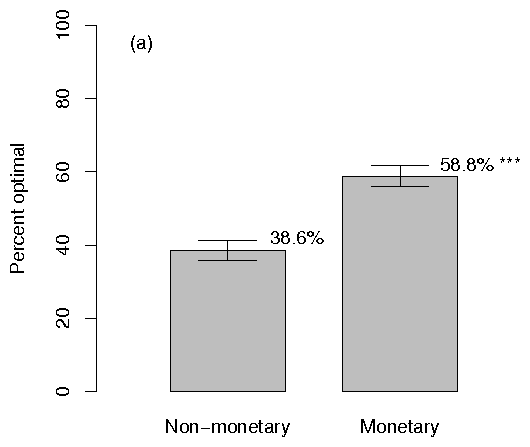

subjects usually kept substantially more when choices were real rather than hypothetical... we can interpret subjects as having some nonfinancial goal - to appear... generous... - which is partially displaced by profit-maximization when incentives are increased. This kind of incentive effect is fundamentally different from the effect of incentives in inspiring greater effort, clearer thinking, and better performance.If our Sharing Game participants have a similar goal of wishing to appear generous, then we can expect them to behave competitively less often when points are not backed by real money. In addition, Hertwig and Ortmann (2001) call for "learning more about the specific conditions under which payoffs improve, do not matter to, or impair task performance." From a theoretical perspective it appears important to further clarify the conditions under which financial incentives affect performance, as Hertwig and Ortmann (2001) have argued. It is also important from a pragmatic standpoint: if certain studies of economic games produce the same results with hypothetical and real incentives, then a great deal of human participant money may be saved. The Sharing Game task used in the present experiments shares a characteristic with the popular Prisoner's Dilemma Game (e.g., Rachlin, 1997; Fantino, Gaitan, Meyer, & Stolarz-Fantino, 2006) in that both games constrain the choices of participants and present them with conflicting options. In that regard the Sharing Game differs from the popular UG and DG in that on any given choice the participant must choose between getting more for oneself (and still more for the other participant) or less for oneself (and still less for the other participant). Choices on the UG and particularly the DG are relatively unconstrained. The Sharing Game forces the participant to choose between an outcome that is optimal for both participants and one that is competitive (giving a relative, but non-optimal advantage to the allocator). An equitable choice is absent. However, the trials are arranged so that it is possible for the participants to respond equitably over trials. Thus, as mentioned above, participants behaving according to inequality aversion theories (e.g., Fehr & Schmidt, 1999; Bolton & Ockenfels, 2000) may be expected to alternate choices, thereby maintaining equal payoffs for both participants. The distribution of choices should permit the characterization of participants' choices as optimal, equitable, or competitive. The possible effects of other variables (such as monetary incentive and whether the other participant is a person or computer) should enable us to determine the extent to which these distributions of choices are stable or are influenced by these variables. Would participants allocate resources optimally in this task by always selecting the larger payoff for themselves and the other player? If not, how would the frequency of non-optimal choices (choosing the smaller payoff) be affected by each of the three variables (nature of other player, monetary incentive, and display of the other player's cumulative score)? Would participants who do not consistently choose optimally consistently choose the "competitive" outcome (lower payoffs, with the participant receiving the larger share)? Or would they equalize the payoffs for the two players?

| Player One receives 7 and Player Two receives 9 |

| or |

| Player One receives 5 and Player Two receives 3 |

| Second (competitive) alternative | |||

| Player 2 (putative other or computer) receives | Player 1 (participant) receives | Player 2 (putative other or computer) receives | |

| 6 | 8 | 4 | 2 |

| 6 | 7 | 5 | 4 |

| 7 | 9 | 5 | 3 |

| 8 | 11 | 5 | 2 |

| 9 | 13 | 5 | 1 |

| Men (n = 50) | Women (n = 150) | |

| Monetary | 26 | 74 |

| Non-monetary | 24 | 76 |

| Human | 25 | 75 |

| Computer | 25 | 75 |

| Monetary/Human | 11 | 39 |

| Monetary/Computer | 15 | 35 |

| Non-monetary/Human | 14 | 36 |

| Non-monetary/Computer | 10 | 40 |