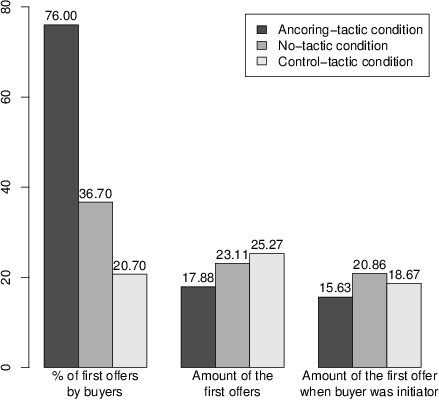

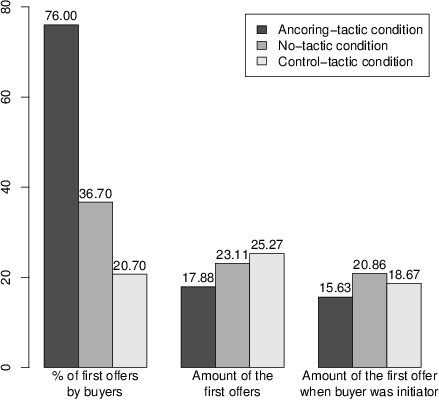

| Figure 1: Summary of results regarding first offers in the three experimental conditions. |

Judgment and Decision Making, Vol. 9, No. 6, November 2014, pp. 548-557

Winning a battle but losing the war: On the drawbacks of using the anchoring tactic in distributive negotiationsYossi Maaravi* Asya Pazy# Yoav Ganzach# |

In two experiments, we explored the possible drawbacks of applying the anchoring tactic in a negotiation context. In Study 1, buyers who used the anchoring tactic made higher profits, but their counterparts thought their own results were worse than expected and thus were less willing to engage in future negotiations with them. Study 2 showed that using the anchoring tactic in a market decreased accumulated profits by increasing the rate of impasses and prolonging the negotiations. The implications of these findings are discussed.

Keywords: first offers, anchoring, negotiation, bargaining.

There are many different definitions of negotiation, but most of them agree that it involves decision-making processes. Thus, many of the heuristics and biases in decision making also apply to negotiation (Kahneman & Tversky, 1973). One of these heuristics is the anchoring and adjustment heuristic, which plays an important role in negotiation dynamics. Indeed, the first offer is considered an anchor from which the responding party adjusts in order to formulate his or her counter offer (Galinsky & Mussweiler, 2001). But, while making the first offer is usually considered an advantage, research has also pointed to a few limitations and drawbacks of doing so (Maaravi, Ganzach & Pazy, 2011; Moran, Ritov, 2002; Rosette, Kopelman & Abbott, 2014). The current article explores additional drawbacks of using the anchoring and adjustment heuristic as a tactic in negotiations.

The anchoring tactic, a commonly prescribed tactic in distributive negotiations, is based on the anchoring and adjustment heuristic (Kahneman & Tversky, 1973). According to this heuristic, when people judge an unknown quantity (for instance, an opponent’s reservation price in a negotiation) they tend to anchor on a given number (for instance, the first offer made by the opponent) and adjust from it. This rule of thumb may lead to systematic errors both because people tend to cling to an anchor even when it is a completely arbitrary number and because their adjustments are often insufficient.

The anchoring effect has been replicated in various domains such as general knowledge questions (Tversky & Kahneman, 1974), real estate evaluations (Northcraft & Neale, 1987), judicial verdicts (Englich, Mussweiler & Strack, 2006) and negotiations (Galinsky & Mussweiler, 2001), and it has been found to be highly robust.

In the context of negotiation, the first offer can be viewed as an anchor. Evidence indicates that the first offer influences the counteroffer as well as the outcome in favor of the initiator (Galinsky & Mussweiler, 2001; Ritov, 1996). Based on such evidence, first offer became an important subject for academic research (e.g., Galinsky & Mussweiler, 2001; Maaravi, Pazy & Ganzach, 2011; Ritov & Moran, 2006;), and negotiation courses and textbooks recommend using an anchoring tactic in order to maximize profits (e.g., Bazerman & Neale, 1992; Malhotra & Bazerman, 2007; Raiffa, Richardson & Metcalfe, 2002; Thompson, 2005). Specifically, negotiators are advised to make the first offer and make it as extreme as possible, while still in the reasonable range.

Note that this tactic is typically recommended for distributive negotiations. Negotiation literature often distinguishes between two major types of negotiation: distributive negotiation and integrative negotiation. Whereas the former is defined as a competitive (win-lose) process of “slicing a fixed-pie” between the negotiating parties, the latter is characterized as a creative problem-solving process in which both parties work together to find a mutually beneficial (win-win) “pie-expanding” solution (Bazerman & Neale, 1992; Thompson, 2005). Since these two types of negotiation are inherently different, negotiation specialists seek distinct tactics for each of them. Indeed, while the anchoring tactic is usually recommended for distributive settings (Galinsky & Mussweiler, 2001), it may lead to suboptimal results in integrative negotiation (Moran & Ritov, 2002; Ritov & Moran, 2006).

Past research has pointed to the possible drawbacks of using the anchoring tactic in integrative negotiations (Ritov & Moran, 2006). The current article questions the benefits of using such a tactic even in distributive settings. It identifies psychological and economic limitations and disadvantages of using this tactic in both a single distributive negotiation and in a market setting with many potential distributive deals. Two examples of the limitations of this tactic are Maaravi and colleagues’ (2011) assertion that adding an argument to a first offer when counterarguments are available may reduce the anchoring effect, and the work by Janiszewski & Uy (2008) showing that round numbers make worse anchors than do exact numbers. An example of a disadvantage of this tactic is recent research that has demonstrated how making the first offer led to lower levels of satisfaction accompanied by increased levels of anxiety (Rosette et al., 2014). Here, we add two other important disadvantages. First, from the attitudinal/emotional perspective, we show that, in a single negotiation, the anchoring tactic influences the attitudes of one’s counterpart in a negative way. Whereas Rosette et al. (2014) focused on the satisfaction (and anxiety) of the initiating party, the present research is concerned with the satisfaction of the non-initiating party. Second, from the economic perspective, we show that in a market setting this tactic may lead to a decreased level of long-term performance—a disadvantage that has not been addressed in any of the above articles.

The negative psychological consequences of the anchoring tactic for one’s counterpart may affect the future profits of the negotiator who uses this tactic. In a distributive setting, defined as a zero-sum game, the higher profits of the negotiator who uses this tactic often means lower profits for his or her counterpart. In addition, the use of this tactic may cause a larger gap between the negotiators, as the initiator makes an extreme first offer. When there is no time pressure and no good alternatives to a negotiated agreement, the counterpart may sign a mediocre agreement (rather than reach an impasse), but may not appreciate his or her results and consequently be less willing to negotiate with the same counterpart in the future (Barry & Oliver, 1996; Novemsky & Schweitzer, 2004). Such attitudes in one’s counterpart mean that the negotiator who uses this tactic may win the battle (i.e., reach better results in this specific negotiation) but lose the war (i.e., impair his or her long-term economic results by losing a potential business partner). Moreover, the negative attitudes of the counterpart may affect the reputation of the user of this tactic and cause other negotiators to judge his or her intentions negatively. This judgment may cause the counterparts to use more distributive and fewer integrative tactics when negotiating with the user. For example, Tinsley et al. (2002) demonstrated that more experienced negotiators extracted larger individual profits, but not when they had a reputation for being distributive. In sum, using this tactic may result in short-term gains but long-term losses.

Such negative effects or limitations have not yet been documented because previous research in this area has manipulated the amount of the first offer or the role of the negotiator who presented it (Galinsky & Mussweiler, 2001; Maaravi et al., 2011), but not the deliberate use of the anchoring tactic and its possible drawbacks.

In most negotiations, the social norm is for the sellers rather than the buyers to state the initial price. For example, this is the case in the following situations: a listing price of an apartment, the price of a used car, the price of a service or a product in the B2B market, among others. Consequently, sellers have a built-in role advantage of using at least part of the anchoring tactic, namely, “making the first offer” (even if they are not aware of it). Consequently, in order to clearly demonstrate both the advantages (better results) and the drawbacks (see above) of the anchoring tactic, in the first study we prescribed it only to buyers.

Thus, we predict that, when there is no time pressure and no good alternatives, buyers who use the anchoring tactic will reach better (lower) settlement prices than buyers in the control (who use another tactic) or no-tactic groups, but their counterparts will be less satisfied with their results and less willing to engage in future negotiations with them.

In addition, using the anchoring tactic in a market where time pressure exists and where multiple alternatives are available may also impair one’s economic results directly. Negotiators who use the anchoring tactic are likely to be less economically efficient in market settings as they will tend to spend more time on each negotiation (Neale & Bazerman, 1985) and reach impasses more frequently (White & Neale, 1994). Note that the above reasoning does not necessarily imply low profit in a single encounter. In fact, we suggest that the very same anchoring tactic that brings higher profit in a single negotiation may result in lower accumulated profit in a market setting.

Study 1 consisted of a single face-to-face negotiation between a seller and a buyer. A random third of the buyers received instructions to use the anchoring tactic, another one third received instructions to use another tactic (control group) while the remaining buyers did not get any instructions regarding a negotiation tactic.

One hundred and ninety undergraduates at an Israeli college business school participated in the experiment during a class meeting. Fourteen participants were not included, due to missing data, yielding 176 participants (56.8% male, 43.2% female). Their average age was 23.5. Half of the participants were randomly assigned to a buyer role and the other half to a seller role. Approximately one third of the buyers were instructed to use the anchoring tactic. Another third were instructed to use another kind of tactic described as one which would improve their results. The remaining participants received no instructions regarding a negotiation tactic. The sellers did not receive any instructions regarding a negotiation tactic. Participants were given their experimental materials and were instructed to read them thoroughly. Next, they were randomly assigned to dyads and started negotiating.

We used the pharmaceutical plant scenario from Galinsky and Mussweiler’s anchoring experiment (2001). Sellers (buyers) were asked to assume the role of a CEO of a company that intended to sell (buy) a pharmaceutical plant. The plant was on sale because the company had decided to stop manufacturing its line of products. Buyers and sellers alike were informed that: (a) a highly experienced workforce was available for recruiting in the vicinity of the plant, (b) the plant had been purchased three years earlier from a bankrupt company for 15 million NIS, below the market price at the time, (c) two years ago the value of the plant was estimated at 19 million NIS, but since then real estate prices in the area had declined by about 5%, (d) the plant was a unique property. Therefore, general real estate trends might be irrelevant to its pricing, and (e) a similar plant had recently been sold for 26 million NIS.

In addition to the common information, each role received its unique BATNA information. The BATNA—best alternative to a negotiated agreement—is considered one of the most important sources of power in negotiation (Bazerman & Neale, 1992). The sellers’ BATNA was to strip the plant and sell the land and machinery separately; the revenues in that case would be 17 million NIS. The best alternative for buyers was to build a new plant from scratch, which would cost 25 million NIS. All participants were instructed to refrain from revealing their BATNAs to their counterparts.

For the anchoring tactic, the instructions were as follows:

A Tactic to Improve Negotiation ResultsIn the present negotiation, we request that you use the “anchoring tactic”. Successful negotiators use this tactic in order to increase their profits. To use it properly, you should:

1. Make the first offer in the negotiation.

2. Make a first offer that is relatively extreme in your favor. Such an extreme first offer is expected to be an anchor from which the negotiation starts. It will enable you to buy the product at a lower price.

3. In case the seller precedes you and offers first, be careful not to base your counteroffer on his/her first offer. Instead, try as much as possible to re-anchor your counterpart: Respond with the extreme offer that you intended to make in the first place.

For the do-your-best tactic (control group), the instructions were as follows:

A tactic to improve negotiation resultsIn the present negotiation we request that you use the “do-the-best-you-can tactic”. Successful negotiators use this tactic in order to increase their profits. To use it properly, you should:

1. Read the instructions thoroughly.

2. Take the negotiation as seriously as possible.

3. Try and reach the best results you can in the negotiation.

When the negotiation was over, each pair of participants (buyer and seller) completed a “dyadic questionnaire” with the following questions: “Who made the first offer (buyer or seller)?”; “What was the amount of the first offer?”; “Did you reach an agreement?”; “What was the settlement price?” In addition, each participant filled out a personal questionnaire with the following questions: “How do you estimate your profit relative to the rest of the class?” (relative profit); “How satisfied are you with your results?” (satisfaction); and “How willing are you to make future deals with your counterpart?” (future negotiation). All items were measured on a 5-point scale from (5) very high to (1) very low.

As a manipulation check, we examined both the amount of the first offer and the tendency of the buyers to make the first offer in the three possible conditions: anchoring-tactic, control-tactic and no-tactic. While 76% of the first offers in the anchoring-tactic condition were made by the buers, only 20.7% and 36.7% of the first offers were made by buyers in the control-tactic and no-tactic groups (respectively). We ran three Chi square tests to examine these differences. The anchoring-tactic codition differed from the two other conditions significantly:: χ2 (1, 54) = 16.52, p < .001 and χ2 (1, 55) = 8.51, p < .01, for the control-tactic and no-tactic groups (respectively). The control-tactic and no-tactic groups did not differ significantly: : χ2 (1, 59) = 1.84, p = .176

Figure 1: Summary of results regarding first offers in the three experimental conditions.

In addition, we compared the effect of using a tactic on the amount of the first offer for the three different dyads. One-tailed t-tests revealed that first offers in dyads in the anchoring-tactic condition were significantly lower (M = 17.88 million, SD = 5.24) than first offers in the control condition (M = 25.27 million, SD = 5.18): t(52) = 5.20 p < .001), and the no-tactic condition (M = 23.11 million, SD = 4.65): t(53) = 3.92, p < .001). A two-tailed t-test did not yield a significant difference for the two latter groups: t(57) = 1.68, p = .1.

In order to provide further evidence for the effect of the anchoring tactic, we repeated the same analysis only for dyads where the buyers initiated the negotiation by presenting the first offer. This analysis can establish the second part of the prescribed tactic (i.e., Make a first offer that is relatively extreme in your favor). Here too, the results were significant and supported our hypotheses. The first offers for the three conditions were: M = 15.63 million, SD = 3.02, M = 20.86 million, SD = 5.66 and M = 18.67 million, SD = 3.08, for the anchoring, no-tactic and control conditions, respectively. One-tailed t-tests demonstrated that first offers by buyers in the anchoring condition were significantly lower than such offers in both the no-tactic condition (t(28) = 3.32, p < .01) and the control-condition (t(23) = 2.14, p = .022). Here too, a two-tailed t-test yielded a non-significant difference for the two latter groups (t(15) = 0.87, p = .39).

Finally, in order to further establish that there was no a-priori difference between the three conditions, we repeated the same analysis only for dyads where the sellers initiated the negotiation by presenting the first offer. Since the sellers did not differ in any way between the three conditions, we expected no difference in their first offers. Indeed, the results showed no significant difference between sellers’ initial offers: F(2, 45) = 2.38, p = .10. The first offers for the three conditions were: M = 25.00 million, SD = 4.38, M = 24.42 million, SD = 3.48 and M = 27.00 million, SD = 4.12, for the anchoring, no-tactic and control conditions, respectively.

Taken together the above results (see Figure 1 for a summary of results) indicate that in general the participants in the anchoring-tactic condition indeed followed the instructions to initiate the negotiation and made more extreme (lower) first offers.

In line with past research, there was a strong positive correlation between the amount of the first offer and the amount of the settlement price: r(82) = 0.60, p < 0.001, indicating an anchoring effect of the first offer on the settlement price.

In order to examine the economic advantage of using the anchoring tactic, we examined the effect of using a tactic on the amount of the settlement price for the three different dyads. The settlement prices in the control condition and the no-tactic condition were practically identical (M = 21.53 million, SD = 2.26 and M = 21.57 million, SD = 3.13, respectively), t(55) = 0.068, p = .95. On the other hand, the settlement prices in these two latter conditions were significantly higher than the price in the anchoring-tacticcondition (M = 19.92 million, SD = 3.04) t(51) = 2.2, p = .016 (one-tailed), and t(52) = 1.96, p = .027 (one-tailed) for the control condition and the no-tactic condition, respectively.

Table 1: Negotiator’s profits by negotiator’s and counterpart’s conditions - Study 1. In all cases, p < 0.001.

Measures Relative profit Satisfaction Satisfaction .55 – Future negotiation .59 .50

Next, we turned to analyze sellers’ response to the three questions in the personal questionnaire: “How do you estimate your profit relative to the rest of the class?” (relative profit); “How satisfied are you with your results?” (satisfaction); and “How willing are you to make future deals with your counterpart?” (future negotiation). We computed the correlations between the three items. The correlations between all three items were significant (see Table 1). The analysis of the entire sample—i.e., the responses of both sellers and buyers—yielded the same results: significant positive correlations among all three questionnaire items. This additional analysis suggests that the three items in the questionnaire are valid and reliable not only for sellers.

Figure 2: A path analysis model of the economic and attitudinal variables—Study 1. * p < .05, ** p < .01, *** p < .001

Second, we turned to examine the possible disadvantage of using the anchoring tactic. We used one-tailed t-test to examine the effect of using a tactic by the buyers on sellers’ willingness to engage in future negotiations with the specific buyer they had negotiated with. Sellers were significantly less willing in the anchoring-tactic condition (M = 3.56, SD = 1.26) than in both the no-tactic (M = 4.23, SD = 0.82) and the control-tactic (M = 4.21, SD = 0.86) conditions: t(53) = 2.38, p = .011, and t(52) = 2.23, p = .015, respectively. The two latter conditions did not differ significantly: t(57) = 0.12, p = .90 (two-tailed).

In order to explore the relations between the economic variables and the questionnaire items as well as the relations between the questionnaire items themselves, we conducted a path analysis using multiple regressions. The variables in the model were: the use of tactics by the buyer, the settlement price and seller settlement price expectations. In addition, in the model, we included the three questions in the questionnaire: relative profit, satisfaction and future negotiation. This analysis yielded a model (Figure 2) that demonstrates how the use of the anchoring tactic by the buyers may lead them to better personal results, but also to negative counterparts’ feelings and attitudes that may result in counterparts’ reluctance to engage in future negotiations. Note that the anchoring tactic had no marginal effect on sellers’ attitudes (i.e., lower levels of satisfaction and lower willingness to renegotiate) beyond its effect on their economic and perceived outcomes (see the General Discussion section for further analysis).

Taken together, the results of Study 1 confirmed our predictions. Buyers who used the anchoring tactic were more prone to make the first offer, and made more extreme (lower) first offers than did buyers in the two other conditions (no tactic, and control tactic). The use of this tactic resulted in better economic results in a distributive one-time negotiation with no time pressures and no other valid alternatives. But the use of this tactic also had a downside. Sellers whose counterparts used this tactic reached worse settlement prices, which led them to lower estimations of their relative profits and consequently to lower degrees of satisfaction with their results and lower degrees of willingness to engage in future negotiations with these buyers.

Study 1 has a few limitations. First, in Study 1, we have demonstrated only the indirect economic drawbacks of using the anchoring tactic that may occur due to its psychological effects on one’s counterpart. Specifically, we hypothesized and provided evidence that the use of this tactic may lead to one’s counterpart reaching inferior results compared to the counterparts of negotiators who do not use this tactic or use different tactics. These inferior results may induce lower satisfaction, which can lead to a lower willingness to engage in future negotiations with the same partner. These results are in line with past research that has shown that less satisfied counterparts may be less obligated to signed agreements or less willing to make future negotiations (Barry & Oliver, 1996; Novemsky & Schweitzer, 2004). However, as we mentioned above, this is only an indirect effect that may or may not influence the focal negotiator in the future.

Second, while a growing body of research indicates that time is an important factor in human decision-making (Rand, Greene & Nowak, 2012; Shalvi, Eldar & Bereby-Meyer, 2012), in Study 1 there were no actual time constraints or time pressure. Participants had ten minutes to complete the negotiations, but no dyad failed to complete the negotiation due to this time limit. This setting may differ from real-world situations in which time is usually an important factor. For example, think of a small company that develops and sells custom-made software products in the B2B market. If a customer requests a price proposal from the sales manager of this company and receives an extreme offer that results in prolonged negotiation, it may impair the economic results of the company in at least three ways: (1) the time and energy that, for such a prolonged negotiation, cost money; (2) dedicating a long time to a specific negotiation means that less time is available for searching and negotiating with more potential customers; (3) a prolonged negotiation creates a higher possibility of resulting in an impasse both because it may signal to the customer that an agreed price is impossible, and because the customer may be reluctant to partner with a tough supplier.

Third, for reasons that were explained above, in Study 1 only buyers, and not sellers, were instructed to use the anchoring tactic. But in an open market both buyers and sellers may use similar tactics.

Finally, although in Study 1 the materials of both the sellers and the buyers included an alternative to the negotiation (i.e., best alternative to a negotiated agreement, BATNA), the experimental setting was such that it encouraged dyads to close deals rather than to reach an impasse. This is because each of the participants was paired to a specific counterpart and could not switch to another in case he or she was not pleased with the behavior or offers of his or her counterpart. This created a demand characteristic to complete the negotiation as it prevented sellers who negotiated with buyers with the anchoring tactic to quit the negotiation altogether.

We designed Study 2 to address these limitations. Most importantly, we intended to demonstrate that “winning the battle but losing the war” means not only losing a specific potential long-term business partner, but also getting better results in a specific negotiation at the expense of missing many other potential opportunities. It has long been proposed that, since negotiators do not reveal their goals or reservation prices, first offers—among other pieces of information—serve as informational cues that decrease uncertainty (Liebert, Smith & Hill, 1968). But when a negotiator uses the anchoring tactic and makes relatively extreme first offers, it may have two negative effects. First, it may take longer for the negotiators to reach a mutually acceptable settlement price, as the difference between the extreme first offer and the counter offer is greater. Second, the likelihood of reaching such an agreement decreases altogether, as the parties may fail to realize the very existence of a positive bargaining zone (White & Neale, 1994). These negative effects were not present in Study 1, where we used a single negotiation encounter for which plenty of time was available and where alternatives were only “on paper”.

Thus, in Study 2 we examined the effect of using the anchoring tactic in a market setting where multiple opportunities are available in a limited span of time. In accordance with past research, we argue that the average time per negotiation for negotiators who use the anchoring tactic will be higher than that of negotiators who do not use it. In addition, the former will be more likely to end a negotiation in an impasse. Finally, we suggest that the above two effects may reduce negotiators’ accumulated profits in a market setting, although their profits in single encounters will be higher than that of negotiators who do not use this tactic.

Study 2 was a face-to-face market setting where participants could buy or sell different products by negotiating with multiple partners.

Fifty-two MBA students participated in the experiment. All worked full time while taking evening graduate classes. As explained below, the design used a multi-transaction market simulation where numerous sellers could negotiate with numerous buyers at any given time.

The experiment took place during a class meeting. Participants were randomly assigned to the seller or buyer roles. A random half was instructed to use the anchoring tactic by the same method as in Study 1.

The sellers’ materials indicated that they were importers who purchased electronic chips in China and sold them to distributors in the USA. They had 12 different chips to sell. They were told that they were about to participate in a market simulation in which they should sell as many chips as possible for the highest prices they could get in order to maximize their total profits. Each chip had to be sold to a different buyer and no chip could be sold more than once. Sellers got a list of 12 chips marked from A to L, along with the buying price for each (prices ranged from $140 to $240). The instructions emphasized that only the seller (but not the potential buyers) knew the buying price of the chips.

The buyers’ materials were identical except that their instructions page described them as buyers of electronic chips interested in purchasing the chips from importers and reselling them to USA companies. They got a list of 12 chips marked from A to L and the prices they could later sell them for (prices ranged from $210 to $360, respectively).

Participants wore numbered role tags with different colors for buyers and sellers so that they could easily identify one another in the market. After completing a deal they walked around the room in order to find negotiation partners. The entire experiment was restricted to twenty minutes. A large digital clock was visible to all. Two prizes of 100 NIS were promised to participants who accumulated the highest profits in this market.

Participants filled out a form after each round. The form included the following items: the letter (A, B, C,…L) of the negotiated chip in order to ensure that no chip was sold more than once; the counterpart’s serial number in order to ensure that no more than one deal was completed with each counterpart; the beginning time and the ending time of the negotiation; the result (agreement/impasse); and finally, the settlement price in case of a deal. The two negotiators were requested to sign the form next to each round.

The multiple-negotiation setting did not allow measurement of psychological variables following each single interaction as in the first study.

Three hundred and three negotiation encounters occurred during the 20-minute simulation. The distribution of dyad types was as follows: 25.7% dyads of two negotiators who were instructed to use the anchoring-tactic, 49.2% mixed dyads, and 25.1% dyads of two no-tactic negotiators. This distribution confirms that encounters between all types of negotiators in this free-market simulation occurred by chance.

The large number of encounters in this study enabled us to examine the three types of interactions between the two types of negotiators. The results indicated that dyads composed of two negotiators with the anchoring-tactic were significantly more likely to end in an impasse (15.4%) than those composed of only one such negotiator (6.7%), X2 = 4.40, p = .018 (one-sided) or those composed of two negotiators with no tactic (3.9%,), X2 = 5.73, p = .009 (one-sided) The two latter groups were not significantly different: X2 = 0.706, p = .20 (one-sided).

The same decreasing order was apparent with regard to the time per deal as measured in seconds. Negotiations between two negotiators with the anchoring-tactic were significantly longer (M = 46.5, SD = 30.11) than negotiations where only one negotiator used this tactic (M = 40.4, SD = 24.9): t(225) = 1.64, p = 0.051 (one-sided); and also longer than negotiations where none used this tactic (M = 33.9, SD = 24.12): t(152) = 2.87, p = .003 (one-sided). In fact, even when only one of the negotiators used this tactic it prolonged the negotiation process, as the two latter groups also differed significantly: t(223) = 1.87, p = .032 (one-sided). These results support our predictions that using the anchoring tactic in a free market simulation may lead to lower economic efficiency due to a higher rate of impasses and prolonged negotiations.

The results of individual participants (as opposed to the above analysis that focused on dyads) provided further support for these conclusions. First, the average time per negotiation for participants who used the anchoring tactic was longer than for negotiators who did not use this tactic: 104.59 seconds (SD = 13.33) vs. 89.21 (SD = 13.63), respectively. This result was highly significant: t (50) = 4.11, p < .0001. Second, negotiators who used the anchoring tactic participated in fewer negotiations (M = 11.9, SD = 1.11) than negotiators who did not use this tactic (M = 11.2, SD = 1.63; t(50) = 1.69, p = .05, one-tailed), and also closed fewer deals (M = 9.74, SD = 2.10) than the latter group (M = 11.28, SD = 0.84; t(50) = 3.41, p < .0001, one-tailed). Third, negotiators who used the anchoring tactic reached an impasse in 14% (SD = 15) of the negotiations they participated in, whereas the respective ratio for negotiators who did not use this tactic was only 5% (SD = 6.85) (for the difference, t(50) = 2.53, p = .008, one-tailed). Finally, negotiaors who used the anchoring tactic achieved lower total profits (M = 469.69, SD = 139.65) compared to negotiators who did not use this tactic (M = 521.36, SD = 98.55; t(50) = 1.53, p = .065, one-tailed). Taken together, the above patterns negatively influenced the accumulated profits of negotiators who were instructed to use the anchoring tactic compared to negotiators who were not. A path analysis (see Figure 3) using multiple regressions revealed this negative effect. The analysis suggests that the anchoring tactic results in both a higher percentage of impasses as well as in prolonged processes, which, in turn, reduces both the total number of negotiations as well as the total number of signed deals. And closing fewer deals in a given time period can cause the negotiators who used this tactic to make less profit.

Figure 3: Path analysis of negotiator’s accumulated profit in a market setting—Study 3. * p < .05, ** p < .01, *** p < .001

Interestingly enough, and in line with the results obtained in Study 1, in single encounters buyers in the anchoring tactic condition made higher profits compared to buyers in the no-tactic condition. We conducted two analyses to demonstrate this pattern. First, we ran a multiple regression analysis on the dyadic level with the conditions of sellers and buyers (with vs. without the anchoring tactic) as the independent variables and the percentage of the “negotiation-pie” as the dependent variable. The negotiation-pie was computed by subtracting the cost of the product to the seller from the price the buyer could get for it in the future. In line with our contention that sellers tend to make the first offer naturally, and consequently the anchoring tactic is more of an economic “game-changer” for buyers, only buyers’ condition significantly predicted the percentage of the negotiation-pie: β = .17, t(275) = 2.77, p < .001.

Second, we analyzed the results of buyers with vs. without the anchoring tactic, and did the same for sellers. We conducted separate analyses for the two roles to avoid a dependency problem. Since negotiations are dyadic and profits of the two negotiating parties are dependent, analyzing the profits of both sellers and buyers together at the individual (as opposed to the dyadic) level is, in effect, duplicating the data and including dependent observations. Since negotiators closed deals of different products with different prices, we averaged the percentage of their profit per sold or bought products (relative to either cost or re-sale price, depending on role). In line with the results of Study 1, buyers who used the anchoring tactic made higher average profits in single encounters than did buyers who did not use this tactic: M = 54.30 (SD = 8.99) vs. M = 47.96 (SD = 8.03), respectively. This result was almost significant: t(1, 25) = 1.94, p = .06. The same analysis for sellers did not yield a significant difference, probably because, as explained above, sellers tend to make the first offer even when they are not instructed to do so. Sellers who used the anchoring tactic made an average profit of 43.93 (SD = 13.30) compared to 44.19 (SD = 9.13) for sellers without this tactic: t(1, 2) = 0.06, p = .95 (two tailed).

In sum, as the 20 minutes elapsed, compared to negotiators in the no-tactic condition, negotiators in the anchoring-tactic condition indeed “won every battle” as they gained more money in each specific negotiation, but “lost the war” as they made lower aggregated profits due to both prolonged negotiations and a higher rate of impasses.

When facing uncertainty, people tend to base their decisions on heuristic rules (Tversky & Kahneman, 1974). Since negotiations are characterized by a significant degree of uncertainty, negotiators are inclined to use heuristics in order to reach different decisions (Bazerman & Neale, 1992; Galinsky & Mussweiler, 2001). In this context, they use the first offer as an anchor in order to determine the amount of the counteroffer through a process of anchoring and adjustment. In light of the dramatic and robust effects of first offers on negotiation outcomes, first offers have become an important research subject. Recent studies have focused on various aspects of first offers, such as determining the extremity of a first offer (Galinsky, Mussweiler & Medvec, 2002; Rapoport, Weg & Felsenthal, 1990), strategies that eliminate the anchoring effect of first offers (Galinsky & Mussweiler, 2001), factors affecting those who will make the first offer (Kray, Thompson & Galinsky, 2001; Magee, Galinsky & Gruenfeld, 2007), and ways in which past experience influences future behavior regarding a first offer (Galinsky, Seiden, Kim & Medvec, 2002).

Although many aspects of first offers in negotiation have been investigated (for a review, see: Oesch & Galinsky, 2003), there are still important research questions that remain unanswered. In this article we tried to answer one such question, namely, the psychological and economic drawbacks of applying the anchoring tactic in a negotiation context.

Previous research demonstrated that it is advantageous to offer first (Galinsky & Mussweiler, 2001) and to offer high (Chertkoff & Conley, 1967; Liebert et al., 1968). However, no previous research that we know of has tested the effects of prescribing this tactic to negotiators. In the current study, we demonstrated that the use of this tactic in a market setting has substantial economic drawbacks. Moreover, even in single encounters the strategy can be counterproductive when psychological consequences are taken into consideration. We found that counterparts of negotiators who used this tactic were less willing to engage in future interactions with their partner due to lower levels of satisfaction and profit estimations (Study 1).

The potential for short-term economic advantage, namely, an advantage in a single negotiation, as compared with maximizing accumulated profits the future or in a series of negotiations at the cost of reduced efficiency and harmful interaction, can be captured by the idea that the deliberate use of an anchoring strategy exacerbates the competitive and adversarial nature of negotiation. Negotiators focus strictly on their immediate self-interest regardless of other tradeoffs, including the risk of spending excessive time or failing to strike a deal altogether. In this sense, the use of the anchoring strategy sets distributive negotiations farther apart from integrative win-win negotiations (Bazerman, Magliozzi & Neale, 1985; Neale & Bazerman, 1985).

Regarding the content of the anchoring strategy, it was presented in this study as a composite of three elements: offer first, offer high, and ignore the counterpart’s offer. The design did not allow me to test the effects of specific elements. Therefore, we could not ascertain whether specific elements, or all three as a whole, accounted for the results. Future research should base experimental treatments on single components and should study their separate effects. I note that “ignore counterpart’s offer”, the third element in the experimental delivery of the anchoring strategy, is similar to forewarning a decision maker about the effect of an anchor number. We might suspect that this element of our treatment was ineffective, because forewarning does not reduce the effect of externally provided anchors (Epley & Gilovich, 2005). However, even if this element did not impair the effect of the first offer, it still could have affected the overall adverse atmosphere by encouraging trained participants to disregard their partners, and hence future research should not overlook it.

Another important question for future research is whether buyers’ use of the anchoring tactic had a marginal effect on sellers (lower levels of satisfaction and lower willingness to renegotiate) beyond its effect on sellers’ economic and perceived outcomes. According to the path analysis that was presented in Study 1 the answer to this question is negative;, anchoring had no additional impact beyond its effect on first offers and consequently on outcomes. But other variables not measured in Study 1 can suggest otherwise. For example, use of the anchoring tactic could cause negotiators not only to make the first offer but also to insist on that offer. Insisting on the first offer cannot be captured solely via the amount of the first offer, but calls for using other variables such as negotiation time or the difference the first offer and the response to the counteroffer that were not measured in Study 1. The results of Study 2 imply that such an effect may exist, for the use of the anchoring tactic was indeed related to such tough behavior that resulted in a higher frequency of impasses as well as in prolonged negotiations.

Finally, future research should also examine whether it is possible to help negotiators benefit from the advantages of the anchoring tactic while avoiding its drawbacks. One possible way to achieve this goal is forewarning, which, in certain circumstances, has been shown to help decision makers overcome cognitive biases and persuasion attempts (e.g., Dean, Austin & Watts, 1971; Ford & Weldon, 1981).

One contribution of the current work to the literature on first offers is that it suggests a different perspective on the issue of transforming laboratory findings in decision making into prescriptive advice. We would like to argue that, especially in complex settings like negotiations, this leap is not always straightforward. For example, past research has shown that people were more willing to do a small favor when it was justified by an argument than when it was not (Langer, Blank & Chanowitz, 1978). This result, if transformed into advice or a prescription for negotiators, may encourage them to add supporting arguments to their first offers. However, in a recent work (Maaravi et al., 2011), we have demonstrated that when counterarguments are available (that is, in most negotiations) such a prescription could backfire and result in worse, rather than better, settlement prices, since adding a rationale to the first offer causes the responding party to act in the same way and to look for counterarguments.

Similarly, the current studies could be viewed as relatively more elaborate experiments that examine another prescription which we referred to as “the anchoring tactic”. Whereas past research has manipulated who is making the first offer (e.g., Galinsky & Mussweiler, 2001; Rosette et al., 2014), in the current work we used a manipulation that actually instructed subjects to use the prescriptive advice (i.e., make a first low/high offer depending on role) and explained the rationale behind it. In addition, we measured not only the short economic consequences (e.g., first offers, settlement prices) at the dyadic level, but also psychological consequences at the individual level, consequences that may affect long term profit (i.e., satisfaction and willingness to engage in future negotiation) as well as the long term economic consequences (i.e., accumulated profit). This method and measures enabled us to show that, although using the anchoring tactic resulted in better economic results in single encounters, it was not clear whether prescribing it to negotiators would benefit them in the long run. Thus, although negotiations involve decision-making processes, they may be a unique case, much like group decision-making (e.g., Kerr & Tindale, 2004), that calls for more careful and case-specific investigation.

Barry, B., & Oliver, R. (1996). Affect in dyadic negotiation: A model and propositions. Organizational Behavior and Human Decision Processes, 67, 127–143.

Bazerman, M. H., Magliozzi, T., & Neale, M. A. (1985). Integrative bargaining in a competitive market. Organization Behavior and Human Performance, 34, 294–313.

Bazerman, M. H., & Neale, M. A. (1992). Negotiating rationally. New York: Free Press.

Dean, R. B., Austin, J. A., & Watts, W. A. (1971). Forewarning effects in persuasion: Field and classroom experiments. Journal of Personality and Social Psychology, 18(2), 210–221.

Englich, B., Mussweiler, T., & Strack, F. (2006). Playing dice with criminal sentences: The influence of irrelevant anchors on experts’ judicial decision making. Personality and Social Psychology Bulletin, 32(2), 188–200

Fisher, R., Ury, W. & Patton, B. (1991). Getting to yes: Negotiating agreement without giving in. New York: Penguin Books.

Ford, J. K., & Weldon, E. (1981). Forewarning and accountability: Effects on memory-based interpersonal judgments. Personality and Social Psychology Bulletin, 7(2), 264–268.

Galinsky, A. D., & Mussweiler, T. (2001). First offers as anchors: The role of perspective-taking and negotiator focus. Journal of Personality and Social Psychology, 81 (4), 657–669.

Janiszewski, C. & Uy, D. (2008) Precision of the Anchor Influences the Amount of Adjustment. Psychological Science, 19, 121–127.

Kahneman, D., & Tversky, A. (1973). On the psychology of prediction. Psychological Review, 80(4), 237–251.

Kerr N. L., & Tindale R. S. (2004). Group performance and decision making. Annual Review of Psychology. 55: 623–55

Rosette, A. S., Kopelman, S., & Abbott, J. L. (2014). Good grief! Anxiety sours the economic benefits of first offers. Group Decision and Negotiation, 23, 629–647.

Liebert R. M., Smith W. P., & Hill J. H. (1968). The effects of information and magnitude of initial offer on interpersonal negotiation. Journal of Experimental Social Psychology, 4(4), 431–441.

Maaravi Y., Pazy A., & Ganzach Y. (2011) Pay as much as you can afford: Counterpart’s ability to pay and first offers in negotiation. Judgment and Decision Making. 6, 275–282.

Maaravi, Y., Ganzach, Y., & Pazy, A. (2011). Negotiation as a form of persuasion: Arguments in first offers. Journal of Personality and Social Psychology, 101(2), 245–255.

Malhotra, D., & Bazerman, M. H. (2007). Negotiation genius. New York, NY: Bantam Books.

Moran, S., & Ritov, I. (2002). Initial perceptions in negotiations: evaluation and response to “logrolling” initial offers. Journal of Behavioral Decision Making, 15, 101–124.

Neale, M. A., & Bazerman, M. H. (1985). The effect of externally set goals on reaching integrative agreements in competitive markets. Journal of Occupational Behaviour, 6(1), 19–32.

Northcraft, G. B., & Neale M. A. (1987). Experts, amateurs, and real estate: An anchoring-and-adjustment perspective on property pricing decisions. Organizational Behavior and Human Decision Processes, 39(1), 84–97.

Novemsky, N., & Schweitzer, M. E. (2004). What makes negotiators happy? The differential effects of internal and external social comparisons on negotiator satisfaction. Organizational Behavior and Human Decision Processes, 95(2), 186–197.

Raiffa, H., Richardson, J., & Metcalfe, D. (2002). Negotiation analysis: The science and art of collaborative decision making. Cambridge MA: The Belknap Press of Harvard University Press.

Rand, D. G., Greene, J. D., & Nowak, M. A. (2012). Spontaneous giving and calculated greed, Nature, 489, 427–430

Ritov, I. (1996). Anchoring in a simulated competitive market negotiation. Organizational Behavior and Human Decision Processes, 67, 16–25.

Ritov, I. & Moran, S. (2006). Missed opportunity for creating value in negotiations: Reluctance to making integrative gambit offers. Journal of Behavioral Decision Making, 19, 1–15.

Rosette, A. S., Kopelman, S., & Abbott, J. L. (2014). Good Grief! Anxiety Sours the Economic Benefits of First Offers. Group Decision and Negotiation, 23(3), 629–647.[200F?]

Shalvi, S., Eldar, O., & Bereby-Meyer, Y. (2012). Honesty requires time (and lack of justifications). Psychological Science, 23, 1264–1270.

Thompson, L. (2005). The mind and heart of the negotiator. Upper Saddle River, NJ: Pearson Prentice Hall.

Tinsley, C. H., O’Connor, K. M., & Sullivan, B. A. (2002). Tough guys finish last: The perils of a distributive reputation. Organizational Behavior & Human Decision Processes, 88(2), 621–642.

Tversky, A., & Kahneman, D. (1974). Judgment under uncertainty: Heuristics and biases. Science, 185(4157), 1124–1131.

White, S. B., & Neale, M. A. (1994). The role of negotiator aspirations and settlement expectancies in bargaining outcomes. Organizational Behavior and Human Decision Processes, 57(2), 303–318.

Copyright: © 2014. The authors license this article under the terms of the Creative Commons Attribution 3.0 License.

This document was translated from LATEX by HEVEA.