Judgment and Decision Making, Vol. 13, No. 1, January 2018, pp. 73-78

A new test of the risk-reward heuristicWilliam J. Skylark* Sidharth Prabhu-Naik* |

Risk and reward are negatively correlated in a wide variety of

environments, and in many cases this trade off approximates a fair

bet. Pleskac and Hertwig (2014) recently proposed that people have

internalized this relationship and use it as the basis for

probability estimation and subsequent choice under conditions of

uncertainty. Specifically, they showed that risky options with

high-value outcomes are inferred to have lower probability than

options offering a less valuable reward. We report two experiments

that test a simple corollary of this idea. In both studies,

participants estimated the magnitude of prizes offered by lotteries

with known win-probabilities. The relationship between estimates and

probabilities followed the power relationship predicted by the

risk-reward heuristic, albeit with a tendency to overestimate

outcome magnitude. In addition, people’s estimates predicted their

willingness to take the gamble. Our results provide further evidence

that people have internalized the ecological relationship between

risk and reward in financial lotteries, and we suggest that this

relationship exerts a wide-ranging influence on decision-making.

Keywords: risk, reward, judgment, choice.

1 Introduction

In a recent paper, Pleskac and Hertwig (2014) examined the

relationship between probability and payoff in a range of natural

environments, including roulette, horse-race betting, life insurance,

dairy farming, and academic publishing. In all cases, there was a

consistent negative association between probability and reward. For

example, journals with a higher impact factor have a lower acceptance

rate, and bull semen samples that are expected to produce

greater increases in farm profitability are less likely to successfully fertilize the

female.

Pleskac and Hertwig argued that this negative relationship arises

because real-world lotteries tend towards a fair bet, such that a

gamble which costs L to play and offers a prize of G will have

win-probability P = L/G.1 This

can happen for a number of reasons. For example, in a market for

gambles, sellers wish to offer low rewards with low probabilities,

whereas buyers seek high rewards with high probabilities, driving the

offered gambles towards an equilibrium in which the expected returns

are equal to the stake. This is exemplified by roulette, where the

payouts perfectly track the probabilities such that the expected net

return (in the European version) is always a loss of 2.7% of the

stake – a value very close to the fair-bet payout, with just a small

shift in the house’s favour to keep the casino in business.

Pleskac and Hertwig (2014) further argued that people have extracted

this environmental contingency and use it as the basis for judgment

and choice. Specifically, they posited the risk-reward heuristic: when

the probability of winning is unknown, infer that it is equal to

L/G. They tested this in two studies. First, they offered lab

participants the opportunity to play a lottery for real money;

participants were told that the lottery cost $2 to play and that the

prize was $2.50, $4, $10, or $20 (varied

between-participants). Participants were confronted with an envelope

and a bingo basket containing 100 balls and told that the envelope

contained a number from 1–100 that determined their probability of

winning. After finding out the number in the envelope, they would draw

a ball and, if its number was equal to or less than the number in the

envelope, they would win. Prior to opening the

envelope, participants had to estimate the number of

winning balls and decide whether to play. Study 2 was similar but conducted on-line using a

hypothetical gamble and a wider range of prizes.

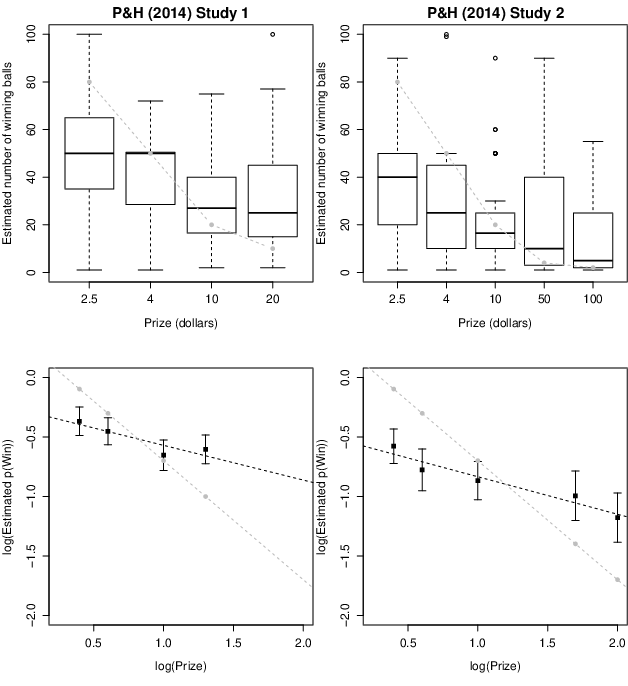

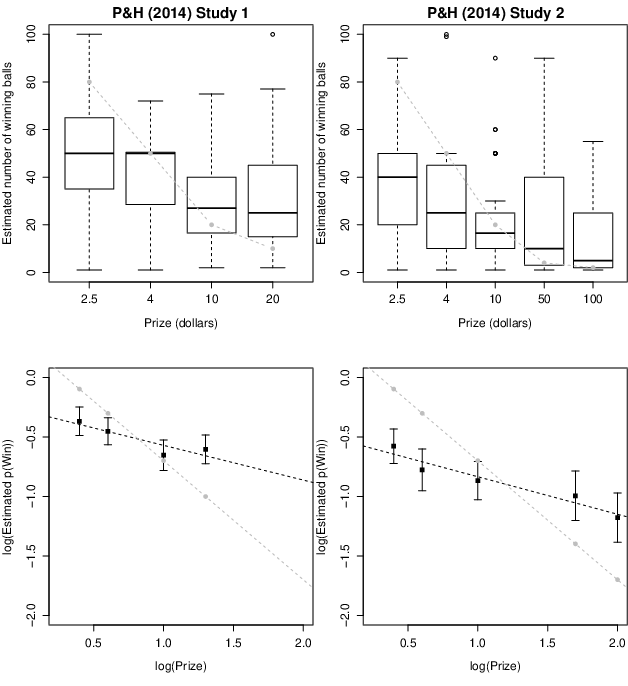

The results of both studies are replotted in Figure 1. In both cases,

the estimated probability of winning clearly decreases as the size of

the prize increases. The bottom panels show the results on a

log-log plot and demonstrate that the judgments follow the functional

form predicted by the risk-reward heuristic, but that there is a

regressive effect: people overestimated small probabilities and underestimated large probabilities (e.g., Erev, Wallsten

& Budescu, 1994). In other words, the data potentially support an

error-prone application of the heuristic, which nonetheless strongly

anchors participants’ probability estimates.

| Figure 1: Results of Studies 1 and 2 from Pleskac & Hertwig

(2014). The top panels show the distribution of estimated

probability values for each prize condition. The grey dashed line

indicates the predictions of the risk-reward heuristic. The bottom

panels show the mean of the log-transformed estimates against the

log-transformed prize values; the black dashed line shows the

best-fitting linear function and the grey dashed line shows the

predictions of the risk-reward heuristic. Error bars indicate 95%

confidence intervals. |

These estimates also predicted choice behaviour. At the aggregate

level, participants in the high-outcome conditions (where the mean

probability estimates were above what would be expected for a fair

bet) were more willing to play the lottery than were those in the

low-outcome conditions (where estimated probabilities were smaller

than expected from a fair bet). At the individual level, regression

analysis showed that both outcome value and estimated probability

predicted the decision to play. However, the risk-reward heuristic is

agnostic about the decision rule or process by which probability

estimates shape choice. For example, the estimates may provide the

basis for the calculation (and maximization) of expected value or

expected utility (Savage, 1954), the computations of Prospect Theory

(Kahneman & Tversky, 1979), or a process heuristic like elimination by

aspects (Tversky, 1969).

We report two experiments that test a simple extension of the

risk-reward heuristic: namely, that people use probabilities to infer

rewards. Specifically, we test whether a person offered the chance to

pay L to play a lottery that offers P chance of winning G will

infer that G = L/P, and whether this inference predicts their

decision about whether or not to play. This would be a logical

consequence of the relation proposed by Pleskac and Hertwig (2014),

but human estimates and choices routinely show asymmetries and task

dependencies which mean this may not be observed in practice (e.g.,

Holyoak & Mah, 1982; Lichentstein & Slovic, 1971). The numerous

differences in the ways that probabilities and monetary values are

experienced, represented, and processed means that the principles by

which people estimate rewards from probabilities need not be the same

as those by which they estimate probabilities from rewards. Correspondingly,

our experiments provide a straightforward but important test of the

idea that people are sensitive to the ecological risk-reward

trade-off. We note from the outset that gambles with explicit

probabilities but uncertain outcomes are less common than those for

which outcomes are explicit but probabilities are unknown (decisions

under ambiguity). However, we believe that the impact of probability

values on inferences about outcome magnitude nonetheless have

implications for many risky choices, as we discuss below.

2 Method

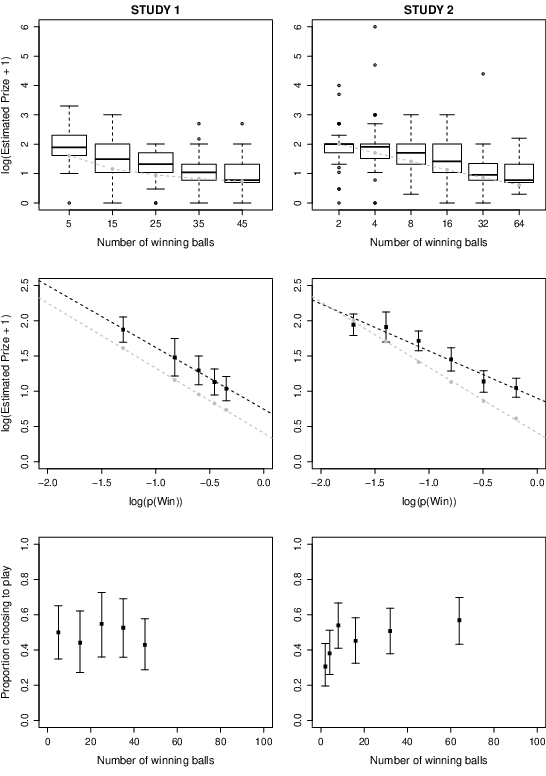

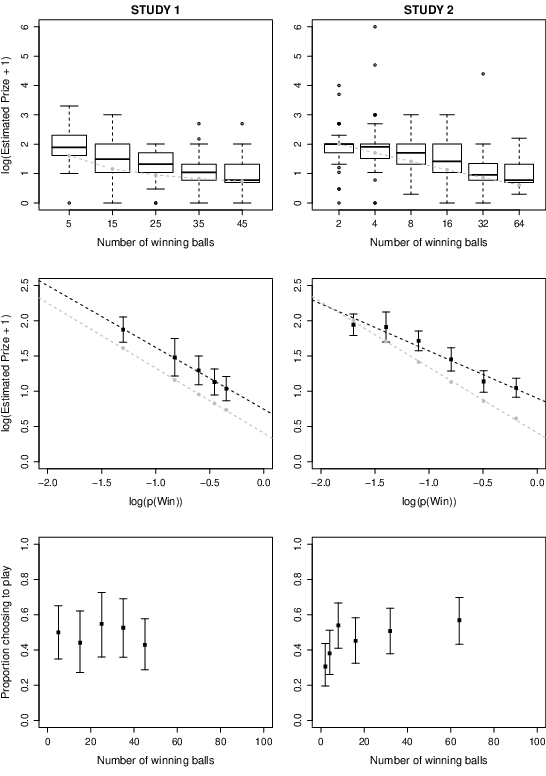

| Figure 2: Results of Studies 1 and 2. The top panels show the distribution of estimated prize values for each probability condition. The grey dashed line indicates the predictions of the risk-reward heuristic. The middle panels show the mean of the log-transformed estimates against the log-transformed probabilities; the black dashed line shows the best-fitting linear function and the grey dashed line shows the predictions of the risk-reward heuristic. The bottom panels show the proportion of participants in each condition who chose to play the gamble. Error bars indicate 95% confidence intervals. |

Both experiments were modelled closely on Pleskac and Hertwig’s (2014)

Study 2. Participants were told about a hypothetical lottery which

costs $2 to play and which offers a prize with a probability that was

varied between participants. Participants had to estimate the prize

and then state whether they would choose to play. Our Study 2 was a

replication and extension of Study 1, using a larger sample, a wider

range of probabilities, more stringent checks for attentiveness, and a

clearer statement of the choice that participants were asked to

consider. Given the similarity between the two experiments, we report

them together.

2.1 Participants

Like Pleskac and Hertwig’s (2014) Study 2, both experiments were

conducted on-line using participants from Amazon’s Mechanical

Turk. Eligible participants were those aged 18 or over who completed

the task and whose ip address had not previously occurred earlier in

the data file, and who indicated that they had not previously

attempted the task (see e.g., Matthews & Dylman, 2014). Study 1 recruited

205 eligible participants, of whom 7 failed an attention check leaving

a final sample of 198 (114 male) aged 20–61 (M=35.9,

SD=10.7). Study 2 recruited 411 eligible participants of whom 40

failed one or both attention checks, leaving a final sample of 371

(226 male) aged 18–79 (M=34.0, SD=10.3).

2.2 Design and Procedure

In Study 1, participants provided informed consent and were told that

they would be asked to consider a simple financial decision which,

although hypothetical, they should consider carefully and answer as

honestly and accurately as they can. They then read the following

instructions, which are closely modelled on those used by Pleskac and

Hertwig (2014):

Imagine you have been asked to play the following lottery. The lottery

offers the opportunity to win a monetary prize but it costs you $2 to

play. If you choose to play you would pay the $2 and, without

looking, draw a ball from a basket. In the basket there are 100

balls. The balls are either black or red. If the ball is red you will

win the prize; otherwise, if the ball is black you will receive

nothing. Thus, the number of red balls in the basket determines the

probability that you will win. Given that the number of red balls in

the basket is [5, 15, 25, 35, 45], how much do you estimate the prize

to be?"

After entering their judgment, participants progressed to a page which

asked: “Given the opportunity, would you pay $2 to play the gamble

for your estimated prize money?” and selected "yes" or "no".

There followed an attention check question, which asked the colour of

the winning balls (Red, Blue, Green, Yellow, or "I don’t know"),

followed by a question probing past-participation and demographic

information.

Study 2 was very similar, except for 3 changes. First, a wider range

of probabilities was used (2, 4, 8, 16, 32, and 64 winning

balls). Second, the choice task was modified so as to remind

participants of the probability of winning and of their estimate of

the prize, as follows: “Suppose that your estimate of the prize money

is correct. That is, there are 100 balls in the basket, of which [2,

4, 8, 16, 32, 64] are red. If you draw a red ball, you win

$[participant’s estimate of prize]. Would you pay $2 to play this

lottery?” Third, an additional attention-check was added, which asked

how many winning balls are in the basket.

3 Results

3.1 Prize estimates

As one would expect for judgments of financial value, participants’

estimates were positively skewed; we therefore applied a logarithmic

transformation (log10(x + 1)), after which the data were

approximately normal within each condition. The top panels of Figure 2

show the data for each condition. As can be seen in the figure,

participants’ estimates of the prize decreased as the probability of

winning increased. The sensitivity of prize estimates to probability

was confirmed by a one-way ANOVA for both Experiment 1,

F(4, 193) = 13.00, p <.001, η2 = .212, and for Experiment 2,

F(5, 365) = 22.22, p < .001, η2 = .233. The pattern is

clearer in the middle panels of Figure 2, which show the data on a

log-log plot along with the best fitting line and the linear function

predicted by the risk-reward heuristic. The data match the functional

form of the risk-reward heuristic, although in both studies

participants consistently overestimated the size of the reward

relative to that expected from a fair bet; in Study 2, this tendency

becomes more pronounced as the probability of winning increases,

echoing the regressive effect reported by Pleskac and Hertwig (2014)

(see also Matthews & Stewart, 2009). The complementary regressive

effects found here (where participants estimated rewards from stated

probabilities) and in Pleskac and Hertwig (where people estimated

probabilities from stated rewards) is reminiscent of work by Erev et

al (1994), who showed that noise in the construction of subjective

confidence leads to two complementary regressive tendencies: apparent

overconfidence when one plots percentage-correct against subjective

confidence categories but apparent underconfidence when one plots mean

subjective probabilities against objective probability

categories.2

3.2 Choice task

The proportion of participants who chose to play the lottery is

plotted in the bottom panels of Figure 2. To test

the effects of probability and estimated prize money on the

willingness to play, we fit a series of logistic regression models and

used likelihood ratio tests to compare them. The Null model included

only an intercept; the Probability model included an intercept and the

number of winning balls, coded as a categorical predictor (rather than

positing a particular functional form for the effect); the Prize model

included the intercept and the log-transformed estimates of the prize

money; and the Full model included an intercept and both predictors.

For Study 1, the willingness to gamble was positively related to

participants’ estimates of the prize money: the Prize model was

superior to the Null model, χ2(1) = 14.98, p<.001,

Bprize = 0.843, CI95% = [0.407, 1.310], and the Full model

was better than the Probability model, χ2(1) = 18.23, p <.001,

Bprize = 1.076, CI95% = [0.565, 1.633]. In contrast, the

Probability model was no improvement over the Null model,

χ2(4) = 1.69, p = .793, and the Full model was no better than

the Prize model, χ2(4) = 4.93, p = .294. In short, choices

were predicted by participants’ estimates of the prize money but not

by the probability of winning. As an additional exploration, we re-ran

the analyses using the logarithm of the number of winning balls,

log10(n), as a continuous predictor, in place of the categorical

condition predictor. The pattern of the results was unchanged: there

was a strong effect of the estimated prize, Bprize = 1.071,

CI95% = [0.562, 1.626], p <.001, but little effect of the

number of winning balls, Bnwin =

0.846,CI95% = [−0.074, 1.804], p = .076.

For Study 2, the willingness to gamble was again positively related to

the estimated prize money: the Prize model was superior to the Null

model χ2(1) = 15.59, p <.001, Bprize = 0.603,

CI95% = [0.296, 0.928], and the Full model was better than the

Probability model χ2(1) = 41.11, p <.001, Bprize = 1.295,

CI95% = [0.859, 1.769]. However, unlike Study 1 there was also

an effect of the win-probability: the Probability model was superior

to the Null model, χ2(5) = 12.65, p <.027, and the Full model

was better than the Prize model, χ2(5) = 38.17, p

<.001. Again, using the log-transformed number of winning balls as a

continuous predictor revealed the same pattern: Bprize = 1.299,

CI95% = [0.868, 1.768], p <.001, Bnwin = 1.568,

CI95% = [1.030, 2.138], p < .001.

3.3 Potentially spurious responses

A total of 15 participants (10 in Study 1, 5 in Study 2) estimated the

prize as $0; a further 6 (1 in Study 1, 5 in Study 2) gave very large

estimates (> $1000). Our preference is to take all responses at

face value (it is not unusual for lotteries to offer very large

prizes, or for them to be rigged such that the player cannot win

anything), but such responses might arguably be typos or indicate

failure to understand the task. Re-running all analyses without these

responses made very little difference to the plots or to the

inferential tests, except that for Study 2 the improvement of the

Probability model over the Null model was no longer significant,

χ2(5) = 10.44, p = .064; however, the Full model was still

superior to the Prize model, χ2(5) = 41.90, p <.001,

indicating that the probability of winning predicted the decision to

play, over and above the person’s estimate of the potential

reward. When the log-transformed number of winning balls was used as a

continuous predictor, the conclusions were the same: for Study 1,

Bprize = 1.031, CI95% = [0.454, 1.647], p <.001,

Bnwin = 0.755, CI95% = [−0.190, 1.736], p = .123; for

Study 2, Bprize = 1.696, CI95% = [1.194, 2.237], p <.001,

Bnwin = 1.761, CI95% = [1.185, 2.373], p < .001.

4 Discussion

Just as people judge that higher rewards will be associated with lower

probability of success (Pleskac & Hertwig, 2014), so they judge that

higher probabilities will be associated with lower rewards (our

Studies 1 and 2). In both cases, the relationship is approximately

linear on a log-log plot, consistent with the functional form

predicted by the risk-reward heuristic. To this extent, both sets of

studies support that heuristic as an account of inference about the

components of a risky prospect.

However, like Pleskac and Hertwig’s data, our results are inconsistent

with a strong (error-free) application of the heuristic. In

particular, our participants tended to overestimate the probability of

winning relative to what would be expected from a fair bet. This is

surprising when one considers that many financial lotteries are

actually designed to favour the house (for example, had our participants

internalized the risk-reward structure of casino bets, state

lotteries, or bookmakers’ odds, they would have estimated

prizes that were smaller than the risk-reward heuristic would

predict). This could be taken as an example of an optimism bias (see,

e.g., Krizan & Windschitl, 2007). However, like the regressive effect

in Pleskac & Hertwig’s data (and apparent in our Study 2), the

optimism shown by our participants may be due to noisy responding:

estimates of monetary reward are bounded at zero, so positive errors

will tend to be larger than negative ones. More generally, the fact

that probabilities are doubly-bounded (at zero and one) whereas

rewards are only lower-bounded may mean that the precise consequences

of applying the risk-reward heuristic will be different for the two

types of estimation task. In any case, our data support the idea that

the risk-reward heuristic anchors, but does not completely determine,

people’s estimates of probabilities and outcomes.

These estimates influenced choice: in both studies, participants who

expected larger rewards were more likely to take the gamble. Notably,

our studies, like those of Pleskac and Hertwig (2014), always required

participants to make their estimates prior to making their choices

(because the primary interest is in whether people apply the

risk-reward heuristic when estimating probabilities and outcomes); it

remains to be seen whether the same relationship holds when choices

precede estimation.

Researchers often focus on decisions under ambiguity, where the

probability of an outcome is not precisely known. Indeed, Pleskac and

Hertwig (2014) suggested that the risk-reward heuristic may contribute

to the widespread aversion to ambiguous options, and provided some

evidence for this possibility. Prima facie, there are fewer situations

in which precise probabilities are given for uncertain

outcomes. Although there are such scenarios (e.g., when a doctor

states that a treatment has a 50% chance of being successful without

defining "success"), a more important observation is that most real

decisions take place in complex, information-rich environments that

add considerable noise to the representation of outcomes and

probabilities. It is easy to mis-read, mis-hear, or imperfectly

process one or more components of an option, and in many situations

the elements of competing options are not simultaneously presented but

require retrieval from memory. In such situations, people use prior

knowledge and schemas to inform their perceptions and memories (e.g.,

Ghosh & Gilboa, 2014; Vincent, 2015), such that inferences about

outcomes from probabilities, just like inferences about probabilities

from outcomes, will shape the mental representation of the decision.

Thus, even when precise information about probabilities and outcomes

is ostensibly available, in practice people are likely to rely on

prior beliefs and schemas to infer elements of the decision problem,

and these inferences will shape the choice that is made. In other

words, we contend that the risk-reward heuristic is likely to be an

important, computationally-rational strategy in a wide variety of

settings.

References

Erev, I., Wallsten, T. S., & Budescu, D. V. (1994). Simultaneous over- and underconfidence: The role of error in judgment processes. Psychological Review, 101, 519–527.

Ghosh, V. E., & Gilboa, A. (2014). What is a memory schema? A historial perspective on current neuroscience literature. Neuropsychologia, 53, 104–114.

Holyoak, K. J., & Mah, W. A. (1982). Cognitive reference points in judgments of symbolic magnitude. Cognitive Psychology, 14, 328–352.

Kahneman, D. & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47, 263–291.

Lichtenstein, S. & Slovic, P. (1971). Reversals of preference between bids and choices in gambling decisions. Journal of Experimental Psychology, 89, 46–55.

Matthews, W. J., & Dylman, A. S. (2014). The language of magnitude comparison. Journal of Experimental Psychology: General, 143, 510–520.

Matthews, W.J., & Stewart, N. (2009). Psychophysics and the judgment of price: Judging complex objects on a non-physical dimension elicits sequential effects like those in perceptual tasks. Judgment and Decision Making, 4, 64–81.

Pleskac, T. J., & Hertwig, R. (2014). Ecologically rational choice and the structure of the environment. Journal of Experimental Psychology: General, 143(5), 2000–2019.

Savage, L. J. (1954). The foundations of statistics. New York: Wiley.

Tversky, A. (1969). Intransitivity of preferences. Psychological Review, 76, 31–48.

Vincent, B. T. (2015). A tutorial on Bayesian models of perception. Journal of Mathematical Psychology, 66, 103–114.

This document was translated from LATEX by

HEVEA.