Judgment and Decision Making, Vol. 13, No. 6, November 2018, pp. 587-606

Boundary effects in the Marschak-Machina triangle

Krzysztof Kontek*

|

This paper presents the results of a study that sheds new light on

the shape of indifference curves in the Marschak-Machina triangle. The

most important observation, obtained non-parametrically, concerns jumps

in indifference curves at the triangle legs towards the triangle

origin. These jumps, however, do not appear at the hypotenuse. The

pattern observed suggests discontinuity in lottery valuation when the

range of lottery outcomes changes and is best explained by

decision-making models based on the psychological phenomenon of range

dependence (Parducci, 1965; Cohen, 1992; Kontek & Lewandowski, 2018).

Models founded on other psychological phenomena, e.g., discontinuity in

decision weights (Kahneman & Tversky, 1979), cumulative probability

weighting (Tversky & Kahneman, 1992), attention shifting (Birnbaum,

2008), overweighting of salient payoffs (Bordallo, Gennaioli & Shefrin,

2012), and treating stated probabilities as imperfect information

(Viscusi, 1989), predict indifference curve shapes that differ from the

one obtained in this study.

Keywords: Marschak-Machina triangle, indifference curves, certainty equivalents,

trimmed mean, models of decision-making under risk, ranking of models

1 Introduction

The Marschak-Machina triangle (Marschak, 1950; Machina, 1982) is a

graphical tool for both theoretical and experimental considerations

concerning the modeling of decision-making under risk. The triangle

represents the set of all lotteries involving three fixed outcomes

x1<x2<x3 with respective probabilities of p1, p2, and

p3. Probability p1 is represented on the horizontal axis;

probability p3 is represented on the vertical axis; and

probability p2 is their sum subtracted from 1. Every point in this

triangle represents a particular lottery: a point inside the triangle

represents a three-outcome lottery where p1, p2, and p3

are strictly positive; a point on the boundary of the triangle (but not

at one of the corners) represents a two-outcome lottery, since one

pi is zero; while the corners represent certainties.

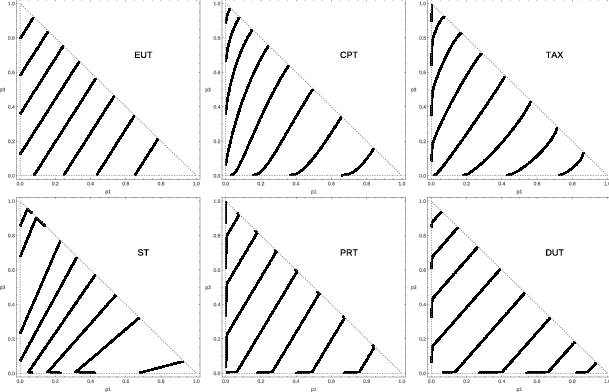

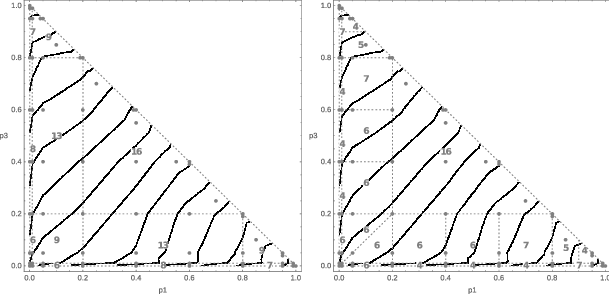

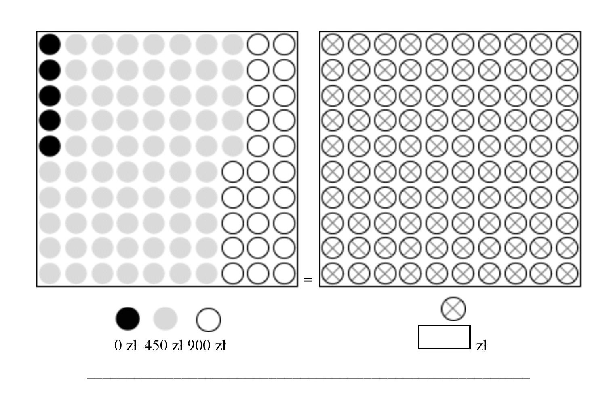

| Figure 1: Indifference curve shapes predicted by: Expected Utility Theory (EUT,

von Neumann and Morgenstern, 1944), Cumulative Prospect Theory (CPT,

Tversky & Kahneman, 1992), the TAX model (TAX, Birnbaum, 2008),

Salience Theory (ST, Bordalo, Gennaioli, and Shefrin, 2012),

Prospective Reference Theory (PRT, Viscusi, 1989), and the Decision

Utility model (DUT, Kontek and Lewandowski, 2018). |

A common and useful way to visualize the predictions of the various

decision-making models is to inspect their indifference curves, as they

connect points representing lotteries of equal utility. If the

decision-maker behaves in accordance with Expected Utility Theory (von

Neumann & Morgenstern, 1944), then his or her preferences can be

represented in the Marschak-Machina triangle by a set of parallel

straight line indifference curves. A number of theories of

decision-making under risk have been developed to explain Expected

Utility violations (more specifically the Allais paradox). These models

predict indifference curves of various shapes: straight lines that

“fan-out” (i.e., that intersect at a point to the south-west of the

triangle origin, Chew & MacCrimmon, 1979; Loomes & Sugden, 1982),

“fan-in” (i.e., that intersect at a point to the north-east of the

hypotenuse, Blavatskyy, 2006), are a mixture of both (Gul, 1991;

Neilson, 1992; Jia et al., 2001; Bordalo, Gennaioli & Schleifer, 2012),

or do not converge to any specific point (Dekel, 1986). The

indifference curves may be concave (Kahneman and Tversky, 1979),

concave or convex (Becker, Sarin, 1987), or concave and convex

(Tversky & Kahneman, 1992; Birnbaum, 2008). They may also be

discontinuous at all boundaries (Kahneman & Tversky, 1979; Viscusi,

1989; Birnbaum, 2008; Bordalo, Gennaioli, Schleifer, 2012), or only at

the triangle legs (Cohen, 1992; Kontek & Lewandowski, 2018). The

Marschak-Machina triangle, with the indifference curves inside it, is

therefore a powerful tool for distinguishing the predictions of

different decision-making models. Example shapes of the indifference

curves predicted by the models discussed in this paper are presented in

Figure 1.

Many investigations have tested hypotheses about the shape of the

indifference map using real data (e.g., Hey & Strazzera, 1989; Camerer,

1989; Loomes, 1991; Harless, 1992; Blavatskyy, 2006; Bardsley et al.,

2010). Harless and Camerer (1994), after analyzing a large number of

experimental data sets, conclude that the EU model should be used when all

the lotteries are located in the interior of the triangle (from which

follows that the indifference curves are parallel straight lines inside the

triangle), but a different model has to be used when some of the lotteries

are located on the boundaries or in the corners of the triangle. The

literature contains evidence of boundary effects (e.g., Conlisk, 1989),

although the shape of the indifference curves in the vicinity of the

triangle boundaries is not clearly stated. For instance, Abdellaoui and

Munier (1998) state only that the hypothesis concerning parallelism of the

indifference curves at the triangle legs is strongly rejected.

This paper presents the results of a study that sheds new light on the

shape of indifference curves in the Marschak-Machina triangle. The study

was performed using a novel method of non-parametrically plotting

indifference curves using certainty equivalents based on the common

cartographic practice of plotting contour maps (Section

??). The approach allows the indifference curves to be

visualized (Section ??) in contrast to most previous

studies, which tested only hypotheses about the shapes of the indifference

curves in the entire triangle or in its regions (Section

??). Importantly, many of the lotteries considered in

the present study were located close to the Marschak-Machina triangle

boundaries (a discussion on the optimal lottery grid is presented in

Section ??). This facilitated the observation of the

boundary effects, most importantly the jumps in the indifference curves at

the triangle legs towards the triangle origin (Section

??). This effect is characterized by a sudden change in

the slopes of the indifference curves (Section

??). Such jumps, however, do not appear at the

hypotenuse. The indifference curves in the triangle interior are parallel

straight lines (with a tendency to fan-in along, but not around, the two

legs).

To confirm the main observations obtained non-parametrically, an estimation

of six decision-making models founded on various psychological phenomena

was made (Section ??). This included Expected Utility

Theory (von Neumann and Morgenstern, 1944), Cumulative Prospect Theory

(CPT, Tversky & Kahneman, 1992), Prospective Reference Theory (PRT,

Viscusi, 1989), the TAX model (Birnbaum, 2008), Salience Theory (ST,

Bordalo, Gennaioli & Shefrin, 2012), and the Decision Utility model (DUT,

Kontek & Lewandowski, 2018). As shown, the best fit is obtained by the

Decision Utility and Prospective Reference models, i.e., those that predict

parallel straight indifference curves in the triangle interior and

discontinuous jumps at the triangle legs towards the triangle origin. The

Cumulative Prospect Theory model, which predicts nonlinear but smooth

indifference curves, was ranked only fourth. The model ranking naturally

leads to a discussion on which of the psychological phenomena underlying

the models might correctly explain the shape of the indifference curves

obtained non-parametrically in this study (Section

??). This pattern suggests discontinuity in the lottery

valuation when the range of lottery outcomes changes and is best explained

by models based on the psychological phenomenon of range dependence

(Parducci, 1965; Cohen, 1992; Kontek & Lewandowski, 2018). Models founded

on other psychological phenomena, e.g., discontinuity in decision weights

(Kahneman & Tversky, 1979), cumulative probability weighting (Tversky &

Kahneman, 1992), attention shifting (Birnbaum, 2008), overweighting of

salient payoffs (Bordallo, Gennaioli & Shefrin, 2012), and treating stated

probabilities as imperfect information (Viscusi, 1989), predict

indifference curve shapes that differ from the one obtained

non-parametrically in this study.

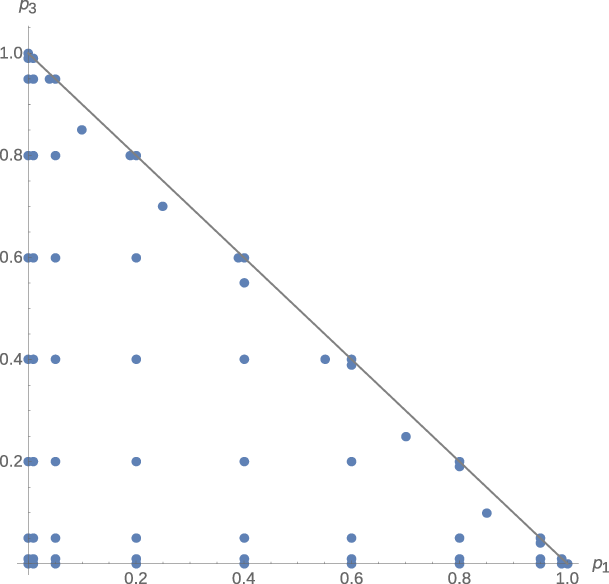

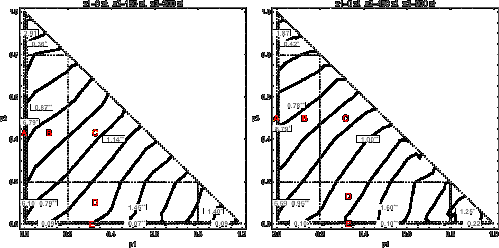

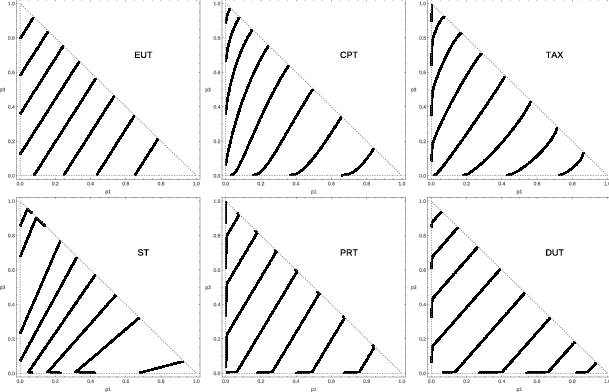

| Figure 2: The Marschak-Machina triangle with the lotteries examined in the

experiment. |

2 Method

The idea of the non-parametric method of plotting

indifference curves comes from contour mapping: a contour line (often

simply called a “contour”) joins points of equal elevation (height) above

a given level, e.g., mean sea level. The procedure is as follows. First,

the lotteries to be examined are chosen; these are the points in the

Marschak-Machina triangle. Second, lottery certainty equivalents (CE) are

determined; these are the “heights” of the respective points. Finally,

these CE values are used to plot a contour map; the contours are the

required indifference curve(s) joining points having the same interpolated

CE value.

2.1 Lotteries involved

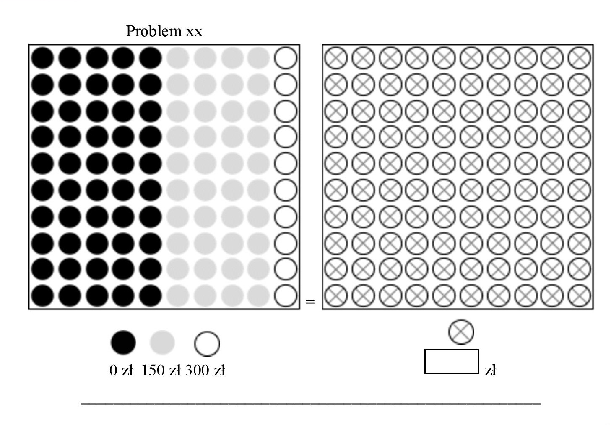

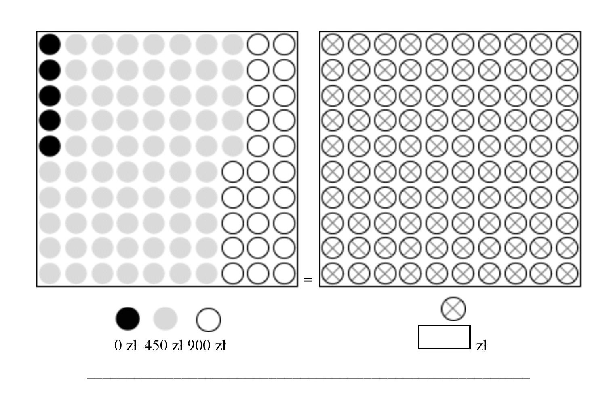

The experiment involved 67 lotteries for each of two payoff schedules:

x1 = 0 zł, x2 = 150 zł, x3 = 300 zł (Triangle 1); and x1 = 0

zł, x2 = 450 zł and x3 = 900 zł (Triangle 2). Złoty (zł) is the

Polish currency; $1 ≈ 4 zł, although the purchasing power for

basic goods is closer to identity. Of the 67 lotteries, 3 were located in

the corners of the triangle, 24 on the boundaries, and the remaining 40 in

the interior. To verify the boundary effects, the distribution of lotteries

was chosen to be more dense near the triangle boundaries and corners

(Figure 2).

The lotteries were constructed from the following list of p1 and

p3 probabilities: {0, 0.01, 0.05, 0.2, 0.4, 0.6, 0.8, 0.95, 0.99,

1}. All combinations { p1, 1−p1−p3, p3} such

that 1−p1−p3≥0 resulted in the lotteries: {0, 1, 0}, {0,

0.99, 0.01}, {0, 0.95, 0.05}, etc. The following lotteries were

added to verify the boundary effects close to the hypotenuse: {0.04,

0.01, 0.95}, {0.19, 0.01, 0.8}, {0.39, 0.01, 0.6}, {0.6, 0.01,

0.39}, {0.8, 0.01, 0.19}, {0.95, 0.01, 0.04}, all having p2 =

0.01 and {0.1, 0.05, 0.85}, {0.25, 0.05, 0.7}, {0.4 0.05, 0.55},

{0.55, 0.05, 0.4}, {0.7, 0.05, 0.25}, and {0.85, 0.05, 0.1}, all

having p2 = 0.05.

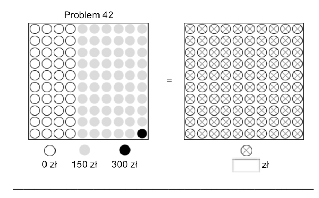

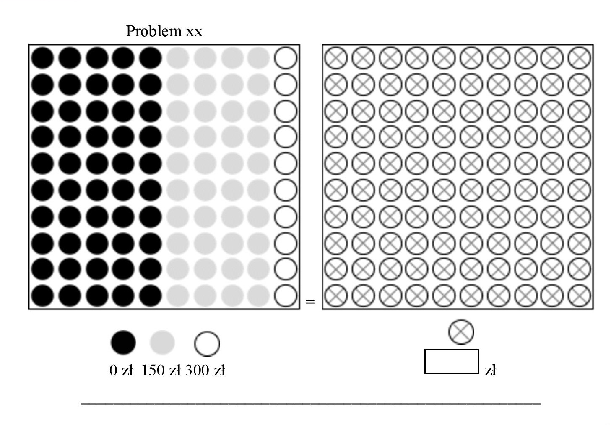

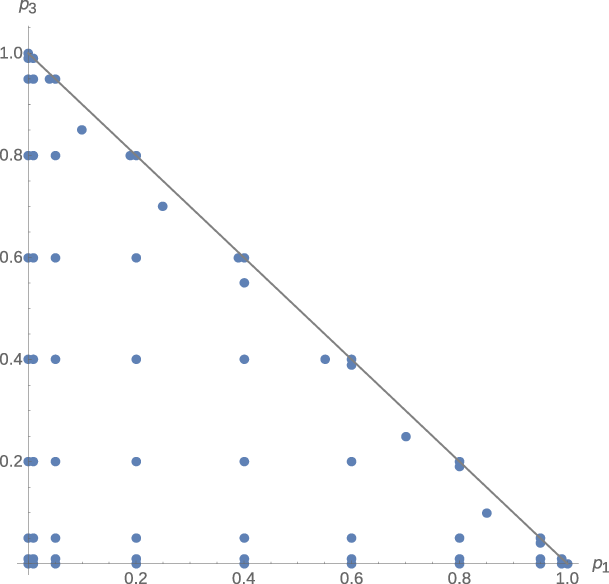

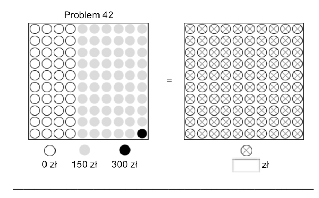

| Figure 3: An example problem from the experiment. |

2.2 CE determination

The term “certainty equivalent” was not used in the instruction (see

Appendix 2), as it is unknown or difficult to understand for most

people. The lotteries were presented in the form of urns containing

black, gray and white balls (for lotteries located in the corners or on

the edges of the triangle, the balls were only one or two colors). To

the right of the urn containing the balls of three colors was another

urn that only contained balls with crosses.

An example problem is demonstrated in Figure 3. In this sample problem,

the value of the black ball was 300 zł, the gray ball 150 zł, and the

white ball 0 zł. The subjects had to state the value that a ball

with a cross would need to have to make them indifferent between

drawing a ball from the left or right urn. The subjects thereby

determined the CEs of the lotteries presented on the left side of the

panel.

The experiment was conducted on the Internet. The problems were presented

to the subjects in random order. Six HTML forms with 134 randomly

ordered problems were prepared. A given form was randomly assigned to each

subject. The black ball offered the maximum payoff in three of the

forms, and the minimum payoff in the others. The gray ball always offered

an intermediate payoff.

2.3 Subjects

There were 237 subjects, all undergraduate economics

students at the Warsaw School of Economics. Their ages ranged from 18 to

25 years with a mean of 20.2 years and 47% were women. The students

received information about the experiment from their supervisors, who

worked with the author of this paper and agreed to promote the

experiment. Participation was voluntary. The subjects were given a

12-zł voucher that they could redeem at the campus cafeteria. As is

known from the literature, the incentive method may have an impact on

the level of risk aversion demonstrated by subjects (e.g., Holt &

Laury, 2002). The subjects were therefore incentivized by

performance as well. They were informed beforehand that some of them

would be taking part in a real lottery. Four subjects were randomly

selected after the data had been collected. The two who offered the

lowest CE for a randomly selected lottery received the amounts they

quoted (70 zł and 90 zł). The other two (who quoted CEs of 100 zł and

130 zł) had to play this lottery. They did not, however, win anything.

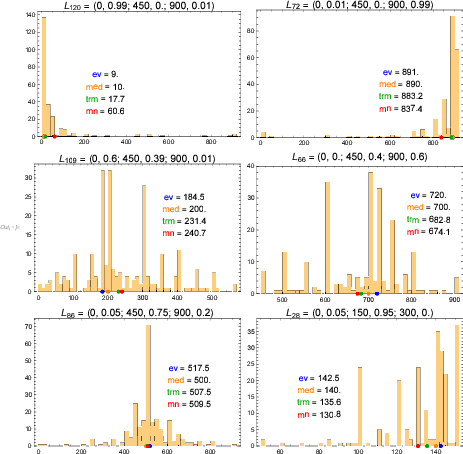

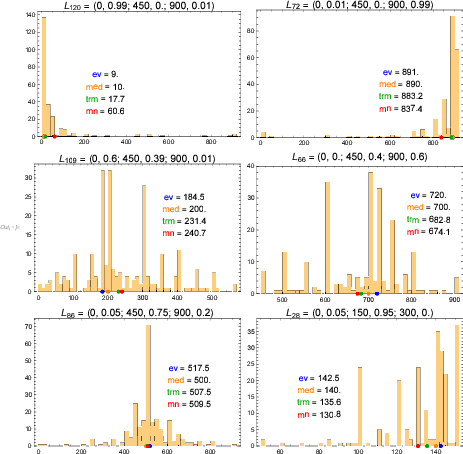

| Figure 4: Example histograms of CE responses for particular lotteries

presented with expected (ev), median (med), mean (mn) and 20% trimmed

mean (trm) values. |

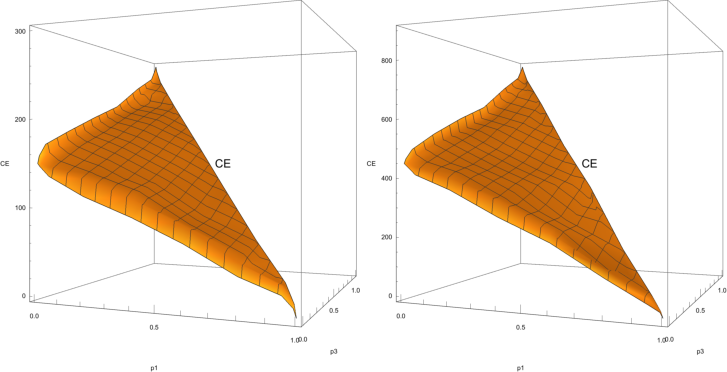

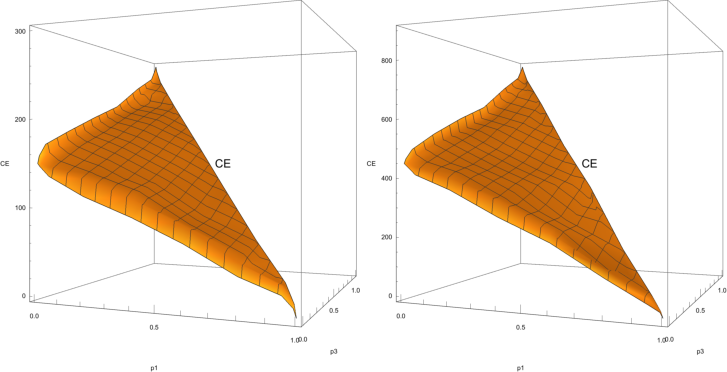

| Figure 5: 3D plots of the aggregated CE values: Triangle 1 (left); and

Triangle 2 (right). |

As the experiment was conducted on the Internet, the subjects could

respond at their convenience. They first registered and familiarized

themselves with the instructions online. They were then required to

solve two sample problems. The time to answer all questions was planned

at 40–50 minutes, although they were asked to work at their own pace.

The average time was about 41 minutes. The value of the voucher (12 zł)

therefore exceeded the minimum hourly wage in Poland, which is about 10

zł.

3 Results

3.1 Aggregating the data

Responses in experiments involving lottery CEs are usually noisy,

skewed, and contain a lot of outliers. The level of noise encountered

in this experiment is probably magnified by the fact that many of the

lotteries under consideration involved three outcomes, rather than two,

as in typical lottery experiments. Moreover, people tend to round their

CE valuations to the nearest ten, fifty, or even hundred (e.g., 10, 50,

700 rather than 9, 54, 670). These rounded CE values may then appear

several times in the responses of different subjects. The term “tied

values” is used in the literature on robust statistics to describe

repetitive responses (see e.g., Wilcox, 2011, 2012). Example histograms

of CE responses obtained for particular lotteries are presented in

Figure 4.

For the reasons presented above, it is of great importance to choose a

proper measure of CE location. The mean value is known to be very

sensitive to outliers (e.g., the upper left graph in Figure 4, which has

a mean value of 60.6, but a median value of only 10.0). The median

value is less sensitive to outliers. However, it is sensitive to tied

values (e.g., graphs in the middle row and the lower left, with a median

of 200, 700, and 500). Many robust location estimators are proposed in

the literature. The trimmed mean estimator is simple to compute, yet,

according to Wilcox (2012), often performs better than more complex

ones when sampling from heavy-tailed distributions. More specifically,

it usually has a narrower confidence interval than the median, mean,

and other measures of central tendency. The trimmed mean is the mean of

the elements in a list after dropping a fraction f of the

smallest and largest elements. Wilcox (2011) suggests f = 20%

for data in social and behavioral sciences. The 20% trimmed mean is a

compromise between the mean (f = 0 %; no points dropped) and

the median (f = 50%; all but one point dropped). Therefore,

as seen in Figure 4, the 20% trimmed mean (in green) assumes a value

between the mean (in red) and the median (in orange).

Applying the 20% trimmed mean estimator results in 134 aggregated CE

values (presented in Appendix 1), which are further used in the

analyses. However, using median or mean CE values does not change the

general observations regarding the shape of the indifferences curves.

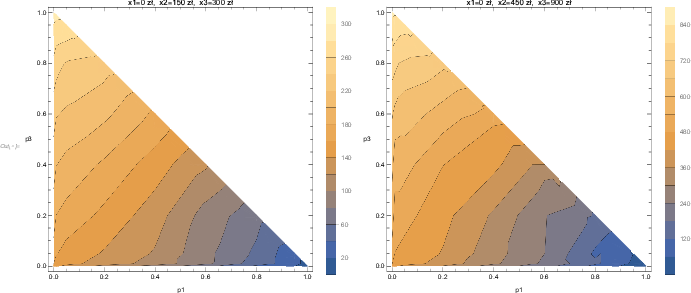

3.2 Plotting the CE surfaces

The aggregated CE values are first visualized using a 3D plot (see

Figure 5). Note that the three triangle corners are tied to the values

of 0, 150, and 300 (left) and 0, 450, and 900 (right), as they

represent certainties. Observe the CE surface shape at its edges. The

surface rises and drops sharply at the p1 and p3 axes,

although the slope is maintained at the hypotenuse.

Note that moving upwards from the p1 axis into the area of positive

p3 values (i.e., introducing a new high outcome x3) sharply

increases the lottery CE value. Per contra, moving right from the

p3 axis into the area of positive p1 values (i.e., introducing

a new low outcome x1) sharply decreases the lottery CE value. This

suggests that changing the range of lottery outcomes might explain this

pattern. No such sharp change in the CE value is observed when moving

from the cube diagonal into the triangle interior (i.e., introducing a

new middle outcome x2). In this case, however, the range of lottery

outcomes remains unchanged.

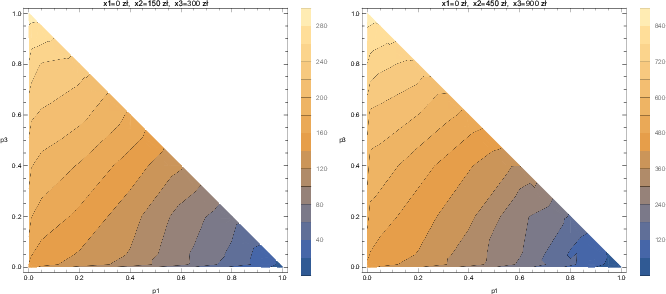

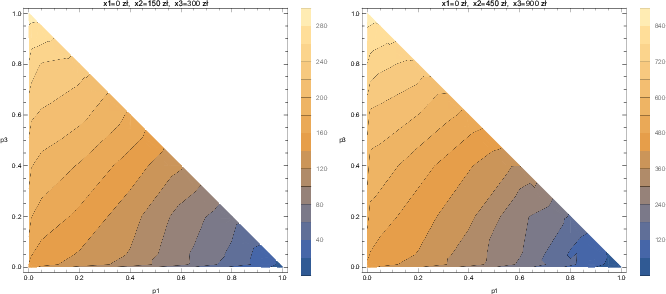

| Figure 6: Indifference curves in two Marschak-Machina triangles: Triangle 1

(left) with outcomes x1 = 0 zł,

x2 = 150 zł, and x3 =

300 zł; and Triangle 2 (right) with outcomes x1

= 0 zł, x2 = 450 zł, and

x3 = 900 zł. The Mathematica®

program draws colored contour plots, so that areas of low CE contour

values are marked using “cold” colors, and areas of high contour values

are marked using “warm” colors. |

3.3 Plotting the indifferences curves

The indifference curves are plotted using the Wolfram

Mathematica® ListContourPlot function, which generates a

contour plot from height values defined at specified points. Similar

functionalities are offered by e.g., “filled.contour” in R and “contour” in

Matlab. According to the Mathematica® tutorial, the

program plots the required contour lines by linearly interpolating heights

along the lines connecting adjacent points on the plane. For instance, to

plot a contour of 200, the program first searches for points on the plane

having an interpolated height of 200. Connecting these points then results

in the required indifference curve of 200. Note that the indifference

curves are plotted using a single command: no dedicated software is

needed. The indifference curves obtained using aggregated CE values for

Triangle 1 and Triangle 2 are shown in Figure 6.

Note that indifference curves are expressed in terms of monetary CE

values, rather than hypothetical “utils” (see plot legends). The

contour values of 0, 20, 40, …., 300 are presented in the left diagram,

and those of 0, 60, 120, …, 900 in the right (which results in 14

curves on each plot). However, the plots for any arbitrarily chosen

number of indifference curves and indifference curve values can be

generated without re-running the experiment.

Several observations need to be made. First, the indifference curves seem

to be straight parallel lines in the middle of the triangle. This is the

area where behavior conforms to Expected Utility Theory.

Second, the further north of the origin towards the northwest corner of

the triangle, the flatter the slopes of the indifference curves, and

the further east of the origin towards the southeast corner of the

triangle, the steeper the slopes of the indifference curves. This

results in a pattern of “fanning-in” around the two legs of the

triangle (i.e., the tendency to intersect at a point to the north-east

of the hypotenuse) and “fanning-out” in the area around the southwest

corner of the triangle (i.e., the tendency to intersect at the point to

the south-west of the origin).

Finally, and most importantly for the present study, the indifference

curves appear to have jumps in the direction of the origin near the

legs of the triangle. Significantly, these jumps are not observed near

the hypotenuse.

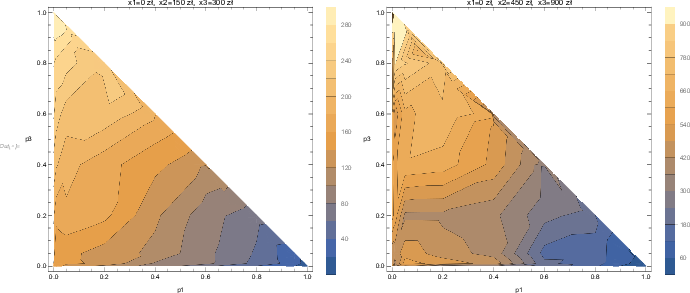

| Figure 7: Simulated indifferences curves after adding a Gaussian noise to

aggregated certainty equivalents. On the left: σ =0.05, on the

right: σ =0.20. |

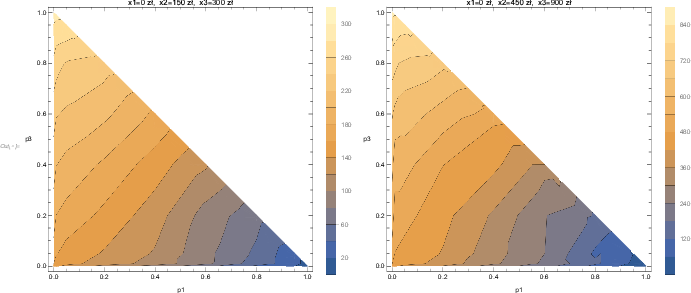

| Figure 8: Simulated indifferences curves after adding a Gaussian noise to

individual certainty equivalents, and then aggregated them using 20%

trimmed mean. On the left: σ =0.05, on the right: σ

=0.20. |

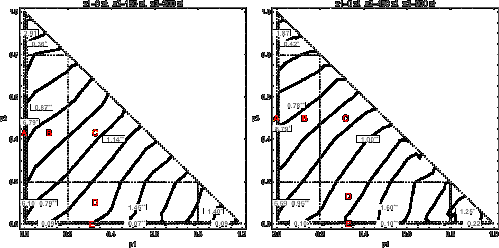

3.4 Limitation and robustness of the method

The method of non-parametrically plotting indifference curves is

sensitive to noise and often results in plots of poor quality when

applied to individual data. At the same time, it is very robust when

the individual data are aggregated using the 20% trimmed mean. The

limitation and the robustness of the method will be illustrated by the

following simulation. Let us assume that the pattern of the

indifference curves presented in Figure 6 reflects the real preferences

of the “average” subject, but a Gaussian noise is added to every

aggregated certainty equivalent value:

C_i^noise=CE_i(1+N(0,σ^2)) .

The simulated indifference curves are presented in Figure 7. As can be

seen, even a small noise ( σ =0.05, graph on the left) seriously

distorts the curves, and a larger one ( σ =0.20, graph on the

right) results in curves that would suggest a lack of any pattern in

the triangle interior and at its boundaries. In fact, the plot on the

right resembles the plots of many of the subjects who took part in the

experiment.

However, adding a Gaussian noise to individual certainty equivalents

(which are already very noisy), and aggregating them using 20% trimmed

means, results in an almost perfect recovery of the observed pattern

(see Figure 8). In fact, there is hardly any discernible difference

between the curves presented in Figure 6 and Figure 8: the median

absolute difference between the certainty equivalent values used to

plot them is 0.4% for σ =0.05 (graphs on the left), and 2%

for σ =0.20 (graphs on the right).

| Figure 9: Sub-areas of the Marschak-Machina triangle used to determine local

slopes of indifference curves. The numbers on the graph show the number

of lotteries in each area. |

The following conclusions can be drawn. First, the method might not be

suitable for plotting individual indifference curves, unless some other

means of reducing the noise are implemented (see also the discussion in

Section ??). Second, the lack of “nice” plots on

the individual level does not necessarily result from a lack of any

interesting effects at the boundaries and in the interior of the

triangle; the method simply fails to recover them when the noise level

is high. Third, the method is very robust when individual data are

aggregated using the 20% trimmed means. Fourth, the pattern obtained

on the group level very likely demonstrates the real preferences of the

“average” decision maker and is not the result of misidentification.

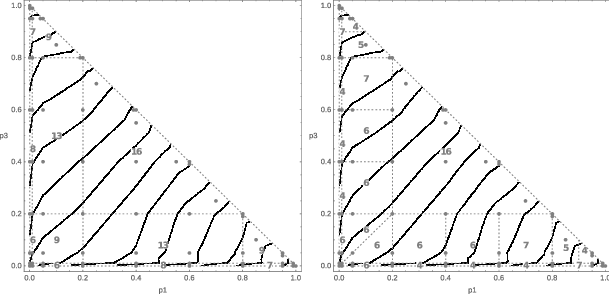

4 Indifference curve slopes

The main observations concerning the shape of

the indifference curves are confirmed by estimating their slopes in the

triangle sub-areas. If decision-makers behave as predicted by

Expected Utility Theory, then their preferences can be represented

in the Marschak-Machina triangle by a set of parallel straight line

indifference curves. For x2=(x1+x3)/2, as in

the present experiment, the slope of the indifference curves for risk

averse people is greater than 1, for risk seeking people less than 1,

and for risk neutral people equal to 1. Lottery CEs may serve to

determine indifference curve slopes using a linear model:

p_3=a+bp_1+cCE ,

in which the required slope is given by the parameter b.

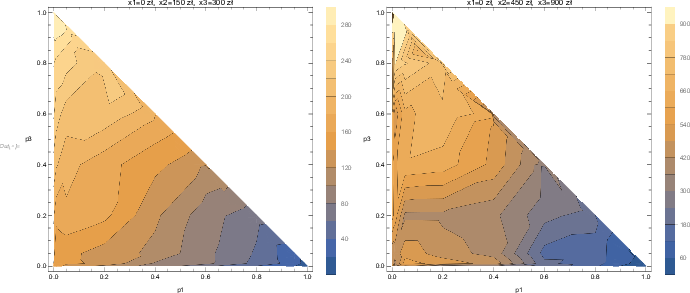

| Figure 10: Indifference curves estimated non-parametrically from the experiment

presented together with local estimations of their slopes in Triangle 1

(left) and Triangle 2 (right). The statistical significance of the

estimated slope values is denoted as: ** for p-value

≤ 0.01, and * for 0.01<p-value ≤

0.05. Area A: 0 ≤ p1 ≤

0.01 and 0.2 ≤ p3 ≤

0.8; Area B: 0.01 ≤ p1

≤ 0.2 and 0.2 ≤ p3

≤ 0.8; Area C: 0.2 ≤ p1

≤ 0.8 and 0.2 ≤ p3

≤ 0.8; Area D: 0.2 ≤ p1

≤ 0.8 and 0.01 ≤ p3

≤ 0.2; Area E: 0.2 ≤ p1

≤ 0.8 and 0 ≤ p3

≤ 0.01. |

4.1 The entire triangle

The minimum least squares procedure applied to aggregated CE values in

the entire triangle leads to b = 1.02 (0.03) for Triangle 1,

and b = 1.06 (0.03) for Triangle 2 (standard errors are given

in parentheses). This suggests that, on average, the subjects

demonstrated slight risk aversion.

4.2 Triangle sub-areas

The same least squares procedure may be applied in triangle sub-areas to

determine local slopes in indifference curves. The triangle has been

split into smaller regions as presented in Figure 9. The numbers on the

graph show the number of lotteries in each area. It is assumed that

lotteries located on the boundaries between two regions (marked as

dotted lines) belong to both regions.

A linear regression procedure was performed in each of these regions to

obtain a number of linear models approximating the indifference curves

locally (the number of degrees of freedom in each model is 3 less than

the number of lotteries). The b value estimations for

aggregated CE values are presented graphically in Figure 10. The

statistical significance of estimated slope values is marked with **

for p-value ≤ 0.01, and * for 0.01 <

p-value < 0.05. Definitions of areas A, B, C, D,

and E, which are most important for deriving conclusions, are given in

Figure 10.

4.3 Areas of straight parallel lines and fanning-in patterns

It can be seen that the indifference curves in Area C of Triangle 1 are

parallel straight lines with a slope of 1.14 (0.04). This is the area

of conformity to Expected Utility.

At the same time, the slope of the indifference curves is 0.87 (0.08) in

Area B, and 1.45 (0.22) in Area D. The same pattern (albeit with some

distortions) can be seen in Triangle 2, where the slope values are 1.00

(0.08), 0.78 (0.12), and 1.60 (0.30) respectively. This indicates a

fanning-in pattern in areas B and D: indifference curves tend to

converge to a point somewhere to the north-east of the Marschak-Machina

triangle.

4.4 Jumps at the legs

These results reveal a sudden change in the slopes of the indifference

curves close to the triangle legs. In Triangle 1, the slope value

changes from 1.45 (0.22) in Area D to 0.07 (0.01) in Area E, i.e., by a

factor of 20. In Triangle 2, there is a similar change from 1.60 (0.30)

to 0.10 (0.02), i.e., by a factor of 16. The same pattern is observed at

the vertical leg. In Triangle 1, the slope value changes from 6.79

(1.90) in Area A to 0.87 (0.08) in Area B, i.e., by a factor of 8, and

in Triangle 2 from 8.79 (2.99) to 0.78 (0.12), i.e., by a factor of 11.

Less abrupt changes can also be observed in the areas around the three

triangle corners, but the results in this case are not statistically

significant.

Unfortunately, the regression procedure on the individual level leads to

statistically insignificant results: individual b values

estimated in the most interesting triangle sub-areas A, B, D, and E

involving 8 or 13 points were statistically insignificant

(p-value > 0.05) for the vast majority of

subjects (93% for Triangle 1, and 95% for Triangle 2). The slope

values estimated for the remaining subjects assumed a value of 1 in

about half the cases, meaning that they gave lottery expected value as

their responses.

4.5 Continuous or discontinuous indifference curves?

These data raise the question as to whether these jumps at the triangle

legs are continuous or discontinuous. It could be argued that 0.01, the

minimum non-zero probability used in the experiment, is still far

greater than 0 (at least on a logarithmic scale) and that the

indifference curves might become smooth for probabilities of less than

0.01. The hypothesis regarding continuity or discontinuity of the

indifference curves at the triangle legs is, however, not testable.

Even if the jumps observed in the experiment had occurred at a

probability of say 0.001, it could still be argued that this was far

greater than 0.

The path of the indifference curves near the two legs of the triangle

suggests, however, that the jumps in the curves are discontinuous. It is

highly unlikely that the indifference curves, which are parallel as they

depart from the hypotenuse and remain so in the middle of the triangle,

would first turn away from the origin, and then (somewhere between a

probability of 0 and 0.01) smoothly turn back towards it. The indifference

curve discontinuity hypothesis would not require such dramatic changes in

the slope values: the indifference curves would remain steep near the

horizontal leg for any non-zero probability p3, and remain flat near the

vertical leg for any non-zero probability p1.

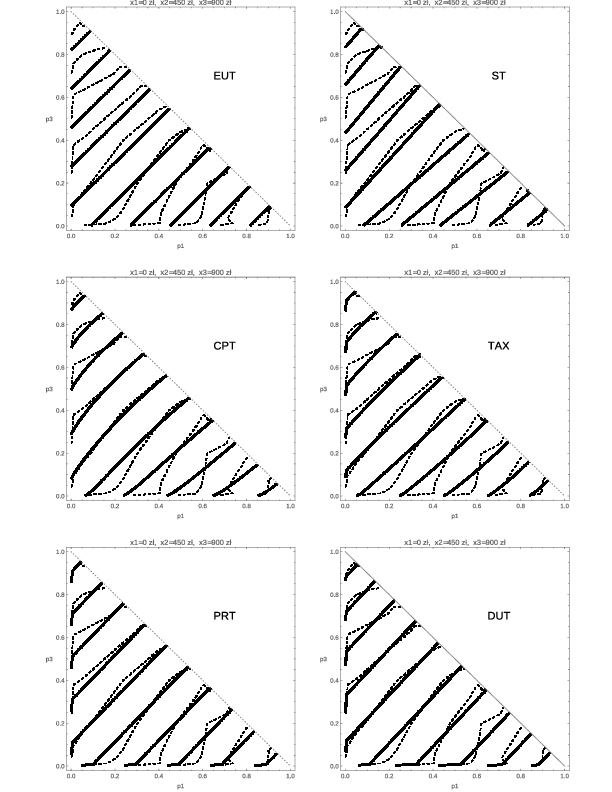

5 Model estimation

The observations presented so far were confirmed

using another analysis: the data collected in the experiment were used to

estimate and compare six decision-making models under risk. Four of them

predict jumps at the triangle boundaries. The idea of this analysis is to

check which models, predicting smooth or discontinuous indifference curves,

better describe the data collected. The models are estimated using CE

values obtained from the experiment and the sum of squared errors (SSE)

values are compared to choose the most accurate model. Certainty

equivalents were used in the past to estimate the CPT parameters (e.g.,

Tversky & Kahneman, 1992; Gonzales & Wu, 1999) and to compare

decision-making models (e.g., Blavatskyy, 2007). This approach differs from

other studies (e.g., Hey & Orme, 1994), in which models were compared on

the basis of preference questions and correct predictions of choices

between two lotteries.

5.1 The models

The typical shapes of the indifferences curves predicted by the models

under consideration are presented in Figure 1. How these models evaluate CE

is detailed below. As before, it is assumed that x1<x2<x3. In what

follows (especially in the case of binary lotteries)

xL=Min[xi] and xH=Max[xi]

will occasionally be used to denote lottery minimum and maximum outcomes

having respective probabilities of pL and pH (when p1=0, the

minimum outcome is x2 rather than x1; when p3=0, the maximum

outcome is x2 rather than x3). A power utility function

v(x)=xα is assumed for the first four models and the

predicted CE value is the utility inverse of the functional.

Expected Utility Theory (EUT, von Neumann and Morgenstern,

1944) is the standard model of decision-making under risk. It evaluates

prospects as follows:

v(CE_EUT)=∑i=1nv(x_i)p_i .

As the model is linear in probabilities, the indifference curves in the

Marschak-Machina triangle are parallel straight lines with no jumps at

the triangle boundaries.

Prospective Reference Theory

(PRT; Viscusi, 1989) is a variant

of the Expected Utility model in which the individual treats stated

probabilities as imperfect information and uses them to update his/her

prior probabilities to posterior ones in the standard Bayesian fashion.

For convenience, the theory assumes a prior probability of 1/n for each

outcome, where n is the number outcomes with pi>0. It follows that:

v(CE_PRT)=β∑i=1nv(x_i)p_i+(1-β)1/n∑i=1nv(x_i) ,

where the parameter β weights: a). the expected utility

functional using stated probabilities (the term on the left) and b).

the expected utility functional using equal probabilities of 1/n

(the term on the right). Changing the number of outcomes n results

in a discontinuous change of the predicted

CEPRT value. This leads to discontinuous jumps

of the indifference curves at all triangle boundaries. As the model is

linear in probabilities, the indifference curves inside the triangle

are parallel straight lines, as they are in the EU model.

Cumulative Prospect Theory

(CPT; Tversky & Kahneman, 1992)

evaluates prospects using a probability weighting function

w(p) applied to cumulative probabilities; the probability

weights are then de-cumulated. Three-outcome lotteries are evaluated using

the functional:

v(CE_CPT) =v(x_3)w(p_3)+v(x_2)[w(p_3+p_2)-w(p_3)]+

v(x_1)[1-w(p_3+p_2)] ,

As the CPT model is nonlinear in probabilities, the indifference curves

in the Marschak-Machina triangle are also nonlinear: they are concave

in the upper-left part of the triangle and convex in the lower-right

part for a typical inverse S-shaped probability weighting function. The

probability weighting function is described in this study using the

two-parameter Prelec (1998) function:

w(p)=e^-γ(-lnp)^δ ,

where parameter δ is responsible for the curvature (lower the

parameter value, more curved the function), and parameter γ

is responsible for the elevation (lower the parameter value, greater

the elevation).

There is no discontinuous change of the predicted

CECPT value when one pi becomes 0, and the

functional simplifies to

v(CECPT)=v(xL)+[v(xH)−v(xL)]w(pH).

Therefore, the indifference curves predicted by the CPT model are smooth

everywhere.

TAX model

(TAX; Birnbaum, 2008) assumes that prospect branches

are assigned decision weights that depend on the “attention” that the

decision maker allocates to a particular branch. A risk-averse

individual shifts attention from high outcome branches to low outcome

ones. The lottery utility is then a weighted average of the outcome

utilities with weights that depend on probabilities and outcome

rankings. Three-outcome lotteries are evaluated as:

v(CE_TAX3)=Av(x_1)+Bv(x_2)+Cv(x_3)/A+B+C ,

where: A=t(p1)+δ /4t(p2)+δ /4t(p3),

B=(1−δ /4)t(p2)+δ /4t(p3), and C=(1−δ /2)t(p3), and where t(p) is the weight

of the branch’s probability (not decumulative probability as in CPT),

and parameter δ defines attention (weights) transfers from

branch to branch (higher the parameter value, greater the attention

transfers to lower branches). Two-outcome lotteries are evaluated as:

v(CE_TAX2)=Av(x_L)+Bv(x_H)/A+B ,

where: A=t(pL)+δ /3t(pH) and

B=(1−δ /3)t(pH). The weights

A, B, and C change discontinuously when the

number of outcomes with a positive probability varies. Therefore, the

lottery valuation changes discontinuously in this case and the

indifference curves might be discontinuous at all triangle boundaries.

The probability weighting function t is described using the power

function t(p)=pγ , and, as the model is nonlinear

in probabilities, the indifference curves are nonlinear: concave in the

left-upper part of the triangle and convex in the lower-right part, as

they are in the CPT model.

Decision Utility model

(DUT; Kontek & Lewandowski, 2018)

applies a normalized utility function D (decision utility) to each

lottery range under consideration. This way the lottery valuation

depends on its range [xL,xH]. Lotteries are compared

with respect to their CE values:

CE_DUT=x_L+(x_H-x_L)D^-1[∑i=1nD(x_i-x_L/x_H-x_L)p_i] .

| Table 1: Estimation results of several decision-making models under

risk. |

| | | | | Parameters |

|

Model | SSE | AIC | BIC | Est. value | St. error | p-value |

| EV | 54 792.9 | 1190.1 | 1195.9 |

| EUT | 54 631.6 | 1189.7 | 1195.5 | α = 0.99 | 0.02 | <10−101 |

| ST | 46 427.1 | 1169.9 | 1178.6 | δ = 0.91 | 0.02 | <10−92 |

| | | | | θ = 20904 | 43400 | 0.63 |

| CPT | 32 118.0 | 1122.5 | 1134.1 | α = 1.12 | 0.05 | <10−46 |

| | | | | γ = 1.09 | 0.04 | <10−52 |

| | | | | δ = 0.86 | 0.01 | <10−96 |

| TAX | 30 183.1 | 1114.2 | 1125.8 | α = 1.05 | 0.02 | <10−83 |

| | | | | γ = 0.95 | 0.02 | <10−73 |

| | | | | δ = 0.12 | 0.02 | <10−5 |

| PRT | 24 860.8 | 1086.2 | 1094.9 | α = 0.96 | 0.01 | <10−124 |

| | | | | β = 0.91 | 0.01 | <10−139 |

| DUT | 20 003.7 | 1057.1 | 1065.8 | r0 = 0.40 | 0.02 | <10−37 |

| | | | | δ = 1.24 | 0.02 | <10−105 |

For a binary lottery, the functional simplifies to:

CEDUT2=xL+(xH−xL)D−1(pH),

which is the same as for CPT, assuming v(x)=x, and

D−1(p)=w(p). Contrary to CPT, however, when

one pi becomes 0 and the lottery range [xL,xH]

changes, the predicted CEDUT value changes

discontinuously. Therefore, the indifference curves are discontinuous

at the triangle legs, but not at the hypotenuse. As the model is linear

in probabilities, the indifference curves inside the triangle are

parallel straight lines, as they are in the EU model. The D

function is described in this study using the CDF of the Two-Sided

Power Distribution (Kotz & van Dorp, 2004):

D(r)={r_0(r/r_0)^δ0<r≤r_0

1-(1-r_0)(1-r/1-r_0)^δr_0<r≤1 ,

where r=xi−xL/xH−xL denotes the relative position of

xi within the lottery range [xL,xH], δ is

the parameter responsible for the curvature (greater the parameter

value, greater the curvature), and r0 defines the value of

r at which the curve crosses the diagonal.

Salience Theory

(ST; Bordalo, Gennaioli & Schleifer, 2012)

provides a context-dependent representation of lotteries in which true

probabilities are replaced by decision weights distorted in favor of

salient payoffs. The functional for the lottery CE is not given in the

original paper and its derivation indicates flaws in the model (for

details, see Kontek, 2016). For instance, the CE value is undefined for

some probability intervals. More seriously, any assumption regarding CE

in those intervals violates monotonicity. Only the formula for binary

lotteries is presented below:

CE_ST={x_L+(x_H-x_L)p/p+δ(1-p)p<δ/δ+A

Ax_L+(A-1)θ/2δ/δ+A<p<1/1+δA

x_L+(x_H-x_L)δp/δp+(1-p)p>1/1+δA ,

where: A=√2xH+θ /2xL+θ , p=pH,

parameter θ affects the salience function σ

(xi,xj)=|xi−xj|/|xi|+|xj|+θ

(greater the parameter value, lower the salience of payoffs in a

given state), parameter δ measures the extent to which

salience distorts decision weights (lower the parameter value, less

salient states are more discounted), and where a constant CE value in

the middle row is assumed to make the model operational. The model

predicts discontinuous jumps at all boundaries, as introducing or

removing an outcome results in a discontinuous change in the predicted

CE value. The indifference curves are non-parallel straight lines

(there are areas of fanning-in, fanning out, and constant CE). Despite

its peculiar features, the ST model is used in this study because it

has recently gained a lot of attention among researchers.

5.2 Estimation results on the group level

The fit of 134 aggregated CE values was performed using the Mathematica

“NonlinearModelFit” function, which constructs a nonlinear least-squares

model and assumes that errors are independent and normally

distributed. Possible settings for the search method include

“ConjugateGradient”, “Gradient”, “LevenbergMarquardt”, “Newton”,

“NMinimize”, and “QuasiNewton”, with the default being “Automatic” (in

which case the method is chosen automatically by the function; this option

was used in estimations). The “NonlinearModelFit” function enables the

parameter space to be constrained, but this was not required for the

aggregate data (except of the ST model). The estimation results are

presented in Table 1. As can be seen, the two-parameter DUT model offers

the best fit, and the PRT model, which also has two parameters, the next

best. The three-parameter TAX model is third, and the CPT model, which also

has 3 parameters, only comes fourth. The ST model, with much poorer

results, is fifth (the p-value of the θ parameter is very high

indicating problems with estimation of the salience function

σ (xi,xj) which is essential for the ST model). The

one-parameter EUT model is only slightly better than Expected Value. This

model ranking is confirmed by the AIC and BIC measures.

As seen the DUT, PRT, and TAX models predicting jumps at the triangle

boundaries are more accurate than CPT, which predicts smooth

indifference curves. This happens even though the DUT and PRT models

use one parameter less than CPT. The poor performance of the ST model

is not surprising given its peculiar features as described above.

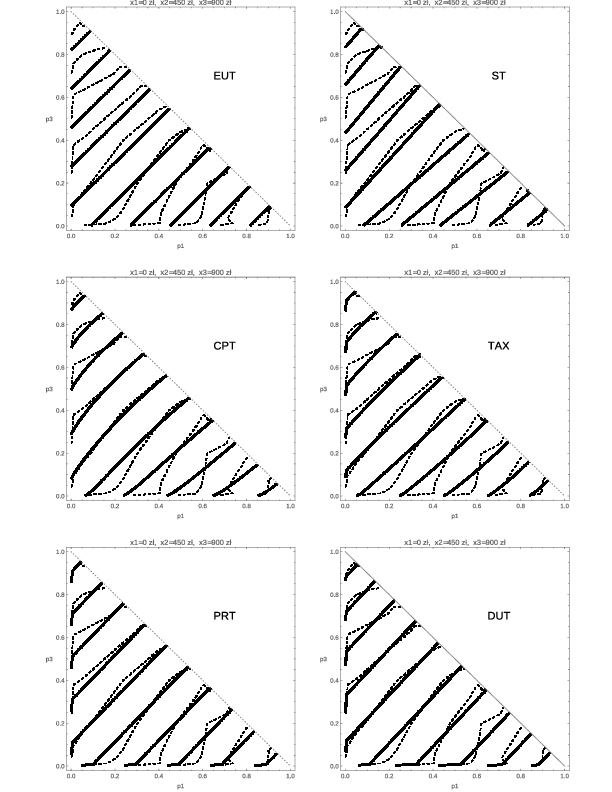

| Figure 11: Indifference curves obtained non-parametrically (dashed) and predicted

by the best-fit models. |

5.3 Predicted vs. observed indifference curves

To make the estimation results more readily comprehensible, the

indifference curves predicted by the best-fit EUT, ST, CPT, TAX, PRT,

and DUT models are presented in Figure 11, together with the

indifference curves obtained non-parametrically. The plots illustrate

the manner and extent to which the predicted curves match those

obtained non-parametrically. As can be seen, the best-fit PRT and DUT

models predict discontinuous jumps on both legs towards the triangle

origin, while the best-fit TAX model predicts discontinuous jumps on

the vertical leg only (jumps at other boundaries are almost invisible).

The CPT model does not predict any jumps. This explains the ranking of

the models obtained in the comparison.

| Table 2: The number of subjects for whom the respective model has the

lowest SSE value. |

| Model | CPT | TAX | PRT | DUT |

| Number of subjects | 110 | 47 | 34 | 46 |

| Percentage of subjects | 46.4% | 19.8% | 14.3% | 19.4% |

These ranking results suggest that the boundary effects at the triangle

legs capture most of the variation in the data. The nonlinearity of the

indifference curves in the triangle interior (if any) is only a

second-order effect. Both the DUT and PRT models perform well because

they conform to Expected Utility inside the triangle, and, at the same

time, capture the specific effects at the triangle legs. Note the

difference between the DUT and PRT models. The size of predicted jumps

along both legs is always the same for PRT but differs for DUT. This

explains why the DUT model performs better than PRT.

It should be noted that the best-fit PRT and TAX models do not predict

any jumps at the hypotenuse, although they generally allow such jumps

(in fact, they predict jumps at the hypotenuse, but these are too small

to be seen on the plot). This additionally confirms that the jumps in

the indifference curves are present only at the triangle legs.

| Table 3: The number

of subjects for whom the respective two-parameter model has the lowest

SSE value. |

| Model | CPT | TAX | PRT | DUT |

| CPT: γ = 1; TAX: γ = 1 | 55 | 47 | 51 | 84 |

| CPT: γ = 1; TAX: β = 1 | 46 | 38 | 65 | 88 |

| CPT: α = 1; TAX: γ = 1 | 77 | 41 | 49 | 70 |

| CPT: α = 1; TAX: β = 1 | 71 | 27 | 61 | 78 |

| Average | 62.25 | 38.25 | 56.5 | 80 |

| Percentage of subjects | 26.3% | 16.1% | 23.8% | 33.8% |

5.4 Estimation results on the individual level

The CPT, TAX, PRT, and DUT models were next estimated using individual

data. Individual data is much more noisy than aggregate data and, in

some cases, may lead to problems with obtaining results. Therefore,

fits were performed with the constrained parameter space (although the

constraints were not too restrictive; for instance, it was assumed for

the CPT model that 0<α <4, 0<γ <20, and 0<δ

<20). Four starting points were chosen for each individual and each

model, and the estimation with the lowest SSE value was chosen as the

best fit. Calculations were performed with the working precision of 16

digits and were conducted in parallel using 8 Mathematica kernels.

The most accurate model for each subject (i.e., having the lowest SSE

value), was then chosen. Table 2 shows the number of subjects for whom

the respective model was the most accurate.

| Table 4: The number of subjects for whom the two-parameter CPT or DUT

model has a lower SSE value, and the mean and median absolute

differences between the models expressed in

%. |

| The best model | CPT | DUT | Mean absolute difference in SSE | Median

absolute difference in SSE |

| CPT: γ =1 | 96 (40.5%) | 141 (59.5%) | 5.3% | 3.6% |

| CPT: α =1 | 115 (48.5%) | 122 (51.5%) | 5.8% | 3.8% |

As can be seen, the CPT model has the lowest SSE value for 46.4% of

subjects. Other models, which allow jumps in the indifference curves at

the triangle boundaries, are the best in the case of the remaining

53.6%. As the CPT and TAX models have three parameters, whereas PRT

and DUT only two, estimations were also made for two-parameter versions

of the CPT and TAX models to make the comparison fair. In the case of

CPT, the version with γ = 1 means that a nonlinear value

function was used together with a one-parameter probability weighting

function, and the version with α =1 means that a linear

value function was used together with a two-parameter weighting

function. In both cases, the two-parameter CPT model performs poorer

than previously, and the DUT model becomes the prevailing one for

33.8% of subjects on average (see Table 3).

Importantly, the CPT model, which predicts smooth indifference curves,

is, on average, the best for only 26.3% of subjects (20-33% depending

on which two parameters are used). Other models (including DUT), that

allow jumps in the indifference curves at the triangle boundaries, are

the best for the remaining 73.7%. The PRT model is generally slightly

less accurate than CPT on the individual level, and the TAX model is

the worst in this comparison.

A direct comparison was finally made between the two-parameter versions

of the CPT and the DUT models. In this case, DUT offers more accurate

fits for 51.5%-59.5% of subjects and performs slightly better than

CPT. The results are presented in Table 4.

It may be argued that the model comparisons presented in Tables 2, 3,

and 4 identify a discrete “winning model”. An SSE difference of 0.01

could lead one to claim that one model is superior without any way to

determine the difference between this situation and one where a model

excels by a difference of 100. Therefore, Table 4 presents also mean

and median absolute differences between the models in terms of SSE

(calculated as an average for all individuals). As seen, the best model

fits differ on average by 5.3%-5.8% (from 0.1% to 363%) in terms of

SSE with either CPT more accurate than DUT, or DUT more accurate than

CPT. This shows that either one or another model offers a clear

advantage for a given individual.

The analysis of individual data presented in this section confirms the

existence of the boundary effects captured by models that predict jumps

at the triangle legs. The comparison also shows that the CPT model

performs comparatively better on the individual than on the aggregate

level. The flexibility of this model by the addition of the third

parameter (important when individual data diverge from the average

pattern) may explain this result.

6 Related literature

Many studies have tested the various hypotheses

about the shape of the indifference map (e.g., Hey & Strazzera, 1989,

Camerer, 1989; Loomes, 1991; Harless, 1992; Harless & Camerer, 1994;

Abdellaoui & Munier, 1998; Blavatskyy, 2006; Bardsley et al., 2010).

There are generally two ways to identify indifference curves in

experiments: ask indifference questions; ask preference questions. The

former involves asking subjects to indicate those lotteries to which

they are indifferent vis-à-vis a given one. This procedure allows an

indifference curve to be plotted by connecting the points representing

indifferent lotteries inside the triangle (Hey & Strazzera, 1989).

The method proposed in this paper is a version of this general

approach: subjects indicate certainty equivalents to which they are

indifferent vis-à-vis a given lottery, and these certainty equivalents

serve to plot the indifference curves. The other approach involves

presenting subjects with a set of pairwise choices and asking them to

indicate their preferences (e.g., Harless & Camerer, 1994). This

approach allows only hypotheses regarding the shapes of indifference

curves in the triangle or regions of it to be tested. Combinations of

both approaches have been used. Loomes (1991) and Cubitt et al. (2015)

ask indifference questions to test hypotheses about the shapes of

indifference curves and underlying axioms. Yet another approach is used

by Hey and Orme (1994), who ask preference questions to estimate

preference functionals (i.e., decision-making models). The indifference

curves predicted by the best model indicate the underlying pattern.

The observation that the EU model works fine for lotteries inside the

Marschak-Machina triangle has often been reported in the literature.

Hey and Orme (1994) state that the EU model appears to fit no worse

than any of the other models for 39% of subjects. Similarly, Carbone

and Hey (1994) find that approximately half their subjects appear to

conform to the EU model. Hey and Strazzera (1989) additionally find

that, for the majority of their subjects, the indifference curves were

in accordance with EU theory. Abdellaoui and Munier (1998) find that

the shape of the indifference curve is compatible with the EU

hypothesis along the middle part of the hypotenuse and in the

“immediate” interior of that middle part. This result is very close to

the one obtained in the present study.

The existence of fanning-in has been reported in the literature by e.g.

Hey and Di Cagno (1990), who observed that the fanning-in point was to

the northeast of one of the three triangles for 14 subjects. Moreover,

the indifference curves fan in for 22 of the 56 subject/triangle pairs.

Blavatskyy (2006) presents a more detailed study concerning

“fanning-out” and “fanning-in”, and suggests that an individual’s

indifference curves tend to “fan-in” when probability mass is

associated with the best and the worst outcomes and tend to “fan-out”

when probability mass is associated with intermediate outcomes. The

results presented in this paper are clearly close to Blavatskyy’s

summary.

There is evidence of boundary effects in the literature, although how

and to what extent these effects affect the shape of the indifference

curves is not clearly stated. Conlisk (1989) moved the Allais lotteries

to the interior of the triangle and concluded that EU theory violations

are less frequent and cease to be systematic when boundary effects are

removed. Camerer (1989), Harless (1992), and Sopher and Gigliotti

(1993) obtained similar results. Harless and Camerer (1994), after

analyzing a large number of experimental data sets, conclude that the

EU model should be used when all the lotteries have the same number of

probable outcomes (i.e., the lotteries are located in the interior of

the triangle), but a different model has to be used when the lotteries

have different numbers of probable outcomes (i.e., some of the lotteries

are located on the boundaries or in the corners of the triangle).

Boundary effects were studied in detail by Abdellaoui and Munier

(1998), who concluded that indifference curves were distorted near

triangle boundaries. They draw a distinction, however, between behavior

near different edges of the triangle. One test, restricted to segments

linking the hypotenuse to the triangle interior leads to an acceptance

of the hypothesis of parallelism. By contrast, the same hypothesis

concerning the segments linking the left and lower edges to the

interior is strongly rejected. The present experiment not only captures

this difference but additionally shows that the distortion near the

triangle legs is due to jumps towards the triangle origin in the

indifference curves.

7 Optimal lottery grid

It may be argued that the variability of the

indifference curves at the triangle legs observed in the present

experiment (coupled with a lack of such variability in the triangle

interior) is simply the result of repeated measurements in this region

of the triangle. The jumps, so this reasoning goes, are observed at the

legs because that is where the points were repeatedly sampled; had

several points been measured close to any point in the triangle

interior, similar jumps would have been observed. This objection can be

easily countered by stating that, if the variability at the legs is the

result of repeated sampling, then the variability observed at the

hypotenuse, where the measurement points were likewise densely located,

should be similar. This, however, is not the case.

More broadly, this objection raises an important question concerning the

optimal lottery grid in Marschak-Machina triangle experiments. It is

well known from experiments involving binary lotteries that the

greatest variability in lottery certainty equivalents occurs for

probabilities close to 0 and 1: the change of the certainty equivalent

value is large when the probability changes from 0 to 0.01, or from 1

to 0.99, but not that large when the probability changes from 0.50 to

0.51. This phenomenon is best expressed by an inverse S-shaped

probability weighting function (Tversky & Kahneman, 1992; Gonzales

& Wu, 1999), which is nonlinear at the probability endpoints and

almost linear in the middle. Tversky and Kahneman (1992) offered a

psychological hypothesis to explain this shape, which they called

diminishing sensitivity. According to this hypothesis, people become

less sensitive to changes in probability as they move away from 0 or 1,

just as they are less sensitive to changes in outcome values as they

move away from the reference point.

It follows that the optimal set of lotteries to test diminishing

sensitivity experimentally should consist of more lotteries having

probabilities close to 0 and 1. Therefore, Tversky and Kahneman used

lotteries having probabilities of 0.01, 0.05, 0.10, 0.25, 0.50, 0.75,

0.90, 0.95, and 0.99, rather than having an equal spread. The

diminishing sensitivity observed experimentally is thus not the result

of applying more lotteries close to the probability endpoints, but

certainly more lotteries at the probability endpoints are required to

test the anticipated diminishing sensitivity (for a contrary opinion

see Stewart, Reimers & Harris, 2015). For the very same reason, and

in order to verify the boundary effects, the distribution of lotteries

in the Marschak-Machina triangle in the present study was chosen to be

more dense near the triangle boundaries and corners. Using

probabilities having an equal spread could make any boundary effects

impossible to detect. Note that some previous investigations were

conducted using an equal spread of probabilities (e.g., Hey & Orme,

1994, with a spread of 1/8). It is therefore not surprising that the

EU model appeared to fit no worse than any of the other models for a

substantial percentage of subjects, as the boundary effects had not

been probably taken into account in the experimental set-up. This also

applies to the present data: removing lotteries close to the triangle

boundaries (i.e., having probabilities of either 0.01 or 0.05) from the

data set results in plots of the indifference curves showing no jumps

at the legs.

Verifying whether there is any local variability in the triangle

interior would require more lotteries in this region. This would

resemble detailed testing of the probability weighting function shape

around its middle part, which, according to many studies, is more less

linear. Thus, although such examination is possible, it would probably

result in conclusions stated already in this paper and in a number of

former studies, i.e., that the indifference curves in the middle part of

the Marschak-Machina triangle are linear with local variability caused

possibly by the noise only.

The question of how to select an optimal lottery grid inside the

Marschak-Machina triangle not only involves determining the shape of

the indifference curves, but also estimating the model parameters, and

comparing decision-making models. The model estimation results

presented in this paper come with the caveat that the fits and the

model ranking apply only to the specific lottery grid in the

Marschak-Machina triangle examined in the experiment. The grid used in

the experiment involves many lotteries in the vicinity of the triangle

edges (to explore the boundary effects), so the model ranking could be

quite different for a different grid. In fact, removing lotteries close

to the triangle boundaries from the data set results in CPT having the

highest ranking, followed by DUT, TAX, and PRT. On the other hand,

using a grid with an equal probability spread would possibly lead to a

ranking that does not take any boundary effects into account, even so

well accepted in the literature as overweighting of small probabilities

and underweighting of large ones. This raises the general question of

how to select an optimal lottery grid when discriminating between

decision-making models (Cavagnaro et al., 2013). Designing an optimal

lottery grid based on axioms in order to plot the indifference curves

and to discriminate between the models of decision-making under risk is

certainly an interesting direction of future research. The number of

lotteries used in the experiment is one of the parameters that needs to

be optimized: the natural inclination to increase this number would

lead to more detailed plots, but, on the other hand, would leave the

subjects less time to focus on each problem and would probably

increase the noise. Thus limiting, rather than increasing the number of

lotteries should be also considered.

8 Discussion

This paper presents experimental results

concerning the shape of indifference curves in the Marschak-Machina

triangle. The plots obtained non-parametrically indicate that: (i)

indifference curves are straight parallel lines in the middle part of

the triangle; this is the area of conformity to the Expected Utility

model; (ii) the indifference curves “fan-in” along the triangle legs

(but not in their vicinity); and (iii) the indifference curves jump

towards the origin along the two legs of the triangle; these boundary

effects are, however, not present at the hypotenuse. This observation

is confirmed by estimating the slopes of the indifference curves in the

triangle sub-areas and by estimating six decision-making models under

risk.

The model ranking naturally leads to a discussion on which of the

psychological phenomena underlying the models best explains the shape

of the indifference curves obtained in this study. The path of the

indifference curves near the two legs of the triangle suggests that the

jumps in the curves are discontinuous. Abrupt changes in the slopes of

the indifference curves were statistically confirmed in the vicinity

of both triangle legs. The discontinuity of indifference curves is not

particularly welcomed by mathematicians and could even be regarded as a

weakness in the model. One possible explanation of this phenomenon

could be discontinuity in probabilities. This feature has a solid

psychological foundation and is prevalent in the psychological

literature. The tendency to overweight certain outcomes relative to

merely probable ones was labeled the “certainty effect” by Kahneman and

Tversky (1979). Certain outcomes, however, are located in the corners

of the Marschak-Machina triangle, and only the jumps starting from

there can be explained by this effect. Discontinuity in decision

weights for probabilities close to 0 and 1 is a slightly more general

concept which can also be applied to lotteries located on the triangle

boundaries. This holds, however, for all probabilities, including the

probability of the middle outcome. The indifference curves are

therefore discontinuous at all three triangle boundaries in the

original Prospect Theory.

Cumulative Prospect Theory, per contra, predicts smooth indifference

curves. For this reason, they do not match the indifference curves obtained

in this study particularly well. Moreover, the lottery certainty

equivalents (especially their aggregated values) are not fitted so

accurately by CPT as by other models. This raises the question as to

whether the cumulative probability weighting postulated by CPT is the right

phenomenon to explain the anomalies observed in decision-making under

conditions of risk. The original idea of probability weighting applied to

individual probabilities (Kahneman & Tversky, 1979) was simple and

convincing: small probabilities are overweighted whereas medium and large

ones are underweighted. Unfortunately, this kind of probability weighting

violates first-order stochastic dominance, which limits its applicability

to prospects involving no more than two non-zero outcomes. Weighting of

cumulative probabilities was introduced to fix this issue (Quiggin, 1980;

Yaari, 1989; CPT, Tversky & Kahneman, 1992). This solution is

mathematically elegant and allows prospects involving any number of

outcomes to be considered. Psychologically, however, it is less plausible,

as this would mean that people assess probabilities cumulatively rather

than individually. Birnbaum (2004) has presented evidence to refute this.

The results presented in this study provide further evidence that the

cumulative probability weighting postulated by CPT might not be

psychologically vindicated.

The phenomenon of range dependence (Parducci, 1965; Cohen, 1992; Kontek &

Lewandowski, 2018) is sound psychologically and adequately explains the

pattern observed. Introducing a new high outcome x3 results in an upward

payoff range extension and a sharp increase in the lottery CE

value. Introducing a new low outcome x1 results in a downward payoff

range extension and a sharp decrease in the lottery CE value. Introducing

a new middle outcome x2 does not change the payoff range and so no sharp

change in the lottery CE value is observed. Essentially, the same

explanation was presented earlier by Abdellaoui and Munier (1998):

lotteries located on the legs of the triangle do not have the same support

as those located elsewhere in the triangle; as a result, either p1=0 or

p3=0 implies a more dramatic change in individual behavior than

p2=0. The three-criteria1 (Cohen,

1992) and decision utility (Kontek & Lewandowski, 2018) models, both

based on range dependence, predict parallel straight line indifference

curves in the triangle interior with jumps towards the triangle origin at

the legs. This pattern was stated non-parametrically in the present

study. The DUT model was, moreover, the most accurate in fitting aggregated

certainty equivalents and in fitting individual ones when two-parametric

models were compared.

Prospective Reference Theory (Viscusi, 1989) predicts the same pattern

of the indifference curves as models based on range dependence, but

allows jumps at the hypotenuse. These happened to be almost invisible

for the aggregated data and the fit was only slightly less accurate

than that of DUT. The PRT model was slightly less accurate than CPT on

the individual level. It is interesting to note that the PRT model was

also among the winners in Hey and Orme’s study (1994). Its good

performance in this study is therefore not accidental. However, the

assumption underlying the theory that individuals treat stated

experimental probabilities as imperfect information and use them to

update their prior probabilities to posterior ones in the standard

Bayesian fashion, seems psychologically less plausible.

Models founded on other psychological phenomena only partially explain

the shape of the indifference curves obtained in this study. The TAX

model, which postulates a shift in attention from high outcome branches

to low outcome ones, generally predicts various shapes of the

indifference curves with jumps allowed at all boundaries. However, the

shape predicted by the best-fit model only partially corresponds with

the stated one (jumps on the vertical axis only). As a result, the

model takes an intermediate position in the rankings: it performs

better than CPT on the group level, but does not perform so well on the

individual level. The overweighting of salient outcomes postulated by

Salience Theory has recently gained a lot of attention among

researchers as a phenomenon explaining anomalies in various areas of

economics and finance. The shape of the indifferences curves predicted

by this model is, however, in strong disagreement with the one stated

in this study. As a result, the Salience Theory model fits the lottery

certainty equivalents collected in the experiment poorly and performs

only slightly better than EU.

To sum up, the best lottery certainty equivalent fits were offered by

models that predict parallel straight line indifference curves in the

triangle interior with jumps at the legs towards the origin. The shape of

the indifference curves obtained non-parametrically explains this

result. As stated in previous studies, Expected Utility Theory generally

holds in the triangle interior. This study shows that the psychological

phenomenon of range-dependence best explains the boundary effects. To

conclude, Expected Utility holds for lotteries having the same range of

outcomes; Expected Utility is violated when the range of outcomes changes

(note that the lotteries in the famous Allais paradox have different

ranges).

The above analysis was made possible thanks to a novel method of

plotting indifference curves inside the Marschak-Machina triangle using

lottery certainty equivalents. One major advantage of this method is

that it allows the indifference curves to be visualized, and not merely

hypotheses concerning their shapes to be tested. Moreover, plots can be

obtained using a standard command available on most statistical

packages, without any dedicated software having to be written.

One problem encountered in this study is the high level of noise

observed in the certainty equivalent values. The level of noise is

probably magnified by the fact that many of the lotteries under

consideration involved three outcomes, rather than two, as in typical

experiments. Despite this, the method proposed generates clear

indifference curve patterns for individual data aggregated using 20%

trimmed means, and is very robust, even if the noise level in

individual responses is artificially increased, as shown by a separate

simulation. The method, however, results in poor quality plots when the

level of noise is too high. Therefore, it often fails to demonstrate a

clear pattern of individual indifference curves, which exposes its

limitation. Possible approaches towards solving this problem include

conducting similar experiments in a laboratory, rather than on the

Internet, using stronger incentive schemes, and devising other ways of

determining certainty equivalents. It is not certain, however, whether

using these means will result in cleaner data. A better approach might

be to repeat collecting responses from the same subject. This would

allow his/her responses to be averaged and the noise levels at given

measurement points to be reduced. Another option would be to perform a

smoothing procedure on the plane in order to get the average value of

the points in the vicinity of any given one. The initial tests using a

smoothing procedure demonstrated the advantage of this approach and, in

many cases, a great improvement of the plots quality. However, care

needs to be exercised when smoothing values on the plane as it may also

smooth the jumps, which are of the greatest interest in this study.

References

Abdellaoui, M., Munier, B. (1998). The Risk-structure Dependence Effect:

Experimenting with an Eye to Decision-aiding. Annals of

Operations Research, 80, 237–252.

Bardsley, N., Cubbit, R., Loomes, G., Moffat P., Starmer C., & Sugden R.

(2010). Experimental Economics: Rethinking the Rules. Princeton

University Press.

Becker, J. L., & Sarin, R. K. (1987). Lottery Dependent Utility.

Management Science, 33(11), 1367–1382.

Birnbaum, M. H. (2004). Tests of rank-dependent utility and cumulative

prospect theory in gambles represented by natural frequencies: Effects

of format, event framing, and branch splitting. Organizational

Behavior and Human Decision Processes, 95, 40–65.

Birnbaum, M. H. (2008). New paradoxes of risky decision making.

Psychological Review, 115, 463–501.

Blavatskyy, P. (2006). Axiomatization of a Preference for Most Probable

Winner. Theory and Decision, 60, 17–33.

Blavatskyy, P. R. (2007). Stochastic expected utility theory.

Journal of Risk and Uncertainty, 34(3), 259–286.

Bordalo, P., Gennaioli, N., & Schleifer, A. (2012). Salience theory of

choice under risk. The Quarterly Journal of Economics, 127(3),

1243–1285.

Camerer, C., (1989). An experimental test of several generalized

utility theories. Journal of Risk and Uncertainty, 2,

61–104.

Carbone, E., & Hey, J. D. (1994). Estimation of expected utility and

non-expected utility preference functionals using complete ranking data. In

Munier B., & Machina M. J. (Eds.) Models and experiments in risk

and rationality, pp. 119–139 Kluwer Academic Publishers.

Cavagnaro, D., Gonzales, R., Myung, J. I., & Pitt, M. A. (2013). Optimal

Decision Stimuli for Risky Choice Experiments: An Adaptive Approach.

Management Science, 59(2), 358–375.

Chew, S. H., MacCrimmon, K. (1979). Alpha-nu choice theory: A

generalization of expected utility theory. Working paper 669,

University of British Columbia.

Cohen, M. (1992). Security level, potential level, expected utility: A

three-criteria decision model under risk. Theory and Decision,

33(2), 101–134.

Conlisk, J., (1989). Three variants on the Allais example.

American Economic Review, 79(3), 392–407.

Cubitt, R. P., Navarro-Martinez, D., & Starmer, C. (2015). On preference

imprecision. Journal of Risk and Uncertainty, 50(1),

1–34.

Dekel, E. (1986). An axiomatic characterization of preferences under

uncertainty: Weakening the independence axiom. Journal of

Economic Theory, 40, 304–318.

Gonzales, R., & Wu, G. (1999). On the shape of the probability weighting

function. Cognitive Psychology, 38, 129–166.

Gul, F. (1991). A Theory of disappointment aversion.

Econometrica, 59, 667–686.

Harless, D. (1992). Predictions about indifference curves inside the

unit triangle. Journal of Economic Behavior and Organization,

18, 391–414.

Harless, W., & Camerer, C. (1994). The predictive utility of generalized

expected utility theories. Econometrica, 62(6),

1251–1289.

Hey, J. D., & Strazzera E., (1989). Estimation of indifference curves in

the Marschak-Machina triangle. Journal of Behavioral Decision

Making, 2, 239–260.

Hey, J. D., & Di Cagno, D. (1990). Circles and triangles: An experimental

estimation of indifference lines in the Marschak-Machina triangle.

Journal of Behavioral Decision Making, 3, 279–306.

Hey, J. D., & Orme, C. (1994). Investigating generalizations of expected

utility theory using experimental data. Econometrica,

62(6), 1291–1326.

Holt, C. A., & Laury, S. K. (2002). Risk aversion and incentive effects.

American Economic Review, 92(5), 1644–1655.

Jia, J., Dyer, J. S., & Butler, J. C. (2001). Generalized disappointment

models. Journal of Risk and Uncertainty, 22(1),

59–78.

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of

decision under risk. Econometrica, 47(2), 263–291.

Kontek, K. (2016). A critical note on Salience Theory of choice under

risk. Economics Letters, 149, 168–171.

Kontek, K., & Lewandowski, M. (2018). Range-dependent utility.

Management Science, 64(6), 2812–2832.

Kotz, S., & van Dorp, J. (2004). Beyond beta. Other continuous families of

distributions with bounded support and applications. World

Scientific Publishing.

Lopes, L. L. (1987). Between hope and fear: The psychology of risk.

Advances in Experimental Social Psychology, 20,

255–295.

Loomes, G., & Sugden, R. Regret theory: An alternative theory of rational

choice under uncertainty. Economic Journal, 92,

805–824.

Loomes, G. (1991). Testing decision theories by using ‘value

equivalences’. Oxford Economic Papers, 43, 644–666.

Machina, M. (1982). Expected utility analysis without the independence

axiom. Econometrica, 50, 277–323.

Marschak, J. (1950). Rational behavior, uncertain prospects, and

measurable utility. Econometrica, 18(2), 111–141.

Neilson, W. S. (1992). Some mixed results on boundary effects.

Economics Letters, 39, 275–278.

Parducci, A. (1965). Category judgment: A range-frequency model.

Psychological Review, 72(6), 407–418.

Prelec, D. (1998). The probability weighting function.

Econometrica, 66, 497–527.

Quiggin, J. (1982). A theory of anticipated utility. Journal of

Economic Behavior and Organization, 3(4), 323–43.

Sopher, B., & Gigliotti, G. (1993). A test of generalized expected utility

theory. Theory and Decision, 35, 75–106.

Stewart, N., Reimers, S., & Harris, A. J. L. (2015). On the origin of

utility, weighting, and discounting functions: How they get their

shapes and how to change their shapes. Management

Science, 61(3), 687–705.

Tversky, A., & Kahneman, D. (1992). Advances in prospect theory:

Cumulative representation of uncertainty. Journal of Risk and

Uncertainty, 5, 297–323.

Viscusi, K. (1989). Prospective reference theory: Toward an explanation

of the paradoxes. Journal of Risk and Uncertainty, 2,

235–264.

Von Neumann L. J., & Morgenstern, O. (1944). Theory of games and economic

behavior. Princeton University Press, Princeton, NJ.

Wilcox, R. (2011). Modern statistics for the social and behavioral

sciences: A practical introduction. CRC Press, Taylor & Francis Group,

Boca Raton, FL.

Wilcox, R. (2012). Introduction to robust estimation and hypothesis

testing. Elsevier.

Yaari, M. E. (1987). The dual theory of choice under risk.

Econometrica, 55(1), 95–115.

Appendix 1: CE values aggregated for the group for Triangle 1