiguity by decision-type interaction, b = −.10, SE = .35, p = .77.

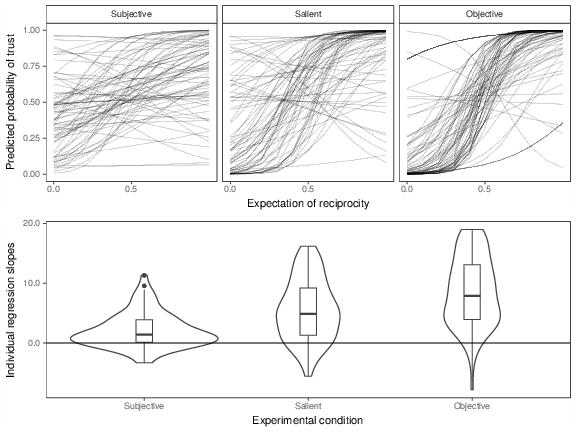

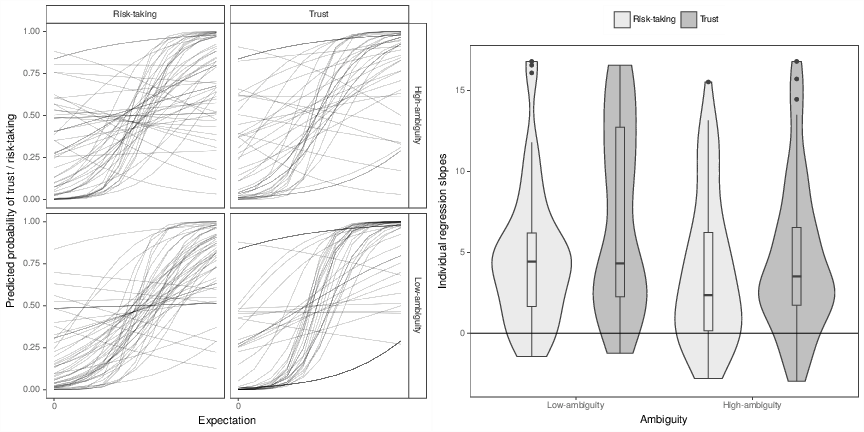

Figure 4: The effects of expectation, decision type (risk-taking vs. trust), and ambiguity (low vs. high) on behavior. Left: For each participant, we estimated a simple logistic model using expectation to predict behavior, and intercepts and slopes were then used to the generated predicted probabilities. Right: The distribution of individual-level regression slopes (i.e., the effect of expectations on trust and risk-taking for each participant) is displayed across conditions.

Our primary analyses focused on whether ambiguity influenced the relationship between expectations and behavior, with the hypothesis that precise expectations would have a stronger effect on decisions than ambiguous expectations. We estimated a logistic model with trust and risk-taking behavior as the dependent variable. This model included terms to test the potential interactions of decision type, ambiguity and expectations, as well as random intercepts for participants and random slopes for expectations. The results reported in Table 2.

Expectations were positively associated with both trust and risk-taking behavior. There were, however, two important qualifications: First, ambiguity moderated the relationship between expectations and behavior, p = .010. To understand this interaction, we estimated the simple effects of expectations in the low- and high-ambiguity conditions: As predicted, expectations in the low-ambiguity conditions had stronger effects on behavior (b = 6.93, SE = .90, p < .001) than expectations in the high-ambiguity conditions (b = 3.80, SE = .69, p < .001). Increasing the expectation of a positive outcome by +.01 was associated with a 7.17% increase in trusting/risk-taking behavior in the low-ambiguity conditions and a 3.87% increase in the high-ambiguity conditions.

Second, the effects of expectations were different for decisions involving trust versus individual risk, p = .017. We compared the simple effects of expectations on trust and risk-taking decisions: Expectations had a stronger positive effect in the trust conditions (b = 7.78, SE = 1.12, p < .001) than in the risk-taking conditions (b = 3.73, SE = .58, p < .001). Increasing the expectation of a positive outcome by +.01 was associated with a 8.11% increase in the odds of trusting behavior and a 3.80% increase in the odds of individual risk-taking.

There was no significant three-way interaction between ambiguity, decision type, and expectations (b = −2.94, SE = 2.17, p = .17), indicating that the tendency to discount ambiguous expectations was similar for trust and risk-taking decisions. Figure 4 displays the effects of expectations on behavior at the level of individual participants. Expectations had stronger effects for trust (vs risk-taking) decisions and when probabilities were precise (vs ambiguous).

The central finding of Study 2 was that precise expectations had a stronger effect on behavior than ambiguous expectations, consistent with the idea that people discount ambiguous information. Moreover, we observed two findings related to the difference between trust and risk-taking decisions: people were more willing to trust, and trust decisions were more sensitive to changes in expectations. The finding that expectations had stronger effects on trust decisions is particularly striking, given that previous accounts have argued that expectations matter more in non-social risk-taking dilemmas (Dunning et al., 2014; Evans & Krueger, 2014). Previous work, however, confounded decision domain (trust vs. risk-taking) with type of expectations (subjective vs. objective). The present results suggest that when type of expectations is held constant across domains, expectations more strongly influence trust than risk-taking decisions.

To what extent are trust decisions based on expectations of reciprocity? Previous studies suggested that trustors neglect expectations (Dunning et al., 2014) and rely too heavily on their own anticipated outcomes (Evans & Krueger, 2014). However, these earlier studies were focused on participants’ subjective expectations of reciprocity. Here, we find that making expectations salient and giving people access to objective probability information dramatically changes how they make decisions. When trustors have access to objective probabilities, they strongly rely on the expectations suggested by these probabilities. In contrast, subjective expectations play a muted role in decision-making because they are not immediately accessible (Study 1) and because they are discounted due to their ambiguity (Study 2).

Models of betrayal aversion (Bohnet & Zeckhauser, 2004) and principled trustfulness (Dunning & Fetchenhauer, 2013) have been proposed to explain how interpersonal trust decisions differ from individual risk-taking decisions. Consistent with principled trustfulness, participants in Study 2 were more likely to trust than engage in individual risk-taking behavior. Yet, closer inspection of the evidence also shows that people favor different types of information when making trust decision and when making nonsocial decisions under risk. Holding outcomes and probabilities constant, trust decisions were more influenced by expectations than individual risk-taking decisions. This finding contradicts the idea that expectations matter less for dilemmas of trust (Evans & Krueger, 2014).

The present results highlight that the extent to which trust is based on instrumental concerns versus other considerations, such as respect for norms, depends on the situation. We found that the effect of expectations is stronger when trustors have access to objective probability information. However, other variables can suppress the influence of expectations. For example, Evans and Van Beest (2017) found that trust decisions were less sensitive to changes in expectations when potential outcomes were described as losses (versus gains). Arguably, trust decisions involving losses are less calculative because self-regarding decisions involving losses are perceived as more overtly harmful to others than equivalent decisions involving gains (Baron, 1995; Leliveld, van Dijk & van Beest, 2008; Van Beest et al., 2005). When considering how a variable, such as gain-loss framing, influences trust, it is important to consider its effects on mean-level behavior and the underlying process of decision-making (e.g., the extent to which decisions are based on expectations).

The present research showed that subjective expectations have a comparatively weak effect on trust. Yet, this effect becomes stronger when trustors are prompted to generate expectations (Study 1), suggesting that trustors may rely on expectations insofar as they readily come to mind (Hertwig, Herzog, Schooler & Reimer, 2008). Consider how this process may influence trust when people have access to different trustworthiness cues: The ease (or difficulty) of forming subjective expectations may depend on the type of information at hand. In our studies, when trustors formed expectations they had to rely on the trustee’s temptation to betray trust (i.e., the trustee’s economic payoffs). Trustors may be more inclined to rely on subjective expectations when these are based on more easily processed cues, such as those observed in the trustee’s appearance (Todorov, Pakrashi & Oosterhof, 2009) and nonverbal behavior (DeSteno et al., 2012). Researchers have identified a comprehensive list of situational and personal cues that trustors use to form subjective expectations of reciprocity (Evans & Krueger, 2016; Thielmann & Hilbig, 2015), yet little is known about how different types of cues alter the relationship between expectations and behavior, or how trustors integrate or prioritize competing trustworthiness cues. Previous taxonomies have differentiated between personal and situational cues (Thielmann & Hilbig, 2015), but it may also be informative to define cues based on how much effort they require to process (Bonnefon, Hopfensitz & De Neys, 2013).

The present studies contribute to a broader literature examining how expectations and subjective beliefs influence behavior in different strategic contexts. Several studies have argued that (subjective) expectations are underemphasized in trust decisions (Dunning et al., 2014; Evans & Krueger, 2014), but other work has found that beliefs play an important role in reciprocity decisions. The theory of trust responsiveness suggests that trustees reciprocate when they believe they have been trusted, and the trustee’s second-order beliefs (i.e., what the trustee believes the trustor expects her to do) are more important than the trustee’s general preferences for fairness or equality (Bacharach, Guerra & Zizzo, 2007; Guerra & Zizzo, 2004). Reciprocity is less likely to occur when the trustee believes that the other party doubts that reciprocity will occur, as when the trustor takes a long time to reach a decision (Van de Calseyde, Keren & Zeelenberg, 2014) or when the trustor purchases insurance against the possibility of betrayal (Van de Calseyde, Keren & Zeelenberg, 2017). Trust, in other words, can act as a self-fulfilling prophecy. As this comparison between trust and reciprocity illustrates, the extent to which social decisions are based on expectations depends on the specific role of the decision-maker.

In Study 2, we compared trust and individual risk decisions without measuring behavior in risky dictator games, where players make risk-taking choices with added interpersonal consequences. Risky dictator games have been used as a control condition in studies comparing trust and risk (e.g., Bohnet & Zeckhauser, 2004) to account for the possibility that the trustor may have interpersonal motives related to equality or efficiency of outcomes (Fehr & Schmidt, 1999; Van Lange, 1999). However, previous studies have found that mean-levels of behavior are similar in risky dictator games and individual risk-taking decisions (Bohnet et al., 2008; Bohnet & Zeckhauser, 2004; Hong & Bohnet, 2007; Schlösser et al., 2015). Furthermore, the trustee’s temptation to be selfish has a relatively small effect on trusting behavior (Evans & Krueger, 2011; Snijders & Keren, 1999) and trustors often decide without searching for information related to the trustee’s outcomes (Evans & Krueger, 2014). Therefore, we think it likely that the risky dictator game would produce results similar to the individual risk-taking conditions used in Study 2.

The present studies also relied on participants recruited through Mturk. Recent work has noted that Mturk participants may have prior experience with canonical judgment and decision-making tasks (Stewart et al., 2015), and this experience may influence the strength of different experimental manipulations (Chandler, Paolacci, Peer, Mueller & Ratliff, 2015; Rand et al., 2014). However, we believe that task experience would — if anything – reduce the differences we observed in the present studies. For example, it seems likely that experienced participants would be less likely to differentiate between trust and individual risk-taking decisions because they recognize the same underlying structure of these dilemmas. Still, studies of the trust game conducted on Mturk may fail to capture some elements of laboratory (and real-life) trust decisions: When strangers interact on Mturk, they may not fully experience the social norm that they should trust in others (Dunning et al., 2014) or suffer the fear of anticipated betrayal (Koehler & Gershoff, 2003). We believe it is valuable for future studies to consider the potential differences between online and laboratory studies of trust among strangers.

Recent work on the psychology of trust proposed that expectations of reciprocity have little impact on the final decision (Dunning et al., 2014; Evans & Krueger, 2014). We find that this claim holds for trust decisions based on subjective expectations. The pattern changes, however, when trustors’ expectations are based on objective, unambiguous information. The strategic processes underlying trust are flexible and heterogeneous, and the way that people reason in dilemmas of trust is shaped by the availability and ambiguity of information. People focus on what comes to mind easily at the moment of decision-making and neglect imprecise information. Understanding how people reason in dilemmas of trust (and how trust differs from individual risk-taking) requires a better understanding of how people attend to information.

Aggarwal, R., Goodell, J. W., & Selleck, L. J. (2015). Lending to women in microfinance: Role of social trust. International Business Review, 24, 55–65.

Aimone, J. A., & Houser, D. (2012). What you don’t know won’t hurt you: a laboratory analysis of betrayal aversion. Experimental Economics, 15, 571–588.

Bacharach, M., Guerra, G., & Zizzo, D. J. (2007). The self-fulfilling property of trust: An experimental study. Theory and Decision, 63, 349–388.

Balliet, D., & Van Lange, P. A. (2013). Trust, punishment, and cooperation across 18 societies: A meta-analysis. Perspectives on Psychological Science, 8, 363–379.

Baron, J. (1995). Blind justice: Fairness to groups and the do-no-harm principle. Journal of Behavioral Decision Making, 8, 71–83.

Bates, D., Mächler, M., Bolker, B., & Walker, S. (2014). lme4: Linear mixed-effects models using Eigen and S4. Available at CRAN.R-project.org/package=lme4).

Berg, J., Dickhaut, J., & McCabe, K. (1995). Trust, reciprocity, and social history. Games and Economic Behavior, 10, 122–142.

Bohnet, I., Greig, F., Herrmann, B., & Zeckhauser, R. (2008). Betrayal aversion: Evidence from Brazil, China, Oman, Switzerland, Turkey, and the United States. The American Economic Review, 294–310.

Bohnet, I., & Zeckhauser, R. (2004). Trust, risk and betrayal. Journal of Economic Behavior & Organization, 55, 467–484.

Bonnefon, J. F., De Neys, W., & Hopfensitz, A. (2013). Evidence for the modularity of trustworthiness detection in an economic game. Journal of Experimental Psychology: General, 142, 143–150.

Brunswik, E., (1955). Representative design and probabilistic theory. Psychological Review, 62, 193–217.

Camerer, C. (2003). Behavioral game theory: Experiments in strategic interaction. Princeton, NJ: Princeton University Press.

Camerer, C., & Mobbs, D. (2017). Differences in behavior and brain activity during hypothetical and real choices. Trends in Cognitive Sciences.

Chandler, J., Paolacci, G., Peer, E., Mueller, P., & Ratliff, K. A. (2015). Using non-naive participants can reduce effect sizes. Psychological Science, 26, 1131–1139.

DeSteno, D., Breazeal, C., Frank, R. H., Pizarro, D., Baumann, J., Dickens, L., & Lee, J. J. (2012). Detecting the trustworthiness of novel partners in economic exchange. Psychological Science, 0956797612448793.

Dunning, D., Anderson, J. E., Schlösser, T., Ehlebracht, D., & Fetchenhauer, D. (2014). Trust at zero acquaintance: More a matter of respect than expectation of reward. Journal of Personality and Social Psychology, 107, 122–141.

Dunning, D., & Fetchenhauer, D. (2013). Behavioral influences in the present tense: On expressive versus instrumental action. Perspectives on Psychological Science, 8, 142–145.

Einhorn, H. J., & Hogarth, R. M. (1985). Ambiguity and uncertainty in probabilistic inference. Psychological Review, 92, 433–461.

Ellsberg, D. (1961). Risk, ambiguity, and the Savage axioms. The Quarterly Journal of Economics, 643–669.

Ert, E., Fleischer, A., & Magen, N. (2016). Trust and reputation in the sharing economy: The role of personal photos in Airbnb. Tourism Management, 55, 62–73.

Evans, A. M., Athenstaedt, U., & Krueger, J. I. (2013). The development of trust and altruism during childhood. Journal of Economic Psychology, 36, 82–95.

Evans, A. M., & Krueger, J. I. (2009). The psychology (and economics) of trust. Social and Personality Psychology Compass, 3, 1003-1017.

Evans, A. M., & Krueger, J. I. (2011). Elements of trust: Risk and perspective-taking. Journal of Experimental Social Psychology, 47, 171–177.

Evans, A. M., & Krueger, J. I. (2014). Outcomes and expectations in dilemmas of trust. Judgment and Decision Making, 9, 90–103.

Evans, A. M., & Krueger, J. I. (2016). Bounded prospection in dilemmas of trust and reciprocity. Reviews of General Psychology, 20, 17-28.

Evans, A. M., & Revelle, W. (2008). Survey and behavioral measurements of interpersonal trust. Journal of Research in Personality, 42, 1585–1593.

Evans, A. M. & Van Beest, I. (2017). Gain-loss framing effects in dilemmas of trust and reciprocity. Journal of Experimental Social Psychology, 73, 151–163.

Fehr, E., & Schmidt, K. M. (1999). A theory of fairness, competition, and cooperation. Quarterly Journal of Economics, 817–868.

Fetchenhauer, D., & Dunning, D. (2009). Do people trust too much or too little? Journal of Economic Psychology, 30, 263–276.

Fetchenhauer, D., & Dunning, D. (2012). Betrayal aversion versus principled trustfulness—How to explain risk avoidance and risky choices in trust games. Journal of Economic Behavior & Organization, 81, 534–541.

Gigerenzer, G., Todd, P. M., & the ABC Research Group (1999). Simple heuristics that make us smart. New York: Oxford University Press.

Guerra, G., & Zizzo, D. J. (2004). Trust responsiveness and beliefs. Journal of Economic Behavior & Organization, 55, 25–30.

Hertwig, R., & Erev, I. (2009). The description-experience gap in risky choice. Trends in Cognitive Sciences, 13, 517–523.

Hertwig, R., & Herzog, S. M. (2009). Fast and frugal heuristics: Tools of social rationality. Social Cognition, 27, 661–698.

Hertwig, R., Herzog, S. M., Schooler, L. J., & Reimer, T. (2008). Fluency heuristic: a model of how the mind exploits a by-product of information retrieval. Journal of Experimental Psychology: Learning, Memory, and Cognition, 34, 1191–1206.

Hong, K., & Bohnet, I. (2007). Status and distrust: The relevance of inequality and betrayal aversion. Journal of Economic Psychology, 28, 197–213.

Koehler, J. J., & Gershoff, A. D. (2003). Betrayal aversion: When agents of protection become agents of harm. Organizational Behavior and Human Decision Processes, 90, 244–261.

Krueger, J. I. (2003). Return of the ego—self-referent information as a filter for social prediction: Comment on Karniol (2003). Psychological Review, 110, 585–590.

Krueger, J. I., Evans, A. M., & Heck, P. R. (2017). Let me help you help me: Trust between profit and prosociality. In P. A. M. Van Lange, B. Rockenbach, & T. Yamagishi (Eds.). Social dilemmas: New perspectives on trust. New York: Oxford University Press.

Kugler, T., Connolly, T., & Kausel, E. E. (2009). The effect of consequential thinking on trust game behavior. Journal of Behavioral Decision Making, 22, 101–119.

Kuznetsova, A., Brockhoff, P. B., & Christensen, R. H. B. (2015). lmerTest: Tests for random and fixed effects for linear mixed effect models (lmer objects of lme4 package). Available at CRAN.R-project.org/package=lmerTest.

Leliveld, M. C., van Dijk, E., & Van Beest, I. (2008). Initial ownership in bargaining: Introducing the giving, splitting, and taking ultimatum bargaining game. Personality and Social Psychology Bulletin, 34, 1214–1225.

Lin, S., Keysar, B., & Epley, N. (2010). Reflexively mindblind: Using theory of mind to interpret behavior requires effortful attention. Journal of Experimental Social Psychology, 46, 551–556.

Martinez, L. F., & Zeelenberg, M. (2015). Trust me (or not): Regret and disappointment in experimental economic games. Decision, 2, 118-126.

Olson, M. J., & Budescu, D. V. (1997). Patterns of preference for numerical and verbal probabilities. Journal of Behavioral Decision Making, 10, 117–131.

Rand, D. G., Peysakhovich, A., Kraft-Todd, G. T., Newman, G. E., Wurzbacher, O., Nowak, M. A., & Greene, J. D. (2014). Social heuristics shape intuitive cooperation. Nature Communications, 5.

Rotter, J. B. (1967). A new scale for the measurement of interpersonal trust. Journal of Personality, 4, 651–665.

Schlösser, T., Fetchenhauer, D., & Dunning, D. (2016). Trust against all odds? Emotional dynamics in trust behavior. Decision, 3, 216-230.

Schlösser, T., Mensching, O., Dunning, D., Fetchenhauer, D. (2015). Trust and rationality: Shifting normative analyses in risks involving other people versus nature. Social Cognition, 33), 459–482.

Simon, H. A. (1955). A behavioral model of rational choice. The Quarterly Journal of Economics, 99–118.

Snijders, C., & Keren, G. (1999). Determinants of trust. In D. V. Budescu, I. Erev, & R. Zwick (Eds.), Games and Human Behavior (pp. 355–385). Mahwah, NJ: Lawrence Erlbaum.

Stewart, N., Ungemach, C., Harris, A. J., Bartels, D. M., Newell, B. R., Paolacci, G., & Chandler, J. (2015). The average laboratory samples a population of 7,300 Amazon Mechanical Turk workers. Judgment and Decision Making, 10, 479–491.

Tamir, D. I., & Mitchell, J. P. (2013). Anchoring and adjustment during social inferences. Journal of Experimental Psychology: General, 142, 151–162.

Thielmann, I., & Hilbig, B. E. (2015). Trust: An integrative review from a person–situation perspective. Review of General Psychology, 19, 249–277.

Todorov, A., Pakrashi, M., & Oosterhof, N. N. (2009). Evaluating faces on trustworthiness after minimal time exposure. Social Cognition, 27, 813–833.

Van Beest, I., Van Dijk, E., De Dreu, C. K., & Wilke, H. A. (2005). Do-no-harm in coalition formation: Why losses inhibit exclusion and promote fairness cognitions. Journal of Experimental Social Psychology, 41, 609–617.

Van de Calseyde, P. P., Keren, G., & Zeelenberg, M. (2014). Decision time as information in judgment and choice. Organizational Behavior and Human Decision Processes, 125, 113–122.

Van de Calseyde, P.P., Keren, G., & Zeelenberg, M. (2017). The hidden cost of insurance on cooperation. In press at Journal of Behavioral Decision Making.

Van Dijk, E., & Zeelenberg, M. (2003). The discounting of ambiguous information in economic decision making. Journal of Behavioral Decision Making, 16, 341–352.

Van Lange, P. A. (1999). The pursuit of joint outcomes and equality in outcomes: An integrative model of Social Value Orientation. Journal of Personality and Social Psychology, 77, 337–349.

Yamagishi, T., Akutsu, S., Cho, K., Inoue, Y., Li, Y., & Matsumoto, Y. (2015). Two-component model of general trust: Predicting behavioral trust from attitudinal trust. Social Cognition, 33, 436–458.

| Trial | Cost-benefit ratio | Temptation | P1 | P2 | R1 | R2 | S | T |

| 1 | Low | Low | 48 | 25 | 81 | 84 | 36 | 97 |

| 2 | 59 | 29 | 107 | 100 | 46 | 125 | ||

| 3 | 44 | 23 | 78 | 76 | 32 | 92 | ||

| 4 | 36 | 18 | 63 | 61 | 28 | 71 | ||

| 5 | Med | 51 | 25 | 91 | 90 | 41 | 125 | |

| 6 | 55 | 27 | 90 | 94 | 41 | 131 | ||

| 7 | 24 | 12 | 42 | 40 | 19 | 62 | ||

| 8 | 41 | 21 | 67 | 68 | 31 | 98 | ||

| 9 | High | 36 | 17 | 64 | 63 | 28 | 147 | |

| 10 | 28 | 15 | 48 | 49 | 21 | 110 | ||

| 11 | 23 | 12 | 43 | 41 | 18 | 94 | ||

| 12 | 46 | 23 | 88 | 87 | 35 | 200 | ||

| 13 | High | Low | 29 | 14 | 36 | 36 | 7 | 44 |

| 14 | 44 | 22 | 54 | 53 | 10 | 65 | ||

| 15 | 19 | 10 | 26 | 26 | 5 | 29 | ||

| 16 | 52 | 25 | 63 | 64 | 13 | 75 | ||

| 17 | Med | 25 | 12 | 31 | 30 | 6 | 48 | |

| 18 | 28 | 13 | 36 | 36 | 7 | 57 | ||

| 19 | 25 | 12 | 31 | 29 | 6 | 49 | ||

| 20 | 28 | 15 | 37 | 36 | 7 | 59 | ||

| 21 | High | 23 | 12 | 29 | 30 | 6 | 87 | |

| 22 | 42 | 21 | 50 | 48 | 11 | 134 | ||

| 23 | 28 | 14 | 34 | 35 | 7 | 99 | ||

| 24 | 37 | 19 | 45 | 44 | 9 | 102 |

Copyright: © 2017. The authors license this article under the terms of the Creative Commons Attribution 3.0 License.

This document was translated from LATEX by HEVEA.