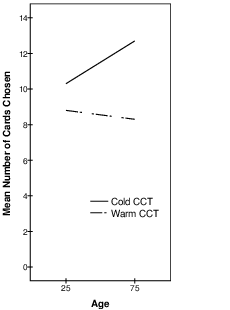

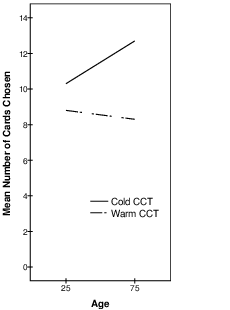

| Figure 1: The interaction plot between age and CCT condition in risk taking (N= 158). |

Judgment and Decision Making, vol. 8, no. 2, March 2013, pp. 179-187

Risky choice in younger versus older adults: Affective context mattersYumi Huang* Stacey Wood# Dale Berger# Yaniv Hanoch% |

Earlier frameworks have indicated that older adults tend to experience decline in their deliberative decisional capacity, while their affective abilities tend to remain intact (Peters, Hess, Västfjäll, & Auman, 2007). The present study applied this framework to the study of risky decision-making across the lifespan. Two versions of the Columbia Card Task (CCT) were used to trigger either affective decision-making (i.e., the “warm” CCT) or deliberative decision-making (i.e., the “cold” CCT) in a sample of 158 individuals across the lifespan. Overall there were no age differences in risk seeking. However, there was a significant interaction between age and condition, such that older adults were relatively more risk seeking in the cold condition only. In terms of everyday decision-making, context matters and risk propensity may shift within older adults depending upon the context.

Keywords: decision-making, dual system, age difference, risk taking, risky choice.

Older adults are engaged in many risky assessments regarding critical issues such as health, finances, and social relationships, yet little consensus exists regarding the nature of age related changes in risk taking. Dual-process models predict that affective and deliberative abilities have important but distinct functions in risk taking behavior across the lifespan and that aging may differentially affect deliberative systems (Peters, Hess, Västfjäll, & Auman, 2007; Peters & Bruine de Bruine, 2012). An implication is that risk assessment in older adults may differ depending upon the affective versus deliberative nature of the task at hand.

Overall, the literature on risk and aging has been mixed. On the one hand we have a range of studies arguing that older adults are risk-averse. Okun (1976), for instance, showed that older adults are more likely to choose less risky options, and Bakshi and Chen (1994) found a negative relationship between age and risky investment behavior. Vroom and Pahl’s (1971) examination of risk taking among managers revealed similar trends: Younger (vs. older) managers were found to be more risk-seeking. Similarly, Schooley and Worden (1999) showed a decline in financial risk tolerance among those over 65 years old, manifested in their decisions to invest more conservatively. An analysis by Bellante and Green (2004) of investment portfolio allocations found that older adults picked more risk-averse options. Similarly, older (vs. younger) university staff took less risk when developing retirement plans (Dulebohn, 2002). Finally, using the Decision-Gamble Task, Deakin, Altken, Robbins, and Sakakian (2004) found that older adults were less willing to take risks than their younger counterparts.

In contrast, a number of laboratory studies and survey data suggest that in some circumstances older adults demonstrated increased risk seeing. Grable (2000) found a positive relationship between age and risk taking, such that older individuals reported greater financial risk tolerance (Hope & Havir, 2002; Mather, 2006; Vander Bilt, Dodge, Pandav, Shaffer, & Ganguli, 2004). However, Dror, Katona, and Mungur (1998) found that younger and older adults exhibited similar risk taking behavior on a gambling task.

A number of researchers have used the Iowa Gambling Task (IGT; Bechara, Damasio, Tranel, & Anderson, 1998) and the Balloon Analogue Risk Task (BART; Lejuz, Read, Kahler, Richards, Ramsey, & Stuart, et al., 2002) to examine age difference in risk taking. Kovalchik, Camerer, Grether, Plott, and Allman (2005) found no behavioral differences on the IGT between young and older adults. Wood, Busemeyer, Koling, Cox, and Davis (2005) revealed that, while older and younger adults both demonstrated effective strategies, older adults employed an affective rather than a deliberative strategy, by attending less to losses. Denburg, Tranel, Bechara, and Damasio (2001), however, presented an even more complex picture. They found that, while the majority of older adults behaved similarly to their younger counterparts, a subsample of the older population showed a higher risk taking tendency. Rolison, Hanoch and Wood (2012) demonstrated that, while the initial behavior of older adults was more conservative on the BART, their overall behavior was similar to that of their younger counterparts, indicating that experience with a task was related to risk behavior. Finally, a study by Henninger, Madden and Huettel (2010), using the BART and the IGT, nicely illustrates the complexity of age effects on risk taking. On the IGT, older adults made worse decisions and tended to take more risks. On the BART, however, older adults were more risk-averse. The authors discuss different cognitive underpinnings to account for these findings. Taken together, these studies highlight the importance of task context in understanding risk taking across the lifespan.

In a meta-analysis of 27 risk and aging studies, Mata, Josef, Samanez-Larkin and Hertwig (2011) reported that age differences in risk behavior can be best understood in the context of task characteristics. That is, tasks that are greatly influenced by task experience (e.g., IGT) often show age differences secondary to learning components. Older adults look relatively risk averse when a task rewards risk seeking, but risk seeking when a task rewards conservative strategies. However, tasks that provided probability-type information did not necessarily show age differences. Further, there were no consistent age differences for gain/loss frame information. The authors noted several limitations of the current literature including a lack of lifespan samples, a lack of studies that examine life time learning and experience, studies of other risk domains (e.g., recreational), and a paucity of studies that specifically manipulate the magnitude of probability information and gain/loss information.

Only a handful of studies have considered how emotion might affect older adults’ risky decisions. Chen and Ma (2009) examined the role of emotions—positive, negative, or neutral—in risky decision among older and younger adults. Chen and Ma found that older adults tended to be more risk-averse than the younger adults. More importantly, their study reveals that older adults’ decisions were more likely to be influenced by positive emotions while younger individuals were more likely to be influenced by negative emotions. A study by Chou, Lee and Ho (2007) offered a similar pattern of results. In this study, younger and older adults completed a risk taking task after they watched positive, negative, or neutral films. Chou et al. failed to find a main effect of age. They did, however, find a main effect for mood, as well as an age by mood interaction. In the positive mood condition, older adults were greater risk takers; in contrast, in the negative mood condition, the younger adults exhibited more risk taking behavior. Clearly more work examining the interaction of risk, emotion, and aging needs to be done.

In sum, the literature provides a complex picture with regard to the relationship between age and risk taking. Task characteristics and emotional manipulations can drive the presence and the nature of these effects.

Dual-process models have provided a useful framework for considering the role of affective and deliberative processes in decision-making across the lifespan. (For a recent review of theoretical frameworks, see Peters & Bruine de Bruine, 2012.) Emotional regulation has been found to improve with aging across a large number of studies (e.g., Charles & Carstensen, 2007; Fung & Carstensen 2003; Mather & Carstensen, 2005; Spaniol, Voss, & Grady, 2008). However, certain aspects of cognitive functioning, including working memory, decline with age (Park, Lautenschlager, Hedden, Davidson, Smith & Smith, 2002). Recent studies found older adults considered fewer pieces of information in their decision-making even while studying the information for longer periods of time, perhaps secondary to cognitive constraints (e.g., Hanoch et al., 2009; Mata & Nunes, 2010; Mata, Schooler, & Rieskamp, 2007).

The current study used the Columbia Card Task (CCT; Figner, Mackinlay, Wilkening, & Weber, 2009; Figner & Weber, 2011), a task that was initially developed to evaluate risk seeking in teenagers. Teenagers are known to demonstrate increased risk seeking under conditions of emotional arousal, but may be rationale decision-makers under more deliberative conditions. The CCT includes a “hot” and a “cold” version: the hot version is designed to trigger affective processes, whereas the cold version is aimed at initiating deliberative processes. In both versions, participants decide whether or not to turn over cards, where each card indicates a gain or a loss. Both versions have 32 cards for each of 24 trials, with three pieces of information that are relevant to making their decisions: (i) the probability of losing on each card (either 1/32 or 3/32), (ii) amount each card can gain (either 10 or 30 points), and (ii) amount each card can lose (either 250 or 750 points). Participants are also told that “within a given trial, cards can be turned over as long as gain cards are encountered” and when a “loss card is encountered … no more cards can be turned over and the specified loss amount is subtracted from the previous payoff” (Figner et al., 2009, p. 712). Risk is conceptualized simply as the number of cards one is willing to turn over. In the hot version, feedback is given after each card is turned over, and the participant decides whether to turn over another card until the trial ends either with the participant deciding to stop or turning a loss card. In the cold version the participant indicates how many cards will be turned over for each trial in turn, and feedback is given only after all trials are completed. However, there is a confound with the “hot” version. Because a trial ends when a loss card is encountered, the true risk tolerance is underestimated if the participant would have been willing to turn more cards. This confound has been addressed with the addition of a “warm” version of the task. The warm version, which was used in the current research, allows the participant to identify at the beginning of a trial all the cards they would like to play on that trial, and then feedback is given as the outcome of that trial at the end of the trial. As such, the participants get feedback at the trial by trial level, rather than the card by card level (hot) (http://www.columbiacardtask.org).

Numeracy—the ability to understand basic mathematical concepts (Schwartz, Woloshin, Black, & Welch, 1997)—has attracted much attention in recent years. There is evidence that older adults as a group exhibit lower levels of numeracy and that lower numerate adults are less adept decision-makers (Banks & Oldfield, 2007; Tanius, Wood, Hanoch, & Rice, 2009; Peters et al., 2007). Galesic, Gigerenzer, and Straubinger (2009) found that older adults fared worse on both numeracy and on interpreting medical risk information and insurance information (see also Wood et al, 2011). Numeracy may be important in understanding risk taking behavior among older adults as it may mediate the relationship between age and use of numerical information in risky situations, accounting for some of the mixed findings regarding age and risk taking behavior.

The current study evaluated risk taking for younger and older adults in two different contexts, one designed to trigger affective processes (i.e., the warm CCT) and one designed to trigger deliberative processes (i.e., the cold CCT). Working memory and numeracy were assessed as potential mediators and moderators of the relationship between age and risk taking. The following specific hypotheses were tested:

One hundred and fifty-eight participants were recruited from the Claremont, California area to participate in this study. Participants ranging from 18 to 93 years of age were randomly assigned to either the warm (n=80) or the cold condition (n = 78) and were compensated with a flat payment of 10 dollars. Education level was coded into five categories: 1 = high school diploma (35%), 2 = occupational or academic associate degree (21%), 3 = bachelor’s degree (18%), 4 = master’s degree (13%) and 5 = professional or doctoral degree (13%).

All participants were tested individually at the Wood Neuropsychology of Decision-Making Lab at Scripps College. After signing the approved IRB consent form, participants completed the following materials.

Participants were required to reach the minimum score of 26 out of 30 on the Mini-Mental State Exam (MMSE; Folstein, Folstein, & McHugh, 1975).

Working memory was measured using the digit span forward and backward tests (Wechsler, 1991). The digit span tests have been found to have high reliability with adults (Cronbach’s alpha > .90, Wechsler,2008). Forward digit span primarily measures the capacity to maintain information, whereas the backward digit span measures the ability to maintain and manipulate information (Figner et al., 2009). The digits were presented orally by an experimenter at the rate of one digit per second. Each participant was asked to repeat the digits in the same order in the digit span forward test, and in reversed order in the digit span backward test. Following correct responses on two successive trials, the number of digits was increased by one digit. Both tests ended when participants made errors on two successive trials.

Each participant was asked to fill out an 11-item numeracy scale (Cronbach’s alpha =.78, Reyna et al., 2009) to assess understanding of probabilistic information (e.g., Imagine that we roll a fair, six-sided die 1,000 times. Out of 1,000 rolls, how many times do you think the die would come up even (2, 4, or 6)? (Lipkus, Samsa, & Rimer, 2001).

Each participant was given 24 trials with 32 cards in each trial and asked how many cards they would like to turn over based on three factors: probability of loss (1 versus 3 loss cards out of a field of 32), gain amount (10 or 30 points per gain card), and loss amount (250 or 750 points). Feedback was given after each trial (warm condition) or only at the end of all 24 trials (cold condition). The 24 trials represented three replications of each of the eight possible combinations of the three factors. The data were collected from an online portal hosted at http://www.columbiacardtask.org. The CCT measures not only the level of risk taking, but also how participants use information to decide how much risk they are going to take.

After completing the study, participants were asked to complete a self-reported decision strategies questionnaire. The questionnaire was designed to assess the extent to which participants used deliberative or affective strategies (Figner et al., 2009) in either the warm or the cold condition. For example, “I tried to solve the task mathematically” was designed to measure the use of a deliberative strategy, and “I solved the task on a gut level” was used to assess the affect-based strategy. In addition, the item “At times during the game I felt a thrill” was used to assess emotional arousal. For each item, participants were asked to mark their agreement on a 0-100 millimeter scale (ranging from “doesn’t apply at all” to “strongly apply”). Finally, the presentation order of working memory span, numeracy, and CCT task with questionnaire was counterbalanced, such that approximately equal numbers of participants were assigned to each of eight possible orders.

Of the original 159 participants, one older participant was excluded because of failing the cognitive screening task (MMSE). An examination of distributions revealed no outliers or missing data.1

Figure 1: The interaction plot between age and CCT condition in risk taking (N= 158).

Table 1: Correlations among age, forward and backward working memory, numeracy, and risk taking (N =158).

Variables 1. Age 2. Forward digit span 3. Backward digit span 4. Numeracy 5. Risk−taking

A hierarchical linear regression was used to test the significance of age, CCT condition (warm or cold), and interaction of age and CCT condition (cold = 0, warm = 1) in predicting risk taking (i.e., average number of cards chosen). The age effect on the first step of the hierarchical analysis was not significant, R2 =.012, F(1, 156) = 1.94, p =. 165, suggesting that age overall did not significantly account for risk taking. Next, the CCT condition in the second step accounted for 10% of the variance in the measure of risk taking Δ R2 = .094, F(1, 155) = 16.28, p < .001, where participants took more risks (i.e., turned over more cards) in the cold CCT than in the warm CCT, β = −.306, t(155) = −4.04, p < .001. There was a significant interaction between age and CCT condition (Figure 1) in the third step of the hierarchical analysis, Δ R2 = .030, F(1, 154) = 5.29, p = .025. Simple effects tests showed age was a significant predictor of risk taking in the cold condition, β = .300, t(76) = 2.75, p =.008, but not in the warm condition, β = −.058, t(78) = .054, p =.589. Risk taking increased with age in the cold CCT but did not differ significantly across age in the warm CCT. This finding supported our first hypothesis that compared to younger adults, older adults would take more risk in a deliberative risk taking condition but not in a more emotional condition.

Because the original numeracy scale had substantial skew and kurtosis (skew = −1.57; kurtosis = 2.87), a log transformation was used on the reversed measure, and the result was reversed back to create the measure of numeracy used for further analyses. As expected, numeracy was negatively related to age, but positively related to each of the digit span measures (see Table 1). The two digit span measures of working memory were strongly correlated with each other, r(156) = .50, p < .001, but neither was significantly correlated with age. No mediation analyses were conducted for the relationship between age and risk taking because neither age nor any of the potential mediators were significantly related to risk taking.

The two working memory measures, forward and backward span, were not significantly related to age, and so these variables were not analyzed further as mediators. Age also was a significant predictor of numeracy, β = −.437, p < .001.

No mediation analyses were conducted for the relationship between age and risk taking because neither age nor any of the potential mediators were significantly related to risk taking.

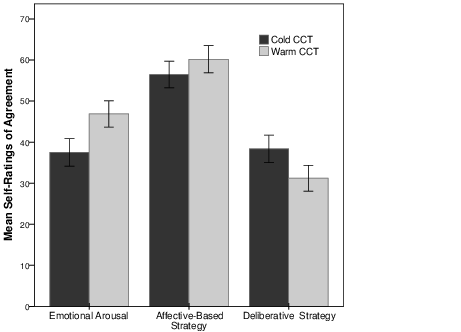

Figure 2: Means and standard errors of self-ratings of agreement for emotional arousal (i.e., the item of Thrill), affect-based strategy (i.e., the item of Gut), and deliberative strategy (i.e., the item of Math) between the cold and warm CCT. Thrill = the item “At times during the game I felt a thrill”; Gut = the item “I solved the task on a gut level”; Math = the item “I tried to solve the task mathematically.”

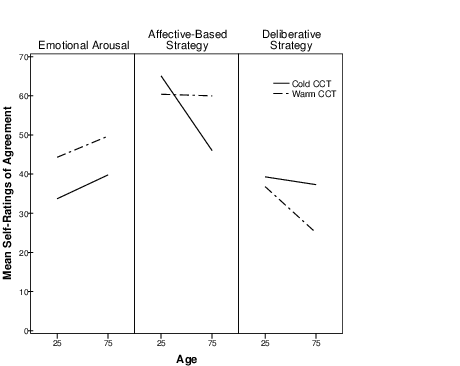

Figure 3: The interaction plot between age and CCT condition in emotional arousal, affective-based, and deliberative strategies (N = 158).

As a manipulation check, emotional arousal was assessed with the item “At times during the game I felt a thrill.” The extent to which participants felt they used affect based (gut) strategies and deliberative (mathematical) strategies was also assessed with ratings on 1 to 100 scales of agreement with “I solved the task on a gut level” and “I tried to solve the task mathematically.” Mean ratings for these items are shown in Figure 2.

A mixed model ANOVA was used to compare strategies across the two CCT conditions. The dependent variable was strategy use in a 2 × 2 ANOVA (gut vs. math strategy × warm vs. cold CCT condition) with strategy as a within-subjects factor and CCT condition as a between-subjects factor. The main effect for strategy (gut vs. math) was significant F(1, 156) = 43.18, p < .001, η p2 = .217, with participants in both cold and warm CCT conditions indicating greater use of the ‘gut’ strategy. There was no significant main effect for CCT condition F(1, 156) = 0.35, p = .557, η p2 = .002 or the interaction, F(1,156) = 2.31, p = .130, η p2 = .015. Although the interaction patterns were in the expected directions, the differences between warm and cold CCT did not attain statistical significance for either strategy (see Figure 2).

Hierarchical linear regressions were used to test the significance of age, CCT condition and the interaction of age and CCT condition in predicting emotional arousal and use of the two strategies (gut and mathematical). Age was not significantly related to the rating of emotional arousal, R2 =.009, F(1,156) = 1.34, p = .249. However, controlling for age, the arousal level did differ by CCT condition, Δ R2 = .025, F(1,155) = 3.99, p = .048. As expected, the rating of emotional arousal was significantly higher in the warm CCT (M = 46.9, SD = 28.5) than in the cold CCT (M = 37.5, SD = 29.7), t(156) = 2.02, p = .045 (two-tailed), d = 0.32 (See Figure 5). There was no significant interaction between age and CCT condition in the third step of the hierarchical analysis (see the first panel in Figure 3).

The use of affective-based gut strategies showed a main effect of age, R2 =.036, F(1, 156) = 5.89, p =. 016, reflecting an average of less endorsement of the gut strategy among older participants. The CCT condition did not account for additional variance, Δ R2 = .005, F(1, 155) = 0.75, p = .388. However, there was a significant interaction between age and CCT condition (second panel of Figure 3), Δ R2 = .033, F(1, 154) = 5.42, p = .021. Simple slopes analysis showed that age was a significant predictor of gut level decision making in the cold condition, β = −.382, t(76) = −3.60, p =.008, but not in the warm condition, β = −.008, t(78) = −0.07, p =.994. Older participants did not think they used the affective strategy much as much as the younger adults did in the cold CCT.

The main effect of age was not significant for use of the deliberative mathematical strategy, R2 =.018, F(1,156) = 2..81, p =. 096. Nor was the CCT condition significant, Δ R2 = .015, F(1,155) = 2.34, p = .128. Although the interaction between age and CCT condition did not attain significance, Δ R2 = .009, F(1,154) = 1.43, p = .234, simple slopes analyses were conducted based on a priori hypotheses. Age was a significant predictor of math level in the warm condition, β = -.382, t(78) = −2.10, p =.039, but not in the cold condition, β = −.038, t(76) = −0.33, p =.742 (third panel of Figure 3). The older participants did not think they used a deliberative strategy as much younger participants did in the warm CCT condition. Taken together, these findings show that the warm CCT condition did elicit a higher level of emotional arousal than the cold CCT condition. Participants in all conditions reported greater use the affective “gut” strategies than the deliberative “math” strategies. However, older participants were less likely than younger participants to use the “gut” strategies in the cold CCT condition or the “mathematical” strategy in the warm CCT condition.

Overall risk taking was not different between younger and older adults across conditions, a finding consistent with previous studies (Kovalchik et al., 2005; Mather, 2006; Wood et al., 2005). However, only older adults showed significantly greater risk taking in the cold CCT compared to the warm CCT. These results suggest that, in the absence of emotional information, older adults were more risk seeking. From a practical point of view, our results illustrate that the context in which risk information is presented can have an important effect on older adults decision making.

Only numeracy was significantly different between younger and older adults, whereas forward and backward digit span did not. In addition, neither digits forwards nor digits backwards were mediators for age and risk-taking for the warm and cold CCT.

The self-reported decision strategies failed to replicate the findings of Figner et al. (2009). Although trends were in the expected direction, participants did not report employing significantly more affect-based strategies in the warm CCT than in the cold CCT, and did not report employing more deliberative strategies in the cold CCT than in warm CCT. However, participants reported stronger thrills in the warm CCT than they did in the cold CCT, suggesting the warm CCT aroused stronger emotions and therefore provoked greater affective processing. The nonsignificant findings for strategies (gut vs. math) may be due to limitations of the self-report measures used here. Further research is needed to develop measures that can be used to examine deliberative and affective strategies in decision-making.

In summary, this study found no substantial overall age differences in risky decision-making. Of course, any laboratory based study may provide limited insight into real-world risk behavior where older adults may rely on others in their decision-making. Older adults demonstrated relatively greater risk-taking in the cold versus the warm condition. Older adults benefited from the emotional information provided in the warm condition to mitigate risk seeking. Furthermore, numeracy, but not working memory, showed differences between younger and older adults. In terms of everyday decision-making, context matters, and risk propensity may very well shift within older adults depending upon the context.

Bakshi, G. S., & Chen, Z. W. (1994). Baby boom, population aging, & capital markets. Journal of Business, 67, 165–202.

Banks, J., & Oldfield, Z. (2007). Understanding pensions: cognitive function, numerical ability and retirement saving. Fiscal Studies, 28, 143–170.

Bechara, A., Damasio, H., Tranel, D., & Anderson, S. W. (1998). Dissociation of working memory from decision making within the human prefrontal cortex. Journal of Neuroscience, 18, 428–437.

Bellante, D., & Green A. C. (2004). Relative risk aversion among the elderly. Review of Financial Economics, 13, 269–281.

Charles, S., & Carstensen, L. (2007). Emotion regulation and aging. In J. J. Gross (Ed.), Handbook of emotion regulation (pp. 307-327). New York: Guilford Press.

Chen, Y., & Ma, X. (2009). Age differences in risky decisions: The role of anticipated emotions. Educational Gerontology, 35, 575–586.

Chou, K., Lee, T., & Ho, A. (2007). Does mood state change risk-taking tendency in older adults? Psychology & Aging, 22, 310–318.

Deakin, J., Aitken, M., Robbins, T., & Sahakian, B. J. (2004). Risk taking during decision-making in normal volunteers: Changes with age. Journal of the International Neuropsychological Society, 10, 590–598.

Denburg, N. L., Tranel, D., Bechara, A., & Damasio, A. R. (2001). Normal aging may compromise the ability to decide advantageously. Brain and Cognition, 47, 156–185.

Dror, I. E., Katona, M., & Mungur, K. (1998). Age differences in decision making: To take a risk or not? Gerontology, 44, 67–71.

Dulebohn, J. H. (2002). An investigation of the determinants of investment risk behavior in employer-sponsored retirement plans. Journal of Management, 28, 3–26.

Falk, R., & Wilkening, F. (1998). Children’s construction of fair chances: Adjusting probabilities. Developmental Psychology, 34, 1340–1357.

Faul, F., Erdfelder, E., Lang, A.-G., & Buchner, A. (2007). G*Power 3: A flexible statistical power analysis program for the social, behavioral, and biomedical sciences. Behavior Research Methods, 39, 175–191.

Figner, B., Mackinlay, R. J., Wilkening, F., & Weber, E. U. (2009). Affective and deliberative processes in risky choice: Age differences in risk taking in the Columbia Card Task. Journal of Experimental Psychology: Learning, Memory, and Cognition, 35, 709–730.

Figner, B., & Weber, E. U. (2011). Who takes risk when and why? Determinants of risk-taking. Current Directions in Psychological Science, 20, 211–216.

Folstein, M. F., Folstein, S. E., & McHugh, P. R. (1975). Mini-mental state: a practical method for grading the cognitive state of patients for the clinician. Journal of Psychiatric Research, 12, 189–198.

Fung, H. H., & Carstensen, L. L. (2003). Sending memorable messages to the old: Age differences in preferences and memory for emotionally meaningful advertisements. Journal of Personality and Social Psychology, 85, 163–178.

Galesic, M., Gigerenzer, G., & Straubinger, N. (2009). Natural frequencies help older adults and people with low numeracy to evaluate medical screening tests. Medical Decision Making, 29, 368–371. http://dx.doi.org/10.1177/0272989X08329463

Grable, J. E. (2000). Financial risk tolerance and additional factors that affect risk taking in everyday money matters. Journal of Business and Psychology, 14, 625–630.

Hanoch, Y., Rice, T., Cummings, J., & Wood, S. (2009). How much choice is too much? The case of the Medicare prescription drug benefit. Health Services Research, 44, 1157–1168.

Hanoch, Y., Wood, S., & Rice, T. (2007). Bounded rationality, emotions and older adult decision making: Not so fast and yet so frugal. Human Development, 50, 333–358.

Henninger, D. E., Madden, D., & Huettel, S. A. (2010). Age-Related Cognitive Decline Predicts Changes in Risk Preference. Psychology & Aging, 25, 262–270.

Hope, J., & Havir, L. (2002). You bet they’re having fun! Older Americans and casino gambling. Journal of Aging Studies, 16, 177–197.

Kovalchik, S., Camerer, C. F., Grether, D. M., Plott, C. R., & Allman, J. M. (2005). Aging and decision making: A broad comparative study of decision behavior in neurologically healthy elderly and young individuals. Journal of Economic Behavior and Organization, 58, 79–94.

Lejuez, C. W., Read, J. P., Kahler, C. W., Richards, J. B., Ramsey, S. E., Stuart, G. L., et al. (2002). Evaluation of a behavioral measure of risk taking: The Balloon Analogue Risk Task (BART). Journal of Experimental Psychology: Applied, 8, 75–84.

Lipkus, I. M., Samsa, G., & Rimer, B. K. (2001). General performance on a Numeracy scale among highly educated samples. Medical Decision Making, 21, 37–44.

Mata, R., Josef, A., Samanez-Larkin, G. & Hertwig, R. (2011). Age Differences in Risky Choices: A Meta-Analysis. Annals of the New York Academy of Sciences. 1235, 18–29.

Mata, R., & Nunes, L. D. (2010). When less is enough: Cognitive aging and consumer choice. Psychology & Aging, 25, 289–98

Mata, R., Schooler, L. & Rieskamp, J. (2007). The aging decision maker: Cognitive aging and the adaptive selection of decision strategies. Psychology &Aging, 22, 796–810.

Mather, M. (2006). A review of decision making processes: Weighing the risks and benefits of aging. In L.L. Carstensen & C.R. Hartel (Eds.), When I’m 64 (pp. 145–173). Washington, DC: National Academies Press.

Mather, M., & Carstensen, L. L. (2005). Aging and motivated cognition: the positivity effect in attention and memory. Trends in Cognitive Sciences, 9, 496–502.

Okun, M. A. (1976). Adult age and cautiousness in decision: A review of the literature. Human Development, 19, 220–233.

Park, D. C., Lautenschlager, G., Hedden, T., Davidson, N. S., Smith, A. D., & Smith, P. K. (2002). Models of visuospatial and verbal memory across the life span. Psychology & Aging, 17, 299–320.

Peters, E. & Bruine de Bruin,, W. (2012). Aging and decision skills. In M. K. Dhami, A., Schlottmann, & M. Waldmann (Eds). Judgment and Decision-making as a Skill: Learning, Development, and Evolution. Cambridge: Cambridge University Press.

Peters, E., Hess, T. M., Va¨stfja¨ll, D., & Auman, C. (2007). Adult age differences in dual information processes: Implications for the role of affective and deliberative processes in older adults’ decision making. Perspectives on Psychological Science, 2, 1–23.

Peters, E., Västfjäll,, D., Slovic, P., Mertz, C. K., Mazzocco, K., & Dickert, S. (2006). Numeracy and decision making. Psychological Science, 17, 407–413.

Raz, N. (2000). Aging of the brain and its impact on cognitive performance: Integration of structural and functional findings. In F. I. M. Craik & T. A. Salthouse (Eds.), Handbook of aging and cognition (2nd ed.). Mahwah, NJ: Lawrence Erlbaum.

Reyna, V. F., Nelson, W., Han, P., & Dieckmann, N. F. (2009). How numeracy influences risk comprehension and medical decision making. Psychological Bulletin, 135, 943–973.

Rolison, J. J., Hanoch, Y., & Wood, S. (2012). Risky decision making in younger and older adults: The role of experience. Psychology & Aging, 27, 129–40.

Schooley, D. K., & Worden, D. D. (1999). Investors’ asset allocations versus life-cycle funds. Financial Analysts Journal, 55, 37–43.

Schwartz, L. M., Woloshin, S., Black, W. C., & Welch, H. G. (1997). The role of numeracy in understanding the benefit of screening mammography. Annals of Internal Medicine, 127, 966–972.

Spaniol, J., Voss, A., & Grady, C. L. (2008). Aging and emotional memory: Cognitive mechanisms underlying the positivity effect. Psychology & Aging, 23, 859–872.

Tanius, B. E., Wood, S., Hanoch, Y., & Rice, T. (2009). Aging and choice: Applications to Medicare Part D. Judgment and Decision Making, 4, 92-101.

Vander, B. J., Dodge H. H., Pandav, R., Shaffer, H. J., & Ganguli, M. (2004) Gambling participation and social support among older adults: A longitudinal community study. Journal of Gambling Studies, 2004, 373–390.

Vroom, V. H., & Pahl, B. (1971). The relationship between age and risk taking among managers. Journal of Applied Psychology, 55, 399–405.

Wechsler, D. (1991). Wechsler intelligence scale for children—third edition. San Antonio, TX: Psychological Corporation.

Wechsler, D. (2008). WAIS-IV technical manual. San Antonio TX, the Psychological Corp.

Wood, S., Busemeyer, J.R., Koling, A., Cox, C.R., & Davis, H. (2005). Older adults as adaptive decision makers: Evidence from the Iowa gambling task. Psychology & Aging, 20, 220–222.

Wood, S., Hanoch, Y., Barnes, A., Liu, P., Cummings, J., Bhattacharya, J., & Rice, T. (2011). Numeracy and Medicare Part D: the importance of choice & literacy for numbers in optimizing decision making for Medicare’s prescription drug program. Psychology & Aging, 26, 295–307.

This work was supported by a Robert Wood Johnson Foundation Investigator Award in Health Policy Research. The views expressed imply no endorsement by the Robert Wood Johnson Foundation. In addition, thanks are due for lab research assistants Meryl O'Bryan, Pi-Ju Liu, Margaret Tsai, Benjamin Rakela, and Jessica Baum.

Copyright: ©2013. The authors license this article under the terms of the Creative Commons Attribution 3.0 License.

This document was translated from LATEX by HEVEA.