| Figure 1: Illustration of the Area Under the Curve. The maximum reward and the maximum delay were set to one. We then converted the indifference points to proportions of the maximum reward, and the delays to proportions of the maximum delay. |

Judgment and Decision Making, vol. 5, no. 2, April 2010, pp. 72-82

Domain-specific temporal discounting and temptationEli Tsukayama*

and

Angela Lee Duckworth |

In this investigation, we test whether temporal discounting is domain-specific (i.e., compared to other people, can an individual have a relatively high discount rate for one type of reward but a relatively low discount rate for another?), and we examine whether individual differences in the types of rewards one finds tempting explain domain-specificity in discount rates. Adults discounted delayed rewards they found particularly tempting (defined as the visceral attraction to and enjoyment of a reward) more steeply than did adults who did not find the rewards as tempting, contrary to what might be expected from the magnitude effect. Furthermore, we found significant group by domain interactions (e.g., chip lovers who do not like beer have relatively high discount rates for chips and relatively low discount rates for beer, whereas beer lovers who do not like chips showed the opposite pattern). These results suggest that domain-specificity in temptation partially accounts for corresponding domain-specificity in temporal discounting.

Keywords: temporal discounting, time preference, intertemporal choice,

domain-specific, temptation.

Temporal discounting refers to the tendency to discount the subjective value of future goods as a function of the delay to receiving them. Generally, people prefer not to wait for rewards; however, the degree to which delayed rewards are discounted varies across individuals. Most research on temporal discounting has examined temporal discounting of monetary rewards (Frederick, Loewenstein, & O’Donoghue, 2002). In this study, we test whether temporal discounting is domain-specific (i.e., compared to other people, can an individual have a relatively high discount rate for one type of reward but a relatively low discount rate for another?). Moreover, we examine whether individual differences in the types of rewards one finds tempting explain domain-specificity in discount rates.

According to the normative model of intertemporal choice, utility from different types of rewards should be discounted at the same rate. Otherwise, discounting exchangeable goods at different rates would lead to preference reversals. Chapman (1996) showed that discount rates were domain-specific and tested a utility function explanation for domain-specificity. According to the utility function explanation, domain-specific discount rates may be due to individual differences in the relative valuation of goods in different domains combined with the magnitude effect, where smaller outcomes are discounted more steeply than larger outcomes (Thaler, 1981). For instance, a person may discount money more steeply than she discounts health because she values health (the larger outcome) more than she values money (the smaller outcome). Chapman ruled out the utility function explanation by showing that domain-specificity persisted even after matching outcomes in utility. She concluded that “important topics for future research are other possible causes of this effect” (p. 787).

We propose that individuals have steeper discount rates for rewards that they desire and enjoy more. Specifically, we hypothesize that temptation — defined as the visceral attraction to and enjoyment of a reward, regardless of the associated harm — increases the tendency to choose smaller-sooner rewards over larger-later rewards.1 For instance, if someone derives tremendous gratification from eating chocolate, then she would require a larger amount of delayed chocolate to match the subjective value of the immediate amount. This prediction is consistent with dual-process models that posit a “hot” emotional system that is mainly influenced by immediate considerations, and a “cool” deliberative system that is influenced by both immediate and long-term considerations (e.g., Loewenstein & O’Donoghue, 2007; Metcalfe & Mischel, 1999). The beta-delta preference model formally represents these processes through a quasi-hyperbolic discount function composed of a beta parameter that makes a sharp distinction between the present and future and a delta parameter that discounts at a constant rate across time (Laibson, 1997; McClure, Laibson, Loewenstein, & Cohen, 2004). Steep discount rates, in this view, arise from relatively high activation of the hot system represented by the beta parameter. To continue our example, the prospect of an immediately consumable chocolate donut would disproportionately activate the chocolate lover’s hot system, which would increase the value of the immediate option and lead to steeper discounting.

In support of our hypothesis, addicts and substance users have steeper discount rates for their favored addictions than for money (Bickel, Odum, & Madden, 1999; Coffey, Gudleski, Saladin, & Brady, 2003; Madden, Petry, Badger, & Bickel, 1997; Petry, 2001).2 Specifically, these studies have found evidence for domain effects (e.g., discount rates in the alcohol domain are higher than in the money domain) and group effects (e.g., alcoholics have higher discount rates than non-alcoholics), but they do not report effects for an interaction.3 These domain and group effects are consistent with but do not provide sufficiently convincing evidence for our hypothesis. It is possible, for example, that alcohol is discounted more steeply than money by both alcoholics and non-alcoholics (i.e., a domain effect), and alcoholics may just have steeper discount rates in general than non-alcoholics (i.e., a group effect).

A group by domain interaction would present strong support for our hypothesis that temptation increases discounting. Specifically, we predict that individuals who are tempted within one domain (e.g., alcohol) will have relatively high discount rates in that domain (relative to both themselves across domains and with other groups within that domain) after accounting for domain and group differences. In the current study, we predict that a) discount rate correlations will be stronger within a domain than between domains, b) individuals who are tempted by a reward will have steeper discount rates for that reward compared to individuals who are less or not tempted by the reward, and c) individuals will have steeper discount rates for rewards that they find tempting compared to rewards that they do not find as tempting.

Five hundred nineteen undergraduate students enrolled in psychology courses at a large, private university in the Northeast participated in this study for research experience credit (M = 20.9 years, SD = 1.9; 66% were women). We removed forty-eight outliers who took longer than 12 minutes (i.e., z > 2.58) to finish the temporal discounting tasks,4 resulting in a final sample of N = 471. Approximately 58% of the participants were Caucasian, 26% were Asian, 7% were Latino, 5% were Black, and 4% were of other ethnic backgrounds.

From March 2008 to May 2009, we posted this study online and advertised it as a survey of personality and behavior on the psychology department’s subject pool website. Participants first filled out an online questionnaire asking how tempting they found certain behaviors.5 They were then directed to another website to complete the temporal discounting measures. Finally, participants completed a demographics questionnaire and were forwarded to a debriefing page.

Participants were asked to “rate how tempted you would be to do the following” on a 5-point scale ranging from 1 = Not tempted at all to 5 = Very tempting. To clarify our definition of temptation, we presented the following description: “How much would you enjoy the following activities if there were no long-term consequences for yourself or anyone else? That is, how attracted are you to these activities regardless of how harmful you might think they are.” The three focal items — Eating candy, Eating chips and other salty snacks, and Drinking beer — were presented in a set of 51 items. (See Appendix A for the questionnaire instructions and items.)

The instructions for the temporal discounting task were as follows:

The purpose of this study is to examine preferences about rewards of money, chips, candy, and beer. You will be asked to choose between an amount that can be received immediately and another amount that can be received after a delay. You will not actually receive the rewards. However, please make each choice as if it were real.When making your choices, please assume the following: There are no risks associated with the delayed option. In other words, you are guaranteed to receive it after the specified delay. Also, choosing the delayed option does not mean that you will receive old goods. Delayed goods are brand new, but you will not receive them until after the delay.

Each participant made choices about four types of rewards — dollars, candy bars, bags of chips, and bottles of beer — at five delays: one week, one month, six months, one year, and three years. For each reward, participants made four choices at each delay for a total of eighty choices (four rewards x five delays x four choices). We randomized the order of rewards for each participant. Likewise, within each type of reward, we randomized the order of delays.

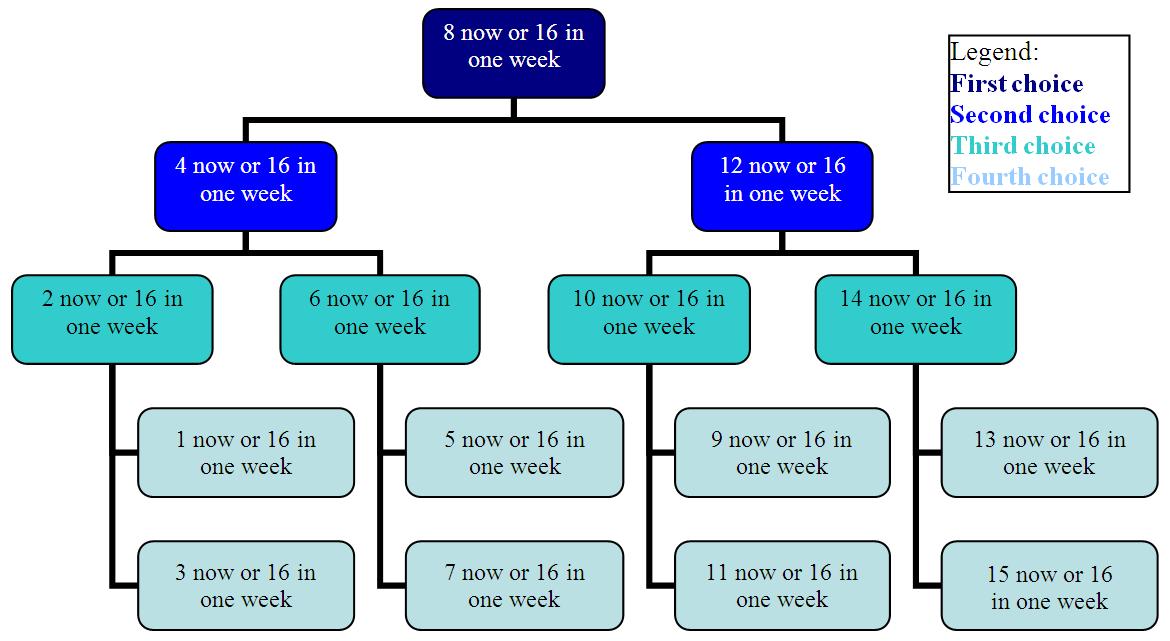

Within each reward by delay set (e.g., dollars in one month), a staircase method was used to converge on participants’ indifference points (the amount of immediate reward equal in subjective value to the delayed reward). The first choice was between an immediate reward of eight units (i.e., dollars, candy bars, bags of chips, or bottles of beer) and a delayed reward of sixteen units. In the three subsequent choices, the delayed reward was held constant, but the immediate amount varied depending on the preceding choice. If the participant selected the immediate reward, the next immediate reward was decreased. However, if the participant selected the delayed reward, the next immediate reward was increased. The size of the adjustment (the increase or decrease in the immediate reward) decreased by fifty percent after every choice: the first adjustment was four units, the second was two, and the last was one. For example, if a participant chose sixteen dollars in a month over eight dollars immediately, the next choice would be between twelve dollars immediately and sixteen dollars in one month. If the participant then chose twelve dollars immediately, the next choice would be between ten dollars immediately and sixteen dollars in one month. See Appendix B for a flowchart of possible choices. After the discounting task, participants were presented with the following question for each type of reward:

Was it difficult to make decisions about [reward]?

An indifference point is the amount of immediate reward that is equal in subjective value to the delayed reward. We computed indifference points as the average of the last immediate reward that was selected and the last immediate reward that was rejected. In the two (out of sixteen) possible circumstances that preferences did not change — always selecting the immediate reward or always selecting the delayed reward — we computed the indifference point as the average of the last immediate amount (either $1 or $15) and the limit ($0 or $16). That is, if the participant always selected the immediate reward, we computed the indifference point as $0.50, and if the participant always selected the delayed reward, we computed the indifference point as $15.50. Thus, there were 16 evenly spaced indifference points ranging from $0.50 to $15.50.

With the indifference points, we computed the area under the curve (AUTC; Myerson, Green, & Warusawitharana, 2001) measure of temporal discounting for each reward type for each participant (i.e., four AUTCs per participant). This measure of discounting does not require the data to conform to a particular model or theory and is generally less skewed than other measures of discounting (Myerson et al., 2001). To compute the AUTCs, we first set the maximum reward (16 units) and the maximum delay (3 years) to equal one. Then, we converted the indifference points to proportions of the maximum reward, and the delays to proportions of the maximum delay. For example, if an indifference point was 14.5 units, we would divide 14.5 by 16 for a new value of .90625. With these new values, we computed the area of trapezoids using the following formula: ( x2 − x1 ) [ ( y1 + y2 ) / 2], where x2 and x1 are consecutive delays (with the “immediate delay” being equal to “0”) and y1 and y2 are the indifference points associated with those delays (“1” for the “immediate delay”). The AUTC is then computed by summing the area of the trapezoids (see Figure 1). Theoretically, AUTCs calculated in this manner can range from 0 to 1.0. However, because the indifference points in this study ranged from 0.5 units to 15.5 units (and not 0 to 16), the effective range of AUTCs was 0.034 to 0.969. So that higher values would indicate steeper discount rates, we reverse-scored the AUTCs (1-AUTC) to use as our measure of temporal discount rates.

Figure 1: Illustration of the Area Under the Curve. The maximum reward and the maximum delay were set to one. We then converted the indifference points to proportions of the maximum reward, and the delays to proportions of the maximum delay.

We calculated discount rates for all participants who completed all relevant trials and who answered either “not at all” or “somewhat, but I eventually came to a decision that felt right” to the difficulty of responding question.6 Out of 471 participants, 96% had discount rates for dollars, 86% had discount rates for candy, 77% had discount rates for chips, and 74% had discount rates for beer.

The distributions of discount rates were slightly negatively skewed (absolute values ≥ -0.93) and platykurtic (absolute values ≥ -1.04). Natural log transformations (conducted before reverse-scoring the AUTCs) reduced the skew (absolute values ≥ -0.75) but exacerbated kurtosis (absolute values ≥ -1.24). Consequently, we conducted Spearman’s Rho (ρ ) correlations and ANOVAs on the untransformed data.7

In order to test our predicted group by domain interaction, we created comparison groups. We predicted that individuals who are tempted by reward x but not reward y would have relatively high discount rates for x and relatively low discount rates for y compared to individuals who are tempted by y but not x. For instance, individuals who like candy but not beer should have relatively high discount rates for candy and relatively low discount rates for beer. We labeled these individuals “candylovers” (n = 93) and operationally defined them as individuals who rated the temptation to eat candy as three or more and the temptation to drink beer as two or less on the five-point scales. We did the same for “chiplovers” (except for the chip item instead of candy; n = 84) and the opposite for “beerlovers” (i.e., individuals who rated the temptation to drink beer as three or more and the temptation to eat candy, or chips depending on the comparison, as two or less; n = 34 in both comparisons).

As predicted, discount rates for the two food items (candy and chips) were more strongly associated than any other pair of discount rates, and the discount rates for consumables (candy, chips, and beer) were more strongly associated with each other than with the discount rates for money. Pairwise and listwise analyses yielded similar results (correlation differences ranged from .01 to .06, average difference = .03), so listwise analyses (n = 260) are presented in Table 1. All correlations were significant at p < .001. The correlation between candy and chips (ρ = .60) was significantly larger than any other (ps < .05). In turn, the correlation between candy and beer (ρ = .49) was higher than the correlations between candy and money (ρ = .34; z = 2.31, p = .02) and beer and money (ρ = .29, z = 3.14, p = .002); and the correlation between chips and beer (ρ = .47) was higher than the correlations between chips and money (ρ = .30, z = 2.56, p = .01) and beer and money (ρ = .29, z = 2.73, p = .006).

Table 1: Means, standard deviations, and Spearman rho correlations for candy, chips, beer, and money discount rates using listwise deletion.

ρ Discount rate M SD Candy Chips Beer 1. Candy .68 .30 – 2. Chips .67 .32 .60 – 3. Beer .65 .32 .49 .47 – 4. Money .57 .29 .34 .30 .29 Note. n = 260. All correlations were significant at p < .001.

Discount rates for money were significantly lower than discount rates for alcohol and food. A one-way repeated measures ANOVA revealed a main effect for domain, F(2.77, 717.33) = 11.13, p < .001 (see Table 1 and Figure 2). Bonferroni-corrected t-tests indicated that money was discounted less steeply than the other rewards (ps < .05) but the discount rates for the other rewards did not differ from each other (ps > .29).

Figure 2: Temporal discounting functions for money, candy, chips, and beer using mean indifference points. Subjective value was computed as the proportion of the amount of the delayed reward. Standard errors ranged from .01 to .02. Error bars are not presented because they were barely visible.

As expected, individuals who were more tempted by a reward tended to have steeper discount rates for that reward, ρ = .14, p = .008 for chips and ρ = .19, p < .001 for beer. Although the rho correlation for candy was not significant (ρ = .03, ns), trend analyses revealed significant linear effects of temptation on discount rates for candy (F(1, 399) = 6.08, p = .01), as well as chips (F(1, 357) = 16.00, p < .001), and beer, F(1, 343) = 16.78, p < .001.8 Figure 3 shows these upward trends.

Figure 3: Mean discount rate as a function of ratings on the corresponding temptation item. Error bars represent the standard error of the mean.

Figure 4: Mean discount rate as a function of reward type (candy or beer) and group (candylovers or beerlovers). Error bars represent the standard error of the mean.

Figure 5: Mean discount rate as a function of reward type (chips or beer) and group (chiplovers or beerlovers). Error bars represent the standard error of the mean.

As predicted, individuals had steeper discount rates for rewards they found tempting than for rewards they did not. Two-way mixed-design ANOVAs with groups (either candylovers vs. beerlovers or chiplovers vs. beerlovers) as the between-individual factor and reward type (either candy and beer or chips and beer) as the within-individual factor revealed significant interaction terms: F(1, 125) = 4.83, p = .03, partial η2 = .04, for the candylover-beerlover comparison (see Figure 4) and F(1, 116) = 8.33, p = .005, partial η2 = .07, for the chiplover-beerlover comparison (see Figure 5). Except for the group effect in the candylover-beerlover comparison, F(1, 125) = 6.55, p = .01, partial η2 = .05, none of the main effects were significant. Planned comparisons revealed that the candylovers and chiplovers had steeper discount rates for candy (t(92) = 2.17, p = .03, d = .23) and chips (t(83) = 2.81, p = .006 , d = .31, respectively, compared to beer. Although similar analyses for beerlovers did not reveal significant differences for candy versus beer (t(33) = –1.57, p = .13 , d = –.27, and for chips versus beer (t(33) = –1.67, p = .10, d = –.29 the results were in the predicted direction, and the effect sizes were larger on average than in candylover and chiplover analyses, suggesting that these analyses did not reach significance because of the relatively small sample size for beerlovers.9

The current investigation found empirical support for domain-specificity in temporal discounting. Discount rate correlations showed a hierarchical pattern: the correlation between food items was higher than the correlations between other items, and correlations between consumable (food and alcohol) items were larger than correlations between consumable items and money.

Nevertheless, the discount rates were all positively correlated (ρ s ≥ .29), suggesting that there is also a domain-general aspect of temporal discounting. Which processes affect temporal discounting across domains? Time perspective is one factor that influences decisions about the present and future (Zimbardo & Boyd, 1999). Present-oriented people might have steeper discount rates in general than those with a predominant future time perspective. It is also possible that people make domain-general decision rules (e.g., if the delay for any reward is less than a month, choose the larger reward; otherwise, choose the immediate reward), which could lead to similar discounting across domains. Another possibility is that working memory, “the ability to maintain active representations of goal-relevant information despite interference from competing or irrelevant information”, is necessary to process and integrate goals and values to make decisions (Shamosh et al., 2008, p. 904). Regardless of domain, individuals with low working memory capacity may be less proficient at evaluating delayed options, and thus may default to immediate options.

Notwithstanding evidence of domain-general processes involved in discounting, individuals in our study tended to have higher discount rates for rewards that they found more tempting. This result is particularly noteworthy because it runs counter to a prediction based on the magnitude effect: the observation that discount rates are lower for more valuable rewards (Thaler, 1981). If temptation were a proxy of overall value, then there should be lower discount rates in tempting domains, not higher discount rates, as we predicted and found. The beta-delta preference model of temporal discounting (Laibson, 1997; McClure et al., 2004) provides a framework that reconciles these apparently paradoxical findings. Temptation directly affects the hot system (represented by the beta parameter), whereas temptation is only indirectly “valued” through the cool system’s evaluation of the impact of temptation on the emotional system (Loewenstein & O’Donoghue, 2007). Consequently, temptation is predicted to have a disproportionate effect on the immediate option through the beta parameter, which would lead to steeper discounting. A possible explanation for the magnitude effect is that large amounts might seem hypothetical and are thus evaluated by deliberative cognitive systems as opposed to visceral emotional systems. According to the beta-delta model, these larger amounts would then be discounted less steeply than smaller amounts that evoke the emotional system.10

Although we were not primarily interested in domain effects (i.e., the mean discount rate in one domain is higher than another), it is noteworthy that our study replicates the finding that consumable rewards are discounted more steeply than non-consumable rewards (Charlton & Fantino, 2008; Estle, Green, Myerson, & Holt, 2007; Odum, Baumann, & Rimington, 2006; Odum & Rainaud, 2003). Furthermore, it is interesting to note that the discount rates for rewards by which participants reported “not tempted at all” did not differ from the discount rate for money (all ts < 1.27; all ps > .21). One interpretation of these findings is that the people who were not tempted by a particular reward considered that reward to be essentially non-consumable.11

This study had several limitations. First, we did not match rewards for utility.12 It is possible, therefore, that we would not have found domain-specificity had we controlled for utility. Against this possibility, Chapman (1996) matched rewards for subjective value and shape of utility functions and still found domain-specificity in discount rates.

Second, the small number of items used to represent domains limits our ability to generalize to other items and domains. Moreover, the focal items (candy, chips, and beer) in our study were all consumable and potentially perceived as harmful, whereas money and health are generally perceived as being unequivocally good. Future studies should include more items and domains to extend these findings.

Third, we used hypothetical rather than real rewards. While at least one study suggests that real rewards are discounted more steeply than hypothetical rewards (Kirby, 1997), several more recent studies suggest that hypothetical and real rewards are discounted similarly (Johnson & Bickel, 2002; Lagorio & Madden, 2005; Madden, Begotka, Raiff, & Kastern, 2003; Madden et al., 2004). Nevertheless, future studies are needed to replicate the current investigation using real rewards.

Fourth, the correlational design of the current investigation limits causal inference. Our conjecture that temptation drives discount rates seems more plausible than the possibility that discount rates drive temptation. However, unmeasured third-variable confounds cannot be ruled out. In an experimental study, temptation for specific rewards might be manipulated (e.g., increasing the temptation of food rewards by requiring participants to fast beforehand) and consequent effects on domain-specific discount rates observed.

Finally, when asking our participants to rate temptation, we did not distinguish between wanting (the motivation for a reward) and liking (the hedonic experience of a reward), which are dissociable processes at the neuroanatomical level (Berridge & Kringelbach, 2008; Berridge, Robinson, & Aldridge, 2009). Although wanting and liking generally tend to co-occur, it would be interesting to examine whether these two processes have different effects on discount rates. A priori, we would predict that wanting would have a stronger effect on discounting as liking presumably exerts its effect on decision-making through wanting (e.g., I want an apple because I like apples). Indeed, the fact that drug addicts can want drugs that they do not like (Robinson & Berridge, 2000), suggests that wanting, and not liking, leads to drug abuse. Because wanting and liking are difficult, if not impossible, to dissociate at the conscious level, it is not clear to us how to test this hypothesis experimentally. Nevertheless, we see this as an important direction for future research.

Although prior studies have examined variation in discount rates by domain (e.g., Estle et al., 2007; Odum & Rainaud, 2003) and across individuals (e.g., Chao, Szrek, Pereira, Pauly, & Center, 2009; Ersner-Hershfield, Garton, Ballard, Samanez-Larkin, & Knutson, 2009; Kirby et al., 2002), this is the first study to our knowledge that simultaneously models and predicts both between- and within-individual differences in domain-specific temporal discount rates. In addition to corroborating Chapman’s (1996) findings that temporal discounting is domain-specific, we provide a possible explanation for this phenomenon. Specifically, we show that temptation partially explains domain-specific temporal discounting: an individual may have a high discount rate for candy but a low discount rate for beer in part because she finds candy more tempting.

Berridge, K. C., & Kringelbach, M. L. (2008). Affective neuroscience of pleasure: Reward in humans and animals. Psychopharmacology, 199, 457–480.

Berridge, K. C., Robinson, T. E., & Aldridge, J. W. (2009). Dissecting components of reward: “Liking”, “wanting”, and learning. Current Opinion in Pharmacology, 9, 65–73.

Berry, W. D. (1993). Understanding regression assumptions. Newbury Park, CA: Sage.

Bickel, W. K., Odum, A. L., & Madden, G. J. (1999). Impulsivity and cigarette smoking: Delay discounting in current, never, and ex-smokers. Psychopharmacology. Special Issue: Impulsivity, 146, 447–454.

Chao, L. W., Szrek, H., Pereira, N. S., Pauly, M. V., & Center, P. S. (2009). Time preference and its relationship with age, health, and survival probability. Judgment and Decision Making, 4, 1–19.

Chapman, G. B. (1996). Temporal discounting and utility for health and money. Journal of Experimental Psychology: Learning, Memory, and Cognition, 22, 771–791.

Charlton, S. R., & Fantino, E. (2008). Commodity specific rates of temporal discounting: Does metabolic function underlie differences in rates of discounting? Behavioural Processes, 77, 334–342.

Coffey, S. F., Gudleski, G. D., Saladin, M. E., & Brady, K. T. (2003). Impulsivity and rapid discounting of delayed hypothetical rewards in cocaine-dependent individuals. Experimental and Clinical Psychopharmacology, 11, 18–25.

Ersner-Hershfield, H., Garton, M. T., Ballard, K., Samanez-Larkin, G. R., & Knutson, B. (2009). Don’t stop thinking about tomorrow: Individual differences in future self-continuity account for saving. Judgment and Decision Making, 4, 280–286.

Estle, S. J., Green, L., Myerson, J., & Holt, D. D. (2007). Discounting of monetary and directly consumable rewards. Psychological Science, 18, 58–63.

Field, A. (2005). Discovering statistics using SPSS (2nd ed.). London: Sage Publications.

Frederick, S., Loewenstein, G., & O’Donoghue, T. (2002). Time discounting and time preference: A critical review. Journal of Economic Literature, 40, 351–401.

Furlong, E. E., & Opfer, J. E. (2009). Cognitive constraints on how economic rewards affect cooperation. Psychological Science, 20, 11–16.

Johnson, M. W., & Bickel, W. K. (2002). Within-subject comparison of real and hypothetical money rewards in delay discounting. Journal of the Experimental Analysis of Behavior, 77, 129–146.

Keppel, G. (1991). Design and analysis: A researcher’s handbook (3rd ed.). Upper Saddle River, NJ: Prentice Hall.

Kirby, K. N. (1997). Bidding on the future: Evidence against normative discounting of delayed rewards. Journal of Experimental Psychology: General, 126, 54–70.

Kirby, K. N., Godoy, R., Reyes-GarcÃa, V., Byron, E., Apaza, L., Leonard, W., et al. (2002). Correlates of delay-discount rates: Evidence from Tsimane’ Amerindians of the Bolivian rain forest. Journal of Economic Psychology, 23, 291–316.

Kline, R. B. (2005). Principles and Practice of Structural Equation Modeling (2nd ed.). New York: Guilford.

Lagorio, C. H., & Madden, G. J. (2005). Delay discounting of real and hypothetical rewards III: Steady-state assessments, forced-choice trials, and all real rewards. Behavioural Processes, 69, 173–187.

Laibson, D. (1997). Golden Eggs and Hyperbolic Discounting. The Quarterly Journal of Economics, 112, 443–477.

Loewenstein, G., & O’Donoghue, T. (2007). The heat of the moment: Modeling interactions between affect and deliberation. Unpublished manuscript.

Madden, G. J., Begotka, A. M., Raiff, B. R., & Kastern, L. L. (2003). Delay discounting of real and hypothetical rewards. Experimental and Clinical Psychopharmacology, 11, 139–145.

Madden, G. J., Petry, N. M., Badger, G. J., & Bickel, W. K. (1997). Impulsive and self-control choices in opioid-dependent patients and non-drug-using control patients: Drug and monetary rewards. Experimental and Clinical Psychopharmacology, 5, 256–262.

Madden, G. J., Raiff, B. R., Lagorio, C. H., Begotka, A. M., Mueller, A. M., Hehli, D. J., et al. (2004). Delay discounting of potentially real and hypothetical rewards: II. Between-and within-subject comparisons. Experimental and Clinical Psychopharmacology, 12, 251–260.

McClure, S. M., Laibson, D. I., Loewenstein, G., & Cohen, J. D. (2004). Separate neural systems value immediate and delayed monetary rewards. Science, 306, 503–507.

Metcalfe, J., & Mischel, W. (1999). A hot/cool-system analysis of delay of gratification: Dynamics of willpower. Psychological Review, 106, 3–19.

Myers, J. L., & Well, A. D. (1995). Research Design and Statistical Analysis. Hillsdale: Lawrence Erlbaum Associates.

Myerson, J., Green, L., & Warusawitharana, M. (2001). Area under the curve as a measure of discounting. Journal of the Experimental Analysis of Behavior, 76, 235–243.

Odum, A. L., Baumann, A. A. L., & Rimington, D. D. (2006). Discounting of delayed hypothetical money and food: Effects of amount. Behavioural processes, 73, 278–284.

Odum, A. L., & Rainaud, C. P. (2003). Discounting of delayed hypothetical money, alcohol, and food. Behavioural processes, 64, 305–313.

Petry, N. M. (2001). Delay discounting of money and alcohol in actively using alcoholics, currently abstinent alcoholics, and controls. Psychopharmacology, 154, 243–250.

Prelec, D., & Loewenstein, G. (1991). Decision making over time and under uncertainty: A common approach. Management Science, 37, 770–786.

Robinson, T. E., & Berridge, K. C. (2000). The psychology and neurobiology of addiction: an incentive-sensitization view. Addiction, 95, S91–S117.

Shamosh, N. A., DeYoung, C. G., Green, A. E., Reis, D. L., Johnson, M. R., Conway, A. R. A., et al. (2008). Individual differences in delay discounting: Relation to intelligence, working memory, and anterior prefrontal cortex. Psychological Science, 19, 904–911.

Tabachnick, B. G., & Fidell, L. S. (2007). Using multivariate statistics (5th ed.). Boston: Allyn & Bacon.

Thaler, R. (1981). Some empirical evidence on dynamic inconsistency. Economics Letters, 8, 201–207.

Zimbardo, P. G., & Boyd, J. N. (1999). Putting time in perspective: A valid, reliable individual-differences metric. Journal of Personality and Social Psychology, 77, 1271–1288.

How much would you enjoy the following activities if there were no long-term consequences for yourself or anyone else? That is, how attracted are you to these activities regardless of how harmful you might think they are. On the following scale, please rate how tempted you would be to do the following activities:

1 | 2 | 3 | 4 | 5 |

Not tempted at all | Somewhat tempted | Moderately tempted | Very tempted | Tempted |

| ___ 1. Losing my temper ___ 2. Getting angry ___ 3. Holding a grudge ___ 4. Complaining about my problems ___ 5. Gossiping ___ 6. Breaking promises ___ 7. Telling another person’s secret ___ 8. Lying ___ 9. Taking more than my fair share (i.e., being greedy) ___ 10. Speaking before thinking ___ 11. Interrupting people when they are talking ___ 12. Giving up when I encounter problems ___ 13. Quitting when I am frustrated ___ 14. Procrastinating ___ 15. Doing my work at the last minute ___ 16. Letting responsibilities pile up ___ 17. Wasting time ___ 18. Doing nothing when I have work to do ___ 19. Delaying the start of big projects ___ 20. Putting off work that needs to get done ___ 21. Getting distracted from my work ___ 22. Quitting when I get bored ___ 23. Stopping my work when I get tired ___ 24. Having dessert ___ 25. Eating chocolate ___ 26. Eating candy | ___ 27. Snacking on junk food ___ 28. Eating snacks ___ 29. Consuming more food than I should ___ 30. Eating when I am not hungry ___ 31. Eating chips and other salty snacks ___ 32. Eating fried food ___ 33. Remaining physically inactive ___ 34. Being sedentary ___ 35. Avoiding physical exercise ___ 36. Avoiding working out (e.g., jogging, going to the gym, etc.) ___ 37. Purchasing things when I don’t really need them ___ 38. Buying things on impulse ___ 39. Buying a lot of things ___ 40. Spending a lot of money ___ 41. Buying things I hadn’t planned to buy ___ 42. Spending rather than saving my money ___ 43. Drinking beer ___ 44. Getting drunk ___ 45. Drinking hard liquor ___ 46. Binge drinking ___ 47. Drinking wine ___ 48. Getting high on drugs ___ 49. Smoking cigarettes ___ 50. Smoking marijuana ___ 51. Smoking cigars |

| Note: The order of items was randomized in this study. | |

This document was translated from LATEX by HEVEA.