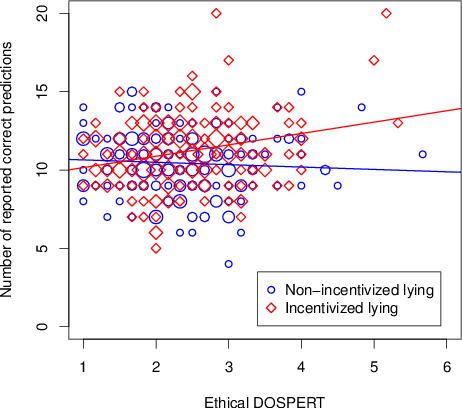

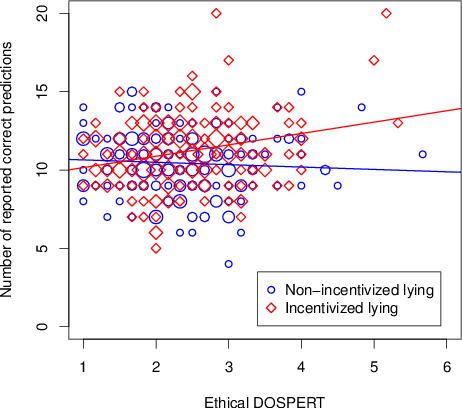

| Figure 1: Number of correct coin-toss predictions as a function of ethical DOSPERT and incentives. Areas of symbols are proportional to the number of observations at each position. Best-fitting lines are shown for each condition. |

Judgment and Decision Making, Vol. 9, No. 1, January 2014, pp. 58-64

Self-reported ethical risk taking tendencies predict actual dishonestyLiora Zimerman* Shaul Shalvi* Yoella Bereby-Meyer* |

Are people honest about the extent to which they engage in unethical behaviors? We report an experiment examining the relation between self-reported risky unethical tendencies and actual dishonest behavior. Participants’ self-reported risk taking tendencies were assessed using the Domain-Specific Risk-Taking (DOSPERT) questionnaire, while actual self-serving dishonesty was assessed using a private coin tossing task. In this task, participants predicted the outcome of coin tosses, held the predictions in mind, and reported whether their predictions were correct. Thus, the task allowed participants to lie about whether their predictions were correct. We manipulated whether reporting higher correct scores increased (vs. not) participants monetary payoff. Results revealed a positive relation between self-reported unethical risky tendencies and actual dishonesty. The effect was limited to the condition in which dishonesty was self-serving. Our results suggest liars are aware of their dishonest tendencies and are potentially not ashamed of them.

Keywords: DOSPERT, risk taking, honesty, lying, dishonesty, unethical behavior.

Risks are prevalent. But to what extent are people willing to take them? It turns out that people’s willingness to take risks depends on the specific domain they consider, and this varies between individuals. For example, some people are willing to take more financial risks when they manage their portfolios while being reluctant to take the risk involved in medically related decisions such as vaccinating their kids. Other people, however, may be more willing to take recreational risks such as skydiving while avoiding ethical risks such as inaccurately filling out their annual tax reports.

One questionnaire often used to assess people’s self-reported willingness to take risks in different domains, is the Domain Specific Risk Taking questionnaire (DOSPERT; Weber, Blais, & Betz, 2002; Blais, & Weber, 2006). The questionnaire differentiates between five risk domains: (1) ethical, (2) financial (separately for investing and gambling), (3) health/safety, (4) social, and (5) recreational. It was validated in predicting specific risk related behaviors. For example, while bungee jumpers score high on their likelihood to take recreational risks, they, at the same time score rather low on their willingness to take financial risks (Hanoch, Johnson, & Wilke, 2006). Similarly, scoring high on the health related risk scale predicts people’s likelihood to engage in actual unhealthy behaviors, while the score on the gambling scale does not predict such health risks (Szrek, Chao, Ramlagan, & Peltzer, 2012). Thus, stable individual differences exist in the tendency to take different types of risks.

Here, we focus on one elusive aspect of human behavior, that might be difficult to assess via self-reports—people’s unethical inclinations. Assessing unethical tendencies is of great importance given how wide spread and expensive unethical conduct is. For example, ward robing—people’s tendency to return used clothes to retailers—costs retailers between $13.9 and $17.7 billion annually (Speights & Hilinski, 2005). People from all walks of life commit many minor unethical acts that accumulate to hefty sums around the globe (see Ayal & Gino, 2011). Being able to assess ones dishonest tendencies clearly matters.

The main question we address here is whether people’s self-reported willingness to take ethical risks correlates with their actual dishonesty. The answer to this question is not yet clear. Are people indeed able to reflect on their own ethical behavior? Will people who lie a lot be dishonest about their dishonest tendencies? If so, dishonest people will portray themselves as honest, and we would find no correlation between self-reported and actual dishonesty. If, however, people tend to be honest about their dishonesty, the correlation between self-reported and actual dishonesty should be positive.

Here, we focused on people’s unethical risk-related self-reported inclinations, measured by the DOSPERT (Weber, Blais, & Betz, 2002), and the extent to which such inclinations correlate with actual dishonesty. We report an experiment revealing that self-reported unethical tendencies positively predict dishonest behavior, but only when dishonesty is self-serving.

One recent indication for the possibility that self-reported ethical risk taking tendencies are positively correlated with actual dishonesty comes from a study by Gino and Margolis (2011). The authors found people’s score on the ethical risk taking DOSPERT sub-scale mediates the relationship between regulatory focus (promotion or prevention) and unethical behavior. Specifically, compared to people induced to think in terms of prevention focus (i.e., attempting to avoid negative outcomes), people thinking in terms of promotion focus (i.e., attempting to achieve positive outcomes) reported a higher likelihood of engaging in ethically risky behaviors, and subsequently behaved more unethically.

In the current study however, we examine whether the trait measured by self-reported dispositional tendency towards ethical risk-taking affects likelihood of engaging in unethical behavior. Importantly, we assess whether this positive correlation between self-reported and actual unethical behavior occurs only when dishonesty is incentivized. We use a task in which participants’ competence is irrelevant, reducing the likelihood that dishonesty will be driven by a desire to demonstrate task competence to one’s self or to others (as in e.g., Ruedy, Moore, Gino & Schweitzer, 2013; Gino & Mogilner, 2014). Thus, only in the incentivized condition did participants have a self-interested motivation to lie—earning more money. Focusing on an incentivized task is important, as real life dishonesty is expected to occur in situations where dishonesty is profitable. Also, almost all the examples in the ethical subscale of the DOSPERT (in the Appendix) concern self-interested behavior.

We engaged participants in an online study in which they were asked to predict the outcomes of their own coin tosses and benefit financially according to their task performance (Shalvi, 2012; see similarly Schurr, Ritov, Kareev & Avrahami, 2012). In this task, participants, in the privacy of their own homes, are asked to pick up a coin, predict the outcome of a toss, then toss the coin and report whether their prediction was correct or not. They do this twenty times. Importantly, as participants toss the coin at their homes, no one can tell what their actual outcomes were. Thus, participants can dishonestly inflate the number of correct predictions they made to earn more money. Although on the individual level we cannot tell whether someone is lying, such assessment can be conducted on the aggregate level by comparing group-level performance to the performance predicted by chance (see Batson, Kobrynowicz, Dinnerstein, Kampf, & Wilson, 1997; Fischbacher & Heusi, 2008; Shalvi, Handgraaf & De Dreu, 2011a; Shalvi, Dana, Handgraaf & De Dreu, 2011b; and Shalvi, 2012). This method is also useful to learn how personality measures relate to actual deceptive behavior without prompting participants’ suspicion (Halevy, Shalvi, & Verschuere, in press).

We assessed whether, and under which settings, self-reported unethical (but not other) risk-taking tendencies, as measured by the DOSPERT, correlate with performance on the coin tossing task. This allowed testing the two possible alternatives: (1) people are dishonest about their dishonesty and thus no correlation between self-reported and actual behavior will be found, vs. (2) people are at least somewhat honest about their dishonesty, and thus the correlation between self-reported and actual behavior will be positive.

Participants were 376 Israeli university students (215 women, Mage = 24.72, SDage = 2.08), who participated in the experiment for the opportunity to win a sum of money. Participants were randomly assigned to one of two conditions: incentivized vs. non-incentivized dishonesty. In the incentivized condition, participants earned money for each correct coin toss prediction, while in the non-incentivized condition, predicting correctly had no financial meaning. Data collection lasted two months in 2012, which included sessions taking place during one week of a heated violent exchange between Israel and Hamas in Gaza (operation “Pillar of Defense”, 2012). None of the reported results were affected by whether they were obtained during this period of unrest or in calmer times. Thus, we do not discuss this issue any further.

Participants performed the experiment online and were asked to have no interruptions during the tasks. We asked participants to hold any kind of coin they may have (1, 2, 5, or 10 ILS coin; 1 ILS ∼ $0.25) and to predict the outcome of tossing it (heads or tails). Next, we asked participants to toss the coin, report the actual outcome and indicate if their prediction was correct or not. This task was performed twenty times, with each coin toss prediction and report done on a separate screen. Participants learned that at the end of the experiment we would randomly choose a number of participants (5 from every 100) to receive pay according to their actual performance. Critically, in the incentivized dishonesty condition, we told participants that the number of correct predictions will determine their pay in ILS (5 ILS for every correct prediction). In the non-incentivized dishonesty condition, participants were informed that if they were selected to receive pay, we would toss a coin twenty times and the number of matches between their own predictions and our coin toss outcomes will determine their pay (5 ILS for every match). Thus, if participants are honest, their expected value in both settings is identical. If, however, they lie in the incentivized setting, they can make more money.

After completing the coin toss task, participants filled out the DOSPERT questionnaire and rated the likelihood that they would engage in domain-specific risky activities on a 7-point scale (1= very unlikely, 7= very likely). The DOSPERT ethical subscale includes such items as “Having an affair with a married man/woman”, and “Passing off somebody else’s work as your own” (6 items in total, α = .55; see full scale in the Appendix). To rule out the possibility that the DOSPERT score will be affected by participants’ coin tossing performance (and/or dishonesty), we added a control condition counterbalancing the order of DOSPERT and the coin tossing task. That is, participants first completed the DOSPERT and only then engaged in the coin tossing task. This allows ruling out the possibility that conducting the task activates moral concerns which are then reflected in the DOSPERT ethical score. To test our prediction that only the ethical (but not other) domain specific risk taking tendencies are associated with actual incentivized dishonesty, we additionally measured all other four DOSPERT sub-scales.

Figure 1: Number of correct coin-toss predictions as a function of ethical DOSPERT and incentives. Areas of symbols are proportional to the number of observations at each position. Best-fitting lines are shown for each condition.

To test the main hypothesis we used General Linear Model (GLM) analysis to predict the reported number of correct coin toss predictions from the ethical DOSPERT (as a continuous measure), and experimental condition (incentivized vs. non-incentivized lying). Supporting the hypothesis that people are honest about their dishonesty we found significant main effects for ethical DOSPERT, F(1, 372) = 3.85, p = .050, η2p = .01, and incentives, F(1, 372) = 10.77, p = .001, η2 p = .028. Participants reported a higher number of correct coin toss predictions when they were financially incentivized to lie (M = 11.17, SD = 2.23) compared to participants who were not incentivized to lie (M = 10.44, SD = 2.03).

We then used the same model but added the interaction term between the ethical DOSPERT and incentives. This time neither main effect was significant in the predicted direction. (Both were slightly reversed.) But, importantly, the interaction between incentives and ethical DOSPERT was significant, F(1, 372) = 10.42, p = .001, η ²p = .027, see Figure 1. Simple effect analyses revealed that, in the incentivized lying condition, the positive effect of ethical DOSPERT on lying was significant, F(1, 187) = 12.92, p < .001, η ²p = .065, in the non-incentivized lying condition, the effect was slightly, and non-significantly, negative. Simply put, as expected, the positive correlation between self-reported and actual dishonesty was present only in the incentivized condition.

To rule out the possibility that cheating in the coin tossing task affects participants’ reports on the DOSPERT scale, we reversed the order of the coin toss and DOSPERT for 79 participants of the complete sample (i.e., of the total n = 376). We used GLM analysis to predict the number of correct predictions from order (DOSPERT and then Coin tossing vs. Coin tossing and then DOSPERT), ethical DOSPERT (as a continuous measure), experimental condition (incentivized vs. non-incentivized lying), and all the interactions between those variables, including the triple interaction between order, incentive, and ethical DOSPERT. Importantly, the triple interaction was not significant ( F(1, 368) = 0.26), thus showing no evidence that the main interaction of interest was a function of order. In a simpler analysis including only the interaction between incentive and ethical DOSPERT as well as order, order had no significant effect of its own ( F(1, 371) = 1.35). These results cast doubt on the possibility that lying affects people’s self-reports or vice-versa. In contrast, these results indicate that the chronic ethical risk-taking tendencies (as measured by DOSPERT), are positively associated with incentivized dishonesty, regardless of the order in which self-reports and behavior are measured.

To rule out the possibility that the interaction between ethical DOSPERT and incentives derives from a few exceptional responses, we removed responses 3SD above and below the sample mean on both ethical DOSPERT and coin tossing performance (i.e., dishonesty), and repeated all analyses. All previously mentioned effects remained significant, p’s < .05, suggesting our results are robust to (removing) such extreme observations.

To verify that the correlation between self-reported unethical risk-taking tendencies and dishonest behavior is, indeed, domain specific, we ran the main analysis with each of the other four DOSPERT scales (financial, health/safety, recreational, and social). If, indeed, ethical risk taking tendencies are domain specific, we should not find the other DOSPERT scales to predict dishonest behavior and/or interactions with the experimental condition. For the health/safety (measure by 6 items; α = .64), recreational (measure by 6 items; α = .83), and social (measure by 6 items; α = .65) DOSPERT sub-scales, the main effects and the interaction between the respective DOSPERT sub-scale and incentives were indeed not significant, all F’s < 1. However, for the financial DOSPERT (measure by 6 items; α = .78), while both the main effect for DOSPERT, F(1, 372) = .07, n.s, as well as the main effect for incentives, F(1, 372) = 2.49, n.s., were not significant, the interaction between them was, F(1, 372) = 8.33, p = .004, η ²p=.02. Simple effects analysis revealed, however, that this interaction was driven by the negative correlation between financial risk and lying in the non-incentivized condition, r (187) = −.19, p = .011, and the lack of correlation in the incentivized setting, r (189) = .12, p = .10. We see no reason why increased risk taking tendencies in financial domain will be negatively correlated with non-incentivized lying. This interaction had little theoretical relevance to the current investigation, and is thus not discussed any further.

Dishonest behavior is a major problem, beginning with “little lies” and extending to theft and fraud. A body of research (e.g., Serota, Levine, & Boster, 2010; Robinson, Lewicki, & Donahue, 2000; Weber, Blais, and Betz, 2002; Gino, Schweitzer, Mead, & Ariely, 2011; Shalvi, Eldar, & Bereby-Meyer, 2012) attempts to explain dishonest behavior, using either measures of self-reports or assessments of actual behavior. The relation between self-reported unethical risky tendencies and actual unethical behavior, however, is not obvious. Here, we provided empirical evidence suggesting people’s self-reported ethical risk-taking tendencies, as measured by the DOSPERT scale, are positively correlated with their actual self-serving dishonesty. When lying did not serve self-interest, the correlation was no longer significant.

Reported results were not caused by alternative factors that we considered. Specifically, the positive correlation between the ethical DOSPERT score and incentivized dishonesty was robust to (1) the order in which the two tasks were presented to participants, as well as to (2) the inclusion/exclusion of extreme (outlier) observations. Importantly, testifying to the fact that risk-taking tendencies are indeed domain specific, with only a theoretically meaningless exception, the correlation between the DOSPERT score and incentivized dishonesty was significant only for the ethical but not for the other DOSPERT sub-scales (finance, health/safety, recreational, and social). The latter observation contributes to the existing research, demonstrating the DOSPERT scale is domain-specific (e.g., Szrek et al., 2012; Hanoch et al., 2006).

Our findings extend previous research suggesting situational factors (such as being in a “promotion” rather than “prevention” mind-set) affects people’s willingness to take ethical risks and thus behave unethically (Gino & Margolis, 2011). Here, we found that the relation between the ethical risk taking tendencies and incentivized dishonesty is not limited to situations in which such risk tendencies are evoked. Rather, our results suggest people high on their chronic ethical (but not other) risk taking tendencies, are more likely to engage in lying to secure personal profit. Further study of the relation between stable personality traits and unethical behavior seems a promising path. Steinel & De Dreu (2004) for example, found competitors were more likely to lie than cooperators. It may be especially interesting to test predictions linking trait and state, for example, by exploring if cooperative people may be more likely to lie in order to serve their group outcome (see Conrads, Irlenbusch, Rainer & Walkowitz, 2013, Gino, Ayal, & Ariely, 2013, Shalvi & De Dreu, 2013).

The link between ethical risk taking tendencies as measured by self-reports and behavior is not trivial. If people are driven by social desirability considerations—a presentation of oneself in a positive light—they should under-report behaviors perceived socially undesirable and unethical (Zerbe & Paulhus, 1987). Such under-reporting should reduce variance on the ethical DOSPERT scale and significantly reduce the ability to detect correlations between the scale and other outcome variables. This opens up the possibility that people who report unethical inclinations, or their lying, are not ashamed about their acts, or do not consider them unethical. Indeed, recent work suggests that people are not always aware that they are lying (Bazerman & Tenbrunsel, 2011), or of the factors leading them to do so (Welsh & Ordóñez, 2013).

One topic for future research is how people filling out the DOSPERT ethical risk taking scale perceive each of the behaviors to be (un)ethical. Some literature suggests that likelihood to cheat is influenced by the ability to neutralize the perception of different behaviors as unethical (Diekhoff, LaBeff, Clark, Williams, Francis, & Haines, 1996) or justify them (Shalvi et al., 2011b; Schweitzer & Hsee, 2002). For example, Haines, Diekhoff, LaBeff, and Clark (1986) found that, while college students recognized cheating as an undesirable behavior, those who classified themselves as cheaters were more likely to neutralize acts of cheating compared to non-cheaters. In other words, being able to self-justify ones lies makes it easier to lie with a clear conscience. Potentially, people reporting a high likelihood to behave unethically when filling out the DOSPERT scale may have used a similar neutralization strategy to construe their behavior as legitimate behavior. Further research is needed, however, to assess how people construe unethical behavior and to verify if indeed, people scoring high on the ethical DOSPERT, are more prone to engage in leniently defining what ethical behavior is.

Surveying people’s opinions and beliefs via self-reported questionnaires is a common strategy in psychological science. Such surveys are used to assess if one is mentally ill, plans to vote to a specific political party, or is aware of a recent marketing campaign. Based on the answers people provide to such surveys, psychiatrists form their diagnosis, political leaders fine-tune their public announcements, and commercial companies launch new products. What people report thinking and doing, clearly is important. The current research revealed a positive correlation between people’s dispositional tendencies towards taking ethical risks and their actual self-serving dishonesty. It seems people taking ethical risks are honest about their unethical tendencies. Importantly, the results reported here strengthen the assumption that risk is domain specific, as only ethical, but not other, risk taking tendencies were correlated with actual incentivized dishonesty. The relation between self-reported ethical risk tendencies and actual dishonesty suggests that self-reports are not merely “cheap talk”.

Batson, C. D., Kobrynowicz, D., Dinnerstein, J. L., Kampf, H. C., & Wilson, A. D. (1997). In a very different voice: Unmasking moral hypocrisy. Journal of Personality and Social Psychology, 72, 1335–1348.

Bazerman, M. H., & Tenbrunsel, A. E. (2011). Blind spots: Why we fail to do what’s right and what to do about it, NJ: Princeton University Press.

Blais, A. R., & Weber, E. A. (2006). Domain-specific risk-taking (dospert) scale for adult populations. Judgment and Decision Making, 1, 37–44.

Conrads, J., Irlenbusch, B., Rainer, R. M., & Walkowitz, G. (2013). Lying and team incentives. Journal of Economic Psychology, 34, 1–7.

Diekhoff, G. M., LaBeff, E. E., Clark, R. E., Williams, L. E., Francis, B., & Haines, V. J. (1996). College cheating: Ten years later. Research in Higher Education, 37, 487–502.

Fischbacher, U., Heusi. F. (2008). Lies in disguise. An experimental study on cheating. Research Paper Series, Thurgau Institute of Economics and Department of Economics at the University of Konstanz.

Gino, F., Ayal, S., & Ariely, D. (2013). Self-serving altruism? The lure of unethical actions that benefit others. Journal of Economic Behavior & Organization, 93, 285–292.

Gino, F., & Margolis, J. D. (2011). Bringing ethics into focus: How regulatory focus and risk preferences influence (un)ethical behavior. Organizational Behavior and Human Decision Processes, 115, 145-156.

Gino, F., & Mogilner, C. (2014). Time, money, and morality. Psychological Science. In press.

Gino, F., Schweitzer, M. E., Mead, N. L., & Ariely, D. (2011). Unable to resist temptation: How self-control depletion promotes unethical behavior. Organizational Behavior and Human Decision Processes, 115, 191–203.

Haines, V. J., Diekhoff, G. M., LaBeff E. E., & Clark, R. E. (1986). College cheating: Immaturity, lack of commitment, and the neutralizing attitude. Research in Higher Education, 25, 342–354.

Halevy, R., Shalvi, S., & Verschuere, B. (in press). Being Honest About Dishonesty: Correlating Self Reports and Actual Lying. Human Communication Research.

Hanoch, Y., Johnson, J. G., & Wilke, A. (2006). Domain-specificity in experimental measures and participant recruitment: An application to risk-taking behavior. Psychological Science, 17, 300–304.

Robinson, R., Lewicki, R. J., & Donahue, E. (2000). Extending and testing a five factor model of ethical and unethical bargaining tactics: Introducing the SINS scale. Journal of Organizational Behavior, 21, 649–664.

Ruedy, N. E., Moore, C., Gino, F., & Schweitzer, M. (2013). The cheater’s high: The unexpected affective benefits of unethical behavior. Journal of Personality and Social Psychology, 105, 531–548.

Schurr, A., Ritov, I., Kareev, Y., & Avrahami, J. (2012). Is that the answer you had in mind? The effect of perspective on unethical behavior, The Center for the Study of Rationality. Judgment and Decision Making, 7, 679–688.

Schweitzer, M. E., & Hsee. C. K. (2002). Stretching the truth: Elastic justification and motivated communication of uncertain information. Journal of Risk and Uncertainty, 25, 185–201.

Serota, K. B., Levine, T. R., & Boster, F. J. (2010). The prevalence of lying in America. Human Communication Research, 36, 1–24.

Shalvi, S. (2012). Dishonestly increasing the likelihood of winning. Judgment and Decision Making, 7, 292–303.

Shalvi, S., & De Dreu, C. K. W. (2013). Oxytocin drives group serving dishonesty, working paper.

Shalvi, S., Dana, J., Handgraaf, M. J. J., & De Dreu, C. K. W. (2011b). Justified ethicality: Observing desired counterfactuals modifies ethical perceptions and behavior. Organizational Behavior and Human Decision Processes, 115, 181–190.

Shalvi, S., Handgraaf, M. J. J., & De Dreu, C. K. W. (2011a.) Ethical manoeuvering: Why people avoid both major and minor lies. British Journal of Management, 22, s16–s27.

Shalvi, S., Eldar, O., & Bereby-Meyer, Y. (2012). Honesty requires time (and lack of justifications). Psychological Science, 23, 1264–1270.

Shalvi, S., Handgraaf, M. J. J., & De Dreu, C. K. W. (2011). Ethical manoeuvering: Why people avoid both major and minor lies. British Journal of Management, 22, s16–s27.

Speights, D., & Hilinski M. (2005). Return Fraud and Abuse: How to Protect Profits. Retailing Issues Letter, 17, 1–6.

Steinel, W., & De Dreu, C. K. (2004). Social motives and strategic misrepresentation in social decision making. Journal of Personality and Social Psychology, 86, 419–434.

Szrek H., Chao, L. W., Ramlagan. S., & Peltzer K. (2012). Predicting (un)healthy behavior: A comparison of risk-taking propensity measures. Judgment and Decision Making, 7, 716–727.

Weber, E. U., Blais, A. R., & Betz, E. (2002). A Domain specific risk-attitude scale: Measuring risk perceptions and risk behaviors. Journal of Behavioral Decision Making, 15, 263–290.

Welsh, D., & Ordóñez, L. (2013). Conscience without cognition: The effects of subconscious priming on ethical behavior. Academy of Management Journal.

Zerbe, W. J., & Paulhus D. L. (1987). Socially desirable responding in organizational behavior: A reconception. Academy of Management Journal, 12, 250–264.

For each of the following statements, please indicate the likelihood that you

would engage in the described activity or behavior if you were to find yourself

in that situation. Provide a rating from Extremely Unlikely to Extremely

Likely, using the following scale: (1) extremely unlikely, (2) moderately

unlikely, (3) somewhat unlikely, (4) not sure, (5) somewhat likely, (6)

moderately likely, (7) extremely likely.

Ethical |

Revealing a friend’s secret to someone else. |

Having an affair with a married man/woman. |

Passing off somebody else’s work as your own. |

Leaving your young children alone at home while running an errand. |

Keeping a wallet you found that contains $200. |

Taking some questionable deductions on your income tax return. |

Health/safety |

Engaging in unprotected sex. |

Driving a car without wearing a seat belt. |

Riding a motorcycle without a helmet. |

Sunbathing without sunscreen. |

Walking home alone at night in an unsafe area of town. |

Drinking heavily at a social function. |

Financial/gambling |

Betting a day’s income on the outcome of a sporting event (e.g., baseball,

soccer, or football). |

Betting a day’s income at the horse races. |

Betting a day’s income at a high-stake poker game. |

Financial/investing |

Investing 5% of your annual income in a very speculative stock. |

Investing 10% of your annual income in a new business venture. |

Investing 10% of your annual income in a moderate growth mutual fund. |

Recreational |

Going whitewater rafting at high water in the spring. |

Taking a sky-diving class. |

Going camping in the wilderness. |

Bungee-jumping off a tall bridge. |

Piloting a small plane. |

Going down a ski run that is beyond your ability. |

Social |

Admitting that your tastes are different from those of a friend. |

Choosing a career that you truly enjoy over a prestigious one. |

Speaking your mind about an unpopular issue in a meeting at work. |

Moving to a city far away from your extended family. |

Starting a new career in your mid-thirties. |

Disagreeing with an authority figure on a major issue. |

The research was funded under the People Program (Marie Curie Actions) of the European Union’s Seventh Framework Program (FP7/2007-2013), REA grant agreement number 333745, awarded to Shaul Shalvi.

Copyright: © 2013. The authors license this article under the terms of the Creative Commons Attribution 3.0 License.

This document was translated from LATEX by HEVEA.