Judgment and Decision Making, vol. 1, no. 1, July 2006, pp. 23-32.

A psychological law of inertia and the illusion of loss aversion

David Gal1

Graduate School of Business

Stanford University

Abstract

The principle of loss aversion is thought to explain a wide range

of anomalous phenomena involving tradeoffs between losses and

gains. In this article, I show that the anomalies loss aversion

was introduced to explain - the risky bet premium, the endowment

effect, and the status-quo bias - are characterized not only by

a loss/gain tradeoff, but by a tradeoff between the status-quo

and change; and, that a propensity towards the status-quo in

the latter tradeoff is sufficient to explain these phenomena.

Moreover, I show that two basic psychological principles - (1)

that motives drive behavior; and (2) that preferences tend to

be fuzzy and ill-defined - imply the existence of a robust and

fundamental propensity of this sort. Thus, a loss aversion principle

is rendered superfluous to an account of the phenomena it was

introduced to explain.

Keywords: inertia, loss aversion, endowment effect, status-quo

bias, risky choice, reference-dependent preferences

An object at rest remains at rest and an object in motion

remains in motion unless acted upon by an outside force.

- Newton's First Law of Motion (law of inertia)

1 Introduction

Research has shown that people tend to evaluate outcomes not

in terms of their impact on an individual's resulting state of

wealth, but in terms of changes from a reference state (e.g.,

Kahneman & Tversky, 1979). Moreover, evidence has been interpreted

to imply that people are loss averse: negative changes (i.e.,

losses) from a reference state are thought to loom larger than

positive changes (i.e., gains) of equivalent magnitude (e.g Kahneman

& Tversky, 1979; Tversky & Kahneman, 1991). This principle,

named loss aversion, is commonly considered the most robust and

important finding of behavioral decision theory, and has been

widely hailed (Camerer, 2005) and cited as a "seemingly ubiquitous

phenomenon" (Novemsky & Kahneman, 2005).

This seeming ubiquity is evident in the economics and finance

literature, where loss aversion has been cited, inter alia, to

account for the equity premium puzzle (Benartzi & Thaler, 1995),

the disposition effect (O'Dean, 1998), and the inability of risk-aversion

based on wealth to explain people's unwillingness to accept small

even bets (Rabin & Thaler, 2001). In the marketing literature,

loss aversion has similarly been cited widely to account, inter

alia, for the endowment effect (e.g., Sen & Johnson, 1997; Strahilevitz

& Loewenstein, 1998), the compromise effect (Simonson & Tversky,

1992), and an observed asymmetry in the price elasticity of demand

(Putler, 1992; Hardie, Johnson, & Fader, 1993).

The principle of loss aversion was first introduced by Kahneman

and Tversky (1979) to account for the finding that experimental

subjects required a premium over expected value to accept a bet

offering an even chance of a gain or loss ("the risky

bet premium"). Subsequently, the principle was extended to

the context of riskless choice: Thaler (1980) coined the term

"endowment effect" to refer to the finding that

randomly assigned owners of an object appear to value the object

more than randomly assigned non-owners of the object. For

instance, in one well-known series of endowment effect

experiments, Kahneman, Knetsch and Thaler (1990) found that

randomly assigned owners of a mug required significantly more

money to part with their possession (around $7) than randomly

assigned buyers were willing to pay to acquire it (around $3).

Kahneman et al. (1990, 1991) and Tversky and Kahneman (1991)

attributed this result to loss aversion: owners' loss of the mug

loomed larger than buyers' gain of the mug. "The status

quo bias" - individuals' tendency to prefer to remain at the

status-quo - is similarly attributed to loss aversion: It is

assumed that the loss of the status-quo option looms larger than

the gain of an alternative option (e.g., Kahneman et al., 1991).

For instance, in one empirical demonstration of the status-quo

bias, Samuelson and Zeckhauser (1988) showed that individuals

participating in a hypothetical investment choice task were more

likely to choose to invest an inheritance in a particular

investment option (out of four) when that option was presented as

the status-quo (i.e., when they were informed that the money from

the inheritance was already invested in that option).

Remarkably for a principle that is so pervasive, the principle

of loss aversion is not derived from any theory of behavior or

more basic psychological principles, but is an ad hoc principle

introduced to account for a range of phenomena involving tradeoffs

between losses and gains that are anomalous in the context of

the classical choice paradigm. The absence of an accepted psychological

theory to account for loss aversion has led to a paradoxical

situation: loss aversion is cited as the explanation for phenomena

associated with loss/gain tradeoffs (e.g., the endowment effect,

status-quo bias, risky bet premium) and, circuitously, the

same phenomena are cited as evidence for the existence of loss

aversion.

This is not to say that loss aversion lacks a potentially

plausible psychological basis. Indeed, a number of researchers

have attempted to uncover an underlying psychological mechanism

that could explain a loss/gain asymmetry. Posited psychological

mechanisms for loss aversion include the proposition that the

hedonic impact of losses is greater than that of gains (e.g.,

Bar-Hillel & Neter, 1996), that people's locus of attention

tends to be focused on losses more than on gains (Carmon &

Ariely, 2000), and - through studies with either animals or

fMRI - that a loss/gain asymmetry is cognitively hard-wired.

A common feature of these attempts to uncover a psychological

mechanism for loss aversion is the premise that a fundamental

loss/gain asymmetry in fact exists, and that this asymmetry is

reflected in the phenomena it purports to explain. In contrast,

in the present research, I do not attempt to explain the existence

of a loss/gain asymmetry, but to challenge the notion that a

reference-dependent asymmetry is necessary to explain these phenomena

at all. In particular, I recognize that the phenomena most commonly

cited as evidence for loss aversion - the status-quo bias, the

endowment effect, and the risky bet premium - are characterized

not only by a loss/gain tradeoff, but by a tradeoff between the

status-quo and change; and, that a propensity towards the status

quo in the latter tradeoff is sufficient to explain these phenomena.

Moreover, I show that two basic psychological principles - (1)

that motives drive behavior, and (2) that preferences tend to

be fuzzy and ill-defined - imply the existence of a robust and

fundamental propensity of this sort. Thus, a propensity to remain

at the status-quo - i.e., inertia - is not simply an alternative

account to loss aversion for these phenomena, but one that renders

the introduction of a loss aversion principle superfluous.

The remainder of this article is organized as follows: First,

I discuss the implication of the nature of behavior and preferences

for a propensity to remain at the status-quo. Subsequently, I

compare this inertia account with the loss aversion account for

the status-quo bias, the endowment effect, and the risky bet

premium. I conclude with the argument that the existence of a

basic behavioral tendency to favor the status-quo over change

renders the loss aversion principle superfluous to an account

of the phenomena it was introduced to explain, and that the principle

should therefore be abandoned.

2 A psychological law of inertia

In this section, I argue that a propensity to remain at the status

quo, rather than a fundamental loss/gain asymmetry, offers the

most parsimonious account for the phenomena loss aversion was

introduced to explain. That is, a propensity to remain at the

status-quo logically follows from basic, well-founded psychological

principles, whereas loss aversion is an auxiliary principle,

introduced ad hoc to account for seemingly anomalous phenomena.

In this section I show how psychological insights into the nature

of behavior and preferences imply a robust tendency for people

to remain at the status-quo in two parts: First the need for

psychological motives to drive behavior implies that people will

tend to remain at the status-quo when they have no clear preference

between the status-quo and an alternative (or `change') option.

In addition, the fuzzy and ill-defined nature of preferences

implies that people will often have unclear preferences between

options, and hence, that a propensity to remain at the status

quo is likely to be a robust effect.

2.1 Motive-driven behavior

In the classical choice paradigm (Von Neumann & Morgenstern,

1944) of precise and well-defined preferences, individuals making

a choice between two options, A and B, are thought to either

(1) prefer A to B, (2) prefer B to A, or (3) be indifferent between

A and B (i.e., to prefer A and B exactly the same). A particular

preference ordering is assumed to be independent of context,

the description of the problem, or the procedure used to elicit

the preferences. Therefore, in the classical choice paradigm,

preference for A or B should be the same regardless of whether

option A or option B is the status-quo option. This implies

that individuals who prefer option A to option B should choose

option A regardless of whether it is the status-quo option or

not; and, likewise, that individuals who prefer option B to option

A should choose option B regardless of whether it is the status

quo option or not.

However, a question arises as to what individuals who are

indifferent between Option A and Option B should do. That is,

what option should be chosen by individuals who have the same

exact valuation for Options A and B? Although such a situation is

not addressed in the economic literature, it seems clear that

individuals who are indifferent between two options should choose

the status quo. For instance, even in the absence of transaction

costs, we should not be surprised, in the context of precise and

well-defined preferences, if people "prefer" to keep the dollar

in their pocket rather than exchange it for another dollar. This

is because, at the most basic level, economists and psychologists

alike recognize that people's behavior is directed in accordance

with psychological motives (i.e., reasons, drive states, goals,

incentives, etc.).

From this basic notion, it follows that people will not act to

alter the status-quo unless they are impelled to do so by some

motive.2 Moreover, we can surmise that

the possibility of becoming better off - but not

equally as well off - can provide the necessary motive

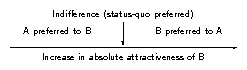

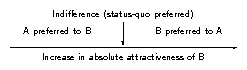

to impel people to change the status quo (see Figure 1A). This

discussion is formalized as follows:

Psychological Law of Inertia: A person will tend to

maintain the status-quo unless impelled to alter the status-quo

by a psychological motive to do so.

Corollary: The possibility of becoming better off -

but not equally as well off - can provide the necessary motive

to impel a person to alter the status-quo.

As highlighted by the discussion to this point, the need for

a psychological force, or motive, to alter the status-quo implies

that people can be expected to manifest a preference to remain

at the status-quo when they are indifferent between options.

However, such an effect is unlikely to be very robust in the

context of precise and well-defined preferences, because such

precise preferences make the likelihood of indifference between

two nonidentical options extremely slight. For instance, if an

individual is indifferent between options A and B, then the classical

choice assumption of monotonic preferences implies that the individual

should prefer option A and a penny to option B. Thus, given a

large pool of individuals, it is likely that only a minimal percentage

of participants will value both options exactly the same, and

these individuals will thus have only a minimal impact on any

outcome that aggregates responses over this pool of individuals.

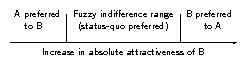

A: Assuming precise and well-defined preferences:

B: Assuming fuzzy and ill-defined preferences:

Figure 1: Relative preference for Option A over Option B with increasing

absolute attractiveness of Option B.

Figure 1: Relative preference for Option A over Option B with increasing

absolute attractiveness of Option B.

2.2 Fuzzy and ill-defined preferences

In the previous subsection, I argued that a change to the status

quo requires a motive to alter the status-quo, and, accordingly,

there is a tendency to remain at the status-quo when people are

indifferent between options. However, I also acknowledged that

the classical notion of precise and well-defined preferences

implies that indifference between nonidentical options is quite

rare, and thus any proclivity towards the status-quo is unlikely

to be a robust effect.

However, in recent times, the classical notion of precise and

well-defined preferences has been challenged by a great deal

of evidence, which has shown that preferences tend to be fuzzy

and ill defined, and that they are often constructed on an ad

hoc basis (for review, see Slovic, 1995; Bettman, Luce, & Payne,

1998). Moreover, evidence suggests that people are unable to

precisely assess the value of options and outcomes in an absolute

sense (e.g., Hsee, 1996; Nowlis & Simonson, 1997). For instance,

Kivetz and Simonson (2002) have shown that people tend to use

the relative effort of others as a reference to judge the absolute

amount of effort associated with a frequency reward program.

More specifically, they showed that if a "deal" is relatively

better for person X than for the average individual, it will

be extremely attractive - to the point where it might be preferred

over a dominated option. In one experiment, Kivetz and Simonson

offered diners a reward program in which they could receive a

free meal at a dining hall after having paid for a certain number

of meals. In a between subject design, they found that sushi

lovers would actually prefer a reward program which required

the purchase of 10 sandwiches and 10 sushi platters to a program

which required only the purchase of the 10 sandwiches. Although

the former option was dominated by the latter, sushi lovers perceived

a relative advantage in that they would likely have eaten the

sushi anyway. Based on this relative advantage, sushi lovers

inferred that they were getting a "bargain" in an absolute

sense.

Research on choice deferral also suggests that people are unable

to precisely judge the value of options in an absolute sense.

For instance, Dhar (1997) finds that when two options are rated

similarly in terms of their attractiveness, people are likely

to defer choice, rather than choose one of the two options. This

suggests that people are unable to precisely judge the absolute

attractiveness of the options and, accordingly, do not have a

precise ordering of preferences over the options that would allow

them to justify choosing one option over the other.

If we extend this reasoning to a choice between any two options,

A and B, then we can surmise that people may be indifferent - i.e.,

have no clear preference - between options A and B, and also

have no clear preference between option A plus a penny and option

B - and even between option A plus a dollar and option B. That

is, fuzzy and ill-defined preferences imply a fuzzy range of

absolute attractiveness values for option A, that are not

clearly differentiated in terms of relative attractiveness

to option B - and vice versa (see Figure 1B). For example, if

option A is a monetary amount and option B is a mug, it is possible

that values of A between roughly $3 and roughly $7 will not

feel sufficiently different from the value of the mug to induce

a clear preference between the monetary amount and the mug. Similarly,

if option A is $5 and option B is a mug, people may have no

clear preference both between $5 and a mug with a standard handle

and between $5 and a mug with a fancy handle - even if they strongly

prefer the fancy handle relative to the standard handle.

Thus, the recognition that preferences tend to be fuzzy and ill-defined

suggests that people will often have unclear preferences between

two options. Accordingly, we can expect that people will often

lack a motive to alter the status-quo.

3 Inertia versus loss aversion

In the previous section, I argued that the nature of behavior

and preferences imply a fundamental behavioral proclivity to

prefer the status-quo to change. In this section, I show that

a propensity to remain at the status-quo can account for the

status-quo bias, the endowment effect, and the risky bet premium - the

phenomena most widely cited as evidence for loss aversion - and

do so in a more logically consistent manner.

3.1 Status-quo bias and endowment effect

As discussed earlier in this article, experimental evidence has

demonstrated that people have a tendency to remain at the status

quo. Proponents of loss aversion assert that a status-quo propensity

is a consequence of a loss/gain asymmetry (i.e., a reference-dependent

asymmetry in favor of losses), whereas the proposed inertia account

asserts that any such asymmetry is auxiliary to an explanation

of the basic behavioral propensity to remain at the status-quo.

Instead, the inertia account asserts that the status-quo bias

logically follows from the basic principle that behavior is directed

in accordance with psychological motives.

Clearly, the inertia account is more parsimonious than the loss

aversion account; however, is there a way to also compare the

descriptive validity of the inertia and loss aversion accounts

as explanations for the status-quo bias? We can consider a thought

experiment of the extreme case where an individual has precisely

identical valuations for the status-quo option and an alternative

option: would an individual exchange the dollar bill in her pocket

for another, essentially identical, dollar bill absent some external

motivation (e.g., a desire to comply with an experimenter's request)

to do so? An inertia account predicts that, absent an external

motive, an individual will "choose" to retain her dollar bill

rather than exchange it for a different dollar bill because of

the absence of any motive to exchange dollar bills.

In contrast, a loss aversion account makes no such prediction.

This is because it is assumed (quite reasonably) that people

do not typically view an exchange of identical items as a tradeoff

between a loss and a gain. For instance, Kahneman (2003) has

stated that loss aversion should not be expected to apply in

an exchange of five $1 bills for a $5 bill. Similarly, Novemsky

and Kahneman (2005, p. 123), in highlighting one of several proposed

"boundaries of loss aversion," surmise that "[A] shopper is

unlikely to experience loss aversion when giving up a good for

a nearly identical one."

Although a thought experiment is likely sufficient, I conducted

a simple experiment to confirm that the outcome of a choice between

two essentially identical options will significantly favor

the status-quo option (as predicted by the inertia account, but

not by the loss aversion account). In a between subject design,

110 participants - undergraduates at a large west coast university - were

asked to imagine that they owned a quarter minted in either Denver

or Philadelphia. They were then asked whether - given a choice - they

would choose to switch their coin with a coin minted in the other

city, assuming insignificant time and effort involvement for

the switch. Over 85% of participants in either condition chose

to retain their original coin, consistent with the inertia account

of the status-quo bias.

Although the experiment described above involved goods that had

well-defined relative valuations (i.e., their valuations were

equal), people typically do not have well-defined

relative valuations for goods. Therefore, we can expect that

there will be many pairs of options for which people will have no

relative preference for one option over the other (as between two

quarters) - and hence no reason or motive to alter the

status-quo.

Thus, the inertia account can explain a propensity towards the

status-quo both when a status-quo option and an alternative

option have equivalent valuations and when they do not.

Conversely, a loss aversion account is descriptively consistent

with a propensity towards the status-quo in cases where the

status-quo option and an alternative option are not equivalent,

but it provides no insight into why such a propensity persists

when option values are equivalent.

3.1.1 Endowment effect

As discussed earlier in this article, the endowment effect is

the name for the finding that randomly assigned owners of an

object appear to value their possession more than randomly assigned

non-owners.

Because the status-quo bias and endowment effect are such similar

phenomena, the logic regarding inertia as an explanation of the

status-quo bias in the previous subsection extends fairly trivially

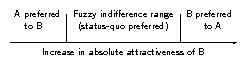

to the endowment effect. For instance, using the Kahneman et

al., (1990) example of buyers and sellers with divergent reservation

prices for a mug, it is clear that sellers view ownership of

the mug as the status-quo and non-ownership (plus receipt of

payment) as the change option. For buyers, the status-quo and

change options are reversed (see Figure 1B).

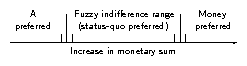

Moreover, when one of the two options is a variable monetary

sum as in the Kahneman et al. (1990) experiments, measures of

maximum willingness to pay (WTP) to acquire a good and minimum

willingness to accept (WTA) to part with a good can be thought

of as rough approximations to the fuzzy boundaries of the fuzzy

indifference range depicted in Figure 1B. This is highlighted

in Figure 2, which can be viewed as an instance of Figure 1B

where option B is a variable monetary sum. WTP represents the

lower boundary because at higher valuations there is either (a)

indifference between the monetary sum and the good, or (b) the

monetary sum is preferred to the good. Therefore, there is no

motive for the individual to pay any more money for the good

than the lower boundary of the fuzzy indifference range. Similar

logic applies to WTA as the upper boundary of the indifference

range.

Figure 2: Relative preference for a Good A over a variable monetary sum.

One potential challenge to the inertia account of the endowment

effect arises from the findings of Dubourg, Jones-Lee, and Loomes

(1994). Dubourg et al. (1994) found that the gap between their

experimental participants' WTP and WTA persisted even after accounting

for "imprecise preferences." Specifically, Dubourg et al. attempted

to define participants' WTP and WTA as confidence intervals rather

than as point estimates. They defined the upper end of the WTP

interval as "the smallest amount a respondent definitely would

not pay" for a good and the lower end of the WTP interval

as "the largest amount a respondent definitely would pay."

Similar elicitation procedures were used to obtain the upper

and lower ends of respondents' WTA interval. Dubourg et al. hypothesized

that if imprecise preferences were the source of the endowment

effect, then the WTP and WTA range would overlap, but participants'

point estimates of their WTP might trend toward the lower WTP

bound and their point estimates of their WTA might trend toward

the upper bound of the WTA interval leading to a WTP/WTA gap.

Instead, they found that the entire WTP interval tended to be

well below the entire WTA interval. Thus, they surmised that

imprecise preferences could not wholly account for the WTP/WTA

gap.

Although the notion of imprecise preferences in Dubourg et al.'s

account sounds similar to the notion that people often lack clear

relative preferences between options, the manner in which Dubourg

et al. operationalize a range of imprecise preferences does not

equate to the fuzzy indifference range described by the inertia

account. Indeed, the inertia account predicts that

measures of WTP should be below measures of WTA because it is the

gap between WTP and WTA that represents the fuzzy indifference

range (i.e., the range over which people do not have a clear

preference for the money or the good and hence do not trade due

to the absence of a motive to trade.) Dubourg et al.'s use of

different elicitation methods to obtain a range for each of WTP

and WTA merely demonstrates that the borders of the

indifference range should not be thought of as clear demarcations

between indifference and a clear preference for one option over

another, but as fuzzy and imprecise. Accordingly, different

elicitation methods of WTP and WTA should be expected to yield

different values for the borders of the fuzzy indifference range.

This is highlighted by the short lines on either side of the long

line in Figure 2. The short lines represent possible ranges for

WTP and WTA as found by Dubourg et al. (1994), whereas the long

lines between them represent particular point estimates of WTP

and WTA.

Figure 2: Relative preference for a Good A over a variable monetary sum.

One potential challenge to the inertia account of the endowment

effect arises from the findings of Dubourg, Jones-Lee, and Loomes

(1994). Dubourg et al. (1994) found that the gap between their

experimental participants' WTP and WTA persisted even after accounting

for "imprecise preferences." Specifically, Dubourg et al. attempted

to define participants' WTP and WTA as confidence intervals rather

than as point estimates. They defined the upper end of the WTP

interval as "the smallest amount a respondent definitely would

not pay" for a good and the lower end of the WTP interval

as "the largest amount a respondent definitely would pay."

Similar elicitation procedures were used to obtain the upper

and lower ends of respondents' WTA interval. Dubourg et al. hypothesized

that if imprecise preferences were the source of the endowment

effect, then the WTP and WTA range would overlap, but participants'

point estimates of their WTP might trend toward the lower WTP

bound and their point estimates of their WTA might trend toward

the upper bound of the WTA interval leading to a WTP/WTA gap.

Instead, they found that the entire WTP interval tended to be

well below the entire WTA interval. Thus, they surmised that

imprecise preferences could not wholly account for the WTP/WTA

gap.

Although the notion of imprecise preferences in Dubourg et al.'s

account sounds similar to the notion that people often lack clear

relative preferences between options, the manner in which Dubourg

et al. operationalize a range of imprecise preferences does not

equate to the fuzzy indifference range described by the inertia

account. Indeed, the inertia account predicts that

measures of WTP should be below measures of WTA because it is the

gap between WTP and WTA that represents the fuzzy indifference

range (i.e., the range over which people do not have a clear

preference for the money or the good and hence do not trade due

to the absence of a motive to trade.) Dubourg et al.'s use of

different elicitation methods to obtain a range for each of WTP

and WTA merely demonstrates that the borders of the

indifference range should not be thought of as clear demarcations

between indifference and a clear preference for one option over

another, but as fuzzy and imprecise. Accordingly, different

elicitation methods of WTP and WTA should be expected to yield

different values for the borders of the fuzzy indifference range.

This is highlighted by the short lines on either side of the long

line in Figure 2. The short lines represent possible ranges for

WTP and WTA as found by Dubourg et al. (1994), whereas the long

lines between them represent particular point estimates of WTP

and WTA.

3.1.2 Degree of preference clarity

Although the principle of loss aversion is agnostic about the

magnitude of the loss aversion coefficient (Daniel Kahneman,

personal communication, 2004), several researchers have sought

to address this question empirically. In general, most researchers

have concluded that the "coefficient of loss aversion" is somewhere

around 2 (e.g., Tversky & Kahneman, 1992). However, other researchers

have found that the degree of loss aversion depends on the degree

of similarity between options being evaluated. For instance,

unlike in the quarters experiment presented earlier in this section,

Chapman (1998) found that a majority of experimental participants

were willing to trade items that they owned for identical

items. Moreover, Chapman showed that participants were more willing

to trade identical items than similar items and similar items

than dissimilar items. However, Chapman was able to obtain these

results only when she offered participants a nickel for the act

of trading in order to cover participants' "transaction costs."

The inertia account introduced in this article provides insight

into this finding whereas the loss aversion account is silent.

Specifically, the requirement for an incentive - in the form of

a nickel - to induce transactions for identical and similar items

is in accord with the inertia account. When items being traded

are identical or very similar, relative preferences are well-defined - i.e.,

there is a relatively narrow range of absolute values of the

options over which there is no clear preference between the options

(i.e., a narrow indifference range in Figure 1B) - and hence, even

a slight increase in the value of the alternative option (e.g.,

an extra nickel) will be a sufficient enough incentive for participants

to alter the status-quo.

In other words, a participant asked to trade item X for item X

will have no motive to do so; however a participant asked to

trade item X for item X + 5 cents can recognize that item X +

5 cents is clearly better than item X, and hence has a motive to

execute the trade (absent transaction costs). On the other hand,

if a participant has no clear preference between two dissimilar

items, X and Y, then she is also unlikely to have a clear

preference between item X + 5 cents and item Y (see Figure 1B),

and therefore is likely to lack a motive to alter the status-quo

with or without a nickel incentive.

3.1.3 Do people like the status-quo?

In recent research, Moshinsky and Bar-Hillel (2005) found that

participants tended to evaluate public policy options more favorably

when they were presented as the status-quo option than when they

were not, a phenomenon they dubbed, the "status-quo label bias."

Moshinksy and Bar-Hillel (2005) argued that this finding constituted

support for loss aversion. This is an interesting assertion,

because it is diametrically opposed to the findings and arguments

of Loewenstein and Kahneman (1991) and Kahneman et al. (1991).

Loewenstein and Kahneman (1991) found that despite the persistence

of an endowment effect, experimental participants did not rate

the attractiveness of endowed options more favorably than the

same options when they were not endowed. Kahneman et al. (1991)

interpreted this finding to imply that the endowment effect does

not "enhance the appeal of the good one owns, only the pain

of giving it up." Thus, while the status-quo label bias may

be - under certain circumstances - a complimentary contributor

to a status-quo bias, evidence for a status-quo label bias does

not appear to support the loss aversion account over the inertia

account of the status-quo bias.

3.2 Risky bet premium

The status-quo bias and endowment effect phenomena involve a

loss/gain tradeoff that is entangled with a status-quo/change

tradeoff. That is, the status-quo option is always associated

with potential loss, whereas the change option is always associated

with potential gain.

At first inspection, the risky bet premium phenomenon does not

appear to involve a status-quo/change tradeoff. There appears

to be only a tradeoff between the potential for loss associated

with taking the bet and the potential for gain associated with

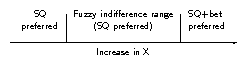

taking the bet. However, upon closer inspection, the risky bet

premium phenomenon is actually quite similar to the endowment

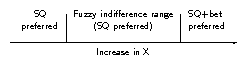

effect and status-quo bias phenomena. In particular, in deciding

whether to accept a single risky bet, the status-quo option is

not taking the bet, whereas the change option is taking

the bet. That is, the decision to accept a single risky bet can

be thought of as a choice between two options, A and B, where

Option A is not taking the bet (i.e., the status-quo) and Option

B is taking the bet (i.e., the change option). This is depicted

in Figure 3, which can be viewed as an instance of Figure 1B

where option A is the status-quo and Option B is the status-quo

plus a risky bet.

Figure 3: Relative preference for status-quo (SQ) over SQ plus a risky

bet with 50% chance of losing $c and 50% chance of Winning

$X.

The loss aversion account of the risky bet premium ignores the

status-quo/change tradeoff. It asserts that people demand a premium

over expected value to accept an even bet because the potential

for loss associated with taking the bet looms larger than the

potential for gain associated with taking the bet. This, of course,

is premised on the belief that, objectively, people should judge

the value of risky prospects according to their expected value

(e.g., Arrow, 1965).

In reality, however, this presumption is a simplification made

so that risky prospects can be incorporated into rational (i.e.,

mathematical) theories of choice. There is, in fact, no demonstrably

objective formula by which people should judge risky prospects.

Instead, people should judge risky prospects according to their

goals: they should weigh their desire to avoid potential loss

against their desire to acquire potential gains according to

their preference for the tradeoff between them.

However, because this preference is likely to be fuzzy and ill-defined,

there is likely to be a fuzzy range of values for a prospect

for which people will not have a clear preference between the

prospect and the status-quo. For instance, people may have no

clear preference between the status-quo and a prospect featuring

a 50% chance of losing $100 and a 50% chance of gaining $100;

and, they may also not have a clear preference between the status

quo and a 50% chance of losing $100 and a 50% chance of gaining

$150. That is, they may not have a clear sense that either bet,

on balance, will tend to make them better off than not taking

the bet. Thus, people are likely to demand a premium to accept

an even bet when they have no preexisting psychological motive

to alter the status-quo.

To distinguish these competing accounts, I conducted a simple

experiment, where participants faced a choice between risky prospects

that featured a tradeoff between potential loss and potential

gain, but no clear tradeoff between the status-quo and change.

Specifically, experimental participants (133 undergraduates at

a large west coast university) were asked to allocate a hypothetical

monetary sum between a risk-free ("safe") option and an even

bet. The problem featured no clear tradeoff between the status

quo and change because the problem featured no clear status-quo

option. The problem appeared as follows:3

Figure 3: Relative preference for status-quo (SQ) over SQ plus a risky

bet with 50% chance of losing $c and 50% chance of Winning

$X.

The loss aversion account of the risky bet premium ignores the

status-quo/change tradeoff. It asserts that people demand a premium

over expected value to accept an even bet because the potential

for loss associated with taking the bet looms larger than the

potential for gain associated with taking the bet. This, of course,

is premised on the belief that, objectively, people should judge

the value of risky prospects according to their expected value

(e.g., Arrow, 1965).

In reality, however, this presumption is a simplification made

so that risky prospects can be incorporated into rational (i.e.,

mathematical) theories of choice. There is, in fact, no demonstrably

objective formula by which people should judge risky prospects.

Instead, people should judge risky prospects according to their

goals: they should weigh their desire to avoid potential loss

against their desire to acquire potential gains according to

their preference for the tradeoff between them.

However, because this preference is likely to be fuzzy and ill-defined,

there is likely to be a fuzzy range of values for a prospect

for which people will not have a clear preference between the

prospect and the status-quo. For instance, people may have no

clear preference between the status-quo and a prospect featuring

a 50% chance of losing $100 and a 50% chance of gaining $100;

and, they may also not have a clear preference between the status

quo and a 50% chance of losing $100 and a 50% chance of gaining

$150. That is, they may not have a clear sense that either bet,

on balance, will tend to make them better off than not taking

the bet. Thus, people are likely to demand a premium to accept

an even bet when they have no preexisting psychological motive

to alter the status-quo.

To distinguish these competing accounts, I conducted a simple

experiment, where participants faced a choice between risky prospects

that featured a tradeoff between potential loss and potential

gain, but no clear tradeoff between the status-quo and change.

Specifically, experimental participants (133 undergraduates at

a large west coast university) were asked to allocate a hypothetical

monetary sum between a risk-free ("safe") option and an even

bet. The problem featured no clear tradeoff between the status

quo and change because the problem featured no clear status-quo

option. The problem appeared as follows:3

Allocation Task:

Assume you have $100 that you want to invest and that the available

options are the two investment options below. How would you allocate

your money between the 2 options?

Investment Option A

You will make 3% on your investment for sure.

Investment Option B

You will double your investment with a 50% chance.

You will lose your investment with a 50% chance.

| Of my $100, I would invest $____ in Option A |

| and $____ in Option B.

|

After a series of unrelated tasks, participants were also asked - as

in previous risky bet premium experiments - to indicate the premium

they would require to accept a single risky bet. The problem

appeared as follows:

Single Risky Bet Task:

Suppose you were offered a risky bet that offered a 50%

chance of losing $100 and a 50%

chance of winning X. What is the least X would have to

be for you to be willing to take this bet?

X would have to be $____.

In the single risky bet task - consistent with prior findings - less

than 2% of participants were willing to accept an even bet,

and the rest tended to require a significant premium to accept

the bet (median value of X was $500).

In contrast, in the allocation task, 23% of participants allocated

the entire monetary sum to the `even bet' option, 55% of participants

allocated some of the monetary sum to the `even bet' option and

some to the `safe' option, and only 23% of participants allocated

the entire monetary sum to the `safe' option. Thus, the results

of these two tasks showed a robust requirement for a premium

to accept an even bet only when participants were faced with

a status-quo/change tradeoff (i.e., in the single risky bet task).

Indeed, this is the first experiment to show that a large percentage

of experimental participants - nearly 80% - are willing to accept

an even bet, a finding which challenges the most basic prediction

of loss aversion (i.e., that people are unwilling to accept even

bets.)

3.2.2 Discussion

The results of this experiment show that people demand a premium

over expected value to accept a single bet with even odds of

a gain or loss, but do not necessarily demand such a premium

when allocating funds across assets with different levels of

risk (i.e., in a task with greater ecological validity). At first

blush, one concern is that the allocation task may have prompted

a demand effect, whereby participants assumed that the task was

intended to elicit allocations to both of the options. However,

the finding that nearly half of participants allocated the entire

monetary sum to a single option, and that of those participants,

half allocated the entire sum to the risky option, suggests that

demand effects cannot explain the large share of funds allocated

to the risky option.

Another initial concern is that the sums participants were asked

to allocate were small. It is possible that participants would

have allocated a greater share of the monetary sum to the safe

option had participants been asked to allocate a sum that constituted

a larger share of their budgets or wealth. However, risky bet

premium experiments are typically conducted with small sums of

money, because it has been recognized that larger sums will lead

to an increasing impact of wealth, budgets and other classical

economic variables on participants' decision making (e.g., Kahneman

& Tversky, 1979). Indeed, Rabin and Thaler (2001) argue that

it is the fact that people are so risk averse with such small

sums of money that provides the greatest support for the existence

of loss aversion. Thus, the findings of this experiment are highly

inconsistent with the loss aversion account, but consistent with

the proposed inertia account of the risky bet premium.

However, the fact that the evidence from this experiment is consistent

with the inertia account does not imply that the evidence strongly

supports the inertia account. I have argued that the main difference

between the allocation task and the single risky bet task is

the absence of a clear status-quo option - and hence of a tradeoff

between the status-quo and change - in the allocation task. An

alternative account, however, is that the manipulations between

tasks (e.g., temporal distance and choice vs. willingness-to-pay)

simply led to a dramatic shift in risk preference between tasks:

participants were risk-seeking in the allocation tasks and, a

few minutes later, dramatically risk-averse in the single risky

bet task.

However, such a dramatic change in risk preference between tasks

seems implausible. Moreover, despite the superficial difference

in risk preference expressed by participants across tasks - i.e.,

"risk-seeking" in the allocation task and "risk-averse" in

the single risky bet task - there was a correlation in the decisions

participants made between tasks. Those participants who required

the highest premiums in the single risky bet task (based on a

median split) tended to allocate a greater part of their hypothetical

monetary sum (64% vs. 46%) to the safe option in the allocation

task (t(131) = 2.71; p < 0.01). Thus, it would appear

that participants were, in fact, expressing a real and relatively

consistent underlying preference for risk - i.e., for the tradeoff

between potential loss and potential gain - across tasks, but

that this preference was being systematically shifted by an influence

unrelated to risk preference: a propensity to remain at the status

quo in the single risky bet task, but not in the allocation task.

4 Does loss aversion exist?

So far, in this article, I have argued that the notion that motives

drive behavior - together with the fuzzy and ill-defined nature

of preferences - necessarily implies a basic behavioral tendency

to remain at the status-quo, without the need for any other auxiliary

principle. I have also shown that this basic behavioral tendency

is sufficient for explaining the existence of a status-quo bias,

an endowment effect, and a risky bet premium, and that it provides

a more logically consistent account for these phenomena than

loss aversion.

Given this inertia account, what are the implications for the

existence of loss aversion? To be sure, the existence of inertia

does not preclude the possibility that other influences also

contribute to the complex phenomena investigated in this article.

Among those factors are anticipated regret, locus of attention,

and the status-quo label bias. Other research, however, casts

further doubt on the existence of a fundamental loss/gain asymmetry

by challenging the evidence for loss aversion in phenomena that

involve a loss/gain tradeoff but not a status-quo/change

tradeoff. For instance, the equity premium puzzle - the finding

that historical returns on stocks have significantly exceeded

those on bonds (beyond what could be explained by simple risk

aversion) - has previously been cited as evidence for loss aversion

(Benartzi & Thaler, 1995). However, Fama and French (2002) noted

that using historical data on returns alone is not very meaningful

for judging the forward-looking equity premium - i.e., the returns

investors could reasonably have expected at the time. Fama and

French (2002) estimated the forward-looking equity premium to

be substantially smaller than the realized equity premium, obviating

the need for a loss aversion explanation.4 Similarly, the

scanner panel data finding by Hardie et al. (1993) that demand

is more elastic for price increases than for price decreases

was challenged by a study by Bell and Lattin (2000), who found

no such asymmetry after controlling for the confounding influence

of heterogeneity in consumer price responsiveness.5

Even this evidence cannot disprove the existence of loss

aversion; but, the inability of researchers to find evidence for

loss aversion in these phenomena and its dispensability to an

account of the phenomena it was introduced to explain - as

highlighted by this article - do suggest that its existence may

well be moot. An analogy from cosmological physics serves to

highlight this point. At the end of the nineteenth and start of

the twentieth centuries cosmology faced an anomaly: Maxwell's

equations of electromagnetism required that light travel at a

constant rate, but Newtonian mechanics required all motion to be

relative. Hence, to resolve this anomaly, physicists posited the

existence of a `luminiferous ether,' a universal substance in

space; light was thus thought to move relative to the ether.

Then, in 1905, Einstein's theory of special relativity showed

that if time was not fixed - an observation subsequently

confirmed by empirical evidence - the presence of an ether was

no longer required. Thus, relativity did not preclude the

existence of the ether, but it did render its existence

superfluous to an explanation of the phenomenon it was introduced

to explain. Accordingly, the concept of an ether was abandoned.

Analogously, a basic behavioral tendency to remain at the status

quo does not disprove the existence of a fundamental loss/gain

asymmetry, but it does render its existence superfluous to an

account of the phenomena it was introduced to explain. Indeed,

given the fuzzy and ill-defined nature of preferences, and the

need for a motive to drive behavior, we should be surprised if

we did not observe a status-quo bias, an endowment effect,

and a risky bet premium. Therefore, like the ether, logic dictates

that the principle of loss aversion be abandoned.6

References

Arnott, R. D. & Bernstein, P. L. (2002). What risk premium is

"normal"? Financial Analysts Journal, 58, 64-85.

Arrow, K. (1965). Aspects of the theory of

risk-bearing. Helsinki: Yrjö Hahnsson Foundation.

Bell, D. & Lattin, J. (2000). Looking for loss aversion in

scanner panel data: the confounding effect of price response

heterogeneity. Marketing Science, 19, 185-201.

Bar-Hillel, M. & Neter, E. (1996). Why are people reluctant to

exchange lottery tickets? Journal of Personality & Social

Psychology, 70, 17-28.

Benartzi, S., & Thaler, R. (1995). Myopic loss aversion and the equity

premium puzzle. Quarterly Journal of Economics, 110, 73-92.

Bettman, J., Luce, M., & Payne, J. (1998). Constructive consumer

choice processes. Journal of Consumer Research, 25, 187-217

Camerer, C. (2005). Three cheers-psychological, theoretical,

empirical-for loss aversion. Journal of Marketing Research, 42,

129-134.

Carmon, Z., & Ariely, D. (2000). Focusing on the forgone: why

value can appear so different to buyers and sellers. Journal of

Consumer Research, 27, 360-370.

Chapman, G., (1998). Similarity and reluctance to trade. Journal

of Behavioral Decision Making, 11, 47-58.

Dhar, R. (1997). Consumer preference for a no-choice option. Journal of

Consumer Research, 24, 215-231.

Dubourg, W. R., Jones-Lee, M. W., & Loomes, G. (1994). Imprecise

preferences and the WTP-WTA disparity. Journal of Risk

and Uncertainty, 9, 115-133.

Fama, E. F., & French, K. R. (2002). The equity

premium. Journal of Finance, 57, 637-660.

Hardie, B., Johnson, E. J., & Fader, P. (1993). Modelling loss

aversion and reference dependence effects on brand

choice. Marketing Science, 12, 378-394.

Hsee, C. K. (1996). The evaluability hypothesis: An explanation

for preference reversals between joint and separate evaluations

of alternatives. Organizational Behavior and Human Decision

Processes, 67, 247-257

Kahneman, D. (2003). A psychological perspective on

economics. American Economic Review (Proceedings), 93,

162-168.

Kahneman, D., Knetsch, J. L., & Thaler, R. (1990). Experimental

tests of the endowment effect and the Coase theorem. Journal of

Political Economy, 99, 1325-1348.

Kahneman, D., Knetsch, J. L., & Thaler, R. (1991). The endowment

effect, loss aversion, and status-quo bias. Journal

of Economic Perspectives, 5, 193-206.

Kahneman, D., & Tversky, A. (1979). Prospect theory: an analysis of

decision under risk. Econometrica, 47, 263-291.

Loewenstein, G., & Kahneman, D. (1991). Explaining the endowment

effect. Working Paper, Carnegie Mellon University (data reported

in Kahneman et al., 1991)

Moshinsky, A., & Bar-Hillel, M. (2005). Loss aversion and the

status-quo label bias. Working Paper, Hebrew University.

Nowlis, S. & Simonson, I. (1997). Attribute-task compatibility

as a determinant of consumer preference reversals. Journal of

Marketing Research, 34, 205-218.

Novemsky, N. & Kahneman, D. (2005). The boundaries of loss

aversion. Journal of Marketing Research, 42, 119-128.

Odean, T., (1998). Are investors reluctant to realize their

losses? Journal of Finance, 53, 1775-1798.

Putler, D, (1992). Incorporating reference price effects into a

theory of consumer choice.

Marketing Science, 11, 287-309.

Rabin, M., & Thaler, R. (2001). Risk Aversion. Journal of Economic

Perspectives, 15, 219-232.

Samuelson, W., & Zeckhauser, R. (1988). Status-quo bias in

decision making, Journal of Risk and Uncertainty, 1,

7-59.

Sen, S., & Johnson, E. J. (1997). Mere-possession effects

without possession in consumer choice. Journal of

Consumer Research, 24, 105-117.

Simonson, I., & Tversky, A. (1992). Choice in context: tradeoff

contrast and extremeness aversion. Journal of Marketing Research,

29, 281-295.

Slovic, P., (1995). The construction of preference. American

Psychologist, 50, 364-371.

Strahilevitz, M. A., & Loewenstein, G. (1998). The effect of

ownership history on the valuation of objects. Journal of

Consumer Research, 25, 276-289.

Thaler, R. (1980). Toward a positive theory of consumer

choice. Journal of Economic Behavior and Organization, 1, 39-60.

Tversky, A., & Kahneman, D. (1991). Loss aversion in riskless

choice: a reference-dependent model. Quarterly Journal of

Economics, 106, 1039-1061.

Tversky, A., & Kahneman, D. (1992). Advances in prospect theory:

cumulative representations of uncertainty. Journal of

Risk and Uncertainty, 5, 297-323.

Von Neumann, J., & Morgenstern, O. (1944). Theory of games and

economic behavior. Princeton, NJ: Princeton University Press.

Footnotes:

1I am grateful to Michal Maimaran, Baba

Shiv, Itamar Simonson, Christian Wheeler, Barbara Mellers,

the associate editor, and Jonathan Baron, the editor, for

comments on earlier drafts of this manuscript. Address

correspondence to: David Gal, 729 Escondido Rd. 12,

Stanford, CA 94305,

dgal@stanford.edu.

2Throughout this article, "alter the

status-quo" can be taken to include the similar case of

"reject the default option."

3The problem was the

first of six investment allocation type problems and participants

were asked to assume that the duration of the investment in each

problem was one year.

4Arnott and Bernstein

(2002) estimated that the forward looking equity premium at the

time of their study was zero or even negative

5I thank

Jim Lattin for reviewing this point.

6Abandoning

loss aversion does not imply abandoning other elements of Prospect

Theory's value function. None of the arguments made in this article

in any way challenge the separate coding of losses and gains

around a reference point, the concavity of the value function

in the domain of gains, or the convexity of the value function

in the domain of losses. This article merely challenges the notion

that the loss and gain curves are asymmetric (i.e., steeper in

the domain of losses than in the domain of gains).

File translated from

TEX

by

TTH,

version 3.67.

On 18 Jul 2006, 15:40.