Judgment and Decision Making, vol. 5,

no. 7, December 2010, pp. 467-476

A simple remedy for overprecision in judgmentUriel Haran*

Carnegie Mellon University

Don A. Moore

University of California, Berkeley

Carey K. Morewedge

Carnegie Mellon University |

Overprecision is the most robust type of overconfidence. We present a

new method that significantly reduces this bias and offers insight into

its underlying cause. In three experiments, overprecision was

significantly reduced by forcing participants to consider all possible

outcomes of an event. Each participant was presented with the entire

range of possible outcomes divided into intervals, and estimated each

interval’s likelihood of including the true answer.

The superiority of this Subjective Probability Interval Estimate

(SPIES) method is robust to range widths and interval grain

sizes. Its carryover effects are observed even in subsequent estimates

made using the conventional, 90% confidence interval method: judges

who first made SPIES judgments considered a broader range of values in subsequent

conventional interval estimates as well.

Keywords: overconfidence, overprecision, subjective

probability, interval estimates, judgment and decision making.

1 Introduction

The Federal Home Loan Mortgage Corporation, otherwise known as Freddie

Mac, provides an online calculator on its website

(www.freddiemac.com) to help potential clients determine

whether they should buy a home or rent one. Among the factors

included in this calculation is the estimated appreciation value of

the home in question, defined by the website as “the yearly

percentage rate that an asset increases in value”. The user has to

enter a percentage value by which, according to her best judgment, her

potential home will increase or decrease. However, when a negative

value (i.e., a forecast that the house’s value will go down) was

entered, it was followed by an error message: “Please fix the

following errors: Appreciation rate must be a number between 0.00 and

100.00.” The design of this online calculator conveyed Freddie Mac’s

belief that housing prices can change only between 0% and +100%,

with any rate outside this range being improbable. However, according

to the Federal Housing Finance Agency (2010), the average yearly

appreciation rate of houses in the United States was consistently

outside this range from the second quarter of 2007 through the first

quarter of 2010, falling as low as −12.03% (and even lower than

−28% in some states). This forecasting error, among others,

resulted in Freddie Mac’s near failure, before its take-over by the

U.S. government in 2008. (More than two years later, in December

2010, Freddie Mac finally changed its on-line calculator to account

for house value depreciation.)

The failure of Freddie Mac to anticipate a depreciation of U.S. house

prices is but one of many examples of overprecision in

judgment. Overprecision is a form of overconfidence, found to be both

prevalent and particularly impervious to debiasing (Moore & Healy,

2008). Also referred to as overconfidence in interval estimates

(e.g., Soll & Klayman, 2004), overprecision is the excessive

certainty that one knows the truth. Among its documented consequences

are errors in clinical diagnosis (Christensen-Szalanski & Bushyhead,

1981; Oskamp, 1965), excessive market trading (Daniel, Hirshleifer, &

Subrahmanyam, 1998; Odean, 1999), and excessive conviction by

individual climate scientists that they know the future trajectory of

climate change (Morgan & Keith, 1995; Zickfeld, Morgan, Frame, &

Keith, 2010). Overprecision is typically measured by eliciting a

confidence interval — a range of values that the judge is confident,

to a certain degree, will include the true value in question (Alpert

& Raiffa, 1982). Research has repeatedly found that the confidence

people have in their beliefs exceeds their accuracy, meaning that the

confidence intervals they produce are too narrow (i.e., overly

precise, see Soll & Klayman, 2004). This pattern is observed in

novice as well as expert judgments (Clemen, 2001; Henrion &

Fischhoff, 1986; Juslin, Winman, & Hansson, 2007; McKenzie, Liersch,

& Yaniv, 2008; Morgan & Keith, 2008).

Attempts to debias overprecision have had limited success. Koriat,

Lichtenstein, and Fischhoff (1980) argued that people’s

excessive confidence in their beliefs is driven by the more extensive

search they conduct for supporting evidence than for evidence that

contradicts their beliefs. In their experiments, participants were

presented with two possible answers to a question, chose the answer

they thought was correct, and reported their confidence in the accuracy

of their chosen answer. They were grossly overconfident when they

expressed very high confidence. However, when

asked to consider evidence contradicting their answers before reporting

their confidence, participants reported lower confidence levels. Soll

and Klayman (2004) manipulated this search for evidence by asking their

participants to specify the fractile cutoffs at the top and bottom ends

of the range of possible values. So instead of asking their

participants to specify the ends of an 80% confidence interval, they

asked their participants (1) for a number low enough that there was a

90% chance the true answer was above it; and (2) for a number so high

that there was a 90% chance the true answer was below it. Using this

approach, Soll and Klayman were able to modestly reduce overprecision.

Other research has tried to reduce overconfidence by focusing on the

format of the question (Juslin, Wennerholm, & Olsson, 1999; Seaver,

von Winterfeldt, & Edwards, 1978; Teigen & Jørgensen, 2005).

This research found that interval evaluation, based on probability

judgments of fixed intervals, produces less overconfidence than

interval production. For example, participants asked to create 90%

confidence intervals produce excessively-narrow intervals, but other

participants, who subsequently estimate their confidence for the

participant-created intervals, report less than 90% confidence in

their accuracy. Building on these findings, Winman, Hansson, &

Juslin (2004) proposed the adaptive interval assessment (ADINA) method

of eliciting judgments. Using this method, a desired confidence level

for an interval is determined in advance. An interval is produced

around a specific value (generated either by the judge, a peer, or at

random), and the judge estimates the probability that this interval

contains the correct answer. If this probability is higher than the

desired confidence level, a narrower interval is presented next, and,

similarly, if the initial probability is lower than the desired

probability, then a wider interval is presented. This procedure is

repeated until the probability assigned to the interval matches the

desired confidence level. The authors found that the resulting

intervals from this procedure displayed less overprecision than

intervals that were produced directly. Unfortunately, this reduction

in overprecision appeared to be tied to the assessment format:

subsequent assessments made with a different response format (e.g.,

confidence intervals) reverted to their old, overly precise form,

suggesting that the change in methods did not affect the cognitive

process by which estimates were produced. In short, no method has

been found that both reduces overprecision and trains judges to

consider a wider range of values when making subsequent estimates in a

different format.

1.1 SPIES - Subjective Probability Interval Estimates

We propose a novel method of producing interval estimates for

quantitative values that has the potential to significantly reduce

overprecision. Our method, Subjective Probability Interval

Estimates (SPIES), works by forcing judges to consider the entire

range of possible answers to a question. The judge sees the full range

of possible outcomes, divided into a series of intervals. For each

interval, the judge estimates the probability that it includes the

correct answer, with the sum of these probabilities constrained to

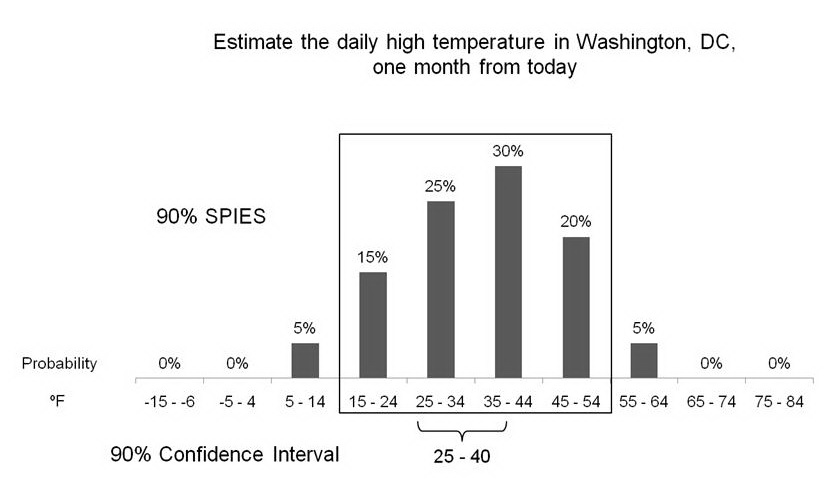

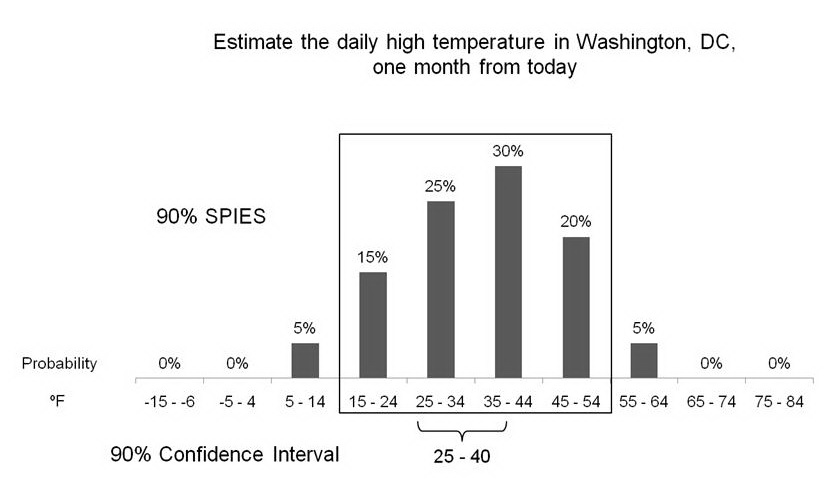

equal 100% (e.g., Figure 1).

| Figure 1: Illustration of hypothetical estimates using SPIES

and a 90% confidence interval for the daily high temperature in

Washington, DC, one month in the future. The 90% SPIES interval ranges from

15ºF to 54ºF, whereas the 90%

confidence interval ranges from 25ºF to

40ºF. |

We expect SPIES will be superior to previously instantiated methods for

two reasons. First, SPIES forces judges to consider all possible values,

including extreme values, which they may otherwise fail to consider

spontaneously. Overlooking these extreme values may account, at least

in part, for the overprecision observed in interval estimates. By

requiring the judge to consider all values and assign each of them some

probability of being correct, even if this probability is zero, SPIES

may significantly reduce this bias.

Second, the SPIES method includes features found to be instrumental in

reducing overprecision. This method makes use of multiple judgments,

which, as Soll & Klayman (2004) found, produce lower overprecision

than single interval estimates. Also, building on the findings of

research on format dependence (e.g., Juslin et al., 2007; Teigen &

Jørgensen, 2005), SPIES is based on probability judgments, which

appear to induce less overprecision than do interval estimates. This

reduction may be further enhanced by constraining the summed

probability assigned to outcomes to equal 100%, limiting the tendency

to overstate subjective probabilities (Tversky & Koehler, 1994).

We report three experiments that tested our approach. Experiment 1

compared overprecision levels produced by SPIES to those produced by

other methods of eliciting quantitative predictions. Experiment 2

tested the robustness of SPIES to different range widths and

interval grain sizes. Experiment 3 tested the robustness of SPIES to

ranges with defined bounds, and examined whether SPIES can increase

accuracy of estimates of extreme values, as well as of values which lay

closer to the middle of the range. In addition, Experiment 3 measured

the carryover effects of SPIES on subsequent estimates made using a

different method.

2 Experiment 1

Experiment 1 tested whether SPIES can reduce overprecision, relative to

two other methods of estimating intervals — 90% confidence intervals,

the most widely used method of interval production, and

5th and 95th fractile estimates,

which together imply a 90% confidence interval.

2.1 Method

2.1.1 Participants

103 Pittsburgh residents responded to an email solicitation, sent to

past participants in studies of the Center for Behavioral Decision

Research, inviting them to participate in an online study. One of the

participants was randomly selected to receive a $100 prize.

Participants estimated the high temperature in Pittsburgh one month

from the day on which they completed the survey, in three different

formats. In a 90% confidence interval format, participants

entered two values, between which they were 90% sure the actual

temperature would fall. In a fractile format,

participants specified their estimated distribution’s

5th fractile (i.e., a number sufficiently low that

they were 95% sure it would be below that the actual temperature),

and the 95th fractile (i.e., a number they were 95%

sure would fall above the actual temperature). In addition,

participants made Subjective Probability Interval Estimates

(SPIES) — they were presented with the following temperature

intervals: below 40°F, 40–49, 50–59, 60–69, 70–79,

80–89, 90–99, 100–109, and 110°F or above. They then

estimated, for each interval, the probability that it would contain

the actual temperature. The web page required the participants to adjust

the probabilities so that they summed to 100% before proceeding.

Presentation order of the three formats was randomly determined, and

not recorded.

2.2 Results

Because the assigned confidence level for intervals produced by the

first two methods was 90%, we chose this level as our target

confidence for intervals produced by SPIES. We used an algorithm to

calculate these confidence intervals, which identifies the temperature

interval with the highest subjective probability and adds its

neighboring intervals until the sum of probabilities reaches closest

to, but not more than 90%. The algorithm then adds the proportion of

the adjacent interval with the next highest probability (or the two

intervals on both sides of the aggregated interval, when they are

assigned equal probabilities) needed to reach 90%. We refer to the

resulting confidence interval as 90% SPIES.1 This is

a conservative calculation of 90% SPIES, designed to produce a

confidence interval out of the fewest possible subjective probability

intervals. In cases where an extreme interval (i.e., below

40°F, 110°F or above) was included in a

participant’s 90% SPIES, we calculated that interval’s width as

10°F.

The true temperatures on the days for which participants made their

estimates were between 67°F and 73°F. A

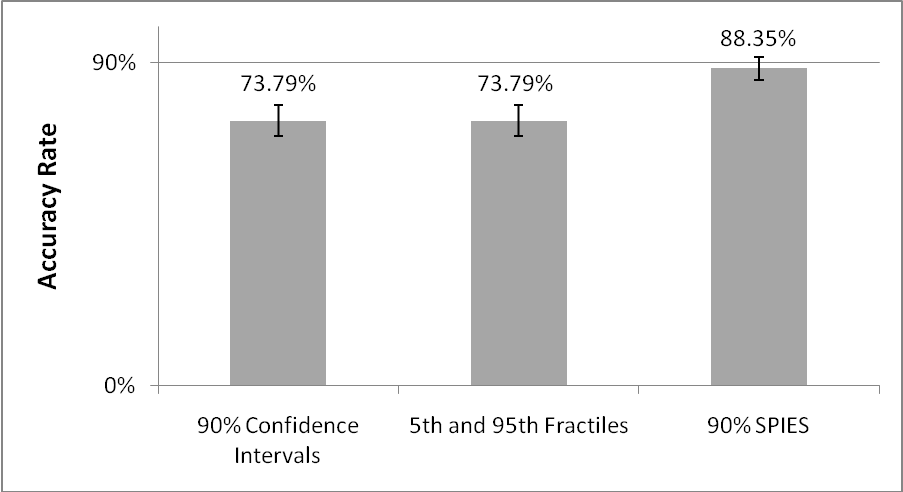

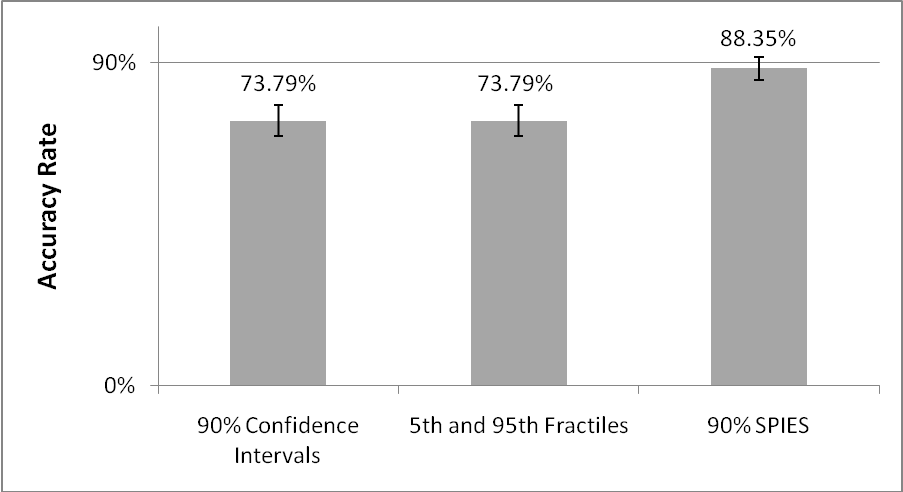

repeated-measures ANOVA comparing the accuracy of participants’

estimates across the three methods revealed a significant difference,

F(2, 101) = 4.98, p = .009, η

2 = .090. 90% confidence intervals and

intervals produced by the 5th and

95th fractiles did not differ in their accuracy,

both including the correct answer 73.79% of the time (SD =

44.19).2 90% SPIES, however, included the correct answer in

88.35% of the estimates (SD = 32.24), a significantly higher

hit rate than both 90% confidence intervals, t(102) = 2.88,

p = .005, d = 0.57, and fractiles, t(102) =

2.69, p = .008, d = 0.53. Whereas 90% confidence

intervals and fractiles displayed significant overprecision of

16.21%, ts(102) = 3.72, p < .0005,

d = 0.74, the accuracy level produced by SPIES was not

significantly different from the 90% confidence level assigned to

them, t(102) = 0.52, p = .60, meaning that these

estimates did not exhibit overprecision (see Figure 2).

| Figure 2: Accuracy rates displayed by 90% confidence

intervals, fractiles and 90% SPIES in Experiment 1. Error bars

indicate ±1 SE. |

The SPIES method does not seem to have improved participants’

intuition regarding the precise temperature, as measured by the

distance between an interval’s midpoint and the true answer. A

repeated-measures ANOVA revealed a significant method effect,

F(2, 101) = 3.49, p = .034, η

2 = .065, but the midpoints of 90%

SPIES intervals were not significantly closer to the true answer than either

those of 90% confidence intervals, t(102) = 1.39, p

= .167, or those between the 5th and

95th fractiles, t < 1.

We also compared the widths of the intervals generated by the three

methods. A repeated-measures ANOVA revealed a significant effect of

method on interval width, F(2,101) = 21.71, p

< .0005, η 2 = .301.

Within-subject contrasts show that 90% SPIES intervals were significantly wider

(M = 31.81, SD = 11.96) than 90% confidence

intervals (M = 23.58, SD = 14.42), t(102) =

5.73, p < .0005, d = 0.62, but slightly,

and non-significantly, narrower than fractiles (M = 33.15,

SD = 22.48), t < 1. The fractile

estimates’ relatively large mean width, as well as

their high variability, can be accounted for by the fact that eight of

these estimates reached either below 30°F or above

119°F (the boundary values we set for calculating 90%

SPIES), and resulted in relatively wide intervals.3

2.3 Discussion

Of the three methods tested in this experiment, the SPIES method was

the only one in which confidence was correctly calibrated with

accuracy. Although 90% confidence intervals and fractile estimates

produced a higher hit rate than that typically found in prior research

(Klayman, Soll, Gonzalez-Vallejo, & Barlas, 1999), the accuracy of

SPIES was significantly higher than both of these methods. Moreover,

the SPIES method not only produced better accuracy, it eliminated

overprecision.

Another noteworthy finding is that SPIES produced a significantly higher

hit rate than did fractile estimates. This result suggests that,

although in both methods judges unpack their estimates into multiple

judgments, this feature is not the primary driver of the superior

calibration found in SPIES.

The results of this experiment are not conclusive regarding why SPIES

were more accurate. On the one hand, interval midpoints did not differ

between the three estimation formats in their distance from the true

value, suggesting the better hit-rate is due to the estimates made

using SPIES being more inclusive. On the other hand, 90% SPIES

achieved a higher hit rate than fractile estimates without being

significantly wider. As noted, we believe this is due to the constraint

put on including extreme values in the SPIES intervals, but not in the other

estimates. This issue was addressed in Experiment 3. First, we wanted

to test whether the improved performance produced by SPIES holds for

different configurations of intervals. This is an important issue

because the SPIES method necessitates two choices: how big to make the

range of possible responses and into how many intervals to divide that

range. These variations may influence the amount of attention given by

the judge to the values she considers, and, subsequently, affect the

quality of the estimates produced. Therefore, we sought to test the

robustness of the results obtained in Experiment 1 to these variations.

3 Experiment 2

In Experiment 2, we varied the width of the range of subjective

probability intervals for which estimates were made and the number of

intervals into which this range was divided. We expected that SPIES

would be better calibrated than 90% confidence intervals, regardless

of the width of their range, or of how many intervals the SPIES task

consisted.

3.1 Method

3.1.1 Participants

The study was conducted online, using participants from Amazon

Mechanical Turk (described by Paolacci et al., 2010). 116 U.S.-based

participants (63 women, Mage = 36.78)

completed a survey for 5¢ each.

3.2 Procedure

Participants estimated the day’s high temperature in Washington, DC

exactly one month after the day on which they took the survey. In a 2

x 2 between-subjects design, participants specified SPIES intervals with a

narrow range (−15°F to 84°F)4 or with a wide range (−65°F to

134°F), which were divided into either ten or twenty

intervals. These divisions resulted in three interval grain-sizes:

fine (5°F), medium (10°F) and coarse

(20°F). Two intervals of extreme values were added at

both ends of these ranges: “-16°F or lower” or

“-166°F or lower” at one end, and “85°F or

higher” or “135°F or higher” at another end (see Table

1). To compare SPIES with conventional interval estimates, an

additional group of participants produced a 90% confidence interval.

3.3 Results

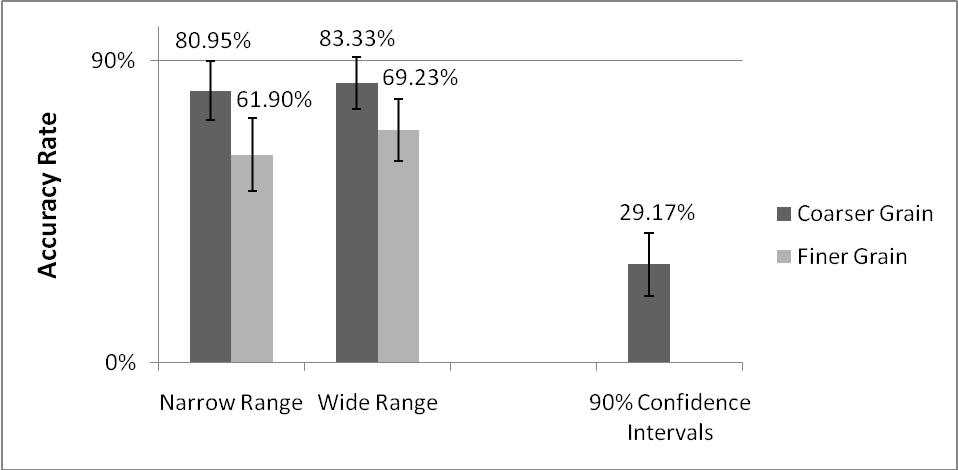

Actual temperatures on the days for which participants provided their

estimates fell between 31°F and 40°F. First, we

compared the accuracy of 90% confidence intervals to that of estimates

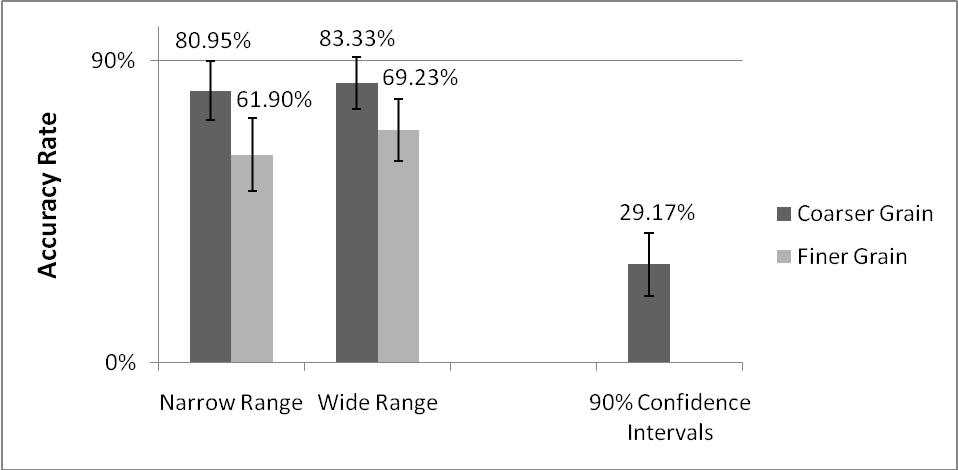

made using SPIES. Similar to Experiment 1, 90% SPIES achieved a

significantly higher hit rate (M = 73.91%, SD =

44.15) than 90% confidence intervals (M = 29.17%, SD

= 46.43), t(114) = 4.38, p < .0005,

d = 0.99. As expected, 90% SPIES of all four configurations

produced accurate estimates at a significantly higher rate than 90%

confidence intervals, ts ≥ 2.28, ps ≤

.027, ds ≥ 0.68 (see Figure 3).

| Figure 3: Accuracy rates displayed by SPIES of different range

widths and grain sizes and by 90% confidence intervals in Experiment

2. Error bars indicate ±1 SE. See Table 2 for hit

rates of the different SPIES configurations. |

Second, we tested whether the different configurations of the SPIES

task affected participants’ estimates. A 2 (range width:

100°F, 200°F) x 2 (number of intervals: 10,

20) between-subjects ANOVA on the hit rates of 90% SPIES

revealed no significant effects of either range width, F

< 1, or number of intervals, F(1,88) = 3.23,

p = .08; nor was there a significant interaction, F

< 1 (see Table 2). In order to perform a more conservative

test of the effect of range width on participants’ estimates, we

compared the two conditions in which participants made SPIES judgments with a

medium, 10ºF grain size (see Table 1). These two

conditions differed only in range width: one group was presented with

a 100ºF range, whereas for the other group, the

SPIES task spanned 200ºF. The comparison between

these two groups revealed no significant effect of range width on hit

rates (100ºF range: M = 80.95%, SD

= 40.24%; 200ºF range: M = 69.23%,

SD =47.07%), t < 1.

| Table 1: Range Width and Grain Size Condition Assignment in Experiment 2. |

Range Width | Number of intervals | Grain Size | Extreme Intervals |

Narrow (100ºF) | 20 + 2 extreme intervals | Fine (5ºF) | −16°F or lower 85°F or higher |

Narrow (100ºF) | 10 + 2 extreme intervals | Medium (10ºF) | −16°F or lower 85°F or higher |

Wide (200ºF) | 20 + 2 extreme intervals | Medium (10ºF) | −66°F or lower 135°F or higher |

Wide (200ºF) | 10 + 2 extreme intervals | Coarse (20ºF) | −66°F or lower 135°F or higher |

We did, however, find that the width of 90% SPIES was affected by the

configuration of the task. We conducted a similar ANOVA on

estimate width, which revealed significant main effects of the

overall SPIES’ range width and the number of intervals

it included, F(1,88) = 12.52, p = .001, η

2 =.125 and F(1,88) = 12.25,

p = .001, η 2 =.122,

respectively, with no interaction, F < 1 (see Table

3). However, a comparison of the two 10ºF grain size

groups found no effect of range width on estimate width

(100ºF range: M = 33.40, SD =

16.58; 200ºF range: M = 33.50, SD =

12.93), t < 1.

As in Experiment 1, the estimated intervals’ midpoints

were not affected by our manipulations. The distances of 90%

SPIES’ midpoints from their respective true values did

not vary with range width, F(1, 88) = 1.47, p = .228,

or with grain size, F < 1, nor was there an

interaction, F < 1. No significant difference in

midpoint accuracy was found between 90% SPIES and 90% confidence

intervals, either, t < 1.

In light of the significant effects on estimate width and the large,

though only marginally-significant effect of number of intervals on

hit rates, we sought to examine the extent to which participants were

sensitive to the different SPIES configurations. We tested this by

measuring the number of intervals to which participants assigned some

probability higher than zero in their estimates. A 2 (range width) x 2

(number of intervals) ANOVA found a significant effect of interval

number, wherein participants for whom the SPIES task consisted of

twenty intervals gave significantly more intervals (M = 6.36,

SD = 3.81) non-zero probabilities than those who were

presented with only ten intervals (M = 4.24, SD =

2.30), F(1, 88) = 14.94, p < .0005. The

ANOVA also found a significant range width effect, F(1, 88) =

22.69, p < .0005, but the direct comparison of the

two 10ºF grain size groups found no effect of range

width on the number of intervals with non-zero probabilities

(100ºF range: M = 5.14, SD = 2.83;

200ºF range: M = 4.62, SD = 1.79),

t < 1. Together, these results suggest that

participants who made estimates with the finer-grained SPIES were

aware of the need to use a larger number of intervals and adjusted

their estimates, but not sufficiently to fully equate their estimates’

width to those made with coarser-grained intervals.

| Table 2: 90% SPIES hit rates by range width and grain size in Experiment 2. |

| | Range Width |

Number of intervals | Narrow | Wide |

10 | 80.95% (40.24%) | 83.33% (38.07%) |

20 | 61.90% (49.76%) | 69.23% (47.07%) |

| Table 3: 90% SPIES width (in degrees F) by range width and grain size

in Experiment 2. |

| | Range Width |

Number of intervals | Narrow | Wide |

10 | 33.40 (16.58) | 44.95 (11.80) |

20 | 25.48 (11.12) | 33.50 (12.93) |

3.4 Discussion

As in Experiment 1, SPIES had a significantly higher hit rate than

standard 90% confidence interval estimates. More important, this

difference was consistent across the various range widths and interval

grains.

One common feature of the first two experiments is that both included

estimates of values on an unbounded scale (i.e., temperatures), for

which we did not specify a minimum or a maximum value. In the absence

of such explicit bounds, the highest and lowest intervals in the SPIES

task may be perceived by the judge as reasonable bounds, between which

the experimenters expect the true answer to lie. Because these

intervals were included in the SPIES tasks, but not in confidence

interval estimates, they may account for some of the difference in

performance between the two methods. Also, in both experiments, the

true values eventually fell closer to the middle of the scale than to

any one of its ends. In Experiment 3 we sought to address these

issues, by specifying the high and low bounds of the range in all

conditions, as well as by varying the true values being estimated.

Another question which remains open is whether the difference between

SPIES and confidence interval production is solely due to the different

elicitation format, or whether SPIES enact a change in the underlying

process by which estimates are generated. We hypothesize that training

judges to consider the entire range of possible values, using SPIES,

will have effects beyond the current elicitation method, and will

affect subsequent estimates made in different formats. We tested this

hypothesis in Experiment 3.

4 Experiment 3

In Experiment 3, participants estimated a series of values, using

confidence intervals for half of their estimates and SPIES for the

others. Participants estimated the year in which all

20th Century U.S. presidents were first elected to

office. These years were therefore on a bounded scale, ranging from

1900 to 1999. In addition, since these election years for all

presidents were estimated, the true values fell at various points on

the scale, both near the ends and closer to the middle.

We varied the elicitation method within-subjects. Participants produced

90% confidence intervals for half of their estimates, and SPIES for

the other half, the order of which was counterbalanced. This design

enabled us to test for the influence of SPIES on subsequent confidence

interval estimates, by measuring differences in 90% interval widths

between confidence intervals produced before SPIES and those produced

after. If format dependence is solely responsible for the reduction in

overprecision exhibited in SPIES, then, similar to the findings of

Winman et al. (2004), confidence intervals will not be affected after

switching from SPIES. If, as we suggest, SPIES change the process by

which judges make confidence estimates, then 90% confidence intervals

should include a wider range of values if made after SPIES than when

made beforehand.

4.1 Method

4.1.1 Participants

334 Pittsburghers (169 women, M age = 22.6, SD = 6.79)

completed a survey in the lab, in exchange for $3 or course credit.

Participants answered a 16-item quiz, estimating the years in which

all 20th Century U.S. presidents were first elected

to office5. For

each president, participants estimated either a 90% confidence

interval or SPIES. The SPIES task included all years from 1900 to

1999, divided into ten intervals, each representing a decade, with no

end intervals for more extreme values. Similarly, in the confidence

interval production condition, any estimate that included years

outside the 20th century could not be submitted, and

the participant was instructed to revise it. Half of the participants

provided 90% confidence intervals for the first eight estimates and

SPIES for the last eight; for the other half, this order was reversed.

Items appeared in a different random order for each participant.

4.2 Results

We calculated 90% SPIES the same way as in Experiments 1 and 2. Next,

we conducted a 2 (elicitation method: SPIES, confidence intervals) x 2

(elicitation order: first eight estimates, last eight estimates) mixed

ANOVA6 on hit rates, which

showed that 90% SPIES had a significantly higher hit rate than 90%

confidence intervals. SPIES included the correct answer 76.91% of

the time (SD = 20.17), compared with 54.34% (SD =

26.26%) in 90% confidence intervals, F(1,332) = 192.34,

p < .001, η

2 =.367. This result supported our

prediction that SPIES would provide greater accuracy for estimated

values in bounded ranges, regardless of where on the range the true

value eventually falls. As in Experiments 1 and 2, we found no

significant effect of elicitation method on interval midpoint

accuracy, F(1, 332) = 1.11, p = .29.

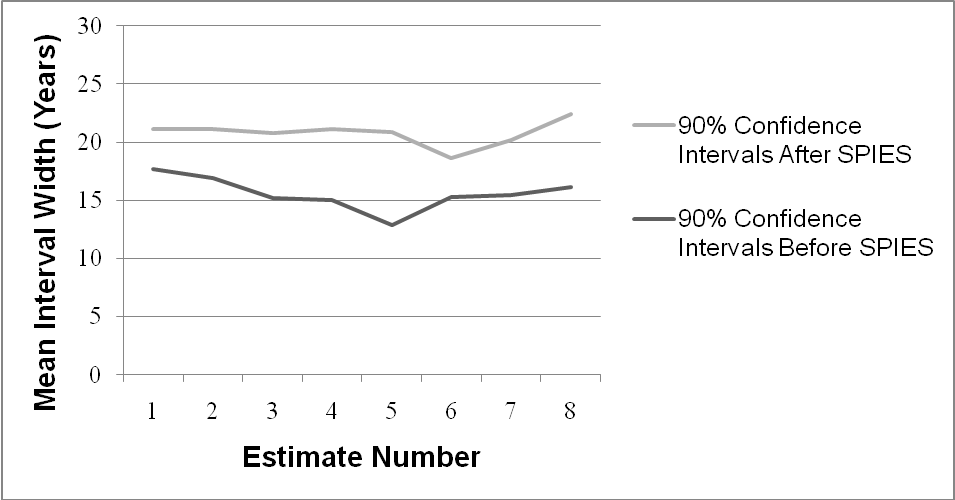

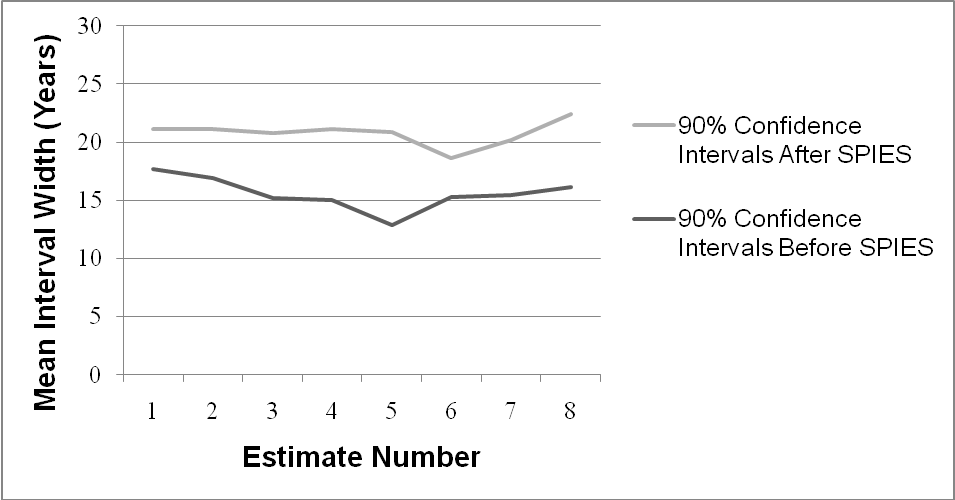

A similar ANOVA on estimate width yielded a significant effect

of SPIES on subsequent confidence interval width. SPIES produced

significantly wider estimates (M = 36.27, SD = 20.09) than

90% confidence intervals (M = 18.17, SD = 14.84),

but there was also a significant Elicitation method x Elicitation order

interaction, F(1,332) = 3.97, p = .047, η

2= .012. Simple effects tests revealed

that 90% confidence intervals produced after having taken the SPIES

task were significantly wider (M = 20.77 years,

SD = 16.13) than those produced in the first set of estimates

(M = 15.57, SD = 12.95), t(332) = 3.25,

p = .001, d = 0.36, whereas 90% SPIES did not differ

between the two groups, t < 1. This result suggests

that SPIES had a carryover effect on subsequent confidence interval

estimates, leading judges to consider a wider range of values in their

estimates. To rule out learning and time effects, we conducted a

repeated-measures ANOVA on confidence interval widths for each item

participants estimated. The last confidence interval estimate in each

set was not, on average, wider than the first estimate in the set,

F < 1, suggesting the greater width of

confidence intervals made after SPIES than of those made before SPIES

was not due to a simple improvement with experience or time within the

same elicitation method (see Figure 4).

| Figure 4: Estimate-by-estimate mean widths of 90% confidence

intervals made in the first set of estimates (before SPIES), compared

to those of 90% confidence intervals in the second set of estimates,

after having made SPIES judgments in the first set in Experiment 3. |

4.3 Discussion

The results of this experiment confirm that the increased accuracy

observed in SPIES does not depend on features of the possible range of

values being estimated, or on where on this range the true value

actually falls. Furthermore, the carryover effect of SPIES on

subsequent confidence interval estimates suggests that the reduced

bias in SPIES is not due to format dependence alone. It also

demonstrates a change in the process by which judgments are made. The

more extensive consideration of values in SPIES prompted judges to

generate wider confidence intervals in later estimates.

5 General discussion

Overprecision in judgment continues to be a robust and intriguing

phenomenon with potentially profound and harmful consequences in

domains as diverse as corporate investment and scientific progress

(e.g., Henrion & Fischhoff, 1986; Malmendier & Tate, 2005; Morgan &

Keith, 2008). SPIES appears to be a practical and simple method of

producing interval estimates that effectively reduces overprecision.

Across three experiments that elicited different estimates, SPIES led

to greater accuracy than other elicitation methods — and in some

cases completely eliminated overprecision. The results further

suggest that SPIES may affect the process by which people make

quantitative estimates, as confidence interval estimates produced

after SPIES included a wider range of values than estimates produced

before this intervention.

Future research is needed to elucidate the underlying mechanism by

which SPIES results in reduced overprecision. SPIES may evoke a more

extensive search for information, which puts the judge in a more

inquisitive mindset (e.g., Galinsky, Moskowitz, & Skurnik, 2000),

leading to a better and more deliberate estimation process.

Alternatively, considering all subjective probability intervals may

work by increasing the amount of available estimate-relevant

information in memory, forcing a fuller consideration of alternative

hypotheses (Hirt & Markman, 1995; McKenzie, 1997, 1998; Morewedge &

Kahneman, 2010).

In addition to our laboratory findings, we believe SPIES can easily be

used for producing estimates in real-world settings. As Experiment 2

shows, SPIES provides superior results to confidence interval

estimates, regardless of how the SPIES task is presented. The

structure of the method, which utilizes the entire range of possible

values, allows the production of intervals of virtually any target

width or confidence level from the same estimate, and even allows

changing the target width or confidence without having to estimate the

same value multiple times. Furthermore, SPIES appears to have

positive carryover effects, suggesting that the method may help train

judges to improve their estimates when the range of possible outcomes

of an event is uncertain and traditional confidence interval estimates

are required.

Another useful feature of SPIES is the added information it provides

about the judge’s sense of uncertainty regarding the estimated

value. Traditional confidence intervals provide information only about

the two values beyond which the judge thinks the true value has a very

low chance of being, but not which values within the confidence

interval are perceived as more probable than others. Point estimates

and probability judgments, which are widely used in industry, provide

very little information about the judge’s sense of the extent to which

the true value may vary. SPIES, on the other hand, provides information

on the values which the judge estimates as the most probable, as well

as her sense of the variability in her estimate. This information can

be highly valuable in cases such as estimates of future product

demands which affect present stock, production and pricing.

One limitation of the experiments depicted in this paper is that they

tested the SPIES method on only one type of estimates plagued by

overprecision, namely interval estimates. Future research should test

whether this method is applicable in forecasts of discrete events

(e.g., the chances that a building will sustain an earthquake; which

candidate will win an election). Another limitation is that, despite

its simplicity for the judge, the SPIES method is too complex and time

consuming for many everyday estimates. The use of SPIES is recommended

in contexts where the consequences are large and ample time or a

computer is available to calculate a confidence interval, but they are

hardly the panacea for all estimates and forecasts. Nevertheless, we

believe expert judges and professionals who make estimates of uncertain

quantities may benefit from adopting SPIES.

References

Alpert, M., & Raiffa, H. (1982). A progress report on the training of

probability assessors. In D. Kahneman, P. Slovic, & A. Tversky,

Judgment under Uncertainty: Heuristics and Biases. Cambridge:

Cambridge University Press.

Christensen-Szalanski, J. J., & Bushyhead, J. B. (1981).

Physicians‘ use of probabilistic information in real

clinical setting. Journal of Experimental Psychology: Human

Perception and Performance, 7, 928–935.

Clemen, B. (2001). Assessing 10–50–90s: a surprise. Decision

Analysis, 20, 2.

Daniel, K., Hirshleifer, D., & Subrahmanyam, A. (1998). Investor

Psychology and Security Market Under- and Overreactions. The

Journal of Finance, 53, 1839–1885.

Federal Housing Finance Agency. (2010). Quarterly average and

median prices for states and U.S.: 2000Q1 - Present. Retrieved

December 10, 2010, from http://www.fhfa.gov/Default.aspx?Page=87

Galinsky, A. D., Moskowitz, G. B., & Skurnik, I. (2000).

Counterfactuals as self-generated primes : The effect of prior

counterfactual activation on person perception judgments.

Social Cognition, 18, 252–280.

Henrion, M., & Fischhoff, B. (1986). Assessing uncertainty in physical

constants. American Journal of Physics, 54, 791–798.

Hirt, E. R., & Markman, K. D. (1995). Multiple explanation: A

consider-an-alternative strategy for debiasing judgments.

Journal of Personality and Social Psychology, 69, 1069–1086.

Juslin, P., Wennerholm, P., & Olsson, H. (1999). Format dependence in

subjective probability calibration. Journal of Experimental

Psychology: Learning, Memory, and Cognition, 25, 1038–1052.

Juslin, P., Winman, A., & Hansson, P. (2007). The Naïve Intuitive

Statistician: A Naïve Sampling Model of Intuitive Confidence

Intervals. Psychological Review, 114, 678–703.

Klayman, J., Soll, J. B., Gonzalez-Vallejo, C., & Barlas, S. (1999).

Overconfidence: It depends on how, what, and whom you ask.

Organizational Behavior and Human Decision Processes, 79, 216–247.

Koriat, A., Lichtenstein, S., & Fischhoff, B. (1980). Reasons for

confidence. Journal of Experimental Psychology: Human Learning

and Memory, 6, 107–118.

Malmendier, U., & Tate, G. (2005). CEO overconfidence and corporate

investment. The Journal of Finance, 60, 2661–2700.

McKenzie, C. (1997). Underweighting alternatives and overconfidence.

Organizational Behavior and Human Decision Processes, 71,

141–160.

McKenzie, C. R. (1998). Taking into account the strength of an

alternative hypothesis. Journal of Experimental Psychology:

Learning, Memory, and Cognition, 24, 771–792.

McKenzie, C., Liersch, M., & Yaniv, I. (2008). Overconfidence in

interval estimates: What does expertise buy you? Organizational

Behavior and Human Decision Processes, 107, 179–191.

Moore, D. A., & Healy, P. J. (2008). The trouble with overconfidence.

Psychological Review, 115, 502–517.

Morewedge, C. K., & Kahneman, D. (2010). Associative processes in

intuitive judgment. Trends in Cognitive Sciences, 14, 435–440.

Morgan, M. G., & Keith, D. W. (1995). Subjective judgments by climate

experts. Environmental Science & Technology, 29, 468–476.

Morgan, M. G., & Keith, D. W. (2008). Improving the way we think about

projecting future energy use and emissions of carbon dioxide.

Climatic Change, 90, 189–215.

Odean, T. (1999). Do investors trade too much? The American

Economic Review, 89, 1279–1298.

Oskamp, S. (1965). Overconfidence in case-study judgments.

Journal of Consulting Psychology, 29, 261–265.

Paolacci, G., Chandler, J., & Stern, L. N. (2010). Running experiments

on Amazon Mechanical Turk. Judgment and Decision Making, 5,

411–419.

Seaver, D. A., von Winterfeldt, D., & Edwards, W. (1978). Eliciting

subjective probability distributions on continuous variables.

Organizational Behavior & Human Performance, 21, 379–391.

Soll, J., & Klayman, J. (2004). Overconfidence in interval estimates.

Journal of Experimental Psychology: Learning, Memory, and

Cognition, 30, 299–314.

Teigen, K. H., & Jørgensen, M. (2005). When 90% confidence

intervals are 50% certain: on the credibility of credible intervals.

Applied Cognitive Psychology, 19, 455–475.

Tversky, A., & Koehler, D. J. (1994). Support theory: a nonextensional

representation of subjective probability. Psychological Review,

101, 547–567.

Winman, A., Hansson, P., & Juslin, P. (2004). Subjective probability

intervals: How to reduce overconfidence by interval evaluation.

Journal of Experimental Psychology: Learning, Memory, &

Cognition, 30, 1167–1175.

Zickfeld, K., Morgan, M. G., Frame, D. J., & Keith, D. W. (2010).

Expert judgments about transient climate response to alternative future

trajectories of radiative forcing. Proceedings of the National

Academy of Sciences, 107, 12451–12456.

Appendix: MATLAB code for calculating SPIES

%Your input data file should be in a .csv file, and include only the

%data entered in the SPIES task, without column headers or participant

%ID's. The output file will be a text file, which will include the

%subjective probabilities incorporated in the result interval, as well

%as the interval's low and high bounds.

function [] = SPIES(filename)

filenamenew = [filename(1:(end - 4)) 'out.txt'];

data = importdata(filename);

%The four lines below this comment are for configuring your SPIES task:

%rangeMin = the SPIES task's low bound.

%rangeMax = the SPIES task's high bound.

%intervalGrainSize = the width of the SPIES' intervals.

%targetConfidence = the result confidence interval's desired level of

% confidence.

rangeMin = 0;

rangeMax = 100;

intervalGrainSize = 10;

targetConfidence = 90;

minColRange = (rangeMin:intervalGrainSize:rangeMax - intervalGrainSize);

maxColRange = (rangeMin+intervalGrainSize:intervalGrainSize:rangeMax);

result = [];

for ii = 1:size(data, 1)

dataRow = data(ii, :);

len = length(dataRow);

matrix = zeros(len, len);

for i1 = 1:len

for j1 = i1:len

matrix(i1, j1) = sum(dataRow(i1:j1));

end

end

maxValueIndex = 1;

for k = 1:len

if (dataRow(k) >= dataRow(maxValueIndex))

maxValueIndex = k;

end

end

bottom = maxValueIndex;

top = maxValueIndex;

while (sum(dataRow(bottom:top)) <= targetConfidence)

if (bottom > 1)

if (top == len)

bottom = bottom - 1;

else

if (dataRow(bottom - 1) > dataRow(top + 1))

bottom = bottom - 1;

else

if (dataRow(bottom - 1) < dataRow(top + 1))

top = top + 1;

else

if (dataRow(bottom - 1) == dataRow(top + 1))

top = top + 1;

bottom = bottom - 1;

end

end

end

end

else

if (top < len)

top = top + 1;

else

% This should not happen

end

end

end

includedSPIES = zeros(1, len);

includedSPIES(bottom:top) = dataRow(bottom:top);

startRange = minColRange(bottom);

endRange = maxColRange(top);

while (sum(includedSPIES(bottom:top)) > targetConfidence || ...

includedSPIES(bottom) == 0 || includedSPIES(top) == 0 )

extra = sum(dataRow(bottom:top)) - targetConfidence;

if (extra == 0)

while (includedSPIES(bottom) == 0)

bottom = bottom + 1;

end

while (includedSPIES(top) == 0)

top = top - 1;

end

startRange = minColRange(bottom);

endRange = maxColRange(top);

continue;

end

if (dataRow(bottom) + dataRow(top) <= extra)

includedSPIES(bottom) = 0;

includedSPIES(top) = 0;

bottom = bottom + 1;

top = top - 1;

startRange = minColRange(bottom);

endRange = maxColRange(top);

continue;

end

diff = dataRow(bottom) - dataRow(top);

if (diff == 0)

valuePerUnit = dataRow(bottom) / intervalGrainSize;

unitToUse = dataRow(bottom) - (extra / 2);

startRange = maxColRange(bottom) - ...

(unitToUse / valuePerUnit);

endRange = minColRange(top) + ...

(unitToUse / valuePerUnit);

includedSPIES(top) = includedSPIES(top) - (extra / 2);

includedSPIES(bottom) = includedSPIES(bottom) - (extra / 2);

continue;

end

if (diff > 0)

if (dataRow(top) <= extra)

includedSPIES(top) = 0;

top = top - 1;

endRange = maxColRange(top);

continue;

end

valuePerUnit = dataRow(top) / intervalGrainSize;

unitToUse = dataRow(top) - (extra);

endRange = minColRange(top) + ...

(unitToUse / valuePerUnit);

includedSPIES(top) = includedSPIES(top) - (extra);

continue;

end

if (diff < 0)

if (dataRow(bottom) <= extra)

includedSPIES(bottom) = 0;

bottom = bottom + 1;

startRange = minColRange(bottom);

continue;

end

valuePerUnit = dataRow(bottom) / intervalGrainSize;

unitToUse = dataRow(bottom) - (extra);

startRange = maxColRange(bottom) - ...

(unitToUse / valuePerUnit);

includedSPIES(bottom) = includedSPIES(bottom) - (extra);

continue;

end

end

result(ii, 1:(len + 2)) = [includedSPIES,startRange, endRange];

end

dlmwrite(filenamenew, result, ' ');

This document was translated from LATEX by

HEVEA.